Filed Pursuant to Rule 424(b)(5)

Registration No. 333-208330

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 22, 2015)

19,772,727 Shares of Common Stock

Warrants to Purchase 11,863,636 Shares of Common Stock

We are offering 19,772,727 shares of our common stock and warrants to purchase up to 11,863,636 shares of our common stock at an exercise price of

$1.42 per whole share of common stock. The shares of common stock and warrants will be sold in units, with each unit consisting of one share of common stock and 0.6 of a warrant to purchase one share of common stock. Each unit will be sold at a

price of $1.10 per unit. The shares of common stock and warrants will be mandatorily separable immediately upon issuance.

Our common stock is

listed on The NASDAQ Capital Market under the symbol “GALE.” On January 6, 2016 the last reported sale price of our common stock on The NASDAQ Capital Market was $1.29 per share.

The warrants are not and will not be listed for trading on The NASDAQ Capital Market, or any other securities exchange or nationally recognized trading

system. There is no market through which the warrants may be sold, and purchasers may not be able to resell the warrants purchased under this prospectus supplement. This may affect the pricing of the warrants in the secondary market, the

transparency and availability of trading prices, and the liquidity of the warrants.

Investing in our securities

involves significant risks. See “Risk Factors” beginning on page S-11 of this prospectus supplement and on page 1 of the accompanying prospectus and the documents incorporated by reference in this prospectus

supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or

disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

| |

|

Per

Unit |

|

|

Total |

|

| Price to the public |

|

$ |

1.10 |

|

|

$ |

21,750,000 |

|

| Underwriting discounts and commissions(1) |

|

$ |

0.066 |

|

|

$ |

1,305,000 |

|

| Proceeds, before expenses, to us |

|

$ |

1.034 |

|

|

$ |

20,445,000 |

|

| (1) |

For additional information about the expenses for which we have agreed to reimburse the underwriters in connection with this offering, see “Underwriting” beginning on page S-30 of this prospectus supplement.

|

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to

purchase up to an additional 2,965,909 shares of common stock at a price of $1.0246 per share and/or additional warrants to purchase up to 1,779,545 shares of common stock at a price of $0.0094 per warrant to cover over-allotments, if any.

The underwriters expect to deliver the units on or about January 12, 2016.

RAYMOND JAMES

|

|

|

|

|

|

|

|

|

| Roth Capital Partners |

|

Noble Financial Capital Markets |

|

FBR |

|

|

Maxim Group LLC |

|

The date of this prospectus supplement is January 7, 2016.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of the registration statement on Form S-3 (File No. 333-208330) that we filed with the Securities and

Exchange Commission, or the SEC, using a “shelf” registration process to register sales of our securities under the Securities Act of 1933, as amended, or the Securities Act. This document consists of two parts. The first part is this

prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part is the accompanying prospectus filed with the SEC as part of the registration statement that was declared

effective by the SEC on December 22, 2015, including the documents incorporated by reference, that gives more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are

referring to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

We sometimes collectively refer to the shares of common stock and warrants offered hereby and the shares of common stock underlying the

warrants as the “securities.”

If information in this prospectus supplement is inconsistent with any document incorporated by

reference that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include

important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents to which we have referred you in the section of

this prospectus entitled “Where You Can Find More Information.”

You should rely only on this prospectus supplement, the

accompanying prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus. We and the underwriters have not authorized anyone to provide you with information that

is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This

prospectus supplement, the accompanying prospectus and any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such

offer or solicitation in such jurisdiction. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of any date other than as of the date of this

prospectus supplement or the accompanying prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying

prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to

such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

The industry and market data contained or

incorporated by reference in this prospectus supplement and the accompanying prospectus are based either on our management’s own estimates or on independent industry publications, reports by market research firms or other published independent

sources. Unless otherwise indicated, all information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus concerning our industry in general or any segment thereof, including information regarding our

general expectations and market opportunity, is based on management’s estimates using internal data, data from industry related publications, consumer research and marketing studies and other externally obtained data.

ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus supplement or in the accompanying prospectus or

incorporated by reference into this prospectus supplement and the accompanying prospectus and does not contain all of the information that may be important to you or that you should consider before investing in our securities. Before making an

investment decision, you should read this prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the accompanying prospectus in their entirety, including “Risk

Factors” beginning on page S-12 of this prospectus supplement.

About Galena

Overview

Galena Biopharma, Inc.

(“we,” “us,” “our,” “Galena” or the “company”) is a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical

needs. Galena’s development portfolio is focused primarily on addressing the rapidly growing patient populations of cancer survivors by harnessing the power of the immune system to prevent cancer recurrence. The Company’s pipeline consists

of multiple mid- to late-stage clinical assets, including novel cancer immunotherapy programs led by NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. NeuVax is currently in a pivotal, Phase 3 clinical trial with several concurrent Phase 2 trials

ongoing both as a single agent and in combination with other therapies. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancers and in a Phase 1b clinical trial given sequentially with GALE-302.

We are seeking to build value for shareholders through pursuit of the following objectives:

| |

• |

|

Develop novel cancer immunotherapies to address unmet medical needs through the use of peptide-based vaccines targeting well-established tumor antigens. One of our key strategies is to target the adjuvant, minimum

residual disease setting, in high risk patients who are more likely to benefit from treatment via immunotherapy. Our immunotherapy programs are currently targeting two key areas: secondary prevention intended to significantly decrease the risk of

disease recurrence in breast cancer, gastric cancer, endometrial and ovarian cancers; and primary prevention intended to treat breast cancer earlier in the treatment spectrum. |

| |

• |

|

Expand our development pipeline by enhancing the clinical and geographic footprint of our technologies. We intend to accomplish this through the initiation of new clinical trials as well as through acquisition of

additional development stage products in related oncology indications. |

| |

• |

|

Leverage valuable partnerships and collaborations, as well as investigator-sponsored clinical trials, to maximize the scope of potential clinical opportunities in a cost effective and efficient manner.

|

| |

• |

|

Focus our resources on our expanding clinical development programs. On November 19, 2015 and December 24, 2015, respectively, we sold our Abstral® (fentanyl) Sublingual Tablets product and our Zuplenz®

(ondansetron) Oral Soluble Film product and related assets, and as of December 31, 2015, we ceased our commercial operations. |

S-1

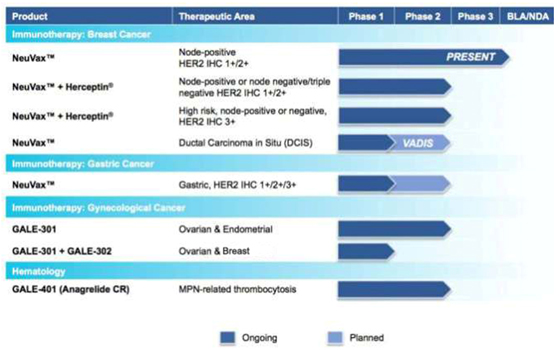

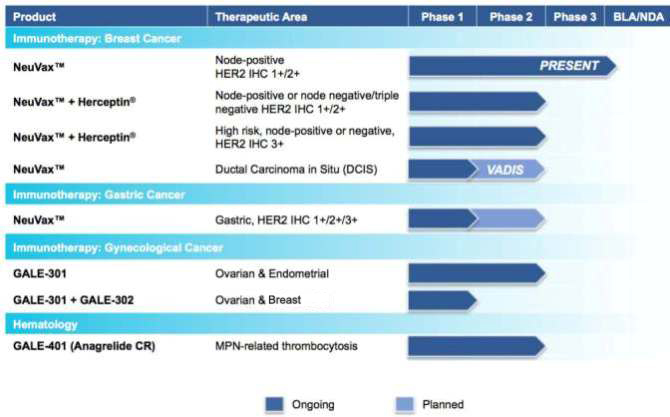

The chart below summarizes the current status of our clinical development pipeline:

Novel Cancer Immunotherapies

Our targeted cancer immunotherapy approach is currently based upon two key areas: preventing secondary recurrence of cancer, which is becoming

increasingly important as the number of cancer survivors continues to grow; and, primary prevention intended to treat breast cancer earlier in the treatment spectrum. Once a patient’s tumor becomes metastatic, the outcome is often fatal, making

the prevention of recurrence a potentially critical component of overall patient care. Our programs primarily target patients in the adjuvant (after-surgery) setting who have relatively healthy immune systems, but may still have residual disease.

Minimal residual disease, or single cancer cells (occult cancer cells) or micrometastasis, that are undetectable by current radiographic scanning technologies, can result in disease recurrence.

Our therapies utilize an immunodominant peptide combined with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating

factor (rhGM-CSF), and work by harnessing the patient’s own immune system to seek out and attack any residual cancer cells. Using peptide immunogens has many potential clinical advantages, including a favorable safety profile, since these drugs

may lack the toxicities typical of most cancer therapies. They also have the potential to evoke long-lasting protection through activation of the immune system and a convenient, intradermal mode of delivery. We are currently engaged in multiple

clinical trials with NeuVax™ (nelipepimut-S), GALE-301, and GALE-302, targeting the prevention of recurrence in breast, gastric, ovarian and endometrial cancers.

NeuVax™ (nelipepimut-S)

NeuVax™ (nelipepimut-S), our lead product candidate, is a cancer immunotherapy targeting human epidermal growth factor receptor (HER2)

expressing cancers. NeuVax is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established and validated target for therapeutic intervention in breast and gastric carcinomas. The NeuVax vaccine is

combined with GM-CSF for injection under the skin, or intradermal administration. Data has shown that an increased presence of circulating tumor cells (CTCs) may predict Disease Free Survival (DFS) and Overall Survival (OS)—suggesting a

dormancy of isolated micrometastases, which, over time, may lead to recurrence. After binding to the specific HLA molecules on antigen presenting cells, the nelipepimut-S sequence stimulates specific cytotoxic T lymphocyte (CTLs). These activated

CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and

intra-antigenic epitope spreading.

Breast Cancer:

According to the National Cancer Institute, over 230,000 women in the U.S. are diagnosed with breast cancer annually. While improved diagnostics and targeted therapies have decreased breast cancer mortality in the U.S., metastatic breast cancer

remains incurable. Approximately 75% of breast cancer patients have tissue test positive for some increased amount of the HER2 receptor, which is associated with disease progression and decreased survival. Only approximately 20% to 30% of all breast

S-2

cancer patients—those with HER2 immunohistochemistry (IHC) 3+ disease, or IHC 2+ and fluorescence in situ hybridization (FISH) positive—have a HER2 directed, approved treatment option

available. This leaves the majority of breast cancer patients with low-to-intermediate HER2 IHC 1+/2+ ineligible for therapy and without an effective targeted treatment option to prevent cancer recurrence.

We have multiple trials currently ongoing for NeuVax. For our pivotal, Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node-

Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) trial, NeuVax is targeting the 30,000-40,000 of the over 230,000 female breast cancer patients annually diagnosed in the U.S. who are at a higher risk of their

breast cancer recurring, which we refer to as “disease recurrence,” after achieving “no evidence of disease” (NED) status, (or becoming a “survivor”) with standard-of-care therapy (surgery, chemotherapy, radiation).

These high-risk patients have a particular molecular signature and disease status: HER2 IHC 1+/2+ (oncoprotein associated with aggressive tumor growth), node positive (disease present in the axillary lymph nodes prior to surgery), and HLA A2/A3

(human leukocyte antigen from A2/A3 patients who have the same loci of genes which represents approximately 65% of the population). Up to 25% of resectable, node-positive breast cancer patients, having no radiographic evidence of disease following

surgery and adjuvant chemo/radiation therapy, are expected to relapse within three years following diagnosis. The prognosis upon recurrence is very poor. These cancer patients presumably still had isolated, undetected tumor CTCs that led to a

recurrence of cancer in the breast (local recurrence) or in another location (metastatic disease). In addition to our Phase 3 trial, we currently have two additional Phase 2 breast cancer trials ongoing with NeuVax in combination with trastuzumab

(Herceptin®; Genentech/Roche) targeting the prevention of recurrence in expanded indications.

We also recently announced our intent

to initiate a Phase 2 trial with NeuVax as a single agent in patients with ductal carcinoma in situ (DCIS) in collaboration with the National Cancer Institute (NCI), potentially positioning NeuVax earlier in the treatment cycle towards primary

prevention. The trial will have an immunological endpoint evaluating NeuVax peptide-specific cytotoxic T lymphocyte (CTL; CD8+ T cell) response in vaccinated patients. DCIS, is defined by the NCI as a noninvasive condition in which abnormal cells

are found in the lining of a breast duct, and is the most common type of breast cancer. The abnormal cells have not spread outside the duct to other tissues in the breast. In some cases, DCIS may become invasive cancer and spread to other tissues,

and at this time, there is no way to know which lesions could become invasive. Current treatment options for DCIS include breast- conserving surgery and radiation therapy with or without tamoxifen, breast-conserving surgery without radiation

therapy, or total mastectomy with or without tamoxifen. According to the American Cancer Society, in 2015 there were an estimated 50,040 diagnoses of DCIS.

Gastric Cancer: Gastric cancer (also known as stomach cancer) is a disease in which the cells forming the inner lining of the stomach

become abnormal and start to divide uncontrollably, forming a cancerous tumor mass. Cancer can develop in any of the five sections of the stomach. Symptoms and outcomes of the disease will vary depending on the location of the cancer. Stomach cancer

is one of the leading causes of cancer deaths in several areas of the world, most notably in Asia. Annually, almost one million people will be diagnosed worldwide with stomach cancer and over 700,000 will die from the disease. More than 90% of

stomach cancers are caused by adenocarcinomas, malignant cancers that originate in glandular tissues. Overexpression of the HER2 receptor occurs in approximately 20% of gastric and gastro-esophageal junction adenocarcinomas, predominantly those of

the intestinal type. Overall, without regard to the stage of cancer, only approximately 28% of patients with stomach cancer live at least five years following diagnosis and new adjuvant treatments are needed to prevent disease recurrence.

We currently have a number of ongoing or planned clinical trials designed to expand the clinical and geographical footprint of NeuVax:

| |

• |

|

Phase 3 Ongoing: Our Phase 3 PRESENT (Prevention of Recurrence in Early- Stage, Node-Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) study

targeted enrollment of 700 HER2 1+/2+ patients under a Special Protocol Assessment (SPA) granted by the U.S. Food and Drug Administration (FDA). The multinational, multicenter, randomized, double-blinded PRESENT trial is ongoing in North America,

Western and Eastern Europe, and Israel. The trial is fully enrolled with 758 patients. |

| |

• |

|

Phase 2b Ongoing: A randomized, multicenter, investigator-sponsored, 300 patient Phase 2b clinical trial is enrolling HER2 1+/2+ node-positive and high-risk node-negative breast cancer patients who are HLA A2+, A3+,

A24+ or A26+ to study NeuVax in combination with trastuzumab in the adjuvant setting. This trial is co-funded by Genentech/Roche (providing both trastuzumab and monetary support) and Galena (providing NeuVax and monetary support). |

| |

• |

|

Phase 2 Ongoing: An investigator-sponsored trial is ongoing to study NeuVax in combination with trastuzumab. The study will enroll 100 node positive and negative HER2 IHC 3+ patients or HER2 gene-amplified breast cancer

patients who are HLA A2+ or HLA A3+ and are determined to be at high-risk for recurrence. Partial funding for this trial comes from the Department of Defense (DoD) through the Congressionally Directed Medical Research Program via legislation known

as the Defense Appropriations Act. The grant was awarded under a Breast Cancer Research Program with the Breakthrough Award given to the lead investigator for the trial. |

S-3

| |

• |

|

Phase 2 Planned: A clinical trial, entitled, VADIS: Phase 2 trial of the Nelipepimut-S Peptide VAccine in Women with DCIS of the Breast is planned to initiate by early 2016. The Phase 2 trial will be a single-blind,

double arm, randomized, controlled trial in pre- or post-menopausal patients with DCIS and are HLA-A2 positive. VADIS will be co-funded and run in collaboration with the National Cancer Institute (NCI). |

| |

• |

|

Phase 2 Planned: A Phase 2 clinical trial in patients with gastric cancer is expected to initiate in 2016. The trial will be run in India by our partner, Dr. Reddy’s Laboratories, Ltd., as part of our NeuVax

commercialization agreement in that region with Dr. Reddy’s. |

GALE-301 and GALE-302

Our second immunotherapy franchise targets folate binding protein receptor-alpha, a well-validated therapeutic target, which has been shown to

be highly over-expressed (20-80 fold) in ovarian, endometrial and breast cancers. Both GALE-301 (E39) and GALE-302 (E39’) are immunogenic peptides that can stimulate CTLs to recognize and destroy FBP-expressing cancer cells. GALE-301 consists

of the FBP peptide E39 combined with GM-CSF, and is currently in a Phase 2a clinical trial for the prevention of recurrence in patients with ovarian and endometrial cancers. GALE-302 is an attenuated version of the E39 peptide and is currently in a

Phase 1b randomized, single-center trial investigating a novel vaccination series using GALE-301 and GALE-302 to evaluate the immune response and monitor long-term immunity. Current treatments after surgery for these diseases are principally with

platinum based chemotherapeutic agents and patients suffer a high recurrence rate; and, most patients relapse with an extremely poor prognosis. Although not powered for efficacy, promising preliminary results from the Phase 2a clinical trial of

GALE-301 were presented in September 2015 at the European Cancer Congress and demonstrated statistically significant data with the estimate for disease free survival at two years at 85.7% (1000 mcg dose group) vs. 33.6% for the control group (p <

.02), and that GALE-301 was well-tolerated with primarily Grade 1 and 2 toxicities and elicited a strong in vivo immune response.

In

November 2015, we presented preliminary data at the Society for Immunotherapy of Cancer Conference on the primary vaccine series (PVS) from a randomized Phase lb trial with GALE-301 and GALE-302 demonstrating that the in vivo immune response is

enhanced with the use of the attenuated E39’ (GALE-302) after E39 (GALE-301). Both agents were shown to be immunogenic and well tolerated with no differences in toxicities between primary vaccine sequences.

Ovarian and Endometrial Cancer: According to the NCI Surveillance, Epidemiology, and End Results (SEER) Program, new cases of ovarian

cancer occur at an annual rate of 12.1 per 100,000 women in the U.S., with an estimated 21,290 cases for 2015. Although ovarian cancer represents about 1.3% of all cancers, it represents about 2.4% of all cancer deaths, or an estimated 14,180

deaths in 2015. Approximately 1.3% of women will be diagnosed with ovarian cancer at some point during their lifetime (2010 – 2012 data). The prevalence of ovarian cancer in the U.S. is about 192,000 women, and the five-year survivorship for

women with ovarian cancer is 45.6%. Due to the lack of specific symptoms, the majority of ovarian cancer patients are diagnosed at later stages of the disease, with an estimated 75% of women presenting with advanced-stage (III or IV) disease. These

patients have their tumors routinely surgically debulked to minimal residual disease, and then are treated with platinum- and/or taxane-based chemotherapy. While many patients respond to this treatment regimen and become clinically free-of-disease,

the majority of these patients will relapse. Depending upon their level of residual disease, the risk for recurrence after completion of primary therapy ranges from 60% to 85%. Unfortunately for these women, once the disease recurs, treatment

options are limited and the disease remains incurable.

According to the NCI SEER Program, new cases of endometrial cancer occur at an

annual rate of 25.1 per 100,000 women in the U.S., with an estimated 54,870 cases for 2015. Although endometrial cancer represents about 3.3% of all cancers, it represents about 1.7% of all cancer deaths, or an estimated 10,170 deaths in 2015.

Approximately 2.8% of women will be diagnosed with endometrial cancer at some point during their lifetime (2010 – 2012 data). The prevalence of endometrial cancer in the U.S. is about 620,000 women, and the five-year survivorship for women with

endometrial cancer is 81.7%.

Hematology

GALE-401 (anagrelide controlled release (CR))

In January 2014, we announced the acquisition of the worldwide rights to anagrelide controlled release (CR), which we renamed GALE-401, through

our acquisition of Mills Pharmaceuticals, LLC. GALE-401 contains the active ingredient anagrelide, an FDA-approved product, for the treatment of patients with myeloproliferative neoplasms (MPNs) to lower abnormally elevated platelet levels. The

currently available immediate release (IR) version of anagrelide causes adverse events that are believed to be dose and plasma concentration dependent. Therefore, reducing the maximum concentration (Cmax) is hypothesized to reduce the side effects,

but preserve efficacy.

S-4

Multiple Phase 1 studies in 98 healthy subjects have shown GALE-401 reduces the Cmax of

anagrelide following oral administration, appears to be well-tolerated at the doses administered, and to be capable of reducing platelet levels. The Phase 1 program provided the desired PK/PD (pharmacokinetic/pharmacodynamic) profile to enable the

initiation of the ongoing Phase 2 proof-of-concept trial. The Phase 2, open label, single arm, proof-of-concept trial enrolled 18 patients in the United States for the treatment of thrombocytosis, or elevated platelet counts in patients with MPNs.

Phase 2 top-line safety and efficacy data was presented in June 2015 at the European Hematology Association 20th Congress, and we expect to present a more mature data set at the 57th American Society of Hematology Annual Meeting in December 2015.

Based on a regulatory meeting with the FDA, Galena believes a 505(b)(2) regulatory filing is an acceptable pathway for development and potential approval of GALE-401.

Myeloproliferative neoplasms: MPNs are a closely related group of hematological malignancies in which the bone marrow cells that produce the

body’s blood cells develop and function abnormally. The main MPNs are Polycythemia Vera (PV), Essential Thrombocythemia (ET), Primary Myelofibrosis (PMF), and Chronic Myelogenous Leukemia (CML), all of which are associated with high platelet

counts. The MPNs are progressive blood cancers that can strike anyone at any age, and for which there is no known cure.

Alliance Partners in

Therapeutic Areas

We are actively looking to leverage our technology platforms by seeking to work with pharmaceutical and

biotechnology partners in a number of therapeutic areas in oncology. Our team has experience targeting products in multiple indications, and based on this experience, we believe we can expand the clinical utility of our current development

candidates as well as discover more drug candidates by working with partners than we can develop with our own resources. We are seeking to work with partners in the discovery and development of drugs in a number of therapeutic areas and technology

platforms.

Intellectual Property

Patents and other intellectual property rights are crucial to our success. It is our policy to protect our intellectual property rights through

available means, including filing and prosecuting patent applications in the U.S. and other countries, protecting trade secrets, and utilizing regulatory protections such as data exclusivity. We also include restrictions regarding use and disclosure

of our proprietary information in our contracts with third parties, and utilize customary confidentiality agreements with our employees, consultants, clinical investigators and scientific advisors to protect our confidential information and

know-how. Together with our licensors, we also rely on trade secrets to protect our combined technology especially where we do not believe patent protection is appropriate or obtainable. It is our policy to operate without infringing on, or

misappropriating, the proprietary rights of others. The following chart summarizes our intellectual property rights:

|

|

|

|

|

|

|

|

|

| Drug Candidate |

|

Indication |

|

Scope |

|

Strategic Partner |

|

Estimated

Exclusivity

Period |

| NeuVax™ (nelipepimut-S) |

|

Breast cancer recurrence |

|

Pending and/or issued |

|

University of

Texas/MDACC/

Henry M. Jackson

Foundation |

|

2028 |

|

|

|

|

|

| NeuVax™ (nelipepimut-S) |

|

Gastric |

|

Pending and/or issued |

|

Dr. Reddy’s

Laboratories |

|

2028 |

|

|

|

|

|

| NeuVax™ (nelipepimut-S) |

|

DCIS |

|

Pending and/or issued |

|

National Cancer

Institute/

University of

Texas, MD

Anderson Cancer

Center |

|

2028 |

|

|

|

|

|

| NeuVax™ in combination with Herceptin® |

|

Breast cancer |

|

Pending and/or issued |

|

Henry M. Jackson

Foundation,

Genentech/Roche |

|

2026 |

|

|

|

|

|

| NeuVax™ in combination with other compounds |

|

Breast cancer |

|

Pending and/or issued |

|

Pending |

|

2037 |

|

|

|

|

|

| GALE-301 & GALE-302 |

|

Breast, ovarian and endometrial cancer |

|

Pending and/or issued |

|

Henry M. Jackson

Foundation |

|

2035 |

|

|

|

|

|

| GALE-401 (Anagrelide Controlled Release) |

|

Platelet Lowering |

|

Pending and/or issued |

|

BioVascular, Inc. |

|

2029 |

S-5

Out-License Agreements

Teva Pharmaceuticals

Effective December 3, 2012, we entered into a license and supply agreement with ABIC Marketing Limited, a subsidiary of Teva

Pharmaceuticals (“ABIC”). Under the agreement, we granted ABIC exclusive rights to seek marketing approval in Israel for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the European

Medicines Agency, and to market, sell and distribute NeuVax in Israel assuming such approval is obtained. ABIC’s rights also include a right of first refusal in Israel for all future indications for which NeuVax may be approved.

Under the license and supply agreement, ABIC will assume responsibility for regulatory registration of NeuVax in Israel, provide financial

support for local development, and commercialize the product in the region in exchange for making royalty payments to us based on future sales of NeuVax. ABIC also agrees in the license and supply agreement to purchase all supplies of NeuVax from us

at a price determined according to a specified formula.

Dr. Reddy’s Laboratories Ltd.

Effective January 14, 2014, we entered into a strategic development and commercialization partnership with Dr. Reddy’s

Laboratories Ltd. (“Dr. Reddy’s”), under which we licensed commercial rights in India to Dr. Reddy’s for NeuVax in breast and gastric cancers. Under the agreement, Dr. Reddy’s will lead the Phase 2 development of

NeuVax in India in gastric cancer, significantly expanding the potential patient population addressable with NeuVax.

Kwangdong

Pharmaceutical Co., Ltd.

Effective April 30, 2009, we entered into a license agreement with Kwangdong Pharmaceutical Co, Ltd

(Kwangdong). Under the agreement, we granted Kwangdong exclusive rights to seek marketing approval in The Republic of Korea (South Korea) for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the

European Medicines Agency, and to market, sell and distribute NeuVax in South Korea assuming such approval is obtained.

Recent Developments (in

reverse chronological order)

Strategic Review of Commercial Operations – Following a strategic review of our

commercial operations, we recently sold our commercial assets.

During the three months ended September 30, 2015, we completed

a strategic review of the commercial business and operations. As a result of the review, we recently sold our Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (odansetron) Oral Soluble Film products and related assets as described below.

On November 19, 2015, we entered into an asset purchase agreement with Sentynl Therapeutics Inc., or Sentynl, pursuant to which we

sold to Sentynl our Abstral® (fentanyl) Sublingual Tablets product and related assets. The assets included our rights in the asset purchase agreement and the license agreement between us and Orexo AB by which we acquired rights in Abstral®.

Our future obligations under the agreements with Orexo AB have been assumed by Sentynl, except that we will continue to be responsible for certain channel liabilities related to Abstral for a specified period of time post-closing. We also will be

responsible for any pre-closing liabilities and obligations related to Abstral and have agreed in the asset purchase agreement to indemnify Sentynl for any breach of our representations, warranties and covenants in the asset purchase agreement up to

a certain agreed upon amount.

The total potential consideration payable to us under the purchase agreement is $12 million, comprised of

an $8 million upfront payment and up to an aggregate of $4 million in future payments based on Sentynl’s achievment of specified net sales of Abstral®.

On December 17, 2015, we entered into an asset purchase agreement with Midatech Pharma PLC, or Midatech, pursuant to which we sold to

Midatech on December 24, 2015 our Zuplenz® (ondansetron) Oral Soluble Film product and related assets. The

S-6

assets included our rights in the license and supply agreement between us and MonoSol Rx, LLC, or MonoSol, by which we acquired rights in Zuplenz. Our future obligations under the MonoSol

agreement have been assumed by Midatech, except that we will continue to be responsible for certain channel liabilities related to Zuplenz for a specific period of time post-closing. We also will be responsible for any pre-closing liabilities and

obligations related to Zuplenz and have agreed in the asset purchase agreement to indemnify Midatech for any breach of our representations, warranties and covenants in the asset purchase agreement up to a certain agreed upon amount.

The total potential consideration payable to us under the purchase agreement is $29.75 million, comprised of an $3.75 million upfront payment

and up to an aggregate of $26 million in future payments based on Midatech’s achievement of specified net sales of Zuplenz®.

In

a separate agreement with MonoSol entered into on December 16, 2015, we and MonSol agreed to amend the MonoSol license and supply agreement in order to reduce the number of field representatives that we were required to maintain with respect to

Zuplenz, and we agreed to pay MonoSol $900,000 of the upfront fee and 20% of any future payments we receive under the Midatech purchase agreement.

In connection with our sale of Abstral, Zuplenz and related assets, we discontinued our commercial operations as of December 31,2015.

Governmental Investigations - We have been subpoenaed in connection with federal investigations.

A federal investigation of two of the high-prescribing physicians of our former Abstral product has resulted in a criminal prosecution of the

two physicians for alleged violations of the federal False Claims Act and other federal statutes. The criminal trial of the two physicians is set for some time in 2016. We have received a trial subpoena for documents and we have been in contact with

the U.S. Attorney’s Office for the Southern District of Alabama, which is handling the criminal trial, and are cooperating in the production of documents. We are not a target or subject of that investigation. There also have been federal and

state investigations of a company that has a product that competes with Abstral in the same therapeutic class, and we have learned that the FDA and other governmental agencies may be investigating our Abstral promotion practices. On

December 16, 2015, we received a subpoena issued by the U.S. Attorney’s Office in District of New Jersey requesting the production of a broad range of documents pertaining to our marketing and promotional practices for Abstral. We have

been in contact with the U.S. Attorney’s Office for the District of New Jersey and are cooperating in the production of the requested documents.

Shareholder Litigation Settlements – We have reached agreements in principle to settle our shareholder

derivative and class action litigations.

On December 3, 2015, we reached an agreement in principle to

settle the consolidated shareholder derivative action, In re Galena Biopharma, Inc. Derivative Litigation, Civil Action No. 3:14-cv-00382-SI, pending in the United States District Court for the District of Oregon against us and certain

of our current and former officers and directors. The settlement will not become effective until approved by the Court. The settlement includes a payment of $15 million in cash by our insurance carriers, which we will use to fund a portion of the

class action settlement, and cancellation of 1,200,000 outstanding director stock options. The settlement also will require that we adopt and implement certain corporate governance measures and will provide that the plaintiffs’ counsel may

apply to the court for an award of attorneys’ fees and expenses up to $5 million, which if awarded by the court to the plaintiffs’ counsel will be paid by our insurance carriers. The settlement will not include any admission of wrongdoing

or liability on the part of us or the individual defendants and will include a full release of us and the current and former officers and directors in connection with the allegations made in the consolidated federal derivative actions and state

court derivative actions.

On December 3, 2015, we also agreed in principal to resolve and settle the securities

putative class action lawsuit, In re Galena Biopharma, Inc. Securities Litigation, Civil Action No. 3:14-cv-00367-SI, pending against us, certain of our current and former officers and directors and other defendants in the United States

District Court for the District of Oregon. The agreement, which is subject to shareholder notice and Court approval, provides for a settlement payment of $20 million to the class and the dismissal of all claims against us and the other defendants in

connection with the consolidated federal securities class actions. Of the $20 million settlement payment to the class, $16.7 million will be paid by our insurance carriers and $3.3 million will be paid by us through a combination of $2.3 million in

cash and $1 million in shares of our common stock. We will be responsible for defense costs and any settlements or judgments incurred for any related opt-out lawsuits.

S-7

GALE-302 Immunological Data Optimizing GALE-301 Presented - We presented

preliminary immunologic data for our GALE-301 and GALE-302 Phase 1b clinical trial at the Society for Immunotherapy of Cancer (SITC) 30th Anniversary Annual Meeting.

On November 7, 2015 we presented the poster, entitled, “Preliminary report of a clinical trial supporting the sequential use

of an attenuated E39 peptide (E39’) to optimize the immunologic response to the FBP (E39+GM-CSF) vaccine,” that compared three primary vaccine series (PVS) sequences of GALE-301 (E39) and GALE-302 (E39’) in ovarian and breast cancer

patients to optimize the ex vivo immune responses, local reactions (LR), and delayed type hypersensitivity (DTH) reactions. The data demonstrated that the in vivo immune response is enhanced with the use of the attenuated E39’

(GALE-302) after E39 (GALE-301). The optimal vaccination sequence utilizing three inoculations of GALE-301 followed by three inoculations of GALE-302 produced the most prominent and statistically significant LR and DTH responses.

Patent Infringement Litigation Settlement – We settled the patent infringement litigation involving Abstral.

On October 27, 2015, we reported that on October 23, 2015 we, Orexo AB and Actavis Laboratories Fl, Inc. (“Actavis”)

had entered into a settlement and license agreement, which will permit Actavis to enter the market with a generic or authorized generic version of Abstral in June 2018 or earlier under certain circumstances. The litigation, Orexo AB v. Actavis

Laboratories FL, Inc., CA No. 3:15-cv-00826, was dismissed with prejudice by the United States District Court for the District of New Jersey, and the settlement and license agreement has been filed with the Federal Trade Commission and the

Department of Justice under applicable law. This settlement and license agreement was assigned to Sentynl pursuant to the asset purchase agreement described above related to our sale of Abstral.

Collaboration with the National Cancer Institute – We announced a Phase 2 clinical trial with NeuVax in Ductal Carcinoma in

Situ Patients.

On September 30, 2015, we announced a collaboration with the National Cancer Institute (NCI) to initiate a

Phase 2 clinical trial with NeuVax in patients diagnosed with Ductal Carcinoma in Situ (DCIS). The trial will be entitled VADIS: Phase 2 trial of the Nelipepimut-S Peptide Vaccine in Women with DCIS of the Breast. The University of Texas M.D.

Anderson Cancer Center (MDACC) Phase I and II Chemoprevention Consortium will be the lead clinical trial site for this multi-center trial with Elizabeth Mittendorf, M.D., Ph.D. serving as the study Principal Investigator. The Consortium is funded

through the Division of Cancer Prevention at NCI, which will provide financial and administrative support for the trial. We will provide NeuVax, as well as additional financial and administrative support. The single-blind, double arm, randomized,

controlled trial is expected to be initiated in the first quarter of 2016.

Financial Condition

We had cash and cash equivalents of approximately $34.8 million as of September 30, 2015. We believe that our existing cash and cash

equivalents together with the net proceeds of this offering should be sufficient to fund our operations for at least one year. This projection is based on our current planned operations and revenue expectations and is subject to changes in our plans

and uncertainties inherent in our business, and we may need to seek to replenish our existing cash and cash equivalents sooner than we project. We also have funding available under our purchase agreement with Lincoln Park Capital Fund, LLC (subject

to the lock-up restrictions described in the “Underwriting” section of this prospectus supplement) and sales agreements with MLV & Co. and Maxim Group LLC described in the accompanying prospectus, but there is no guarantee that

such funding will be available to us on favorable terms or will be sufficient to meet all of our future funding needs.

Corporate Information

Our principal executive offices are located at 2000 Crow Canyon Place, Suite 380, San Ramon, California 94583, and our phone number is

(855) 855-4253. Our website address is www.galenabiopharma.com. We do not incorporate the information on our website into this prospectus, and you should not consider such information part of this prospectus.

We were incorporated as Argonaut Pharmaceuticals, Inc. in Delaware on April 3, 2006 and changed our name to RXi Pharmaceuticals

Corporation on November 28, 2006. On September 26, 2011, we changed our company name from RXi Pharmaceuticals Corporation to Galena Biopharma, Inc.

S-8

The Offering

|

|

|

| Common stock offered by us pursuant to this prospectus supplement |

|

19,772,727 shares (excluding 11,863,636 shares of common stock issuable upon exercise of the warrants being offered in this offering). This prospectus supplement also relates to the offer and sale of the shares of common stock

underlying the warrants being offered by us. |

|

|

| Warrants offered by us |

|

Warrants to purchase up to 11,863,636 shares of our common stock at an exercise price of $1.42 per whole share. The warrants will be exercisable upon issuance and will expire on the five-year anniversary of issuance. See

“Description of Our Securities.” |

|

|

| Common stock to be outstanding after this offering |

|

181,673,173 shares, or 193,536,809 shares of our common stock assuming the warrants offered in this offering were to be immediately issued and exercised in full. |

|

|

| Over-allotment option |

|

We have granted the underwriters a 30-day option to purchase up to 2,965,909 additional shares of common stock at a price of $1.0246 per share and/or additional warrants to purchase up to 1,779,545 shares of common stock at a price

of $0.0094 per warrant to cover over-allotments, if any. |

|

|

| Use of proceeds |

|

We currently intend to use the net proceeds from this offering to fund our Phase 3 PRESENT study of NeuVax and other clinical trials of our product candidates, and to augment our working capital and our general corporate purposes.

See “Use of Proceeds” on page S-25 of this prospectus supplement for more information about our intended use of the net proceeds. |

|

|

| Dividend policy |

|

We do not anticipate paying any cash dividends on our common stock. |

|

|

| The NASDAQ Capital Market symbol |

|

Our common stock is listed on The NASDAQ Capital Market under the symbol “GALE.” The warrants are not and will not be listed on The NASDAQ Capital Market or other securities exchange or nationally recognized trading

system. |

|

|

| Risk factors |

|

Investing in our securities involves significant risks. See “Risk Factors” beginning on page S-11 of this prospectus supplement and on page 1 of the accompanying prospectus and the documents incorporated by reference in

this prospectus supplement and the accompanying prospectus. |

The number of shares of common stock shown above to be outstanding after this offering is based on 161,900,446

shares outstanding as of September 30, 2015 and excludes as of such date:

| |

• |

|

675,000 shares held in treasury; |

| |

• |

|

11,188,443 shares of our common stock subject to outstanding options having a weighted-average exercise price of $2.83 per share; |

| |

• |

|

10,250,759 shares of our common stock reserved for issuance in connection with future awards under our 2007 stock incentive plan; |

| |

• |

|

528,131 shares of our common stock reserved for future sale under our employee stock purchase plan; |

S-9

| |

• |

|

23,308,475 shares of our common stock subject to outstanding warrants having a weighted-average exercise price of $2.10 per share; and |

| |

• |

|

11,863,636 shares of common stock issuable upon exercise of warrants to be issued in this offering. |

The shares of common stock issuable upon the exercise of our outstanding warrants and the exercise price of the warrants are subject to

anti-dilution adjustments in certain circumstances. See “Dilution” for more information about these possible anti-dilution adjustments.

Unless otherwise indicated, the information contained in this prospectus supplement assumes no exercise by the underwriters of their option to

purchase up to an additional 2,965,909 shares of common stock and/or additional warrants to purchase up to 1,779,545 shares of common stock to cover over-allotments, if any.

S-10

RISK FACTORS

Investing in our securities involves significant risks. Before making an investment decision, you should carefully consider the risks

described below, together with the information under “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and the other information incorporated by reference in this prospectus. Some of

these factors relate principally to our business and the industry in which we operate. Other factors relate principally to your investment in our common stock. If any of these risks were to occur, our business, financial condition, results of

operations, cash flows or prospects could be materially and adversely affected. In such case, you may lose all or part of your investment.

The risks and uncertainties described below and in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q

are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations.

Risks Relating to Our Former Commercial Operations

We are subject to U.S. federal and state health care fraud and abuse and false claims laws and regulations, and we recently have been subpoenaed in

connection with marketing and promotional practices related to Abstral. Prosecutions under such laws have increased in recent years and we may become subject to such prosecutions or related litigation under these laws. If we have not fully complied

with such laws, we could face substantial penalties.

Our former commercial operations are subject to various U.S. federal and

state fraud and abuse laws, including, without limitation, the federal False Claims Act, federal Anti-Kickback Statute, and the federal Sunshine Act.

A federal investigation of two of the high-prescribing physicians for Abstral has resulted in the criminal prosecution of the two physicians

for alleged violations of the federal False Claims Act and other federal statutes. The criminal trial is set for some time in 2016. We have received a trial subpoena for documents and we have been in contact with the U.S. Attorney’s Office for

the Southern District of Alabama, which is handling the criminal trial, and are cooperating in the production of documents. We do not believe we are a target or subject of that investigation. There also have been federal and state investigations of

a company that has a product that competes with Abstral in the same therapeutic class, and we have learned that the FDA and other governmental agencies may be investigating our Abstral promotion practices. On December 16, 2015, we received a

subpoena issued by the U.S. Attorney’s Office in District of New Jersey requesting the production of a broad range of documents pertaining to our marketing and promotional practices for Abstral. We have been in contact with the U.S.

Attorney’s Office for the District of New Jersey and are cooperating in the production of the requested documents. We are unable to predict whether we could become subject to legal or administrative actions as a result of these matters, or the

impact of such matters. If we are found to be in violation of the False Claims Act or any other applicable state or and federal fraud and abuse laws, we may be subject to penalties, such as civil and criminal penalties, damages, fines, or an

administrative action of exclusion from government health care reimbursement programs. We can make no assurances as to the time or resources that will need to be devoted to these matters or their outcome, or the impact, if any, that these matters or

any resulting legal or administrative proceedings may have on our business or financial condition.

The federal False Claims Act

prohibits persons from knowingly filing, or causing to be filed, a false claim to, or the knowing use of false statements to obtain payment from, the federal government. Qui tam suits filed under the False Claims Act can be brought by any

individual on behalf of the government and such individuals, commonly known as “relators” or “whistleblowers,” may share in any amounts paid by the entity to the government in fines or settlement. The frequency of filing qui tam

actions has increased significantly in recent years, causing greater numbers of health care companies to have to defend such qui tam actions and pay substantial sums to settle such actions.

The federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving, or providing remuneration,

directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal health care program such as the Medicare and Medicaid

programs. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal health care covered business, the statute has been violated.

The Anti-Kickback Statute is broad, and despite a series of narrow safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the health care industry. Penalties for violations of the federal Anti-Kickback

Statute include criminal penalties and civil and administrative sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal health care programs. An alleged violation of the Anti- Kickback Statute may be

used as a predicate offense to establish liability pursuant to other federal laws and regulations such as the federal False Claims Act. Many states have also adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the

referral of patients for health care items or services reimbursed by any source, not only Medicare and Medicaid programs.

S-11

The federal Patient Protection and Affordable Care Act includes provisions expanding the ability

of certain relators to bring actions that would have been dismissed under prior law. When an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the

government, plus civil penalties for each separate false claim. The Deficit Reduction Act of 2005 encouraged states to enact or modify their state false claims acts to be at least as effective as the federal False Claims Act by granting states a

portion of any federal Medicaid funds recovered through Medicaid-related actions. Most states have enacted state false claims laws, and many of those states included laws including qui tam provisions. The federal Patient Protection and Affordable

Care Act includes provisions known as the Physician Payments Sunshine Act, which requires manufacturers of drugs, biologics, devices and medical supplies covered under Medicare and Medicaid to record any transfers of value to physicians and teaching

hospitals and to report this data beginning in 2013 to the Centers for Medicare and Medicaid Services for subsequent public disclosures. Manufacturers must also disclose investment interests held by physicians and their family members. Failure to

submit the required information may result in civil monetary penalties of up to $1 million per year for knowing violations and may result in liability under other federal laws or regulations. Similar reporting requirements have also been enacted on

the state level in the U.S., and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with health care professionals. In addition, some states such as Massachusetts

and Vermont imposed an outright ban on certain gifts to physicians. These laws could affect our product promotional activities by limiting the kinds of interactions we could have with hospitals, physicians or other potential purchasers or users of

our system. Both the disclosure laws and gift bans also will impose administrative, cost and compliance burdens on us.

We face product liability

exposure and, if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate.

The commercial sale of our products after they are approved exposes us to possible product liability claims. This risk exists even if a

product is approved for commercial sale by the FDA and manufactured in facilities licensed and regulated by the FDA. Our products are designed to affect important bodily functions and processes. Any side effects, manufacturing defects, misuse or

abuse associated with our products could result in injury to a patient or even death. For example, because Abstral is designed to be self-administered by patients, it is possible that a patient could fail to follow instructions and as a result apply

a dose in a manner that results in injury. In addition, Abstral is an opioid pain reliever that contains fentanyl, which is regulated as a “controlled substance” under the Controlled Substances Act of 1970 (the “CSA”) and could

result in harm to patients relating to its potential for abuse. Product liability claims may be brought against us by consumers, health care providers, pharmaceutical companies or others selling or otherwise coming into contact with our products or

generic versions of our products. If we cannot successfully defend ourselves against product liability claims we could incur substantial liabilities. Because we have sold Abstral and Zuplenz, regardless of merit or eventual outcome, product

liability claims may result in:

| |

• |

|

impairment of our business reputation; |

| |

• |

|

costs of related litigation; |

| |

• |

|

distraction of management’s attention from our primary business; or |

| |

• |

|

substantial monetary awards to patients or other claimants. |

We have obtained product

liability insurance coverage for commercial product sales with a $10 million per occurrence and a $10 million annual aggregate coverage limit. We also carry excess product liability insurance coverage for commercial product sales with an additional

$5 million per occurrence and an additional $5 million annual aggregate coverage limit. Our insurance coverage may not be sufficient to cover all of our product liability related expenses or losses and may not cover us for any expenses or losses we

may suffer. Moreover, insurance coverage is becoming increasingly expensive and, in the future, we may not be able to maintain insurance coverage at a reasonable cost, in sufficient amounts or upon adequate terms to protect us against losses due to

product liability. If we determine that it is prudent to increase our product liability coverage based on sales of our products, we may be unable to obtain this increased product liability insurance on commercially reasonable terms or at all. Large

judgments have been awarded in class action or individual lawsuits based on drugs that had unanticipated side effects, including side effects that may be less severe than those of our products. A successful product liability claim or series of

claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and have a material adverse effect our business, results of operations, financial condition and prospects.

Our business involves the use of hazardous materials and we and our third-party manufacturers and suppliers must comply with environmental laws and

regulations, which can be expensive and restrict how we do business.

Our third-party manufacturers and suppliers activities

involve the controlled storage, use and disposal of hazardous materials. We and our manufacturers and suppliers are subject to laws and regulations governing the use, manufacture, storage, handling and

S-12

disposal of these hazardous materials even after we sell or otherwise dispose of the products. In some cases, these hazardous materials and various wastes resulting from their use were stored at

our contractors or manufacturers’ facilities pending use and disposal. We cannot completely eliminate the risk of contamination, which could cause injury to our employees and others, environmental damage resulting in costly clean-up and

liabilities under applicable laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. Although we expect that the safety procedures utilized by our third-party contractors and

manufacturers for handling and disposing of these materials will generally comply with the standards prescribed by these laws and regulations, we cannot guarantee that this will be the case or eliminate the risk of accidental contamination or injury

from these materials. In such an event, we may be held liable for any resulting damages and such liability could exceed our resources. We do not currently carry biological or hazardous waste insurance coverage and our property and casualty and

general liability insurance policies specifically exclude coverage for damages and fines arising from biological or hazardous waste exposure or contamination.

We will continue to be responsible for certain liabilities and obligations related to Abstral and Zuplenz, and if unknown liabilities were to arise it

could have a material adverse effect on us.

Under our respective asset purchase agreements with Sentynl and Midatech, our future

obligations under our former agreements with Orexo AB and MonoSol have been assumed by Sentynl and Midatech, respectively, except that we will continue to be responsible for chargebacks, rebates, patient assistance and certain other product

distribution channel liabilities related to Abstral and Zuplenz for a specified period of time post-closing. We also will be responsible for any pre-closing liabilities and obligations related to Abstral and Zuplenz, including unknown liabilities,

and have agreed in the respective asset purchase agreements to indemnify Sentynl and Midatech for any breach of our representations, warranties and covenants in the respective asset purchase agreements up to a certain agreed to amount. We cannot

quantify these responsibilities to Sentanyl and Midatech, but if substantial unknown liabilities were to arise, it could have a material adverse effect on our financial condition.

Risks Relating to Our Development Programs

Our

drug candidates may not receive regulatory approval or be successfully commercialized.

Before they can be marketed, our products

in development must be approved by the FDA or similar foreign governmental agencies. The process for obtaining FDA approval is both time-consuming and costly, with no certainty of a successful outcome. Before obtaining regulatory approval for the

sale of any drug candidate, we must conduct extensive preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of our product candidates. Although our drug candidates have exhibited no serious adverse events

(“SAEs”) in the Phase 1 and 1/2 clinical trial, SAEs or other unexpected side effects may arising during further testing and development. A failure of any preclinical study or clinical trial can occur at any stage of testing. The results

of preclinical and initial clinical testing of these products may not necessarily indicate the results that will be obtained from later or more extensive testing. It also is possible to suffer significant setbacks in advanced clinical trials, even

after obtaining promising results in earlier trials.

Clinical trial designs that were discussed with the authorities prior to their commencement

may not result in the success of the trials or subsequently may not be considered sufficient for approval. Thus, our special protocol assessment with the FDA for our PRESENT trial does not ensure success of the trial or guarantee regulatory approval

of NeuVax for the treatment of breast cancer.

We reached agreement with the FDA regarding the special protocol assessment, or

SPA, for the design of our NeuVax Phase 3 PRESENT trial as an adjuvant in the treatment of patients with Node positive HER2 negative breast cancer in 2009. A SPA certifies the agreement with the FDA regarding the study endpoints, study design

and statistical assumptions of the clinical trial. The SPA is documented as part of the administrative record, and is binding on the FDA and may not be changed unless we fail to follow the agreed upon protocol, data supporting the test are found to

be false or incomplete, or the FDA determines that a substantial scientific issue essential to determining the safety or effectiveness of the drug was identified after the testing began. In June 2013, the FDA agreed to an amendment to the SPA to

account for the use of a companion diagnostic. Even with a SPA, approval of an NDA or a biological license application is not guaranteed because a final determination that an agreed upon protocol satisfies a specific objective, such as the

demonstration of efficacy, or supports an approval decision, will be based on a complete review of all the data submitted to the FDA. There is no assurance, therefore, that NeuVax Phase 3 PRESENT trial will be successful or that Neu Vax for the

treatment of patients with Node positive HER2 negative breast cancer will be approved by the FDA.

A number of different factors could prevent us

from obtaining regulatory approval or commercializing our product candidates on a timely basis, or at all.

We, the FDA or other

applicable regulatory authorities, an Independent Data Safety Monitoring Board or “IDSMB” governing our clinical trials, or an institutional review board, or “IRB,” which is an independent committee registered with and

S-13

overseen by the U.S. Department of Health and Human Services, or “HHS,” that functions to approve, monitor and review biomedical and behavioral research involving humans, may suspend

clinical trials of a drug candidate at any time for various reasons, including if we or it believe the subjects or patients participating in such trials are being exposed to unacceptable health risks. Among other reasons, adverse side effects of a

drug candidate on subjects or patients in a clinical trial could result in the FDA or other regulatory authorities suspending or terminating the trial and refusing to approve a particular drug candidate for any or all indications of use.

Clinical trials of a new drug candidate require the enrollment of a sufficient number of patients, including patients who are suffering from

the disease the drug candidate is intended to treat and who meet other eligibility criteria. Rates of patient enrollment are affected by many factors, and delays in patient enrollment can result in increased costs and longer development times than

we expect at present. Patients who are enrolled at the outset of this standard of care also may eventually choose for personal reasons not to participate in the study. We also compete for eligible patients with other breast cancer trials underway

from time to time, and we may experience delays in patient enrollment due to the dependency of other large trials underway in the same patient population.

Clinical trials also require the review and oversight of IRBs, which approve and continually review clinical investigations to protect the

rights and welfare of human subjects. An inability or delay in obtaining IRB approval could prevent or delay the initiation and completion of clinical trials, and the FDA may decide not to consider any data or information derived from a clinical

investigation not subject to initial and continuing IRB review and approval.

In addition, cancer vaccines are a relatively new form of

therapeutic treatment and a very limited number of such products have received regulatory approval. Therefore, the FDA or other regulatory authority may apply standards for approval of a new cancer vaccine that is different from past experience.

Numerous factors could affect the timing, cost or outcome of our drug development efforts, including the following:

| |

• |

|

difficulties or delays in enrolling patients in our Phase 1/2 clinical trials of GALE-301 (folate binding protein (FBP) vaccine), our Phase 2 clinical trial of GALE-401 (anagrelide controlled release) or other clinical

trials in conformity with required protocols or projected timeline or in our other NeuVax clinical trials; |

| |

• |

|

conditions imposed on us by the FDA, including the possibility that the FDA would require an additional Phase 3 trial of NeuVax, or comparable foreign authorities regarding the scope or design of our clinical trials;

|

| |

• |

|

difficulties or delays in arranging for third parties to conduct clinical trials of our product candidates; |

| |

• |

|

problems in engaging IRBs to oversee trials or problems in obtaining or maintaining IRB approval of studies; |

| |

• |

|

third-party contractors failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner; |

| |

• |

|

our drug candidates having very different chemical and pharmacological properties in humans than in laboratory testing and interacting with human biological systems in unforeseen, ineffective or harmful ways, and the

possibility that our previous Phase 2 trials will not be indicative of our drug candidates’ performance in larger patient populations; |

| |

• |

|

the need to suspend or terminate our clinical trials if the participants are being exposed to unacceptable health risks; |

| |

• |

|

insufficient or inadequate supply or quality of our drug candidates or other necessary materials necessary to conduct our clinical trials; |

| |

• |

|

disruption at our foreign clinical trial sites resulting from local social or political unrest or other geopolitical factors; |

| |

• |

|

effects of our drug candidates not being the desired effects or including undesirable side effects or the drug candidates having other unexpected characteristics; |

| |

• |

|

negative or inconclusive results from our clinical trials or the clinical trials of others for drug candidates similar to our own or inability to generate statistically significant data confirming the efficacy of the

product being tested; |

| |

• |

|

adverse results obtained by other companies developing similar drugs; |

S-14

| |

• |

|

modification of the drug during testing; and |

| |

• |

|

reallocation of our financial and other resources to other clinical programs. |

It is possible

that none of the product candidates that we develop will obtain the appropriate regulatory approvals necessary for us to begin selling them or that any regulatory approval to market a product may be subject to limitations on the indicated uses for

which we may market the product. The time required to obtain FDA and other approvals is unpredictable but often can take years following the commencement of clinical trials, depending upon the complexity of the drug candidate. Any analysis we

perform of data from clinical activities is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. Any delay or failure in obtaining required approvals could have a material

adverse effect on our ability to generate revenue from the particular drug candidate.

In addition, the length of time to develop the

product candidates as well as any regulatory delays in the development and regulatory approval process could cause the patent exclusivity to be unavailable or greatly reduced for each product candidate. The lack of patent exclusivity could have a

material adverse effect on our ability to generate revenue from the particular drug candidate.

We are also subject to numerous foreign

regulatory requirements governing the conduct of clinical trials, manufacturing and marketing authorization, pricing and third-party reimbursement. The foreign regulatory approval process includes all of the risks associated with the FDA approval

described above as well as risks attributable to the satisfaction of local regulations in foreign jurisdictions. Approval by the FDA does not assure approval by regulatory authorities outside of the U.S.

We are dependent upon contract manufacturers for clinical supplies of our product candidates, including our sole source of supply of a key component of

our Phase 3 PRESENT study of NeuVax.

We do not have the facilities or expertise to manufacture supplies of any of our product

candidates for clinical trials. Accordingly, we are dependent upon contract manufacturers for these supplies. There can be no assurance that we will be able to secure needed supply arrangements on reasonable terms, or at all. Our failure to secure

these arrangements as needed could have a materially adverse effect on our ability to complete the development of our product candidates or, if we obtain regulatory approval for our product candidates, to commercialize them.

Our current plans call for the manufacture of our compounds by contract manufacturers offering research grade, Good Laboratory Practices grade

and Good Manufacturing Practices grade materials for preclinical studies (e.g., toxicology studies) and for clinical use. Certain of our product candidates are complex molecules requiring many synthesis steps, which may lead to challenges with

purification and scale-up. These challenges could result in increased costs and delays in manufacturing.

NeuVax is administered in

combination with Leukine, a “GM-CSF” available in both liquid and lyopholyzed forms exclusively from Genzyme Corporation, or “Genzyme,” a subsidiary of Sanofi-Aventis. We will continue to be dependent on Genzyme for our supply of

Leukine in connection with the ongoing NeuVax and GALE-301 trials and the potential commercial manufacture of these programs. Any temporary interruptions or discontinuation of the availability of Leukine, or any determination by us to change the

GM-CSF used with NeuVax or GALE-301, may have a material adverse effect on our clinical trials and any commercialization of the assets.

We may not

be able to establish or maintain the third-party relationships that are necessary to develop or potentially commercialize some or all of our product candidates.

We expect to depend on collaborators, partners, licensees, clinical research organizations and other third parties to support our discovery

efforts, to formulate product candidates, to manufacture our product candidates, and to conduct clinical trials for some or all of our product candidates. We cannot guarantee that we will be able to successfully negotiate agreements for or maintain

relationships with collaborators, partners, licensees, clinical investigators, vendors and other third parties on favorable terms, if at all. Our ability to successfully negotiate such agreements will depend on, among other things, potential

partners’ evaluation of the superiority of our technology over competing technologies and the quality of the preclinical and clinical data that we have generated, and the perceived risks specific to developing our product candidates. If we are