SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

December 31, 2015

Date of Report (Date of earliest event reported)

SolarWindow Technologies, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

333-127953

(Commission File Number)

59-3509694

(I.R.S. Employer Identification No.)

10632 Little Patuxent Parkway

Suite 406

Columbia, Maryland 21044

(Address of principal executive offices)

(800) 213-0689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry Into a Material Definitive Agreement.

On December 31, 2015, SolarWindow Technologies, Inc. (the "Company") entered into a Second Amended Bridge Loan Agreement (the "Amendment") with Kalen Capital Corporation ("KCC"), a corporation owning in excess of 10% of the Company's common stock, pursuant to which KCC agreed to extend the maturity date of the loan in the principal amount of $3,000,000 (the "Loan") KCC originally made to the Company on October 7, 2013, as amended on November 10, 2014, from December 31, 2015 to December 31, 2017.

In order to induce KCC to enter into the Amendment and extend the maturity date of the Loan, the Company issued to KCC a Series N Stock Purchase Warrant (the "Series N Warrant") to purchase up to 767,000 shares of the Company's common stock at an exercise price of $3.38 per share through December 31, 2020; the Series N Warrant contains a provision allowing the holder to exercise the Series N Warrant on a cashless basis as further set forth therein. The Company also agreed to extend the termination date of all of KCC's then outstanding warrants to December 31, 2020.

The foregoing descriptions of the Series N Warrant and the Amendment contained herein do not purport to be complete and are qualified in their entirety by reference to the full text of the respective document filed as Exhibit 4.1 and Exhibit 10.1 hereto and are incorporated herein by reference.

The information provided in response to Item 5.02 of this report is incorporated by reference into this Item 1.01.

Item 3.02. Unregistered Sales of Equity Securities.

The information provided in response to Item 1.01 of this report is incorporated by reference into this Item 3.02. The issuance of the securities was completed in accordance with the exemption provided by, without limitation, Section 4(a)(2) of the Securities Act of 1933, as amended (the "Securities Act") and Regulation S of the ("Regulation S"), as promulgated thereunder, as the sale of the securities were completed in an "offshore transaction, as defined in Rule 902(h) of Regulation S, the Company did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. The investor was not a US person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a US person.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On January 5, 2016, the Company granted to each member of its Board of Directors (the "Board"), John Conklin, Alastair Livesey and Joseph Sierchio, 30,000 shares, 90,000 shares in the aggregate, (the "Shares") of the Company's common stock pursuant to the Company's 2006 Incentive Stock Option Plan. As part of the grant of the Shares the Company and each of the Board members entered into a Lock-Up Agreement (the "Lock-Up Agreement") pursuant to which the Board members agreed that for a period of one year from the date of entry they will not, without the express written consent of the Company, make, offer to make, agree to make, or suffer any Disposition, as defined in the Lock-Up Agreement, of more than 25% of the Shares.

The description of the Lock-Up Agreement set forth herein is qualified in its entirety by reference to the full text of the Lock-Up Agreement, a form of which is attached hereto as Exhibit 10.2.

On January 2016, the Board increased the annual cash retainer for each of its non-employee directors from $17,000 to $18,000, beginning on March 1, 2016.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

Exhibit No. | | Description |

| | |

4.1 | | Series N Stock Purchase Warrant |

| | |

10.1 | | Second Amended Bridge Loan Agreement between SolarWindow Technologies, Inc. and Kalen Capital Corporation dated December 31, 2015 |

| | |

10.2 | | Form of Lock-Up Agreement |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on January 7, 2016.

| SolarWindow Technologies, Inc. | |

| | | | |

| By: | /s/ John Conklin | |

| Name: | John Conklin | |

| Title: | President and Chief Executive Officer | |

3

EXHIBIT 4.1

NEITHER THIS SECURITY NOR ANY SECURITIES WHICH MAY BE ISSUED UPON EXERCISE OF THIS SECURITY HAVE BEEN REGISTERED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY U.S. STATE OR OTHER JURISDICTION OR ANY EXCHANGE OR SELF-REGULATORY ORGANIZATION, IN RELIANCE UPON EXEMPTIONS FROM REGISTRATION UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, AND SUCH OTHER LAWS AND REQUIREMENTS, AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD, EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR LISTING OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, SUCH REGISTRATION AND/OR LISTING REQUIREMENTS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH WILL BE REASONABLY ACCEPTABLE TO THE COMPANY.

SOLARWINDOW TECHNOLOGIES, INC.

FORM OF SERIES N STOCK PURCHASE WARRANT

No. N-0001 | December 31, 2015 |

SolarWindow Technologies, Inc., a Nevada corporation (the "Company"), hereby certifies that Kalen Capital Corporation, its permissible transferees, designees, successors and assigns (collectively, the "Holder"), for value received, is entitled to purchase from the Company at any time and from time to time commencing on the date first appearing above (the "Issuance Date"), up to and through 12:01a.m. (EST) on the date five (5) years from the Issuance Date (the "Termination Date") up to 767,000 shares (each, a "Share" and collectively the "Shares") of the Company's common stock, par value $0.001 (the "Common Stock"), at an exercise price per Share of $3.38 (the "Exercise Price"). The number of Shares purchasable hereunder and the Exercise Price are subject to adjustment as provided in Section 4 hereof.

1. Method of Exercise; Payment.

(a) Exercise. The purchase rights represented by this Warrant may be exercised, either for cash or on a cashless basis, by the Holder, in whole or in part, at any time, or from time to time, by the surrender of this Warrant (with the notice of exercise form (the "Notice of Exercise") attached hereto as Exhibit A duly executed) at the principal office of the Company, and by paymentto the Company of an amount equal to the Exercise Price multiplied by the number of the Shares being purchased, which amount may be paid, at the election of the Holder, by wire transfer or certified check payable to the order of the Company. The person or persons in whose name(s) any certificate(s) representing Shares shall be issuable upon exercise of this Warrant shall be deemed to have become the holder(s) of record of, and shall be treated for all purposes as the record holder(s) of, the Shares represented thereby (and such Shares shall be deemed to have been issued) immediately prior to the close of business on the date or dates upon which this Warrant is exercised.

In the event Holder wishes to exercise this Warrant by means of a "cashless exercise" in which Holder shall be entitled to receive a certificate for the number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

(A) equals the closing price of the Company's Common Stock, as reported (in order of priority) on the Trading Market on which the Company's Common Stock is then listed or quoted for trading on the Trading Date preceding the date of the election to exercise; or, if the Company's Common Stock is not then listed or traded on a Trading Market, then the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Recipient and the Company;

(B) equals the Exercise Price of the Warrant, as adjusted from time to time in accordance herewith; and

(X) equals the number of Warrant Shares Holder wishes to exercise in accordance with the terms of this Warrant by means of a cashless exercise.

(b) Stock Certificates. In the event of any exercise of the rights represented by this Warrant, as promptly as practicable after this Warrant is surrendered and delivered to the Company along with all other appropriate documentation on or after the date of exercise and in any event within ten (10) days thereafter, the Company at its expense shall issue and deliver to the person or persons entitled to receive the same a certificate or certificates for the number of Shares issuable upon such exercise. In the event this Warrant is exercised in part, the Company at its expense will execute and deliver a new Warrant of like tenor exercisable for the number of Shares for which this Warrant may then be exercised.

(c) Taxes. The issuance of the Shares upon the exercise of this Warrant, and the delivery of certificates or other instruments representing such Shares, shall be made without charge to the Holder for any tax or other charge in respect of such issuance.

2. Warrant.

(a) Transfer and Replacement. Subject to compliance with applicable securities laws, this Warrant and all rights hereunder (including, without limitation, any registration rights) are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto as Exhibit B duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Company shall execute and deliver a new Warrant or Warrants in the name of the assignee or assignees and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Warrant evidencing the portion of this Warrant not so assigned, and this Warrant shall promptly be cancelled. A Warrant, if properly assigned, may be exercised by a new holder for the purchase of Warrant Shares without having a new Warrant issued. The Holder consents that the Company may, if it desires, permit the transfer of this Warrant out of the Holder's name only when the Holder's request for transfer is accompanied by an opinion of counsel reasonably satisfactory to the Company that neither the sale nor the proposed transfer results in a violation of the Securities Act of 1933, as amended (the "Securities Act"), or any applicable state "blue sky" laws. At any time prior to the exercise hereof, this Warrant may be exchanged upon presentation and surrender to the Company, alone or with other warrants of like tenor of different denominations registered in the name of the same Holder, for another warrant or warrants of like tenor in the name of such Holder exercisable for the aggregate number of Shares as the warrant or warrants surrendered.

(b) Replacement of Warrant. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction, or mutilation of this Warrant and, in the case of any such loss, theft, or destruction, upon delivery of an indemnity agreement reasonably satisfactory in form and amount to the Company, or, in the case of any such mutilation, upon surrender and cancellation of this Warrant, the Company, at its expense, will execute and deliver in lieu thereof, a new Warrant of like tenor.

(c) Cancellation; Payment of Expenses. Upon the surrender of this Warrant in connection with any transfer, exchange or replacement as provided in this Section 3, this Warrant shall be promptly canceled by the Company. The Holder shall pay all taxes and all other expenses (including legal expenses, if any, incurred by the Holder or transferees) and charges payable in connection with the preparation, execution and delivery of Warrants pursuant to this Section 3.

(d) Warrant Register. The Company shall maintain, at its principal executive offices (or at the offices of the transfer agent for the Warrant or such other office or agency of the Company as it may designate by notice to the holder hereof), a register for this Warrant (the "Warrant Register"), in which the Company shall record the name and address of the person in whose name this Warrant has been issued, as well as the name and address of each transferee and each prior owner of this Warrant.

3. Rights and Obligations of Holders of this Warrant.

The Holder of this Warrant shall not, by virtue hereof, be entitled to any rights of a shareholder in the Company, either at law or in equity; provided, however, that in the event any certificate representing shares of Common Stock or other securities is issued to the holder hereof upon exercise of this Warrant, such holder shall, for all purposes, be deemed to have become the holder of record of such Common Stock on the date on which this Warrant, together with a duly executed Notice of Exercise, was surrendered and payment of the aggregate Exercise Price was made, irrespective of the date of delivery of such Common Stock certificate.

4. Adjustments.

During the Exercise Period, the Exercise Price and the number of Warrant Shares shall be subject to adjustment from time to time as provided in this Section 4.

(a) Subdivision or Combination of Common Stock. If the Company at any time subdivides (by any stock split, stock dividend, recapitalization, reorganization, reclassification or otherwise) the shares of Common Stock acquirable hereunder into a greater number of shares, then, after the date of record for effecting such subdivision, the Exercise Price in effect immediately prior to such subdivision will be proportionately reduced. If the Company at any time combines (by reverse stock split, recapitalization, reorganization, reclassification or otherwise) the shares of Common Stock acquirable hereunder into a smaller number of shares, then, after the date of record for effecting such combination, the Exercise Price in effect immediately prior to such combination will be proportionately increased.

(b) Adjustment in Number of Shares. Upon each adjustment of the Exercise Price pursuant to the provisions of this Section 4, the number of shares of Common Stock issuable upon exercise of this Warrant shall be adjusted by multiplying a number equal to the Exercise Price in effect immediately prior to such adjustment by the number of shares of Common Stock issuable upon exercise of this Warrant immediately prior to such adjustment and dividing the product so obtained by the adjusted Exercise Price.

(c) Consolidation, Merger or Sale. In case of any consolidation of the Company with, or merger of the Company into any other corporation, or in case of any sale or conveyance of all or substantially all of the assets of the Company other than in connection with a plan of complete liquidation of the Company, then as a condition of such consolidation, merger or sale or conveyance, adequate provision will be made whereby the holder of this Warrant will have the right to acquire and receive upon exercise of this Warrant in lieu of the shares of Common Stock immediately theretofore acquirable upon the exercise of this Warrant, such shares of stock, securities or assets as may be issued or payable with respect to or in exchange for the number of shares of Common Stock immediately theretofore acquirable and receivable upon exercise of this Warrant had such consolidation, merger or sale or conveyance not taken place. In any such case, the Company will make appropriate provision to insure that the provisions of this Section 5 hereof will thereafter be applicable as nearly as may be in relation to any shares of stock or securities thereafter deliverable upon the exercise of this Warrant. The Company will not effect any consolidation, merger or sale or conveyance unless prior to the consummation thereof, the successor corporation (if other than the Company) assumes by written instrument the obligations under this Section 4 and the obligations to deliver to the holder of this Warrant such shares of stock, securities or assets as, in accordance with the foregoing provisions, the holder may be entitled to acquire.

(d) Distribution of Assets. In case the Company shall declare or make any distribution of its assets (including cash) to holders of Common Stock as a partial liquidating dividend, by way of return of capital or otherwise, then, after the date of record for determining shareholders entitled to such distribution, but prior to the date of distribution, the holder of this Warrant shall be entitled upon exercise of this Warrant for the purchase of any or all of the shares of Common Stock subject hereto, to receive the amount of such assets which would have been payable to the holder had such holder been the holder of such shares of Common Stock on the record date for the determination of shareholders entitled to such distribution.

(e) Notice of Adjustment. Upon the occurrence of any event which requires any adjustment of the Exercise Price, then, and in each such case, the Company shall give notice thereof to the holder of this Warrant, which notice shall state the Exercise Price resulting from such adjustment and the increase or decrease in the number of Warrant Shares purchasable at such price upon exercise, setting forth in reasonable detail the method of calculation and the facts upon which such calculation is based. Such calculation shall be certified by the Chief Financial Officer of the Company.

(f) Minimum Adjustment of Exercise Price. No adjustment of the Exercise Price shall be made in an amount of less than 1% of the Exercise Price in effect at the time such adjustment is otherwise required to be made, but any such lesser adjustment shall be carried forward and shall be made at the time and together with the next subsequent adjustment which, together with any adjustments so carried forward, shall amount to not less than 1% of such Exercise Price.

(g) No Fractional Shares. No fractional shares of Common Stock are to be issued upon the exercise of this Warrant, but the Company shall round up the number of shares to the issued.

(h) Other Notices. In case at any time:

| | (i) | the Company shall declare any dividend upon the Common Stock payable in shares of stock of any class or make any other distribution (including dividends or distributions payable in cash out of retained earnings) to the holders of the Common Stock; |

| | | |

| | (ii) | the Company shall offer for subscription pro rata to the holders of the Common Stock any additional shares of stock of any class or other rights; |

| | | |

| | (iii) | there shall be any capital reorganization of the Company, or reclassification of the Common Stock, or consolidation or merger of the Company with or into, or sale of all or substantially all its assets to, another corporation or entity; or |

| | | |

| | (iv) | there shall be a voluntary or involuntary dissolution, liquidation or winding up of the Company; |

then, in each such case, the Company shall give to the holder of this Warrant (a) notice of the date on which the books of the Company shall close or a record shall be taken for determining the holders of Common Stock entitled to receive any such dividend, distribution, or subscription rights or for determining the holders of Common Stock entitled to vote in respect of any such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation or winding-up and (b) in the case of any such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation or winding-up, notice of the date (or, if not then known, a reasonable approximation thereof by the Company) when the same shall take place. Such notice shall also specify the date on which the holders of Common Stock shall be entitled to receive such dividend, distribution, or subscription rights or to exchange their Common Stock for stock or other securities or property deliverable upon such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation, or winding-up, as the case may be. Such notice shall be given at least 30 days prior to the record date or the date on which the Company's books are closed in respect thereto. Failure to give any such notice or any defect therein shall not affect the validity of the proceedings referred to in clauses (i), (ii), (iii) and (iv) above.

(i) Certain Events. If any event occurs of the type contemplated by the adjustment provisions of this Section 4 but not expressly provided for by such provisions, the Company will give notice of such event as provided in Section 9 hereof, and the Company's Board of Directors will make an appropriate adjustment in the Exercise Price and the number of shares of Common Stock acquirable upon exercise of this Warrant so that the rights of the holder shall be neither enhanced nor diminished by such event.

5. Legends.

Prior to issuance of the shares of Common Stock underlying this Warrant, all such certificates representing such shares shall bear a restrictive legend to the effect that the Shares represented by such certificate have not been registered under the Securities Act, and that the Shares may not be sold or transferred in the absence of such registration or an exemption therefrom, such legend to be substantially in the form of the bold-face language appearing at the top of Page 1 of this Warrant.

6. Disposition of Warrants or Shares.

The Holder of this Warrant, each transferee hereof and any holder and transferee of any Shares, by his or its acceptance thereof, agrees that no public distribution of Warrants or Shares will be made in violation of the provisions of the Securities Act. Furthermore, it shall be a condition to the transfer of this Warrant that any transferee thereof deliver to the Company his or its written agreement to accept and be bound by all of the terms and conditions contained in this Warrant.

7. Merger or Consolidation.

The Company will not merge or consolidate with or into any other corporation, or sell or otherwise transfer its property, assets and business substantially as an entirety to another corporation, unless the corporation resulting from such merger or consolidation (if not the Company), or such transferee corporation, as the case may be, shall expressly assume, by supplemental agreement reasonably satisfactory in form and substance to the Holder, the due and punctual performance and observance of each and every covenant and condition of this Warrant to be performed and observed by the Company.

8. Notices.

Except as otherwise specified herein to the contrary, all notices, requests, demands and other communications required or desired to be given hereunder shall only be effective if given in writing by certified or registered U.S. mail with return receipt requested and postage prepaid; by private overnight delivery service (e.g. Federal Express); by facsimile transmission (if no original documents or instruments must accompany the notice); or by personal delivery. Any such notice shall be deemed to have been given (a) on the business day immediately following the mailing thereof, if mailed by certified or registered U.S. mail as specified above; (b) on the business day immediately following deposit with a private overnight delivery service if sent by said service; (c) upon receipt of confirmation of transmission if sent by facsimile transmission; or (d) upon personal delivery of the notice. All such notices shall be sent to the following addresses (or to such other address or addresses as a party may have advised the other in the manner provided in this Section 9):

If to the Company:

SolarWindow Technologies, Inc.

10632 Little Patuxent Parkway

Suite 406

Columbia, Maryland 21044

President and Chief Executive Officer

If to the Holder:

Kalen Capital Corporation

688 West Hastings St.

Suite 700

Vancouver, BC V6B 1P1

Canada

Attention: President

Notwithstanding the time of effectiveness of notices set forth in this Section 8, a Notice of Exercise shall not be deemed effectively given until it has been duly completed and submitted to the Company together with this original Warrant and payment of the Exercise Price in a manner set forth in this Section 8.

9. Governing Law.

This Agreement shall be governed by and construed solely and exclusively in accordance with and pursuant to the internal laws of the State of New York without regard to the conflicts of laws principles thereof. The parties hereto hereby expressly and irrevocably agree that any suit or proceeding arising directly and/or indirectly pursuant to or under this Agreement shall be brought solely in a federal or state court located in the City of New York. By its execution hereof, the parties hereby covenant and irrevocably submit to the in personam jurisdiction of the federal and state courts located in the City of New York, New York and agree that any process in any such action may be served upon any of them personally, or by certified mail or registered mail upon them or their agent, return receipt requested, with the same full force and effect as if personally served upon them in New York. The parties hereto expressly and irrevocably waive any claim that any such jurisdiction is not a convenient forum for any such suit or proceeding and any defense or lack of in personam jurisdiction with respect thereto. In the event of any such action or proceeding, the party prevailing therein shall be entitled to payment from the other party hereto of all of its reasonable counsel fees and disbursements.

10. Successors and Assigns.

This Warrant shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns.

11. Headings.

The headings of various sections of this Warrant have been inserted for reference only and shall not affect the meaning or construction of any of the provisions hereof.

12. Severability.

If any provision of this Warrant is held to be unenforceable under applicable law, such provision shall be excluded from this Warrant, and the balance hereof shall be interpreted as if such provision were so excluded.

13. Modification and Waiver.

This Warrant and any provision hereof may be amended, waived, discharged or terminated only by an instrument in writing signed by the Company and the Holder.

14. Specific Enforcement.

The Company and the Holder acknowledge and agree that irreparable damage would occur in the event that any of the provisions of this Warrant were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties shall be entitled to an injunction or injunctions to prevent or cure breaches of the provisions of this Warrant and to enforce specifically the terms and provisions hereof, this being in addition to any other remedy to which either of them may be entitled by law or equity.

15. Assignment.

This Warrant may be transferred or assigned, in whole or in part, at any time and from time to time by the then Holder by submitting this Warrant to the Company together with a duly executed Assignment in substantially the form and substance of the Form of Assignment which accompanies this Warrant as Exhibit B hereto, and, upon the Company's receipt thereof, and in any event, within five (5) business days thereafter, the Company shall issue a Warrant to the Holder to evidence that portion of this Warrant, if any as shall not have been so transferred or assigned.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Company has caused this Warrant to be duly executed by one of its officers thereunto duly authorized.

| SOLARWINDOW TECHNOLOGIES, INC. | |

| | | | |

| By: | /s/ John Conklin | |

| Name: | John Conklin | |

| Title: | President & Chief Executive Officer | |

EXHIBIT A

NOTICE OF EXERCISE

To Be Executed by the Holder in Order to Exercise the Warrant

The undersigned Holder hereby elects to purchase _______ Shares pursuant to the attached Warrant, and requests that certificates for securities be issued in the name of:

__________________________________________________________

__________________________________________________________

__________________________________________________________

(Please type or print name and address)

__________________________________________________________

(Social Security or Tax Identification Number)

and to be delivered to:______________________________________________________________

___________________________________________________________________.

(Please type or print name and address if different from above)

If such number of Shares being purchased hereby shall not be all the Shares that may be purchased pursuant to the attached Warrant, a new Warrant for the balance of such Shares shall be registered in the name of, and delivered to, the Holder at the address set forth below.

In full payment of the purchase price with respect to the Shares purchased and transfer taxes, if any, the undersigned hereby tenders payment of $__________ by check, money order or wire transfer payable in United States currency to the order of [________________].

OR

If permitted, the cancellation of such number of Shares as is necessary, in accordance with the formula set forth in Section 1(a) of the Warrant with respect to the maximum number of Shares purchasable pursuant to the cashless exercise procedure set forth Section 1(a).

| HOLDER: | |

| | | |

| By: | | |

Name: | | |

Title: | | |

Address: | | |

| | |

Dated: | | |

8

EXHIBIT 10.1

SECOND AMENDED BRIDGE LOAN AGREEMENT

THIS SECOND AMENDEDBRIDGE LOAN AGREEMENT is dated as of December 31, 2015, by and between SolarWindow Technologies, Inc., a corporation organized under the laws of the State of Nevada ("Borrower"), and Kalen Capital Corporation, a corporation organized under the laws of the Province of Alberta, Canada ("Creditor").

W I T N E S S E T H:

WHEREAS, Borrower and Creditor have entered into Bridge Loan Agreement dated as of October 7, 2013 (the "Original Agreement"), pursuant to which Creditor agreed to make a loan to Borrower in the principal amount of THREE MILLION DOLLARS (US$3,000,000) (the "Loan Amount");

WHEREAS, on November 10, 2014, Borrower and Creditor entered into an Amended Bridge Loan Agreement (the "First Amendment") pursuant to which the parties agreed to extend the maturity date of the Loan to December 31, 2015; and

WHEREAS, Borrower and Creditor desire to extend the maturity date of the Loan to December 31, 2017 (the "Maturity Date"), all on the terms and conditions set forth herein;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Certain Definitions. In addition to other words and terms defined elsewhere in this Agreement, all capitalized but undefined terms used herein shall have the meaning set forth in the First Amendment.

2. Agreement to Extend Maturity Date. Subject to the terms and conditions hereof and relying upon the representations and warranties herein set forth, Creditor agrees to extend the maturity date of the Loan Amount and all accrued but unpaid interest due thereon to December 31, 2017. All references in the Amended Note to Maturity Date shall mean December 31, 2017. Unless requested by Creditor, no new promissory note shall be issued.

3. Issuance of Warrant. Contemporaneously with the signing of this Agreement, Borrower shall issue to Creditor such documentation as required to evidence the issuance of a Series N Stock Purchase Warrant (the "Series N Warrant") to purchase up to 767,000 shares of Borrower's common stock, representing approximately 15% of the shares and warrants that would have been issuable to Creditor had it converted the Loan Amount and all accrued but unpaid interest on the date hereof. The exercise price of the Series N Warrant shall be $3.83 per share, representing an approximately 15% discount to the volume weighted average price of the Borrower's shares of common stock for the 20 trading days prior to the date hereof. The Series N Warrant shall be exercisable for a period of five (5) years from the date of issuance and shall have a provision allowing the holder to exercise the warrant on a cashless basis.

4. Extension of Warrants. As consideration for Creditor agreeing to extend the Loan to the Maturity Date, Borrower hereby agrees to extend the termination date of all of Creditor's existing warrants to the later of: (i) the current termination date of the respective warrant, or (ii) December 31, 2020 (the "Extended Termination Date"). If requested by Creditor, Borrower shall exchange any current warrant for a new warrant evidencing the Extended Termination Date. Notwithstanding the foregoing, Creditor shall not be obligated to exchange any warrant and Borrower hereby agrees to amend its warrant registry to reflect the Extended Termination Date.

5. Conversion to Units of Borrower's Equity Securities. Creditor may elect, in its sole discretion, to convert all or any portion of the outstanding principal amount of the Loan, and any or all accrued and unpaid interest thereon into units of Borrower's equity securities as further set forth in the First Amendment. Notwithstanding the foregoing, the parties hereto agree that the warrant issuable as part of the Units upon conversion of the Loan shall have a floor of $1.00. Additionally, the parties agree that any reference in the First Amendment to Series L Warrant shall be changed to "Warrant," the series of which shall be designated at the time of issuance in the event of conversion by Creditor.

6. No Other Changes. Except as specifically set forth herein, the First Amendment shall remain in full force and effect

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties have entered into this Second Amended Bridge Loan Agreement as of the date first written above.

| SolarWindow Technologies, Inc. | |

| | | |

| By: | /s/ John Conklin | |

Name: | John Conklin | |

Title: | President and Chief Executive Officer | |

| | |

| | |

Kalen Capital Corporation | |

| | |

By: | /s/ Harmel S. Rayat | |

Name: | Harmel S. Rayat | |

Title: | President | |

2

EXHIBIT 10.2

LOCK-UP AGREEMENT

THIS LOCK-UP AGREEMENT (this "Agreement") is made and entered into as of this 5th day of January, 2016 (the "Effective Date") by and among SolarWindow Technologies, Inc. a corporation organized under the laws of the State of Nevada (the "Company") and the shareholder whose name appears on the signature page hereto ("Shareholder"). The Company and Shareholder may hereinafter be referred to as a "Party" and collectively as the "Parties."

RECITALS

WHEREAS, Shareholder is a member of the Company's Board of Directors (the "Board");

WHEREAS, for his service as a member of the Board, Shareholder was issued 30,000 shares of Company common stock, par value $0.001 (the "Shares"); and

WHEREAS, as part of the issuance of the Shares by the Board the Shareholder agreed to enter into this Agreement with Company;

NOW, THEREFORE, in reliance on the foregoing recitals and in consideration of and for the mutual covenants contained herein, the Parties hereto agree as follows:

1. Lock-Up by the Shareholder. The Shareholder hereby agrees that, without prior written consent of the Company, from the Effective Date until the first anniversary of the Effective Date (the "Lock-Up Period") will not make, offer to make, agree to make, or suffer any Disposition (as defined below) of more than twenty-five percent (25%) of the Shares or any interest therein. For the purposes of this Agreement, "Disposition" shall mean any sale, exchange, assignment, gift, pledge, mortgage, hypothecation, transfer or other disposition or encumbrance of all or any part of the rights and incidents of ownership of the Shares, including the right to vote, and the right to possession of the Shares as collateral for indebtedness, whether such transfer is outright or conditional, or for or without consideration.

2. Restriction On Proxies and Non-Interference. The Shareholder hereby agrees that, during the Lock-Up Period, Shareholder will not (i) grant any proxies or powers of attorney that would permit any such proxy or attorney-in-fact to take any action inconsistent herewith; (ii) deposit the Shares into a voting trust or enter into a voting agreement with respect to the Shares; or (iii) take any action that would make any representation or warranty of such Shareholder untrue or incorrect or would result in a breach by that Shareholder of its obligations under this Agreement. Shareholder further agrees not to enter into any agreement or understanding with any other person or entity, the effect of which would be inconsistent with or violative of any provision contained in this Agreement.

3. Representations and Warranties of the Shareholder. Shareholder hereby represents and warrants to the Company the following:

a. Ownership of Shares. Shareholder is the sole record and beneficial owner of the Shares. Shareholder has sole voting power and sole power to issue instructions with respect to the matter set forth in this Agreement, sole power of disposition, and sole power to agree to all of the matters set forth in this Agreement, in each case with respect to all of such Shares, with no limitations, qualifications or restrictions on such rights, subject to applicable securities laws and the terms of this Agreement.

b. Authorization. Shareholder has the requisite legal capacity and competency, and the full legal right to execute and deliver this Agreement and perform its obligations hereunder. This Agreement has been duly and validly executed and delivered by the Shareholder and constitutes a valid and binding agreement enforceable against the Shareholder in accordance with its terms except (i) as may be limited by applicable bankruptcy, insolvency or similar laws affecting creditors' rights, and (ii) that the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court before which any proceeding therefore may be brought.

c. No Conflicts. Except for filings, authorizations, consents and approvals as may be required under the Securities Act of 1933, as amended (the "Securities Act") and the Securities Exchange Act of 1934, as amended , (i) no filing with, and no permit, authorization, consent or approval of, any state or federal governmental authority, or any other person or entity, is necessary for the execution of this Agreement by Shareholder and the consummation by Shareholder of the transactions contemplated hereby, and (ii) neither the execution and delivery of this Agreement by Shareholder, the consummation by Shareholder of the transactions contemplated hereby, or compliance by Shareholder with any of the provisions hereof will (A) result in a violation or breach of, or constitute a default (or give rise to any third party right of termination, cancellation, material modification or acceleration) under any of the terms, conditions or provisions of any note, loan agreement, bond, mortgage, indenture, license, contract, commitment, arrangement, understanding, agreement or other instrument or obligation of any kind to which Shareholder is a party or by which Shareholder or any of its properties or assets may be bound, or (B) violate any order, writ, injunction, decree, judgment, statute, role or regulation applicable to such Shareholder or any of his properties or assets.

d. No Encumbrances. Shareholder owns the Shares free and clear of all liens, claims, security interests, proxies, voting trusts or agreements, or any other encumbrances whatsoever, except for (i) any such matters arising hereunder and (ii) bona fide pledges of such shares as security for obligations owed to the Company.

4. Representations and Warranties of the Company. The Company has full legal right, power and authority to enter into and perform all of its obligations under this Agreement. The execution and delivery of this Agreement by the Company has been authorized by all necessary corporate action on the part of the Company and will not violate any other agreement to which the Company is a party. This Agreement has been duly executed and delivered by the Company and constitutes a legal, valid and binding agreement of the Company, enforceable in accordance with its terms, except as the enforcement thereof may be limited in bankruptcy, insolvency, reorganization, moratorium or similar laws.

5. Entire Agreement. This Agreement constitutes the entire understanding and agreement of the Parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements or understandings, inducements or conditions, express or implied, written or oral, between the Parties.

6. Certain Events. Shareholder agrees that this Agreement and the obligations hereunder shall attach to his Company stock and shall be binding upon any other person or entity to which legal or beneficial ownership of the Shares shall pass, whether by operation of law or otherwise, including, without limitation, such Shareholder's heirs, guardians, administrators or successors. Notwithstanding any such transfer of the Shares, the transferor shall remain liable for the performance of all obligations under this Agreement of the transferor.

7. Rights of Assignees; Third Party Beneficiaries. This Agreement shall be binding upon, inure to the benefit of, and be enforceable by, the Parties and their respective heirs, executors, administrators, legal representatives, successors and permitted assigns. Nothing expressed in this Agreement is intended or shall be construed to give any person or entity other than the Parties or their respective heirs, executors, administrators, legal representatives, successors or permitted assigns, any legal or equitable right, remedy or claim under this Agreement or any provision contained herein.

8. Specific Performance. The Parties acknowledge that money damages are an inadequate remedy for breach of this Agreement because of the difficulty of ascertaining the amount of damage that will be suffered by the non-breaching Party in the event this Agreement is breached. Therefore, each Party agrees that the non-breaching Party may obtain specific performance of this Agreement without the necessity of establishing irreparable harm or posting any bond, and will be in addition to any other remedy to which such Party may be entitled at law or in equity.

9. Amendment and Waivers. Any term or provision of this Agreement may be amended, and the observance of any term of this Agreement may be waived (either generally or in a particular instance and either retroactively or prospectively) only by a writing signed by the Party to be bound thereby. The waiver by a Party of any breach hereof for default in the performance hereof shall not be deemed to constitute a waiver of any other default or any succeeding breach or default.

10. Attorneys' Fees. Should suit be brought to enforce or interpret any part of this Agreement, the prevailing party shall be entitled to recover, as an element of the costs of suit and not as damages, reasonable attorneys' fees to be fixed by the court (including without limitation, costs, expenses and fees on any appeal). The prevailing party shall be the party entitled to recover its costs of suit, regardless of whether such suit proceeds to final judgment. A party not entitled to recover its costs shall not be entitled to recover attorneys' fees. No sum for attorneys' fees shall be counted in calculating the amount of a judgment for purposes of determining if a party is entitled to recover costs or attorneys' fees.

11. Section Headings. Headings contained in this Agreement are inserted only as a matter of convenience and in no way define, limit, or extend the scope or intent of this Agreement or any provisions hereof.

12. Governing Law and Venue. This Agreement will be governed by and construed and enforced in accordance with the laws of the State of New York, without regard to its choice of law principles, applicable to a contract executed and to be performed in the State of New York. Each Party hereto (i) agrees to submit to personal jurisdiction and to waive any objection as to venue in the state or federal courts located in New York county, New York, (ii) agrees that any action or proceeding shall be brought exclusively in such courts, unless subject matter jurisdiction or personal jurisdiction cannot be obtained, and (iii) agrees that service of process on any party in any such action shall be effective if made by registered or certified mail addressed to such Party at the address specified herein, or to any other addresses as he, she or it may from time to time specify to the other Parties in writing for such purpose. The exclusive choice of forum set forth in this paragraph shall not be deemed to preclude the enforcement of any judgment obtained in such forum or the taking of any action under this Agreement to enforce such judgment in any appropriate jurisdiction.

13. Independent Counsel and Rules of Construction. The Parties acknowledge and agree that they have been advised to, and have had the opportunity to, seek independent counsel and advice with respect to the terms of this Agreement. As such, this Agreement has been negotiated at arm's length between persons sophisticated and knowledgeable in these types of matters. Additionally, any normal rules of construction that would require a court to resolve matters of ambiguities against the drafting party are hereby waived and shall not apply in interpreting this Agreement.

14. Notices. All notices, requests and other communications to any party hereunder shall be sent to the address or email address set forth on the signature page hereto.

15. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original as against any party whose signature appears thereon and all of which together shall constitute one and the same instrument.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Parties have entered into this Lock-Up Agreement as of the date first written above.

COMPANY | | | |

| | | | | |

SolarWindow Technologies, Inc. | | Address: | |

| | | | | |

| | | | 10632 Patuxent Parkway | |

| | | | Suite 406 | |

| | | | Columbia, MD 21044 | |

| | | | john@solarwindow.com | |

| | | | | |

By: | /s/ John Conklin | | | | |

Name: | John Conklin | | | | |

Title: | President and Chief Executive Officer | | | | |

| | | | | |

| | | | | |

SHAREHOLDER | | | | |

| | | | | |

| | | Address: | | |

| | | | | |

By: | | | | | |

Name: | | | | | |

4

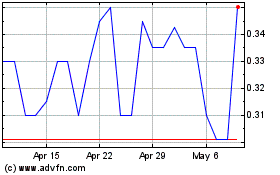

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

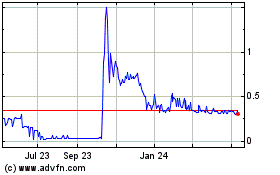

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Apr 2023 to Apr 2024