Lloyds Probe Opens New Front in Government Scrutiny of Markets

January 07 2016 - 2:40AM

Dow Jones News

Broad government scrutiny of possible market rigging has

deepened with a probe by the U.K.'s financial watchdog into trading

of British government bonds by Lloyds Banking Group PLC, according

to people familiar with the matter.

The Financial Conduct Authority's inquiry, which is at an early

stage, is examining whether Lloyds traders sought to increase their

profits, either by driving down the prices that the British bonds,

known as gilts, fetched in government auctions, or by artificially

inflating their prices when the bonds were sold on to other

investors, one person said.

The investigation is currently focused on individual traders at

Lloyds and isn't a broader industrywide probe into the massive gilt

market, one person said. Lloyds in recent months has been handing

over information to the FCA, and some of its traders have retained

outside lawyers, the people said.

The probe is yet another front opening in government

investigations into the manipulation of crucial markets. Since

2012, authorities in the U.S., Britain and elsewhere have levied

more than $10 billion in penalties on some of the world's biggest

banks for trying to rig widely used interest-rate and

foreign-exchange benchmarks. As a result of those cases, those

banks have been obligated to turn over to prosecutors any evidence

of additional wrongdoing, spurring further probes.

Now, markets ranging from U.S. Treasurys to debt issued by

global quasigovernmental agencies have drawn attention from

law-enforcement authorities. And while major banks have settled

currency probes focused on trading between euros and U.S. dollars,

the Justice Department still is looking at individuals involved in

some of those cases, and could bring charges later this year, some

of the people said. Other probes are focused on possible

manipulation of other currencies, such as the Russian ruble and the

Brazilian real.

Taken together, the continuing investigations suggest banks will

remain in the cross hairs of prosecutors and regulators for many

months with the potential for new, sizable penalties. They also

appear to indicate that problems that at first appeared limited to

a handful of markets may be more widespread than that.

One active investigation centers around debt issued by

subsovereigns, supranationals and agencies, or SSAs, which is

currently worth $2.4 trillion in outstanding instruments, according

to Barclays' bond indices.

The U.S. Justice Department and other regulators are looking at

whether traders at different institutions colluded to set prices in

those markets, according to people familiar with the matter. The

FCA has been assisting the Justice Department in that

investigation, which focuses in large part on London-based traders,

some of the people said.

Companies including Bank of America Corp's Merrill Lynch and

Nomura Holdings Inc. recently have suspended London-based traders

in connection with the Justice Department's investigation in the

market for SSA bonds, according to regulatory records and people

familiar with the matter. Reuters earlier reported the suspensions,

and said traders at Credit Suisse and Cré dit Agricole are also

under investigation.

This group of SSA borrowers includes the World Bank and the

European Investment Bank, which raise billions of dollars every

year to invest in development projects. In the U.S., such issuers

include mortgage-finance giants Fannie Mae and Freddie Mac.

As previously reported by The Wall Street Journal, the market

for trading in U.S. government debt also has come under scrutiny by

the Justice Department and regulators. A number of banks have been

turning over information as authorities, including the Securities

and Exchange Commission and the Commodity Futures Trading

Commission, seek evidence of possible manipulation.

Previous investigations were aided by strong evidence of traders

openly discussing their efforts in Bloomberg chat rooms. Some of

the continuing probes, including the further currency

investigations, so far haven't unearthed as much strong evidence,

people familiar with the matter said. Government and internal bank

investigators in the inquiries are examining recordings of phone

calls between traders for similar evidence, which is a more

time-consuming process, the people said.

In some of the cases, U.S. prosecutors still are trying to

determine whether there is a strong U.S. connection to justify

bringing a case, including whether harmed customers were based in

the country, since much of the trading occurred overseas.

The SSA bond investigation and the continuing foreign-currency

probes are similar to earlier cases in the interest-rate-benchmark

and currency markets, which invoked antitrust theories that

multiple banks had colluded to set prices. But the Treasurys

manipulation probe, being handled by the Fraud Section at the

Justice Department, is focused on whether traders at individual

banks used customer information to trade ahead of them, people

familiar with the probes said.

Write to David Enrich at david.enrich@wsj.com, Aruna Viswanatha

at Aruna.Viswanatha@wsj.com and Christopher Whittall at

christopher.whittall@wsj.com

(END) Dow Jones Newswires

January 07, 2016 02:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

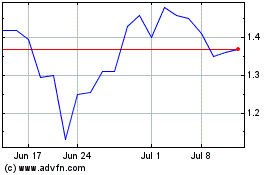

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

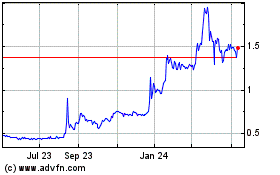

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024