UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 16, 2015

iSign Solutions Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-19301

|

|

94-2790442

|

|

(State or other

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

jurisdiction of

|

|

|

|

Identification No.)

|

|

incorporation)

|

|

|

|

|

275 Shoreline Drive, Suite 500

Redwood Shores, CA 94065

(Address of principal executive offices)

(650) 802-7888

Registrant's telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 16, 2015, the Company held its 2015 Annual Meeting of Stockholders (the "Annual Meeting") at which the stockholders voted upon (i) the election of seven directors, and (ii) ratification of the appointment of Armanino LLP as the Company's independent auditors for the year ending December 31, 2015. The stockholders elected each of the director nominees and approved the ratification of the appointment of Armanino LLP as the Company's independent auditors for the fiscal year ending December 31, 2015.

As of November 16, 2015, the record date for the 2015 Annual Meeting, the Company had 234,307,542 shares of Common Stock outstanding, 928,657 shares of Series A-1 Cumulative Convertible Preferred Stock ("Series A-1 Preferred Stock") outstanding, 13,190,949 shares of Series B Participating Convertible Preferred Stock ("Series B Preferred Stock") outstanding, 5,356,259 shares of Series C Participating Convertible Preferred Stock ("Series C Preferred Stock") outstanding, 7,877,863 shares of Series D-1 Participating Convertible Preferred Stock ("Series D-1 Preferred Stock") outstanding, and 6,223,488 shares of Series D-2 Participating Convertible Preferred Stock ("Series D-2 Preferred Stock") outstanding. Shares of Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock and Series D-2 Preferred Stock have no separate vote by class except as provided under the provisions of the Company's Certificate of Incorporation or as required by applicable law, and instead vote with the holders of Common Stock on an as-converted basis. As of the record date, each share of Series A-1 Preferred Stock was convertible into 7.1429 shares of Common Stock, each share of Series B Preferred Stock was convertible into 23.0947 shares of Common Stock, each share of Series C Preferred Stock was convertible into 44.4444 shares of Common Stock, each share of Series D-1 Preferred Stock was convertible into 44.4444 shares of Common Stock, and each share of Series D-2 Preferred Stock was convertible into 20.0000 shares of Common Stock. Accordingly, as of the record date, the 928,657 outstanding shares of Series A-1 Preferred Stock were convertible into 6,633,304 shares of Common Stock, the 13,190,949 outstanding shares of Series B Preferred Stock were convertible into 304,011,802 shares of Common Stock, the 5,356,293 outstanding shares of Series C Preferred Stock were convertible into 238,055,717 shares of Common Stock, the 7,877,863 shares of Series D-1 Preferred Stock were convertible into 350,126,894 shares of Common Stock, and the 6,223,488 shares of Series D-2 Preferred Stock were convertible into 124,469,760 shares of Common Stock. Thus, the holders of Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock, and Series D-2 Preferred Stock were entitled to 6,633,304, 304,011,802, 238,055,717, 350,126,894, and 124,469,760 votes, respectively, for their shares of Preferred Stock. Shares of Common Stock, Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock, and Series D-2 Preferred Stock representing an aggregate of 847,842,933 votes on an as-converted basis were voted in person or by proxy at the 2015 Annual Meeting.

With the exception of the election of directors Philip Sassower, Andrea Goren and Michael Engmann to the Company's Board of Directors, who are elected only by the holders of the Company's Series B Preferred Stock and Series C Preferred Stock under the provisions of the Company's Certificate of Incorporation, all matters voted on by the Company's stockholders at the Company's 2015 Annual Meeting were voted on by the holders of the Company's Common Stock, Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock, and Series D-2 Preferred Stock voting together on an as-converted basis. The table below sets forth information regarding the results of the voting at the 2015 Annual Meeting.

Proposal 1: Election of Directors

The stockholders voted to elect the following individuals as directors for a one-year term as follows (shares of Common Stock, Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock, and Series D-2 Preferred Stock presented together on an as-converted basis):

|

Nominees

|

For

|

Withheld

|

Broker Non-Votes

|

|

Mr. Jeffrey Holtmeier

|

738,690,060

|

7,376,996

|

101,775,887

|

|

Mr. David Welch

|

738,689,860

|

7,377,196

|

101,775,877

|

|

Mr. Stanley Gilbert

|

743,694,204

|

2,372,852

|

101,775,877

|

|

Mr. Francis Elenio

|

745,355,018

|

712,038

|

101,775,877

|

The stockholders voted to elect the following individuals as directors for a one-year term as follows (shares of Series B Preferred Stock and Series C Preferred Stock presented together on an as-converted basis):

| Nominees |

For |

Withheld |

Broker Non-Votes |

|

Mr. Phillip Sassower

|

362,403,837

|

0

|

0

|

|

Mr. Andrea Goren

|

362,403,837

|

0

|

0

|

|

Mr. Michael Engmann

|

362,403,837

|

0

|

0

|

Proposal 2: Ratification of Auditors

The stockholders ratified the appointment of Armanino LLP as the Company's independent auditors for the year ending December 31, 2015 (shares of Common Stock, Series A-1 Preferred Stock, Series B Preferred Stock, Series C Preferred Stock, Series D-1 Preferred Stock, and Series D-2 Preferred Stock presented together on an as-converted basis):

|

For

|

Against

|

Abstain

|

|

846,072,597

|

1,370,736

|

399,600

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Communication Intelligence Corporation

|

|

Date: January 6, 2016

|

|

|

D

|

By:

|

/s/ Andrea Goren

|

|

|

|

|

|

|

|

|

Andrea Goren

|

|

|

|

Chief Financial Officer

|

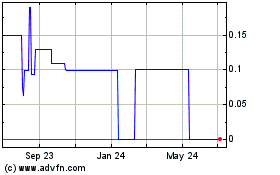

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

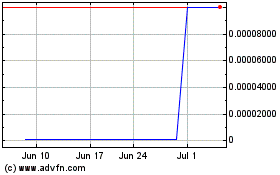

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Apr 2023 to Apr 2024