UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

December 13, 2015

F5 Networks, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Washington | | 000-26041 | | 91-1714307 |

| | | | |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

|

| | |

| | |

401 Elliott Avenue West | | |

Seattle, WA | | 98119 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (206) 272-5555

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

F5 Networks, Inc. (the “Company” or “F5”) previously reported on a current report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 14, 2015 that John McAdam had been appointed as the Company’s President and Chief Executive Officer and that Manuel Rivelo had resigned as the Company’s President and Chief Executive Officer and as a director, effective December 13, 2015.

The Company approved a compensation arrangement for Mr. McAdam as F5’s President and Chief Executive Officer. On December 30, 2015, the Company approved for Mr. McAdam an annual base salary rate of $910,000 and a target bonus for the last three quarters of fiscal year 2016 of 130% of his base salary rate for such period. In addition, the Company will on February 1, 2016 provide Mr. McAdam restricted stock units having an aggregate target fair market value of approximately $3,750,000 on the date of grant, of which 40% of the target value of the restricted stock units will be time-based restricted unit awards and 60% of the target value of the awards will be performance-based restricted stock units (with such number of performance-based restricted stock units potentially being higher or lower depending on actual performance). These restricted stock unit awards will vest to the extent applicable quarterly through the first quarter of fiscal 2017, without a continuous service requirement, and otherwise be subject to such other terms as set forth in the F5 Networks, Inc. 2014 Incentive Plan and applicable award agreements.

Further, in connection with Mr. Rivelo’s resignation from the Company in December 2015 (approximately five-sixths through the first quarter of fiscal 2016), the Company and Mr. Rivelo entered into a waiver and non-competition agreement and general release of all claims, whereby Mr. Rivelo agreed to, among other things, non-competition, non-solicitation and non-disparagement obligations in exchange for Mr. Rivelo having the opportunity to continue to vest through February 2016 in 3,867 time-based restricted stock units and 3,867 performance-based restricted stock units assuming at target Company performance for the first quarter of fiscal 2016 (with such number of performance-based restricted stock units potentially being higher or lower depending on actual first quarter fiscal 2016 performance). These restricted stock unit amounts represent approximately five-sixths of that number of restricted stock units that would have vested in February 2016 for the first quarter of fiscal 2016 if Mr. Rivelo’s service with the Company had not terminated. Mr. Rivelo forfeited the remainder of his restricted stock units. In addition, Mr. Rivelo will receive a cash bonus for the first quarter of fiscal year 2016 calculated in accordance with the Company’s executive compensation program for fiscal year 2016, which will be prorated at five-sixths of the bonus amount that Mr. Rivelo would have been paid for the first quarter of fiscal year 2016 if his service with the Company had not terminated. In accordance with applicable law, if Mr. Rivelo does not revoke this agreement during the statutory seven-day revocation period, it will become fully effective.

The foregoing description of the waiver and non-competition agreement and general release of all claims does not purport to be complete and is qualified in its entirety by reference to the full text of the agreement, which is attached to this current report on Form 8-K/A as Exhibit 10.1 and is incorporated herein by reference.

|

| |

Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits:

|

| |

10.1 | Waiver and Non-Competition Agreement and General Release of All Claims by and between Manuel Rivelo and F5 Networks, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| F5 NETWORKS, INC. (Registrant) | |

Date: January 6, 2016 | By: | /s/ Scot F. Rogers | |

| | Scot F. Rogers | |

| | Executive Vice President and General Counsel | |

EXHIBIT INDEX

|

| | |

| | |

Exhibit No. | | Description |

10.1 | | Waiver and Non-Competition Agreement and General Release of All Claims by and between Manuel Rivelo and F5 Networks, Inc. |

WAIVER AND NON-COMPETITION AGREEMENT

AND GENERAL RELEASE OF ALL CLAIMS

This Waiver and Non-Competition Agreement and General Release (“Agreement”) is entered into by Manuel Rivelo (“Employee”) and F5 Networks, Inc. (“Company” or “Employer”).

BACKGROUND

A. Employee's employment relationship with the Company will be or has been terminated as of December 13, 2015 (the “Separation Date”).

B. Employee and the Company wish to enter into an Agreement to clarify and resolve any disputes that may exist between them arising out of the employment relationship and its termination, and any continuing obligations of the parties to one another following the end of the employment relationship.

C. The Company has advised Employee of the right to consult an attorney prior to signing this Agreement and has provided Employee with up to 21 calendar days to consider its severance offer and to seek legal assistance. Employee has either consulted an attorney or voluntarily elected not to consult legal counsel, and understands that this Agreement constitutes a waiver of all potential claims against the Company.

D. This Agreement is not and should not be construed as an admission or statement by either party that it or any other party has acted wrongfully or unlawfully. Both parties expressly deny any wrongful or unlawful action.

AGREEMENT

In consideration for the covenants herein and other valuable consideration, Employer and Employee agree as follows:

1.EMPLOYMENT SEPARATION DATE. Employee's employment relationship with the Company will be or has been terminated as of the Separation Date. Employee claims and shall claim no further right to employment by Employer beyond the Separation Date. Employee understands and agrees that the terms contained in the Agreement are offered by the Company contingent upon Employee’s resignation from his position as a Director on Employer's Board of Directors, effective at the pleasure of the Board, as well as any and all other director, officer and managerial positions he holds with any of the subsidiaries of the Company. If Employee fails to execute and hand-deliver a Letter of Resignation, in the form attached as Exhibit A to this Agreement, to Scot F. Rogers, Executive V.P. and General Counsel, by 6:00 p.m. Pacific time December 12, 2015, the terms offered in this Agreement are null and void.

2.WAGES AND BENEFITS. Employee acknowledges that Employee has been paid all compensation, benefits, vacation and other amounts owed Employee for all time worked through the Separation Date. Coverage under Employer’s group medical plan is effective through December 2015. Any funds Employee has in Employer’s 401(k) plan shall be handled in accordance with the terms and conditions of that plan. Except as otherwise provided in this Agreement, all other compensation and benefits shall cease on the Separation Date. Other than the foregoing and the amounts set forth in Section 3 of this Agreement, Employer shall owe Employee no further compensation and/or benefits.

3.CONSIDERATION. In recognition of his work for Employer, and specifically to support the release and non-competition and non-solicitation provisions provided herein, Employer shall provide Employee with the following consideration contingent on Employee’s compliance with the Employee’s obligations under this Agreement:

The vesting of service-based restricted stock units representing the Employee’s right to receive 3867 shares of the Company’s common stock granted under the F5 Networks, Inc. 2014 Incentive Plan as amended and restated (the “Plan”) shall continue until such shares vest fully on February 1, 2016 as set forth in Appendix 1 to this Agreement or such earlier time as set forth in the Plan (the “Continuing Time-Based Awards”). Such Continuing Time-Based Awards will continue to vest until fully vested on February 1, 2016 pursuant to the terms of the Plan and Employee’s grant

|

| | |

Manuel Rivelo | Confidential | Page 1 of 7 |

documents, including his Award Agreements, provided that the Company agrees that the vesting of such Continuing Time-Based Awards to the extent listed on Appendix 1 will not be subject to the Continuous Service requirement as set forth in the Employee’s Award Agreement and defined in the Plan. Employee agrees that the only performance-based restricted stock units with respect to which he has the opportunity to vest on or after the Separation Date are the performance-based restricted stock units set forth on Appendix 1 hereto as the “Continuing Performance-Based Awards”, which have the opportunity to vest with respect to the first quarter of Fiscal Year 2016 (the “Continuing Performance-Based Awards”). Employee agrees that he forfeits on his Separation Date all restricted stock units other than the Continuing Time-Based Awards and the Continuing Performance-Based Awards and he will not have the opportunity to receive any Company stock with respect to performance-based restricted stock units other than the Continuing Performance-Based Awards and will not have the opportunity to receive any Company stock with respect to service-based restricted stock units other than the Continuing Time-Based Awards.

A cash bonus for the first quarter of Fiscal Year 2016 in accordance with the executive compensation plan for Fiscal Year 2016 as approved by the Compensation Committee and the Board of the Company will be prorated at five-sixths of the amount that would have been paid to Employee for the first quarter of Fiscal Year 2016 if Employee’s service had not terminated and such prorated cash bonus will be paid to Employee at substantially the same time other executives receive such cash bonus compensation for the first quarter of Fiscal Year 2016.

Employee acknowledges and agrees that except as required by this Agreement, Employer has no obligation to provide any of the above-stated consideration. Employee further acknowledges and agrees that Employer provides the consideration set forth in this Section 3 as consideration for the covenants and release herein, including but not limited to the non-compete and non-solicitation obligations set forth in Section 8 below, that such vesting and payment would not be provided by Employer in the absence of this Agreement, and that such vesting and payment constitute adequate consideration for the covenants and release set forth in this Agreement. All consideration shall be less appropriate taxes and withholdings.

4.WAIVER AND RELEASE. Except for claims based on an alleged breach of this Agreement, Employee, on behalf of himself and Employee’s marital community, heirs, executors, administrators and assigns, expressly waives against Employer, its present and former businesses, subsidiaries and affiliates, and their collective current and former officers, directors, employees, managers, agents, trustees, representatives, general and limited partners, members and attorneys (all of which are collectively referred to as “Released Parties”) any and all claims, damages, causes of action or disputes, whether known or unknown, based upon acts or omissions relating to Employee's employment or the end of Employee's employment with Employer, occurring or that could be alleged to have occurred on or prior to the execution of this Agreement; and further release, discharge and acquit Released Parties, individually and in their representative capacities, from such claims, damages, causes of action or disputes. This waiver and release includes, but is not limited to, any and all claims for wages, employment benefits, and damages of any kind whatsoever arising out of any contracts, expressed or implied; any covenant of good faith and fair dealing; estoppel or misrepresentation; discrimination or retaliation on any unlawful basis; harassment; unjust enrichment; wrongful termination or constructive discharge; any federal, state, local or other governmental statute or ordinance, including, without limitation, Title VII of the Civil Rights Act of 1964, as amended; the Americans with Disabilities Act; the Fair Labor Standards Act; the Employee Retirement Income Security Act, as amended; the Civil Rights Act of 1866; the Older Workers Benefit Protection Act; the Age Discrimination in Employment Act (“ADEA”); any state or federal wage payment statute; or any other legal limitation on the employment relationship.

Employee acknowledges that Released Parties are in no way liable for any released claims described in this Section. Employee agrees to defend and indemnify Released Parties (including payment of fees as incurred) against any such claims whether made by him or on behalf of him to the full extent permitted by law. Excluded from this release are claims that Employee may have with regard to vested benefits under ERISA or any other claim that may not be released in accordance with law and any rights or claims that may arise after the date this Agreement is executed. Employee understands that Employee is not barred from bringing an action challenging the validity of this Agreement under the ADEA. Employee further understands that this release does not preclude filing a charge of age discrimination with the U.S. Equal Employment Opportunity Commission.

|

| | |

Manuel Rivelo | Confidential | Page 2 of 7 |

5.NO ACTION. Employee represents and warrants that no charge, complaint, lawsuit or cause of action has been filed based on any released claim. If Employee is ever awarded or recovers in any forum any amount as to a claim Employee has purported to waive in this Agreement (other than under the ADEA if Employee would be allowed lawfully to pursue such a claim), such amounts shall be payable to Employer and Employee hereby assigns the right to any such amounts to Employer.

6.CONFIDENTIALITY. Without prior written consent of Employer, Employee agrees to keep the terms of this Agreement (including the fact and amount of payments under this Agreement) and matters relating to Employee’s resignation completely confidential, and will not disclose any information concerning this Agreement or its terms or Employee’s resignation to anyone other than Employee’s spouse, legal counsel and/or financial advisors, who will be informed of and be bound by this confidentiality clause. This provision is not intended to restrict Employee from making disclosures as may be required by law or legal process.

Except as the Employer reasonably believes is needed for legal or regulatory purposes, as is already otherwise in the public sphere or with prior written consent of Employee, the Company agrees not to disclose any information concerning this Agreement or matters relating to Employee’s resignation.

Employer and Employee understand that Employer will provide information relating to this Agreement (including filing the Agreement) in filings made with the Securities and Exchange Commission.

7.COMPANY PROPERTY. Employee represents and warrants that Employee on or prior to the Separation Date will turn over to Employer all files, memoranda, keys, cellular phones, computers, pagers, and other electronic devices, credit cards, manuals, data, records and other documents, including electronically recorded documents, photographs, data, employee handbooks, and physical property that Employee received from Employer or its employees or that Employee generated in the course of Employee’s relationship with Employer.

8.NONCOMPETITION & NON-SOLICITATION.

8.1 Non-Competition. During the period commencing on the Separation Date and ending on the one year anniversary of the Separation Date (the “Non-Competition Period”), Employee shall not (without the prior written consent of the Employer) engage, in any; be or become an officer, director, manager, member, employee, owner, affiliate, salesperson, co-owner, partner, trustee, promoter, technician, engineer, analyst, agent, representative, supplier, contractor, consultant, advisor or manager of or to, or otherwise acquire or hold any interest in, or participate in or facilitate the financing, operation, management or control of, any Competing Business (as defined below); or contact, solicit or communicate with Employer’s customers for the benefit of a Competing Business; provided, however, that nothing in this Agreement shall prevent or restrict Employee from any of the following: (i) owning as a passive investment less than 1% of the outstanding shares or interests of the capital stock or other equity of a Competing Business when Employee is not otherwise associated with such corporation; (ii) performing speaking engagements and receiving honoraria in connection with such engagements; (iii) being employed by any government agency, college, university or other non-profit research organization; (iv) owning a passive equity interest in a private debt or equity investment fund in which the Employee does not have the ability to control or exercise any managerial influence over such fund; (v) working for a venture capital, growth equity, private equity, or similar fund that has portfolio companies and/or similar investments in a Competing Business, so long as Employee does not actively participate in the relationship between such fund and the portfolio companies and/or similar investments in a Competing Business; or (vi) any activity consented to in writing by Employer.

“Competing Business” means the following companies, including their parent, subsidiary, or affiliated companies, or their respective successors or assigns:

Citrix Systems; Radware; A10 Networks; Appcito; Avi Networks; Palo Alto Networks; Fortinet; Brocade Communications Systems; Check Point Software Technologies Ltd.; Imperva; Akamai; and Blue Coat Systems, Inc.

8.2 Non-Solicitation. Employee further agrees that Employee shall not during the period commencing on the Separation Date and ending on the one year anniversary of the Separation Date (the “Non-Solicitation Period”), directly

|

| | |

Manuel Rivelo | Confidential | Page 3 of 7 |

or indirectly, without the prior written consent of Employer: personally or through others, solicit or attempt to solicit (on Employee’s own behalf or on behalf of any other person) any employee of Employer or any subsidiary or affiliate of Employer, or their respective successors or assigns, to leave his or her employment with Employer or any subsidiary or affiliate of Employer, or any of their respective successors or assigns; personally or through others, induce, attempt to induce, solicit or attempt to solicit (on Employee’s own behalf or on behalf of any other person), any employee of Employer or any subsidiary or affiliate of Employer, or their respective successors or assigns, to engage in any activity that Employee would, under the provisions of Section 8.1 hereof, be prohibited from engaging in. Notwithstanding the foregoing, for purposes of this Agreement, the placement of general advertisements that may be targeted to a particular geographic or technical area but that are not specifically targeted toward employees of Employer or any subsidiary of Employer or their respective successors or assigns, shall not be deemed to be a breach of this Section.

8.3 Prior Agreements Superseded. The covenants contained in Section 8 supplement certain of the terms of the Employee Nondisclosure and Assignment Agreement (the “Employee Agreement”) between the Company and Employee dated October 30, 2011, which is attached hereto as Exhibit B and incorporated by this reference. To the extent of any conflict between the terms of the Employee Agreement and the main body of this Agreement, the terms of this Agreement will prevail.

8.4 Severability. In the event that the provisions of this Section 8 are deemed to exceed the time, geographic or scope limitations permitted by applicable law, then Employer and Employee agree that such provisions shall be reformed to the maximum time, geographic or scope limitations, as the case may be, permitted by applicable law.

9. KNOWING AND VOLUNTARY AGREEMENT. Employee hereby warrants and represents that Employee: (1) has carefully read this Agreement and finds the manner in which it is written understandable; (2) knows the contents hereof; (3) is hereby advised to consult with an attorney regarding this Agreement and its effects prior to executing this Agreement; (4) understands that Employee is giving up certain claims, damages, and disputes known or unknown that may have arisen on or before the date of this Agreement; (5) has been given 21 calendar days to consider whether to accept this Agreement, and has signed it only after reading, considering and understanding it; (6) understands its contents and its final and binding effect; and (7) has signed the Agreement as his free and voluntary act. If Employee signs this Agreement before the expiration of the 21-day period that he has been given to consider it, he is expressly waiving his right to consider the Agreement for any remaining portion of that 21-day period. Employee acknowledges that in executing this Agreement, Employee does not rely upon any representation or statement by Employer or any other Released Party concerning the subject matter of this Agreement, except as expressly set forth in the text of the Agreement.

10.TIME TO CONSIDER AGREEMENT. The Company is hereby advising Employee to consider this Agreement carefully, and to consult with an attorney of Employee’s choice or a similar advisor if Employee desires to do so, before signing this Agreement. In compliance with the ADEA and the Older Workers Benefit Protection Act, Employee expressly acknowledges that he has been given twenty-one (21) calendar days in which to review this Agreement before signing it.

11.REVOCATION AND EFFECTIVE DATE. Employee has the right to revoke this Agreement within seven (7) calendar days of its execution. To revoke this Agreement, Employee must hand-deliver or email the revocation to Scot F. Rogers, Executive V.P. and General Counsel at s.rogers@f5.com by no later than 5:00 p.m. Pacific time on the seventh day after Employee signs this Agreement. If Employee effectively revokes this Agreement, all of the promises made by Employee and Employer through or related to this Agreement will not be effective. This Agreement shall become effective on the eighth day after delivery of this executed Agreement by Employee to Employer, provided that Employee has not revoked the Agreement and provided that the conditions precedent have been met (“Effective Date”).

12.NON-DISPARAGEMENT. Employee represents and warrants that Employee shall not, directly or indirectly, disparage, defame, or make derogatory or negative statements to any person or entity regarding Employer or any of its subsidiaries or affiliates.

|

| | |

Manuel Rivelo | Confidential | Page 4 of 7 |

13.DISPUTE RESOLUTION. Any disputes under this Agreement that are not informally resolved shall be resolved through binding arbitration in Seattle, Washington by a single neutral arbitrator under the then-current rules of arbitration pertaining to employment disputes issued by the American Arbitration Association (“AAA”), except that any such arbitration shall be administered by the Judicial Arbitration & Mediation Service (“JAMS”) in Seattle, Washington. The arbitrator shall be authorized to consider and resolve any and all such claims by a motion for summary judgment. Any and all applicable statutes of limitation shall apply to claims or disputes brought in the arbitration to the same extent such statutes of limitation would apply in actions brought in state or federal court. The arbitrator shall be authorized to award the prevailing party its reasonable costs, attorneys’ fees and litigation expenses, including such amounts incurred on appeal (other than if Employee challenges the validity of this Agreement under the ADEA).

14. AMENDMENT. There shall be no modification of this Agreement except as may be agreed to in writing by the parties.

15.OTHER. Employee and Employer each represent and warrant that they are the sole and exclusive owner of all of their respective claims, demands and causes of action, and that no other party has any right, title or interest whatsoever in any of the matters referred to herein, and there has been no assignment, transfer, conveyance or other disposition by Employee or Employer of any matters referred to herein. Employee has made no claim or filing with any federal, state or local agency, court or arbitration. Nothing in this Agreement is intended as or should be construed as an admission of liability or wrongdoing by any of the parties to the Agreement.

16.NO CHANGE OF CONTROL. Employer represents and warrants that this Agreement is not being entered into in anticipation of or contingent upon a change in ownership or control of the Employer as set forth in Section 280G of the Internal Revenue Code of 1986.

17.GENERAL. This Agreement shall be governed by and interpreted under the laws of the State of Washington, excluding its choice of law rules. The provisions of this Agreement are severable, and if any part of it is found to be unlawful or unenforceable, it shall be interpreted to render it enforceable. If no such interpretation is possible, such provision shall be severed from the Agreement and the other provisions of this Agreement shall remain fully valid and enforceable and the remainder of the Agreement shall be interpreted to render it enforceable to the maximum extent consistent with applicable law. This Agreement shall in all respects be interpreted in accordance with the plain meaning of its terms and not strictly for or against any of the parties hereto. The parties acknowledge that they do not rely and have not relied upon any representation or statement made by any of the parties other than the representations and warranties expressly set forth in this Agreement. This Agreement may be executed in counterparts and such counterparts, when taken together, shall constitute one agreement.

18.TAX TREATMENT. This Agreement does not address Employee’s specific tax situation and Employee should consult with Employee’s own tax advisor. The Employer does not guarantee to Employee any tax treatment, outcome or liability, under any laws applicable to Employee, of any benefits provided under this Agreement, including, but not limited to, consequences under Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”). No provision of this Agreement shall be interpreted or construed to transfer any tax liability, including any liability for failure to comply with the requirements of Section 409A, from Employee to the Employer. Employee hereby assumes full and sole responsibility for payment of taxes due from him or the consideration, if any, on the consideration tendered herein and further agrees to defend, indemnify, and hold the Employer harmless from and against any loss, liability, obligation, action, cause of action, claims, demands, or other expenses of any nature whatsoever, relating to, in connection with, or arising out of the payment of said taxes and interest, and/or penalties imposed, arising out of any such tax. Further, the Employer and Employee intend that this Agreement and the payments and other benefits provided hereunder shall be exempt from the requirements of Section 409A and be interpreted, operated and administered in a manner consistent with such intention.

19.ENTIRE AGREEMENT. Except for the Employee Agreement to the extent described in Section 8.3 above, this Agreement contains the entire understanding between Employee and Employer regarding the subject matter of this Agreement. This Agreement is entered into without reliance on any promise or representation, written or oral, other than those expressly contained herein. It supersedes entirely all prior agreements between Employee and Employer except those explicitly referenced herein or necessary for the parties to perform their obligations under this Agreement,

|

| | |

Manuel Rivelo | Confidential | Page 5 of 7 |

and then such agreements shall be applicable and enforceable only to the extent necessary for the parties to perform their obligations under this Agreement except otherwise provided herein.

|

| | | | |

| | | | |

Employee: Manuel Rivelo | | |

By: | /s/ Manuel Rivelo | | Date: January 1, 2016 |

| Manuel Rivelo | | |

|

| | | | |

| | | | |

Employer: F5 Networks, Inc. | | |

By: | /s/ Scot F. Rogers | | Date: December 30, 2015 |

| Scot F. Rogers | | |

| Executive Vice President and General Counsel | | |

|

| | |

Manuel Rivelo | Confidential | Page 6 of 7 |

APPENDIX 1

|

| | |

| Continuing Time-Based Awards | Continuing Performance-Based Awards |

Grant Date | February 1, 2016 Time-Based Vesting13 | February 1, 2016 Performance-Based Vesting23 |

11/1/12 | 796 | 796 |

11/1/13 | 789 | 789 |

11/3/14 | 550 | 550 |

5/1/15 | 320 | 320 |

11/2/15 | 1412 | 1412 |

|

| | |

| | |

1 | Represents the number of shares underlying certain unvested service-based restricted stock units that will vest on February 1, 2016 pursuant to the terms of the Plan and Employee’s grant documents, including his Award Agreement, but without the requirement of Continuous Service.

|

2 | Represents the number of shares at target performance underlying certain unvested performance-based restricted stock units that have the opportunity to vest on February 1, 2016 pursuant to the terms of the Plan and Employee’s grant documents, including his Award Agreement, but without the requirement of Continuous Service.

|

3 | All other service-based and performance-based restricted stock units (including 1/6th of the service-based and performance-based restricted stock units that could have vested on February 1, 2016) are forfeited as of the Separation Date.

|

|

| | |

Manuel Rivelo | Confidential | Page 7 of 7 |

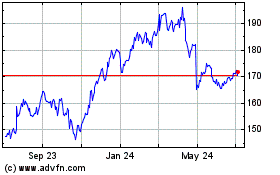

F5 (NASDAQ:FFIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

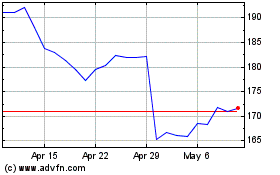

F5 (NASDAQ:FFIV)

Historical Stock Chart

From Apr 2023 to Apr 2024