Current Report Filing (8-k)

December 29 2015 - 8:57AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 24, 2015

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-33958 | | 20-8099512 |

(State or other jurisdiction of incorporation or organization) | | (Commission

File Number)

| | (I.R.S. Employer

Identification No.) |

| | | | |

| | 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583 (855) 855-4253

| | |

| | (Address of Principal Executive Offices) (Zip Code)

| | |

| | | | |

Registrant’s telephone number, including area code: (855) 855-4253

|

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 1.02. | Termination Of A Material Definitive Agreement |

On December 18, 2015, Galena Biopharma, Inc. (the “Company”) filed with the Securities and Exchange Commission a Current Report on Form 8-K (the “Prior Report”) announcing that the Company and Midatech Pharma PLC, a public limited company organized under the laws of England and Wales (“Midatech”), entered into an Asset Purchase Agreement (the “Purchase Agreement”), pursuant to which the Company agreed to sell to Midatech and Midatech agreed to purchase from the Company, certain assets of the Company related to and including its Zuplenz® (ondansetron) Oral Soluble Film (“Zuplenz”).

On December 24, 2015, the Company and Midatech closed upon the Purchase Agreement. In connection with the closing of the transactions contemplated by the Purchase Agreement, the Company assigned to Midatech all of its rights to and interests in the Company’s License and Supply Agreement, dated July 17, 2014 (the “MonoSol License”). As a result of such assignment, Midatech assumed all of the Company’s obligations under the MonoSol License.

The disclosures set forth in Item 1.01 of the Prior Report are hereby incorporated by reference into this Item 2.01.

|

| |

Item 2.01 | Completion of Acquisition or Disposition of Assets |

The disclosures set forth in Item 1.01 of the Prior Report are hereby incorporated by reference into this Item 2.01.

|

| |

Item 2.05 | Costs Associated with Exit or Disposal Activities |

On November 9, 2015, the Company announced the plan of divestiture of its commercial operations including the marketed products, Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film. Such divestiture will result in the closure of its commercial operations by the end of the fourth quarter of 2015 and expects a total headcount reduction of approximately 29 employees. The Company will now focus its resources and efforts on the continued development of its high value oncology pipeline.

The Company estimates that it will incur total charges related to the divestiture of approximately $11 million to $12 million including an $8.1 million asset impairment recorded in the third quarter of 2015, approximately $1.5 million in one time separation costs, and approximately $1.5 million to $2.5 million in channel liability and contract termination costs. The Company expects to record all of the non-cash impairment charges in the third and fourth quarters of 2015 and the rest of the charges recorded in the fourth quarter of 2015 and paid in the first quarter of 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | GALENA BIOPHARMA, INC. |

| | | | |

Date: | | December 29, 2015 | | | | By: | | /s/ Mark W. Schwartz |

| | | | | | | | Mark W. Schwartz Ph.D. President and Chief Executive Officer |

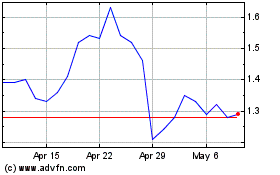

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

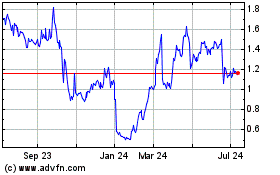

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024