As filed with the U.S. Securities and Exchange Commission on December 28, 2015

Registration No. 333-198306

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SOLARWINDOW TECHNOLOGIES, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 3674 | | 59-3509694 |

(State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer |

incorporation or organization) | | Classification Code number) | | Identification No.) |

SolarWindow Technologies, Inc. 10632 Little Patuxent Parkway, Suite 406 Columbia, Maryland 21044 (800) 213-0689 | | John A. Conklin SolarWindow Technologies, Inc. 10632 Little Patuxent Parkway, Suite 406 Columbia, Maryland 21044 (800) 213-0689 |

(Address and telephone number of principal executive offices) | | (Name, address and telephone number of agent for service) |

Copies to:

Joseph Sierchio, Esq.

Elishama Rudolph, Esq.

Sierchio & Company, LLP

430 Park Avenue

Suite 702

New York, New York 10022

Telephone: (212) 246-3030

Facsimile: (212) 246-3039

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Post-Effective Amendment No. 1 becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933 Act, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) | | |

This filing constitutes a Post-Effective Amendment to the Registration Statement on Form S-1 (File No. 333-198306), which was declared effective on December 17, 2014. This Post-Effective Amendment shall hereafter become effective in accordance with Section 8(c) of the Securities Act of 1933 on such date as the Securities and Exchange Commission, acting pursuant to Section 8(c), may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to Form S-1 (this "Post-Effective Amendment") is being filed pursuant to Section 10(a)(3) of the Securities Act to update our registration statement on Form S-1 (Registration No. 333-198306) (the "Registration Statement"), which was previously declared effective by the Securities and Exchange Commission on December17, 2014, to (i) include the consolidated financial statements and the notes thereto included in our Annual Report on Form 10-K, for the fiscal year ended August 31, 2015, and (ii) update certain other information in the Registration Statement. No additional securities are being registered under this Post-Effective Amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

SUBJECT TO COMPLETION, DATED DECEMBER 28, 2015

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sales is not permitted.

6,000,000 SHARES

NEW ENERGY TECHNOLOGIES, INC. COMMON STOCK

This prospectus relates to the resale by Kalen Capital Corporation, a private corporation organized under the laws of the Province of Alberta (the "Selling Stockholder") of a maximum of 6,000,000 shares (collectively, the "Shares") of our common stock, par value $0.001. The Shares being offered under this prospectus are comprised of:

| (a) | up to 3,503,042 shares of common stock issuable as part of the Units upon conversion of the Convertible Note in the principal amount of $3,000,000, which we issued to the Selling Stockholder as part of a loan made to us by the Selling Stockholder on October 7, 2013; and |

| |

| (b) | 2,496,958 shares of common stock previously purchased by the Selling Stockholder from us or our affiliates in transactions exempt from the registration requirements of the Securities Act. |

Although we will pay substantially all the expenses incident to the registration of the Shares we will not receive any proceeds from the sales by the Selling Stockholder.

The Selling Stockholder and any underwriter, broker-dealer or agent that participates in the sale of the hares or interests therein may be deemed "underwriters" within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions, profit or other compensation any of them earns on any sale or resale of the shares, directly or indirectly, may be underwriting discounts and commissions under the Securities Act. If the Selling Stockholder is determined to be an "underwriter" within the meaning of Section 2(a)(11) of the Securities Act it will be subject to the prospectus delivery requirements of the Securities Act.

Our common stock is presently quoted for trading under the symbol "WNDW" on the OTC Markets Group Inc. QBTM tier (the "OTCQB"). On December 24, 2015, the closing price of the common stock, as reported on the OTCQB was $4.23 per share. The Selling Stockholder has advised us that it will sell the shares of common stock registered hereunder from time to time in the open market, on the OTCQB, in privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or otherwise as described under the section of this prospectus titled "Plan of Distribution."

The purchase of the shares offered through this prospectus involves a high degree of risk. Please refer to "Risk Factors" beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| | | Page # | |

PROSPECTUS SUMMARY | | | 5 | |

THE OFFERING | | | 6 | |

RISK FACTORS | | | 8 | |

NOTE REGARDING FORWARD-LOOKING STATEMENTS | | | 22 | |

USE OF PROCEEDS | | | 23 | |

DETERMINATION OF OFFERING PRICE | | | 23 | |

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS | | | 23 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 24 | |

DESCRIPTION OF OUR BUSINESS AND PROPERTY | | | 28 | |

DIRECTORS, EXECUTIVE OFFICERS AND CONTROL PERSONS | | | 40 | |

EXECUTIVE COMPENSATION | | | 45 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 47 | |

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS | | | 48 | |

DESCRIPTION OF OUR SECURITIES | | | 50 | |

THE SELLING STOCKHOLDER | | | 53 | |

PLAN OF DISTRIBUTION | | | 55 | |

LEGAL MATTERS | | | 56 | |

EXPERTS | | | 57 | |

WHERE YOU CAN FIND ADDITIONAL INFORMATION | | | 57 | |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | | 58 | |

CONSOLIDATED FINANCIAL STATEMENTS | | | 58 | |

You should rely only on the information contained in this prospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus or incorporated by reference herein is accurate only on the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of new information, future events or any other reason.

This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS SUMMARY

This summary highlights certain information that we present more fully in the rest of this prospectus. This summary does not contain all of the information you should consider before investing in the securities offered pursuant to this prospectus. You should read the entire prospectus carefully, including the "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and related notes, before making an investment decision.

Except where the context otherwise requires and for purposes of this prospectus only, "we," "us," "our," "Company," "our Company," and "SolarWindow" refer to SolarWindow Technologies, Inc., a Nevada corporation, and its consolidated subsidiaries.

Our Company

We were incorporated in the State of Nevada on May 5, 1998, under the name "Octillion Corp." On December 2, 2008, we amended our Articles of Incorporation to effect a change of name to New Energy Technologies, Inc. Effective as of March 9, 2015, we amended our Articles of Incorporation to change our name to SolarWindow Technologies, Inc. The accompanying consolidated financial statements include our accounts and those of our wholly owned subsidiaries.

We have been developing two (2) sustainable electricity generating systems. These novel technologies are branded as SolarWindow™ and MotionPower™. On March 2, 2015, we announced that we will exclusively focus on further developing and bringing to market products derived from our SolarWindow™ technology.

At the time of this filing, our proprietary patent-pending SolarWindow™ transparent electricity-generating coatings are the subject of 14 U.S. and international patent filings.

Our SolarWindow™ technology provides the ability to harvest light energy from the sun and artificial sources and generate electricity from a see-through, semi-transparent, coating of organic photovoltaic ("OPV") solar cells applied to glass and plastics. Our SolarWindow™ technology is the subject of a patent pending technology. Initially being developed for application on glass surfaces, SolarWindow™ could potentially be used on any of the more than 85 million commercial and residential buildings in the United States alone.

Corporate Information

Our corporate headquarters is located at 10632 Little Patuxent Parkway, Suite 406 Columbia, Maryland 21044. Our telephone number is (800) 213-0689; our fax number is (240) 554-2316. Our website is www.solarwindow.com. Information contained on our web site (or any other website) does not constitute part of this prospectus.

Risk Factors

Our business operations are subject to numerous risks, including the risk of delays in or discontinuation of our research and development due to lack of financing, inability to obtain necessary regulatory approvals to market the products, unforeseen safety issues relating to the products and dependence on third party collaborators to conduct research and development of the products. Because we are an early stage company with a limited history of operations, we are also subject to many risks associated with early-stage companies. For a more detailed discussion of some of the risks you should consider, you are urged to carefully review and consider the section entitled "Risk Factors" beginning on page 8 of this prospectus.

THE OFFERING

Securities Being Registered: | | Up to 6,000,000 shares of common stock, comprised of: (a) up to 3,503,042 shares of common stock issuable as part of the Units upon conversion of the Convertible Note in the principal amount of $3,000,000, which we issued to the Selling Stockholder as part of a loan made to us by the Selling Stockholder on October 7, 2013; and (b) 2,496,958 shares of common stock previously purchased by the Selling Stockholder from us or our affiliates in transactions exempt from the registration requirements of the Securities Act. |

| | |

Offering Price: | | The Selling Stockholder will determine at what price it may sell the offered shares, and such sales may be made at prevailing market prices, or at privately negotiated prices. |

| | |

Selling Stockholder: | | The Selling Stockholder is an existing stockholder who purchased or otherwise acquired shares, or warrants to purchase shares, of our common stock from us in private transactions pursuant to exemptions from the registration requirements of the Securities Act. Please refer to the section titled "Selling Stockholder" of this prospectus. |

| | |

Shares Outstanding Prior to Completion of the Offering: | | 26,854,721 |

| | |

Authorized Capital Stock: | | Our authorized capital stock consists of stock of 300,000,000 shares of common stock, each with a par value of $0.001, and 1,000,000 shares of preferred stock, each with a par value of $0.10. No preferred shares were issued and outstanding. |

| | |

Shares Outstanding upon Closing of the Offering: | | Assuming the Convertible Note is converted on its maturity date for the maximum number of shares issuable based upon a conversion price of $1.00, upon completion of the offering, we will have 30,357,763 shares outstanding, without giving effect to the exercise of any outstanding options or warrants. |

| | |

OTCQB Symbol: | | WNDW |

| | |

Transfer Agent: | | Worldwide Stock Transfer, LLC, One University Plaza, Suite 505, Hackensack, NJ 07601. |

| | |

Risk Factors: | | Our business operations are subject to numerous risks, including the risk of delays in or discontinuation of our research and development due to lack of financing, inability to obtain necessary regulatory approvals to market the products, unforeseen safety issues relating to the products and dependence on third party collaborators to conduct research and development of the products. Because we are an early stage company with a limited history of operations, we are also subject to many risks associated with early-stage companies. For a more detailed discussion of some of the risks you should consider, you are urged to carefully review and consider the section titled "Risk Factors" of this prospectus. |

| | |

Use of Proceeds: | | Although we will pay substantially all the expenses incident to the registration of the Shares, we will not receive any proceeds from the sales by the Selling Stockholder. |

| | |

Duration of Offering: | | Pursuant to the terms of a registration rights agreement we entered into on October 7, 2013 (the "Registration Rights Agreement") as part of the loan provided to us by the Selling Stockholder, we agreed to register for resale all of the shares issuable to the Selling Stockholder upon conversion of the Convertible Note, including shares issuable upon exercise of warrants and to keep the registration statement, of which this prospectus is a part of, until the earlier of: (a) the date the Selling Stockholder securities have been sold in accordance with Rule 144; (b) such securities become eligible for resale without volume or manner-of-sale restrictions and without current public information pursuant to Rule 144 as set forth in a written opinion letter to such effect, addressed, delivered and acceptable to our transfer agent as reasonably determined by us, upon the advice of our counsel; or (c) such securities have otherwise been disposed of by the investor pursuant to an exemption from the registration requirements of the Securities Act. We further provided the Selling Stockholder with demand registration rights for all shares, and shares issuable upon exercise of warrants, owned by the Selling Stockholder as of October 7, 2014 and our failure to file any required registration statements would result in penalties requiring us to issue additional shares of common stock, as further set forth in the Registration Rights Agreement. |

Selected Financial Data

The following tables set forth a summary of certain selected consolidated financial data for the fiscal years ended August 31, 2015 and 2014. This information is derived from our consolidated financial statements. Historical results are not necessarily indicative of the results that may be expected for any future period. The consolidated financial data below should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and notes included elsewhere in this prospectus.

Statements of Operations Data | | For the Year Ended August 31, 2015 | | | For the Year Ended August 31, 2014 | |

Revenue | | $ | 0 | | | $ | 0 | |

Loss from operations | | $ | (3,115,290 | ) | | $ | (3,012,910 | ) |

Net loss | | $ | (8,092,744 | ) | | $ | (3,892,381 | ) |

Basic and diluted net loss per share | | $ | (0.32 | ) | | $ | (0.16 | ) |

Weighted average shares outstanding used in basic and diluted net loss per share calculation | | | 25,131,836 | | | | 24,279,448 | |

Balance Sheet Data | | As of August 31, 2015 | | | As of August 31, 2014 | |

Cash and cash equivalents | | $ | 228,465 | | | $ | 785,237 | |

Working capital | | $ | (2,898,860 | ) | | $ | (74,216 | ) |

Total assets | | $ | 386,287 | | | $ | 974,091 | |

Total liabilities | | $ | 3,254,612 | | | $ | 1,023,710 | |

Total stockholders' equity (deficit) | | $ | (2,868,325 | ) | | $ | (49,619 | ) |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before purchasing any Shares. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected, the trading price of our common stock could decline, and you may lose all or part of your investment. You should acquire the Units only if you can afford to lose your entire investment. You should also refer to the other information contained in this prospectus, including our financial statements and the notes to those statements, and the information set forth under the caption "Forward Looking Statements." The risks described below and contained in our other periodic reports are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business operations.

Risks Related To Our Business

We have experienced significant losses, have not generated any revenues, expect losses to continue for the foreseeable future and our auditors have issued a going concern explanation in their report on our most recent audited financial statements.

We have not generated any revenue since inception and do not expect to generate any revenue for the foreseeable future. We had a net loss of $8,092,744 and $3,892,381 for our fiscal years ended August 31, 2015 and 2014, respectively, and we have incurred a cumulative deficit of $29,039,014 from inception (May 5, 1998) through August 31, 2015. We anticipate incurring losses through at least December 2016. As a result of our recurring losses from operations and substantial accumulated deficit, our independent registered public accounting firm included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited consolidated financial statements for our fiscal year ended August 31, 2015.

The sale by our stockholders of restricted shares, either pursuant to a resale prospectus or Rule 144, may adversely affect our ability to raise the funds we will require to effectuate our business plan.

As of the date of this prospectus, we had 26,854,721 shares issued and outstanding, of which 7,446,802 are deemed "restricted securities" within the meaning of Rule 144, as promulgated under the Securities Act ("Rule 144"). The possibility that substantial amounts of our common stock may be sold into the public market, either under Rule 144, or pursuant to a resale registration statement, may adversely affect prevailing market prices for the common stock and could impair our ability to raise capital in the future through the sale of equity securities because of the perception that future resales could decrease our stock price and because of the availability of resale shares to those interested in investing in our common stock.

We may require additional financing to expand, accelerate or sustain our current level of operations beyond February 2016, and failure to obtain such financing would have a material adverse effect on our business, operating results, financial condition and prospects.

As of August 31, 2015, we had cash and cash equivalents of $228,465. We anticipate that we will remain engaged in research and product development activities at least through December 2016. Based upon our current level of operations and expenditures, we believe that absent any modification or expansion of our existing research, development and testing activities, cash on hand should be sufficient to enable us to continue operations through February 2016. There is no assurance that we will be able to generate revenue and achieve profitability or secure additional financing once our current cash balance is depleted. Any significant expansion in scope or acceleration in timing of our current research and development activities, or commencement of any marketing and sales activities, will require additional funds.

If adequate funds, including proceeds, if any, from this offering are not available on reasonable terms or at all, it would result in a material adverse effect on our business, operating results, financial condition and prospects. In particular, we may be required to delay, reduce the scope of or terminate one or more of our research programs, sell rights to our SolarWindow™ technology or other technologies or products based upon such technologies, or license the rights to such technologies or products on terms that are less favorable to us than might otherwise be available. If we raise additional funds by issuing equity or debt securities, further dilution to stockholders may result and new investors could have rights superior to existing stockholders.

Even if financing is available to us, because we cannot currently estimate the amount of funds or time required to commercialize our technologies, we may secure less funding than is actually required to effectuate our business plan.

We are currently in the advanced stages of our research and development and have come to the point where larger and faster equipment is necessary for development to continue and to be able to come to market with a commercially viable product; however, we cannot accurately predict the amount of funding or the time required to successfully commercialize the SolarWindow™ technology. The actual cost and time required to commercialize these technologies may vary significantly depending on, among other things, the results of our research and development efforts, the cost of developing, acquiring, or licensing various enabling technologies, changes in the focus and direction of our research and development programs, competitive and technological advances, the cost of filing, prosecuting, defending and enforcing claims with respect to patents, the regulatory approval process and manufacturing, marketing and other costs associated with commercialization of these technologies. Because of this uncertainty, even if financing is available to us, we may secure insufficient funding to effectuate our business plan.

We may compete for the time and efforts of our officers and directors.

Certain of our officers and directors are also officers, directors, and employees of other companies, and we may have to compete with the other companies for their time, attention and efforts. Except for Mr. John A. Conklin, our President and Chief Executive Officer, Chief Financial Officer and a director, none of our directors anticipate devoting more than approximately five (5%) percent of their working time to our matters.

The success of our research and development activities is uncertain. If such efforts are not successful, we will be unable to generate revenues from our operations and we mayhave to cease doing business.

Commercialization of the SolarWindow™ technology will require significant further research, development and testing as we must ascertain whether the SolarWindow™ technology can form the basis for a commercially viable technology or product. If our research and development fails to prove commercial viability of the SolarWindow™ technology, we may need to abandon our business model and/or cease doing business, in which case our shares may have no value and you may lose your investment. We anticipate we will remain engaged in development through at least December 2016.

The development of the SolarWindow™ technology is subject to the risks of failure inherent to the development of any novel technology.

Ultimately, the development and commercialization of the SolarWindow™ technology is subject to a number of risks that are particular to the development and commercialization of any novel technology. These risks include, but are not limited to, the following:

| · | our research and development efforts may not produce a commercially viable product; |

| · | we may fail to maintain license rights to the SolarWindow™ technology (or any of its derivatives); |

| · | we may fail to develop, acquire, or license various enabling technologies that may be integral to the commercialization of the SolarWindow™ (or any of its derivatives); |

| · | the SolarWindow™ technology (or any of its derivatives) may ultimately prove to be ineffective, unsafe or otherwise fail to receive necessary regulatory approvals; |

| · | the SolarWindow™ technology (or any of its derivatives), even if safe and effective, may be difficult to manufacture on a large scale or uneconomical to market; |

| · | our marketing license or proprietary rights to products derived from the SolarWindow™ technology may not be sufficient to protect our products from competitors; |

| · | the proprietary rights of third parties may preclude us or our collaborators from making, using or marketing products utilizing the SolarWindow™ technology; or, |

| · | third parties may market superior, more effective, or less expensive technologies or products having comparable results to the SolarWindow™ (or any of its derivatives). |

If we ultimately do not obtain the necessary regulatory approvals for the commercialization of theSolarWindow™ technology, we will not achieve profitable operations and your investment may be lost.

In order to commercialize the SolarWindowTM technology, we may need to obtain regulatory approval from various local, state, federal or international agencies. At this time, we do not have a product to be submitted for regulatory approval. The process for obtaining such regulatory approvals may be time consuming and costly, and there is no guaranty that we will be able to obtain such approvals. The failure to obtain any necessary regulatory approvals could delay or prevent us from achieving profitability, which could result in the total loss of your investment.

Our ability to operate profitably is directly related to our ability to develop, protect and perfect rights in and to our proprietary technology.

We rely on a combination of trademark, trade secret, nondisclosure, copyright and patent law to protect our SolarWindow™ technology, which may afford only limited protection.

We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity, scope or enforceability of our proprietary rights. Any such claims could be time consuming, result in costly litigation, or force us to enter into royalty or license agreements rather than dispute the merits of such claims, requiring us to pay royalties and/or license fees to third parties. There is always a risk that patents, if issued, may be subsequently invalidated, either in whole or in part and this could diminish or extinguish protection for any technology we may license or may adversely affect our ability to fully commercialize our technologies.

We generally require our subsidiaries and our employees, consultants, advisors and collaborators to execute appropriate agreements with us, regarding the confidential information developed or made known to such persons during the course of their engagement by us. These agreements provide that any proprietary technologies developed during such engagement are owned by us and that confidential information pertaining to such technologies will be kept confidential and not disclosed to third parties except in specific circumstances. These agreements also provide for the assignment to us by any such person of any patents issued with respect to any such technologies. If these provisions are breached, we may not be able to fully perfect our rights to the technologies in question, and in some instances, we may not have an appropriate remedy available for the damages that we may incur as a result of any such breach.

We may be accused of infringing the intellectual property rights of others.

We cannot guarantee that we will not become the subject of infringement claims or legal proceedings by third parties with respect to our current programs or future technology developments. Any such claims could be time consuming, result in costly litigation and could ultimately lead to a determination that the SolarWindow™ technology, or any of its derivatives, infringe on a third party's patent rights.

If we fail to obtain additional licenses in the future required to maintain our rights to market products developed, if any, we may need to curtail or cease operations.

We may not retain all rights to developments, inventions, patents and other proprietary information resulting from any collaborative arrangements, whether in effect as of the date hereof or which may be entered into at some future time with third parties. As a result, we may be required to license such developments, inventions, patents or other proprietary information from such third parties, possibly at significant cost to us. Our failure to obtain and maintain any such licenses could have a material adverse effect on our business, financial condition and results of our operations. In particular, the failure to obtain a license could prevent us from using or commercializing our technology.

Compliance with environmental regulations, or dealing with harmful or hazardous materials involved in our research and development, may require us to divert our limited capital resources.

Our research and development programs do not generally involve the handling of harmful or hazardous materials, but they may occasionally do so. Accordingly, we may become subject to federal, state and local laws and regulations governing the use, handling, storage and disposal of hazardous and biological materials. If violations of environmental, health and safety laws occur, we could be held liable for damages, penalties and costs of remedial actions. These expenses or this liability could have a significant negative impact on our business, financial condition and results of operations. We may violate environmental, health and safety laws in the future as a result of human error, equipment failure or other causes. Environmental laws could become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with violations. We may be subject to potentially conflicting and changing regulatory agendas of political, business and environmental groups. Changes to or restrictions on permitting requirements or processes, hazardous or biological material storage or handling might require an unplanned capital investment or relocation. Failure to comply with new or existing laws or regulations could harm our business, financial condition and results of operations. We do not have any insurance coverage with respect to damages or liabilities we may incur as a result of these activities.

In seeking to acquire or develop technologies,weare operating in highly competitive markets and our competitors enjoy numerous competitive advantages over us.

Our commercial success will depend on our ability to compete effectively in product development areas such as, but not limited to, safety, efficacy, ease of use, customer compliance, price, marketing and distribution. Our competitors may succeed in developing products that are more effective than any products derived from our research and development efforts or that would render such products obsolete and non-competitive. The alternative energy industry is characterized by intense competition, rapid product development and technological change. Most of the competition that we encounter is expected to come from companies, research institutions and universities who are researching and developing technologies and products similar to or competitive with any we may develop.

These companies enjoy numerous competitive advantages, including:

| · | significantly greater name recognition; |

| · | established relations with customers; |

| · | established distribution networks; |

| · | more advanced technologies and product development; |

| · | additional lines of products, and the ability to offer rebates, higher discounts or incentives to gain a competitive advantage; |

| · | greater experience in conducting research and development, manufacturing, obtaining regulatory approval for products, and marketing approved products; |

| · | greater financial and human resources for product development, sales and marketing, and |

| · | the ability to endure potentially prolonged patent litigation. |

As a result, we may not be able to compete effectively against these companies or their products.

Any products developed from our SolarWindow™technology will face competition from other companies producing solar power and/or energy harvesting products.

The solar power market is intensely competitive and rapidly evolving. The energy harvesting market is not well-defined, immature, and evolving with uncertainty. When, or if, this market matures, it may also be intensely competitive.

Our competitors are better capitalized, have established market positions, and if we fail to attract and retain customers and establish a successful distribution network for our solar products, we may be unable to achieve adequate sales and market share. There are a number of major multi-national corporations that produce solar power and alternative energy products, which may be competitive with those that we are seeking to develop, including Heliatek, Dyetec Solar, Dysol, Solarmer Energy, BP Solar, Kyocera, Sharp, GE, Mitsubishi, Solar World AG and Sanyo, Eight19, Ubiquitous Energy, Oxford Photovoltaics, ONYX Solar, among others. We also expect that future competition will include new entrants to the solar power market offering new technological solutions. Further, many of our competitors are developing and are currently producing products based on new solar power and alternative energy technologies that may have costs similar to, or lower than, our projected costs.

Technological changes could render our products uncompetitive or obsolete, which could prevent us from achieving market share and sales.

Our failure to refine our technologies and to develop and introduce new products could cause our products to become uncompetitive or obsolete, which could prevent us from achieving market share and sales. The alternative energy industry is rapidly evolving and highly competitive. We will need to invest significant financial resources in research and development to keep pace with technological advances in the industry and to compete in the future and we may be unable to secure such financing. We believe that a variety of competing solar and alternative energy technologies may be under development by other companies that could result in lower manufacturing costs or higher product performance than those expected for our products. Our development efforts may be rendered obsolete by the technological advances of others, and other technologies may prove more advantageous for the commercialization of products.

To the extent we are able to develop and commercialize products based upon or derived from the SolarWindow™ technology, if such products do not gain market acceptance, we may not achieve sales and market share.

The development of a successful market for our products may be adversely affected by a number of factors, some of which are beyond our control, including:

| · | customer acceptance of our products; |

| · | our failure to produce products that compete favorably against other alternative energy and solar-photovoltaic power products on the basis of cost, quality and performance; |

| · | our failure to produce products that compete favorably against conventional energy sources and alternative distributed-generation technologies, such as wind, biomass and solar thermal, on the basis of cost, quality and performance; |

| · | performance and reliability of our products as compared with conventional and alternative energy products; |

| · | our failure to qualify for and secure government reimbursements, tax incentives and any other financial subsidies that may be available to consumers for the implementation of alternative energy technologies such as solar systems at such time as our products become available for commercial sale, and which potential customers for our products may reasonably expect; and |

| · | our failure to develop and maintain successful relationships with manufacturers, distributors, and other resellers, as well as strategic partners. |

If our products fail to gain market acceptance, we will be unable to achieve sales and market share.

If solar-photovoltaic harvesting technologies are not suitable for widespread adoption or sufficient demand for such products does not develop or takes longer to develop than we anticipate, we may not be able to profitably exploit the SolarWindow™ technology.

The market for OPV solar-energy related products is emerging and rapidly evolving, and the market for energy harvesting products is generally unproven and not yet established. The success of products for these markets is uncertain.

If our solar power or energy harvesting technologies prove unsuitable for widespread commercial deployment or if demand for such power products fails to develop sufficiently, we would be unable to achieve sales and market share. In addition, demand for such products in the particular markets and geographic regions we target may not develop or may develop more slowly than we anticipate. Many factors will influence the widespread adoption of solar and energy capture and conversion products, including:

| · | cost-effectiveness of such technologies as compared with conventional and competitive alternative energy technologies; |

| · | performance and reliability of such products as compared with conventional and competitive alternative energy products; |

| · | success of other alternative energy technologies such as hydrogen fuel cells, wind turbines, bio-diesel generators and solar thermal technologies; |

| · | public concern regarding energy security, the potential risks associated with global warming, the environmental and social impacts of fossil fuel extraction and use; |

| · | fluctuations in economic and market conditions that impact the viability of conventional and competitive alternative energy sources; |

| · | increases or decreases in the prices of oil, coal and natural gas; |

| · | capital expenditures by customers, which tend to decrease when domestic or foreign economies slow; |

| · | continued deregulation of the electric power industry and broader energy industry; and |

| · | availability of government subsidies and incentives. |

Our growth and success, and that of the SolarWindow™ technologies and products, depends on our ability to develop new products and services and adapt to market and customer needs.

The sectors in which we operate experience rapid and significant changes due to the introduction of innovative technologies. Introducing new technology products and innovative services, which we must do on an ongoing basis to meet customers' needs, requires a significant commitment to research and development, which may not result in success. We are a pre-revenue and may suffer if it invests in technologies that do not function as expected or are not accepted in the marketplace or if its products, systems or service offers are not brought to market in a timely manner, become obsolete or are not responsive to our customers' requirements.

Our business model and strategy involves growth through acquisitions, joint ventures and mergers that may be difficult to execute.

Our business model and strategy involves growth through acquisitions, joint ventures and mergers. External growth transactions are inherently risky because of the difficulties that may arise in integrating people, operations, technologies and products, and the related acquisition, administrative and other costs.

We are dependent upon hiring and retaining highly qualified management and technical personnel.

Competition for highly qualified management and technical personnel is intense in our industry. Future success depends in part on our ability to hire, assimilate and retain engineers, salespeople and other qualified personnel, especially in the area of OPV with focus in our SolarWindow™ technologies and products. A key risk is our ability to anticipate their needs for certain key competences and to implement HR solutions to recruit or improve these competences. We believe that two (2) key competences required in the near term are a PhD OPV Scientist and a Chief Financial Officer.

We may be the subject of product liability claims and other adverse effects due to defective products, design faults or harm caused to persons and property.

Despite our development, testing, and quality procedures, our SolarWindow™ products might not operate properly or might contain design faults or defects, which could give rise to disputes in respect of its liability. Product liability related to defective products could lead to a loss of revenue, claims under warranty and legal proceedings. Such disputes could result in a fall-off in demand or harm our reputation for safety and quality.

Our SolarWindow™ technology and products will be subject to environmental, occupational safety & hygiene, Underwriter laboratory, electrical codes, and other state and federal, EU, and other Country regulations.

Our SolarWindow™ technologies and products are will subject to extensive and increasingly stringent environmental, occupational safety & health, Underwriter Laboratory, electrical codes, and other state and federal, EU laws and regulations ("Laws & Regulations"). There can be no guarantee that we will not be required to pay significant fines or compensation as a result of past, current or future breaches of Laws & Regulations. This exposure exists even if we are not responsible for the breaches, in cases where they were committed in the past by companies or businesses that were not part of ours that may be exposed to the risk of claims for breaches of these Laws & Regulations. Such claims could adversely affect our financial position and reputation, despite the efforts and investments made to comply at all times with all applicable Laws & Regulations. If we fail to conduct its businesses in full compliance with the applicable Laws & Regulations, the judicial or regulatory authorities could require us to conduct investigations and/or implement costly curative measures.

Our business faces significant risks related to interest rate, State & Federal subsidies, modified accelerated cost recovery system, taxes, depreciation, etc.

Our Financial and Revenue Modeling and Estimates are exposed to risks associated with the effect of changing interest rates, State & Federal subsidies, modified accelerated cost recovery system (MACRS), taxes, depreciation, renewable energy tax credits, etc. risk. These risks affect borrowings; return on investment (ROI), internal rate of return (IRR) or economic rate of return (ERR), etc. and the ability to borrow or raise capital to secure deployment funding. If any of these Financial and Revenue Modeling and Estimation parameters fail to exist, cease to be available, or diminish in any way, our Financial and Revenue Modeling and Estimates may not be accurate or reveal profitability, or favorable ROI and/or IRR necessary for SolarWindow™ technology or related product deployment.

Our financial model may prove to be inaccurate and our SolarWindow™ technology or related products may not be cost effective.

Although our independently verified financial model has shown that our SolarWindow™ technology can provide a one year payback, it is based upon a number of assumptions that may not prove accurate. If the financial model is inaccurate our SolarWindow™ technology or related product may not provide potential customers with sufficient ROI to be a cost effective alternative to other available products.

An increase in raw material prices could have negative consequences on our long-term profitability.

We face exposure to fluctuations in energy, raw and chemical material, and glass and plastic film prices. If we are not able to hedge, compensate or pass on our increased costs to customers, this could have an adverse impact on its financial results and stability, and deployment of SolarWindow™ technologies or products.

We lack sales and marketing experience and will likely rely on third party marketers.

We have limited experience in sales, marketing or distribution of photovoltaic and energy capture and conversion products. We expect to market and sell or otherwise commercialize the SolarWindow™ technology (or any of its derivatives) through distribution, co-marketing, co-promotion or licensing arrangements with third parties. Therefore, any revenues received by us will be dependent on the efforts of third parties. If any such parties breach or terminate their agreements with us or otherwise fail to conduct marketing activities successfully and in a timely manner, the commercialization of the SolarWindow™ technology (or any of its derivatives) would be delayed or terminated, which would adversely affect our ability to generate revenues and our profitability.

Risks Related To Ownership of Our Common Stock and This Offering

The trading price of our common stock historically has been volatile and may not reflect its actual value.

The trading price of our common stock has, from time to time, fluctuated widely and in the future may be subject to similar fluctuations. The trading price may be affected by a number of factors including the risk factors set forth herein, as well as our operating results, financial condition, general economic our control. In recent years, broad stock market indices in general, and smaller capitalization companies in particular, have experienced substantial price fluctuations. In a volatile market, we may experience wide fluctuations in the market price of our common stock. These fluctuations may have a negative effect on the market price of our common stock. In addition, the sale of our common stock into the public market upon the effectiveness of this registration statement could put downward pressure on the trading price of our common stock.

Our common stock is a penny stock and is not traded on a national securities exchange, therefore you may find it difficult to sell the shares of our common stock you acquire in this offering.

Our common stock is traded on the OTCQB. The OTCQB is viewed by most investors as a less desirable, and less liquid, marketplace. As a result, an investor may find it more difficult to purchase, dispose of or obtain accurate quotations as to the value of our common stock.

Additionally, our common stock is subject to regulations of the SEC applicable to "penny stock." Penny stock includes any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Rules 15g-1 through 15g-9 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), imposes certain sales practice requirements on broker-dealers who sell our common stock to persons other than established customers and "accredited investors" (as defined in Rule 501(c) of the Securities Act). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and purchasers of our common stock to sell their shares of our common stock.

In addition, the penny stock regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule proscribed by the SEC relating to the penny stock market must be delivered by a broker-dealer to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for our common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

Although our common stock is currently quoted on the OTCQB, if we do not meet or comply with the recent changes to the OTCQB our shares may be delisted from the OTCQB and would likely be traded on the OTC Pink (aka the Pink Sheets).

Although our common stockis currently quoted on the OTCQB, effective as of May 1, 2014, the OTC Markets Group Inc. changed its rules for OTCQB eligibility. To be eligible for OTCQB, companies will be required to:

| · | Meet a minimum bid price test of $0.01. Securities that do not meet the minimum bid price test will be downgraded to OTC Pink; |

| · | Submit an application to OTCQB and pay an application and annual fee; and |

| · | Submit an OTCQB Annual Certification confirming the Company Profile displayed on www.otcmarkets.com is current and complete and providing additional information on officers, directors, and controlling shareholders. |

Management has not yet determined whether it will submit the required application and pay the associated fees to remain quoted on the OTCQB. In the event we do not submit an application and pay those fees our common stock will likely be downgraded to the OTC Pink, which could adversely affect the market liquidity of our common stock.

Kalen Capital Corporation ("KCC"), a private corporation solely owned by Mr. Harmel S. Rayat, a former office r and director and director of ours, beneficially owns approximately 55% of our issued and outstanding stock. This ownership interest may preclude you from influencing significant corporate decisions.

As of December 7, 2015, KCC, a private corporation solely owned by Harmel S. Rayat, beneficially owned approximately 21,682,541 shares (including shares issuable upon exercise of outstanding warrants, conversion of the Convertible Note and the exercise of the warrants included upon conversion thereof), or approximately 55%, of our outstanding common stock. On October 7, 2013, we received a loan in the principal amount of $3,000,000 from KCC and issued the Convertible Note, as amended pursuant to the Amended Bridge Loan Agreement (the "Amended BLA, which if converted on December 7, 2015 in the full amount, including all accrued interest, at $1.37 per Unit, would result in the issuance of an additional 2,545,753 shares of our common stock and a warrant to purchase up to an additional 2,545,753 shares of our common stock. As a result, Mr. Rayat may be able to exercise significant influence over matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, and will have significant control over our management and policies. Mr. Rayat's interests may be different from yours. For example, he may support proposals and actions with which you may disagree or which are not in your interest. This concentration of ownership could delay or prevent a change in control of our company or otherwise discourage a potential acquirer from attempting to obtain control of our company, which in turn could reduce the price of our common stock. In addition, Mr. Rayat could use his voting influence to maintain our existing management and directors in office, or support or reject other management and Board proposals that are subject to stockholder approval, such as the adoption of employee stock plans and significant unregistered financing transactions.

Trusts established for the benefit of Mr. Rayat's children collectively beneficially own approximately 19% of our issued and outstanding stock, if these trusts vote together with KCC their ownership interest may preclude you from influencing significant corporate decisions.

1420524 Alberta Ltd. and 1420468 Alberta Ltd. are trusts established for the benefit of Kalen Rayat and Talia Rayat, respectively, Mr. Rayat's children; together these trusts beneficially own approximately 19% of our issued and outstanding stock (including shares issuable upon exercise of outstanding warrants). Although Mr. Rayat has disclaimed beneficial ownership of the shares owned by these trusts, if the trusts vote together with KCC they may be able to exercise significant influence over matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, and will have significant control over our management and policies. Their interests may be different from yours. This concentration of ownership could delay or prevent a change in control of our company or otherwise discourage a potential acquirer from attempting to obtain control of our company, which in turn could reduce the price of our common stock. In addition, they could use their voting influence to maintain our existing management and directors in office, or support or reject other management and Board proposals that are subject to stockholder approval, such as the adoption of employee stock plans and significant unregistered financing transactions.

The trading price of our common stock historically has been volatile and may not reflect its actual value.

The trading price of our common stock has, from time to time, fluctuated widely and in the future may be subject to similar fluctuations. The trading price may be affected by a number of factors including the risk factors set forth herein, as well as our operating results, financial condition, general economic our control. In recent years, broad stock market indices in general, and smaller capitalization companies in particular, have experienced substantial price fluctuations. In a volatile market, we may experience wide fluctuations in the market price of our common stock. These fluctuations may have a negative effect on the market price of our common stock. In addition, the sale of our common stock into the public market upon the effectiveness of this registration statement could put downward pressure on the trading price of our common stock.

The sale by our stockholders of restricted shares, either pursuant to a resale prospectus or Rule 144, may adversely affect our ability to raise the funds we will require to effectuate our business plan.

As of the date of this prospectus, we had 26,854,721 shares issued and outstanding, of which 7,446,802 are deemed "restricted securities" within the meaning of Rule 144. The possibility that substantial amounts of our common stock may be sold into the public market, either under Rule 144, or pursuant to a resale registration statement, may adversely affect prevailing market prices for the common stock and could impair our ability to raise capital in the future through the sale of equity securities because of the perception that future resales could decrease our stock price and because of the availability of resale shares to those interested in investing in our common stock.

Our common stock is a penny stock and is not traded on a national securities exchange, therefore you may find it difficult to sell the shares of our common stock you acquire in this offering.

Our common stock is traded on the OTCQB. The OTCQB is viewed by most investors as a less desirable, and less liquid, marketplace. As a result, an investor may find it more difficult to purchase, dispose of or obtain accurate quotations as to the value of our common stock.

Additionally, our common stock is subject to regulations of the SEC applicable to "penny stock." Penny stock includes any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Rules 15g-1 through 15g-9 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), imposes certain sales practice requirements on broker-dealers who sell our common stock to persons other than established customers and "accredited investors" (as defined in Rule 501(c) of the Securities Act). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and purchasers of our common stock to sell their shares of our common stock.

In addition, the penny stock regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule proscribed by the SEC relating to the penny stock market must be delivered by a broker-dealer to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for our common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

Although our common stock is currently quoted on the OTCQB, if we do not meet or comply with the recent changes to the OTCQB our shares may be delisted from the OTCQB and would likely be traded on the OTC Pink (aka the Pink Sheets).

Although our common stockis currently quoted on the OTCQB, effective as of May 1, 2014, the OTC Markets Group Inc. changed its rules for OTCQB eligibility. To be eligible for OTCQB, companies will be required to:

| · | Meet a minimum bid price test of $0.01. Securities that do not meet the minimum bid price test will be downgraded to OTC Pink; |

| · | Submit an application to OTCQB and pay an application and annual fee; and |

| · | Submit an OTCQB Annual Certification confirming our Profile displayed on www.otcmarkets.com is current and complete and providing additional information on officers, directors, and controlling shareholders. |

In the event we do not submit an annual certification and pay the fee our common stock will likely be downgraded to the OTC Pink, which could adversely affect the market liquidity of our common stock.

We are not subject to compliance with rules requiring the adoption of certain corporate governance measures, which may limit the protections shareholders have against related party transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

Because a minority of our directors are independent, we do not currently have independent audit, or compensation committees. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against related party transactions, conflicts of interest and similar matters.

Substantial sales of our common stock could lower our stock price.

As of the date of this prospectus we had 26,854,721 shares of common stock outstanding, of which 19,407,919 shares are freely tradable. Sales of substantial amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market price of our common stock to decline.

There are options to purchase shares of our common stock currently outstanding.

As of the date of this prospectus we have granted options to purchase shares of our common stock to various persons and entities, under which we could be obligated to issue up to 655,001 shares of our common stock. The exercise prices of these options range from $0.80 to $5.94 per share. If issued, the shares underlying these options would increase the number of shares of our common stock currently outstanding and dilute the holdings and voting rights of our then-existing stockholders.

There are warrants to purchase shares of our common stock currently outstanding.

As of the date of this prospectus we have issued warrants to purchase shares of our common stock to various persons and entities, under which we could be obligated to issue up to 8,021,537 shares of common Stock. The exercise prices of these warrants are: (a) $0.83 per share for the Series H Warrants exercisable for 3,906 shares; (b) $1.37 for the Series I Warrant exercisable for 921,875 shares; (c) $1.12 for the Series J Warrant exercisable for 3,110,378 shares; (d) $1.20 for the Series K Warrant exercisable for 3,110,378 shares; (e) $1.20 for the Series L Warrant exercisable for 500,000 shares; and (f) $2.34 for the Series M Warrants exercisable for 375,000 shares. If issued, the shares underlying these warrants would increase the number of shares of our common stock currently outstanding and dilute the holdings and voting rights of our then-existing stockholders.

There is a convertible note in the principal amount of $3,000,000 (the "Convertible Note") currently outstanding that, if converted, may require us to issue additional shares of our common stock and warrants to purchase our common stock.

On October 7, 2013, we issued the Convertible Note evidencing a loan made to us by KCC. Pursuant to the terms of the Convertible Note, as amended by the Amended BLA, KCC may elect, in its sole discretion, to convert all or any portion of the outstanding principal amount of the Loan, and any or all accrued and unpaid interest due thereon, into Units, with each Unit consisting of (a) one share of common stock and (b) one warrant allowing KCC to purchase one share of common stock. The Units are convertible at a unit price equal to the lesser of (1) $1.37, or (2) seventy percent (70%) of the 20 day average closing price of the Common Stock as quoted on the OTCQB as of the last trading date prior to the date of exercise, subject to a floor of $1.00. The exercise price of each warrant will be equal to sixty percent (60%) of the 20 day average closing price of our common stock as quoted on the OTCQB as of the last trading date prior to the date of exercise, without a floor (all share prices will be rounded to the nearest cent). The warrant is exercisable for a period of five (5) years from the date of issuance and contains a provision allowing the holder to exercise the warrant on a cashless basis as further set forth therein.

The Warrants to be included as part of the units issuable upon conversion of the Convertible Note do not have a floor and may result in substantial dilution, which may affect our ability to obtain additional financing.

The warrants to be included as part of the units issuable upon conversion of the Convertible Note are exercisable at a price equal to sixty percent (60%) of the 20 day average closing price of our common stock as quoted on the OTCQB as of the last trading date prior to the date of exercise, without a floor; accordingly, the exercise of such warrants may result in substantial dilution. The greater the dilution, the greater the potential that our stock price per share will fall. The more the stock price falls, the greater the number of shares we may have to issue in future conversions and the harder it might be for us to obtain other financing.

We have entered into the Registration Rights Agreement with KCC requiring us to register all the shares owned by KCC as of October 7, 2014, including all shares issuable upon conversion of any warrants then owned by KCC. If we fail to timely file the registration statements we will be obligated to issue additional shares of our common stock to KCC.

On October 7, 2013, as part of the bridge loan made to us by KCC we entered into a registration rights agreement with KCC pursuant to which we agreed to file such number of registration statements as required to register for resale with the SEC all the shares owned by KCC as of October 7, 2014, including all shares issuable upon conversion of any warrants then owned by KCC. As part of the Amended BLA we agreed to include all shares issuable upon exercise of the Series J Warrant, Series K Warrant and the warrant issuable upon exercise of the Convertible Note as part of the Registration Rights Agreement. If we fail to timely file the registration statements we will be obligated to issue additional shares of our common stock to KCC. In the event the we fail to file a registration statement in the time period required, we will issue to KCC additional shares of our common stock equal to 5% of the shares of our common stock that were to be registered for every thirty day period for which we fail to file such registration statement, subject to proration for any portion of such thirty day period and up to a maximum number of shares of our common stock equal to 25% of the number of shares of our common stock that were to be registered. Additionally, in the event we fail to cause a registration statement to be declared effective within ninety days from the date of filing, we will issue to KCC additional shares of our common stock equal to 2.5% of the shares of our common stock that were to be registered for every thirty day period for which we fail to cause the SEC to declare such registration statement effective, subject to proration for any portion of such thirty day period and up to a maximum number of shares of our common stock equal to 10% of the number of shares of common stock included in such registration statement.

There are bridge loans in the principal amount of $4,150,000 outstanding that we do not currently have the funds to repay.

On October 7, 2013, we entered into a bridge loan agreement with KCC in the principal amount of $3,000,000. On March 4, 2015, we entered into a bridge loan agreement with 1420468 Alberta Ltd. pursuant to which they lent us the principal amount of $600,000 at an annual interest rate of 7%. The bridge loan, as amended, has a maturity date of December 31, 2016; we do not currently have sufficient funds to repay the bridge loan. On December 7, 2015, we entered into a bridge loan agreement with KCC, pursuant to which KCC agreed to lend us up to $550,000 at an annual interest rate of 10%. The bridge loan has a maturity date of the earlier of (a) September 1, 2016 or (b) the date on which we complete one or more financings for which we receive $3,000,000; we do not currently have sufficient funds to repay any of the bridge loans.

We may issue preferred stock which may have greater rights than our common stock.

Our Articles of Incorporation allow our Board of Directors (the "Board") to issue up to 1,000,000 shares of preferred stock. Currently, no shares of preferred stock are issued and outstanding. However, we can issue shares of our preferred stock in one or more series and can set the terms of the preferred stock without seeking any further approval from the holders of our common stock. Any preferred stock that we issue may rank ahead of our common stock in terms of dividend priority or liquidation premiums and may have greater voting rights than our common stock. In addition, such preferred stock may contain provisions allowing it to be converted into shares of common stock, which could dilute the value of our common stock to then current stockholders and could adversely affect the market price, if any, of our common stock.

Our compliance with changing laws and rules regarding corporate governance and public disclosure may result in additional expenses to us which, in turn, may adversely affect our ability to continue our operations.

Keeping abreast of, and in compliance with, changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and, in the event we are ever approved for listing on a registered national exchange, such exchange's rules, will require an increased amount of management attention and external resources. We intend to continue to invest all reasonably necessary resources to comply with evolving standards, which may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Our failure to adequately comply with any of these laws, regulations, standards or rules may result in substantial fines or other penalties and could have an adverse impact on our ongoing operations.

Because we do not intend to pay dividends for the foreseeable future you should not purchase our shares if you are seeking dividend income.

We currently intend to retain future earnings, if any, to support the development and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our Board after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words "may," "will," "should," "expect," "anticipate," "estimate," "believe," "intend," or "project" or the negative of these words or other variations on these words or comparable terminology. These statements are expressed in good faith and based upon our current assumptions, expectations and projections, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our technologies, our potential profitability, and cash flows, (b) our growth strategies, (c) expectations from our ongoing sponsored research and development activities, (d) anticipated trends in the industries in which our technology would be utilized, (e) our future financing plans, and (f) our anticipated needs for working capital.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks and uncertainties. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation.

We have little likelihood of long-term success unless we are able to continue to raise capital from the sale of our securities or financing from other sources until, if ever, we generate positive cash flow from operations.

USE OF PROCEEDS

This prospectus relates to the resale of certain shares of our common stock that may be offered and sold from time to time by the Selling Stockholder. This prospectus also relates to shares of our common stock which have previously been issued or may be issued to the Selling Stockholder upon exercise of the Convertible Note. We will not receive any proceeds from the sale of the Shares by the Selling Stockholder in this offering.

DETERMINATION OF OFFERING PRICE

The Selling Stockholder will determine at what price it may sell the Shares, and such sales may be made at prevailing market prices, or at privately negotiated prices. The conversion price of the Units has been arbitrarily determined by us and bears no significant relationship to our assets, earnings, book value or any other objective standard of value. Please refer to "Plan of Distribution."

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON STOCK

AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the OTCQB under the symbol "WNDW". Our warrants to purchase common stock are not currently traded on any market.

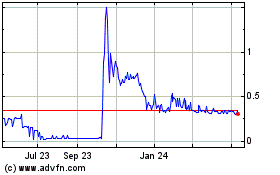

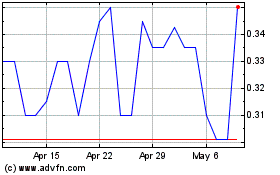

The following table sets forth the high and low bid quotations of our common stock for each quarter during the past two fiscal years as reported by the OTCQB:

| | | High | | | Low | |

| | | | | | | |

Fiscal Year Ended August 31, 2015 | | | | | | |

First Quarter 2015 (September 1 - November 30, 2014) | | $ | 1.82 | | | $ | 1.17 | |

Second Quarter 2015 (December 1, 2014 - February 28, 2015) | | $ | 1.74 | | | $ | 1.20 | |

Third Quarter 2015 (March 1 - May 31, 2015) | | $ | 2.35 | | | $ | 1.52 | |

Fourth Quarter 2015 (June 1 - August 31, 2015) | | $ | 3.82 | | | $ | 1.92 | |

| | | | | | | | | |

Fiscal Year Ended August 31, 2014 | | | | | | | | |

First Quarter 2014 (September 1 - November 30, 2013) | | $ | 3.31 | | | $ | 1.85 | |

Second Quarter 2014 (December 1, 2013 - February 28, 2014) | | $ | 2.95 | | | $ | 2.30 | |

Third Quarter 2014 (March 1 - May 31, 2014) | | $ | 2.56 | | | $ | 1.94 | |

Fourth Quarter 2014 (June 1 - August 31, 2014) | | $ | 2.04 | | | $ | 1.50 | |

As of the date of this prospectus, there were approximately 43 stockholders of record (this number does not include stockholders who hold their stock through brokers, banks and other nominees).

Dividend Policy

We have not paid any dividends on our common stock and our Board presently intends to continue a policy of retaining earnings, if any, for use in our operations. The declaration and payment of dividends in the future, of which there can be no assurance, will be determined by the Board in light of conditions then existing, including earnings, financial condition, capital requirements and other factors. The Nevada Revised Statutes prohibit us from declaring dividends where, if after giving effect to the distribution of the dividend:

| · | We would not be able to pay our debts as they become due in the usual course of business; or |

| · | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution. |

Except as set forth above, there are no restrictions that currently materially limit our ability to pay dividends or which we reasonably believe are likely to limit materially the future payment of dividends on common stock.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS