UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended October 31, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______To _______

Commission file number: 333-156059

Minerco, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Nevada | | 27-2636716 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

800 Bering Drive, Suite 201

Houston, TX 77057

(Address of principal executive offices)

(888) 473-5150

(Registrant’s telephone number, including area code)

_____________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | o | Non-accelerated filer | o |

Accelerated filer | o | Smaller reporting company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

APPLICABLE ONLY TO CORPORATE ISSUERS

As of December 21, 2015 the registrant had 56,252,248 outstanding shares of its common stock.

Table of Contents

|

| |

PART I – FINANCIAL INFORMATION |

| Page |

Item 1. Financial Statements | |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

Item 4. Controls and Procedures | |

| |

PART II – OTHER INFORMATION |

| |

Item 1. Legal Proceedings | |

Item 2. Unregistered Sales of Equity Securities | |

Item 3. Defaults Upon Senior Securities | |

Item 4. Mine Safety Disclosures | |

Item 5. Other Information | |

Item 6. Exhibits | |

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The unaudited interim financial statements of Minerco, Inc. follow. All currency references in this report are to U.S. dollars unless otherwise noted.

|

| | |

| Index |

Consolidated Balance Sheets (unaudited) | 4 |

|

Consolidated Statements of Operations and Comprehensive Loss (unaudited) | 6 |

|

Consolidated Statements of Cash Flows (unaudited) | 7 |

|

Consolidated Notes to the Unaudited Financial Statements | 8 |

|

Minerco, Inc.

Consolidated Balance Sheets

(unaudited)

|

| | | | | | | | |

| | October 31, 2015 | | July 31, 2015 |

ASSETS |

Cash | | $ | 281 |

| | $ | 7,258 |

|

Accounts Receivable, Net | | 115,127 |

| | 128,029 |

|

Inventory | | 256,081 |

| | 304,746 |

|

Prepaid Expenses | | 22,030 |

| | 5,896 |

|

Notes Receivable, Current | | — |

| | 117,196 |

|

Current Assets | | 393,519 |

| | 563,125 |

|

Other Assets | | |

| | |

|

Property and Equipment, net | | 101,708 |

| | 112,360 |

|

Prepaid Expenses, Noncurrent | | — |

| | 250,000 |

|

Goodwill | | 607,891 |

| | 607,891 |

|

Customer Relationships, net | | 146,138 |

| | 148,077 |

|

Intangible Assets, net | | 346,295 |

| | 98,048 |

|

Total Assets | | $ | 1,595,551 |

| | $ | 1,779,501 |

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

Current Liabilities | | |

| | |

|

Accounts payable and accrued liabilities | | $ | 2,635,216 |

| | $ | 2,460,186 |

|

Note Payable, net of unamortized discount $18,360 and $0 | | 176,106 |

| | 149,970 |

|

Accounts Payable – Related Party | | 481,752 |

| | 453,705 |

|

Convertible debt, net unamortized discount $368,684 and $204,036 | | 153,989 |

| | 89,690 |

|

Capital Lease Obligations, Current | | 7,899 |

| | 22,080 |

|

Line of Credit | | 123,187 |

| | 12,660 |

|

Derivative liabilities | | 847,685 |

| | 352,587 |

|

Short term Debt | | 2,075,000 |

| | 2,175,000 |

|

Total Current Liabilities | | 6,500,834 |

| | 5,715,878 |

|

Capital Lease Obligations, Noncurrent | | — |

| | 1,758 |

|

Total Liabilities | | 6,500,834 |

| | 5,717,636 |

|

Stockholders’ Deficit |

|

| | | | | | | | |

Series A Convertible Preferred stock, $0.001 par value, 15,000,000 shares authorized, 150,000 outstanding at October 31, 2015 and at July 31, 2015 | | 150 |

| | 150 |

|

Series B Convertible Preferred stock, $0.001 par value, 2,000,000 shares authorized, 974,309 and 365,809 outstanding at October 31, 2015 and at July 31, 2015 | | 975 |

| | 366 |

|

Series C Convertible Preferred stock, $0.001 par value, 1,000,000 shares authorized, 836,543 outstanding at October 31, 2015 and at July 31, 2015 | | 837 |

| | 837 |

|

Common stock, $0.001 par value, 250,000,000 shares authorized, 40,725,268 and 34,962,336 outstanding at October 31, 2015 and at July 31, 2015 | | 40,724 |

| | 34,963 |

|

Additional paid-in capital | | 26,206,133 |

| | 25,748,411 |

|

Accumulated deficit | | (29,680,299 | ) | | (28,128,489 | ) |

Total Minerco stockholders’ Deficit | | (3,431,480 | ) | | (2,343,762 | ) |

Noncontrolling Interest | | (1,473,803 | ) | | (1,594,373 | ) |

Total Stockholders’ Deficit | | (4,905,283 | ) | | (3,938,135 | ) |

Total Liabilities and Stockholders’ Deficit | | $ | 1,595,551 |

| | $ | 1,779,501 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(unaudited)

|

| | | | | | | | | | | | |

| |

Three Months Ended October 31, 2015

(Successor) | |

October 25, 2014 through

October 31, 2014

(Successor) | | August 1, 2014 Through October 24, 2014 (Predecessor) |

Sales: | | | | | | |

Products | | $ | 308,345 |

| | $ | 27,624 |

| | $ | 409,803 |

|

Services | | 12,168 |

| | — |

| | 66,000 |

|

Total Sales | | 320,513 |

| | 27,624 |

| | 475,803 |

|

Cost of Goods Sold | | 288,476 |

| | 20,415 |

| | 335,197 |

|

Gross Profit | | 32,037 |

| | 7,209 |

| | 140,606 |

|

Selling and Marketing | | 47,991 |

| | — |

| | — |

|

General and Administrative | | 878,075 |

| | 28,111 |

| | 363,259 |

|

Total Operating Expenses | | 926,066 |

| | 28,111 |

| | 363,259 |

|

Net Loss from Operations | | (894,029 | ) | | (20,902 | ) | | (222,653 | ) |

Other Income (Expenses): | | |

| | |

| | |

|

Interest Expense, net | | (175,085 | ) | | (987 | ) | | (17,465 | ) |

Gain/(Loss) on Derivative Liability | | (289,080 | ) | | — |

| | — |

|

Gain/(Loss) on Debt for Equity Swap | | (176,909 | ) | | — |

| | — |

|

Total Other Expenses | | (641,074 | ) | | (987 | ) | | (17,465 | ) |

Loss from Continuing Operations | | (1,535,103 | ) | | (21,889 | ) | | (240,118 | ) |

Net loss | | (1,535,103 | ) | | (21,889 | ) | | (240,118 | ) |

Net loss attributable to Noncontrolling interest | | (95,529 | ) | | (14,287 | ) | | — |

|

Net loss attributable to Minerco | | (1,439,574 | ) | | (7,602 | ) | | (240,118 | ) |

Preferred Stock Dividends | | 112,236 |

| | 15,122 |

| | — |

|

Net loss attributable to common shareholders | | $ | (1,551,810 | ) | | $ | (22,724 | ) | | $ | (240,118 | ) |

Total Other Comprehensive Income (Loss) | | |

| | |

| | |

|

Unrealized gain (loss) on AFS securities | | — |

| | 2,981 |

| | 9,356 |

|

Total Other Comprehensive Income (Loss) | | — |

| | 2,981 |

| | 9,356 |

|

Other Comprehensive Income (Loss) attributable to noncontrolling interest | | — |

| | 2,706 |

| | — |

|

Other Comprehensive Income (Loss) attributable to Minerco | | $ | — |

| | 275 |

| | $ | 9,356 |

|

Total Comprehensive Income (Loss) | | $ | (1,551,810 | ) | | $ | (22,449 | ) | | $ | (230,762 | ) |

Net Loss Per Common Share – Basic and Diluted | | $ | (0.04 | ) | | $( | 0.00) |

| | |

Weighted Average Common Shares Outstanding | | 36,286,598 |

| | 28,065,307 |

| | |

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco, Inc.

Consolidated Statements of Cash Flows

(unaudited)

|

| | | | | | | | | | | | |

| | Three Months ended

October 31, 2015

(Successor) | | The Period October 25, to

October 31, 2014(Successor) | | The Period August 1, 2014 to October 24, 2014

(Predecessor) |

Cash Flows from Operating Activities | | | | | | |

Net income (loss) for the period | | $ | (1,535,103 | ) | | $ | (21,889 | ) | | $ | (240,118 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | |

| | |

| | |

|

Loss on AFS | | — |

| | (2,981 | ) | | — |

|

Bad Debt Expense | | — |

| | — |

| | 90,300 |

|

Depreciation and Amortization | | 14,344 |

| | — |

| | 11,020 |

|

Loss on derivative liability | | 289,080 |

| | — |

| | — |

|

Stock based compensation | | 312,496 |

| | — |

| | — |

|

Accretion Expense | | 104,299 |

| | — |

| | — |

|

Loss on debt for equity exchange | | 176,909 |

| | — |

| | — |

|

Changes in operating assets and liabilities: | | |

| | |

| | |

|

Accounts receivable | | 12,902 |

| | (231,190 | ) | | 16,626 |

|

Inventory | | 48,665 |

| | 91,165 |

| | 166,736 |

|

Prepaid expenses and other current assets | | (16,134 | ) | | — |

| | — |

|

Accounts payable | | 54,643 |

| | — |

| | (217,226 | ) |

Investments | | — |

| | 2,981 |

| | — |

|

Accounts payable - RP | | 28,047 |

| | 221,960 |

| | — |

|

Accrued expenses | | 57,151 |

| | — |

| | 70,546 |

|

Net Cash Provided (Used) in Operating Activities | | (452,701 | ) | | 60,046 |

| | (102,116 | ) |

| | | | | | |

Cash Flows from Financing Activities | | |

| | |

| | |

|

Repayments of note payable | | (13,864 | ) | | — |

| | (27,500 | ) |

Proceeds from short term debt | | 325,000 |

| | — |

| | — |

|

Proceeds from note payable | | 40,000 |

| | — |

| | 150,000 |

|

Member Contributions | | — |

| | — |

| | 30,000 |

|

Net proceeds (payments) from line of credit | | 110,527 |

| | (2,666 | ) | | (31,467 | ) |

Member Distributions | | — |

| | — |

| | (3,250 | ) |

Repayments of Capital Lease Obligations | | (15,939 | ) | | — |

| | (14,717 | ) |

Net Cash Provided (Used) by Financing Activities | | 445,724 |

| | (2,666 | ) | | 103,066 |

|

Net change in cash | | (6,977 | ) | | 57,380 |

| | 950 |

|

Cash, Beginning of Period | | 7,258 |

| | 950 |

| | — |

|

Cash, End of Period | | $ | 281 |

| | $ | 58,330 |

| | $ | 950 |

|

Supplemental disclosures of cash flow information | | | | | | |

|

Cash paid for interest | | $ | 17,901 |

| | $ | — |

| | $ | 16,082 |

|

Cash paid for income taxes | | — |

| | — |

| | — |

|

Non Cash investing and Financing activities: | | |

| | |

| | |

|

Net liabilities of Successor | | $ | — |

| | $ | 2,610,053 |

| | $ | — |

|

Net liabilities of Predecessor | | — |

| | 1,811,546 |

| | — |

|

Increase in fair value of assets due to Acquisition | | — |

| | 43,956 |

| | — |

|

Exchange Accounts Payable for Series B Convertible Preferred | | 20,000 |

| | — |

| | — |

|

Reclass Prepaids to Intangibles | | 250,000 |

| | — |

| | — |

|

Convertible Debt and accrued interest converted into common shares | | 42,408 |

| | — |

| | — |

|

|

| | | | | | | | | | | | |

Debt and accrued interest Converted into Shares | | 182,644 |

| | — |

| | — |

|

Debt Discount recorded for derivative liability | | 268,948 |

| | — |

| | — |

|

Reclass derivative liability to equity | | 62,930 |

| | — |

| | — |

|

Conversion of Series B Convertible Preferred stock to Common Shares | | 3,378 |

| | — |

| | — |

|

Exchange Common for Series B Convertible Preferred Stock | | 525 |

| | — |

| | — |

|

Exchange Note Receivable for Athena interest | | 117,196 |

| | — |

| | — |

|

Shares Issued for Athena Acquisition | | 122,693 |

| | — |

| | — |

|

Dividend Declared | | 112,236 |

| | — |

| | — |

|

Unrealized gain on Investment |

| — |

| | — |

| | 9,356 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements

Minerco, Inc.

Consolidated Notes to the Financial Statements

(unaudited)

1. Basis of Presentation

The accompanying unaudited interim financial statements of Minerco, Inc. (“Minerco” or the “Company”), have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (the “SEC”), and should be read in conjunction with the audited financial statements and notes thereto contained in Minerco’s Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Consolidated Notes to the Financial Statements which substantially duplicate the disclosure contained in the audited financial statements for fiscal 2015 as reported in Minerco’s Form 10-K have been omitted.

On October 24, 2014, through its subsidiary, Athena Brands, Inc. (“Athena”), the Company entered into an Agreement (the “Membership Interest Purchase Agreement”) with Avanzar Sales and Distribution, LLC, a California Limited Liability Company (“Avanzar”) to acquire an initial thirty percent (30%) equity position and fifty-one percent (51%) voting interest for the Purchase Price of $500,000 with an option to acquire an additional twenty-one percent (21%) interest and Second Option to acquire up to seventy-five percent (75%) of Avanzar (the "Acquisition"). The acquisition broadens the company's base in the consumer packaged goods industry through vertical integration. The acquisition was accounted for in accordance with ASC 805, Business Combinations.

The Acquisition has been accounted for in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for business combinations and accordingly, the Company’s assets and liabilities, excluding deferred income taxes, were recorded using their fair value as of October 24, 2014. Under SEC rules, Avanzar is considered the predecessor business to Minerco given Avanzar’s significant size compared to Minerco at the date of acquisition

The basis of presentation is not consistent between the successor and predecessor entities and the financial statements are not presented on a comparable basis. As a result, the accompanying consolidated statements of operations, cash flows and comprehensive income (loss) are presented for two different reporting entities:

Successor — relates to the financial periods and balance sheets succeeding the Membership Interest Purchase Agreement; and

Predecessor — relates to the financial periods preceding the Acquisition (prior to October 24, 2014).

Unless otherwise indicated, the “Company” as used throughout the remainder of the notes, refers to both the Successor and Predecessor.

2. Going Concern

These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize it assets and discharge its liabilities in the normal course of business. During the three months ended October 31, 2015, the Company has an accumulated deficit of $29,680,299 and revenue of $320,513. The continuation of the Company as a going concern is dependent upon the company's continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company intends to fund operations through revenue from operations and equity and debt financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending July 31, 2016.

3. Intangible Assets

Finite lived Intangible Assets, net, at October 31, 2015 and July 31, 2015 consists of:

|

| | | | | | | | |

| | October 31, 2015 | | July 31, 2015 |

VitaminFizz Name Licensing Rights | | $ | 30,000 |

| | $ | 30,000 |

|

VitaminFizz Brand Purchase | | 250,000 |

| | — |

|

Vitamin Creamer | | 75,000 |

| | 75,000 |

|

Less accumulated amortization | | (8,705 | ) | | (6,952 | ) |

Intangible Assets, net | | $ | 346,295 |

| | $ | 98,048 |

|

The Company amortization expense of $0, $0 and $1,753 during the during period from October 25, 2014 to October 31, 2014, the period from August 1, 2014 to October 24, 2014 and the three months ended October 31, 2015 respectively.

VITAMINFIZZ ®

On September 28, 2015, the Company, through its subsidiary Athena, and VitaminFIZZ Brands, LP ("VF Brands") entered into an Asset Purchase Agreement for the VitaminFIZZ Brand (the "Brand") to purchase certain intellectual property and tangible assets from the Seller including but not limited to the trademark "VitaminFIZZ," formulation, website, design logos and other trade secrets relating to the VitaminFIZZ Brand for a purchase price of $300,000 which includes a credit for monies contributed to the Brand, the assumption by VF Brands of certain of Athena's debts payable in the amount $214,126 and the balance to be distributed at the discretion of VF Brands in 4 installments over 120 days. This replaces the brand licensing agreement dated November 21, 2013 and amended June 25, 2014. The Company made the first payment of $50,000 on September 28, 2015 and second payment of $50,000 on November 25, 2015. Pursuant to this transaction we reclassified $250,000 from Prepaid Expenses, Noncurrent to Intangible Assets.

4. Property and Equipment, Net

Equipment, net, at October 31, 2015 and July 31, 2014 consists of:

|

| | | | | | | | | | |

| | Useful Life | | October 31, 2015 | | July 31, 2015 |

Furniture and Fixtures | | 5 years | | $ | 6,297 |

| | $ | 6,297 |

|

Computer and Equipment | | 3 years | | 2,413 |

| | 2,413 |

|

Leasehold Improvements | | Remaining life of lease | | 830 |

| | 830 |

|

Capital Leases | | Term of lease | | 266,017 |

| | 266,017 |

|

Accumulated Depreciation | | | | (173,849 | ) | | (163,197 | ) |

Property and Equipment, net | | | | $ | 101,708 |

| | $ | 112,360 |

|

Depreciation expense was $0, $11,020 and $10,652 for the period October 25, 2014 to October 31, 2014, for the period August 1 to October 24, 2014 and for the three months ended October 31, 2015 respectively.

5. Inventory

Inventory, at October 31, 2015 and July 31, 20145 consists of:

|

| | | | | | | | |

| | October 31, 2015 | | July 31, 2015 |

Raw Materials | | $ | — |

| | $ | — |

|

Work in progress | | — |

| | — |

|

Finished Goods | | 256,081 |

| | 304,746 |

|

Inventory, net | | $ | 256,081 |

| | $ | 304,746 |

|

6. Fair Value of Financial Instruments

ASC 820, “Fair Value Measurements”, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, accounts payable and accrued liabilities, and due to related party. Pursuant to ASC 820, the fair value of the Company's cash equivalents is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The Company believes that the recorded values of all of the other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

The following table sets forth by level with the fair value hierarchy the Company’s financial assets and liabilities measured at fair value on October 31, 2015.

|

| | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Assets | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Liabilities | | | | | | | | |

Derivative Financial Instruments | | $ | — |

| | $ | — |

| | $ | 847,685 |

| | $ | 847,685 |

|

The following table sets forth by level with the fair value hierarchy the Company’s financial assets and liabilities measured at fair value on July 31, 2015.

|

| | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Assets | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Liabilities | | | | | | | | |

Derivative Financial Instruments | | $ | — |

| | $ | — |

| | $ | 352,587 |

| | $ | 352,587 |

|

7. Convertible note payable and derivative liabilities

During the three months ended October 31, 2015, the Company exchanged $268,948 in principal and accrued interest under its line of credit with Post Oak for two convertible promissory notes in the amount of $268,948. The notes carry an interest rate of 8%. The notes are convertible at a variable conversion price of 50% of the market price and calculated using the lowest trading days during the preceding 20 days before conversion. The total principal due at July 31, 2015 was $293,726 with an unamortized discount of $204,036 resulting in a balance of $89,690 at July 31, 2015. The Company had conversions of $40,000 in principal and $2,408 in accrued interest during the three months ended October 31, 2015. Total principal due at October 31, 2015 is $522,673 with an unamortized discount of $368,684 with a resulting balance of $153,989.

Due to their being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options embedded in the Convertible Promissory Notes, the options are classified as derivative liabilities and recorded at fair value.

Derivative Liability:

As of October 31, 2015, the fair values of the conversion options on the convertible notes were determined to be $847,685 using a Black-Scholes option-pricing model. Upon the issuance dates of the Convertible Promissory Notes, $268,948 was recorded as

debt discount and $207,665 was recorded as day one loss on derivative liability. During the three months ended October 31, 2015 loss on mark-to-market of the conversion options of $81,415. As of October 31, 2015 and July 31, 2015, the aggregate unamortized discount is $368,684 and $204,036, respectively.

The following table summarizes the derivative liabilities included in the consolidated balance sheet at October 31, 2015:

|

| | |

Balance at July 31, 2015 | 352,587 |

|

Debt discount | 268,948 |

|

Day one loss on fair value | 207,665 |

|

Loss on change in fair value | 81,415 |

|

Write off due to Conversion | (62,930 | ) |

Balance at October 31, 2015 | 847,685 |

|

Pursuant to ASC 815, “Derivatives and Hedging,” the Company recognized the fair value of the embedded conversion feature of all the notes. The initial fair value of the derivative liability was determined using the Black Scholes option pricing model with a quoted market price of $0.045 to $0.30, a conversion price of $0.0205 to $0.035, expected volatility of 172% to 424%, no expected dividends, an expected term of one year and a risk-free interest rate of 0.01% to 0.32%. The discount on the convertible loan is accreted over the term of the convertible loan. During the three months ended October 31, 2015, the Company recorded amortization of debt discoiunt of $104,299.

8. Debt

Minerco Line of Credit

On May 1, 2014, the Company entered into an Agreement (the “Line of Credit”) with Post Oak, LLC ("Post Oak”), where, among other things, the Company and Lender entered into a Line of Credit Financing Agreement in the principal sum of up to Two Million Dollars ($2,000,000), or such lesser amount as may be borrowed by the Company as Advances under this line of credit (the “Line of Credit”). On April 1, 2015, the Company increased the line of credit to Three Million Dollars ($3,000,000). As of October 31, 2015 and July 31, 2015, the Company had 2,075,000 and 2,175,000 outstanding under the line of credit respectively.

During the three months ended October 31, 2015, Post Oak exchanged $300,000 in its line of credit with us with unrelated third parties and loaned the Company $325,000.

During the three months ended October 31, 2015, the Company exchanged $268,948 in principal and accrued interest under its line of credit with Post Oak for two convertible promissory notes in the amount of $268,948.

During the three months ended October 31, 2015, the Company converted $128,589 of principal and interest of the line of credit into 595,000 Series B Preferred shares and recorded a loss of $109,411 due the difference between the fair market value of $238,000 and note and interested converted to settle the debt respectively. There is no accounting impact for the modification as there were not associated fees with the line of credit.

During the three months ended October 31, 2015, the Company converted $54,055 of principal and interest of the line of credit into 1,176,471 shares of common stock and recorded a loss of $68,298 due the difference between the fair market value of $122,353 and note and interest converted to settle the debt respectively. There is no accounting impact for the modification as there were not associated fees with the line of credit.

The summary of the Line of Credit is as:

This Line of Credit bears interest at the rate of ten percent (10.00%) per annum.

The entire outstanding principal amount of this Line of Credit is due and payable on October 31, 2016 (the “Maturity Date”).

Advances. Subject to the provisions of Section 2, the Company has the right, at any time or from time to time prior to the Maturity Date to request loans and advances from the Lender (individually an “Advance” and collectively, the “Advances”). Each such Advance is to be considered a legal promissory note, is to be in the amount of $250,000, and is to be reflected on Schedule A to

this Line of Credit and initialed as received by an officer or director of the Company. The Lender is not under any obligation to make advances under this Line of Credit.

Use of Proceeds. All proceeds received by the Company from each Advance made by the Lender under this Line of Credit are to be used by the Company for expenses incurred by the Company in connection with working capital and any other operating expenses determined to be necessary by the Company.

Interest Payments, Balloon Payment. The Company pays interest at the rate of ten percent (10.00%) per annum, calculated on a per day basis for each Advance made by Lender, and the Company is obligated to make one interest payment in twelve (12) months and one interest payment in eighteen (18) months. The Company is obligated to make a payment for the entire unpaid balance of all Advances, plus any accrued unpaid interest, as per a “balloon” payment, in two (2) years from the date of the Line of Credit.

Minerco Notes Payable

On September 11, 2015, the Company signed a line of credit with Capital Advance Partners, LLC for the amount of $58,360 with $18,360 recognized as a discount on the note payable for net proceeds of $40,000 payable over 4 months. $13,864 was repaid during the three months ended October 31, 2015 and as of October 31, 2015, $26,136 is outstanding, net of discount of $18,360.

Avanzar Notes Payable

Avanzar has received proceeds from various unrelated third parties and these notes have an interest rate of between 8% and 12% and mature between February 28, 2015 and December 31, 2015. The total principal due as of October 31, 2015 is $149,970. A schedule of the notes payable are below:

|

| | | | | | | | | | | |

Principal at 7/31/2015 | | Principal at 10/31/2015 | | Interest Rate |

| | Maturity |

$ | 20,000 |

| | $ | 20,000 |

| | 8 | % | | In default |

$ | 10,000 |

| | $ | 10,000 |

| | 8 | % | | In default |

$ | 20,000 |

| | $ | 20,000 |

| | 8 | % | | In default |

$ | 49,970 |

| | $ | 49,970 |

| | 12 | % | | In default |

$ | 10,000 |

| | $ | 10,000 |

| | Non-interest bearing |

| | In default |

$ | 20,000 |

| | $ | 20,000 |

| | 8 | % | | December 31, 2015 |

$ | 20,000 |

| | $ | 20,000 |

| | 8 | % | | In default |

$ | 149,970 |

| | $ | 149,970 |

| | | | |

There were no repayments during the three months ended October 31, 2015.

Avanzar Line of Credit

On May 27, 2014, Avanzar signed a line of credit with BFS West Capital for a principal amount of $168,000 payable over 15 months and matures in August 2015 and $134,190 is outstanding as of July 31, 2014. As of July 31, 2015, $12,660 is outstanding. The current interest rate is 50.65% per annum.

On September 1, 2015, Avanzar signed a line of credit with BFS West Capital for a principal amount of $125,000 and the repayment amount is $177,500. The factor rate is 1.42.

During the three months ended October 31, 2015, $14,473 was repaid from the line of credit and as of October 31, 2015, $123,187 is outstanding.

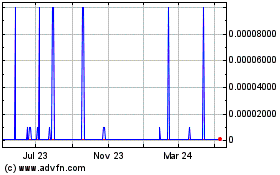

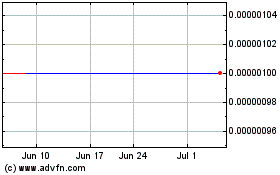

9. Common Stock

On August 5, 2014, we effectuated an increase in our authorized shares of common stock from 2,500,000,000 to 3,500,000,000. On October 2, 2015, the Company effected a 100 for 1 reverse stock split, decreasing authorized shares of common stock from 3,500,000,000 to 250,000,000 and as a result decreasing the issued and outstanding share of common stock from 3,496,233,557 to 34,962,336 and decreasing the issued and outstanding shares of Class A Preferred from 15,000,000 to 150,000. All shares amounts in these financial statements have been retroactively adjusted for all periods presented to reflect this stock split.

For the three months ended October 31, 2015, Minerco has issued following shares:

On September 15, 2015, the Company issued 100,000 common shares for consulting services. The shares vested immediately. The fair value of these shares was determined to be $11,000 and was expensed as stock compensation.

On October 1, 2015, the Company exchanged 595,000 shares of Series B Preferred for 2,975,000 shares of common stock.

On October 9, 2015, the Company exchanged 80,000 shares of Series B Preferred for 400,000 shares of common stock.

On October 9, 2015, the Company converted $54,055 of principal and interest of the line of credit into 1,176,471 shares of common stock and recorded a loss of $68,298 due the difference between the fair market value of $122,353 and note and interest converted to settle the debt respectively.

During the three months ended October 31, 2015, the Company issued, 1,632,869 common shares for the conversion of $42,408 convertible promissory notes and accrued interest. These notes converted at conversion rates between $0.0205 and $0.035.

10. Preferred Stock

The preferred stock may be divided into and issued in series. The Board of Directors of the Company is authorized to divide the authorized shares of preferred stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes.

On January 11, 2011, the Company authorized 25,000,000 shares of unclassified preferred stock.

Class A Convertible Preferred Stock

On January 11, 2011, the Company designated 15,000,000 shares of its preferred stock as Class A Convertible Preferred Stock (“Class A Stock”). Each share of Class A Stock is convertible into 10 shares of common stock, has 100 votes, has no dividend rights except as may be declared by the Board of Directors, and has a liquidation preference of $1.00 per share.

Class B Convertible Preferred Stock

Dividends

The Series B Shares accrue dividends at the rate per annum equal to 8% of the Stated Value which initially is ten dollars per share payable in cash; provided that after an initial public offering of the Company’s common stock the dividends may be paid at the option of the Company in cash or additional shares of common stock.

Conversion

Each Series B Share (together with any accrued but unpaid dividends thereon) is convertible into shares of Common Stock at the option of the holder at any time at a conversion price per share equal to the sum of the Stated Value a divided by the Conversion Price, subject to adjustment as described below. The initial Conversion Price shall be equal to $0.02. The Series B Shares automatically convert to common stock immediately prior to the closing of a firmly underwritten public offering for gross offering proceeds of at least $10,000,000 or upon the consent of two-thirds of the holders of Series B Shares.

Redemption

The Company has the right to redeem the Series B Shares at any time at a price per share equal to the Stated Value multiplied by 125%.

Liquidation

In the event of a liquidation, dissolution or winding up of the Company and other Liquidation Events as defined in the Certificate of Designations, holders of Series B Shares are entitled to receive from proceeds remaining after distribution to the Company’s creditors and prior to the distribution to holders of Common Stock but junior to the Series A Preferred Stock the (x) Stated Value (as adjusted for any stock splits, stock dividends, reorganizations, recapitalizations and the like) held by such holder and (y) all accrued but unpaid dividends on such shares.

Anti-Dilution

The Series B Shares are entitled to weighted average anti-dilution protection under certain circumstances specified in the Certificate of Designations.

Voting

Except as otherwise required by law and except as set forth below, holders of Series B Shares will, on an as-converted basis, vote together with the Common Stock as a single class. Each holder of Series B Shares is entitled to cast the number of votes equal to five times the number of shares of Common Stock into which such shares of Series B Shares could be converted at the record date for determining stockholders entitled to vote at the meeting.

During the three months ended October 31, 2015, the Company converted $128,589 of principal and interest of the line of credit into 595,000 Series B Preferred shares and recorded a loss of $109,411 due the difference between the fair market value of $238,000 and note and interested converted to settle the debt respectively.

On September 9, 2015, the Company and JusThink, Inc. entered into an exchange agreement, whereby the Company issued 32,000 shares of Series B in settlement of $20,000 in accounts payable. The Company recognized a gain of $800 on the transaction due to the difference between the fair market value of $19,200 and accounts payable settled.

On September 28, 2015, the Company and MSF International, Inc. ("MSF"), effective August 1, 2015, entered into an exchange agreement whereby MSF exchanged 50 shares, or approximately five percent (5%), of Athena owned by MSF in exchange for 400,000 shares of the Company's Class B Preferred Stock. This transaction was recognized through equity section on the balance sheet in the amount of $93,956 and there was no gain or loss on the transaction.

On October 1, 2015, the Company and Eco Processing, LLC ("Eco"), entered into an exchange agreement whereby Eco exchanged 15 shares, or approximately one and half percent (1.5%), of Athena owned by Eco in exchange for 150,000 shares of the Company's Class B Preferred Stock. This transaction was recognized through equity section on the balance sheet in the amount of $28,187 and there was no gain or loss on the transaction.

On October 7, 2015, MSF converted 80,000 shares of Preferred B stock into 400,000 shares of common stock.

During the three months ended October 31, 2015, the Company entered into exchange agreements with 12 shareholders to exchange 752,713 shares of common stock for 156,900 shares of Series B, as of October 31, 2015, only 524,258 shares of common stock have been exchanged for 106,500 shares of Series B.

On September 10, 2014, the Company issued 500,000 Class B convertible preferred shares to its Chief Executive Officer valued at $0.62 or $1,550,000. The Company recognized this as compensation and will amortize this over the vesting period which is July 31, 2017. On January 7, 2015, the Company entered into an exchange agreement with V. Scott Vanis, our Principal Executive Officer (“Vanis”), where, among other things, the Company and Vanis exchange Vanis’ five hundred thousand (500,000) shares of the Company’s Class ‘B’ Preferred stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class ‘C’ Preferred stock. The total expense for three three months ended October 31, 2015 is $150,748.

On September 10, 2014, the Company issued 500,000 Class B convertible preferred shares to its Chief Financial Officer valued at $0.62 or $1,550,000. The Company recognized this as compensation and will amortize this over the vesting period which is July 31, 2017. On January 7, 2015, the Company entered into an exchange agreement with Sam J Messina III, our Principal Accounting Officer (“Messina”), where, among other things, the Company and Messina exchange Messina’s five hundred thousand (500,000) shares of the Company’s Class ‘B’ Preferred stock and all accrued and unpaid dividends for two hundred fifty thousand (250,000) shares of the Company’s Class ‘C’ Preferred stock. The total expense for the three months ended October 31, 2015 is $150,748.

Class C Convertible Preferred Stock

On January 7, 2015, the Company filed a Certificate of Designations for the creation of a class of Series C Preferred Stock with the Nevada Secretary of State. The number of shares constituting Series C Preferred is 1,000,000. The stated value is $20.00 per share. The holders of the Series C Preferred are also entitled to a liquidation preference equal to the stated value plus all accrued and unpaid dividends. Each share of Series C Preferred is convertible into 1,000 shares of common stock; however the conversion price is subject to adjustment. Holders of shares of Series C Preferred vote together with the common stock as a single class and each holder of Series C Preferred shall be entitled to 5 votes for each share of Common Stock into which such shares of Series C Preferred held by them could be converted. The Company has the right to redeem the shares of Series C Preferred at any time after the date of issuance at a per share price equal to 125% of the stated value.

During the three months ended October 31, 2015, the Company had preferred dividends of $112,236.

11. Related Parties

As of October 31, 2015, the Company owes its current Chief Executive Officer $295,161 ($238,911– July 31, 2015) in accrued salary ($18,750 per month) and $140,341 ($181,044 – July 31, 2015) for advances made to the Company. The Company owes its current Chief Financial Officer $46,250 ($33,500 – July 31, 2015) in accrued salary ($12,500 per month. The advances are due on demand and non interest bearing.

As of October 31 and July 31, 2015, the Company owes one of its members $23,170 and $23,170, respectively, for advances made to the Company.

12. Commitments

Capital Leases

We have a capital leases for property and equipment through our subsidiary Avanzar. At October 31, 2015, total future minimum payments on our capital lease were as follows:

|

| | | |

2016 | $ | 6,120 |

|

2017 | 1,670 |

|

Total | $ | 7,790 |

|

Operating Leases

We have an operating lease for San Diego office. At October 31, 2015, total future minimum payments on our operating lease were as follows:

|

| | | |

2016 | $ | 20,391 |

|

2017 | 26,721 |

|

2018 | 2,308 |

|

Total | $ | 49,420 |

|

13. Noncontolling Interest

The Company owns 81.8% of its subsidiary Athena. The remaining 18.2% is owned by unrelated third parties. Athena owns 75% equity interest of Avanzar Sales and Distribution, LLC. The net loss attributable to noncontrolling interest for the three months ended October 31, 2015 was $95,529.

On September 2, 2015, the Company and MSF entered into a Mutual Release and Settlement Agreement for the Pledge and Security Agreement. In exchange for forgiving the promissory note in the amount $682,850 which was impaired to $117,196 as of July 31, 2015, MSF exchanged 50 shares, or approximately five percent (5%), of Athena owned by MSF. During the three months ended October 31, 2015, this transaction was recognized through equity section on the balance sheet in the amount of $117,196 and there was no gain or loss recognized.

14. Subsequent Events

On November 5, 2015, we issued 1,995,000 common shares in one (1) transaction upon the exchange of $43,890 in debt exchange agreement under the line of credit with Post Oak, LLC.

On November 13, 2015, we issued 490,799 common shares in one (1) transaction upon exchange of $10,061 in principal and accrued interest under a convertible promissory note dated October 16, 2015.

On November 13, 2015, we issued 420,000 common shares in one (1) transaction upon exchange of $8,770 in principal and accrued interest under a convertible promissory note dated November 4, 2015.

On November 19, 2015, we issued 539,276 common shares in one (1) transaction upon the exchange of $6,110 in debt exchange agreement under the line of credit with Post Oak, LLC.

On November 19, 2015, we issued 800,000 common shares in one (1) transaction upon exchange of $9,888 in principal and accrued interest under a convertible promissory note dated November 4, 2015.

On November 20, 2015, we issued 1,116,000 common shares in three (3) transactions for consulting services which were recognized as expense in the amount $25,668.

On November 24, 2015, we issued 1,350,576 common shares in one (1) transaction upon exchange of $14,924 in principal and accrued interest under a convertible promissory note dated October 22, 2014.

On November 26, 2015, we issued 2,100,000 common shares in one (1) transaction upon exchange of $22,554 in principal and accrued interest under a convertible promissory note dated November 4, 2015.

On November 30, 2015, we issued 2,500,000 common shares in one (1) transaction upon the exchange of $25,000 in debt exchange agreement under the line of credit with Post Oak, LLC.

On December 1, 2015, we issued 1,009,000 common shares in one (1) transaction upon exchange of $9,747 in principal and accrued interest under a convertible promissory note dated November 4, 2015.

On December 4, 2015, we issued 2,021,479 common shares in one (1) transaction upon exchange of $20,215 in principal and accrued interest under a convertible promissory note dated October 16, 2015.

On December 8, 2015, we issued 1,184,850 common shares in one (1) transaction upon the exchange of $14,692 in debt exchange agreement under the line of credit with Post Oak, LLC.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This quarterly report on Form 10-Q for the quarter ended October 31, 2015 contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including “could”, “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report.

Business Overview

Since 2012, our primary focus has been on our subsidiary Athena Brands, Inc. ("Athena"), formerly Level 5 Beverage Company, Inc., and its functional beverage business. In September, 2012, we formed Athena, a specialty beverage company which develops, produces, markets and distributes a diversified portfolio of forward-thinking, good-for-you consumer brands. Athena has developed or acquired exclusive rights to four separate and distinct brands: VitaminFIZZ®, Vitamin Creamer®, COFFEE BOOST and The Herbal Collection™, and The Herbal Collection has been transferred and assigned from Athena to us. During the three months ended October 31, 2015 we generated revenue of $320,513 all of which was generated from sales from our distribution business.

We organically developed the COFFEE BOOST™ Brands, and we acquired the exclusive, worldwide rights to the VitaminFIZZ® Brand from VITAMINFIZZ, L.P. in November, 2013. In 2014, we acquired 100% of the right, title and intellectual property to the Vitamin Creamer® Brand. The current focus of our business is on the VitaminFIZZ® brand and in September 2014, we acquired 100% ownership of the brand. We are currently completing the research and development of the VitaminCreamer® brand to include a Boost and Relax, and we are completing the formulation and packaging for The Herbal Collection™ brand.

Athena also owns a majority interest in Avanzar, a sales and distribution company locate in Brea, California. Avanzar is a full service brokerage which includes account management, trade development and logistics services as well as in house DSD operations throughout Southern California. Avanzar distributes products to some of the most trusted retailers in the United States, including Kroger, Albertsons, HEB, Golub (Price Chopper), Whole Foods, Walgreens, 7-Eleven, Tesoro, Circle K, Chevron, Kmart, Gelson's and Winco. On October 24, 2014 (effective September 15, 2014), we entered into a Membership Interest Purchase Agreement with Avanzar to acquire the controlling interest in Avanzar. Athena acquired an initial thirty percent (30%) equity position and fifty-one percent (51%) voting interest in Avanzar for the purchase pice of $500,000 with an option to acquire a twenty-one percent (21%) interest in Avanzar and second option to acquire up to an aggregate of seventy-five percent (75%) interest in Avanzar. The Agreement was effective as of September 15, 2014. As of April 30, 2015, all 3 of the options were exercised.

As of September 20, 2013, we completely discontinued operations of our Renewable Energy line of business. On May 5, 2015, effective April 30, 2015, we entered into a Securities Purchase Agreement (the "Agreement") with MSF a Belize corporation for the sale to MSF of all our rights and title and interest in its (i) Chiligatoro Hydro-Electric Project and its earned interest therein; (ii) Iscan Hydro-Electric Project and its 10% royalty interest therein; and (iii) its Sayab Wind Project and its 6% royalty interest therein (the “Assets”). The purchase price consisted of MSF assuming Thirty Two Thousand Six Hundred Forty-two US Dollars ($32,642) of certain of our accounts payable and a note payable by MSF to us in the principal amount of Six Hundred Eighty Two Thousand Eight Hundred Fifty US Dollars ($682,850) Dollars, accruing interest at a rate of 5% per annum, with interest payable quarterly commencing September 1, 2015 and the principal balance thereof and accrued and unpaid interest due and payable twelve (12) months after the date of its closing.

On March 30, 2010, the Company effected a 6 for 1 forward stock split, increasing the issued and outstanding shares of common stock from 55,257,500 to 331,545,000 shares. On February 13, 2012, the Company effected a 150 for 1 reverse stock split, decreasing the issued and outstanding share of common stock from 1,054,297,534 to 7,028,670 shares. On May 13, 2013, we effectuated an increase in our authorized shares of common stock from 1,175,000,000 to 2,500,000,000. On August 5, 2014, we effectuated an increase in our authorized shares of common stock from 2,500,000,000 to 3,500,000,000. On October 2, 2015, the Company effected a 100 for 1 reverse stock split, decreasing the issued and outstanding share of common stock from 3,496,235,155 to 34,962,352 and decreasing the issued and outstanding shares of Class A Preferred from 15,000,000 to 150,000. All shares amounts in these financial statements have been retroactively adjusted for all periods presented to reflect this stock split.

Results of Operations

Our results of operations are presented below:

|

| | | | | | | | |

| |

Three Months Ended October 31, 2015

(Successor) | | Three Months Ended October 31, 2014 (Combined) |

Sales: | | | | |

Products | | $ | 308,345 |

| | $ | 437,427 |

|

Services | | 12,168 |

| | 66,000 |

|

Total Sales | | 320,513 |

| | 503,427 |

|

Cost of Goods Sold | | 288,476 |

| | 355,612 |

|

Gross Profit | | 32,037 |

| | 147,815 |

|

Selling and Marketing | | 47,991 |

| | — |

|

General and Administrative | | 878,075 |

| | 391,370 |

|

Total Operating Expenses | | 926,066 |

| | 391,370 |

|

Net Loss from Operations | | (894,029 | ) | | (243,555 | ) |

Other Income (Expenses): | | |

| |

|

|

Interest Expense, net | | (175,085 | ) | | (18,452 | ) |

Gain/(Loss) on Derivative Liability | | (289,080 | ) | | — |

|

Gain/(Loss) on Debt for Equity Swap | | (176,909 | ) | | — |

|

Total Other Expenses | | (641,074 | ) | | (18,452 | ) |

Loss from Continuing Operations | | (1,535,103 | ) | | (262,007 | ) |

Net loss | | (1,535,103 | ) | | (262,007 | ) |

Net loss attributable to Noncontrolling interest | | (95,529 | ) | | (14,287 | ) |

Net loss attributable to Minerco | | (1,439,574 | ) | | (247,720 | ) |

Preferred Stock Dividends | | 112,236 |

| | 15,122 |

|

Net loss attributable to common shareholders | | $ | (1,551,810 | ) | | $ | (262,842 | ) |

Total Other Comprehensive Income (Loss) | | |

| |

|

|

Unrealized gain (loss) on AFS securities | | — |

| | 12,337 |

|

Total Other Comprehensive Income (Loss) | | $ | — |

| | 12,337 |

|

Other Comprehensive Income (Loss) attributable to noncontrolling interest | | — |

| | 2,706 |

|

Other Comprehensive Income (Loss) attributable to Minerco | | $ | — |

| | 9,631 |

|

Total Comprehensive Income (Loss) | | $ | (1,551,810 | ) | | $ | (253,211 | ) |

Net Loss Per Common Share – Basic and Diluted | | $ | (0.04 | ) | | $ (0.00) |

Weighted Average Common Shares Outstanding | | 36,286,598 |

| | 28,065,307 |

|

Results of Operations for the Three months ended October 31, 2015

The three months ended October 31, 2015 represent Successor results and the three months ended October 31, 2014 represent mostly Predecessor results so any comparisons between the three months ended October 31, 2015 and 2014 may not be meaningful.

Revenues

During the three months ended October 31, 2015, total revenue was $320,513 compared to total revenue of $503,427 during the same period in fiscal 2014. The decrease was due a decrease in service related revenue and decrease in capital invested into the distribution business due to a reallocation of capital.

Gross Profit

During the three months ended October 31, 2015, gross profit was $32,037 compared to gross profit of $147,815 during the same period in fiscal 2015 The decrease was due the Athena’s promotion sales during the quarter to launch new retailers. Gross margin were 29% in the three months ended October 31, 2014 compared to 10.0% in the three months ended October 31, 2015.

Operating Expenses

Our total operating expenses for the three months ended October 31, 2015 were $926,066, compared to operating expenses of $391,370 during the same period in fiscal 2015. The increase was due an increase in business activity of as we launched retailers during the quarter and due to an increase in infrastructure for our beverage business.

Our general and administrative expenses consist of professional fees, transfer agent fees, investor relations expenses and general office expenses. Our professional fees include legal, accounting and auditing fees.

During the three months ended October 31, 2015 we incurred a net loss of $1,535,103 compared to a net loss of $262,007 during the same period in fiscal 2015. The increase in our net loss during the three months ended October 31, 2015 was primarily due to the launch of several major key retailers during the quarter and due to an increase in infrastructure for our beverage business.

Liquidity and Capital Resources

As of October 31, 2015, we had $281 in cash, $115,127 in accounts receivable, $22,030 in current prepaid assets, and $256,081 in inventory and $1,595,551 in total assets, $6,500,834 in total liabilities and a working capital deficit of $6,107,315. Our accumulated deficit from our inception on June 21, 2007 to October 31, 2015 is $29,680,299 and was funded primarily through equity and debt financing.

We are dependent on our net revenues and funds raised through our equity and debt financing.

During the three months ended October 31, 2015 our monthly cash requirements to fund our operating activities was approximately $123,923. Our cash on hand of $281, as of October 31, 2015, will not allow us to continue to operate until we receive Athena revenue proceeds and additional financings. We estimate our planned expenses for the next 24 months (beginning December, 2015) to be approximately $10,862,000, as summarized in the tables below assuming revenue from our beverage sales will exceed $5,000,000 over the next 12 months and $10,000,000 in fiscal 2017. If revenue is not as anticipated as, we will be forced to scale our expenses according to our business requirements which will negatively impact our ability to increase revenue.

|

| | | |

Expense Overview | | | |

Description | | | |

| Fiscal Year 2016 ($) | Fiscal Year 2017 ($) | Total |

Advertising | 250,000 | 1,000,000 | 1,250,000 |

Warehouse & Delivery | 150,000 | 150,000 | 300,000 |

Insurance | 75,000 | 150,000 | 225,000 |

Inventory Purchases / Production (net Cash) | 1,000,000 | 2,000,000 | 3,000,000 |

Consulting Services | 200,000 | 250,000 | 450,000 |

Retail incentive | 200,000 | 250,000 | 450,000 |

Sales incentive | 100,000 | 200,000 | 300,000 |

Sales Representative Payroll | 125,000 | 250,000 | 375,000 |

Payroll Taxes | 20,000 | 40,000 | 60,000 |

Rent or Lease | 120,000 | 150,000 | 270,000 |

Filling Equipment Lease | 0 | 100,000 | 100,000 |

Sales Commission | 150,000 | 300,000 | 450,000 |

Research & Development | 100,000 | 200,000 | 300,000 |

POS material | 200,000 | 400,000 | 600,000 |

Taxes & Licenses | 30,000 | 30,000 | 60,000 |

Utilities & Telephone | 25,000 | 30,000 | 55,000 |

Sampling | 200,000 | 250,000 | 450,000 |

Accounting & Legal fees | 250,000 | 300,000 | 550,000 |

General and Administrative Expenses | 280,000 | 350,000 | 630,000 |

| | | |

Contingencies (10%) | 347,000 | 640,000 | 987,000 |

Total | 3,822,000 | 7,040,000 | 10,862,000 |

Our general and administrative expenses for the year are expected to consist primarily of salaries, transfer agent fees, investor relations expenses and general office expenses. The professional fees are related to our regulatory filings throughout the year.

Athena has started generating revenues for us; however, there can be no assurances that enough sales or revenues will be received to support our capital needs.

Future Financings

Our financial statements for the three months ended October 31, 2015 have been prepared on a going concern basis and contain an additional explanatory paragraph in Note 2 which identifies issues that raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any minimal adjustments that might result from the outcome of this uncertainty.

As of October 31, 2015, we have generated $320,513 of revenues for the three months ended October 31, 2015, have achieved losses since inception, and rely upon the sale of our securities to fund our operations. As a new competitor in the beverage line of business, there can be no assurance we will generate any significant revenue from the sale of any such products and our future cash needs vary from those estimated. Accordingly, we are dependent upon obtaining outside financing to carry out our operations and pursue any acquisition and exploration activities. In addition, we require funds to meet our current operating needs and to repay certain demand note obligations and other convertible debt obligations that will mature shortly.

We had $281 in cash as of October 31, 2015. We intend to raise the balance of our cash requirements for the next 12 months from revenues received from Athena, private placements, shareholder loans or possibly a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough money through such efforts, we may review other financing possibilities such as bank loans. At this time we have a three million dollar line of credit with Post Oak, LLC which has an outstanding balance of $2,075,000, as of October 31, 2015, but there is no guarantee that any additional financing will be available to us or if available, on terms that will be acceptable to us. We intend to negotiate with our management and

any consultants we may hire to pay parts of their salaries and fees with stock and stock options instead of cash. If we are unable to obtain the necessary additional financing, then we plan to reduce the amounts spent on our acquisition and development activities and our general and administrative expenses so as not to exceed the amount of capital resources that are available to us. Specifically, we anticipate deferring development, expansion and certain acquisitions pending the receipt of additional financing. Still, if we do not secure additional financing, our current cash reserves and working capital will be not be sufficient to enable us to sustain our operations for the next 12 months unless revenue increases dramatically, even if the Company does decide to scale back its operations.

Outstanding Indebtedness

Set forth below is a chart of our outstanding convertible debt obligations as of October 31, 2015:

|

| | | | | | | | | | |

| | Original Amount | | Balance on 10/31/2015 | | Date of Issuance | | Maturity Date | | Features |

Convertible Promissory Note | | 250,000 | | 13,726 | | 10/22/2014 | | 10/22/2015 | | 8% interest rate converts at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 days |

Convertible Promissory Note | | 250,000 | | 250,000 | | 6/4/2015 | | 2/6/2016 | | 8% interest rate converts at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 days |

Convertible Promissory Note | | 105,830 | | 95,830 | | 10/16/2015 | | 10/17/2015 | | 8% interest rate converts at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 days |

Convertible Promissory Note | | 163,118 | | 163,118 | | 10/30/2015 | | 10/31/2016 | | 8% interest rate converts at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 days |

Outstanding Notes

As of October 31, 2015, our obligations under outstanding notes totaled an aggregate principal amount of $522,674. Of such amount $13,726 was due October 22, 2015, $250,000 is due February 6, 2015, $95,830 is due October 17, 2015 and $163,118 is due October 31, 2015. We currently do not have sufficient funds to pay all of the past due or future notes.

On October 22, 2014 and June 4, 2015, we entered into two Securities Purchase Agreement and Convertible Promissory Note with Union Capital for $250,000. On October 16, 2015 and October 30, 2015, we entered into two notes in the amount of $105,830 and $163,118 for a total of $268,948 that were exchanged for portion of the outstanding line of credit with Post Oak, LLC ("Post Oak"). The convertible notes carry 8% rate of interest and the Notes are convertible into common stock at a variable conversion price of 50% of the market which shall be calculated as the lowest day during the preceding 20 days before conversion.

On May 1, 2014, we entered into an agreement with Post Oak, which was amended on April 1, 2015, pursuant to which, among other things, we and Post Oak entered into a Line of Credit Financing Agreement in the principal sum of up to Three Million Dollars ($3,000,000), or such lesser amount as may be borrowed by us as Advances under this line of credit. The Line of Credit bears interest at the rate of ten percent per annum (10.00%) unless modified by certain provisions of the Line of Credit. The entire outstanding principal balance amount of this Line of Credit is due and payable on April 30, 2016. We are required to make one interest payment twelve months from the date of each advance and one interest payment eighteen months from the date of each advance. We are obligated to make a payment for the entire unpaid balance of all advances, plus any accrued interest, in a “balloon”

payment, which is due in two years from the date of the Line of Credit Agreement. As of October 31, 2015, there was $2,0750,000 outstanding under this line of credit.

On September 11, 2015, we signed a line of credit with Samson Partners, LLC for the principal amount of $58,360 payable over 4 months. As of October 31, 2015, $26,136 is outstanding.

Avanzar

Set forth below is a chart of Avanzar's notes payable as October 31, 2015:

|

| | | | | | | |

Principal at 10/31/2015 | | Interest Rate |

| | Maturity |

$ | 20,000 |

| | 8 | % | | In default |

$ | 10,000 |

| | 8 | % | | In default |

$ | 20,000 |

| | 8 | % | | In default |

$ | 49,970 |

| | 12 | % | | In default |

$ | 10,000 |

| | Non-interest bearing |

| | In default |

$ | 20,000 |

| | 8 | % | | December 31, 2015 |

$ | 20,000 |

| | 8 | % | | In default |

$ | 149,970 |

| | | | |

On September 3, 2015, Avanzar signed a line of credit with BFS West Capital for a principal amount of $140,000 payable over 12 months. As of October 31, 2015, $123,187 is outstanding.

Product Research and Development

Our Research and Development (R&D) consisted of formulating the VitaminFIZZ®, Vitamin Creamer®, Coffee Boost™ and Athena® product lines. We spent $0 in the three months ending October 31, 2015 and 2014 respectively. The R&D for the product lines is the only R&D activities since the Company’s inception. we anticipate spending at least $100,000 in R&D activities over the next two fiscal years.

Acquisition of Plants and Equipment and Other Assets

We do not anticipate selling or acquiring any material properties, plants or equipment during the next 12 months.

Off-Balance Sheet Arrangements

The Company has no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Inflation

The amounts presented in the financial statements do not provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than reported if the effects of inflation were reflected either by charging operations with amounts that represent replacement costs or by using other inflation adjustments.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls

We maintain disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934, as amended the "Exchange Act") designed to provide reasonable assurance that the information required to be reported in our Exchange Act filings is recorded, processed, summarized and reported within the time periods specified and pursuant to Securities and Exchange Commission rules and forms, including controls and procedures designed to ensure that this information is accumulated and communicated to our management, including our Principal Executive Officer, as appropriate, to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report, our management, with the participation of our Principal Executive Officer and our Principal Financial Officer, carried out an evaluation of the effectiveness of our disclosure controls and procedures. Inasmuch as we only have two individuals serving as officers, directors and employees we have determined that the Company has, per se, inadequate controls and procedures over financial reporting due to the lack of segregation of duties despite the fact that the duties of the Chief Executive Officer and Chief Financial Officer are performed by two individuals. Management recognizes that its controls and procedures would be substantially improved if there was a greater segregation of the duties and as such is actively seeking to remediate this issue. Management believes that the material weakness in its controls and procedures referenced did not have an effect on our financial results. Based upon this evaluation, our Principal Executive Officer and Principal Financial Officer concluded that our disclosure controls and procedures were ineffective.

Changes in Internal Control

There were no changes in our internal control over financial reporting (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act) during the three months ended October 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

On April 15, 2014, we filed a complaint and sued JMJ Financial (“JMJ”) relating to an alleged illegal conversion pursuant to a Promissory Note dated November 19, 2013 (the “Note”) in the Circuit Court of 11th Judicial Circuit in and for Miami-Dade County. The suit alleges that the Note violates Florida’s usury laws and is, therefore, unenforceable. Minerco sought (a) a declaratory judgment that the Note is null and voidab initio, and (b) preliminary and permanent injunctive relief prohibiting JMJ from converting any purported amounts owed pursuant to the Note into shares of our common stock. In May 2014, the injunctive relief bond was set at $2,500,000, cash, which we did not satisfy. Therefore, we did not receive injunctive relief from the court at that time. On June 24, 2014, JMJ filed its Answer and Affirmative Defenses, in which it denied that the Note is usurious, and set forth multiple affirmative defenses, including failure to state a claim upon which relief can be granted and estoppel. On December 12, 2014, we filed a Motion for Leave to File Amended Complaint (the “Motion”) against JMJ Financial relating to the same Note, seeking in its amended complaint the following relief: (a) a declaratory judgment that the Note violates Florida’s usury laws, and thus is null and void ab initio; (b) damages for JMJ’s conversions of the entire purported outstanding balance of the Note that have occurred subsequent to the commencement of the lawsuit; and (c) reasonable attorney’s fees and costs. The Motion was granted, and the Amended Complaint was deemed filed, on January 17, 2015. Discovery is ongoing. The outcome is uncertain.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES

Set forth below are the sales of unregistered securities during the three months ended October 31, 2015 and through the filing date.

On October 16, 2015 we issued one convertible promissory note and securities purchase agreement in the principal amount of $105,830 that bears interest at a rate of 8% per annum at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 trading days before conversion. The issuance of the note was exempt from registration under Section 4(a)(2) of the Securities Act. No underwriter was involved in the offer of sale of the note. The issuance of the note did not involve a public offering. This issuance was done with no general solicitation or advertising by us. In addition, the investor had the necessary investment intent as required by Section 4(2) since it agreed to, and received, securities bearing a legend stating that such note are restricted. This restriction ensures that this note will not be immediately redistributed into the market and therefore not part of a public offering.

On October 30, 2015 we issued one convertible promissory note and securities purchase agreement in the principal amount of $163,118 that bears interest at a rate of 8% per annum at a variable conversion price of 50% of the market price calculated based on the lowest day during the preceding 20 trading days before conversion. The issuance of the note was exempt from

registration under Section 4(a)(2) of the Securities Act. No underwriter was involved in the offer of sale of the note. The issuance of the note did not involve a public offering. This issuance was done with no general solicitation or advertising by us. In addition, the investor had the necessary investment intent as required by Section 4(2) since it agreed to, and received, securities bearing a legend stating that such note are restricted. This restriction ensures that this note will not be immediately redistributed into the market and therefore not part of a public offering.

On November 13, 2015, we issued 490,799 common shares in one (1) transaction upon exchange of $10,061 in principal and accrued interest under a convertible promissory note dated October 16, 2015. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 13, 2015, we issued 420,000 common shares in one (1) transaction upon exchange of $8,770 in principal and accrued interest under a convertible promissory note dated November 4, 2015. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 19, 2015, we issued 539,276 common shares in one (1) transaction upon the exchange of $6,110 in debt exchange agreement under the line of credit with Post Oak, LLC. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 19, 2015, we issued 800,000 common shares in one (1) transaction upon exchange of $9,888 in principal and accrued interest under a convertible promissory note dated November 4, 2015. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 20, 2015, we issued 1,116,000 common shares in three (3) transactions for consulting services which were recognized as expense in the amount $25,668.

On November 20, 2015, we issued 1,350,576 common shares in one (1) transaction upon exchange of $14,924 in principal and accrued interest under a convertible promissory note dated October 22, 2014. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 26, 2015, we issued 2,100,000 common shares in one (1) transaction upon exchange of $22,554 in principal and accrued interest under a convertible promissory note dated November 4, 2015. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.

On November 30, 2015, we issued 2,500,000 common shares in one (1) transaction upon the exchange of $25,000 in debt exchange agreement under the line of credit with Post Oak, LLC. The shares of common stock were issued in reliance on Section 3(a)(9) of the Act as they were issued upon conversion of securities with existing shareholders and no commission or other remuneration was paid or given in connection with the conversion.