Current Report Filing (8-k)

December 18 2015 - 2:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December 18, 2015 (December 16, 2015)

STEEL DYNAMICS, INC.

(Exact name of registrant as specified in its charter)

|

Indiana |

|

0-21719 |

|

35-1929476 |

|

(State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

|

of incorporation) |

|

|

|

Identification No.) |

7575 West Jefferson Blvd, Fort Wayne, Indiana 46804

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 260-969-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On December 16, 2015, Steel Dynamics, Inc. issued a press release titled “Steel Dynamics Provides Fourth Quarter 2015 Earnings Guidance and Announces Fourth Quarter Cash Dividend.” A copy of that press release is attached hereto as Exhibit 99.1.

The information contained in Exhibit 99.1 is furnished under this Item 8.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing thereunder or under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits

(d ) Exhibits.

The following exhibit is furnished with this report:

|

Exhibit Number |

|

Description |

|

|

|

|

|

99.1 |

|

A press release dated December 16, 2015, titled “Steel Dynamics Provides Fourth Quarter 2015 Earnings Guidance and Announces Fourth Quarter Cash Dividend.” |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

STEEL DYNAMICS, INC. |

|

|

|

|

|

|

|

/s/Theresa E. Wagler |

|

Date: December 18, 2015 |

By: |

Theresa E. Wagler |

|

|

Title: |

Executive Vice President and

Chief Financial Officer |

2

Exhibit 99.1

|

Press Release

December 16, 2015 |

7575 W. Jefferson Blvd.

Fort Wayne, IN 46804 |

Steel Dynamics Provides Fourth Quarter 2015 Earnings Guidance and Announces Fourth Quarter Cash Dividend

FORT WAYNE, INDIANA, December 16, 2015 / PRNewswire / Steel Dynamics, Inc. (NASDAQ/GS: STLD) today, the company provided fourth quarter 2015 earnings guidance in the range of $0.03 to $0.07 per diluted share, compared to sequential third quarter 2015 earnings of $0.25 per diluted share and prior year fourth quarter adjusted earnings of $0.40 per diluted share, which excluded non-cash fixed asset impairment charges related to the company’s Minnesota Operations and certain post-acquisition costs related to the company’s Columbus steel mill acquisition.

Despite lower earnings, the company expects to still generate cash flow from operations in excess of $200 million during the fourth quarter 2015, which would result in record high liquidity at the end of 2015.

The company is currently in the process of conducting its required annual assessment of goodwill and indefinite-lived intangible asset valuation and based on step one of the two-stepped process, believes that the carrying values associated with its metals recycling operations are impaired. However, step two of the analysis is still underway and a reasonable range of impairment has not yet been determined. Accordingly, no potential asset impairment has been included in the provided fourth quarter 2015 guidance.

Profitability from the company’s steel operations for the fourth quarter 2015 is expected to be significantly lower in comparison to the sequential third quarter 2015 results, based on lower steel shipments caused by continued high level of steel imports, customer destocking and seasonally lower demand. While lower shipments are expected across the steel platform, the most significant decline is anticipated in the company’s commodity-grade hot roll products. Fourth quarter 2015 overall average steel product pricing is expected to decrease meaningfully, offsetting the savings derived from lower ferrous scrap costs. The heavy equipment, agricultural and energy markets remain challenged, while the automotive market remains strong and the construction market continues to improve.

Sustained strong demand for the company’s fabricated steel joist and decking products in what is typically a seasonally lower demand timeframe indicates the non-residential construction market is continuing a positive trend. Fourth quarter 2015 fabrication shipments are expected to increase from sequential third quarter levels. However, average pricing is expected to be lower based on both market conditions and a shift in product mix related to the September 2015 acquisition of additional decking assets. Steel raw material costs are not expected to decline to the same degree as product pricing; therefore, despite improved volume, fourth quarter 2015 profitability from the company’s fabrication operations is expected to be lower than the record results achieved in the sequential third quarter.

Metals recycling financial results are expected to decline to a loss position for the fourth quarter 2015, based on lower shipments and metal spread compression. Lower domestic steel mill utilization is expected to result in significantly weaker ferrous scrap shipments and has decreased ferrous scrap selling values approximately $65 to $70 per ton from the end of September 2015 to the end of November 2015.

Dividends

The company’s board of directors has declared a quarterly cash dividend of $0.1375 per common share. The dividend is payable to shareholders of record at the close of business on December 31, 2015, and is payable on or about January 11, 2016.

About Steel Dynamics, Inc.

Steel Dynamics, Inc. is one of the largest domestic steel producers and metals recyclers in the United States based on estimated annual steelmaking and metals recycling capability, with annual sales of $8.8 billion in 2014, approximately 7,500 employees, and manufacturing facilities primarily located throughout the United States (including six steel mills, eight steel coating facilities, an iron production facility, approximately 80 metals recycling locations and eight steel fabrication plants).

Forward-Looking Statement

This press release contains some predictive statements about future events, including statements related to conditions in the steel and metallic scrap markets, Steel Dynamics’ revenues, costs of purchased materials, future profitability and earnings, and the operation of new or existing facilities. These statements are intended to be made as “forward-looking,” subject to many risks and uncertainties, within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. These statements speak only as of this date and are based upon information and assumptions, which we consider reasonable as of this date, concerning our businesses and the environments in which they operate. Such predictive statements are not guarantees of future performance, and we undertake no duty to update or revise any such statements. Some factors that could cause such forward-looking statements to turn out differently than anticipated include: (1) the effects of uncertain economic conditions; (2) cyclical and changing industrial demand; (3) changes in conditions in any of the steel or scrap-consuming sectors of the economy which affect demand for our products, including the strength of the nonresidential and residential construction, automotive, appliance, pipe and tube, and other steel-consuming industries; (4) fluctuations in the cost of key raw materials (including steel scrap, iron units, and energy costs) and our ability to pass-on any cost increases; (5) the impact of domestic and foreign import price competition; (6) unanticipated difficulties in integrating or starting up new or acquired businesses; (7) risks and uncertainties involving product and/or technology development; and (8) occurrences of unexpected plant outages or equipment failures.

More specifically, we refer you to SDI’s more detailed explanation of these and other factors and risks that may cause such predictive statements to turn out differently, as set forth in our most recent Annual Report on Form 10-K, in our quarterly reports on Form 10-Q or in other reports which we from time to time file with the Securities and Exchange Commission. These are available publicly on the SEC website, www.sec.gov, and on the Steel Dynamics website, www.steeldynamics.com.

Contact: Theresa E. Wagler, Executive Vice President and Chief Financial Officer —+1.260.969.3500

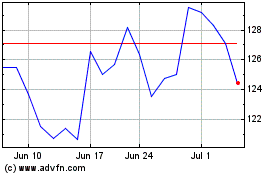

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

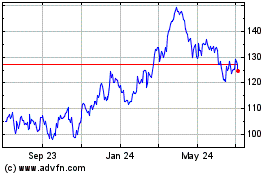

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Apr 2023 to Apr 2024