Huron Consulting Group Inc. (NASDAQ: HURN), a leading provider

of business consulting services, today announced a definitive

agreement to divest its Huron Legal practice to Consilio, Inc., a

global leader in eDiscovery and document review services, for

minimum gross proceeds of $112 million in cash upon closing, plus a

cash post-closing payment contingent upon final full year 2015

financial results and subject to certain other adjustments set

forth in the agreement. The sale is expected to close in the fourth

quarter of 2015 following the satisfaction of regulatory

requirements and other customary closing conditions. In connection

with the anticipated sale, Huron’s board of directors has increased

the Company’s current share repurchase authorization to $125

million inclusive of the $36.5 million remaining on the existing

share repurchase authorization.

“With its highly experienced team and exceptional focus on

client service, Huron Legal has achieved a leading reputation in

the industry,” said James H. Roth, president and chief executive

officer, Huron Consulting Group. “Combining Consilio’s global focus

and Huron Legal’s strong domestic presence will provide the scale

and expertise necessary to support the complex issues facing

corporate law departments and law firms around the world. We have

tremendous respect for the Consilio team, and we believe the

combined business will provide a compelling set of offerings to

meet the needs of its multinational clients and users of complex

legal services.”

“Huron Legal provides a highly complementary platform to our

business in terms of both service line and geographic presence,

but, more importantly, shares our commitment to delivering

high-value, quality service to clients,” added Andy Macdonald,

chief executive officer of Consilio. “We are excited to have Huron

Legal join the Consilio team.”

After the close of the transaction, Huron will concentrate its

resources and investments in the Company’s Healthcare, Education

and Life Sciences and Business Advisory segments to drive future

growth and generate long-term value for its shareholders.

“As Huron looks to the future, we remain excited by the dynamic

markets we serve, our incredible team of professionals, and our

ability to enhance our focus and resources to accelerate growth

within our businesses,” continued Roth.

Share Repurchase Authorization

In connection with the transaction, the Company’s board of

directors authorized an increase to the current share repurchase

program to $125 million inclusive of the $36.5 million remaining

under the existing share repurchase program, which was extended

through October 31, 2016. The amount and timing of the repurchases

will be determined by management and depend on a variety of

factors, including the trading price of the Company’s common stock,

general market and business conditions, and applicable legal

requirements.

“We believe Huron is well positioned to sustain growth through

its solid cash flow generated by a portfolio of service offerings

that meet the changing needs of our growing client base,” said C.

Mark Hussey, chief operating officer and chief financial officer,

Huron Consulting Group. “With the anticipated sale of our Legal

practice, we continue to maintain a strong and flexible balance

sheet that allows us to continue to invest in our businesses, while

returning excess cash to shareholders through share

repurchases.”

Transaction Overview

Under the terms of the definitive agreement, Huron will receive

minimum gross proceeds of $112 million in cash at closing, before

taxes and transaction-related expenses, plus a cash post-closing

payment contingent upon final full year 2015 financial results. The

Company expects net proceeds at closing after taxes and

transaction-related expenses to be approximately $90 million before

the contingent post-closing payment, if any. The Company intends to

use the net proceeds from the transaction primarily to purchase

shares under the increased share repurchase authorization.

The transaction is expected to close in the fourth quarter

of 2015, and is subject to clearance under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976 and other customary closing

conditions.

William Blair & Company acted as financial advisor and

Skadden, Arps, Slate, Meagher & Flom, LLP served as legal

advisor to the Company.

Further information regarding the material terms and conditions

contained in the definitive agreement will be included in Huron’s

forthcoming Current Report on Form 8-K in connection with the

closing of the transaction.

Outlook for 2015(1)

As a result of the pending transaction, the Huron Legal business

will be treated as a discontinued operation for 2015, and Huron

updates its full year 2015 guidance to reflect this change. Based

on currently available information, the Company updates guidance

for full year 2015 revenues before reimbursable expenses from

continuing operations to a range of $695 million to $699 million.

The Company also updates its earnings guidance to reflect

continuing operations and now expects EBITDA from continuing

operations in a range of $134 million to $137 million, Adjusted

EBITDA from continuing operations in a range of $138 million to

$141 million, GAAP diluted earnings per share from continuing

operations in a range of $1.91 to $1.95, and non-GAAP Adjusted

diluted earnings per share from continuing operations in a range of

$2.96 to $3.00.

In connection with the sale, the Company expects to reduce its

corporate costs by approximately $11 million to more closely align

to a level required to support the ongoing scale of its continuing

operations. In addition, Huron expects to incur restructuring

charges for certain costs not assumed by the purchaser. The amount

and timing of the restructuring charges have not yet been

determined and are expected to primarily relate to reductions in

office facilities and other costs of separating the divested

business.

Management will provide a more detailed discussion of the

transaction and its 2015 outlook during the Company’s investor

webcast.

The Company expects to announce its 2016 earnings guidance in

conjunction with the release of its fourth quarter and full year

2015 earnings results, which is currently scheduled to occur on

February 22, 2016.

Investor Webcast

The Company will host a conference call and webcast today,

December 10, 2015, at 6:00pm Eastern Time (5:00pm Central Time).

The conference call is being webcast by NASDAQ OMX and can be

accessed at Huron Consulting Group’s website at

http://ir.huronconsultinggroup.com. To participate by telephone,

the dial-in number is (855) 789-8162 with passcode 3236844. A

replay of the webcast will be available approximately two hours

after the conclusion of the call and for 90 days thereafter.

A supplemental presentation that will be discussed on the

conference call and webcast will be made available in the Investor

Relations section of the Company’s website at

http://ir.huronconsultinggroup.com prior to the conference call,

and will be available for 90 days thereafter.

Investor Day 2016

The Company will host an investor day in Chicago on Wednesday,

February 24, 2016 at 10:00am Eastern Time (9:00am Central Time)

with presentations given by James H. Roth, president and chief

executive officer, and members of executive and practice

management. The presentations will include a question and answer

session.

Use of Non-GAAP Financial Measures(1)

In evaluating the Company’s financial performance and outlook,

management uses EBITDA, Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted net income, and Adjusted diluted

earnings per share, which are non-GAAP measures. Management

believes that such measures, as supplements to operating income,

net income, and diluted earnings per share, and other GAAP

measures, are useful indicators for investors. These useful

indicators can help readers gain a meaningful understanding of the

Company's core operating results and future prospects. Investors

should recognize that these non-GAAP measures might not be

comparable to similarly titled measures of other companies. These

measures should be considered in addition to, and not as a

substitute for or superior to, any measure of performance, cash

flows or liquidity prepared in accordance with accounting

principles generally accepted in the United States.

About Huron Consulting Group

Huron Consulting Group helps clients in diverse industries

improve performance, transform the enterprise, reduce costs,

leverage technology, process and review large amounts of complex

data, address regulatory changes, recover from distress and

stimulate growth. Our professionals employ their expertise in

finance, operations, strategy, analytics, and technology to provide

our clients with specialized analyses and customized advice and

solutions that are tailored to address each client's particular

challenges and opportunities to deliver sustainable and measurable

results. The Company provides consulting services to a wide variety

of both financially sound and distressed organizations, including

healthcare organizations, leading academic institutions, Fortune

500 companies, governmental entities and law firms. Huron has

worked with more than 450 health systems, hospitals, and academic

medical centers; more than 400 corporate general counsel; and more

than 400 universities and research institutions. Learn more at

www.huronconsultinggroup.com.

Statements in this press release that are not historical in

nature, including those concerning the Company’s current

expectations about its future requirements and needs, are

“forward-looking” statements as defined in Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are identified by words such as “may,” “should,”

“expects,” “provides,” “anticipates,” “assumes,” “can,” “will,”

“meets,” “could,” “likely,” “intends,” “might,” “predicts,”

“seeks,” “would,” “believes,” “estimates,” “plans,” or “continues.”

These forward-looking statements reflect our current expectations

about our future requirements and needs, results, levels of

activity, performance, or achievements. Some of the factors that

could cause actual results to differ materially from the

forward-looking statements contained herein include, without

limitation: failure to achieve expected utilization rates, billing

rates and the number of revenue-generating professionals; inability

to expand or adjust our service offerings in response to market

demands; our dependence on renewal of client-based services;

dependence on new business and retention of current clients and

qualified personnel; failure to maintain third-party provider

relationships and strategic alliances; inability to license

technology to and from third parties; the impairment of goodwill;

various factors related to income and other taxes; difficulties in

successfully integrating the businesses we acquire and achieving

expected benefits from such acquisitions; risks relating to

privacy, information security, and related laws and standards; and

a general downturn in market conditions. With respect to our

proposed sale of Huron Legal, additional factors that could cause

actual results to differ materially from those indicated or implied

by the forward-looking statements include, among others: the

occurrence of any event, change or other circumstances that could

give rise to the termination of the definitive agreement we entered

into in connection with the proposed sale, the ability to satisfy

all conditions to closing, including obtaining clearances under the

Hart-Scott-Rodino Antitrust Improvements Act of 1976, and complete

the proposed sale, the disruption of management’s attention from

our ongoing business operations due to the proposed sale and the

failure to achieve projected corporate cost savings. These

forward-looking statements involve known and unknown risks,

uncertainties and other factors, including, among others, those

described under “Item 1A. Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2014, that may cause

actual results, levels of activity, performance or achievements to

be materially different from any anticipated results, levels of

activity, performance, or achievements expressed or implied by

these forward-looking statements. We disclaim any obligation to

update or revise any forward-looking statements as a result of new

information or future events, or for any other reason.

HURON CONSULTING GROUP INC. RECONCILIATION

OF NON-GAAP MEASURES FOR FULL YEAR 2015 OUTLOOK

RECONCILIATION OF NET INCOME TO

ADJUSTED EARNINGS BEFORE INTEREST,

TAXES, DEPRECIATION AND AMORTIZATION (1)

(In millions) (Unaudited) Guidance

Ranges For the Year Ending December 31, 2015

Continuing Discontinued Total

Operations Operations Company

Low High Low High

Low High Projected revenues - GAAP $ 695.0

$ 699.0 $ 140.0 $ 142.0 $

835.0 $ 841.0 Projected net income (loss) -

GAAP $ 42.0 $ 44.0 $ (10.0 ) $ (9.0 ) $ 32.0 $ 35.0

Add back: Income tax expense 31.0 32.0 3.0 3.0 34.0 35.0 Interest

and other expenses 19.0 19.0 1.0 1.0 20.0 20.0 Depreciation and

amortization 42.0 42.0

9.0 9.0 51.0

51.0 Projected earnings before interest, taxes,

depreciation and

amortization (EBITDA) (1)

134.0 137.0 3.0 4.0 137.0 141.0 Add back: Loss on sale of Huron

Legal, net of taxes - - 17.0 17.0 17.0 17.0 Transaction expenses

related to sale of Huron Legal - - 8.0 8.0 8.0 8.0 Restructuring

charges 3.0 3.0 1.0 1.0 4.0 4.0 Litigation and other (gains) losses

1.0 1.0 -

- 1.0 1.0

Projected adjusted EBITDA (1) $ 138.0 $ 141.0

$ 29.0 $ 30.0 $ 167.0 $ 171.0

Projected adjusted EBITDA as a percentage of projected

revenues (1) 19.8 % 20.2 % 20.7 %

21.1 % 20.0 % 20.4 %

RECONCILIATION OF NET INCOME TO

ADJUSTED NET INCOME (1)

(In millions) (Unaudited) Guidance

Ranges For the Year Ending December 31, 2015

Continuing Discontinued Total

Operations Operations Company

Low High Low High

Low High Projected net income (loss) - GAAP $

42.0 $ 44.0 $ (10.0 ) $ (9.0 ) $ 32.0

$ 35.0 Projected diluted earnings (loss) per

share - GAAP $ 1.91 $ 1.95 $ (0.45 ) $

(0.43 ) $ 1.46 $ 1.52 Add back:

Loss on sale of Huron Legal, net of taxes - - 17.0 17.0 17.0 17.0

Transaction expenses related to sale of Huron Legal - - 8.0 8.0 8.0

8.0 Amortization of intangibles assets 29.0 29.0 1.0 1.0 30.0 30.0

Restructuring charges 3.0 3.0 1.0 1.0 4.0 4.0 Litigation and other

(gains) losses 1.0 1.0 - - 1.0 1.0 Non-cash interest on convertible

notes 7.0 7.0 - - 7.0 7.0 Tax effect (16.0 )

(16.0 ) (5.0 ) (5.0 ) (21.0 )

(21.0 ) Total adjustments, net of tax 24.0 24.0 22.0 22.0

46.0 46.0 Projected adjusted net income (1) 66.0

68.0 12.0 13.0

78.0 81.0 Projected

adjusted diluted earnings per share (1) $ 2.96 $ 3.00

$ 0.58 $ 0.60 $ 3.54 $

3.60 (1) In evaluating the Company’s outlook,

management uses Projected EBITDA, Projected adjusted EBITDA,

Projected adjusted EBITDA as a percentage of revenues, Projected

adjusted net income, and Projected adjusted diluted earnings per

share, which are non-GAAP measures. Management believes that the

use of such measures, as supplements to Projected net income and

Projected diluted earnings per share, and other GAAP measures, are

useful indicators for investors. These useful indicators can help

readers gain a meaningful understanding of the Company’s core

operating results and future prospects without the effect of

non-cash or other one-time items. Investors should recognize that

these non-GAAP measures might not be comparable to similarly titled

measures of other companies. These measures should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance, cash flows or liquidity prepared in

accordance with accounting principles generally accepted in the

United States.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151210006518/en/

Huron Consulting Group Inc.Media Contact:Jenna

Nichols312-880-5693jnichols@huronconsultinggroup.comorInvestor

Contact:C. Mark HusseyorJohn

Kelly312-583-8722investor@huronconsultinggroup.com

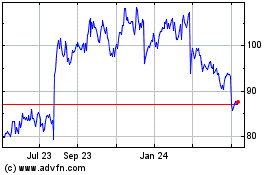

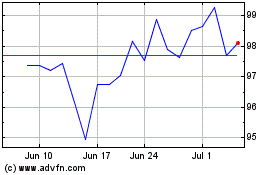

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Apr 2023 to Apr 2024