By Nicole Friedman and Timothy Puko

Oil prices fell to their lowest point in seven years Monday,

hammering energy industry stocks as many investors bet that heavily

indebted producers, having weathered months of low commodity

prices, are now at greater risk of going out of business.

The selloff hit companies in the markets for oil, petroleum

products, natural gas and coal. Oil prices have fallen so low for

so long now that many investors worry that some companies won't be

able to generate enough income to stay in business and pay off

loans no matter how much oil they pump.

Monday's declines were triggered by forecasts of mild weather

that point to tepid U.S. heating demand through the end of the

year. They extended a rout set off last week when the Organization

of the Petroleum Exporting Countries opted to keep its production

high.

Prices for oil and natural gas have lost more than one-quarter

of their value in the U.S. so far this year, thanks to robust

output and growing inventories. The prospect of soft demand and

unrestrained supply is undermining hopes for a turnaround.

"Investors can't see any evidence that things will get better,"

says Dan Pickering, co-president and head of TPH Asset Management

in Houston, which oversees about $1.5 billion.

Oil futures fell 5.8% to $37.65 a barrel in New York, the lowest

settlement since February 2009. Natural-gas futures fell 5.4% to

$2.067 per million British thermal units in New York, the lowest

level since October.

Shares of a number of high-profile energy companies posted even

deeper losses. Among the biggest losers Monday were Consol Energy

Inc., the biggest producer of natural gas and coal in the

Appalachian Basin, which was down 15%, and Williams Cos., the

Tulsa, Okla.-based operator of pipelines and other infrastructure,

which was down 13%.

Bonds were battered as well. Bonds of Chesapeake Energy Corp.,

which is seeking to restructure some of its debt through an

exchange offer, traded at 32.8 cents on the dollar, a decline of

17%, according to data from MarketAxess Holdings Inc. Oasis

Petroleum Inc. bonds shed 6% to trade at 79 cents. A bond from EP

Energy LLC traded at 80 cents, down about 5%.

The pessimism around energy even spread to pipeline-and-storage

companies that had long been billed as havens from the ups and

downs of the underlying markets. Investors are now concerned the

broader pain will slow the acquisitions and dividend growth that

had drawn them to the sector.

The NYSE Alerian MLP Index, a widely followed benchmark of

pipeline and transportation companies, tumbled 6.2% on Monday.

"Nobody is safe," said Tim Parker, portfolio manager in the U.S.

equity division at T. Rowe Price Group Inc.

Pain from the oil bust already has rippled throughout the

industry. Energy companies have laid off hundreds of thousands of

employees around the world, and oil-producing nations from

Venezuela to Russia are struggling with lower revenue.

The U.S. energy industry, which has boomed in recent years due

to technologies like hydraulic fracturing and horizontal drilling

that have opened vast new fields, has taken a hard hit.

Pipeline firm Kinder Morgan Inc. said Friday it would review its

dividend policy, a move the market has interpreted as a sign that

it and similarly situated firms may cut or cancel payouts to

shareholders to shore up cash.

Consol illustrates the topsy-turvy path some companies have

followed during the energy boom. The Pittsburgh-area company paid

$3.5 billion to buy gas rights near its Appalachian mines in 2010

and shrank its longtime coal-mining business to focus on the

cleaner-burning fuel, then suffered as its shares fell more than

80% this year.

Like many of its peers, Consol keeps expanding production,

telling investors in October that it plans to increase gas output

by 20% in 2016.

In doing so it has locked itself into a cutthroat race with

other gas drillers. This summer, the company announced that it

found one of the biggest gushers in U.S. history, only to see gas

prices and its own share price continue to fall out of fear similar

wells would keep the market glutted for years.

"They need to cut their capital spending," says Rob Thummel,

portfolio manager at Tortoise Capital Advisors, which manages $14.6

billion in energy assets.

Consol is selling assets to raise cash and balancing its budget

using "conservative commodity prices," a company spokesman said in

a statement. "Proceeds from these assets sales will help de-lever

the company, continuing to strengthen our balance sheet and

liquidity position."

Many oil-and-gas companies find it nearly impossible to cut back

because of the large debt loads they took on to fund their growth

when energy prices were higher. That leaves many producing just to

pay their debts. Meanwhile, hedges that have allowed them to sell

oil and gas above the market rate are expiring.

"We think that next year there's going to be more pain in the

sector" says David Yepez, investment analyst at Exencial Wealth

Advisors in Oklahoma City, which manages $1.4 billion. "I think

things are going to get worse before they get better."

The El Niño weather phenomenon has limited demand for natural

gas and other heating fuels in the U.S. this year. Forecasts

released Monday show above-average temperatures persisting for the

next two weeks, at a time of year when demand for indoor heating is

typically robust.

Temperatures in cities in the Midwest and East Coast could range

between 15 and 25 degrees warmer than usual for the next 10 days,

says Matt Rogers, meteorologist and president at Commodity Weather

Group LLC.

Some traders say it is risky to bet on further declines for oil

prices that are already down 29% on the year and well below $40--a

level under which analysts say many producers can't make money and

will have to cut back.

As of Dec. 1, money managers including hedge funds had made an

unusually large number of bets that U.S. crude prices would fall,

according to Commodity Futures Trading Commission data.

That could spark a sharp rally if fund managers close out those

positions at once, traders say. That happened in August, sending

prices up 27% in three sessions.

But Mr. Pickering says mutual funds and other large investors

are reluctant to buy beaten-down shares and bonds during the last

month of the year.

Until global oil inventories begin to shrink, Mr. Pickering

says, "the bears are in control."

Gregory Zuckerman contributed to this article.

Write to Nicole Friedman at nicole.friedman@wsj.com and Timothy

Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

December 08, 2015 00:09 ET (05:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

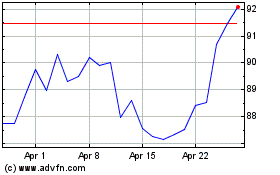

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

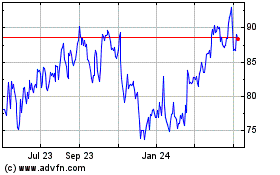

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024