Tuna Leaders Call Off Acquisition

December 04 2015 - 1:40AM

Dow Jones News

Thai Union Group PCL, a large international seafood producer, on

Thursday canned its proposed $1.5 billion acquisition of U.S. rival

Bumble Bee Seafoods, following antitrust objections from the

Justice Department.

Thai Union, which holds the Chicken of the Sea brand, said that

it and Bumble Bee had vigorously advocated the deal's merits to

U.S. antitrust enforcers, but concluded that antitrust approval was

unlikely under the time frame stipulated in the transaction.

"We have decided to focus our energy on our existing business.

Thai Union remains committed to the North American seafood market,"

said the company's president, Thiraphong Chansiri.

The Justice Department's antitrust division said it had serious

concerns about the deal because it would have combined the second-

and third-largest sellers of shelf-stable tuna in the U.S. The

StarKist Co. brand leads the U.S. market in canned tuna, followed

by Bumble Bee and Chicken of the Sea, respectively.

"Consumers are better off without this deal," said Bill Baer,

the department's antitrust chief. "Our investigation convinced

us—and the parties knew or should have known from the get-go—that

the market is not functioning competitively today, and further

consolidation would only make things worse."

The companies had announced their deal last December. Thai Union

had said the acquisition would help it improve operating efficiency

and advance innovation and product development, especially in North

American markets.

The company's announcement of the termination came Friday

morning Bangkok time, since Asia is ahead of the U.S. time

zones.

Bumble Bee is owned by private-equity firm Lion Capital LLP.

Thai Union said it and Lion Capital mutually agreed to abandon the

deal. Representatives for Bumble Bee didn't immediately respond to

a request for comment.

The development is the latest evidence that U.S. antitrust

enforcers continue to be active in objecting to deals they believe

will lead to unacceptable levels of market concentration. Other

transactions that have fallen this year after the government

objected include Comcast Corp.'s bid for Time Warner Cable Inc.,

Sysco Corp.'s bid for rival food distributor US Foods Inc. and a

semiconductor industry deal between Applied Materials Inc. and

Tokyo Electron Ltd.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 04, 2015 01:25 ET (06:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

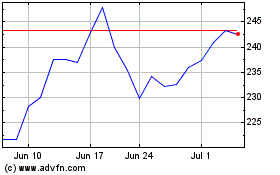

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

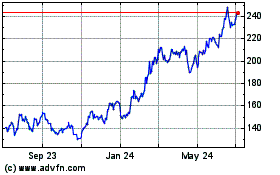

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024