Labor SMART Issues Open Letter to The Staffing Group CEO

Company Seeks to Form Strategic Alliance

ATLANTA, GA-(Marketwired - Dec 1, 2015) - Labor SMART, Inc.

(OTCQB: LTNC) (the "Company"), a leader in providing on-demand blue

collar staffing primarily in the southeastern United States, today

delivered via email the following open letter to the President and

Chief Executive Officer of The Staffing Group, Ltd. (TSGL).

December 1, 2015 400 Poydras St., Suite 1165 New Orleans La

70130 Delivered Via Email

RE: 13D Filing by Labor Smart, Inc.

Mr. McLoone,

As you are now aware, our purchase of 2,000,000 shares of The

Staffing Group Ltd. common stock on November 30, 2015 was followed

by a Schedule 13D filing with the SEC, due to our previously

unannounced acquisition of 1,758, 618 shares of common stock in the

open market and the nature of our intentions. The purpose of this

letter to you today is to clearly state what those intentions are

and seek common ground for a mutually beneficial discussion.

Having launched Labor SMART, Inc. as a publicly traded startup,

I am sensitive to the challenges of building a sustainable business

from scratch with the added fun of engaging the public markets and

all that entails. I am quite familiar with the history of your

company and we've had some discussions over the last two years

regarding potential opportunities, business combinations, etc. I'm

also aware of the burdens you were handed almost immediately upon

becoming CEO of a public company. Given those challenges, I commend

you for the successes you've been able to claim along the way.

At this time, we have three separate, but related proposals that

we would like to discuss with you in a formal setting.

Leveraging Synergies

In your Form 10-Q for the quarter ended June 30, 2015, you

discuss improved gross margins after shedding some high volume

business. This is a tough and gutsy decision to make for the long

term health of the company, and again, I commend you for taking

this action. Still, with gross profit margins under 19%, a lot of

profitability is left on the table. As you may know, Labor SMART

attained a large deductible workers compensation policy in 2014

that drastically reduced our cost of sales. A business combination

with Labor SMART could unlock value and profits hidden behind the

high cost of workers compensation you are incurring. I propose that

we work together to prepare a detailed analysis of the potential

gains that could be had with Labor SMART's strong workers

compensation program as the backbone of a reduction in cost of

sales. This analysis should start with an examination of your loss

runs for the last three years. There may also be a number of

synergies that could be obtained leveraging Labor SMART's corporate

support structure and your company's footprint. Additionally, there

are undoubtedly vertical sales opportunities given the combined

size of our respective customer bases.

Leveraging Experience

Having worked with you at WTS before it was sold to MDT (and

subsequently TrueBlue), I know that you are a solid operator with a

conservative approach to risk. It is my belief that our combined

teams and their experience would offer much to our collective

customers, shareholders, and employees. The first component of this

proposal is that we work together to create a joint venture, or

similar structure, to license the Labor SMART brand, processes, and

methods in addition to a management service agreement whereby Labor

SMART will provide the necessary infrastructure to facilitate an

aggressive growth plan and The Staffing Group provides the day to

day management.

Any growth plan will require capital. I've encountered a number

of challenges to raising capital as a publicly traded company.

Raising startup capital itself is expensive and as our share

structure indicates, extremely dilutive without a substantial

amount of financial engineering from the beginning. I've raised a

small amount of money for Labor SMART and we successfully grew our

business to over $20 million in less than three years. I'm grateful

that we were able to get funding to build the company, but I would

do it differently knowing what I know now. I've expended the better

part of 2015 playing defensive and trying to protect LaborSMART's

shareholders from massive dilution. Fortunately, we have been able

to renegotiate the mechanics of our convertible debt and believe we

can repair the share structure now that we have better control of

conversion rights, but the time lost can never be recovered. And

that leads me to the second part of this specific proposal.

Should we reach mutually beneficial terms to have Labor SMART

license its systems to The Staffing Group, I propose that we take a

"fund from the ground up" approach. Crowd funding legislation is

due to go in to affect next year. I believe there is an opportunity

to crowd fund the startup capital for each new individual branch

that's opened. Labor SMART will agree to be the lead investor with

a minority ownership percentage of each branch opened under the

licensing agreement, but with an option to acquire the branch at

its discretion in the future for a predetermined multiple of

earnings. This structure would insulate your shareholders from

massive dilution and still allow for continued growth of the Labor

SMART brand. For The Staffing Group, this structure offers a runway

to ramp up sales and branch network in a meaningful way and an

equity event as licensed branches are acquired by Labor SMART.

Expand the Board

Lastly, we propose that The Staffing Group increase its Board of

Directors from two directors to a total of five directors, two of

whom will be appointed by Labor SMART, Inc. and a third by mutual

agreement of Labor SMART and The Staffing Group. I do not expect

that this request would be obliged without some consideration. We

are open to exploring a number of different options to get this

request effectuated in a swift manner. I believe you would agree

that one of the most important tasks you currently face is getting

your Form 10-Q filed for the period ended September 30, 2015. We do

not wish to upend that process with added procedural burdens. To be

clear, Labor SMART will take steps to protect its investment if

necessary, but we do not have the intent of becoming a hostile

suitor. Our industry is built on relationships and Labor SMART

believes in creating partnerships and opportunity, not enemies.

In summary, both companies can benefit greatly by engaging in a

mutual partnership, even if the structure is somewhat different

from the ones we have proposed. I believe it is in the best

interest of The Staffing Group's shareholders, with Labor SMART,

Inc. as one of the largest holders, to explore any and every

opportunity that may be present to build value and sustainable

profitability for the benefit of all. As two sizeable regional

players in our industry, we must act boldly to create opportunities

for the future.

I look forward to scheduling a meeting with at your earliest

convenience,

Sincerely,

C. Ryan Schadel President & CEO - Labor SMART, Inc.

Safe Harbor Statement This release contains statements that

constitute forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. These statements

appear in a number of places in this release and include all

statements that are not statements of historical fact regarding the

intent, belief or current expectations of Labor SMART, Inc., its

directors or its officers with respect to, among other things: (i)

financing plans; (ii) trends affecting its financial condition or

results of operations; (iii) growth strategy and operating

strategy. The words "may", "would", "will", "expect", "estimate",

"can", "believe", "potential", and similar expressions and

variations thereof are intended to identify forward-looking

statements. Investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, many of which are beyond Labor SMART,

Inc.'s ability to control, and that actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. More information about the

potential factors that could affect the business and financial

results is and will be included in Labor SMART, Inc.'s filings with

the U.S. Securities and Exchange Commission.

Contact Information

Labor SMART, Inc. shareholderrelations@laborsmart.com

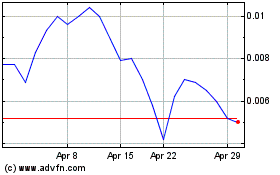

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Apr 2023 to Apr 2024