SCHEDULE 14C

INFORMATION

Information Statement

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Amendment

No. 1

Check the appropriate box:

| ☒ |

Preliminary Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive Information Statement |

..

LIFEAPPS

DIGITAL MEDIA Inc.

(Name of Registrant As Specified in Its Charter)

| Payment of Filing Fee (Check the appropriate box): |

| |

|

|

| ☒ |

No fee required |

| |

|

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| |

|

|

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| |

|

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

EXPLANATORY NOTE

This Amendment No. 1 to the Preliminary

Information Statement on Schedule 14C of LifeApps Digital Media Inc., originally filed with the Securities and Exchange Commission

on November 25, 2015, is being submitted to respond to certain comments from the Securities and Exchange Commission.

LIFEAPPS

DIGITAL MEDIA Inc.

Polo Plaza, 3790 Via De La Valle, #116E

Del Mar, CA 92014

NOTICE OF ACTION TAKEN PURSUANT TO WRITTEN

CONSENT

OF STOCKHOLDERS IN LIEU OF A MEETING

To the Stockholders of LifeApps Digital Media

Inc.:

Notice is hereby given that stockholders holding

a majority of our outstanding shares of common stock, pursuant to a written consent, dated October 26, 2015, have authorized and

approved the following:

Amend our amended and restated certificate of incorporation to (i) change our corporate name to LifeApps Brands

Inc., (ii) effect a one-for-fifteen (1:15) reverse stock split (the “Reverse Split”) of our common stock, $0.001 par

value per share, and (iii) increase our authorized capitalization from 300,000,000 shares of common stock, par value $0.001 per

share, and 10,000,000 shares of preferred stock, par value $0.001 per share, to 500,000,000 shares of common stock, par value $0.001

per share, and 10,000,000 shares of preferred stock, par value $0.001 per share, and to amend the LifeApps Digital Media Inc. 2012

Equity Incentive Plan (the “2012 Plan”) to increase the number of shares issuable under the 2012 Plan from 10,000,000

to 20,000,000, on a post-Reverse Split basis.

The details of the foregoing actions and other

important information are set forth in the accompanying Information Statement. Our Board of Directors has unanimously approved

the above actions.

The amendment to our amended and restated certificate

of incorporation will not be effective until filed with the Delaware Secretary of State. We intend to file the amendment to our

amended and restated certificate of incorporation twenty (20) calendar days after the accompanying Information Statement is first

mailed to our stockholders.

No action is required by you. The accompanying

Information Statement is furnished to you only to inform you of the actions described above before they take effect in accordance

with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended. This Information Statement is being mailed to

you on or about December __, 2015.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE

NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED

HEREIN. The holders of a majority of our outstanding shares of common stock have voted to approve the actions described herein

by written consent in lieu of a meeting. Such written consent is sufficient to satisfy the stockholder vote requirement under DELAWARE

law, and no additional votes will consequently be needed to approve these actions.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY

OF INFORMATION STATEMENT

The Information Statement is also available

at the Securities and Exchange Commission’s website, www.sec.gov.

| Dated: December __, 2015 |

By Order of the Board of Directors, |

|

| |

|

|

| |

/s/ Robert Gayman |

|

| |

Robert Gayman, President and Chief Executive Officer |

LIFEAPPS

DIGITAL MEDIA Inc.

Polo Plaza, 3790 Via De La Valle, #116E

Del Mar, CA 92014

INFORMATION STATEMENT

November __, 2015

This Information Statement

is being furnished to stockholders of LifeApps Digital Media Inc., a Delaware corporation (“LifeApps,” the

“Company,” “we,” “us,” or “our”) to advise them of corporate actions approved

without a meeting by less than unanimous written consent of stockholders. These actions are the adoption of an amendment (the

“Charter Amendment”) to our amended and restated certificate of incorporation (the “Certificate of

Incorporation”) to (i) change our corporate name to LifeApps Brands Inc., (ii) effect a one-for-fifteen (1:15) reverse

stock split (the “Reverse Split”) of our common stock, $0.001 par value per share, and (iii) increase our

authorized capitalization from 300,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of

preferred stock, par value $0.001 per share, to 500,000,000 shares of common stock, par value $0.001 per share, and

10,000,000 shares of preferred stock, par value $0.001 per share, and to amended the LifeApps Digital Media Inc. 2012 Equity

Incentive Plan (the “2012 Plan”) to increase the number of shares issuable under the 2012 Plan from 10,000,000,

on a pre-Reverse Stock Split basis, to 20,000,000, on a post-Reverse Split basis (the “2012

Plan Amendment”).

The Charter Amendment requires the

affirmative vote of a majority of the outstanding shares of common stock entitled to vote thereon. The 2012 Plan Amendment also

requires the affirmative vote of a majority of the outstanding shares of common stock entitled to vote thereon in order for stock

options to be issued under the 2012 Plan to qualify as incentive stock options.

There are no rights of appraisal

or similar rights of dissenters with respect to the Charter Amendment.

A copy of the Charter Amendment is attached

to this Information Statement as Appendix A.

We are sending this Information Statement to

our stockholders as of the close of business on October 26, 2015. As of such date, there were outstanding 298,772,885 of our shares

of common stock. The holders of our outstanding shares of common stock are entitled to one vote per share registered in their names

on our books at the close of business on such date.

Our Board of Directors, by written consent

on October 26, 2015, has approved, and stockholders holding 149,715,385 shares (approximately 50.11%) of our outstanding shares

of common stock on that date, have consented in writing to, the Charter Amendment and the 2012 Plan Amendment. Accordingly, all

corporate actions necessary to authorize the Charter Amendment and the 2012 Plan Amendment have been taken. Under Section 228

of the Delaware General Corporation Law (as the same may be supplemented or amended from time to time, the “DGCL”),

any action required or permitted by the DGCL to be taken at an annual or special meeting of stockholders of a Delaware corporation

may be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action so

taken, is signed by the holders of outstanding stock having at least a majority of the voting power that would be necessary to

authorize or take such action at a meeting. Prompt notice of the approval of the Charter Amendment must be given to those stockholders

who have not consented in writing to the action and who, if the action had been taken at a meeting, would otherwise have been

entitled to notice of the meeting. This information statement constitutes the notice required by Section 228 of the DGCL.

In accordance with the regulations under the

Securities Exchange Act of 1934, as amended, the Charter Amendment will not become effective until at least twenty (20) days after

we have mailed this Information Statement to our stockholders. Promptly following the expiration of this 20-day period, we intend

to file the Charter Amendment with the Delaware Secretary of State; the Charter Amendment will become effective upon its filing

with the Delaware Secretary of State.

PLEASE BE ADVISED THAT THIS IS ONLY AN INFORMATION

STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Our executive offices are located at Polo

Plaza, 3790 Via De La Valle, #116E, Del Mar, CA 92014.

This Information Statement is first being sent

or given to the holders of our outstanding shares of common stock, our only class of voting securities outstanding, on or about

December __, 2015. Each holder of record of shares of our shares of common stock at the close of business on October 26, 2015,

is entitled to receive a copy of this Information Statement.

FREQUENTLY ASKED QUESTIONS

The following questions and answers are intended

to respond to frequently asked questions concerning the actions approved by our Board of Directors and a majority of the stockholders

entitled to vote. These questions do not, and are not intended to, address all the questions that may be important to you. You

should carefully read the entire Information Statement, as well as its appendices and the documents incorporated by reference in

this Information Statement.

| Q: | WHY AREN’T WE HOLDING A MEETING OF STOCKHOLDERS? |

| A: | Our Board of Directors has already approved the Charter Amendment and the 2012 Plan Amendment and

has received the written consent of a majority of the voting interests entitled to vote on such actions. Under the DGCL these actions

may be approved by the written consent of a majority of the voting interests entitled to vote on such matters. Since we have already

received written consents representing the necessary number of votes, a meeting is not necessary and represents a substantial and

avoidable expense. |

| Q: | WHAT IS THE PURPOSE OF THE

CHARTER AMENDMENT TO CHANGE OUR COMPANY NAME? |

| A: | Our Board of Directors has determined that the change of our name to “LifeApps Brands Inc.”

is in the best interests of our company and its stockholders, and will more accurately reflect our current and future business

focus. |

| Q: | WHAT IS THE PURPOSE OF THE CHARTER AMENDMENT TO EFFECT

A REVERSE STOCK SPLIT? |

| A: | Generally, the effect of a reverse

stock split is to increase the market price per share by reducing the number of outstanding

shares. Our Board of Directors believes that having fewer outstanding shares may encourage

investor interest and improve the marketability and liquidity of our common stock. The

reduction in the number of outstanding shares will result in an increase in the number

of authorized but unissued shares available for future issuance by us in connection with

capital raising transactions, mergers and acquisitions, compensation payable in stock

and similar matters. There can be no assurance given however that any of the anticipated

effects of a reverse stock split will occur. At the present time, we have no plans, proposals

or arrangements, written or otherwise, to issue any of the shares of our common stock

that will become available as a result of the Reverse Split. |

| Q: | WHAT ARE THE PURPOSES OF THE INCREASE IN AUTHORIZED

CAPITAL? |

| A: | The purposes of the Amendment are

to authorize additional shares of common stock and preferred stock for us to issue to

raise capital, for mergers and acquisitions, and to provide compensation that is not

payable in cash. At the present time, we have no plans, proposals or arrangements, written

or otherwise, to issue any of the shares of our common stock that will become available

as a result of the increase in our authorized common stock. |

| Q: | HOW WILL THE 2012 PLAN AMENDMENT BE USED? |

| A: | The 2012 Plan Amendment will be used to ensure that there are sufficient shares available for issuance

under the 2012 Plan for the following purposes: to attract and retain qualified directors, officers and employees; to compensate

consultants for services rendered to us which we could not otherwise afford to obtain; and to provide incentives for the generation

of stockholder value. The 2012 Plan is administered by our Board of Directors, who will determine the recipients, size, and other

terms of any awards under the 2012 Plan as modified by the 2012 Plan Amendment. |

| Q: | CAN I REQUIRE YOU TO PURCHASE MY STOCK? |

| A: | No. Under the DGCL, you are not entitled to appraisal and purchase of your stock as a result of

the Charter Amendment or the 2012 Plan Amendment. |

| Q: | WHO WILL PAY THE COSTS OF THE CHARTER AMENDMENT AND THE 2012 PLAN AMENDMENT? |

| A: | We will pay all of the costs of the Charter Amendment and the 2012 Plan Amendment, including distributing

this Information Statement. To the extent applicable, we may also pay brokerage firms and other custodians for their reasonable

expenses for forwarding information materials to the beneficial owners of our shares of common stock. We are not soliciting any

proxies and will not contract for other services in connection with the stockholder action approving the Charter Amendment and

the 2012 Plan Amendment. |

AMENDMENT OF CERTIFICATE OF INCORPORATION

Our Board of Directors and stockholders holding

a majority of our outstanding shares of common stock (the “Majority Stockholders”) have approved the Charter Amendment

to (i) change our corporate name to LifeApps Brands Inc., (ii) effect a one-for-fifteen (1:15) reverse stock split, the Reverse

Split, of our common stock, $0.001 par value per share, and (iii) increase our authorized capitalization from 300,000,000 shares

of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share, to 500,000,000

shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

We intend to file, as soon as practicable on

or after the twentieth (20th) day after this Information Statement is sent to our stockholders, the Charter Amendment

effectuating the above-described amendments with the Delaware Secretary of State. The Charter Amendment will become effective on

the date it is accepted for filing with the Delaware Secretary of State. It is presently contemplated that such filing will be

made on or after December __, 2015.

NAME CHANGE

We are changing our corporate name to LifeApps

Brands Inc. Our Board of Directors has determined that the change of our name to LifeApps Brands Inc. is in the best interests

of our company and its stockholders, and will more accurately reflect our current and future business focus. LifeApps is moving

towards a strategy of creating digital mobile applications along with physical products and related services all under the LifeApps

brand, through internal development as well as acquisitions. We expect that this new approach will encompass not only the

medical health related fields but other, non-health related themes as well.

1-FOR-15 REVERSE STOCK SPLIT

Our Board of Directors

and stockholders holding a majority of our outstanding common shares have approved an amendment to our Certificate of Incorporation

to effect a one-for-fifteen (1:15) reverse stock split of our common stock, the Reverse Split.

Pursuant to the Reverse

Split, each fifteen (15) shares of our common stock registered in the name of a stockholder at the effective time of the Reverse

Split will be converted into one share of our common stock. As required under Delaware law, with respect to the shares of common

stock that would be converted into less than one share in the Reverse Split, the Company, at its discretion, will either (a) pay

cash equal to the product of such fraction multiplied by the fair market value of one share of common stock, or (b) issue a scrip

or warrant in registered form to purchase our common stock which shall enable the holder thereof to receive a full share upon the

surrender of such scrip or warrant aggregating a full share.

Our Board of Directors

has the discretion to determine if and when to effect the Reverse Split and may abandon the Reverse Split. We expect to consummate

the Reverse Split as soon as possible after the earlier of (a) twenty (20) days have passed from the commencement of our mailing

or otherwise providing this Information Statement, and (b) we have received approval of the Reverse Split from FINRA.

The Reverse Split will

only become effective following our filing of the Charter Amendment and our receipt of FINRA approval. The form of the proposed

Charter Amendment to effect the Reverse Split is attached to this Information Statement as Appendix A and the following

discussion is qualified in its entirety by the full text of the Charter Amendment.

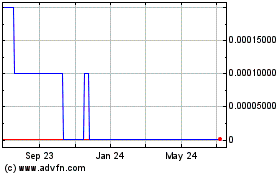

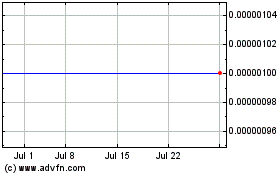

Purposes of the Reverse Stock Split

Generally, the effect of

a reverse stock split is to increase the market price per share by reducing the number of outstanding shares. A reverse stock split

typically does not increase the aggregate market value of all outstanding shares. Our Board of Directors believes that an increased

stock price may encourage investor interest and improve the marketability and liquidity of our common stock. Because of the trading

volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and

practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending

low-priced stocks to their customers.

Some of those policies

and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Our Board

of Directors believes that the anticipated higher market price resulting from a reverse split may reduce, to some extent, the negative

effects on the liquidity and marketability of our common stock inherent in some of the policies and practices of institutional

investors and brokerage firms described above. Additionally, because brokers’ commissions on low-priced stocks generally

represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share

of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total

share value than would be the case if the share price were substantially higher.

Our Board of Directors

also believes that the Reverse Split will afford the Company additional flexibility in consummating potential future financing

and/or strategic transactions without the need for further stockholder approval. One consequence of the Reverse Split will be an

increase in the ratio of the number of shares of our common stock that are authorized but unissued to the number of shares that

are issued and outstanding. This will enable our Board of Directors to issue a greater multiple of our currently outstanding common

stock without seeking stockholder approval to increase the total number of authorized shares.

Potential Risks of the Reverse Stock Split

Following the Reverse Split,

there can be no assurance that the bid price of our common stock will continue at a level in proportion to the reduction in the

number of outstanding shares resulting from such Reverse Split. In other words, there can be no assurance that the post-split market

price of our common stock can be maintained for any period of time. Accordingly, the total market capitalization of our common

stock after the proposed Reverse Split may be lower than the total market capitalization before the proposed Reverse Split.

Additionally, the liquidity

of our common stock could be affected adversely by the reduced number of shares outstanding after the Reverse Split. Although our

Board of Directors believes that a higher stock price may help generate investor interest, there can be no assurance that the Reverse

Split will result in a per-share price that will attract institutional investors or investment funds or that such share price will

satisfy the investing guidelines of institutional investors or investment funds. As a result, the decreased liquidity that may

result from having fewer shares outstanding may not be offset by any increased investor interest in our common stock resulting

from a higher per share price.

Principal Effects of a Reverse Stock Split

If our Board of Directors

determines to effect the Reverse Split, our issued and outstanding shares of common stock would decrease at the rate of 1 share

of common stock for every 15 shares of common stock currently outstanding. The Reverse Split would be effected simultaneously for

all of our common stock, and the exchange ratio would be the same for all shares of our common stock.

The following table contains

approximate information relating to our common stock, based on share information as of November __, 2015:

| |

|

Current |

|

|

After 1:15

Reverse Split |

|

| |

|

|

|

|

|

|

| Authorized Common Stock |

|

|

300,000,000 |

|

|

|

500,000,000 |

1 |

| Common Stock issued and outstanding |

|

|

298,772,885 |

|

|

|

19,918,192 |

|

Common Stock Reserved for Issuance

|

|

|

10,000,000

|

|

|

|

20,000,000

|

|

| Common Stock Authorized but Unissued |

|

|

1,227,115

|

|

|

|

480,081,808

|

|

Our common stock is currently

registered under Section 12(g) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the

Exchange Act. We do not expect the Reverse Split to affect the registration of our common stock under the Exchange Act. Our common

stock is currently quoted on the OTC Markets QB Tier, and the Reverse Split will not be implemented until we receive requisite

approval from FINRA.

After the effective date

of the Reverse Split, each stockholder will own fewer shares of our common stock. However, the Reverse Split will generally affect

all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in us, except to the

extent that the Reverse Split results in any of our stockholders receiving cash or scrip in lieu of fractional shares as described

herein. Proportionate voting rights and other rights and preferences of the holders of our common stock will not be affected by

the Reverse Split other than as a result of the payment of cash or the issuance of scrip in lieu of issuing fractional shares.

Further, the number of stockholders of record will not be affected by the Reverse Split.

1 Reflects the increase in our authorized capitalization approved

by our majority shareholders on October 26, 2015.

The Reverse Split may result

in some stockholders owning “odd-lots” of fewer than 100 shares of our common stock. Brokerage commissions and other

costs of transactions in odd lots are generally somewhat higher than the costs of transactions on “round-lots” of even

multiples of 100 shares. The Reverse Split would not change the number of authorized shares of our common stock as designated by

our Certificate of Incorporation. Therefore, because the number of issued and outstanding shares of common stock would decrease,

the number of shares remaining available for issuance under our authorized pool of common stock would increase.

These additional shares

of common stock would be available for issuance from time to time for corporate purposes such as raising additional capital, acquisitions

of companies or assets and sales of stock or securities convertible into or exercisable for common stock. We believe that the

availability of the additional shares along with the additional increase in our authorized common stock discussed elsewhere in

this Information Statement will provide us with the flexibility to meet business needs as they arise and to take advantage of

favorable opportunities. If we issue additional shares for any of these purposes, the ownership interest of our current stockholders

would be diluted. At the present time, we have no plans, proposals or arrangements, written or otherwise, to issue any of the

shares of our common stock that will become available as a result of the Reverse Split.

These proposals have been

prompted solely by the business considerations discussed in the preceding paragraphs. Nevertheless, the additional shares of our

common stock that would become available for issuance following the Reverse Split could also be used by our management to oppose

a hostile takeover attempt or delay or prevent changes in control or changes in or removal of management, including transactions

that are favored by a majority of our stockholders or in which our stockholders might otherwise receive a premium for their shares

over then-current market prices or benefit in some other manner. For example, without further stockholder approval, our Board of

Directors could sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current

Board of Directors. Except as discussed above, our Board of Directors is not aware of any pending takeover or other transactions

that would result in a change in control, and the proposal was not adopted to thwart any such efforts.

Fractional Shares

No fractional shares of our common stock will be issued as a result of the Reverse Split. Instead, stockholders

who otherwise would be entitled to receive a fractional share because they hold a number of shares which are not evenly divisible

as a result of the Reverse Split ratio, upon surrender to the exchange agent of the certificates representing such fractional shares,

shall be entitled to receive (a) cash equal to the product of such fraction multiplied by the fair market value of one share of

common stock, or (b) a scrip or warrant in registered form to purchase our common stock which shall enable the holder thereof to

receive a full share upon the surrender of such scrip or warrant aggregating a full share.

Reduction in Stated Capital

Pursuant to the Reverse

Split, the par value of our common stock will remain $0.001 per share. As a result of the Reverse Split, on the effective date

thereof, the stated capital on our balance sheet attributable to our common stock will be reduced in proportion to the size of

the Reverse Split, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced.

Our stockholders’ equity, in the aggregate, will remain unchanged.

No Going Private Transaction

We currently have no intention

to go private, and the Reverse Split is not intended to be the first step in a “going private transaction” and will

not have the effect of a going private transaction under Rule 13e-3 of the Exchange Act.

Procedure for Effecting Reverse Stock Split

and Exchange of Stock Certificates

Our officers, in their

discretion, will determine whether to implement the Reverse Split, taking into consideration the factors discussed above.

We would then file the

Charter Amendment amending our Certificate of Incorporation with the Delaware Secretary of State. The form of the Charter Amendment

is attached to this Information Statement as Appendix A. Upon the effective date specified in the Charter Amendment, without

any further action on our part or our shareholders, the issued shares of common stock held by shareholders of record as of the

effective date of the Reverse Split would be converted into a lesser number of shares of common stock calculated in accordance

with the Reverse Split ratio of one-for-fifteen. The number of shares of common stock underlying outstanding options would also

be automatically adjusted on the effective date.

Effect on Beneficial Holders (i.e., Shareholders

Who Hold in “Street Name”)

If the Reverse Split is

approved and we effect the Reverse Split, we intend to treat the common stock held by our shareholders in “street name,”

through a bank, broker or other nominee, in the same manner as shareholders whose shares are registered in their own names. Banks,

brokers or other nominees will be instructed to effect the Reverse Split for their customers holding common stock in “street

name.” However, these banks, brokers or other nominees may have different procedures than registered shareholders for processing

the Reverse Split. If you hold shares of our common stock with a bank, broker or other nominee and have any questions in this regard,

you are encouraged to contact your bank, broker or other nominee.

Effect on Registered “Book-Entry”

Holders (i.e., Shareholders that are Registered on the Transfer Agent’s Books and Records but do not Hold Certificates)

Some of the registered

holders of our common stock may hold some or all of their shares electronically in book-entry form with our transfer agent, Action

Stock Transfer. These shareholders do not have stock certificates evidencing their ownership of our common stock. They are, however,

provided with a statement reflecting the number of shares registered in their accounts. If a shareholder holds registered shares

in book-entry form with our transfer agent, no action would need to be taken to receive post-Reverse Split shares. If a shareholder

is entitled to post-Reverse Split shares, a transaction statement would automatically be sent to the shareholder’s address

of record indicating the number of shares of common stock held following the Reverse Split.

Effect on Certificated Shares

Our transfer agent would

act as our exchange agent for the Reverse Split and would assist holders of our common stock in implementing the exchange of their

certificates.

As soon as practicable

after the effective date of a Reverse Split, shareholders holding shares in certificated form would be sent a transmittal letter

by our transfer agent. The letter of transmittal would contain instructions on how a shareholder should surrender his or her certificates

representing common stock (“Old Certificates”) to the transfer agent in exchange for certificates representing the

appropriate number of whole post-Reverse Split common stock, as applicable (“New Certificates”). No New Certificates

would be issued to a shareholder until that shareholder has surrendered all Old Certificates, together with a properly completed

and executed letter of transmittal, to the transfer agent. No shareholder would be required to pay a transfer or other fee to exchange

Old Certificates. The letter of transmittal would contain instructions on how you may obtain New Certificates if your Old Certificates

have been lost. If you have lost your certificates, you may have to pay any surety premium and the service fee required by our

transfer agent.

Until surrendered, we would

deem outstanding Old Certificates held by shareholders to be canceled and only to represent the number of whole shares to which

these shareholders are entitled.

Any Old Certificates submitted

for exchange, whether because of a sale, transfer or other disposition of shares, would automatically be exchanged for New Certificates.

Shareholders should

not destroy any stock certificates and should not submit any certificates until requested to do so by the transfer agent. Shortly

after the Reverse Split the transfer agent would provide registered shareholders with instructions and a letter of transmittal

for converting Old Certificates into New Certificates. In that case, shareholders are encouraged to promptly surrender Old Certificates

to the transfer agent (acting as exchange agent in connection with the Reverse Split) in order to avoid having shares become subject

to escheat laws.

No Dissenters’ Rights

In connection with the

approval of the Reverse Split, you and our other stockholders will not have a right to dissent and obtain payment for their shares

under the DGCL or our Certificate of Incorporation or by-laws.

Tax Consequences

The following discussion

sets forth the material United States federal income tax consequences that management believes will apply to us and our stockholders

who are United States holders at the effective time of the Reverse Split. This discussion does not address the tax consequences

of transactions effectuated prior to or after the Reverse Split, including, without limitation, the tax consequences of the exercise

of options, warrants, convertible debentures or similar rights to purchase stock. Furthermore, no foreign, state or local tax considerations

are addressed herein. For this purpose, a United States holder is a stockholder that is: (i) a citizen or resident of the United

States, (ii) a domestic corporation, (iii) an estate whose income is subject to United States federal income tax regardless of

its source, or (iv) a trust if a United States court can exercise primary supervision over the trust’s administration and

one or more United States persons are authorized to control all substantial decisions of the trust.

No gain or loss should

be recognized by a stockholder upon his or her exchange of pre- Reverse Split shares for post- Reverse Split shares. The aggregate

tax basis of the post- Reverse Split shares received in the Reverse Split will be the same as the stockholder’s aggregate

tax basis in the pre- Reverse Split shares exchanged therefor. The stockholder’s holding period for the post- Reverse Split

shares will include the period during which the stockholder held the pre- Reverse Split shares surrendered in the Reverse Split.

We should not recognize

any gain or loss as a result of the Reverse Split.

INCREASE IN AUTHORIZED CAPITAL STOCK

Our Certificate of Incorporation authorizes

us to issue 300,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value

$0.001 per share. Our Board of Directors and the Majority Stockholders have approved the Charter Amendment to increase our authorized

capitalization to 500,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par

value $0.001 per share. As of the date hereof, there are 298,772,885 shares of common stock outstanding and no shares of preferred

stock outstanding.

The increase in authorized

capital will not have any immediate effect on the rights of our existing stockholders. However, our Board of Directors will have

the authority to issue authorized shares of common stock or preferred stock at such times, for such purposes and for such consideration

as the Board of Directors may determine to be appropriate without requiring future stockholder approval of such issuances, except

as may be required by applicable law or applicable stock exchange regulations. At the present time, we have no plans, proposals

or arrangements, written or otherwise, to issue any of the shares of our common stock that will become available as a result of

the increase in our authorized common stock.

2012 Equity Incentive

2012 Plan; 2012 PLAN AMENDMENT

Our Board of Directors

and our Majority Stockholders approved the LifeApps Digital Media Inc. 2012 Equity Incentive Plan (sometimes referred to herein

as the “2012 Plan”). The 2012 Equity Incentive Plan became effective upon its adoption by our Board of Directors by

written consent on September 10, 2012.

On October 26, 2015,

our Board of Directors and our Majority Stockholders approved the 2012 Plan Amendment. Pursuant to the 2012 Plan Amendment, the

number of shares of our common stock reserved for issuance under the 2012 Plan has been increased to 20,000,000, on a post-Reverse

Split basis, from 10,000,000 shares, pre-Reverse Split. This increase was adopted in view of our planned 1 for 15 reverse stock-split.

The following is

a description of the material provision of the 2012 Plan, as revised by the 2012 Plan Amendment. The summary that follows is not

intended to be complete. Please see the copy of the 2012 Equity Incentive Plan, as revised by the 2012 Plan Amendment, attached

hereto as Appendix B for a complete statement of its terms and conditions.

The purpose of the

2012 Equity Incentive Plan is to attract and retain the best available personnel for positions of substantial responsibility;

to provide incentives to individuals who perform services for us; and to promote the success of our business. The following classes

of persons will be eligible to participate in the 2012 Plan: officers or other employees of the Company or its affiliates, individuals

that the Company or an affiliate of the Company has engaged to become an officer or employee, or consultants or advisors of the

Company or its affiliates who provide services to the Company or its affiliates, including non-employee members of our Board of

Directors. At the present time, we have two persons who are our executive officers and directors, two additional persons who are

non-employee directors and approximately eight persons who are employees or consultants who are eligible for grants under the

2012 Plan. In making a determination as to who shall receive a grant under the 2012 Plan and what that grant shall consist of,

the Company takes into account the duties and responsibilities of the employee, director or consultant, the value of his services,

his potential contribution to our success, the anticipated number of years of future service and other relevant factors.

The 2012 Equity

Incentive Plan, as amended by the 2012 Plan Amendment, reserves a total of 20,000,000 shares, post-Reverse Split, of our common

stock for issuance under the 2012 Plan. If an incentive award granted under the 2012 Plan expires, terminates, is unexercised

or is forfeited, or if any shares are surrendered to us in connection with an incentive award, the shares subject to such award

and the surrendered shares will become available for further awards under the 2012 Plan.

The number of shares

of our common stock subject to the 2012 Plan, any number of shares subject to any numerical limit in the 2012 Plan, and the number

of shares and terms of any incentive award will be adjusted in the event of any change in our outstanding common stock by reason

of any stock dividend, spin-off, split-up, stock split, reverse stock split, recapitalization, reclassification, merger, consolidation,

liquidation, business combination or exchange of shares or similar transaction.

Although we currently

do not have a sufficient number of shares of our authorized but unissued common stock available for reservation to cover the 10,000,000

shares of our common stock that are currently authorized for grant under the 2012 Plan, following effectiveness of the Reverse

Split and the increase in our authorized common stock, we will have sufficient authorized common stock to reserve the 20,000,000

shares authorized for issuance under the 2012 Plan Amendment.

Administration

If formed, the compensation

committee of our Board of Directors will administer the 2012 Equity Incentive Plan. In the event the compensation committee is

not formed by our Board of Directors, our entire Board of Directors will serve the role of the committee. The administrative body

will be hereinafter referred to as the “Administrator.” Subject to the terms of the 2012 Equity Incentive Plan, the

Administrator will have complete authority and discretion to determine the terms of awards under the 2012 Plan.

Awards

The 2012 Equity

Incentive Plan authorizes the grant of incentive stock options, nonqualified stock options, stock appreciation rights, restricted

stock, restricted stock units, performance shares, restricted stock or restricted stock units.

Stock Options.

Stock options entitle the participant, upon exercise, to purchase a specified number of shares of our common stock at a specified

price and for a specified period of time. The exercise price for each stock option shall be determined by the Administrator but

shall not be less than 100% of the fair market value of our common stock on the date of grant. The “fair market value”

means the value of the common stock as the Administrator may determine in good faith, by reference to the closing price of such

stock on any established stock exchange or national market system on which our common stock is listed on the day of determination,

or if our common stock is not so listed, the value of such stock as may be determined by the Administrator in good faith.

Any stock options

granted in the form of an incentive stock option will be intended to comply with the requirements of Section 422 of the Internal

Revenue Code of 1986, as amended. Only options granted to employees qualify for incentive stock option treatment.

Each stock option

shall expire at such time as the Administrator shall determine at the time of grant. No stock option shall be exercisable later

than the tenth anniversary of its grant. A stock option may be exercised in whole or in installments. A stock option may not be

exercisable for a fraction of a share. Shares of our common stock purchased upon the exercise of a stock option must be paid for

in full at the time of exercise in cash or such other consideration determined by the Administrator.

Stock Appreciation

Rights. A stock appreciation right (“SAR”) is the right to receive a payment equal to the excess of the fair market

value of a specified number of shares of common stock on the date the SAR is exercised over the exercise price of the SAR. The

exercise price for each SAR shall not be less than 100% of the fair market value of our common stock on the date of grant, and

the term shall be no more than ten years from the date of grant. At the discretion of the Administrator, the payment upon an SAR

exercise may be in cash, in shares equivalent thereof, or in some combination thereof.

Upon exercise of

an SAR, the participant shall be entitled to receive payment from us in an amount determined by multiplying the excess of the fair

market value of a share of our common stock on the date of exercise over the exercise price of the SAR by the number of shares

with respect to which the SAR is exercised. The payment may be made in cash or stock, at the discretion of the Administrator.

Restricted Stock

and Restricted Stock Units. Restricted stock and restricted stock units may be awarded or sold to participants under such terms

and conditions as shall be established by the Administrator. Restricted stock and restricted stock units shall be subject to such

restrictions as the Administrator determines, including a prohibition against sale, assignment, transfer, pledge or hypothecation,

and a requirement that the participant forfeit such shares or units in the event of termination of employment. A restricted stock

unit provides a participant the right to receive payment at a future date after the lapse of restrictions or achievement of performance

criteria or other conditions determined by the Administrator.

Performance Stock.

The Administrator shall designate the participants to whom long-term performance stock are to be awarded and determine the number

of shares, the length of the performance period and the other vesting terms and conditions of each such award; provided the stated

performance period will not be less than twelve (12) months. Each award of performance stock shall entitle the participant to a

payment in the form of shares of our common stock upon the attainment of performance goals and other vesting terms and conditions

specified by the Administrator. The Administrator may, in its discretion, make a cash payment equal to the fair market value of

shares of common stock otherwise required to be issued to a participant pursuant to a Performance Stock Award.

All awards are discussed

in more detail in the 2012 Equity Incentive Plan. All awards made under the 2012 Plan may be subject to vesting and other contingencies

as determined by the Administrator and will be evidenced by agreements approved by the Administrator which set forth the terms

and conditions of each award.

Duration, Amendment and Termination

Unless sooner terminated

by the Administrator, the 2012 Equity Incentive Plan will terminate on September 10, 2022. Our Board of Directors will have the

power to amend, alter, suspend or terminate the 2012 Plan at any time or from time to time without stockholder approval or ratification,

unless necessary and desirable to comply with applicable law. No change may be made that increases the total number of shares of

common stock reserved for issuance pursuant to the 2012 Plan or reduces the minimum exercise price for options or exchange of options

for other incentive awards, unless such change is authorized by our stockholders within one year. However, before an amendment

may be made that would adversely affect a participant who has already been granted an award, the participant’s consent must

be obtained.

New Plan Benefits

At present, we have

no plans to make additional grants under the 2012 Plan as amended.

Description of Securities

General

We are a Delaware corporation, and our affairs

are governed by our Certificate of Incorporation, our by-laws and the DGCL. The following are summaries of material provisions

of our Certificate of Incorporation and the DGCL insofar as they relate to the material terms of our shares of common stock. The

following summary description relating to our share capital does not purport to be complete and is qualified in its entirety by

our Certificate of Incorporation and by-laws.

Shares of common stock

Our Board of Directors believes that the

increase in authorized shares of common stock is desirable in order to provide us with a greater degree of flexibility to issue

shares of common stock, without the expense and delay of a special stockholders’ meeting, in connection with future equity

financings, future opportunities for expanding the business through investments or acquisitions, management incentive and employee

benefit plans and for other general corporate purposes. At the present time, we have no plans, proposals or arrangements, written

or otherwise, to issue any of the shares of our common stock that will become available as a result of the increase in our authorized

common stock.

To the extent that additional authorized shares

of common stock are issued in the future, they will decrease our existing stockholders’ percentage equity ownership and,

depending upon the price at which they are issued, could be dilutive to the existing stockholders. The holders of our shares of

common stock have no preemptive rights.

Voting

Holders of shares of common stock are entitled

to one vote for each ordinary share on all matters to be voted on by the shareholders. Holders of shares of common stock do not

have cumulative voting rights. Holders of shares of common stock are entitled to share ratably in dividends, if any, as may be

declared from time to time by the Board of Directors in its discretion from funds legally available therefor. In the event of a

liquidation, dissolution or winding up of the Company, the holders of shares of common stock are entitled to share pro rata all

assets remaining after payment in full of all liabilities.

Holders of shares of common stock have no preemptive

rights to purchase shares of common stock. There are no conversion or redemption rights or sinking fund provisions with respect

to the shares of common stock.

Dividends

The holders of our shares of common stock are

entitled to such dividends as may be declared by our Board of Directors. We have not paid any dividends on our shares of common

stock to date and do not intend to pay dividends prior to the completion of a business combination. The payment of dividends in

the future will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent

to completion of a business combination. The payment of any dividends subsequent to a business combination will be within the discretion

of our then Board of Directors. It is the present intention of our Board of Directors to retain all earnings, if any, for use in

our business operations and, accordingly, our Board of Directors does not anticipate declaring any dividends in the foreseeable

future.

Preferred Stock

We are currently authorized to issue 10,000,000

blank check shares of preferred stock, $0.001 par value per share with designations, rights and preferences determined from

time to time by our Board of Directors. The Charter Amendment will not increase the number of authorized shares of preferred stock.

Shares of preferred stock may be issued from

time to time in one or more series, each of which will have such distinctive designation or title as shall be determined by our

Board of Directors prior to the issuance of any shares thereof. Shares of preferred stock will have such voting powers, full or

limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications,

limitations or restrictions thereof, as shall be stated in such resolution or resolutions providing for the issue of such class

or series of preferred stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares

thereof. The number of authorized shares of preferred stock may be increased or decreased (but not below the number of shares thereof

then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then outstanding shares of

our capital stock entitled to vote generally in the election of the directors, voting together as a single class, without a separate

vote of the holders of the preferred stock, or any series thereof, unless a vote of any such holders is required pursuant to any

preferred stock designation.

We do not have any current plans, proposals

or arrangements, written or otherwise, to create or issue any shares of preferred stock using the “blank check” authority

afforded our Board of Directors by the Certificate of Incorporation. However, our Board of Directors believes that this authority

is beneficial because it provides us with increased flexibility in pursuit of equity financing. Having authorized “blank

check” preferred stock permits us to issue preferred stock for purposes that may be identified in the future, including (i)

to raise additional capital or (ii) to engage in a range of investment and strategic opportunities through equity financings. The

shares of preferred stock permit our Board of Directors to undertake the foregoing actions on an expedited basis, without the delay

and expense ordinarily attendant on obtaining further shareholder approvals. In addition, our Board of Directors believes that

the having authorized “blank check” preferred stock improves our ability to attract needed investment capital, as various

series of the preferred stock may be customized to meet the needs of any particular transaction or market conditions. “Blank

check” preferred stock is commonly authorized by publicly traded companies and is frequently used as a preferred means of

raising capital. In particular, in recent years, smaller companies have been required to utilize senior classes of securities to

raise capital, with the terms of those securities being highly negotiated and tailored to meet the needs of both investors and

the issuing companies. Such senior securities typically include liquidation and dividend preferences, protections, conversion privileges

and other rights not found in shares of common stock.

The issuance of preferred stock could affect

the relative rights of the holders of our shares of common stock. Depending on the exact powers, preferences and rights, if any,

of the preferred stock as determined by our Board of Directors at the time of issuance, the voting power and economic interest

of the holders of our shares of common stock may be diluted. For example, the holders of preferred stock may be entitled to (i)

certain preferences over the holders of our shares of common stock with respect to dividends or the power to approve the declaration

of a dividend, (ii) in the event of liquidation of our company, receive a certain amount per share of their preferred stock before

the holders of our shares of common stock receive any distribution, (iii) rights to convert their preferred stock into shares of

common stock, and (iv) voting rights which would tend to dilute the voting rights of the holders of our shares of common stock.

The aforementioned are only examples of how shares of our preferred stock, if issued, could result in:

| · | Reduction of the amount of funds otherwise available for payment of dividends on our shares of

common stock; |

| · | Restrictions on dividends on our shares of common stock; |

| · | Dilution of the voting power of our shares of common stock; and |

| · | Restrictions on the rights of holders of our shares of common stock to share in our assets upon

liquidation until satisfaction of any liquidation preference granted to the holders of our preferred stock. |

Possible Anti-Takeover Effects of the Proposed

Increase in Authorized Capital Stock

The increase in authorized capital with respect

to the authorized number of shares of common stock and the subsequent issuance of such shares could have the effect of delaying

or preventing a change in control of our company without further action by our stockholders. Authorized and unissued shares of

common stock could be issued (within the limits imposed by applicable law) in one or more transactions. Any such issuance of additional

shares of common stock could have the effect of diluting the earnings per share and book value per share of outstanding shares

of common stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to

obtain control of us.

Our Board of Directors acknowledges that the

issuance of preferred stock may have the effect of discouraging or thwarting persons seeking to take control of us through a corporation

transaction, tender offer or a proxy fight or otherwise seeking to bring about the removal of our incumbent management. Because

the authorization of “blank check” preferred stock could be used by our Board of Directors for the adoption of a shareholder

rights plan or “poison pill,” the preferred stock may be viewed as having the effect of discouraging an attempt by

another person or entity to acquire control of us through the acquisition of a substantial numbers of shares of common stock.

While the Charter Amendment may have anti-takeover

ramifications, our Board of Directors believes that the reasons for such the Charter Amendment set forth above outweigh any disadvantages.

To the extent that such amendment may have anti-takeover effects, such amendment may encourage persons seeking to acquire our company

to negotiate directly with the Board of Directors, enabling the Board of Directors to consider the proposed transaction in a manner

that best serves our stockholders’ interests. The Charter Amendment has not been made in response to, and is not being presented

to deter, any effort to obtain control of us.

No Dissenters’ Rights

Under the DGCL and our Certificate of Incorporation,

holders of our voting securities are not entitled to any rights of appraisal or similar rights of dissenters with respect to the

Charter Amendment or the 2012 Plan Adoption.

Financial Information

Our audited consolidated

financial statements and accompanying notes filed with our Annual Report (our “Annual Report”) on Form 10-K for the

year ended December 31, 2014, are incorporated herein by reference.

Our unaudited condensed

consolidated interim financial statements and accompanying notes filed with our Quarterly Reports on Form 10-Q (our “Quarterly

Report”) for the quarterly periods ended March 31, 2015, June 30, 2015 and September 30, 2015, are incorporated herein by

reference.

Item 7 of Part II

of our Annual Report “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

is incorporated herein by reference.

Item 2 of Part II

of our Quarterly Reports “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

is incorporated herein by reference.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information

with respect to the beneficial ownership of our common stock known by us as of November __, 2015, by:

| · | each person or entity known by us to be the beneficial owner of more than 5% of our common stock; |

| · | each of our executive officers; and |

| · | all of our directors and executive officers as a group. |

Except as otherwise indicated, the persons

listed below have sole voting and investment power with respect to all shares of our common stock owned by them, except to the

extent such power may be shared with a spouse.

Unless otherwise noted, the address of each

person below id c/o LifeApps Digital Media Inc., Polo Plaza, 3790 Via De La Valle, #116E, Del Mar, CA 92014.

Title of Class: Common Stock

| Name and Address of Beneficial Owner |

|

Amount and Nature

of Beneficial

Ownership (1) |

|

|

Percentage

of Class (2) |

|

| |

|

|

|

|

|

|

| Robert Gayman |

|

|

67,350,000 |

(3) |

|

|

22.26 |

% |

| Arnold Tinter |

|

|

1,750,000 |

(4) |

|

|

* |

|

| Howard Fuller |

|

|

400,000 |

(5) |

|

|

* |

|

| Lawrence P. Roan |

|

|

84,915,385 |

|

|

|

28.42 |

% |

| |

|

|

|

|

|

|

|

|

| All directors and executive officers as a group (4 persons) |

|

|

154,415,385 |

|

|

|

51.39 |

% |

*Less than 1%

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC. For this purpose, a beneficial owner of a security

includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise,

has or shares (a) the power to vote, or to direct the voting of, such security and/or (b) the power to dispose, or to direct the

disposition of, such security. Shares of common stock subject to options or warrants currently exercisable or convertible, or exercisable

or convertible within 60 days of November __, 2015, are deemed outstanding for computing the percentage of the person holding such

option or warrant but are not deemed outstanding for computing the percentage of any other person. |

| (2) | Percentages based upon 298,772,885 shares of common stock

outstanding as of November __, 2015. |

| (3) | Includes 3,850,000 shares of our common stock that may be issued within 60 days upon exercise of

incentive stock options granted under our 2012 Equity Incentive Plan. |

| (4) | Includes 750,000 shares of our common stock that may be issued within 60 days upon exercise of incentive

stock options granted under our 2012 Equity Incentive Plan. |

| (5) | Includes 100,000 shares of our common stock that may be issued within 60 days upon exercise of incentive

stock options granted under our 2012 Equity Incentive Plan. |

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the disclosure requirements

of the Securities Exchange Act of 1934, as amended, and in accordance therewith, file reports, information statements and other

information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information

filed by the Company can be inspected and copied at the public reference facilities maintained by the SEC at Room 1024, 450 Fifth

Street, N.W., Washington, DC 20549. Copies of such material can also be obtained upon written request addressed to the SEC, Public

Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. In addition, the SEC maintains a web site

on the Internet (http://www.sec.gov ) that contains reports, information statements and other information regarding issuers

that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

You may request a copy of these filings, at

no cost, by writing LifeApps Digital Media Inc. at Polo Plaza, 3790 Via De La Valle, #116E, Del Mar,

CA 92014 or telephoning the Company at (858) 577-0500. Any statement contained in a document that is incorporated by reference

will be modified or superseded for all purposes to the extent that a statement contained in this Information Statement (or in any

other document that is subsequently filed with the SEC and incorporated by reference) modifies or is contrary to such previous

statement. Any statement so modified or superseded will not be deemed a part of this Information Statement except as so modified

or superseded.

This Information Statement is provided to the

Stockholders only for information purposes in connection with the Authorized Share Increase, pursuant to and in accordance with

Rule 14c-2 of the Exchange Act. Please carefully read this Information Statement.

| Dated: December

__, 2015 |

By Order of the Board of Directors, |

|

| |

|

|

| |

/s/ Robert Gayman |

|

| |

Robert Gayman |

| |

President and Chief Executive Officer |

APPENDIX A

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT OF AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

LifeApps Digital Media Inc.

The undersigned corporation organized and existing

under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That

by unanimous written consent of the Board of Directors of LifeApps Digital Media Inc., in lieu of a meeting, in accordance with

Section 141 of the General Corporation Law of the State of Delaware, resolutions were duly adopted setting forth proposed amendments

of the Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”)

of said corporation, declaring said amendments to be advisable and calling for the stockholders of said corporation to approve

said amendments by written consent in accordance with 228 of the General Corporation Law of the State of Delaware. The resolutions

setting forth the proposed amendments are as follows:

RESOLVED, that the Certificate

of Incorporation of the Corporation be amended by changing Article First thereof so that, as amended, said Article shall be and

read as follows:

FIRST: The name of the corporation is LifeApps Brands

Inc.

and further,

RESOLVED, that the Certificate

of Incorporation of the Corporation be amended by changing Article Fourth thereof so that, as amended, said Article shall be and

read as follows:

FOURTH: The Corporation is authorized

to issue two classes of stock to be designated, respectively, Common Stock, par value $0.001 per share (“Common Stock”)

and Preferred Stock, par value $0.001 per share (“Preferred Stock”). The total number of shares of Common Stock that

the Corporation shall have authority to issue is five hundred million (500,000,000). The total number of shares of Preferred Stock

that the Corporation shall have authority to issue is ten million (10,000,000).

The Board of Directors of the

Corporation is hereby granted the power to authorize by resolution, duly adopted from time to time, the issuance of any or all

of the preferred stock in any number of classes or series within such classes and to set all terms of such preferred stock of any

class or series, including, without limitation, its powers, preferences, rights, privileges, qualifications, restrictions and/or

limitations. The powers, preference, rights, privileges, qualifications, restrictions and limitations of each class or series of

the preferred stock, if any, may differ from those of any and all other classes or other series at any time outstanding. Any shares

of any one series of preferred stock shall be identical in all respects with all other shares of such series, except that shares

of any one series issued at different times may differ as to the dates from which dividends thereof shall be cumulative.

Reverse Stock Split.

As determined by the Board of Directors of the Corporation, in the exercise of its sole discretion, a split ratio of fifteen (15)

of the issued and outstanding shares of Common Stock as of the time the certificate containing this amendment becomes effective

(the ‘‘Split Effective Time’’), shall be combined and converted (the “Reverse Split”) automatically,

without further action, into one (1) fully paid and non-assessable share of Common Stock. In lieu of any fractional shares to which

a holder would otherwise be entitled, the Corporation, at its discretion, shall either: (a) pay cash equal to the product of such

fraction multiplied by the fair market value of one share of Common Stock, as of the Split Effective Time or (b) issue a scrip

or warrant in registered form to purchase our Common Stock which shall enable the holder thereof to receive a full share upon the

surrender of such scrip or warrant aggregating a full share; Each holder of record of a certificate which immediately prior to

the Split Effective Time represents outstanding shares of Common Stock (an ‘‘Old Certificate’’) shall be

entitled to receive upon surrender of such Old Certificate to the Corporation’s transfer agent for cancellation, a certificate

(a ‘‘New Certificate’) representing the number of whole shares of Common Stock into and for which the shares

formerly represented by such Old Certificate so surrendered are combined and converted. From and after the Split Effective Time,

Old Certificates shall represent only the right to receive New Certificates as aforesaid and, to the extent the Corporation so

elects, cash pursuant to the provisions hereof. The amount of capital represented by the shares of Common Stock outstanding in

the aggregate immediately after the Split Effective Time shall be adjusted from the capital account of the Common Stock to the

additional paid in capital account for each share of Common Stock fewer outstanding immediately following the Reverse Split than

immediately prior to the Reverse Split, such transfer to be made at the Split Effective Time.

SECOND: That thereafter, pursuant to

resolution of its Board of Directors, stockholders of said corporation holding the necessary number of shares as required by statute

consented to the said amendments in writing, in lieu of a meeting, in accordance with Section 228 of the General Corporation Law

of the State of Delaware.

THIRD: That said amendment was duly

adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, said corporation

has caused this certificate to be signed this [____] day of [_________], 2015.

| |

|

|

|

| |

LifeApps Digital Media Inc. |

|

| |

|

|

|

| |

By: |

|

|

| |

|

Name: Robert Gayman |

|

| |

|

Title: President and Chief Executive Officer |

|

APPENDIX B

LIFEAPPS DIGITAL

MEDIA INC.

2012 EQUITY INCENTIVE

PLAN

As Amended on October

26, 2015

1. PURPOSE.

The LifeApps Digital Media Inc. 2012 Equity Incentive Plan (the “Plan”) has two complementary purposes:

(a) to attract and retain outstanding individuals to serve as officers, employees, directors, consultants and advisors to the

Company and its Affiliates, and (b) to increase stockholder value. The Plan will provide participants with incentives to increase

stockholder value by offering the opportunity to acquire shares of the Company’s Common Stock or receive monetary payments

based on the value of such Common Stock, on the potentially favorable terms that this Plan provides.

2. EFFECTIVE

DATE. The Plan shall become effective upon its adoption by the Board of Directors of the Company, subject to approval

by the stockholders of the Company within twelve (12) months of the effective date. Any Awards granted under the Plan prior to

such stockholder approval shall be conditioned on such approval.

3. DEFINITIONS.

Capitalized terms used in this Plan have the following meanings:

(a) “Affiliate”

means any entity that, directly or through one or more intermediaries, is controlled by, controls, or is under common control

with, the Company within the meaning of Code Sections 414(b) or (c), provided that, in applying such provisions, the phrase “at

least fifty percent (50%)” shall be used in place of “at least eighty percent (80%)” each place it appears therein.

(b) “Award”

means a grant of Options (as defined below), Stock Appreciation Rights (as defined in Section 3(w) hereof), Performance Shares

(as defined in Section 3(p) hereof), Restricted Stock (as defined in Section 3(s) hereof), or Restricted Stock Units (as defined

in Section 3(t) hereof).

(c) “Bankruptcy”

shall mean (i) the filing of a voluntary petition under any bankruptcy or insolvency law, or a petition for the appointment of

a receiver or the making of an assignment for the benefit of creditors, with respect to the Participant, or (ii) the Participant

being subjected involuntarily to such a petition or assignment or to an attachment or other legal or equitable interest with respect

to the Participant’s assets, which involuntary petition or assignment or attachment is not discharged within 60 days after

its date, and (iii) the Participant being subject to a transfer of its Issued Shares by operation of law (including by divorce,

even if not insolvent), except by reason of death.

(d) “Board”

means the Board of Directors of the Company.

(e) “Change

of Control” shall be deemed to have occurred as of the first day that any one or more of the following conditions is satisfied,

including, but not limited to, the signing of documents by all parties and approval by all regulatory agencies, if required:

(i) The

stockholders approve a plan of complete liquidation or dissolution of the Company; or

(ii) The

consummation of (A) an agreement for the sale or disposition of all or substantially all of the Company’s assets (other

than to an Excluded Person (as defined below)), or (B) a merger, consolidation or reorganization of the Company with or involving

any other corporation, other than a merger, consolidation or reorganization that would result in the holders of voting securities

of the Company outstanding immediately prior thereto continuing to hold (either by remaining outstanding or by being converted

into voting securities of the surviving entity), at least fifty percent (50%) of the combined voting power of the voting securities

of the Company (or such other surviving entity) outstanding immediately after such merger, consolidation or reorganization.

An Excluded Person means: (i) the Company

or any of its Affiliates, (ii) a trustee or other fiduciary holding securities under any employee benefit plan of the Company

or any of its Affiliates, (iii) an underwriter temporarily holding securities pursuant to an offering of such securities or (iv)

a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their

ownership of stock in the Company.

Notwithstanding the foregoing, with respect

to an Award that is considered deferred compensation subject to Code Section 409A, if the definition of “Change of Control”

results in the payment of such Award, then such definition shall be amended to the minimum extent necessary, if at all, so that

the definition satisfies the requirements of a change of control under Code Section 409A.

(f) “Code”

means the Internal Revenue Code of 1986, as amended. Any reference to a specific provision of the Code includes any successor

provision and the regulations promulgated under such provision.

(g) “Committee”

means the Compensation Committee of the Board (or a successor committee with similar authority) or if no such committee is named

by the Board, than it shall mean the Board.

(h) “Common

Stock” means the Common Stock of the Company, par value $0.001 per share.

(i) “Company”

means LifeApps Digital Media Inc., a Delaware corporation, or any successor thereto.

(j) “Exchange

Act” means the Securities Exchange Act of 1934, as amended from time to time. Any reference to a specific provision of the

Exchange Act shall be deemed to include any successor provision thereto.

(k) “Fair

Market Value” means, per Share on a particular date, the value as determined by the Committee using a reasonable valuation

method within the meaning of Code Section 409A, based on all information in the Company’s possession at such time, or if

applicable, the value as determined by an independent appraiser selected by the Board or Committee.

(l) “Issued

Shares” means, collectively, all outstanding Shares issued pursuant to an Award and all Option Shares.

(m) “Option”

means the right to purchase Shares at a stated price upon and during a specified time. “Options” may either be “incentive

stock options” which meet the requirements of Code Section 422, or “nonqualified stock options” which do not

meet the requirements of Code Section 422.

(n) “Option

Shares” means outstanding Shares that were issued to a Participant upon the exercise of an Option.

(o) “Participant”

means an officer or other employee of the Company or its Affiliates, or an individual that the Company or an Affiliate has engaged