UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November

30, 2015

| |

| ORAMED PHARMACEUTICALS INC. |

| (Exact name of registrant as specified in its charter) |

| DELAWARE |

|

001-35813 |

|

98-0376008 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

| Hi-Tech Park 2/4 Givat Ram, PO Box 39098, Jerusalem, Israel |

|

91390 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

+972-2-566-0001

(Registrant’s telephone number, including area

code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On November 30, 2015, Oramed Pharmaceuticals Inc., or

the Company, entered into a Securities Purchase Agreement, or SPA, with Hefei Tianhui Incubator of Technologies Co., Ltd., or HTIT,

pursuant to which HTIT agreed to buy and the Company agreed to sell 1,155,367 restricted shares of Common Stock of the Company,

or the Shares, at a price of $10.38631 per Share, for the aggregate amount of $12 million. The transaction is expected to close

on or before December 21, 2015, or the Closing Date, subject to the payment of the purchase price, the delivery of the Shares,

HTIT obtaining required governmental approvals in China for the investment and wire of U.S. Dollars to the Company, and additional

customary closing conditions.

Under the SPA, effective as of the Closing Date, Mr.

Nadav Kidron, or Mr. Kidron, will serve as proxy and attorney in fact of HTIT, with full power of substitution, to cast on behalf

of HTIT all votes that HTIT is entitled to cast with respect to the Shares at any and all meetings of the shareholders of the Company,

to consent or dissent to any action taken without a meeting and to vote all the Shares held by HTIT in any manner Mr. Kidron deems

appropriate except for matters related to the Company’s activities in the People’s Republic of China, on which Mr.

Kidron will consult with HTIT before taking any action as proxy.

Pursuant to the SPA, within two weeks from the Closing

Date, HTIT will have the right to designate one individual to be nominated to serve as a director on the board of directors of

the Company until the first annual shareholders meeting of the Company following the Closing Date.

In addition, on November 30, 2015, the Company, its Israeli wholly-owned subsidiary and HTIT entered into a Technology License Agreement, or the License Agreement.

According to the License Agreement, the Company will grant HTIT an exclusive commercialization license in the territory of the

Peoples Republic of China, Macau and Hong Kong, or the Territory, related to the Company’s oral insulin capsule, ORMD-0801.

Pursuant to the license agreement, HTIT shall conduct, at its own expense, certain pre-commercialization and regulatory activities

with respect to the Company’s technology and ORMD-0801 capsule, and shall pay to the Company (i) royalties of 10% on net

sales of the related commercialized products to be sold by HTIT in the Territory, or Royalties, and (ii) an aggregate of approximately

$37.5 million, of which $3 million is payable immediately, $8 million will be paid in near term installments subject to the Company

entering into certain agreements with certain third parties, and $26.5 million payable upon achievement of certain milestones and

conditions. In the event that the Company does not meet certain conditions the Royalties rate may be reduced to a minimum of 8%.

The closing of the

License Agreement is conditioned upon the approval of the Israeli Chief Scientist, which is expected to be received during January

2016.

This Current Report on Form 8-K is neither an offer

to sell nor a solicitation of an offer to buy any of the Company's securities. No offer, solicitation or sale will be made in any

jurisdiction in which such offer, solicitation or sale is unlawful.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The sale of the Shares described in Item 1.01 of this

Current Report on Form 8-K were made in a private placement without registration under the Securities Act of 1933, as amended,

or the Securities Act, or state securities laws, in reliance upon an exemption from registration pursuant to Section 4(a)(2) of

the Securities Act.

Warning Concerning Forward-Looking Statements

This Current Report on Form 8-K contains statements

which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other

securities laws. These forward-looking statements are based upon the Company’s present intent, beliefs or expectations, but

forward-looking statements are not guaranteed to occur and may not occur. For example, the Company is using forward-looking statements

when it discusses the closing of the SPA, when it discusses future milestones, conditions and Royalties under the License

Agreement and when it discusses the approval of the Israeli Chief Scientist of the License Agreement and its timing. Further, the

Company and HTIT may not succeed in the commercialization of the products, and, even if the products are commercialized, they may

not be sold in the Territory for various reasons and therefore the Company may not receive any Royalties on such products. These forward-looking statements are based on the current expectations of the management of the Company only,

and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described

in the forward-looking statements, including the satisfaction of closing conditions in the SPA prior to the issuance of shares

to HTIT, and risks and uncertainties related to the progress, timing, cost, and results of clinical trials and product development

programs; difficulties or delays in obtaining regulatory approval or patent protection for the Company’s product candidates;

competition from other pharmaceutical or biotechnology companies; and the Company’s ability to obtain additional funding

required to conduct its research, development and commercialization activities. In addition, the following factors, among others,

could cause actual results to differ materially from those described in the forward-looking statements: changes in technology and

market requirements; delays or obstacles in launching the Company’s clinical trials; changes in legislation; inability to

timely develop and introduce new technologies, products and applications; lack of validation of our technology as the Company progresses

further and lack of acceptance of the Company’s methods by the scientific community; inability to retain or attract key employees

whose knowledge is essential to the development of the Company’s products; unforeseen scientific difficulties that may develop

with the Company’s process; greater cost of final product than anticipated; loss of market share and pressure on pricing

resulting from competition; laboratory results that do not translate to equally good results in real settings; the Company’s

patents may not be sufficient; and the Company’s products may harm recipients, all of which could cause the actual results

or performance of the Company to differ materially from those contemplated in such forward-looking statements. For

these reasons, among others, you should not place undue reliance upon the Company’s forward looking statements. Except as

required by law, the Company undertakes no obligation to revise or update any forward looking statements in order to reflect any

event or circumstance that may arise after the date of this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ORAMED PHARMACEUTICALS INC. |

| |

|

|

| |

By: |

/s/ Nadav Kidron |

| |

Name: |

Nadav Kidron |

| November 30, 2015 |

Title: |

President and CEO |

4

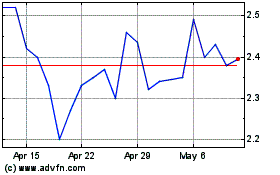

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

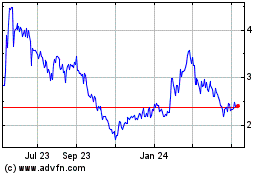

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Apr 2023 to Apr 2024