UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

November 10, 2015

Date of report (Date of earliest event reported)

SurModics,

Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Minnesota |

|

0-23837 |

|

41-1356149 |

| (State of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 9924 West 74th Street

Eden Prairie, Minnesota |

|

55344 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(952) 500-7000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

On November 10, 2015, SurModics, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original

8-K”) with the United States Securities and Exchange Commission disclosing the Company’s results of operations for the quarter ended September 30, 2015. This Amendment No. 1 on Form 8-K/A is being filed to update the

financial statements included with Exhibit 99.1 to Item 2.02 of the Original 8-K. The financial statements have been updated to reflect an other-than-temporary

impairment charge of $1.5 million associated with one of the Company’s strategic investments, which charge was deemed necessary based on information that was first made available to the Company after the filing of the Original 8-K.

| Item 2.02 |

Results of Operations And Financial Condition. |

On November 10, 2015, SurModics,

Inc. (the “Company”) issued a press release (the “Press Release”) announcing the results for the quarter ended September 30, 2015. The Company subsequently updated the financial statements attached to the Press

Release to reflect an other-than-temporary impairment charge of $1.5 million associated with one of the Company’s strategic investments and the updated financial

statements are furnished as Exhibit 99.1 to this report.

The information contained in this Item 2.02, including Exhibit 99.1, shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, except

as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Updated Financial Statements to Press Release dated November 10, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

SURMODICS, INC. |

|

|

| Date: November 27, 2015 |

|

/s/ Andrew D. C. LaFrence |

|

|

Andrew D. C. LaFrence |

|

|

Vice President Finance and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Updated Financial Statements to Press Release dated November 10, 2015. |

Exhibit 99.1

SurModics, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Years Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Royalties and license fees |

|

$ |

9,197 |

|

|

$ |

8,098 |

|

|

$ |

31,763 |

|

|

$ |

30,277 |

|

| Product sales |

|

|

6,844 |

|

|

|

6,166 |

|

|

|

24,925 |

|

|

|

22,798 |

|

| Research and development |

|

|

1,323 |

|

|

|

1,072 |

|

|

|

5,210 |

|

|

|

4,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

17,364 |

|

|

|

15,336 |

|

|

|

61,898 |

|

|

|

57,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product costs |

|

|

2,588 |

|

|

|

2,279 |

|

|

|

8,619 |

|

|

|

8,016 |

|

| Research and development |

|

|

4,326 |

|

|

|

4,062 |

|

|

|

16,165 |

|

|

|

15,550 |

|

| Selling, general and administrative |

|

|

3,684 |

|

|

|

3,561 |

|

|

|

15,525 |

|

|

|

15,297 |

|

| Claim settlement |

|

|

2,500 |

|

|

|

— |

|

|

|

2,500 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

13,098 |

|

|

|

9,902 |

|

|

|

42,809 |

|

|

|

38,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income from continuing operations |

|

|

4,266 |

|

|

|

5,434 |

|

|

|

19,089 |

|

|

|

18,576 |

|

|

|

|

|

|

| Other (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment income |

|

|

7 |

|

|

|

44 |

|

|

|

156 |

|

|

|

238 |

|

| Other income |

|

|

— |

|

|

|

8 |

|

|

|

496 |

|

|

|

842 |

|

| Impairment loss on investments |

|

|

(1,500 |

) |

|

|

(1,184 |

) |

|

|

(1,500 |

) |

|

|

(1,184 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (loss) income, net |

|

|

(1,493 |

) |

|

|

(1,132 |

) |

|

|

(848 |

) |

|

|

(104 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income taxes |

|

|

2,773 |

|

|

|

4,302 |

|

|

|

18,241 |

|

|

|

18,472 |

|

|

|

|

|

|

| Income tax provision |

|

|

(1,415 |

) |

|

|

(1,858 |

) |

|

|

(6,294 |

) |

|

|

(6,265 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

1,358 |

|

|

|

2,444 |

|

|

|

11,947 |

|

|

|

12,207 |

|

| Loss from discontinued operations, net of taxes |

|

|

— |

|

|

|

(100 |

) |

|

|

— |

|

|

|

(176 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

1,358 |

|

|

$ |

2,344 |

|

|

$ |

11,947 |

|

|

$ |

12,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.10 |

|

|

$ |

0.18 |

|

|

$ |

0.92 |

|

|

$ |

0.90 |

|

| Discontinued operations |

|

|

(0.00 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.01 |

) |

| Net income |

|

$ |

0.10 |

|

|

$ |

0.17 |

|

|

$ |

0.92 |

|

|

$ |

0.88 |

|

|

|

|

|

|

| Diluted income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.10 |

|

|

$ |

0.18 |

|

|

$ |

0.90 |

|

|

$ |

0.88 |

|

| Discontinued operations |

|

|

(0.00 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.01 |

) |

| Net income |

|

$ |

0.10 |

|

|

$ |

0.17 |

|

|

$ |

0.90 |

|

|

$ |

0.87 |

|

|

|

|

|

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

12,934 |

|

|

|

13,593 |

|

|

|

13,029 |

|

|

|

13,632 |

|

| Diluted |

|

|

13,190 |

|

|

|

13,829 |

|

|

|

13,289 |

|

|

|

13,876 |

|

SurModics, Inc. Fourth Quarter 2015 Results

Page

2

SurModics, Inc. and

Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| |

|

(Unaudited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash and short-term investments |

|

$ |

55,588 |

|

|

$ |

46,551 |

|

| Accounts receivable |

|

|

7,478 |

|

|

|

4,751 |

|

| Inventories |

|

|

2,979 |

|

|

|

2,817 |

|

| Other current assets |

|

|

1,744 |

|

|

|

1,145 |

|

| Current assets of discontinued operations |

|

|

— |

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

67,789 |

|

|

|

55,280 |

|

|

|

|

| Property and equipment, net |

|

|

12,968 |

|

|

|

13,133 |

|

| Long-term investments |

|

|

— |

|

|

|

16,823 |

|

| Other assets |

|

|

17,953 |

|

|

|

19,653 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

98,710 |

|

|

$ |

104,889 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

4,700 |

|

|

$ |

4,022 |

|

| Current liabilities of discontinued operations |

|

|

— |

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

4,700 |

|

|

|

4,067 |

|

|

|

|

| Other liabilities |

|

|

2,137 |

|

|

|

2,071 |

|

| Total stockholders’ equity |

|

|

91,873 |

|

|

|

98,751 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

98,710 |

|

|

$ |

104,889 |

|

|

|

|

|

|

|

|

|

|

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

3

SurModics, Inc. and

Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Years Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

| Operating Activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

11,947 |

|

|

$ |

12,031 |

|

| Loss from discontinued operations |

|

|

— |

|

|

|

176 |

|

| Depreciation and amortization |

|

|

2,805 |

|

|

|

2,715 |

|

| Stock-based compensation |

|

|

2,381 |

|

|

|

3,337 |

|

| Gains on sale of available-for-sale securities and strategic investments |

|

|

(492 |

) |

|

|

(842 |

) |

| Impairment loss on strategic investment |

|

|

1,500 |

|

|

|

1,184 |

|

| Net other operating activities |

|

|

(564 |

) |

|

|

(586 |

) |

| Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(2,727 |

) |

|

|

581 |

|

| Accounts payable and accrued liabilities |

|

|

373 |

|

|

|

(738 |

) |

| Income taxes |

|

|

(123 |

) |

|

|

116 |

|

| Net change in other operating assets and liabilities |

|

|

(34 |

) |

|

|

563 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities from continuing operations |

|

|

15,066 |

|

|

|

18,537 |

|

|

|

|

|

|

|

|

|

|

| Investing Activities: |

|

|

|

|

|

|

|

|

| Net purchases of property and equipment |

|

|

(1,877 |

) |

|

|

(2,278 |

) |

| Cash transferred to discontinued operations |

|

|

(45 |

) |

|

|

(354 |

) |

| Net other investing activities |

|

|

18,616 |

|

|

|

25,019 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by investing activities from continuing operations |

|

|

16,694 |

|

|

|

22,387 |

|

|

|

|

|

|

|

|

|

|

| Financing Activities: |

|

|

|

|

|

|

|

|

| Purchase of common stock to fund employee taxes |

|

|

(825 |

) |

|

|

(1,111 |

) |

| Repurchase of common stock |

|

|

(20,000 |

) |

|

|

(12,545 |

) |

| Net other financing activities |

|

|

1,142 |

|

|

|

748 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities from continuing operations |

|

|

(19,683 |

) |

|

|

(12,908 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by continuing operations |

|

|

12,077 |

|

|

|

28,016 |

|

|

|

|

|

|

|

|

|

|

| Discontinued operations: |

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(45 |

) |

|

|

(354 |

) |

| Net cash provided by financing activities |

|

|

45 |

|

|

|

354 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

12,077 |

|

|

|

28,016 |

|

| Cash and Cash Equivalents: |

|

|

|

|

|

|

|

|

| Beginning of year |

|

|

43,511 |

|

|

|

15,495 |

|

|

|

|

|

|

|

|

|

|

| End of year |

|

$ |

55,588 |

|

|

$ |

43,511 |

|

|

|

|

|

|

|

|

|

|

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

4

SurModics, Inc. and

Subsidiaries

Supplemental Segment Information

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

% Change |

|

| |

|

|

|

|

% of Total |

|

|

|

|

|

% of Total |

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Medical Device |

|

$ |

13,118 |

|

|

|

75.5 |

% |

|

$ |

11,216 |

|

|

|

73.1 |

% |

|

|

16.9 |

% |

| In Vitro Diagnostics |

|

|

4,246 |

|

|

|

24.5 |

|

|

|

4,120 |

|

|

|

26.9 |

|

|

|

3.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

17,364 |

|

|

|

100.0 |

% |

|

$ |

15,336 |

|

|

|

100.0 |

% |

|

|

13.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended September 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

% Change |

|

| |

|

|

|

|

% of Total |

|

|

|

|

|

% of Total |

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Medical Device |

|

$ |

45,944 |

|

|

|

74.2 |

% |

|

$ |

43,068 |

|

|

|

75.0 |

% |

|

|

6.7 |

% |

| In Vitro Diagnostics |

|

|

15,954 |

|

|

|

25.8 |

|

|

|

14,371 |

|

|

|

25.0 |

|

|

|

11.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

61,898 |

|

|

|

100.0 |

% |

|

$ |

57,439 |

|

|

|

100.0 |

% |

|

|

7.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Years Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Medical Device |

|

$ |

4,687 |

|

|

$ |

6,170 |

|

|

$ |

21,192 |

|

|

$ |

22,636 |

|

| In Vitro Diagnostics |

|

|

1,264 |

|

|

|

1,182 |

|

|

|

4,484 |

|

|

|

3,459 |

|

| Corporate |

|

|

(1,685 |

) |

|

|

(1,918 |

) |

|

|

(6,587 |

) |

|

|

(7,519 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating income |

|

$ |

4,266 |

|

|

$ |

5,434 |

|

|

$ |

19,089 |

|

|

$ |

18,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

5

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP Information

For the Three Months Ended September 30, 2015

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported

GAAP(1) |

|

|

Adjustments |

|

|

Adjusted

Non-GAAP(2) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Royalties and license fees |

|

$ |

9,197 |

|

|

$ |

(763 |

) |

|

$ |

8,434 |

|

| Product sales |

|

|

6,844 |

|

|

|

|

|

|

|

6,844 |

|

| Research and development |

|

|

1,323 |

|

|

|

|

|

|

|

1,323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

17,364 |

|

|

$ |

(763 |

) |

|

$ |

16,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

4,266 |

|

|

$ |

1,737 |

(3) |

|

$ |

6,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

1,358 |

|

|

$ |

2,624 |

(4) |

|

$ |

3,982 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share (5) |

|

$ |

0.10 |

|

|

|

|

|

|

$ |

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Reflects operating results in accordance with U.S. generally accepted accounting principles (GAAP). |

| (2) |

Adjusted Non-GAAP amounts consider adjustments to increase other income by $1,500 related to an impairment charge associated with the strategic investment in CeloNova BioSciences, Inc.; a $763 reduction in revenue

related to pre-fourth quarter fiscal 2015 royalties recognized during the quarter as two customer-related contingencies were resolved; and a $2,500 adjustment reducing expense for a customer claim settlement. The revenue and claim settlement

adjustments resulted in a net tax expense of $613. The adjustment to increase other income did not generate an income tax expense as there was an offsetting release of a capital loss valuation reserve allowance. |

| (3) |

Adjusted to reflect the pre-tax adjustments discussed in note (2) above. |

| (4) |

Adjusted to reflect the after-tax impact of the adjustments discussed in note (2) above. |

| (5) |

Diluted earnings per share from continuing operations is calculated using the diluted weighted average shares outstanding for the period presented. |

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

6

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP Information

For the Three Months Ended September 30, 2014

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported

GAAP(1) |

|

|

Adjustments |

|

|

Adjusted

Non-GAAP(2) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Royalties and license fees |

|

$ |

8,098 |

|

|

|

|

|

|

$ |

8,098 |

|

| Product sales |

|

|

6,166 |

|

|

|

|

|

|

|

6,166 |

|

| Research and development |

|

|

1,072 |

|

|

|

|

|

|

|

1,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

15,336 |

|

|

|

|

|

|

$ |

15,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income from continuing operations |

|

$ |

5,434 |

|

|

|

|

|

|

$ |

5,434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

2,444 |

|

|

$ |

1,184 |

(3) |

|

$ |

3,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share from continuing operations(4) |

|

$ |

0.18 |

|

|

|

|

|

|

$ |

0.26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Reflects operating results in accordance with U.S. generally accepted accounting principles (GAAP). |

| (2) |

Adjusted Non-GAAP amounts consider adjustments to increase other income by $1,184 associated with an investment impairment charge associated with the strategic investment in ThermopeutiX. The adjustment to increase

other income did not generate an income tax expense as there was an offsetting release of a capital loss valuation reserve allowance. |

| (3) |

Adjusted to reflect the adjustment discussed in note (2) above. |

| (4) |

Diluted earnings per share from continuing operations is calculated using the diluted weighted average shares outstanding for the period presented. |

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

7

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP Information

For the Year Ended September 30, 2015

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported

GAAP(1) |

|

|

Adjustments |

|

|

Adjusted

Non-GAAP(2) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Royalties and license fees |

|

$ |

31,763 |

|

|

$ |

(560 |

) |

|

$ |

31,203 |

|

| Product sales |

|

|

24,925 |

|

|

|

|

|

|

|

24,925 |

|

| Research and development |

|

|

5,210 |

|

|

|

|

|

|

|

5,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

61,898 |

|

|

$ |

(560 |

) |

|

$ |

61,338 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

19,089 |

|

|

$ |

1,940 |

(3) |

|

$ |

21,029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

11,947 |

|

|

$ |

2,031 |

(4) |

|

$ |

13,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income per share (5) |

|

$ |

0.90 |

|

|

|

|

|

|

$ |

1.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Reflects operating results in accordance with U.S. generally accepted accounting principles (GAAP). |

| (2) |

Adjusted to reflect a reduction in revenue by $560 for the portion of a one-time customer royalty payment related to periods prior to fiscal 2015, a $523 reduction in other income associated with the sale of Intersect

ENT shares, an adjustment to increase other income by $1,500 impairment charge associated with a strategic investment in CeloNova BioSciences, Inc.; and a $2,500 increase to operating income related to a customer claim settlement. The adjustments to

reduce royalty revenues and increase operating income related to a claim settlement reflects a net tax expense of $685. The net increase in other income did not generate an income tax expense as there was an offsetting release of a capital loss

valuation reserve allowance. Finally, the income tax provision is increased to reflect a discrete income tax benefits of $201 associated with the December 2014 signing of the Tax Increase Prevention Act of 2014 which retroactively reinstated federal

R&D income tax credits for calendar 2014. |

| (3) |

Adjusted to reflect the pre-tax impact of the operating expense adjustment discussed in note (2) above. |

| (4) |

Adjusted to reflect the after-tax impact of the adjustments discussed in note (2) above. |

| (5) |

Diluted net income per share is calculated using the diluted weighted average shares outstanding for the period presented. |

- more -

SurModics, Inc. Fourth Quarter 2015 Results

Page

8

SurModics, Inc. and

Subsidiaries

Supplemental Non-GAAP Information

For the Year Ended September 30, 2014

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As Reported

GAAP(1) |

|

|

Adjustments |

|

|

Adjusted

Non-GAAP(2) |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Royalties and license fees |

|

$ |

30,277 |

|

|

|

|

|

|

$ |

30,277 |

|

| Product sales |

|

|

22,798 |

|

|

|

|

|

|

|

22,798 |

|

| Research and development |

|

|

4,364 |

|

|

|

|

|

|

|

4,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

57,439 |

|

|

|

|

|

|

$ |

57,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

18,576 |

|

|

$ |

914 |

(3) |

|

$ |

19,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

12,207 |

|

|

$ |

1,055 |

(4) |

|

$ |

13,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share from continuing operations(5) |

|

$ |

0.88 |

|

|

|

|

|

|

$ |

0.96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Reflects operating results in accordance with U.S. generally accepted accounting principles (GAAP). |

| (2) |

Adjusted Non-GAAP amounts consider adjustments to reduce operating expenses by $914 associated with acceleration of Board of Director stock-based compensation awards, a $709 reduction in other income associated with

contingent milestone payments related to the sale of Vessix Vascular shares which were sold in fiscal 2014 and a $1,184 increase in other income associated with an investment impairment charge associated with the strategic investment in

ThermopeutiX. The income tax provision includes a $334 expense associated with the Board of Director stock-based compensation expense reduction. The adjustments to increase other income did not generate an income tax expense as there was an

offsetting release of a capital loss valuation reserve allowance. |

| (3) |

Adjusted to reflect the pre-tax impact of the operating expense adjustment discussed in note (2) above. |

| (4) |

Adjusted to reflect the after-tax impact of the adjustments discussed in note in (2) above. |

| (5) |

Diluted earnings per share from continuing operations is calculated using the diluted weighted average shares outstanding for the period presented. |

- # # # -

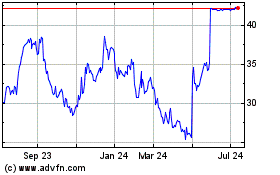

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

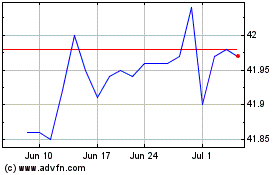

SurModics (NASDAQ:SRDX)

Historical Stock Chart

From Apr 2023 to Apr 2024