UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2015.

Commission File Number 001-36204

| ENERGY

FUELS INC. |

| (Translation of registrant’s name into English) |

|

225 Union Blvd., Suite 600

Lakewood, CO 80228 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| |

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| |

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

/s/ David C. Frydenlund |

| Date: November 25,

2015 |

David C. Frydenlund

Senior Vice President, General Counsel & Corporate Secretary |

INDEX TO EXHIBITS

| 99.1 |

News release dated November 25,

2015 - Energy Fuels Sells Non-Core Uranium Assets to enCore Energy |

Exhibit 99.1

Energy Fuels Sells Non-Core Uranium Assets

to enCore Energy

LAKEWOOD, CO, Nov. 25, 2015 /CNW/ - Energy

Fuels Inc. (NYSE MKT:UUUU; TSX:EFR) ("Energy Fuels" or the "Company") is pleased to announce that it has

entered into a definitive agreement to sell a package of non-core uranium assets to enCore Energy Corp. (TSX.V:UE) ("enCore")

and Tigris Uranium U.S. Corp., including unpatented mining claims and leases known as the Marquez and Nose Rock projects in New

Mexico, the Moonshine project in Arizona, and the Cedar Mountain, Geitus, Blue Jay, and Marcy Look projects in Utah (the "Properties").

Disposition of the Properties is a part of Energy Fuels' continuing asset rationalization strategy that cuts holding, permitting,

and corporate costs and allows the Company to focus on its higher quality uranium assets.

The consideration to be received by Energy

Fuels for the sale of the Properties totals (i) cash of $329,960, and (ii) 14,250,000 common shares of enCore. At closing,

Energy Fuels will own 19.9% of the issued and outstanding shares of enCore and hold a seat on enCore's board of directors.

Finally, enCore will assume all liabilities on the Properties, including all debts, obligations and environmental claims.

Energy Fuels is disposing of these Properties

as they do not fit into the Company's long-term production plans, due to their lower relative grades and various other technical

and economic considerations. Energy Fuels' current focus is on projects at the lower-end of the Company's cost curve, including

the Nichols Ranch ISR project, the permitted Hank ISR project, the near-permitted Jane Dough ISR project, the high-grade Canyon

mine, the alternate feed material business at the White Mesa Mill, and the larger-scale Roca Honda, Sheep Mountain, and Henry Mountains

conventional projects.

Stephen P. Antony, President and CEO of Energy

Fuels stated: "Energy Fuels is pleased to continue our asset rationalization strategy by selling certain of our non-core

assets to enCore Energy, and I believe this deal makes good sense for both companies. Energy Fuels is focusing on higher-grade,

lower-cost and larger-scale uranium projects, while we continue to cut costs and monetize assets that do not fit our long-term

business plans. We are also receiving shares of enCore Energy, a company that we believe has the ability to potentially unlock

the value of the assets we are selling. enCore has a strong management and technical team with an excellent track-record

of advancing projects in the U.S., and our ownership in enCore will provide our shareholders with a vehicle to realize the potential

value of these assets."

About Energy Fuels: Energy

Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities.

Energy Fuels operates two of America's key uranium production centers, the White Mesa Mill in Utah and the Nichols Ranch Processing

Facility in Wyoming. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a licensed

capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch Processing Facility, acquired

in the Company's acquisition of Uranerz Energy Corporation, is an in situ recovery ("ISR") production center with a licensed

capacity of 2 million pounds of U3O8 per year. Energy Fuels also has the largest NI 43-101 compliant

uranium resource portfolio in the U.S. among producers, and uranium mining projects located in a number of Western U.S. states,

including two producing mines, mines on standby, and mineral properties in various stages of permitting and development.

The Company's common shares are listed on the NYSE MKT under the trading symbol "UUUU", and on the Toronto Stock Exchange

under the trading symbol "EFR".

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news

release, including any information relating to the closing of the sale of non-core assets, the Company's long-term business plans

and focus on projects in the lower end of the Company's cost curve including the Nichols Ranch project, the Canyon mine, and the

alternate feed material business, enCore's ability to unlock value and its future prospects, and any other statements regarding

Energy Fuels' future expectations, beliefs, goals or prospects constitute forward-looking information within the meaning of applicable

securities legislation (collectively, "forward-looking statements"). All statements in this news release that are

not statements of historical fact (including statements containing the words "expects", "does not expect",

"plans", "anticipates", "does not anticipate", "believes", "intends", "estimates",

"projects", "potential", "scheduled", "forecast", "budget" and similar expressions)

should be considered forward-looking statements. All such forward-looking statements are subject to important risk factors

and uncertainties, many of which are beyond Energy Fuels' ability to control or predict. A number of important factors could

cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including

without limitation: the closing of the sale of non-core assets, the Company's long-term business plans and focus on projects in

the lower end of the Company's cost curve including the Nichols Ranch project, the Canyon mine, and the alternate feed material

business, enCore's ability to unlock value and its future prospects; and other risk factors as described in Energy Fuels' most

recent annual information forms and annual and quarterly financial reports.

Energy Fuels assumes no obligation to update

the information in this communication, except as otherwise required by law. Additional information identifying risks and

uncertainties is contained in Energy Fuels' filings with the various securities commissions which are available online at www.sec.gov and

www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations,

beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may

not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements,

that speak only as of the date hereof.

SOURCE Energy Fuels Inc.

%CIK: 0001385849

For further information: Investor Relations Inquiries: Energy

Fuels Inc., Curtis Moore - VP - Marketing & Corporate Development, (303) 974-2140 or Toll free: (888) 864-2125, investorinfo@energyfuels.com,

www.energyfuels.com

CO: Energy Fuels Inc.

CNW 08:00e 25-NOV-15

This regulatory filing also includes additional resources:

ex991.pdf

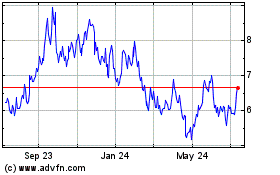

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024