Here's Are the Real Reasons Comcast Customers Won't Get to Watch Nets, Yankees Games

November 25 2015 - 4:52PM

Dow Jones News

By Joe Flint And Shalini Ramachandran

The business of TV is going through so much change that even

live sports--the golden goose of the industry--are no longer

immune.

Once upon a time, a cable provider dropping the network that

airs the New York Yankees for subscribers in the northeast would

have been almost unthinkable. But that's exactly what happened last

week. The dispute between Comcast Corp. and YES Network showcases

the rising tensions between TV distributors and programmers as both

try to adapt to the realities of online viewing, cord-cutting and

the power of data.

Last week, Comcast stopped carrying YES Network, a regional

sports channel that is home to the New York Yankees and Brooklyn

Nets and majority owned by 21st Century Fox. Comcast had been

distributing the channel to roughly 900,000 homes in New Jersey,

Connecticut and Pennsylvania.

Pay-TV providers have been willing to pay more to carry YES

Network than any other regional sports network in the

country--almost $5 a month per subscriber, according to SNL Kagan.

So what changed? That depends on who you ask.

Comcast cited new insights into its set-top-box viewing data as

a key factor in its decision to stop carrying YES, noting that the

channel cost too much relative to its low viewership. The data

showed that more than 90% of Comcast customers who receive YES

didn't watch the equivalent of even one-quarter of the Yankees' 130

baseball games this past season. (It is worth noting that the

channel wasn't dropped until the baseball off-season.)

Fox said it's yet to see Comcast's data and claims the dispute

is really over Comcast wanting to maintain a contractual clause

that could have hampered Fox's ability to strike deals with

emerging digital TV distributors. (21st Century Fox was until

mid-2013 part of the same company as Wall Street Journal-owner News

Corp.)

While carriage fee disputes have been going on for years, the

fights have gotten more frequent as distributors seek to push back

on rising programming costs, and as TV channels seek to stake out

their flexibility in the streaming landscape.

"The precedents that are made here will ripple through the

industry," said Ed Desser, president of consulting firm Desser

Sports Media.

At issue from Fox's perspective is contractual language known as

a "most-favored nation" clause, which essentially helps a

distributor ensure that a channel won't strike a better deal with a

rival, according to people close to Fox. Comcast was asking for

"special treatment that tilts the playing field in their favor,"

YES Network Chief Executive Tracy Dolgin said in an interview.

Under its old contract, which was struck before Fox took a

controlling interest in the channel, YES Network was bound by a

most-favored nation clause to offer Comcast any better terms that

it might offer a rival distributor, like a cheaper rate or

streaming rights. Comcast wanted to maintain that clause in the new

contract, a person close to Comcast said.

But Fox wanted the clause to apply to its channels as a group to

ensure that Comcast doesn't get to "cherry-pick" favorable terms

from a creative deal it might strike with a new entrant, the people

close to Fox said. For instance, if it granted Apple the right to

carry YES at a cheaper rate but won wider distribution of other Fox

channels like Fox Sports 1, it would want Comcast to also abide by

the terms. That means Comcast would have to agree to the wider

distribution of those other channels to secure the cheaper rate for

YES. Under the previous clause, Comcast would only have had to

abide by terms that apply to YES.

Comcast viewed Fox's demand as an attempt to use the Yankees to

leverage greater distribution of Fox's other channels, a person

close to Comcast said.

Comcast's carriage deal with YES expired Jan. 31. During

contract extensions, Comcast had agreed to pay a higher rate, which

Fox executives point to as a sign that the dispute wasn't over

price. But Comcast agreed to the higher rate while it was in the

process of buying Time Warner Cable, the person close to Comcast

said. After the merger fell apart, the price no longer made sense,

the person said.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 25, 2015 16:37 ET (21:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

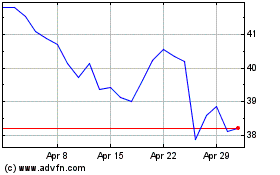

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024