UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): November 24, 2015

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction

of Incorporation)

|

| | |

| | |

001-16435 | | 59-2389435 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On November 24, 2015, Chico’s FAS, Inc. (the “Company”) held a conference call with the investment community to discuss its financial results for the third quarter ended October 31, 2015. A copy of the transcript of the conference call is attached hereto as Exhibit 99.1.

The information presented herein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject the Company to liability pursuant to that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly stated by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

| | |

| | |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on November 24, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | CHICO’S FAS, INC. |

| | | |

Date: November 25, 2015 | | | | By: | | |

| | | | /s/ Todd E. Vogensen |

| | | | Todd E. Vogensen, Executive Vice President, |

| | | | Chief Financial Officer and Assistant Corporate Secretary |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on November 24, 2015 |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Jennifer Powers Adkins – Vice President-Investor Relations, Chico’s FAS, Inc.

David F. Dyer – President & Chief Executive Officer, Chair of the Board, Chico’s FAS, Inc.

Todd E. Vogensen – Executive Vice President - Chief Financial Officer, Chico’s FAS, Inc.

Other Participants

Kate Fitzsimons – Analyst, RBC Capital Markets LLC

Thomas A. Filandro – Analyst, Susquehanna Financial Group LLLP

Nicholas M. Hiatt – Analyst, SunTrust Robinson Humphrey, Inc.

Susan K. Anderson – Analyst, FBR Capital Markets & Co.

Tracy Kogan – Analyst, Citigroup Global Markets, Inc. (Broker)

Randal J. Konik – Analyst, Jefferies LLC

Liz O. Pierce – Analyst, Brean Capital LLC

Paul Stephen Alexander – Analyst, BB&T Capital Markets

Anna Andreeva – Analyst, Oppenheimer & Co., Inc. (Broker)

Adrienne Yih-Tennant – Analyst, Wolfe Research LLC

Betty Chen – Analyst, Mizuho Securities USA, Inc.

Gene Vladimirov – Analyst, Nomura Securities International, Inc.

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, and welcome to the Chico’s FAS, Inc. Third Quarter Earnings Conference Call. All participants will be in a listen-only mode. [Operator Instructions] After today’s presentation, there’ll be an opportunity to ask questions. [Operator Instructions]

I would now like to turn the conference over to Jennifer Powers Adkins, Vice President Investor Relations. Please go ahead.

Jennifer Powers Adkins, Vice President-Investor Relations

Thanks, Emily, and good morning, everyone. Welcome to Chico’s FAS Third Quarter Earnings Conference Call and Webcast. Joining me today at our National Store Support Center in Fort Myers are: Dave Dyer, our CEO; and Todd Vogensen, our CFO.

Before Dave begins his executive overview, we would like to remind you that our discussion this morning includes forward-looking statements and quarter-to-date data points which are subject to and protected by the Safe Harbor statement found in our SEC filings and in today’s earnings release. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially. Also, our current and prior-year results discussed on this call exclude impairment restructuring and strategic charges. A reconciliation to GAAP results is included in today’s press release for your reference.

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

E

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And with that, I’ll turn it to over to Dave.

David F. Dyer, President & Chief Executive Officer, Chair of the Board

Okay. Thanks, Jennifer, and good morning to everyone. Well, our third quarter results were hardly what we were aiming for. At our last call, we reported beginning the quarter down over 4%. As we ended August, we’ve made headway on these negative comps. September, however, especially the first three weeks, was just terrible. Several factors contributed to the September results: the shift of timing of promotions due Labor Day calendar shift, a historically warm September, and a volatile stock market.

September’s weakness had an outsized impact on us as that month typically is one of our biggest sales months of the year. On the brighter side, sales improved throughout October resulting in positive comps for the month. But given Chico’s brand’s weak performance in August, and September’s importance to the quarter overall, the October rebound was not enough to offset the loss of sales. I am pleased, however, that we responded decisively by clearing inventory through promotional events which resulted in our inventories being down nearly 5% at the end of the quarter. This is certainly good news for us going into the fourth quarter.

With that, let me first highlight the third quarter performance in total, then go more into detail brand-by-brand. For the third quarter, total sales declined by 3.7% and comparable sales declined by 3.3%. We managed to keep gross margin flat. SG&A increased by $6 million primarily due to expenses relating to the implementation of our new POS system. Adjusted earnings per share decreased to $0.13 from $0.19 for the last year.

As we move through the quarter, we continue to focus on controlling inventory levels and promoting strategically to drive gross margin gains. As a result, we were able to realize slight gross margin leverage including Boston Proper – excluding Boston Proper and we exited the quarter with inventories down 4.8% over last year.

As for November, sales to-date have been a bit sluggish, in line with broader retail trends. Our quarter-to-date total company comparable sales according to our unaudited daily flash report are down 4.8%.

Heading into the fourth quarter, we remain committed to executing our own strategy rather than being overly active to other retailers. Our service proposition is best-in-class which enables us to build lifetime relationships with our customers. Our inventory position and our customer service proposition in turn helps us maintain some discipline in our pricing decisions.

Now, I’d like to give you additional brand-by-brand details on our performance, starting with the Chico’s brand. The Chico’s brand third quarter comparable sales ended down 4.7%. As we discussed in our last call, there was a delay in major pants promotion in August that set the brand back somewhat. By the time the program was launched, the overlap with key Labor Day promotional period it was not as impactful as we would like. As I mentioned early, stock market volatility weighed heavily on the Chico’s customers’ wallet and warmer weather kept her from buying colder weather fashions.

As we cut our color and pattern penetration to manage inventories lower, the fourth quarter, the team reworked the line to balance color and pattern across the assortment. We should see this better balance as we head into the holidays. Toward the end of September, as the weather cooled,

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

we became sharper in our marketing and promotional messages and, as a result, our sales trends improved significantly.

Once again, knits were our strongest category while wovens were challenging. Sweaters, jackets, and jewelry had a slow start in the quarter but started kicking in during October as much of the country started to see fall-like temperatures.

Looking ahead to the holidays, our inventories are well-positioned. Chico’s new holiday book was delivered earlier this month. You may have seen how the brand is highlighting festive and colorful sweaters made with luxury yarns and faux fur trim fashion pieces. Jackets and new shorter silhouettes and beautiful colors designed in piece to burnout patterns. We also have a range of new giftables both including statement jewelry and loungewear.

Now, turning to White House | Black Market. The quarter comparable sales were down 2%. As I mentioned on the second quarter call, White House had a solid August; unfortunately, September was challenging for reasons I’ve stated and additionally because of the shift of the key promotion into August, which occurred in September last year. Here, again, warmer weather did not encourage the White House customer to purchase our cold-weather styles; however, as the weather turned cooler, we started to see healthy mid-single digit comps which continued throughout October.

Pont e ankle pants were a standout this quarter. We took one of our most successful knit fabrics and expanded it from being more casual into being more polished. In Tops, we enjoyed a nice business thanks to newness in novelty fabrics and fashion silhouettes, including longer layers over shorter proportions. Generally, we saw a great success in styling around layering, sleeveless outerwear, jackets and sweaters with sleeves layered underneath. Our recently re-launched accessory business played a critical role in elevating the brand styling. Belts, shoes, boots, scarves, and fashion jewelry exceeded our expectations.

From a strategic perspective, dresses are a core competency of the White House | Black Market brand. Still, we’ve struggled with the category the past few years. This quarter, dress sales were lower than last year, which was a result of our plan to pull back and reprioritize. However, we have seen an improvement in productivity and expect to see further improved performance next year as the new line of White House dresses comes to market. Interestingly, as a side note, dresses drive nearly three times more website traffic than tops do. So, with that natural traffic, we should be able to convert at a higher rate when a new product becomes available. As we sit here today, we’re pleased with the progress that we are seeing at White House | Black Market.

Now, turning to Soma. The first three weeks of September were tough as well. The brand was up against the successful Enhancing Shape bra launch from September 2014. Soma did comp positively in August and October, but it was not enough to offset September’s sales miss. As the quarter progressed and we increased our promotional messaging, Soma started to see the traffic come back and comps return to the mid-single digit level. Our most successful categories for the quarter were bras, sleepwear, and beauty.

It’s important to note that the fourth quarter for Soma, unlike our other brands, is the largest quarter in terms of both sales and profits. We’re confident that we’re geared up and ready for it. Soma just launched its new TV and digital ad campaign, which will be one of their strongest ever with three new commercials. Bras, sleepwear, and fragrance will appear together in one spot for the first time, highlighting their selection of gifting options.

In a second commercial we are presenting their first-ever Black Friday promotion. Soma’s holiday book is already out and it features more sophisticated color and prints as well as beautiful dressy

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

sleepwear choices. We’ve intensified gift-giving items and adjusted the store layout to deliver a more elevated experience.

Additionally, we’re pleased to announce that we just signed a new franchise agreement with Liverpool department stores for 31 Soma shop-in-shops in Mexico. As you may know, Liverpool franchises the Chico’s brand in Mexico as well. We’ve been very pleased with our growth and our success there. We expect Soma shop-in-shops to open the first quarter of next year.

Before turning things over to Todd, I also wanted to mention that just last week, we’ve completed one of our biggest customer experience initiatives; that is, our new POS system. It’s been rolled out to all of our stores on time and on budget. Our previous POS system was installed in 2001, so this is really a landmark event, replacing a system that’s over 15-years old. I’m very proud of our dedicated teams across the company who worked on this major undertaking. We successfully implemented new systems in over 1,500 stores and we trained over 20,000 associates: clearly, a massive upgrade. The new system is foundational to other initiatives that will enhance customer experience and allow our customers to buy wherever and whenever she wants. Our amazing customer service will even be more amazing.

Let me stress that the Chico’s FAS game plan over the medium term has not changed. We will continue to drive significant free cash flow by improving operating margins, buying inventory conservatively, and managing expenses tightly, as well as enhancing the customer experience.

With that, I’m going to turn the call over to Todd, then I’ll be back with a wrap-up. Here’s Todd.

Todd E. Vogensen, Executive Vice President – Chief Financial Officer

All right. Thanks, Dave, and good morning, everyone. As you heard from Dave, our business was not immune to the retail difficulties in the third quarter. Sales and traffic were weak, so we responded by actively managing our promotions to maintain the sell-through on our inventories. For the third quarter, net sales were $641 million, a decrease of 3.7% from last year. Our gross margin leverage was flat to last year at 54.7%. Gross margin dollars decreased to $350 million versus $364 million last year.

Once again, our conservative inventory management benefited our results. We were able to achieve flat leverage despite the more promotional intensity across retail this quarter. Outside of costs related to our new POS system, as Dave mentioned, we launched a significant portion and completed that system implementation this quarter. Outside of costs related to that POS system, SG&A dollars were approximately flat as well. SG&A grew to $328 million, up from $322 million last year. As sales turned down, we scrutinized various expense categories such as store labor hours and headquarter expenses to ensure that we allocated our resources most appropriately and cost-effectively. Adjusted net income for the quarter decreased by $11 million to $18 million as a result of the decline in sales.

Turning to the balance sheet. We ended the quarter with $139 million in cash and short-term investments after repaying $2.5 million of our scheduled term loan principal payments and distributing $11 million to our shareholders through our dividend. As we announced earlier today, our board of directors authorized a new $300 million share repurchase plan and they approved our quarterly dividend in the amount of $0.0775 per share both of which signaled confidence in our strategies and our future potential.

Total inventories this quarter ended down nearly 5%, primarily as a result of our proactive inventory management through the quarter. Capital expenditures totaled $24 million in the third quarter,

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

mostly from our investment in stores and the implementation of our new point-of-sale system. Overall, we opened 12 new stores in the quarter and closed 14.

Also, we made good progress in our plans to exit Boston Proper. We intend to close the brick-and-mortar stores by year-end and we’re also targeting to complete the sale of our direct-to-consumer business before the end of our fiscal year. We will be providing 2015 quarterly Boston Proper results in an 8-K later today, so that you can clearly see what our business looks like with and without those results. Overall, year-to-date, our operating margin excluding Boston Proper would’ve been higher by 100 basis points.

In view of the industry-wide trends that we’ve been experiencing and also hearing about from other retailers, we are actively managing our resource allocation and making appropriate adjustments to our financial plans. As I said in the past, whether we’re investing in capital, expense, inventory, or talent to name a few, I believe in allocating resources based on a thorough review of the risk-adjusted return on investment.

Looking ahead in the fourth quarter, we’re expecting a flattish gross margin rate versus last year. Fortunately, we exited the third quarter with our inventories well-positioned which sets us up positively for maximizing gross margin dollars in the fourth quarter. Also, with the bulk of our new POS system costs behind us, we would expect SG&A to be up modestly over last year, primarily resulting from increased store occupancy costs and a moderate increase in incentive compensation.

Our tightly-managed inventories should continue to produce on-hand inventory growth as flat to slightly down. Our capital expenditure estimate remains at approximately $100 million for fiscal 2015 inclusive of $30 million for the point-of-sale implementation, and we’re on target to open approximately 40 new stores this year. Also, 70 to 75 stores across our brands will close this year including the 20 Boston Proper stores. We’ve already closed 33 stores company-wide through the third quarter.

We evaluate the performance of our fleet on a regular basis as we look to improve the productivity of our stores and, as a result of this ongoing evaluation, we’ve identified additional stores to close before the end of 2017 bringing the total to 170 to 175 store closures for the three years of 2015 to 2017.

For our share count, our weighted average diluted shares outstanding will be approximately 137 million for the fourth quarter and 139 million for the full year of 2015 assuming no further share repurchases.

As we look ahead, we remain focused on consistently delivering the merchandise and amazing experience our customers expect from us. Our ongoing commitment to managing inventory conservatively and controlling expenses prudently will enable us to make progress towards our medium-term goal of double digit operating margins. We’re in a strong position. We have three highly respected brands with extremely loyal customer bases. We generate significant cash flow, and we have minimal debt. Our newly authorized repurchase and dividend programs further demonstrate our confidence in our business.

As Dave mentioned, our overall strategies have not changed. We will continue to monitor and adjust our financial plans as necessary to drive a healthy business, and we’re establishing the foundation for our future growth by continuing to invest and enhancing our customer experience.

Now, I’d like to turn the call back over to Dave.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

David F. Dyer, President & Chief Executive Officer, Chair of the Board

Great. Thanks, Todd. While the third quarter certainly was challenging, however, I’m pleased with how our teams moved quickly to reverse the tide and get our brands back on track. We ended the quarter with inventories well-positioned across the board. During the holiday season, we’ll have thoughtful and planned promotions. These were designed to maximize traffic so our associates can work their magic once we get our loyal customer into the store. Going forward, we’ll continue to manage our inventory conservatively and promote strategically to drive a healthier business.

In fashion, it isn’t about whether you have disappointing results at some point, it happens to everyone; what matters is how you respond.

Finally, as you know, we recently announced that Shelley Broader will be coming on board as our new Chief Executive Officer effective December 1. I am absolutely thrilled. Shelley brings deep retail experience, as well as a dynamic energy and rigor in her approach. She had a remarkably successful track record of developing brands, taking on competition and winning. And best of all, her values are our values both on an unwavering focus on the customer. I know she looks forward to meeting and talking with our investors and analysts in the coming months.

Although it’s hard to get too sentimental with a bunch of cynical analysts, this will be my last call with you guys. And I would like to say, I appreciate your support and, most of the time, your criticism over the last seven years. Chico’s FAS is a terrific company with great values of customer first integrity, and respect for our associates. We are financially strong and will stand the test of time. The company is in great hands with Shelley.

Thank you again. And now, I’m going to turn the call back over to Jennifer for Q&A.

Jennifer Powers Adkins, Vice President-Investor Relations

Thank you, Dave. That concludes our prepared comments. At this time, we would be happy to take your questions. In the interest of time and consideration to others, please limit yourself to one question.

I’ll turn the call back over to Emily now.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: Thank you. We will now begin the question-and-answer session. [Operator Instructions] Our first question is from Brian Tunick of the Royal Bank of Canada. Please go ahead.

<Q – Kate Fitzsimons – RBC Capital Markets LLC>: Yes. Hi. This is Kate, on for Brian. Thanks for taking our question. I guess just on the quarter-to-date commentary, if you could give us any color by brand what you’re seeing there? And then I guess my second question would be on the inventory, it’s down 4.8% at the end of the quarter. Is it fair to think that you would have been cleaner ending the quarter if the sales hadn’t decelerated, or were you just able to adjust inter-quarter to end where you want it to be? Thank you very much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: So, two questions I think. In terms of quarter-to-date comps, we tend not to provide too much detail. It’s a good data point that we feel like it’s appropriate to share but at the same time, it is just a data point that’s mid-month. I think maybe one thing to note is, Soma has had a string of very positive results over time. Outside of the particular thing that Dave mentioned in September wrapping around on the new launch, Soma is back to positive comps in both August, October, and November. And so, feel like it kind of back on track there, which is important for us and for our long term.

On inventories, really, we manage our inventories very proactively to end in what we felt like was a positive position. What you’ll see from us as we go through the quarter is if we’re not seeing the sales response that we want, we can get more promotional to try to move through those inventories and that’s exactly what you saw this quarter. So really, this was a matter of making sure that we ended well-positioned so that we could move into the fourth quarter on a positive note.

<Q – Kate Fitzsimons – RBC Capital Markets LLC>: Great. Thanks very much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: Our next question is from Tom Filandro of Susquehanna International Group. Please go ahead.

<Q – Tom Filandro – Susquehanna Financial Group LLLP>: Hey. Thanks. And first, Dave, best of luck to you in the future. You’ve been a great CEO. We all appreciate you. A broad question, this is a pretty significant slowdown relative to expectations. So, just from your point of view, can you give us an assessment of what you think the consumer is feeling right now? And as more of a sort of fast forward, are you guys making any adjustments to the business beyond the holiday season, if this volatile trends continue, and what, if any, areas can you adjust in the business if it continues to be this way? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, I think it was really the perfect storm that happened in September with the Labor Day shift, a little volatility in the stock market, which certainly for our Chico’s brand as we’ve said the stock market sometimes performs as her mood ring since a lot of those customers are either thinking about retirement or retired. So I think that that affected us, and honestly in September I haven’t, in quite a while, seen brakes come on business the way they did in that first three weeks of September. It was across all brands, across all regions, across the board. It’s like somebody flipped a light switch then. And I think the warm weather certainly hurt as we had our cooler and cold weather assortments out there.

But yeah, I think that that caught not only us but, from what I’ve read, most of the industry somewhat by surprise. Luckily, we have been planning very conservatively all year and certainly managing our inventory as we’ve decided we’d rather be in a chase mode than build it and they will

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

come or buy it and they will come. We’ve decided to chase. So, I think that we need to get through perhaps the Christmas season and reassess as we get into next year. I will tell you that next year we’re planning conservatively as well, as we’ve said that our near and midterm objectives are just the same: control inventories, manage expense, and take care of the customer and the customer experience. But we are approaching certainly next year conservatively until we get some indications that are otherwise. There’s just a lot going on right now and we’d like to get through the holiday season and then reassess.

<Q – Tom Filandro – Susquehanna Financial Group LLLP>: Thank you. Best of luck and happy Thanksgiving.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: All right. Thanks, Tom.

Operator: Our next question is from Pam Quintiliano of SunTrust. Please go ahead.

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: Hi, guys. This is actually Nick Hiatt. I’m on for Pam. I just have a couple of questions for you. First, I know you mentioned the stock market volatility and the impact on your customer, but I just want to get your thoughts on the CNN effect and if you think the presidential debates and recent international news have also had an impact? And then, I want to ask a follow-up on the port delays. And can you just remind us...

<A – Dave Dyer – Chico’s FAS, Inc.>: [inaudible] (25:38)

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: I’m sorry?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Go ahead.

<A – Dave Dyer – Chico’s FAS, Inc.>: I got it. On the port delays. I got it. Okay.

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: Okay. And if you can just remind us when that began to impact assortments last year? And lastly, if you can maybe talk about the percent of cold weather product in your assortment and whether or not you have the ability to cut orders or shift timing on those?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, that is quite a multiple-clause question, but I’ll...

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: Sorry about that.

<A – Dave Dyer – Chico’s FAS, Inc.>: I’ll try to get through all that I can remember.

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: Okay.

<A – Dave Dyer – Chico’s FAS, Inc.>: To start with, as I said, it’s the perfect storm. Yes, I think everything is having an impact whether it’s debates, certainly what happened in Paris, I think that that will weigh on people’s mind; certainly, the travel alert, the worldwide travel alert that was just put out. I think there is a convergence of many, many things that are going on right now. I don’t expect it to be long-term. I do expect it to be certainly influences through holiday and perhaps into the first quarter.

However, that said, I think if the weather turns cooler over the next few weeks, we will probably have a decent but less than expected Christmas and I think if the weather – if we – we just have to watch and see what happens with the weather. I think that the spring could have some upside

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

certainly from the way that we plan, but who knows with what’s going on. But there couldn't have been more things happening, coming together really to, I guess, create and confuse the market over the last few months.

The port. The port delays really began impacting us last year, this was the time, certainly as we got into November that we were moving freight to the East Coast of Florida, or East Coast of the U.S. and beginning to back down on the West Coast. I believe that by mid-quarter, we had completely abandoned the West Coast because of their issues and probably as we get into early spring and first quarter, we really were over the West Coast effect. But that said, it did add another week to 10 days to our in-transit and to our shipping as we get into the first quarter of next year.

And there was another question in there somewhere, if you can remember, Todd, maybe you can add...

<A – Todd Vogensen – Chico’s FAS, Inc.>: No, I think you pretty well covered cold weather goods versus warm weather.

<A – Dave Dyer – Chico’s FAS, Inc.>: Okay.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Port delays, just to add on to that, I know we talked about in our Q4 call and Q1 call that there was incremental air freight that we did incur last year for the port delays. So, we really started to see the impact beginning in November becoming more acute as we got closer to the first of the year.

<Q – Nick Hiatt – SunTrust Robinson Humphrey, Inc.>: Great. Thank you. That answers all my questions. Good luck on the quarter.

<A – Todd Vogensen – Chico’s FAS, Inc.>: All right. Thank you.

Operator: Our next question is from Susan Anderson of FBR. Please go ahead.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Good morning. Thanks for taking my question. And, Dave, just want to say we’ll miss you and best of luck. So, I just want to drill down a little bit on the SG&A. So, I guess, aside the POS implementation, how much was the sales deleverage and then the higher [ph] BNO (29:16) and do you still expect that to grow in line with sales? And then just looking at operating margin, if my math is correct, if you take out the POS and Boston Proper, it would’ve only been down about 85 basis points, does that make sense?

<A – Todd Vogensen – Chico’s FAS, Inc.>: I haven’t done the backwards math but that seems directional. And yeah, one thing for us, are buying costs are in gross margin, occupancy costs are in SG&A. So, just something to kind of take into consideration, as you look at the leverage points. Definitely for us, we are looking at managing those SG&A costs in line with sales. Now, when sales are down 3.7% that becomes a little bit more challenging, but going through this year knowing we were hoping to reestablish a reasonable level of incentive comp, knowing that we had the POS implementation, those were going to be headwinds to that.

So, we have gotten past the POS implementation which is good and then, looking forward, we know at least in Q4, we’re probably facing a very slight level of SG&A increase and we’re working on ways, as we speak, to make sure we can try to mitigate that.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Great. Thank you.

Operator: Our next question is from Paul Lejuez of Citigroup. Please go ahead.

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Tracy Kogan – Citigroup Global Markets, Inc. (Broker)>: Hey. Thanks. It’s Tracy, filling in for Paul. Two questions. I was hoping you could give us or help us, give us color on merchandise margin or gross margin by division; was there pressure actually at some of the divisions even though you were flat overall? And then secondly, what are your initial thoughts for CapEx next year? You won’t have that $30 million in POS. So, just wondering what you’re thinking. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: So, first on CapEx, you’re right. This year, our target is $100 million in total CapEx which includes the $30 million for point-of-sale systems. I think it’s fair to say as we look forward, there will ongoing be certain technology projects that are going to be big onetime costs. One of the things we’re talking about for next year is RFID and testing out some things there. So, if you’re looking at the $80 million to $90 million range for next year, that’s probably a good starting point for now. When we come out with our Q4 results in February, we’ll give a little bit more precise guidance and data points around the rest of 2016.

The other part of the question?

<A – Jennifer Powers Adkins – Chico’s FAS, Inc.>: Merchandise...

<Q – Tracy Kogan – Citigroup Global Markets, Inc. (Broker)>: And merchandise margins by division.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Merchandise margins? Yeah, Dave really hit it on the head that in September as we saw the pullback, it was very broad spread. And we could tell it was something probably bigger than any one grand thing just by virtue of the fact that it did cut across all brands. So, I would say this quarter, merchandise margin was probably lower than what we would have liked to have seen really across all the brands as we move to get current on inventory and make sure we were well-positioned going into Q4.

<Q – Tracy Kogan – Citigroup Global Markets, Inc. (Broker)>: Great. Thanks, guys.

Operator: Our next question is from Randy Konik of Jefferies. Please go ahead.

<Q – Randy Konik – Jefferies LLC>: Hey. How are you? Quick question. So, can you give us some perspective on loyalty members’ sales contribution versus non-loyalty, and just the volatility or lack thereof on the two different types of consumers? And there’s been some initiatives around more digitization of the customer profiles and more – it sounds like there was going to be more outreach by the sales associates. Kind of where are we in that process and so forth with that strategy? Thanks.

<A – Dave Dyer – Chico’s FAS, Inc.>: You want to take it?

<A – Todd Vogensen – Chico’s FAS, Inc.>: I’ll start out and...

<A – Dave Dyer – Chico’s FAS, Inc.>: All right.

<A – Todd Vogensen – Chico’s FAS, Inc.>: I'll start out and you can add on your expertise. So, I think it’s fair to say especially when you see a pullback that is broad spread like we saw in Q3, that the most highly loyal customers are the ones that are more likely to come in and buy and that’s exactly what we saw. That said, we do have a lot of initiatives that are out there trying to reach either new customers or customers that are maybe towards the earlier end of their loyalty with any of our brands. And so, a lot of very targeted marketing that we’re just starting to really see the fruits of.

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Dave Dyer – Chico’s FAS, Inc.>: I would say that when we look at the quarter, if I had to say two things that kind of drove the negative comps, I would say that it was average unit retail as we reacted to the September mess and started to make sure that we were taking care of the inventory lumps that we may have had, and the second was just traffic. Traffic was absolutely about as bad as I’ve seen it in a while. The interesting thing for us is if I look at our shopper traffic, over this last year and actually quarter-by-quarter, we are running higher in all of our brands than the average, than the national average by region and by brand.

That said, maybe we’re the tallest of the shortest. I don’t know. So, I would say that our loyalty – our customers are still shopping. We have a very loyal following. Our file is still well over 9 million, still in great shape. Our loyalty customers, over 90% of our customers, 94% I believe in Chico’s and slightly less than that in White House are in our loyalty programs. Those customers are still shopping. So, they were affected a little bit by frequency and a little bit by – when they did come in they got bargains that they probably weren’t counting on.

<Q – Randy Konik – Jefferies LLC>: Can I ask a quick follow-up?

<A – Dave Dyer – Chico’s FAS, Inc.>: Yeah.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Sure.

<Q – Randy Konik – Jefferies LLC>: All right. Sorry. So, was there any regional variability in the business? And then, when you look at the inventory and the balance sheet, is that kind of – that number being down, is that kind of what we should expect across the divisions or is one division more lighter on inventory than the other? Just trying to get some perspective there and that’s my last question. Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: In September, I would say there wasn’t a lot of regional difference. I would say as the weather started turning cooler in October and we’ve had a little cool blast across the North, we did see the Midwest and Northeast improve. But other than that, when I looked at August and September, it was pretty much across the regions.

I think there was another part of that question too, Todd.

<A – Jennifer Powers Adkins – Chico’s FAS, Inc.>: Inventory across the brands.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Oh, inventory across the brands. Really, the same principles that we’re using in any one brand cut across all the brands. So, we’re feeling like we’re well-positioned really across all our brands as we head into Q4.

<A – Dave Dyer – Chico’s FAS, Inc.>: Okay? Randy?

<Q – Randy Konik – Jefferies LLC>: Thank you.

Operator: Our next question is from Liz Pierce of Brean Capital. Please go ahead.

<Q – Liz Pierce – Brean Capital LLC>: Good morning. Thanks. And, Dave, best of luck. Just one housekeeping question and then one other question. On the store closings, Todd, is that in addition to the last number that we had, the 175?

<A – Dave Dyer – Chico’s FAS, Inc.>: No, that’s inclusive of the last number that you had. It’s just – I think we were at 140 or so last time and I think we’ve added another 30 stores to the list.

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, been migrating up over the course of the year as we kind of refine some of our analysis. So, the latest number fully inclusive is that 170 to 175.

<Q – Liz Pierce – Brean Capital LLC>: Okay. And it sounds like that’s an ongoing process?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Oh, absolutely. Yeah, no, we – as real estate is coming due and leases are coming towards end of term or kick outs, we continue to evaluate overall markets. I continue to evaluate what I would call our flow of customers to understand where the sales are going to, and then also look at how that compares to rate increases that we’re seeing from landlords. In cases – in a lot of cases, we’re seeing rate increases that far outstrip anything that we would’ve expected and that causes us to maybe change course a little bit here and there.

<Q – Liz Pierce – Brean Capital LLC>: So, my follow-up question related to that is I know that you guys mentioned last time in terms of the migration of those customers where stores are closing, can you just give us an update on what you’ve seen in terms of migrating them to online or to another store?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah. Our rate of sales transfer actually has been either stable with what we’d expected or in many cases even higher than what we had expected. So, we put in a couple of new plans to really actively try to migrate customers to other stores or online and thus far have seen very, very positive results off of it.

<Q – Liz Pierce – Brean Capital LLC>: Okay. Great. Thanks, and best of luck, guys.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thank you.

Operator: Our next question is from Paul Alexander of BB&T Capital Markets. Please go ahead.

<Q – Paul Alexander – BB&T Capital Markets>: Hi. Thank you for the question. Thank you, Dave. I know you guys have already talked a lot already about the perfect storm that hurt sales particularly in September, but is there any nuance to what happened month-to-month? It seems like September was very weak but then October accelerated significantly, and then November dropped off again. So, any commentary specific to November; is it just about weather week-to-week or month-to-month, or was October driven by incremental clearance and promotion that wasn’t as much of a tailwind in November to-date?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, there was some additional promotion in October, but I also think that it certainly improved. I mean, we even saw the last week of September begin to come back. So, we thought – if we went through August and we started off slow, we knew the reasons for it and we saw that sales start to build as we went through August and actually I was feeling pretty darn good coming into Labor Day and I would say was shocked when I – actually the Sunday before Labor Day, everything looked great and it started really on Labor Day and went for the next two, three weeks.

Like, I was absolutely surprised at the business during that time. The fourth week of September and throughout October, we started seeing improvement and actually in the last few weeks of October, that was certainly helped by some of the promotional activity that we had. But it was positive in the first three weeks and then all of a sudden, in the first couple of weeks of November, it looks like that it’s taken another – business has taken another little sabbatical.

So, I think that there’s going to be some volatility as we go through the next few months, but Christmas always comes and I think it’s going to be a – not our best Christmas, but it’s going to be a decent Christmas.

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Paul Alexander – BB&T Capital Markets>: Thank you. And then just one follow-up. Can you describe again what the dynamic was with the balance of color at Chico’s and you mentioned something like cutting the color penetration but then rebalancing for holiday. Can you just go into that a little more? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: I think that as we got into the fourth quarter, one of the things to control the inventory is what we did is we edited pattern and some of the color choices to manage the inventory more appropriately. Unfortunately, I think that because a lot of the pattern and the color would be what we would call the fashion items, where you don’t buy as deep and perhaps we cut back too much in those and didn’t give the customer enough choice in pattern and color which she really responds to and I think we realized that as we got into the season. Certainly in August, we realized as we took a look, we had the other problems with the pant promotion but then we started making corrections and scrambled. The merchants actually spent some time in New York and with our suppliers and we either pulled things forward that we could that would fit in with the season or tried to react by buying new things that we could get in, in time for the holiday. And I think they did a good job of that getting it back into balance again.

<Q – Paul Alexander – BB&T Capital Markets>: All right. Thank you very much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks.

Operator: Our next question is from Anna Andreeva of Oppenheimer. Please go ahead.

<Q – Anna Andreeva – Oppenheimer & Co., Inc. (Broker)>: Great. Thanks so much. Good morning. I guess, as we think about 2016, maybe talk about the puts and takes on the gross margin line, how much of the better inventory management you guys think has been realized already or do you think that’s still a big opportunity into next year? I guess, with the Boston Proper drag behind you, should 2016 gross margins be up for the company? And just a follow-up on the quarter-to-date trend being down 4.8%, do you expect any acceleration as we go through the holiday? Thanks so much.

<A – Dave Dyer – Chico’s FAS, Inc.>: I don’t expect an acceleration of the trend; I would expect for it to improve. But again, that’s an expectation not a forecast or guidance. My expectation is as we get into Christmas, Christmas will come and it’s going to be a decent Christmas, so that would be my expectation. I would say that when we look – and, Todd, you’re going to have to help me fill in on here for gross margin for spring, we actually reported the numbers and additional air freight from last year in the first and second quarters and into the fourth quarter. And to my memory, it was somewhere around $6 million to $9 million in additional air freight due to the port strike, and then we had extra flow and cost to try to move inventory to the East Coast.

Do you remember the numbers exactly?

<A – Todd Vogensen – Chico’s FAS, Inc.>: I don’t have it sitting in front of me what the exact number was, but it was definitely in the millions and it will be a positive tailwind...

<A – Dave Dyer – Chico’s FAS, Inc.>: It will be a positive to our gross margin and other things for the gross margin?

<A – Todd Vogensen – Chico’s FAS, Inc.>: At this point, we continue to look at ways of being more efficient with our inventory. So, be that looking at inventories by different store tiers or just plain looking at how we’re planning our assortments. There are still plenty of things that we’re looking to do that will help to drive gross margin. And as we get into our Q4 call in February, we’ll have a lot more specifics that we can probably share with you at that point.

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Dave Dyer – Chico’s FAS, Inc.>: The biggest thing to drive gross margin is managing the inventory so you don’t have needless liquidations because you have too much. So, I think that we definitely have our arms around and would be expecting very good inventory control and the ability to chase when we find that we need more.

<Q – Anna Andreeva – Oppenheimer & Co., Inc. (Broker)>: Thanks, guys. Best of luck for the holiday.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: Your next question is from Adrienne Yih of Wolfe Research. Please go ahead.

<Q – Adrienne Yih – Wolfe Research LLC>: Good morning, everybody. Dave, first, thank you for all your dedication and hard work, really happy for your retirement but sad to see you go. I just wanted to say that.

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, the third time may be the charm. We’ll see.

<Q – Adrienne Yih – Wolfe Research LLC>: I know. Maybe you’ll be back.

<A – Dave Dyer – Chico’s FAS, Inc.>: [indiscernible] (46:00)

<Q – Adrienne Yih – Wolfe Research LLC>: So, we always have that to look forward to. My question is a little bit follow up on the gross margin, thanks for that color. So, we should probably expect some additional promo activity to keep the inventory moving, but then offset by the onetime freight from last year? Is that why we’re looking at flat gross margin?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah. I think part – so, I think that’s partially true. I think the other thing that we see is the fact that we came into the season with our inventories down means that we have the ability to stay on top of it and be kind of proactive when we take those promotions and – whereas, in the past, we might have waited and taken a lot deeper clearance markdowns to move through it. Moving through it while it’s fresh is certainly a lot more positive way to go about it. So, there’s a few different moving parts in there: freight, timing of when we promote, and then just plain starting the season off more well-positioned.

<Q – Adrienne Yih – Wolfe Research LLC>: Great. That makes sense. And then on the SG&A line, it was up low low single digits in dollars year-on-year. Should we expect that? Was there a bonus accrual reversal in the third quarter or will there be one in the fourth quarter to help the SG&A? So, any color on that and the breakeven comp for leverage. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: I think it’s fair to say with our results, we were probably not accruing to the same level we were back in Q2. I would not expect any massive reversals, but I think as we get into looking at marginal SG&A growth in Q4. So, it’s much more about store occupancy and though it’s more moderate, any incentive compensation would be more than what we paid last year, so that as well will be just a little bit of the increase.

<Q – Adrienne Yih – Wolfe Research LLC>: Okay. Great. Thank you very much, and best of luck for holiday.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: Your next question is from Betty Chen of Mizuho Securities. Please go ahead.

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Thank you. Congratulations, Dave, on your retirement and best of luck. I was wondering if you can talk a little more about the inventory position. I know it came down nearly 5%, but it sounds like you may still have included some Boston Proper online inventory. Can you quantify what that may have been and whether that is – the inventory position is also down on a unit basis? My second question is just regarding the White House dress business. Can you talk a little bit about sort of what are the challenges in that business right now and what are the changes we should be looking for as we kind of head into 2016? Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Sure. I’ll take the inventory question. So, when you look at Boston Proper, you’re right, that does include some of the Boston Proper online inventory. If we had excluded Boston Proper entirely, our inventories were still down about 4%. So, as we get closer to a sale of the direct-to-consumer business, those inventories would obviously go with the sale of Boston Proper’s assets.

So, like-for-like, we were still down as we were headed into this quarter. And when you’re looking at the composition of it, it really was units. Our average unit cost year-over-year in our inventory, our ending inventory, was pretty flattish. So, the reduction as we were going into the quarter was mostly driven by just fewer units.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: And is that the same...

<A – Dave Dyer – Chico’s FAS, Inc.>: No. Go ahead.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: I was just wondering, is that the same composition we should look for at Q4 end, Todd?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah. That is how we’re buying inventories, is to look at both units in dollars and make sure we’re buying tightly compared to last year, so you can think of that as meaning flat to slightly down.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Great. Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: As far as dresses go, White House | Black Market really was founded based on a dress business. It was social occasion. It was the place to go for a dress. I would say as the dress category over the last several years has softened, and White House | Black Market has also found the category to be tough, but as we go back and look at it, I think that we have probably unnecessarily given away more business than we should have in dresses.

There’s just not a lot of great places left to buy dresses and we think that it’s an opportunity for us. We did it strategically when we pulled back from the category, but we think that again strategically, we can go back after it as we get into next year and we could see some real – be getting success in some of the new dresses that we’re bringing in. So, it’s giving us an idea of how to go forward. It’s going to be different than the social occasions dress business that we’ve had before, although there’ll still be some of that involved, but we see it as an opportunity going into next year.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Great. Thank you. Best of luck.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: Our last question today is from Simeon Siegel of Nomura Securities. Please go ahead.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Hey, guys. This is Gene Vladimirov, on for Simeon. Good morning. I was wondering if you could give us some color around

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

the DTC business, the performance there follow the cadence you highlighted for the quarter and possibly any extra expenses or investments you’ve been putting into the channel?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah. I think one thing for us as we’ve gotten further and further into this, clearly, there’s an ongoing blurring of the lines between online and stores. And I think it was actually Dave at one point as we were trying to figure out when there’s interaction between the two channels, who gets credit for the sale and Dave basically came to the table and said, you know what? It doesn’t matter. A sale is a sale, and that’s really the way that we manage our business. So, as you look at pure DTC business, that’s not necessarily how we view our business.

Now, that being said, there are a lot of things that we are doing differently online to help drive new customers, be it online marketing, be it looking at different projects coming into next year that’ll help improve customer experience and really help bridge her from an online experience into the stores. We have asked our associate views in the store to get better understanding of the customer and how they can service her. There’s just a lot of blurring of the lines between bricks-and-mortar and online that we think are going to continue and accelerate as we go into the future.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Got it. Very helpful. Thanks. Good luck for the holidays.

<A – Todd Vogensen – Chico’s FAS, Inc.>: All right. Thank you.

Operator: This concludes our question-and-answer session today. I would like to turn the conference back over to Jennifer Powers Adkins for any closing remarks.

Jennifer Powers Adkins, Vice President-Investor Relations

Thank you, Emily. That concludes our call for this morning. We do apologize if there were any questions that we did not get to today. As always, I’m available for any follow-ups if necessary. Thank you, all, for joining us this morning, and we appreciate your continuing interest in Chico’s FAS.

Operator: The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

Chico's FAS, Inc. | CHS | Q3 2015 Earnings Call | Nov. 24, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2015. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

17

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

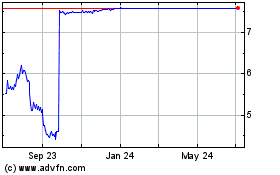

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024