UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

KALOBIOS PHARMACEUTICALS, INC.

(Name of Issuer)

Common Stock, par value $0.001

(Title of Class of Securities)

48344T 10 0

(CUSIP Number)

|

Martin Shkreli

c/o Turing Pharmaceuticals LLC

1177 Avenue of the Americas, 39th Floor

New York, NY 10036

(646) 356-5577 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 16, 2015

(Date of Event which Requires Filing of

this Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

CUSIP No. 48344T 10 0 | Page 2 of 9 |

| 1 |

NAME OF REPORTING PERSONS

Martin Shkreli |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

2,075,200 shares |

| 8 |

SHARED VOTING POWER

0 shares |

| 9 |

SOLE DISPOSITIVE POWER

2,075,200 shares |

| 10 |

SHARED DISPOSITIVE POWER

0 shares |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,890,000 shares (see Item 5) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

70.1% (see Item 5) |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

CUSIP No. 48344T 10 0 | Page 3 of 9 |

| 1 |

NAME OF REPORTING PERSONS

David Moradi |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 shares |

| 8 |

SHARED VOTING POWER

574,800 shares |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

574,800 shares |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,890,000 shares (see Item 5) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

70.1% (see Item 5) |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

CUSIP No. 48344T 10 0 | Page 4 of 9 |

1 |

NAME OF REPORTING PERSONS

Anthion Partners II LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 shares |

| 8 |

SHARED VOTING POWER

574,800 shares |

| 9 |

SOLE DISPOSITIVE POWER

0 shares |

| 10 |

SHARED DISPOSITIVE POWER

574,800 shares |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,890,000 shares (see Item 5) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

70.1% (see Item 5) |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

CUSIP No. 48344T 10 0 | Page 5 of 9 |

| 1 |

NAME OF REPORTING PERSONS

Marek Biestek |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) o |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

240,000 shares |

| 8 |

SHARED VOTING POWER

0 shares |

| 9 |

SOLE DISPOSITIVE POWER

240,000 shares |

| 10 |

SHARED DISPOSITIVE POWER

0 shares |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,890,000 shares (see Item 5) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

|

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

70.1% (see Item 5) |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

CUSIP No. 48344T 10 0 | Page 6 of 9 |

Item 1. Security and Issuer

This statement relates to the common stock,

par value $0.001 per share (the “Common Stock”), of KaloBios Pharmaceuticals, Inc. (the “Issuer”). The

address of the principal executive offices of the Issuer is 442 Littlefield Avenue, South San Francisco, CA, 94080.

Item 2. Identity and Background

The persons filing this statement are Martin

Shkreli, David Moradi and Marek Biestek, all citizens of the United States of America, and Anthion Partners II LLC, a Delaware

limited liability company (“Anthion”) (collectively, the “Reporting Persons”).

Each of the Reporting Persons are members of a “group” within the meaning of Rule 13d-5 and/or Section 13(d)(3) of

the Securities Exchange Act of 1934, as amended (the “Act”). In addition, each of the Reporting Persons is party to

that certain Joint Filing Agreement included as Exhibit 1 to this statement. Accordingly, the Reporting Persons are hereby filing

a joint Schedule 13D. Each Reporting Person provided only the information as to himself or itself and his or its affiliates and

did not independently verify the information contained in this statement provided by any other Reporting Person.

Mr. Shkreli’s present principal occupation

or employment is serving as the Chief Executive Officer of Turing Pharmaceuticals AG, a privately held biotechnology company. The

principal business address of Mr. Shkreli is c/o Turing Pharmaceuticals LLC, 1177 Avenue of the Americas, 39th Floor, New York,

NY 10036.

Mr. Moradi’s present principal occupation

or employment is acting as a private investor. Anthion is a private investment vehicle. The principal business address of Mr. Moradi

and Anthion is 379 West Broadway, New York, NY 10012. Mr. Moradi is the Managing Member of Anthion and, as such, is in the position

to determine the investment and voting decisions made by Anthion.

Mr. Biestek’s present principal occupation

or employment is acting as a private investor. The principal business address of Mr. Biestek is 108-20 71ST Ave, Apt PH2C, Forest

Hills, NY 11375.

None of the Reporting Persons has, during

the past five years, (i) been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii)

been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The Reporting Persons hold, in the aggregate,

2,890,000 shares of Common Stock. The aggregate purchase price of the shares of Common Stock purchased by Mr. Shkreli was $3,263,567.15

and the source of funding for these purchases was his personal funds. The aggregate purchase price of the shares of Common Stock

purchased by Anthion (through which Mr. Moradi beneficially owns the Shares, as described in Item 5 hereto) was $874,145.56

and the source of funding for these purchases was the general working capital of Anthion. The aggregate purchase price of

the shares of Common Stock purchased by Mr. Biestek was $416,896.50 and the source of funding for these purchases was his personal

funds.

Item 4. Purpose of Transaction.

On November 9, 2015, the Issuer filed a

Form 8-K with the Securities and Exchange Commission disclosing that on November 5, 2015 the Issuer’s board of directors

(the “Board”) approved a restructuring plan involving reductions in headcount as part of a plan to reduce operating

costs. On November, 13, 2015, the Issuer issued a press release stating that it had engaged The Brenner Group in connection with

a plan to wind-down operations.

In response to the filing and the press

release, the Reporting Persons began acquiring the Common Stock in the open market with the intent to gain control of the Issuer,

influence management of the Issuer, replace the members of the Board, prevent the commencement of any bankruptcy proceedings or

proceedings for the liquidation, dissolution or wind down of the Company and maximize stockholder value. The Reporting Persons

acquired a majority of the shares of Common Stock on November 17, 2015.

CUSIP No. 48344T 10 0 | Page 7 of 9 |

On November 18, 2015, the Reporting Persons

made a proposal to the Issuer regarding financing options (including those that may lead to the acquisition of additional securities

of the Issuer by the Reporting Persons and third parties, and those that would lead to a material change in the present capitalization

of the Issuer), continuing operations of the Issuer and a change in the Issuer’s management and composition of the Board.

On November 19, 2015, the Issuer appointed

Mr. Shkreli to the position of Chief Executive Officer and Chairman of the Board and Messrs. Moradi, Biestek and Tony Chase as

members of the Board, filling vacancies created by the resignation of all former directors of the Issuer in connection with these

developments. On November 22, 2015, the Issuer appointed Tom Fernandez and Michael Harrison as members of the Board.

The Reporting Persons may, from time to

time, acquire additional shares of Common Stock and/or other equity, debt, notes, instruments or other securities and/or derivative

securities relating thereto (collectively, “Securities”) of the Issuer in the open market or otherwise. They reserve

the right to dispose of any or all of their shares of Common Stock in the open market or otherwise, at any time and from time to

time, and to engage in any hedging or similar transactions with respect to the Securities.

Item 5. Interest in Securities of the Issuer.

(a) As members of a “group”

within the meaning of Rule 13d-5 and/or Section 13(d)(3) of the Act, the Reporting Persons may be deemed to beneficially own, in

the aggregate, 2,890,000 shares of Common Stock, representing approximately 70.1% of the Issuer’s outstanding Common Stock

(based on 4,123,921 shares of Common Stock outstanding as of August 7, 2015, as set forth in the Quarterly Report on 10-Q for the

quarterly period ended June 30, 2015 filed by the Issuer on August 10, 2015).

(b) Mr. Shkreli has sole voting power and

sole dispositive power with regard to 2,075,200 shares of Common Stock and shared voting power and shared dispositive power with

regard to zero shares of Common Stock.

Each of Mr. Moradi and Anthion have sole

voting power and sole dispositive power with regard to zero shares of Common Stock and shared voting power and shared dispositive

power with regard to 574,800 shares of Common Stock. Mr. Moradi may be deemed to indirectly beneficially own (as that term is defined

in Rule 13d-3 under the Act) the shares of Common Stock which Anthion directly beneficially owns. Mr. Moradi disclaims beneficial

ownership of such shares of Common Stock for all other purposes.

Mr. Biestek has sole voting power and sole

dispositive power with regard to 240,000 shares of Common Stock and shared voting power and shared dispositive power with regard

to zero shares of Common Stock.

(c) During the past 60 days the Reporting

Persons made the below listed open-market purchases:

| Reporting Person |

Date |

Number of Shares of Common Stock Purchased |

Price |

| Martin Shkreli |

11/10/2015 |

40,005 |

$0.94 |

| |

11/11/2015 |

28,394 |

$0.94 (1), (14) |

| |

11/16/2015 |

711,355 |

$0.68 (2), (14) |

| |

11/16/2015 |

231,769 |

$1.52(3), (14) |

| |

11/17/2015 |

606,677 |

$1.93(4), (14) |

| |

11/17/2015 |

7,000 |

$2.43 (5), (14) |

| |

11/18/2015 |

440,000 |

$2.02 (6), (14) |

| |

11/20/2015 |

5,000 |

$18.88 |

| |

11/24/2015 |

5,000 |

$38.15 |

| Anthion (on behalf of David Moradi) |

11/16/2015 |

254,300 |

$1.05(7), (14) |

| |

11/16/2015 |

56,700 |

$1.68(8), (14) |

| |

11/17/2015 |

113,800 |

$1.69 (9), (14) |

| |

11/18/2015 |

150,000 |

$2.13 (10), (14) |

| Marek Biestek |

11/16/2015 |

65,000 |

$1.36 (11), (14) |

| |

11/17/2015 |

135,000 |

$1.83 (12), (14) |

| |

11/18/2015 |

40,000 |

$2.04 (13), (14) |

(1) The price is a weighted average price. Mr. Shkreli purchased

28,394 shares in multiple transactions at prices ranging from $0.93 to $0.94, inclusive.

(2) The price is a weighted average price. Mr. Shkreli purchased

711,355 shares in multiple transactions at prices ranging from $0.30 to $1.19, inclusive.

(3) The price is a weighted average price. Mr. Shkreli purchased

231,769 shares in multiple transactions at prices ranging from $1.32 to $1.73, inclusive.

CUSIP No. 48344T 10 0 | Page 8 of 9 |

(4) The price is a weighted average price. Mr. Shkreli purchased

606,677 shares in multiple transactions at prices ranging from $1.38 to $2.37, inclusive.

(5) The price is a weighted average price. Mr. Shkreli purchased

7,000 shares in multiple transactions at prices ranging from $2.38 to $2.45, inclusive.

(6) The price is a weighted average price. Mr. Shkreli purchased

440,000 shares in multiple transactions at prices ranging from $1.80 to $2.37, inclusive.

(7) The price is a weighted average price. Anthion, on behalf

of Mr. Moradi, the Managing Member of Anthion, purchased 254,300 shares in multiple transactions at prices ranging from $0.62 to

$1.61, inclusive.

(8) The price is a weighted average price. Anthion, on behalf

of Mr. Moradi, the Managing Member of Anthion, purchased 56,700 shares in multiple transactions at prices ranging from $1.62 to

$1.85, inclusive.

(9) The price is a weighted average price. Anthion, on behalf of Mr. Moradi, the Managing Member of Anthion,

purchased 113,800 shares in multiple transactions at prices ranging from $1.42 to $1.96, inclusive.

(10) The price is a weighted average price. Anthion, on behalf

of Mr. Moradi, the Managing Member of Anthion, purchased 150,000 shares in multiple transactions at prices ranging from $1.99 to

$2.37, inclusive.

(11) The price is a weighted average price. Marek Biestek purchased

65,000 shares in multiple transactions at prices ranging from $0.82 to $1.66, inclusive.

(12) The price is a weighted average price. Marek Biestek purchased

135,000 shares in multiple transactions at prices ranging from $1.48 to $2.29, inclusive.

(13) The price is a weighted average price. Marek Biestek purchased

40,000 shares in multiple transactions at prices ranging from $2.01 to $2.12, inclusive.

(14) Each Reporting Person undertakes to provide to the Issuer,

any security holder of the Issuer or the staff of the Securities and Exchange Commission, upon request, full information regarding

the number of shares each such person purchased at each separate price within the ranges set forth in their applicable footnotes.

(d) Not applicable.

(e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer |

The information contained in Item 4 of this statement is hereby

incorporated by reference into this Item 6. The Reporting Persons have an informal oral agreement to act as a “group”

within the meaning of Rule 13d-5 and/or Section 13(d)(3) of the Act and are party to the Joint Filing Agreement included as Exhibit

1 to this statement.

Other than as disclosed in this Item 6, there are no other contracts,

arrangements, understandings or relationships (legal or otherwise) between the Reporting Persons and any person with respect to

securities of the Issuer.

| Item 7. |

Material to be Filed as Exhibits. |

The following document is filed as an exhibit:

| |

1. |

Joint Filing Agreement of the Reporting Persons* |

*filed herewith

CUSIP No. 48344T 10 0 | Page 9 of 9 |

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 24, 2015

| |

/s/ Martin Shkreli |

|

| |

MARTIN SHKRELI |

| |

|

| |

/s/ David Moradi |

|

| |

DAVID MORADI |

| |

|

| |

|

| |

ANTHION PARTNERS II LLC |

| |

|

| |

By: |

/s/ David Moradi |

|

| |

Name: David Moradi |

| |

Title: Managing Member |

| |

|

| |

|

| |

/s/ Marek Biestek |

|

| |

MAREK BIESTEK |

Exhibit 1

JOINT FILING AGREEMENT

The undersigned hereby agree that this

Statement on Schedule 13D with respect to the shares of common stock of Kalobios Pharmaceuticals, Inc. dated the date hereof, is,

and any amendments thereto signed by the undersigned shall be, filed on behalf of each of the undersigned pursuant to and in accordance

with the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended.

Dated: November 24, 2015

| |

/s/ Martin Shkreli |

|

| |

MARTIN SHKRELI |

| |

|

| |

/s/ David Moradi |

|

| |

DAVID MORADI |

| |

|

| |

|

| |

ANTHION PARTNERS II LLC |

| |

|

| |

By: |

/s/ David Moradi |

|

| |

Name: David Moradi |

| |

Title: Managing Member |

| |

|

| |

|

| |

/s/ Marek Biestek |

|

| |

MAREK BIESTEK |

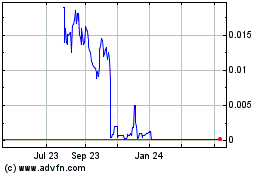

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024