UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6–K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2015

Commission File Number: 000-30540

GIGAMEDIA

LIMITED

8F, No. 22, Lane 407,

Section 2, Tiding

Boulevard

Neihu District

Taipei, Taiwan (R.O.C.)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether

the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is

marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b); 82- .

CONTENTS

Annexed hereto and incorporated herein by reference are copies of the following items:

| 1. |

GigaMedia Limited (the “Registrant”) Notice of 2015 extraordinary general meeting of Shareholders and Proxy Statement, dated November 24, 2015, being mailed to the shareholders of the Registrant in

connection with an extraordinary general meeting of the Registrant’s shareholders, which is scheduled to be held on Wednesday, December 16, 2015 (the “Meeting”), annexed as Exhibit 99.1 hereto; |

| 2. |

Proxy Card being mailed to shareholders of the Registrant for use in connection with the Meeting, annexed as Exhibit 99.2 hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

GIGAMEDIA LIMITED |

|

|

|

|

| Date: November 24, 2015 |

|

|

|

By: |

|

/s/ Collin Hwang |

|

|

|

|

Name: |

|

Collin Hwang |

|

|

|

|

Title: |

|

Chief Executive Officer |

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Form of the Notice of Extraordinary General Meeting and Proxy Statement (with appendices fully redacted), to be mailed to shareholders of the Registrant on or about November 25, 2015, in connection with the Registrant’s

extraordinary general meeting of Shareholders to be held on Wednesday, December 16, 2015. |

|

|

| 99.2 |

|

Form of the Proxy Card to be mailed to shareholders of the Registrant on or about November 25, 2015 for use in connection with the Registrant’s extraordinary general meeting of Shareholders to be held on Wednesday,

December 16, 2015. |

Exhibit 99.1

November 24, 2015

To the Shareholders of GigaMedia Limited:

You

are cordially invited to attend the Extraordinary General Meeting of Shareholders of our Company (the “Meeting”), to be held at 1404-5 Sunbeam Plaza, 1155 Canton Road, Kowloon, Hong Kong, on Wednesday, December 16, 2015, at

10:00 a.m. (Hong Kong time) or thereafter as it may be postponed or adjourned from time to time. At the Meeting, you will be asked to consider and vote on the approval to effect a reverse share split of the Company’s Ordinary Shares by a ratio

of five to one (the “Reverse Share Split”). The Company needs to effect the Reverse Share Split in order to maintain its listing on the Nasdaq Capital Market.

As you may be aware through our various announcements, on January 14, 2015, NASDAQ notified us that the trading price of our Ordinary

Shares no longer met the minimum $1 bid price per share requirement. NASDAQ had first provided the Company an opportunity to regain compliance within 180 day. When the trading price of our Ordinary Shares did not rise above $1 for ten consecutive

days during this 180 calendar day period, on July 9, 2015, NASDAQ again accepted our application to have an additional 180 calendar day period, or until January 11, 2016, to regain compliance on several conditions, including transfer our

listing to the Nasdaq Capital Market. If by January 11, 2016, the trading price of our Ordinary Shares still does not rise above $1 and as a result we could not demonstrate our compliance, our Ordinary Shares will be delisted from the Nasdaq

Capital Market. Furthermore, NASDAQ also reminded us that if the Company chooses to implement a reverse share split so that the shares of our consolidated Ordinary Shares may rise above $1, we must complete the reverse share split no later than ten

business days prior to the expiration date, which is December 24, 2015, in order to timely demonstrate that the Company has regained compliance.

As a result of the foregoing our Board of Directors had carefully evaluated our options and has unanimously: (i) determined that

maintaining the listing of the Company’s Ordinary Shares on the Nasdaq Capital Market is in the best interests of our Company and its shareholders; (ii) determined that the Reverse Share Split is fair to, and in the best interests of, our

Company and its shareholders; (iii) approved the Reverse Share Split and all other transactions contemplated therein; and (iv) determined to recommend that the shareholders of our Company approve the Reverse Share Split and all other

transactions contemplated therein.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE REVERSE SHARE

SPLIT.

This Proxy Statement and the attachments hereto contain important information and you are urged to read them carefully and in

their entirety.

The proposal to effect the Reverse Share Split requires the affirmative vote of the holders of a majority of our Ordinary

Shares present, in person or by proxy, at the Meeting where a quorum is present and voting on the proposal, not including abstentions and broker non-votes. Record holders of our outstanding Ordinary Shares as of the close of business on

November 19, 2015 (New York Time), the record date, are entitled to notice of, and to vote at, the Meeting, and are entitled to one vote at the Meeting per Ordinary Share held. Our outstanding Ordinary Shares constitute the only outstanding

class of our share capital.

Enclosed with this letter you will find a Notice of the Meeting and the related Proxy Statement. The

accompanying Proxy Statement provides you with detailed information about the Meeting and the Reverse Share Split.

YOUR VOTE IS

IMPORTANT REGARDLESS OF THE NUMBER OF ORDINARY SHARES THAT YOU OWN. ACCORDINGLY, YOU ARE REQUESTED TO PROMPTLY COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENVELOPE PROVIDED, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

THIS WILL NOT PREVENT YOU FROM VOTING YOUR ORDINARY SHARES IN PERSON IF YOU SUBSEQUENTLY CHOOSE TO ATTEND THE MEETING.

Thank you for your cooperation.

|

| Very truly yours, |

|

| /s/ CHIEN, Mo Na |

| CHIEN, Mo Na |

| Chairman of the Board of Directors |

NOTICE OF EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS TO BE HELD ON WEDNESDAY DECEMBER 16, 2015

November 24, 2015

To the Shareholders of

GigaMedia Limited:

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting, which we also refer to as the “Meeting”, of

Shareholders of GigaMedia Limited (which we refer to as “GigaMedia” or the “Company”) will be held at 1404-5 Sunbeam Plaza, 1155 Canton Road, Kowloon, Hong Kong, on Wednesday, December 16, 2015, at 10:00 a.m.

(Hong Kong time) or thereafter as it may be postponed or adjourned from time to time. The extraordinary general meeting of shareholders is being held for the purpose of approving to effect a reverse share split of the Company’s Ordinary Shares

by a ratio of five to one (the “Reverse Share Split”) and the transactions contemplated thereunder.

The full text of the resolution

proposed for approval by our shareholders is as follows:

| 1. |

RESOLVED as an Ordinary Resolution: |

| |

(a) |

That with effect immediately and pursuant to the Articles of Association of the Company, approval be and is hereby given for the consolidation of every five (5) existing ordinary shares (“Existing

Shares”) in the capital of the Company held by the shareholders of the Company (“Shareholders”) as at the beginning of the date hereof (the “Books Closure Date”) into one (1) consolidated ordinary

share (“Consolidated Share”) in the manner set out in the circular to the Shareholders dated November 24, 2015 (the “Reverse Share Split”). |

| |

(b) |

Subsequent to the Reverse Share Split, no fractional shares shall be issued to any holder and that instead of issuing such fractional shares, the Company would pay to the shareholder, in cash, the value of any

fractional share arising from the Reverse Share Split. |

| |

(c) |

Each certificate that immediately prior to the Books Closure Date represented shares of Existing Shares (“Old Certificates”), shall thereafter represent that number of shares of Consolidated Shares into

which the shares of Existing Shares represented by the Old Certificate shall have been combined, subject to the treatment of fractional shares as described above. |

| |

(d) |

The Directors and each of them be and is hereby authorised to any and all steps and to do and/or procure to be done any and all acts and things (including without limitation, to approve, sign and execute all such

documents which they in their absolute discretion consider to be necessary, and to exercise such discretion as may be required, to approve any amendments, alterations or modifications to any documents, and to sign, file and/or submit any notices,

forms and documents with or to the relevant authorities) as they and/or he may consider necessary, desirable or expedient in order to implement, finalise and give full effect to this Ordinary Resolution and the Reverse Share Split and/or the matters

contemplated herein. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE REVERSE SHARE

SPLIT.

NOTES

Quorum. The presence in person or by proxy of at least two shareholders holding an aggregate not less than 33 1/3% of the total number

of Ordinary Shares of GigaMedia (excluding treasury shares) is required to constitute a quorum at the Meeting. In the absence of a quorum within 30 minutes from the time appointed for the Meeting, the Meeting shall stand adjourned to the following

business day and will be held on Thursday, December 17, 2015 at the same time and place. At such adjourned meeting, any one or more shareholders present in person or by proxy will constitute a quorum.

Ordinary Resolution. Approval of the Reverse Share Split requires the affirmative vote of a majority of the Ordinary Shares present (in

person or by proxy) at the Meeting (or at any adjournment or postponement thereof) and voting (not including abstentions and broker non-votes) on the proposal.

Eligibility to Vote at Extraordinary General Meeting; Receipt of Notice. Shareholders of record at the close of business on

November 19, 2015 (New York Time) are entitled to notice of and to vote at the Meeting and any adjournment or postponement of the Meeting. The accompanying Proxy Statement, notice, letter to shareholders and proxy card are first being mailed to

our shareholders on or about November 24, 2015.

IT IS IMPORTANT THAT YOUR ORDINARY SHARES BE REPRESENTED AT THE MEETING. Whether or

not you plan to attend in person, please complete, date, sign and return the enclosed proxy card in the enclosed envelope in a timely manner in order that it is received by us at Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717,

or the office of the Company, 8F, No. 22, Lane 407, Section 2, Tiding Boulevard, Taipei 114, Taiwan R.O.C., not later than forty-eight (48) hours before the Meeting, that is by no later than 10:00 p.m. December 13, 2015 (New York

time), or 10:00 a.m. December 14, 2015 (Hong Kong time). No postage is required if mailed in the United States. A proxy need not also be a shareholder. You may revoke your proxy in the manner described in the accompanying Proxy Statement at any

time before your proxy has been voted at the Meeting. Your proxy, if properly executed, will be voted in the manner directed by you. If no direction is made, your proxy will be voted “FOR” each of the matters described above.

If your shares are held in “street name”, through a bank, broker or other nominee, you may either direct such bank, broker or other

nominee on how to vote your shares or obtain a legal proxy from such bank, broker or other nominee to vote your shares at the Meeting.

|

| By order of the Board of Directors, |

|

| /s/ Kuo-Lun Huang |

| Kuo-Lun Huang (aka Collin Hwang) |

| Director and Chief Executive Officer |

IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD BE

COMPLETED, SIGNED, DATED AND RETURNED PROMPTLY

PROXY STATEMENT

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON Wednesday, December 16, 2015

INTRODUCTION

We are

furnishing this Proxy Statement to our shareholders in connection with the solicitation by our Board of Directors of proxies to be used at an Extraordinary General Meeting of Shareholders, as it may be postponed or adjourned from time to time (which

we refer to as the Meeting), to be held at 1404-5 Sunbeam Plaza, 1155 Canton Road, Kowloon, Hong Kong, on Wednesday, December 16, 2015, at 10:00 a.m. (Hong Kong time) or thereafter as it may be postponed or adjourned from time to time. We are

first mailing this Proxy Statement, the accompanying notice, letter to shareholders and proxy card on or about November 24, 2015 to the holders of our Ordinary Shares entitled to notice of, and to vote at, the Meeting. All references to

“GigaMedia”, “the Company”, “we”, “us”, “our” and “our company”, or words of like import, are references to GigaMedia Limited and its subsidiaries, references to “you” and

“your” refer to our shareholders and all references to “$” or to “US$” are to United States dollars.

At the

Meeting, shareholders will be asked to consider and vote to pass their approval to effect a reverse share split of the Company’s Ordinary Shares by a ratio of five to one (the “Reverse Share Split”):

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE REVERSE SHARE SPLIT.

Voting

Only holders of record of

Ordinary Shares at the close of business on November 19, 2015 (New York Time), the record date, are entitled to notice of, and to vote at, the Meeting. As of November 19, 2015, there were 55,261,661 Ordinary Shares outstanding and entitled to vote.

Each Ordinary Share outstanding on the record date will entitle its holder to one vote upon each of the matters to be presented at the Meeting.

The presence in person or by proxy of two or more shareholders holding an aggregate not less than 33 1/3% of the total number of outstanding

Ordinary Shares of GigaMedia (excluding treasury shares) is required to constitute a quorum at the Meeting. In the absence of a quorum within 30 minutes after the time appointed for the Meeting, the Meeting shall stand adjourned to the following

business day and will be held on Thursday, December 17, 2015 at the same time and place. At such adjourned meeting, any one or more shareholders present in person or by proxy will constitute a quorum. Approval of the Reverse Share Split requires the

affirmative vote of a majority of the Ordinary Shares present (in person or by proxy) at the Meeting (or at any adjournment or postponement thereof) and voting (not including abstentions and broker non-votes) on such proposal.

Proxies

Shareholders may elect to vote

their shares once, either by attending the Meeting in person, or by executing and delivering to GigaMedia a proxy as detailed below. If your Ordinary Shares are held in “street name” through a bank, broker or other nominee, you may either

direct such bank, broker or other nominee on how to vote your shares or obtain a legal proxy from such bank, broker or other nominee to vote your shares at the Meeting.

Proxies are being solicited by our Board of Directors and are being mailed together with this Proxy Statement. Certain of our officers,

directors, employees and agents may solicit proxies by telephone, facsimile, electronic mail or other personal contact. However, such parties will not receive additional compensation therefor. We will bear the cost of the solicitation of proxies,

including the cost of preparing, assembling and mailing the proxy materials, and will reimburse the reasonable expenses of brokerage firms and others for forwarding such proxy materials to the beneficial owners of our shares.

All Ordinary Shares represented by properly executed proxies received by us no later than

forty-eight (48) hours prior to the Meeting, that is by no later than 10:00 p.m. December 13, 2015 (New York time), or 10:00 a.m. December 14, 2015 (Hong Kong time), will, unless such proxies have been previously revoked or superseded, be voted

at the Meeting in accordance with the directions on the proxies. A proxy need not also be a shareholder. If no direction is indicated on the properly executed proxy, the shares will be voted “FOR” each of the matters described above.

We know of no other matters to be submitted at the Meeting other than as specified herein.

A shareholder returning a proxy may revoke it at any time prior to commencement of the Meeting by communicating such revocation in writing to

us or by executing and delivering a later-dated proxy. In addition, any person who has executed a proxy and is present at the Meeting may vote in person instead of by proxy, thereby canceling any proxy previously given, whether or not written

revocation of such proxy has been given. Any written notice revoking a proxy should be sent to us at our executive offices located at 8F, No. 22, Lane 407, Section 2, Tiding Boulevard, Taipei 114, Taiwan R.O.C., Attention: Amanda Chang,

Investor Contact.

Required Vote

Approval of the Reverse Share Split requires the affirmative vote of the holders of a majority of the Ordinary Shares present in person or by

proxy at the Meeting and voting on the proposal for the Reverse Share Split, excluding abstentions and broker non-votes.

At the Meeting,

shareholders will be asked to consider and vote to pass the following resolution as an Ordinary Resolution.

| 1. |

RESOLVED as an Ordinary Resolution: |

| |

(a) |

That with effect immediately and pursuant to the Articles of Association of the Company, approval be and is hereby given for the consolidation of every five (5) existing ordinary shares (“Existing

Shares”) in the capital of the Company held by the shareholders of the Company (“Shareholders”) as at the beginning of the date hereof (the “Books Closure Date”) into one (1) consolidated ordinary share

(“Consolidated Share”) in the manner set out in the circular to the Shareholders dated November 24 2015 (the “Reverse Share Split”). |

| |

(b) |

Subsequent to the Reverse Share Split, no fractional shares shall be issued to any holder and that instead of issuing such fractional shares, the Company would pay to the shareholder, in cash, the value of any

fractional share arising from the Reverse Share Split. |

| |

(c) |

Each certificate that immediately prior to the Books Closure Date represented shares of Existing Shares (“Old Certificates”), shall thereafter represent that number of shares of Consolidated Shares into

which the shares of Existing Shares represented by the Old Certificate shall have been combined, subject to the treatment of fractional shares as described above. |

| |

(d) |

The Directors and each of them be and is hereby authorised to any and all steps and to do and/or procure to be done any and all acts and things (including without limitation, to approve, sign and execute all such

documents which they in their absolute discretion consider to be necessary, and to exercise such discretion as may be required, to approve any amendments, alterations or modifications to any documents, and to sign, file and/or submit any notices,

forms and documents with or to the relevant authorities) as they and/or he may consider necessary, desirable or expedient in order to implement, finalise and give full effect to this Ordinary Resolution and the Reverse Share Split and/or the matters

contemplated herein. |

Our Board of Directors recommends a vote “FOR” the approval of the Reverse Share Split.

2

TABLE OF CONTENTS

|

|

|

|

|

| INTRODUCTION |

|

|

1 |

|

| QUESTIONS AND ANSWERS ABOUT THE TRANSACTION |

|

|

4 |

|

| BACKGROUND AND REASONS FOR THE REVERSE SHARE SPLIT |

|

|

7 |

|

| RISK AND POTENTIAL DISADVANTAGES ASSOCIATED WITH THE REVERSE SHARE SPLIT |

|

|

8 |

|

| PROCEDURES FOR IMPLEMENTING THE REVERSE SHARE SPLIT |

|

|

8 |

|

| EFFECT OF THE REVERSE SHARE SPLIT ON HOLDERS OF ORDINARY SHARES |

|

|

8 |

|

| FRACTIONAL SHARES |

|

|

10 |

|

| ACCOUNTING MATTERS |

|

|

10 |

|

| CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE SHARE SPLIT |

|

|

11 |

|

| NO APPRAISAL RIGHT |

|

|

11 |

|

| BOARD RECOMMENDATION |

|

|

11 |

|

| BENEFICIAL OWNERSHIP OF ORDINARY SHARES |

|

|

12 |

|

| WHERE YOU CAN FIND MORE INFORMATION |

|

|

12 |

|

| OTHER MATTERS |

|

|

13 |

|

3

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION

The following questions and answers are intended to briefly address certain commonly asked questions regarding the proposal to effect the

Reverse Share Split. These questions and answers may not address all of the questions that may be important to you as a shareholder of GigaMedia. Please refer to the more detailed information contained elsewhere in this Proxy Statement and the

documents referred to or incorporated by reference in this Proxy Statement, which you are urged to read carefully and in their entirety. See the section of this Proxy Statement entitled “Where You Can Find More Information”

beginning on page 12.

| Q: |

Why am I receiving this Proxy Statement? |

| A: |

Our Company is soliciting proxies for the Meeting. You are receiving this Proxy Statement because you owned Ordinary Shares on November 19, 2015 (New York Time), the record date, and that entitles you to vote at

the Meeting. By use of a proxy, you can vote whether or not you attend the Meeting. This Proxy Statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.

|

| Q: |

What am I being asked to vote on? |

| A: |

You are being asked to vote on the approval to effect a reverse share split of the Company’s Ordinary Shares by a ratio of five to one (the “Reverse Share Split”). |

| Q: |

Why is the Company contemplating the Reverse Share Split? |

| A: |

The Company needs to effect the Reverse Share Split in order to maintain its listing on the Nasdaq Capital Market. |

As you may be aware through our various announcements, on January 14, 2015, NASDAQ notified us that the trading price of our Ordinary Shares no

longer met the minimum $1 bid price per share requirement. NASDAQ had first provided the Company an opportunity to regain compliance within 180 day. When the trading price of our Ordinary Shares did not rise above $1 for ten consecutive days during

this 180 calendar day period, on July 9, 2015, NASDAQ again accepted our application to have an additional 180 calendar day period, or until January 11, 2016, to regain compliance on several conditions, including transfer our listing to the Nasdaq

Capital Market. If by January 11, 2016, the trading price of our Ordinary Shares still does not rise above $1 and as a result we could not demonstrate our compliance, our Ordinary Shares will be delisted from the Nasdaq Capital Market. Furthermore,

NASDAQ also reminded us that if the Company chooses to implement a reverse share split so that the shares of our consolidated Ordinary Shares may rise above $1, we must complete the reverse share split no later than ten business days prior to the

expiration date, which is December 24, 2015, in order to timely demonstrate that the Company has regained compliance.

| Q: |

When will the Reverse Share Split be completed? |

| A: |

All shares held at the beginning of the date of the Meeting will be consolidated pursuant to the Reverse Share Split immediately upon the passing of the resolutions on the date of the Meeting. |

| Q: |

Are there risks I should consider in deciding how to vote on the Reverse Stock Split? |

| A: |

Yes. You should carefully read this Proxy Statement in its entirety, including the factors discussed in the section “Risks and Potential Disadvantages Associated with the Reverse Share Split” beginning

on page 7. |

| Q: |

When and where is the Meeting? |

| A: |

The Meeting will be held on Wednesday, December 16, 2015, at 10:00 a.m. (Hong Kong time) at 1404-5 Sunbeam Plaza, 1155 Canton Road, Kowloon, Hong Kong. In the absence of a quorum within 30 minutes from the time

appointed for the Meeting, the Meeting shall stand adjourned to the following business day and will be held on Thursday, December 17, 2015 at the same time and place. At such adjourned meeting, any one or more shareholders present in person or by

proxy will constitute a quorum. |

4

|

|

|

| Q: |

|

What vote is required for GigaMedia shareholders to approve the Reverse Stock Split? |

|

|

| A: |

|

The approval of the Reverse Stock Split requires the affirmative vote of the holders of a majority of the Ordinary Shares present in person or by proxy at the Meeting where a quorum is present and voting on the Reverse Stock Split,

not including abstentions and broker non-votes. |

|

|

| Q: |

|

How does GigaMedia’s Board of Directors recommend that I vote? |

|

|

| A: |

|

Our Board of Directors has unanimously and approved the Reverse Share Split, and recommends that you vote “FOR” the approval of the Reverse Share Split. |

|

|

| Q: |

|

Why is GigaMedia’s Board of Directors recommending that I vote “FOR” the approval of the Reverse Share Split? |

|

|

| A: |

|

Our Board of Directors had carefully evaluated our options, since the receipt of bid price notice from NASDAQ on January 14, 2015 and

considered various options. Our Board of Directors has now unanimously: (i) determined

that maintaining the listing of the Company’s Ordinary Shares on the Nasdaq Capital Market is in the best interests of our Company and its shareholders; (ii) determined that the Reverse Share Split is fair to, and in the best interests of, our

Company and its shareholders; (iii) approved the Reverse Share Split and all other transactions contemplated therein; and (iv) determined to recommend that the shareholders of our Company to approve the Reverse Share Split and all other transactions

contemplated therein. |

|

|

| Q: |

|

What effects will the proposed Reverse Share Split have on our Company? |

|

|

| A: |

|

Following the completion of the Reverse Share Split, we will remain a public company and, subject to our compliance with all other continued listing requirements of the Nasdaq Capital Market, our Ordinary Shares will continue to be

listed on the Nasdaq Capital Market. |

|

|

| Q: |

|

What happens if the Reverse Share Split is not completed? |

|

|

| A: |

|

If the Reverse Share Split is not completed for any reason, we will remain a public company but we will be delisted from the Nasdaq Capital Market, unless the trading price of our Ordinary Shares rises above $1 for ten consecutive

business days before January 11, 2015 so that we can demonstrate our compliance with the Nasdaq bid price requirements. |

|

|

| Q. |

|

What do I need to do now? |

|

|

| A. |

|

This Proxy Statement contains important information regarding the proposal to effect the Reverse Share Split as well as information about us. It also contains important information regarding the factors considered by our Board of

Directors in evaluating the Reverse Stock Split. You are urged to read this Proxy Statement carefully and in its entirety. You should also complete, sign and date the enclosed proxy card and return it in the enclosed envelope. You should also review

the documents referenced under the section of this Proxy Statement entitled “Where You Can Find More Information” beginning on page 12. |

|

|

| Q. |

|

How do I vote? |

|

|

| A. |

|

You should indicate on the enclosed proxy card how you want to vote, and date, sign and mail it in the enclosed envelope as soon as possible, so that your shares can be voted at the Meeting. The Meeting will take place on Wednesday,

December 16, 2015 at 10:00 a.m. (Hong Kong time), at 1404-5 Sunbeam Plaza, 1155 Canton Road, Kowloon, Hong Kong. Whether or not you submit a proxy, you may attend the Meeting and vote your shares in person. |

|

|

| Q: |

|

What do I do if I want to change my vote? |

5

|

|

|

| A: |

|

You may send a written notice of revocation, or send a later-dated, completed and signed proxy card relating to the same shares, to us at our executive offices located at 8F, No. 22, Lane 407, Section 2, Tiding Boulevard, Taipei

114, Taiwan R.O.C., Attention: Amanda Chang, Investor Contact, so it is received prior to the Meeting. Ordinary Shares represented by properly executed proxies received by us not later than forty-eight (48) hours prior to the Meeting will be voted

at the Meeting in accordance with the directions on the proxies, unless such proxies have been previously revoked or superseded. Alternatively, you may attend the Meeting and vote in person. |

|

|

| Q: |

|

If my shares are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee vote my shares for me? |

|

|

| A: |

|

Your bank, broker or other nominee will vote your shares only if you provide instructions to your bank, broker or other nominee on how to vote. You should follow the procedures provided by your bank, broker or other nominee

regarding the voting of your shares and be sure to provide your bank, broker or other nominee with instructions on how to vote your shares. If your shares are held in “street name” you must contact your bank, broker or other nominee to

change or revoke your voting instructions. |

|

|

| Q: |

|

Who can vote at the Meeting? |

|

|

| A: |

|

Only those holders of record of outstanding Ordinary Shares at the close of business on November 19, 2015 (New York Time), the record date for the Meeting, are entitled to notice of, and to vote at, the Meeting. As of November 19,

2015, there were 55,261,661 Ordinary Shares outstanding and entitled to vote. |

|

|

| Q: |

|

What happens if I sell my shares before the Meeting? |

|

|

| A: |

|

If you transfer your Ordinary Shares after the record date but before the Meeting, you will retain your right to vote at the Meeting. |

|

|

| Q: |

|

Who can help answer my questions? |

|

|

| A: |

|

If you have additional questions about the Reverse Stock Split, or would like additional copies of this Proxy Statement or the enclosed proxy card, you should contact: |

GigaMedia Limited

Attention: Amanda Chang, Investor Contact

8F, No. 22, Lane 407, Section 2, Tiding Boulevard,

Neihu District, Taipei, Taiwan (R.O.C.)

Email: Amanda.Chang@GigaMedia.Com.tw

6

BACKGROUND AND REASONS FOR THE REVERSE SHARE SPLIT

The Board of Directors is submitting the Reverse Share Split to our shareholders for approval with the primary intent of increasing the market

price of our Ordinary Shares to enhance our ability to meet the continuing listing requirements of the Nasdaq Capital Market and to make our Ordinary Shares more attractive to a broader range of institutional and other investors. On January 14,

2015, NASDAQ notified us that the trading price of our Ordinary Shares no longer met the minimum $1 bid price per share requirement. NASDAQ had first provided the Company an opportunity to regain compliance within 180 day. When the trading price of

our Ordinary Shares did not rise above $1 for ten consecutive days during this 180 calendar day period, on July 9, 2015, NASDAQ again accepted our application to have an additional 180 calendar day period, or until January 11, 2016, to

regain compliance on several conditions, including transfer our listing to the Nasdaq Capital Market. If by January 11, 2016, the trading price of our Ordinary Shares still does not rise above $1 and as a result we could not demonstrate our

compliance, our Ordinary Shares will be delisted from the Nasdaq Capital Market. Furthermore, NASDAQ also reminded us that if the Company chooses to implement a reverse share split so that the shares of our consolidated Ordinary Shares may rise

above $1, we must complete the reverse share split no later than ten business days prior to the expiration date, which is December 24, 2015, in order to timely demonstrate that the Company has regained compliance.

We believe that the Reverse Share Split will enhance our ability to maintain our listing on the Nasdaq Capital Market. Nasdaq Capital Markets

requires, among other items, maintenance of a continued price of at least $1.00 per share. Reducing the number of outstanding Ordinary Shares should, absent other factors, increase the per share market price of our Ordinary Shares, although we

cannot provide any assurance that our minimum bid price would remain following the Reverse Share Split over the minimum bid price requirement of the Nasdaq Capital Market.

After carefully evaluating our options, our Board of Directors has unanimously: (i) determined that maintaining the listing of the

Company’s Ordinary Shares on the Nasdaq Capital Market is in the best interests of our Company and its shareholders; (ii) determined that the Reverse Share Split is fair to, and in the best interests of, our Company and its shareholders;

(iii) approved the Reverse Share Split and all other transactions contemplated therein; and (iv) determined to recommend that the shareholders of our Company to approve the Reverse Share Split and all other transactions contemplated

therein.

Additionally, we believe that the Reverse Share Split will make our Ordinary Shares more attractive to a broader range of

institutional and other investors, as we believe that the current market price of our Ordinary Shares may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage

houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some

of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the

stock price than commissions on higher-priced stocks, the current average price per share of our Ordinary Shares can result in individual shareholders paying transaction costs representing a higher percentage of their total share value than would be

the case if the share price were substantially higher. We believe that the Reverse Share Split will make our Ordinary Shares more attractive and cost effective investment for many investors, which will enhance the liquidity of the holders of our

Ordinary Shares.

The Company currently does not have any plans, arrangements or understandings, written or oral, to issue any of the

authorized but unissued shares that would become available as a result of the Reverse Share Split. In addition to increasing the market price of our Ordinary Shares, the Reverse Share Split would also reduce certain of our costs, as discussed below.

Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Share Split is in the Company’s and our shareholders’ best interests.

7

RISK AND POTENTIAL DISADVANTAGES ASSOCIATED WITH THE REVERSE SHARE SPLIT

The primary purpose of the proposed Reverse Share Split of our Ordinary Shares is to consolidate the issued and outstanding shares of existing

Ordinary Shares into a smaller number of consolidated Ordinary Shares so that the shares of our consolidated Ordinary Shares will trade at a higher price per share than recent trading. Although our Board of Directors expects that the Reverse Share

Split will result in an increase in the market price of our consolidated Ordinary Shares, the Reverse Share Split may not increase the market price of our consolidated Ordinary Shares in proportion to the reduction in the number of shares of

existing Ordinary Shares outstanding before the Reverse Share Split or result in the permanent increase in the market price, which is dependent upon many factors, including the Company’s performance, prospects and other factors detailed from

time to time in the Company’s reports filed with the SEC. If the Reverse Share Split is accomplished and the market price of our Ordinary Shares declines, the percentage decline as an absolute number and as a percentage of the Company’s

overall market capitalization may be greater than would occur in the absence of a Reverse Share Split. Even though our Board of Directors believes that the potential advantages of a Reverse Share Split outweigh any disadvantages that might result,

the following are some of the possible disadvantages of a Reverse Share Split:

| • |

|

The reduced number of outstanding Ordinary Shares resulting from a Reverse Share Split could adversely affect the liquidity of our Ordinary Shares. Although our Board of Directors believes that a higher stock price may

help generate investor interest, there can be no assurance that the Reverse Share Split will result in a per share price that will attract investors or that such share price will satisfy the investing guidelines of institutional investors or

investment funds. As a result, the trading liquidity of our Ordinary Shares may not necessarily improve. |

| • |

|

There can be no assurance that the market price per share of our consolidated Ordinary Shares after the Reverse Share Split will increase in proportion to the reduction in the number of shares of existing Ordinary

Shares outstanding before the Reverse Share Split. |

| • |

|

The increase in the ratio of authorized but unissued Ordinary Shares to issued Ordinary Shares resulting from the Reverse Share Split may be construed as having an anti-takeover effect by permitting the issuance of

shares to purchasers who might oppose a hostile takeover bid or oppose any efforts to amend or repeal certain provisions of our certificate of incorporation or bylaws. |

PROCEDURES FOR IMPLEMENTING THE REVERSE SHARE SPLIT

The Reverse Share Split, if approved by our shareholders, would become effective immediately upon the filing of our revised register of

members, which we will do so immediately upon the passing of the resolution.

EFFECT OF THE REVERSE SHARE SPLIT ON HOLDERS OF ORDINARY

SHARES

Upon effecting the Reverse Share Split, every five shares of existing Ordinary Shares will be combined into one new share of

consolidated, post-reverse share split, Ordinary Shares. The table below shows, as of the Record Date, the number of outstanding Ordinary Shares that would result from the Reverse Share Split (without giving effect to the treatment of fractional

shares):

|

|

|

|

|

|

|

|

|

| Reverse Share Split Ratio |

|

Approximate Number of

Outstanding Ordinary Shares

Before the Reverse Share Split |

|

|

Approximate Number of

Outstanding Ordinary Shares

Following the Reverse Share Split |

|

|

|

|

| 5 to 1 |

|

|

55,261,661 |

|

|

|

11,052,812 |

|

The actual number of shares issued after giving effect to the Reverse Share Split will depend on the amount of

shares issued and outstanding at that time.

The Reverse Share Split will affect all holders of our Ordinary Shares uniformly and will not

affect any shareholder’s percentage ownership interest in the Company, except that as described below in “Fractional Shares”, record holders of our existing Ordinary Shares otherwise entitled to a fractional share as a result of the

Reverse Share Split will receive cash in lieu of fractional shares. In addition, the Reverse Share Split will not affect any shareholder’s proportionate voting power (subject to the treatment of fractional shares). The Reverse Share Split would

not alter the number of shares of the Company’s authorized Ordinary Shares.

The proposed Reverse Share Split will not alter the

relative rights and preferences of existing shareholders. All issued and outstanding shares of our Ordinary Shares will remain fully paid and non-assessable after the Reverse Share Split. The number of shareholders of record would not be affected by

the Reverse Share Split, except that as described below in “Fractional Shares”.

8

The implementation of the Reverse Share Split will result in an increased number of authorized

Ordinary Shares available for issuance. The resulting increase in such availability in the authorized Ordinary Shares could have a number of effects on the Company’s shareholders depending upon the exact nature and circumstances of any actual

issuances of authorized but unissued shares. By its nature, the increase in available authorized shares for issuance could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in one

or more transactions that could make a change in control or takeover of the Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock ownership or voting rights of persons seeking to obtain

control of the Company, even if the persons seeking to obtain control of the Company offer an above-market premium that is favored by a majority of the independent shareholders. Similarly, the issuance of additional shares to certain persons allied

with the Company’s management could have the effect of making it more difficult to remove the Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. However, the Company has

no current plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences. Furthermore, our Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control

of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti-takeover device.

Additionally, because holders of our Ordinary Shares have no preemptive rights to purchase or subscribe for any unissued stock of the Company,

the issuance of additional shares of authorized Ordinary Shares that will become newly available as a result of the implementation of the Reverse Share Split will reduce the current shareholders’ percentage ownership interest in the total

outstanding Ordinary Shares.

Following the Reverse Share Split, our consolidated Ordinary Shares will have new Committee on Uniform

Securities Identification Procedures (CUSIP) numbers, which is a number used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by

following the procedures described below. After the Reverse Share Split, we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended. Our consolidated Ordinary Shares will

continue to be listed on the NYSE under the symbol “GIGM”, subject to any decision of our Board of Directors to list our securities on another stock exchange.

Effect of the Reverse Share Split on Beneficial Holders of Ordinary Shares

(i.e. Shareholders who hold in street name)

Upon the implementation of the Reverse Share Split, we intend to treat shares held by shareholders through a bank, broker, custodian or other

nominee in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Share Split for their beneficial holders holding our existing

Ordinary Shares in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered shareholders for processing the Reverse Share Split. Shareholders who hold shares of our existing Ordinary

Shares with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Effect of the Reverse Share Split on Registered “Book-Entry” holders of Ordinary Shares

(i.e. shareholders that are registered on the transfer agent’s books and records

but do not hold stock certificates)

Certain of our registered holders of our Ordinary Shares may hold some or all of their shares electronically in book-entry form with the

transfer agent. These shareholders do not have stock certificates evidencing their ownership of our Ordinary Shares. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

Shareholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be

automatic) to receive whole shares of our consolidated, post-reverse share split, Ordinary Shares, subject to adjustment for treatment of fractional shares.

9

Effect of the Reverse Shares Split on Holders of Certificated Ordinary Shares

Shareholders holding shares of our existing Ordinary Shares in certificated form will be sent a transmittal letter by our transfer agent after

the Reverse Share Split has come into effect. The letter of transmittal will contain instructions on how a shareholder should surrender his, her or its certificate(s) representing shares of our existing Ordinary Shares (the “Old

Certificates”) to the transfer agent in exchange for certificates representing the appropriate number of whole shares of consolidated, post-reverse share split, Ordinary Shares (the “New Certificates”). No New Certificates

will be issued to a shareholder until such shareholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. No shareholder will be required to pay a transfer or other fee

to exchange his, her or its Old Certificates. Shareholders will then receive a New Certificate(s) representing the number of whole shares of our consolidated, post-reverse share split, Ordinary Shares that they are entitled as a result of the

Reverse Share Split, subject to the treatment of fractional shares described below. Until surrendered, we will deem outstanding Old Certificates held by shareholders to be cancelled and only to represent the number of whole shares of our

consolidated, post-reverse share split, Ordinary Shares to which these shareholders are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of

stock, will automatically be exchanged for New Certificates. If an Old Certificate has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends that are on the back of the Old

Certificate(s).

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED

TO DO SO.

Effect of the Reverse Share Split on Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or

Exchangeable Securities

Based upon the Reverse Share Split ratio determined by our Board of Directors, proportionate adjustments are

generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities, entitling the holders to purchase, exchange

for, or convert into, shares of our existing Ordinary Shares. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately

the same value of shares of Ordinary Shares being delivered upon such exercise, exchange or conversion, immediately following the Reverse Share Split as was the case immediately preceding the Reverse Share Split. The number of shares deliverable

upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares.

FRACTIONAL SHARES

No

scrip or fractional shares would be issued if, as a result of the Reverse Share Split, a shareholder would otherwise become entitled to a fractional share. Instead, we would pay to the shareholder, in cash, the value of any fractional share arising

from the Reverse Share Split. The cash payment would equal the closing sale price per share of our Ordinary Shares as reported on the Nasdaq Capital Market on the last trading day preceding the effective date of the Reverse Share Split multiplied by

the number of shares of pre-split Ordinary Share held by the shareholder that would otherwise have been exchanged for such fractional share. No transaction costs would be assessed to shareholders for the cash payment. Shareholders would not be

entitled to receive interest for their fractional shares.

ACCOUNTING MATTERS

The proposed Reverse Share Split will not affect the par value of our Ordinary Share per share. As a result the stated capital attributable to

our Ordinary Shares and the additional paid-in capital account on our balance sheet will not change due to the Reverse Share Split. Reported per share net income or loss will be higher because there will be fewer Ordinary Shares outstanding.

10

CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE SHARE SPLIT

The following summary describes certain material U.S. federal income tax consequences of the Reverse Share Split to holders of our Ordinary

Shares:

Unless otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our

Ordinary Shares that is a citizen or individual resident of the United States, a corporation organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on

a net income basis in respect of our Ordinary Shares (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise primary supervision over administration of such trust and one or more U.S. persons have

the authority to control all substantial decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose income is subject to U.S. federal income taxation regardless of its source may also be a

U.S. holder. This summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or

that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift

institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that elect to mark to market and dealers in securities or

currencies, (ii) persons that hold our Ordinary Shares as part of a position in a “straddle” or as part of a “hedging”, “conversion” or other integrated investment transaction for federal income tax purposes, or

(iii) persons that do not hold our Ordinary Shares as “capital assets” (generally, property held for investment).

If a

partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Ordinary Shares, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status

of the partner and the activities of the partnership. Partnerships that hold our Ordinary Shares, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Share Split.

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative

rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a

material effect on the U.S. federal income tax consequences of the Reverse Share Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING THE

U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE SHARE SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION

U.S. Holders

The Reverse

Share Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a shareholder generally will not recognize gain or loss on the Reverse Share Split, except to the extent of cash, if any, received in lieu of a

fractional share interest in the consolidated, post-reverse share split, Ordinary Shares. The aggregate tax basis of the consolidated, post-reverse share split, Ordinary Shares received will be equal to the aggregate tax basis of the pre-reverse

share split Ordinary Shares exchanged therefore (excluding any portion of the holder’s basis allocated to fractional shares), and the holding period of the post-split shares received will include the holding period of the pre-split shares

exchanged. A holder of the pre-split shares who receives cash will generally recognize gain or loss equal to the difference between the portion of the tax basis of the pre-split shares allocated to the fractional share interest and the cash

received. Such gain or loss will be a capital gain or loss and will be short term if the pre-split shares were held for one year or less and long term if held more than one year. No gain or loss will be recognized by us as a result of the Reverse

Share Split.

NO APPRAISAL RIGHT

Under Singapore law and our charter documents, holders of our Ordinary Shares will not be entitled to dissenter’s rights or appraisal

rights with respect to the Reverse Share Split.

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE REVERSE SHARE SPLIT.

11

BENEFICIAL OWNERSHIP OF ORDINARY SHARES

Major Shareholders

The following table

sets forth information known to us with respect to the ownership of our shares as of November 19, 2015 by each shareholder known by us to own more than 5% of our shares:

|

|

|

|

|

|

|

|

|

| Name of Owner |

|

Shares Owned |

|

|

Percentage of

Shares Owned |

|

| Champion Allied Limited(1) |

|

|

10,799,999 |

|

|

|

19.54 |

% |

| (1) |

Through Champion Allied Limited, a British Virgin Islands company, Andre Koo has a beneficial ownership of 10,799,999 Ordinary Shares of our Company. |

As of November 19, 2015, we had 55,261,661 Ordinary Shares outstanding, of which 44,461,662 Ordinary Shares representing 80.46% of our total

outstanding Ordinary Shares were not held by our major shareholders as disclosed above. As of November 19, 2015, one shareholder of record with a registered address in the United States, Cede & Co., nominee of The Depository Trust Company,

held 43,620249 Shares.

WHERE YOU CAN FIND MORE INFORMATION

We file reports and other information with the SEC under the Exchange Act. You may read and copy this information at the SEC’s public

reference room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. For further information concerning the SEC’s public reference room, you may call the SEC at 1-800-SEC-0330. Our SEC filings are also available to the public from

commercial document retrieval services and at the internet world wide web site maintained by the SEC at www.sec.gov.

The SEC reports set

forth below, as well as reports we file with or submit to the SEC after the date of this Proxy Statement, contain important information about GigaMedia and its financial condition, and are hereby incorporated by reference into this Proxy Statement:

| |

• |

|

Annual Report on Form 20-F for the fiscal year ended December 31, 2014, filed on April 28, 2015; and |

| |

• |

|

Reports of Foreign Private Issuer on Form 6-K submitted on January 20, 2015; February 11, 2015; March 13, 2015; April 10, 2015; April 17, 2015; May 8,

2015; May 12, 2015; May 27, 2015; June 26, 2015, July 7, 2017, July 10, 2015, August 5, 2015 and October 7, 2015. |

Our Annual Report on Form 20-F for the fiscal year ended December 31, 2014 contains a detailed description of our business, and certain

risk factors in connection with the purchase or retention of Ordinary Shares.

EXCEPT FOR INFORMATION SPECIFICALLY INCORPORATED HEREIN BY

REFERENCE, YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. WE HAVE NOT AUTHORIZED ANYONE TO GIVE ANY INFORMATION DIFFERENT FROM THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. THIS PROXY STATEMENT IS DATED NOVEMBER 24,

2015. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROXY STATEMENT IS ACCURATE AS OF ANY LATER DATE, AND THE MAILING OF THIS PROXY STATEMENT TO SHAREHOLDERS SHALL NOT CREATE ANY IMPLICATION TO THE CONTRARY.

12

OTHER MATTERS

Management knows of no other business to be transacted at the Meeting; but, if any other matters are properly presented to the Meeting, the

persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

|

| By order of the Board of Directors, |

|

| /s/ CHIEN, Mo Na |

| CHIEN, Mo Na |

| Chairman of the Board of Director |

November 24, 2015

13

Exhibit 99.2

GIGAMEDIA LIMITED

8F, NO. 22, LANE 407, SECTION 2

TIDING BLVD.

NEIHU DISTRICT, TAIPEI 114 TAIWAN R.O.C

ELECTRONIC DELIVERY OF

FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy

statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please go to www.proxyvote.com and indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY MAIL

Mark, sign and date your proxy card and return it, no less than

48 hours before the time of the meeting, in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

M97644-S39104

KEEP THIS PORTION FOR YOUR RECORDS

PLEASE SIGN, DATE AND RETURN THIS PROXY IN THE ENCLOSED

POSTAGE PRE-PAID ENVELOPE.

DETACH AND RETURN THIS PORTION ONLY

GIGAMEDIA

LIMITED

The Board of Directors recommends you vote FOR the following proposal: For Against Abstain

1. Approval to effect a reverse share split of the Company’s ordinary shares by a ratio of five to one

NOTE: Such other business as may properly come before the meeting or any adjournment thereof.

For address changes/comments, mark here. (see reverse for instructions)

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint

owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting:

The Notice and Proxy Statement are available at www.proxyvote.com.

M97645-S39104

GIGAMEDIA LIMITED

Extraordinary General Meeting of Shareholders

December 16, 2015 10:00 AM

This proxy is solicited by the Board of Directors

I/We, being a Shareholder/Shareholders of the above named Company, hereby appoint Kuo-Lun Huang (aka Collin Hwang) of 8F, No. 22, Lane 407, Section 2 Tiding Blvd., Neihu

District, Taipei R.O.C., failing whom the Chairman of the Meeting, as my/our proxy to vote for me/us on my/our behalf at the Extraordinary General Meeting of the Company to be held at 1404 5 Sunbeam Plaza, 1155 Canton Rd., Kowloon, Hong Kong on

Wednesday, December 16, 2015, at 10:00 AM local time, and at any adjournment or postponement thereof.

This Proxy, when properly executed, and returned in a

timely manner, will be voted at the Extraordinary General Meeting and any adjournments thereof in the manner described herein. If no contrary indication is made, the proxy will be voted as recommended by the Board of Directors and the Company’s

management.

1. The proxy form must be signed by the Shareholder or by the Shareholders’ attorney duly authorized in writing or, if the appointer is a

corporation, either, under seal or in some other manner approved by the directors of the Company.

2. To be effective, the proxy form (and power of attorney or

other authority under which it is signed or a notarially certified copy of such power of authority, if relevant) must be returned to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, no less than 48 hours before the meeting.

Address Changes/Comments:

(If you noted any Address Changes/Comments above,

please mark corresponding box on the reverse side.)

Continued and to be signed on reverse side

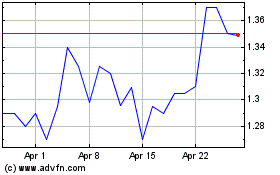

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

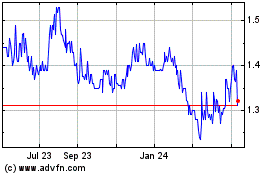

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Apr 2023 to Apr 2024