UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

11/24/2015

SIGNET

JEWELERS LIMITED

(Exact

name of registrant as specified in its charter)

Commission

File Number: 1-32349

|

Bermuda

|

|

|

|

(State or other jurisdiction of

incorporation)

|

|

(IRS Employer

Identification No.)

|

Clarendon House

2

Church Street

Hamilton

HM11

Bermuda

(Address

of principal executive offices, including zip code)

441

296 5872

(Registrant's telephone number, including area

code)

(Former name or former address, if changed since

last report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On November 24, 2015, the Registrant issued a press release announcing

its unaudited earnings and results of operations for the third quarter

ended October 31, 2015. A copy of the press release is attached hereto

as Exhibit 99.1 to this Form 8-K.

The information in this Current Report on Form 8-K is being furnished

pursuant to Item 2.02 Results of Operations and Financial Condition. In

accordance with General Instruction B.2 of Form 8-K, the information in

this report shall not be deemed "filed" for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the "Exchange Act"),

or otherwise subject to the liabilities of that section, nor shall it be

deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly stated by

specific reference in such filing.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

SIGNET JEWELERS LIMITED

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

November 24, 2015

|

By:

|

|

/s/ Michele Santana

|

|

|

|

|

|

Michele Santana

|

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

EX-99.1

|

Press Release – November 24, 2015

|

Exhibit 99.1

Signet

Jewelers Reports Third Quarter Financial Results

Same

Store Sales up 3.3%; EPS $0.19; Adjusted EPS $0.33, up 57.1%

HAMILTON, Bermuda--(BUSINESS WIRE)--November 24, 2015--Signet Jewelers

Limited (“Signet”) (NYSE and LSE:SIG), the world's largest retailer of

diamond jewelry, today announced its results for the 13 weeks ended

October 31, 2015 (“third quarter Fiscal 2016”).

“Signet delivered another quarter of continued growth, highlighted by a

same store sales increase of 3.3% and adjusted earnings per share growth

of 57.1%," commented Mark Light, Chief Executive Officer of

Signet Jewelers. "We are pleased to report strong sales growth in line

with our third quarter guidance. We also delivered excellent earnings

growth, although earnings were affected by a modest margin impact due to

a sales mix shift from Jared to Kay."

Light added, "We are currently experiencing an encouraging start to

November particularly at Jared and Zales. The implementation of store

operations initiatives in the third quarter combined with significant

investment in our recently launched innovative merchandising and

marketing programs have positioned Signet for a strong fourth quarter.

"The integration of Zale continues to go well, and we remain confident

we will deliver $30 million to $35 million in net synergies this fiscal

year. We remain committed to maintaining profitable growth while

balancing investment back into the business with shareholder return.

“I want to thank all Signet team members for their contributions to our

results and for their hard work in preparing for fourth quarter.”

Third Quarter Fiscal 2016 Diluted Earnings per Share (“EPS”) Analysis:

Third quarter EPS was $0.19. Third quarter Adjusted EPS was $0.33.

Adjusted EPS can be reconciled to EPS as follows:

|

|

|

|

|

|

|

|

|

Adjusted EPS1

|

|

Purchase accounting adjustments

|

|

Transaction costs

|

|

Earnings per share

|

|

$0.33

|

|

$(0.03)

|

|

$(0.11)

|

|

$0.19

|

|

|

|

|

|

|

|

|

|

1. Throughout this release, Signet uses adjusted metrics which

adjust for purchase accounting and transaction costs in relation to

the Zale acquisition. See non-GAAP reconciliation tables.

|

|

|

Financial Guidance:

|

|

|

13 weeks ended January 30, 2016 ("Fourth quarter Fiscal 2016")

|

|

Same store sales

|

|

|

3.5% to 5.0%

|

|

EPS

|

|

|

$3.30 to $3.50

|

|

Adjusted EPS

|

|

|

$3.40 to $3.60

|

|

|

|

|

|

|

Fiscal 2016

|

|

Effective tax rate

|

|

|

28% to 29%

|

|

Capital expenditures

|

|

|

$260 million to $280 million

|

|

|

|

|

(reduced from $275 million to $325 million)

|

|

Net selling square footage growth

|

|

|

2% to 3%

|

|

Net synergies

|

|

|

$30 million to $35 million

|

|

|

|

|

|

Capital expenditures will be driven primarily by new Kay and Jared

stores, store remodels, and information technology directed principally

to the Zale division. The reduction from previous guidance is due

principally to timing around remodels, information technology, and

facilities.

|

|

|

Net selling square footage growth is expected to be driven by the

following projected store (and kiosk) changes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross locations

|

|

Net locations

|

|

Net square feet

|

|

Sterling Jewelers division

|

|

|

|

up 55 to 65

|

|

up 30 to 35

|

|

up 3% to 4%

|

|

Zale division

|

|

|

|

up 30 to 35

|

|

approximately flat

|

|

approximately flat

|

|

UK Jewelry division

|

|

|

|

up 5 to 10

|

|

slight increase

|

|

slight increase

|

|

|

|

|

|

|

|

|

|

|

Third quarter Fiscal 2016 Sales Highlights:

Total sales were $1,216.4 million, up $38.5 million or 3.3%, compared to

$1,177.9 million in the 13 weeks ended November 1, 2014 ("third quarter

Fiscal 2015"). Same store sales also increased 3.3% compared to an

increase of 4.2% in the third quarter Fiscal 2015 driven primarily by

branded bridal sales across all store banners as well as higher sales

overall in the Kay Jewelers brand. eCommerce sales in the third quarter

were $50.5 million, up $5.7 million or 12.7% compared to $44.8 million

in the third quarter Fiscal 2015.

-

Sterling Jewelers division sales increases were driven by Kay [+7.1%]

and partially offset by a same store sales decline in Jared [-2.7%].

Branded bridal and select diamond jewelry performed well across store

banners. The average transaction price increased 3.0% and the number

of transactions decreased 0.7%.

-

Zale division sales increases were driven by branded bridal

collections and Piercing Pagoda. The average transaction price

increased 1.0% and the number of transactions increased 1.0%. Piercing

Pagoda's average transaction price increased 11.6%, while the number

of transactions remained flat. Zale Jewelry's average transaction

price decreased 1.9%, while the number of transactions increased 2.9%.

-

UK Jewelry division total sales decreases were driven entirely by

foreign currency exchange rates. The increase in same store sales and

total sales at constant exchange rates was driven primarily by strong

results in diamond jewelry and watches. The average transaction price

and number of transactions for the division increased by 3.4% and

2.3%, respectively.

|

Sales change from previous year

|

|

|

|

Third quarter

Fiscal 2016

|

|

|

|

Same

store

sales¹

|

|

Non-same

store

sales, net²

|

|

Total sales

at constant

exchange

rate³

|

|

Exchange

translation

impact³

|

|

Total

sales

|

|

Total sales

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kay

|

|

|

|

7.1

|

%

|

|

1.9

|

%

|

|

9.0

|

%

|

|

—

|

%

|

|

9.0

|

%

|

|

$

|

462.9

|

|

Jared

|

|

|

|

(2.7

|

)%

|

|

4.9

|

%

|

|

2.2

|

%

|

|

—

|

%

|

|

2.2

|

%

|

|

$

|

232.5

|

|

Regional brands

|

|

|

|

0.3

|

%

|

|

(7.1

|

)%

|

|

(6.8

|

)%

|

|

—

|

%

|

|

(6.8

|

)%

|

|

$

|

38.1

|

|

Sterling Jewelers division

|

|

|

|

3.5

|

%

|

|

2.4

|

%

|

|

5.9

|

%

|

|

—

|

%

|

|

5.9

|

%

|

|

$

|

733.5

|

|

Zales Jewelers

|

|

|

|

2.3

|

%

|

|

—

|

%

|

|

2.3

|

%

|

|

—

|

%

|

|

2.3

|

%

|

|

$

|

220.5

|

|

Gordon’s Jewelers

|

|

|

|

(11.0

|

)%

|

|

(9.6

|

)%

|

|

(20.6

|

)%

|

|

—

|

%

|

|

(20.6

|

)%

|

|

$

|

13.9

|

|

Zale US Jewelry

|

|

|

|

1.4

|

%

|

|

(0.8

|

)%

|

|

0.6

|

%

|

|

—

|

%

|

|

0.6

|

%

|

|

$

|

234.4

|

|

Peoples Jewellers

|

|

|

|

2.2

|

%

|

|

1.1

|

%

|

|

3.3

|

%

|

|

(17.2

|

)%

|

|

(13.9

|

)%

|

|

$

|

40.9

|

|

Mappins

|

|

|

|

(1.6

|

)%

|

|

(6.7

|

)%

|

|

(8.3

|

)%

|

|

(15.0

|

)%

|

|

(23.3

|

)%

|

|

$

|

6.6

|

|

Zale Canada Jewelry

|

|

|

|

1.6

|

%

|

|

(0.1

|

)%

|

|

1.5

|

%

|

|

(16.8

|

)%

|

|

(15.3

|

)%

|

|

$

|

47.5

|

|

Zale Jewelry

|

|

|

|

1.5

|

%

|

|

(0.7

|

)%

|

|

0.8

|

%

|

|

(3.3

|

)%

|

|

(2.5

|

)%

|

|

$

|

281.9

|

|

Piercing Pagoda

|

|

|

|

10.0

|

%

|

|

3.5

|

%

|

|

13.5

|

%

|

|

—

|

%

|

|

13.5

|

%

|

|

$

|

48.0

|

|

Zale division

|

|

|

|

2.6

|

%

|

|

(0.2

|

)%

|

|

2.4

|

%

|

|

(2.9

|

)%

|

|

(0.5

|

)%

|

|

$

|

329.9

|

|

H.Samuel

|

|

|

|

2.0

|

%

|

|

(0.6

|

)%

|

|

1.4

|

%

|

|

(5.8

|

)%

|

|

(4.4

|

)%

|

|

$

|

73.5

|

|

Ernest Jones

|

|

|

|

6.3

|

%

|

|

2.3

|

%

|

|

8.6

|

%

|

|

(6.2

|

)%

|

|

2.4

|

%

|

|

$

|

75.9

|

|

UK Jewelry division

|

|

|

|

4.1

|

%

|

|

0.8

|

%

|

|

4.9

|

%

|

|

(6.0

|

)%

|

|

(1.1

|

)%

|

|

$

|

149.4

|

|

Other segment

|

|

|

|

—

|

%

|

|

33.3

|

%

|

|

33.3

|

%

|

|

—

|

%

|

|

33.3

|

%

|

|

$

|

3.6

|

|

Signet

|

|

|

|

3.3

|

%

|

|

1.6

|

%

|

|

4.9

|

%

|

|

(1.6

|

)%

|

|

3.3

|

%

|

|

$

|

1,216.4

|

|

Adjusted Signet3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

1,222.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Based on stores opened for at least 12 months.

|

|

2.

|

|

Includes all sales from stores not open for 12 months.

|

|

3.

|

|

Non-GAAP measure.

|

|

|

|

|

Third quarter Fiscal 2016 Financial Highlights:

Gross margin was $367.7 million or 30.2% of sales compared to $345.9

million or 29.4% of sales in the third quarter Fiscal 2015. In the third

quarter Fiscal 2016, adjusted gross margin was $373.8 million or 30.6%

of adjusted sales compared to the prior year adjusted gross margin rate

of 30.6%. The flat adjusted gross margin rate was unfavorably impacted

by the credit mix resulting from softer sales at Jared compared to Kay.

As Jared typically has higher credit quality customers than Kay, this

led to greater net bad debt expense. This mix shift unfavorably impacted

gross margin by approximately $4.5 million. Importantly, the credit

portfolio continues perform profitably and as-expected given the new

customer mix. The net bad debt impact was entirely offset by gross

margin synergies, related mostly to the Zale division, as well as

favorable commodity costs.

-

Gross margin dollars in the Sterling Jewelers division increased $7.3

million compared to prior year third quarter. The gross margin rate,

down 90 basis points, decreased principally due to higher net bad debt

from higher in-house credit sales and customer credit mix. This was

partially offset by an improvement in the merchandise margin from

favorable commodity costs.

-

Gross margin dollars in the Zale division increased $1.9 million

compared to prior year third quarter, reflecting higher sales and an

adjusted gross margin rate increase of 120 basis points. The gross

margin rate expansion was driven principally by improved merchandise

margin attributed to synergy initiatives and favorable commodity costs.

-

Gross margin dollars in the UK Jewelry division increased $0.6 million

compared to prior year third quarter, and the gross margin rate

increased 70 basis points. The gross margin rate expansion was driven

principally by favorable commodity costs and leverage on store

occupancy.

Selling, general, and administrative expense ("SGA") was $395.0 million

or 32.4% of sales compared to $388.7 million or 33.0% of sales in third

quarter Fiscal 2015. Included in SGA are $7.4 million of

transaction-related expense and purchase accounting adjustments compared

to prior year third quarter expense of $7.0 million.

-

Third quarter Fiscal 2016 adjusted SGA was $387.6 million or 31.7% of

sales compared to $381.7 million or 32.1% in the prior year. The 40

basis point decrease was due to lower payroll partially offset by

incremental investments in Zale principally around advertising,

information technology support, and employee benefits.

Other operating income was $60.9 million compared to $53.5 million in

the prior year third quarter, up $7.4 million or 13.8%. This increase

was due to the Sterling division’s higher interest income earned from

higher outstanding receivable balances.

Operating income was $33.6 million, or 2.8% of sales compared to $10.7

million or 0.9% of sales last year. Included in operating income were

purchase accounting and transaction-related adjustments which reduced

operating income by $13.5 million in the third quarter compared to

adjustments of $25.0 in the prior year third quarter. Adjusted operating

income was $47.1 million, or 3.9% of sales compared to adjusted

operating income of $35.7 million or 3.0% of sales in the prior year

third quarter. Signet's 90 basis point increase in adjusted operating

margin was due principally to higher sales, net synergies, and SGA

leverage.

-

Operating income in the Sterling Jewelers division was $77.2 million

or 10.5% of sales compared to $68.1 million or 9.8% in the prior year

third quarter. The increase was offset in part by the unfavorable

credit quality mix shift which seasonally has a more pronounced impact

in the relatively lower-volume third quarter.

-

Operating loss in the Zale division, inclusive of purchase accounting

adjustments, was $24.3 million or 7.4% of sales compared to an

operating loss of $34.5 million or 10.4% in the prior year third

quarter.

-

Operating income in the UK division was $0.0 million of sales compared

to an operating loss of $2.7 million or 1.8% of sales in the prior

year third quarter.

-

Operating loss of the Other operating segment, which includes

unallocated corporate administrative costs and the costs of Signet's

diamond sourcing initiative, was $19.3 million compared to a loss of

$20.2 million in the prior year third quarter. The favorable change

was driven by the decline of transaction costs as the Zale acquisition

becomes more fully integrated.

Income tax expense was $6.9 million compared to a benefit of $0.6

million in the prior year third quarter. This year's annual effective

tax rate is expected to be 28% to 29% driven by pre-tax earnings mix by

jurisdiction and the $34.2 million appraisal rights legal settlement in

August which is not deductible for tax purposes.

Balance Sheet and Other Highlights at October 31, 2015:

Cash and cash equivalents were $77.2 million compared to $87.6 million

as of November 1, 2014. The lower cash position was primarily due to the

cash payment of the appraisal litigation settlement and share

repurchases, partially offset by favorable cash provided by operating

activities.

During the third quarter, Signet repurchased $30.0 million of shares, or

239,370 shares at an average cost of $125.33 per share. Year to date

Signet repurchased $111.9 million of shares, or 868,325 shares at an

average cost of $128.91 per share. As of October 31, 2015, there was

$153.7 million remaining under Signet’s 2013 share repurchase

authorization program.

Net accounts receivable were $1,451.5 million, up 12.3% compared to

$1,292.1 million as of November 1, 2014. In the Sterling Jewelers

division the credit participation rate was 63.0% in the 39 weeks ended

October 31, 2015 compared to 61.7% in the 39 weeks ended November 1,

2014. The increase in the credit participation rate was driven by Kay.

Net inventories were $2,727.0 million, up 2.0% compared to $2,674.6

million as of the prior year period due primarily to more stores offset

in part by improved inventory management. With third quarter total sales

growth of 3.3%, Signet was well-positioned with a clean inventory

position to start the fourth quarter.

Long term debt was $1,338.7 million compared to $1,371.3 million in the

prior year period.

On October 31, 2015, Signet had 3,618 stores, consisting of the

following:

|

|

|

|

|

|

|

|

|

|

|

|

|

Store count

|

|

|

|

Jan 31, 2015

|

|

Openings

|

|

Closures

|

|

Oct 31, 2015

|

|

Kay

|

|

|

|

1,094

|

|

37

|

|

(5

|

)

|

|

1,126

|

|

Jared

|

|

|

|

253

|

|

16

|

|

(1

|

)

|

|

268

|

|

Regional brands

|

|

|

|

157

|

|

—

|

|

(7

|

)

|

|

150

|

|

Sterling Jewelers division

|

|

|

|

1,504

|

|

53

|

|

(13

|

)

|

|

1,544

|

|

Zales

|

|

|

|

716

|

|

10

|

|

(6

|

)

|

|

720

|

|

Gordons

|

|

|

|

69

|

|

—

|

|

—

|

|

|

69

|

|

Peoples

|

|

|

|

144

|

|

1

|

|

(5

|

)

|

|

140

|

|

Mappins

|

|

|

|

43

|

|

—

|

|

—

|

|

|

43

|

|

Total Zale Jewelry

|

|

|

|

972

|

|

11

|

|

(11

|

)

|

|

972

|

|

Piercing Pagoda

|

|

|

|

605

|

|

7

|

|

(10

|

)

|

|

602

|

|

Zale division

|

|

|

|

1,577

|

|

18

|

|

(21

|

)

|

|

1,574

|

|

H.Samuel

|

|

|

|

302

|

|

—

|

|

(2

|

)

|

|

300

|

|

Ernest Jones

|

|

|

|

196

|

|

5

|

|

(1

|

)

|

|

200

|

|

UK Jewelry division

|

|

|

|

498

|

|

5

|

|

(3

|

)

|

|

500

|

|

Signet

|

|

|

|

3,579

|

|

76

|

|

(37

|

)

|

|

3,618

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call:

A conference call is scheduled today at 8:30 a.m. ET and a simultaneous

audio webcast and slide presentation are available at www.signetjewelers.com.

The slides are available to be downloaded from the website ahead of the

conference call. The call details are:

|

Dial-in:

|

|

|

|

|

1-647-788-4901

|

|

|

|

|

Access code: 57403664

|

A replay and transcript of the call will be posted on Signet's website

as soon as they are available and will be accessible for one year.

About Signet and Safe Harbor Statement:

Signet Jewelers Limited is the world's largest retailer of diamond

jewelry. Signet operates approximately 3,600 stores primarily under the

name brands of Kay Jewelers, Zales, Jared The Galleria Of Jewelry,

H.Samuel, Ernest Jones, Peoples and Piercing Pagoda. Further information

on Signet is available at www.signetjewelers.com. See also www.kay.com,

www.zales.com, www.jared.com, www.hsamuel.co.uk, www.ernestjones.co.uk,

www.peoplesjewellers.com and www.pagoda.com.

This release contains statements which are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of

1995. These statements, based upon management's beliefs and expectations

as well as on assumptions made by and data currently available to

management, include statements regarding, among other things, Signet's

results of operation, financial condition, liquidity, prospects, growth,

strategies and the industry in which Signet operates. The use of the

words "expects," "intends," "anticipates," "estimates," "predicts,"

"believes," "should," "potential," "may," "forecast," "objective,"

"plan," or "target," and other similar expressions are intended to

identify forward-looking statements. These forward-looking statements

are not guarantees of future performance and are subject to a number of

risks and uncertainties, including but not limited to general economic

conditions, risks relating to Signet being a Bermuda corporation, the

merchandising, pricing and inventory policies followed by Signet, the

reputation of Signet and its brands, the level of competition in the

jewelry sector, the cost and availability of diamonds, gold and other

precious metals, regulations relating to customer credit, seasonality of

Signet's business, financial market risks, deterioration in customers’

financial condition, exchange rate fluctuations, changes in Signet's

credit rating, changes in consumer attitudes regarding jewelry,

management of social, ethical and environmental risks, security breaches

and other disruptions to Signet's information technology infrastructure

and databases, inadequacy in and disruptions to internal controls and

systems, changes in assumptions used in making accounting estimates

relating to items such as extended service plans and pensions, the

impact of the acquisition of Zale Corporation on relationships,

including with employees, suppliers, customers and competitors, and our

ability to successfully integrate Zale's operations and to realize

synergies from the transaction.

For a discussion of these and other risks and uncertainties which could

cause actual results to differ materially from those expressed in any

forward-looking statement, see the "Risk Factors" section of Signet's

Fiscal 2015 Annual Report on Form 10-K filed with the SEC on March 26,

2015. Signet undertakes no obligation to update or revise any

forward-looking statements to reflect subsequent events or

circumstances, except as required by law.

Signet uses adjusted metrics, which adjust for purchase accounting and

transaction costs related to the acquisition to give investors

information as to Signet’s results without regard to the expenses

associated with the acquisition.

|

|

|

Non-GAAP Reconciliation for the third quarter ended October 31,

2015 (in mil. of $ except per share data)

|

|

|

|

|

|

Adjusted Signet

|

|

Purchase

Accounting1

|

|

Transaction

Costs2

|

|

Signet

|

|

Sales

|

|

|

|

1,222.6

|

|

|

100.0

|

%

|

|

(6.2

|

)

|

|

—

|

|

|

1,216.4

|

|

|

100.0

|

%

|

|

Cost of sales

|

|

|

|

(848.8

|

)

|

|

(69.4

|

)%

|

|

0.1

|

|

|

—

|

|

|

(848.7

|

)

|

|

(69.8

|

)%

|

|

Gross margin

|

|

|

|

373.8

|

|

|

30.6

|

%

|

|

(6.1

|

)

|

|

—

|

|

|

367.7

|

|

|

30.2

|

%

|

|

Selling, general and administrative expenses

|

|

|

|

(387.6

|

)

|

|

(31.7

|

)%

|

|

2.4

|

|

|

(9.8

|

)

|

|

(395.0

|

)

|

|

(32.4

|

)%

|

|

Other operating income, net

|

|

|

|

60.9

|

|

|

5.0

|

%

|

|

—

|

|

|

—

|

|

|

60.9

|

|

|

5.0

|

%

|

|

Operating income (loss)

|

|

|

|

47.1

|

|

|

3.9

|

%

|

|

(3.7

|

)

|

|

(9.8

|

)

|

|

33.6

|

|

|

2.8

|

%

|

|

Interest expense, net

|

|

|

|

(11.7

|

)

|

|

(1.0

|

)%

|

|

—

|

|

|

—

|

|

|

(11.7

|

)

|

|

(1.0

|

)%

|

|

Income before income taxes

|

|

|

|

35.4

|

|

|

2.9

|

%

|

|

(3.7

|

)

|

|

(9.8

|

)

|

|

21.9

|

|

|

1.8

|

%

|

|

Income taxes

|

|

|

|

(9.6

|

)

|

|

(0.8

|

)%

|

|

1.7

|

|

|

1.0

|

|

|

(6.9

|

)

|

|

(0.6

|

)%

|

|

Net income (loss)

|

|

|

|

25.8

|

|

|

2.1

|

%

|

|

(2.0

|

)

|

|

(8.8

|

)

|

|

15.0

|

|

|

1.2

|

%

|

|

Earnings per share – diluted

|

|

|

|

0.33

|

|

|

|

|

(0.03

|

)

|

|

(0.11

|

)

|

|

0.19

|

|

|

|

|

(1)

|

|

Includes deferred revenue adjustments related to acquisition

accounting which resulted in a reset of deferred revenue associated

with extended service plans previously sold by Zale Corporation.

Similar to the Sterling Jewelers division, historically, Zale

Corporation deferred the revenue generated by the sale of lifetime

warranties and recognized revenue in relation to the pattern of

costs expected to be incurred, which included a profit margin on

activities related to the initial selling effort. In acquisition

accounting, deferred revenue is only recognized when a legal

performance obligation is assumed by the acquirer. The fair value of

deferred revenue is determined based on the future obligations

associated with the outstanding plans at the time of the

acquisition. The acquisition accounting adjustment results in a

reduction to the deferred revenue balance from $183.8 million to

$93.3 million as of May 29, 2014 as the fair value was determined

through the estimation of costs remaining to be incurred, plus a

reasonable profit margin on the estimated costs. Revenues generated

from the sale of extended services plans subsequent to the

acquisition are recognized in revenue in a manner consistent with

Signet’s methodology. Additionally, accounting adjustments include

the amortization of acquired intangibles.

|

|

|

|

(2)

|

|

Transaction costs are primarily attributed to the legal settlement

over appraisal rights and consulting expenses. These costs are

included within Signet’s Other segment.

|

|

|

|

|

|

|

|

Non-GAAP Reconciliation for the third quarter ended November 1,

2014 (in mil. of $ except per share data)

|

|

|

|

|

|

Adjusted Signet

|

|

Purchase

Accounting1

|

|

Transaction

Costs2

|

|

Signet

|

|

Sales

|

|

|

|

1,189.4

|

|

|

100.0

|

%

|

|

(11.5

|

)

|

|

—

|

|

|

1,177.9

|

|

|

100.0

|

%

|

|

Cost of sales

|

|

|

|

(825.5

|

)

|

|

(69.4

|

)%

|

|

(6.5

|

)

|

|

—

|

|

|

(832.0

|

)

|

|

(70.6

|

)%

|

|

Gross margin

|

|

|

|

363.9

|

|

|

30.6

|

%

|

|

(18.0

|

)

|

|

—

|

|

|

345.9

|

|

|

29.4

|

%

|

|

Selling, general and administrative expenses

|

|

|

|

(381.7

|

)

|

|

(32.1

|

)%

|

|

4.4

|

|

|

(11.4

|

)

|

|

(388.7

|

)

|

|

(33.0

|

)%

|

|

Other operating income, net

|

|

|

|

53.5

|

|

|

4.5

|

%

|

|

—

|

|

|

—

|

|

|

53.5

|

|

|

4.5

|

%

|

|

Operating income (loss)

|

|

|

|

35.7

|

|

|

3.0

|

%

|

|

(13.6

|

)

|

|

(11.4

|

)

|

|

10.7

|

|

|

0.9

|

%

|

|

Interest expense, net

|

|

|

|

(11.0

|

)

|

|

(0.9

|

)%

|

|

(1.6

|

)

|

|

—

|

|

|

(12.6

|

)

|

|

(1.1

|

)%

|

|

Income before income taxes

|

|

|

|

24.7

|

|

|

2.1

|

%

|

|

(15.2

|

)

|

|

(11.4

|

)

|

|

(1.9

|

)

|

|

(0.2

|

)%

|

|

Income taxes

|

|

|

|

(8.2

|

)

|

|

(0.7

|

)%

|

|

5.8

|

|

|

3.0

|

|

|

0.6

|

|

|

0.1

|

%

|

|

Net income (loss)

|

|

|

|

16.5

|

|

|

1.4

|

%

|

|

(9.4

|

)

|

|

(8.4

|

)

|

|

(1.3

|

)

|

|

(0.1

|

)%

|

|

Earnings per share – diluted

|

|

|

|

0.21

|

|

|

|

|

(0.12

|

)

|

|

(0.11

|

)

|

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Includes deferred revenue adjustments related to acquisition

accounting which resulted in a reset of deferred revenue associated

with extended service plans previously sold by Zale Corporation.

Similar to the Sterling Jewelers division, historically, Zale

Corporation deferred the revenue generated by the sale of lifetime

warranties and recognized revenue in relation to the pattern of

costs expected to be incurred, which included a profit margin on

activities related to the initial selling effort. In acquisition

accounting, deferred revenue is only recognized when a legal

performance obligation is assumed by the acquirer. The fair value of

deferred revenue is determined based on the future obligations

associated with the outstanding plans at the time of the

acquisition. The acquisition accounting adjustment resulted in a

reduction to the deferred revenue balance from $183.8 million to

$93.3 million as of May 29, 2014 as the fair value was determined

through the estimation of costs remaining to be incurred, plus a

reasonable profit margin on the estimated costs. Revenues generated

from the sale of extended services plans subsequent to the

acquisition are recognized in revenue in a manner consistent with

Signet’s methodology. Additionally, accounting adjustments include

the recognition of a portion of the inventory fair value step-up of

$32.2 million and amortization of acquired intangibles.

|

|

|

|

(2)

|

|

Transaction costs include transaction-related and integration

expenses associated with advisor fees for legal, tax, accounting and

consulting expenses. Severance costs related to Zale and other

management changes are also included to conform with the current

year presentation. These costs are included within Signet’s Other

segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Income Statements

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended

|

|

39 weeks ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts)

|

|

|

|

October 31,

2015

|

|

November 1,

2014

|

|

October 31,

2015

|

|

November 1,

2014

|

|

Sales

|

|

|

|

1,216.4

|

|

|

1,177.9

|

|

|

4,157.6

|

|

|

3,459.9

|

|

|

Cost of sales

|

|

|

|

(848.7

|

)

|

|

(832.0

|

)

|

|

(2,733.2

|

)

|

|

(2,297.8

|

)

|

|

Gross margin

|

|

|

|

367.7

|

|

|

345.9

|

|

|

1,424.4

|

|

|

1,162.1

|

|

|

Selling, general and administrative expenses

|

|

|

|

(395.0

|

)

|

|

(388.7

|

)

|

|

(1,301.0

|

)

|

|

(1,078.4

|

)

|

|

Other operating income, net

|

|

|

|

60.9

|

|

|

53.5

|

|

|

187.2

|

|

|

161.2

|

|

|

Operating income

|

|

|

|

33.6

|

|

|

10.7

|

|

|

310.6

|

|

|

244.9

|

|

|

Interest expense, net

|

|

|

|

(11.7

|

)

|

|

(12.6

|

)

|

|

(33.8

|

)

|

|

(28.1

|

)

|

|

Income (loss) before income taxes

|

|

|

|

21.9

|

|

|

(1.9

|

)

|

|

276.8

|

|

|

216.8

|

|

|

Income taxes

|

|

|

|

(6.9

|

)

|

|

0.6

|

|

|

(80.8

|

)

|

|

(63.5

|

)

|

|

Net income (loss)

|

|

|

|

15.0

|

|

|

(1.3

|

)

|

|

196.0

|

|

|

153.3

|

|

|

Basic earnings (loss) per share

|

|

|

|

$

|

0.19

|

|

|

$

|

(0.02

|

)

|

|

$

|

2.46

|

|

|

$

|

1.92

|

|

|

Diluted earnings (loss) per share

|

|

|

|

$

|

0.19

|

|

|

$

|

(0.02

|

)

|

|

$

|

2.45

|

|

|

$

|

1.91

|

|

|

Basic weighted average common shares outstanding

|

|

|

|

79.3

|

|

|

79.9

|

|

|

79.7

|

|

|

79.9

|

|

|

Diluted weighted average common shares outstanding

|

|

|

|

79.5

|

|

|

79.9

|

|

|

79.9

|

|

|

80.2

|

|

|

Dividends declared per share

|

|

|

|

$

|

0.22

|

|

|

$

|

0.18

|

|

|

$

|

0.66

|

|

|

$

|

0.54

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except par value per share amount)

|

|

|

|

October 31, 2015

|

|

January 31, 2015

|

|

November 1, 2014

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

77.2

|

|

|

193.6

|

|

|

87.6

|

|

|

Accounts receivable, net

|

|

|

|

1,451.5

|

|

|

1,567.6

|

|

|

1,292.1

|

|

|

Other receivables

|

|

|

|

55.4

|

|

|

63.6

|

|

|

56.7

|

|

|

Other current assets

|

|

|

|

143.2

|

|

|

137.2

|

|

|

133.7

|

|

|

Deferred tax assets

|

|

|

|

3.6

|

|

|

4.5

|

|

|

1.6

|

|

|

Income taxes

|

|

|

|

24.6

|

|

|

1.8

|

|

|

21.6

|

|

|

Inventories

|

|

|

|

2,727.0

|

|

|

2,439.0

|

|

|

2,674.6

|

|

|

Total current assets

|

|

|

|

4,482.5

|

|

|

4,407.3

|

|

|

4,267.9

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net of accumulated depreciation of

$939.7,

$852.1 and $839.0, respectively

|

|

|

|

718.0

|

|

|

665.9

|

|

|

658.8

|

|

|

Goodwill

|

|

|

|

517.6

|

|

|

519.2

|

|

|

524.3

|

|

|

Intangible assets, net

|

|

|

|

434.3

|

|

|

447.1

|

|

|

461.3

|

|

|

Other assets

|

|

|

|

144.5

|

|

|

140.0

|

|

|

133.5

|

|

|

Deferred tax assets

|

|

|

|

132.1

|

|

|

111.1

|

|

|

72.8

|

|

|

Retirement benefit asset

|

|

|

|

40.7

|

|

|

37.0

|

|

|

59.9

|

|

|

Total assets

|

|

|

|

6,469.7

|

|

|

6,327.6

|

|

|

6,178.5

|

|

|

Liabilities and Shareholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Loans and overdrafts

|

|

|

|

249.8

|

|

|

97.5

|

|

|

221.8

|

|

|

Accounts payable

|

|

|

|

371.4

|

|

|

277.7

|

|

|

396.2

|

|

|

Accrued expenses and other current liabilities

|

|

|

|

408.0

|

|

|

482.4

|

|

|

422.7

|

|

|

Deferred revenue

|

|

|

|

241.4

|

|

|

248.0

|

|

|

221.6

|

|

|

Deferred tax liabilities

|

|

|

|

170.5

|

|

|

145.8

|

|

|

151.2

|

|

|

Income taxes

|

|

|

|

0.7

|

|

|

86.9

|

|

|

3.6

|

|

|

Total current liabilities

|

|

|

|

1,441.8

|

|

|

1,338.3

|

|

|

1,417.1

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

|

1,338.7

|

|

|

1,363.8

|

|

|

1,371.3

|

|

|

Other liabilities

|

|

|

|

226.6

|

|

|

230.2

|

|

|

227.2

|

|

|

Deferred revenue

|

|

|

|

597.5

|

|

|

563.9

|

|

|

518.8

|

|

|

Deferred tax liabilities

|

|

|

|

20.1

|

|

|

21.0

|

|

|

1.8

|

|

|

Total liabilities

|

|

|

|

3,624.7

|

|

|

3,517.2

|

|

|

3,536.2

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common shares of $0.18 par value: authorized 500 shares, 79.5

shares

outstanding (January 31, 2015: 80.3 outstanding;

November 1, 2014:

80.2 outstanding)

|

|

|

|

15.7

|

|

|

15.7

|

|

|

15.7

|

|

|

Additional paid-in capital

|

|

|

|

274.7

|

|

|

265.2

|

|

|

261.2

|

|

|

Other reserves

|

|

|

|

0.4

|

|

|

0.4

|

|

|

0.4

|

|

|

Treasury shares at cost: 7.7 shares (January 31, 2015: 6.9 shares;

November

1, 2014: 7.0 shares)

|

|

|

|

(480.3

|

)

|

|

(370.0

|

)

|

|

(373.2

|

)

|

|

Retained earnings

|

|

|

|

3,280.3

|

|

|

3,135.7

|

|

|

2,922.1

|

|

|

Accumulated other comprehensive loss

|

|

|

|

(245.8

|

)

|

|

(236.6

|

)

|

|

(183.9

|

)

|

|

Total shareholders’ equity

|

|

|

|

2,845.0

|

|

|

2,810.4

|

|

|

2,642.3

|

|

|

Total liabilities and shareholders’ equity

|

|

|

|

6,469.7

|

|

|

6,327.6

|

|

|

6,178.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended

|

|

39 weeks ended

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

October 31,

2015

|

|

November 1,

2014

|

|

October 31,

2015

|

|

November 1,

2014

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

|

15.0

|

|

|

(1.3

|

)

|

|

196.0

|

|

|

153.3

|

|

|

Adjustments to reconcile net income (loss) to net cash (used in)

provided

by operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

|

45.0

|

|

|

40.3

|

|

|

129.5

|

|

|

104.8

|

|

|

Amortization of unfavorable leases and contracts

|

|

|

|

(7.0

|

)

|

|

(8.9

|

)

|

|

(24.6

|

)

|

|

(14.8

|

)

|

|

Pension benefit

|

|

|

|

—

|

|

|

(0.6

|

)

|

|

—

|

|

|

(1.8

|

)

|

|

Share-based compensation

|

|

|

|

4.7

|

|

|

3.5

|

|

|

11.8

|

|

|

10.7

|

|

|

Deferred taxation

|

|

|

|

(5.9

|

)

|

|

(28.0

|

)

|

|

8.0

|

|

|

(32.2

|

)

|

|

Excess tax benefit from exercise of share awards

|

|

|

|

—

|

|

|

—

|

|

|

(5.1

|

)

|

|

(7.7

|

)

|

|

Amortization of debt discount and issuance costs

|

|

|

|

1.0

|

|

|

1.0

|

|

|

2.6

|

|

|

6.5

|

|

|

Other non-cash movements

|

|

|

|

0.7

|

|

|

0.6

|

|

|

2.7

|

|

|

0.7

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in accounts receivable

|

|

|

|

41.6

|

|

|

23.5

|

|

|

116.3

|

|

|

81.8

|

|

|

Decrease (increase) in other receivables and other assets

|

|

|

|

2.1

|

|

|

(0.9

|

)

|

|

1.6

|

|

|

(4.9

|

)

|

|

Increase in other current assets

|

|

|

|

(17.6

|

)

|

|

(13.9

|

)

|

|

(12.8

|

)

|

|

(36.7

|

)

|

|

Increase in inventories

|

|

|

|

(317.7

|

)

|

|

(338.2

|

)

|

|

(289.3

|

)

|

|

(321.1

|

)

|

|

Increase in accounts payable

|

|

|

|

174.4

|

|

|

161.8

|

|

|

93.6

|

|

|

132.9

|

|

|

(Decrease) increase in accrued expenses and other liabilities

|

|

|

|

(31.9

|

)

|

|

4.0

|

|

|

(60.5

|

)

|

|

(15.0

|

)

|

|

Increase in deferred revenue

|

|

|

|

1.0

|

|

|

8.2

|

|

|

25.0

|

|

|

29.2

|

|

|

Decrease in income taxes payable

|

|

|

|

(26.8

|

)

|

|

(58.2

|

)

|

|

(104.1

|

)

|

|

(106.7

|

)

|

|

Pension plan contributions

|

|

|

|

(0.5

|

)

|

|

(1.0

|

)

|

|

(2.0

|

)

|

|

(3.2

|

)

|

|

Net cash (used in) provided by operating activities

|

|

|

|

(121.9

|

)

|

|

(208.1

|

)

|

|

88.7

|

|

|

(24.2

|

)

|

|

Investing activities

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment

|

|

|

|

(71.9

|

)

|

|

(75.1

|

)

|

|

(170.8

|

)

|

|

(165.1

|

)

|

|

Purchase of available-for-sale securities

|

|

|

|

(1.9

|

)

|

|

(3.0

|

)

|

|

(3.8

|

)

|

|

(4.2

|

)

|

|

Proceeds from sale of available-for-sale securities

|

|

|

|

—

|

|

|

1.5

|

|

|

3.6

|

|

|

2.5

|

|

|

Acquisition of Zale Corporation, net of cash acquired

|

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(1,429.2

|

)

|

|

Net cash used in investing activities

|

|

|

|

(73.8

|

)

|

|

(76.6

|

)

|

|

(171.0

|

)

|

|

(1,596.0

|

)

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

|

(17.5

|

)

|

|

(14.4

|

)

|

|

(49.6

|

)

|

|

(40.8

|

)

|

|

Proceeds from issuance of common shares

|

|

|

|

3.1

|

|

|

2.2

|

|

|

3.3

|

|

|

4.2

|

|

|

Excess tax benefit from exercise of share awards

|

|

|

|

—

|

|

|

—

|

|

|

5.1

|

|

|

7.7

|

|

|

Proceeds from senior notes

|

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

398.4

|

|

|

Proceeds from term loan

|

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

400.0

|

|

|

Repayments of term loan

|

|

|

|

(7.5

|

)

|

|

(5.0

|

)

|

|

(17.5

|

)

|

|

(5.0

|

)

|

|

Proceeds from securitization facility

|

|

|

|

542.6

|

|

|

493.4

|

|

|

1,738.9

|

|

|

1,424.0

|

|

|

Repayments of securitization facility

|

|

|

|

(542.6

|

)

|

|

(493.4

|

)

|

|

(1,738.9

|

)

|

|

(824.0

|

)

|

|

Proceeds from revolving credit facility

|

|

|

|

177.0

|

|

|

145.0

|

|

|

177.0

|

|

|

145.0

|

|

|

Repayments of revolving credit facility

|

|

|

|

(30.0

|

)

|

|

—

|

|

|

(30.0

|

)

|

|

—

|

|

|

Payment of debt issuance costs

|

|

|

|

—

|

|

|

(2.1

|

)

|

|

—

|

|

|

(20.5

|

)

|

|

Repurchase of common shares

|

|

|

|

(30.0

|

)

|

|

(7.4

|

)

|

|

(111.9

|

)

|

|

(29.8

|

)

|

|

Net settlement of equity based awards

|

|

|

|

—

|

|

|

(3.0

|

)

|

|

(8.3

|

)

|

|

(18.1

|

)

|

|

Principal payments under capital lease obligations

|

|

|

|

(0.2

|

)

|

|

(0.3

|

)

|

|

(0.8

|

)

|

|

(0.5

|

)

|

|

Proceeds from (repayment of) short-term borrowings

|

|

|

|

18.5

|

|

|

43.0

|

|

|

(1.5

|

)

|

|

20.8

|

|

|

Net cash provided by (used in) financing activities

|

|

|

|

113.4

|

|

|

158.0

|

|

|

(34.2

|

)

|

|

1,461.4

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

|

159.8

|

|

|

215.0

|

|

|

193.6

|

|

|

247.6

|

|

|

Decrease in cash and cash equivalents

|

|

|

|

(82.3

|

)

|

|

(126.7

|

)

|

|

(116.5

|

)

|

|

(158.8

|

)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

|

(0.3

|

)

|

|

(0.7

|

)

|

|

0.1

|

|

|

(1.2

|

)

|

|

Cash and cash equivalents at end of period

|

|

|

|

77.2

|

|

|

87.6

|

|

|

77.2

|

|

|

87.6

|

|

CONTACT:

Signet Jewelers

Investors:

James Grant, +1 (330)

668-5412

VP Investor Relations

or

Media:

Signet Jewelers

David

Bouffard, +1 (330) 668-5369

VP Corporate Affairs

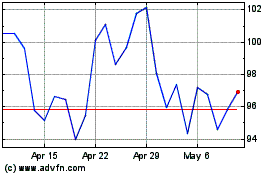

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

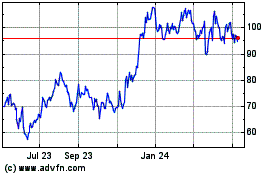

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024