Current Report Filing (8-k)

November 20 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2015

|

Innovative Food Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

| Florida |

0-9376 |

20-1167761 |

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

28411 Race Track Road, Bonita Springs, Florida

|

34135

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (239) 596-0204

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On November 12, 2015 we announced that an institutional investor has agreed to provide $1 million in funding directly to The Fresh Diet, Inc. (“TFD”), a wholly owned subsidiary of the registrant. To date, the investor has delivered $342,000 in connection with that agreement and we expect the balance of the funds to be delivered in tranches over the next 30 days following execution of definitive purchase agreements. Pursuant to the provisions of a non-binding Term Sheet, the terms of the financing are expected to include a capital raise of up to an additional $1M of external financing through the issuance by TFD of one year convertible notes carrying a 9.9% annual interest rate and which will be convertible into TFD’s common stock at an $8M valuation. Investors will receive warrant coverage of 110% and the warrants will be exercisable for five years with one-half of the warrants exercisable at a 32% premium to the conversion price and one-half at a 76% premium to the conversion price. Subject to certain existing debt, the notes will be secured by all assets of TFD. All of the shares underlying the notes and warrants will have piggy-back rights. TFD will agree to certain anti-dilution provisions and certain offering and registration restrictions and the investors will receive certain rights of first refusal. The term sheet contains additional conditions including a milestone of commencing trading of TFD’s common stock on OTCQB in January 2016. Inasmuch as the term sheet is not binding, no investor is bound to invest on these or any other terms.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVATIVE FOOD HOLDINGS, INC. |

|

| |

|

|

|

|

Dated: November 19, 2015

|

|

|

|

|

|

By:

|

/s/ Sam Klepfish |

|

| |

|

Sam Klepfish, CEO |

|

| |

|

|

|

| |

|

|

|

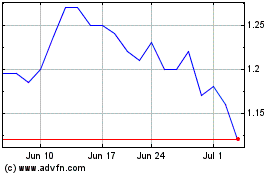

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

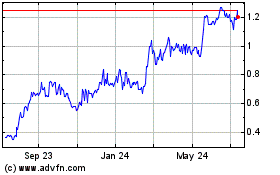

Innovative Food (QB) (USOTC:IVFH)

Historical Stock Chart

From Apr 2023 to Apr 2024