UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 6-K

_______________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of November 2015

Commission file number 0-30752

_______________

AETERNA ZENTARIS INC.

_______________

c/o Norton Rose Fulbright Canada LLP

1 Place Ville Marie

Suite 2500

Montreal, QC

H3B 1R1

(Address of principal executive offices)

_______________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing

the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______.

DOCUMENTS INDEX

Documents Description

99.1 Material Change Report of the registrant dated November 18, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AETERNA ZENTARIS INC.

|

| | | | |

| | | |

Date: November 18, 2015 | | By: | | /s/ Philip A. Theodore |

| | | | Philip A. Theodore |

| | | | Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

|

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

AETERNA ZENTARIS INC.

1. Name and Address of Company

Aeterna Zentaris Inc. (the Corporation)

c/o Norton Rose Fulbright Canada LLP

1 Place Ville Marie

Suite 2500

Montreal, QC

H3B 1R1

2. Date of Material Change

November 16, 2015 and November 18, 2015.

3. News Release

On November 16, 2015 and November 18, 2015, the Corporation issued news releases indicating the material change, which were disseminated in Canada on the Canada NewsWire service. Copies of such news releases are attached hereto as Schedule A and Schedule B, respectively.

4. Summary of Material Change

On November 16, 2015, the Corporation announced that the holders of its issued and outstanding common shares (Common Shares) had approved a share consolidation (the Consolidation) and that the Corporation had determined that the Consolidation ratio will be 100-for-1.

On November 18, 2015, the Corporation announced that the Consolidation became legally effective on November 17, 2015 and that it was expected that the post-Consolidation Common Shares would begin trading on each of NASDAQ and TSX at the opening of markets on November 20, 2015, and it provided other details regarding the implementation of the Consolidation.

The news releases attached as Schedule A and Schedule B hereto set forth a complete description of the Consolidation.

5. Full Description of Material Change

See Item 4.

6. Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

7. Omitted Information

Not applicable.

8. Executive Officer

Further information regarding the matters described in this report may be obtained from Philip A. Theodore, Senior Vice President, General Counsel. Mr. Theodore is knowledgeable about the details of the material change and may be contacted at (843) 900-3211.

9. Date of Report

November 18, 2015.

SCHEDULE A

NEWS RELEASE

(November 16, 2015)

Aeterna Zentaris Announces Shareholder Approval of Share Consolidation

Québec City, Canada, November 16, 2015 - Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the “Company”) today announced that the holders of its issued and outstanding common shares (“Common Shares”) approved a share consolidation (the “Consolidation”) and that the Company has determined that the Consolidation ratio will be 100-for-1.

Representatives of Computershare Trust Company of Canada, who served as the scrutineers of the special meeting of shareholders at which the Consolidation was approved, certified that 333,889,035 of the Company’s Common Shares were voted on the Consolidation, that 235,979,275 shares were voted in favor of the Consolidation (representing 70.68% of the shares voted) and that 97,909,760 shares were voted against the Consolidation (representing 29.32% of the shares voted). The votes cast in favor of the Consolidation therefore satisfied the requirement that the Consolidation be approved by not less than two-thirds of the votes cast by shareholders who voted in respect of the Consolidation.

The Company intends to implement the Consolidation in the coming days and will shortly provide all relevant details regarding the Consolidation, including its effective date and the date on which the Common Shares are expected to commence trading on a post-Consolidation basis on the NASDAQ Capital Market and the Toronto Stock Exchange and information for registered and beneficial shareholders to exchange their pre-Consolidation for post-Consolidation Common Shares.

The Company also announces that Mr. Marcel Aubut is no longer a member of the Board of Directors effective today, November 16, 2015.

About Aeterna Zentaris

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women’s health. For more information, visit www.aezsinc.com.

Contact

Philip Theodore

Senior Vice President

ptheodore@aezsinc.com

-30-

SCHEDULE B

NEWS RELEASE

(November 18, 2015)

Aeterna Zentaris Announces Details and Implementation of Share Consolidation to Regain NASDAQ Compliance

Common shares to begin trading on a consolidated and reverse-split-adjusted basis on November 20, 2015

Québec City, Canada, November 18, 2015 - Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZ) (the “Company”) today announced that the consolidation (the “Consolidation”) of its issued and outstanding common shares (the “Common Shares”) approved by shareholders at a special meeting held on November 16, 2015, occurred at the Consolidation ratio of 100-to-1 and became legally effective on November 17 2015 (the “Share Consolidation Effective Date”).

The Company has received conditional approval from the Toronto Stock Exchange (“TSX”) to effect the Consolidation and has provided notification of the Consolidation to The NASDAQ Stock Market (“NASDAQ”). Subject to final confirmation by each of TSX and NASDAQ, it is expected that the post-Consolidation Common Shares will begin trading on each of NASDAQ and TSX at the opening of markets on November 20, 2015 under the current NASDAQ and TSX trading symbols, “AEZS” and “AEZ”, respectively, under the new post-Consolidation CUSIP and ISIN numbers of 007975402 and ISIN CA0079754028, respectively.

The Consolidation will reduce the number of outstanding Common Shares from approximately 656.0 million to approximately 6.6 million. Proportionate adjustments will be made to the Company's outstanding warrants and stock options. No fractional Common Shares have been issued pursuant to the Consolidation and any fractional shares that would have otherwise been issued have been rounded down to the nearest whole number. Any and all such fractional shares will be aggregated and sold by the Company's transfer agent and registrar on the market, with the net proceeds being proportionately distributed to shareholders. In addition, as of the close of business on November 16, 2015 and immediately prior to the Share Consolidation Effective Date, there remained approximately 1.9 million Series B Common Share Purchase Warrants (the “Series B Warrants”) representing approximately 19 thousand Series B Warrants on a post-Consolidation basis, of which approximately 1.1 million, or approximately 11 thousand on a post-Consolidation basis, are subject to our previously announced agreement with certain holders of Series B Warrants and will be exercisable for approximately 365.5 thousand post-Consolidation Common Shares.

Letters of transmittal with respect to the Consolidation have been mailed to the Company's registered shareholders. All registered shareholders will be required to send their share certificates representing pre-Consolidation Common Shares, along with a properly executed letter of transmittal, to the Company's registrar and transfer agent, Computershare Investor Services Inc., in accordance with the instructions provided in the letter of transmittal. All registered shareholders who submit to Computershare a completed letter of transmittal, along with their respective certificates representing pre-Consolidation Common Shares, will receive in exchange new certificates representing their post-Consolidation Common Shares. Shareholders who hold their Common Shares through a broker, investment dealer, bank, trust company or other nominee or intermediary should contact that nominee or intermediary for assistance in depositing their Common Shares in connection with the Consolidation.

About Aeterna Zentaris

Aeterna Zentaris is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women’s health. For more information, visit www.aezsinc.com.

Contact

Philip Theodore

Senior Vice President

ptheodore@aezsinc.com

-30-

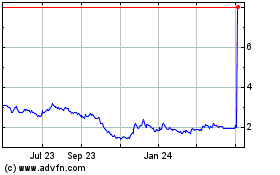

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

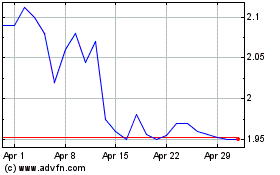

From Mar 2024 to Apr 2024

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024