UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 17, 2015

CANNAVEST CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

(Address

of principal executive offices)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_] Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[_] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[_] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 2.02 Results

of Operations and Financial Condition

The

information provided below in “Item 7.01– Regulation FD Disclosure” of this Current Report on Form 8-K is incorporated

by reference into this Item 2.02.

Item 7.01 Regulation

FD Disclosure

On November 17, 2015, CannaVEST Corp. (the

“Company”) announced the release of its Third Quarter 2015 earnings. A copy of the press release issued by the Company

announcing the release of Third Quarter 2015 earnings is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information set forth under this Item 7.01,

including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of such Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| 99.1 | Press Release of CannaVEST Corp., dated November 17, 2015. |

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: November 17, 2015

CANNAVEST CORP.

By: /s/ Michael Mona, Jr.

Michael Mona, Jr.

President and Chief Executive Officer

Exhibit 99.1

CannaVest Corp. Reports Financial Results

for the third quarter of fiscal 2015

Las Vegas, Nevada, November 17, 2015 –

CannaVest Corp. (OTCBB:CANV) (the “Company”, “CannaVest”, “our” or “we”) is reporting

financial results for the third quarter of fiscal 2015.

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Financial Highlights | |

| | | |

| | | |

| | | |

| | |

| GAAP Measures: | |

| | | |

| | | |

| | | |

| | |

| Product Sales, net | |

$ | 4,151,180 | | |

$ | 1,859,961 | | |

$ | 9,279,117 | | |

$ | 7,497,616 | |

| Net Income | |

$ | (989,549 | ) | |

$ | (482,129 | ) | |

$ | (5,641,426 | ) | |

$ | 7,439,884 | |

| Earnings Per Share - basic and diluted | |

$ | (0.03 | ) | |

$ | (0.01 | ) | |

$ | (0.16 | ) | |

$ | 0.24 | |

| Non-GAAP Measures (unaudited): | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

$ | (656,801 | ) | |

$ | (248,182 | ) | |

$ | (4,858,498 | ) | |

$ | 8,724,511 | |

| Adjusted EBITDA | |

$ | 343,271 | | |

$ | (248,182 | ) | |

$ | (2,137,620 | ) | |

$ | 863,757 | |

___________________

A

reconciliation and explanation of GAAP measures to non-GAAP measures is provided later in this release.

“CannaVest continues to be the market

leader in distributing bulk cannabidiol (“CBD”) oil and CBD-based products,” stated Michael Mona, Jr., chairman

and CEO of CannaVest. “Distribution of our branded products continues to expand as we added 120 new retail locations during

the third quarter, increasing our retail store penetration to 240 locations at September 30, 2015. Our leadership in educating

the market about CBD as a dietary supplement, beauty care product, and, as an ingredient for numerous other products from pet foods,

vape products and specialty beverages, continues to grow” continued Mr. Mona. “We made excellent progress with sales

of $4.2 million for the three months ended September 30, 2015 compared to sales of $1.9 million for the third quarter of 2014.

The third quarter of 2015 result included EBITDA and Adjusted EBITDA of ($656,801) and $343,271, respectively, for the three months

ended September 30, 2015.”

Business Highlights

| · | Continued penetration of $35 billion U.S. Natural Products sales channel. The Company continued

its marketing efforts to this sales channel during the third quarter and achieved placement in over 240 stores by September 30,

2015. We are expanding our education and marketing efforts in partnership with our broker relationships to further expand this

sales channel. |

| · | Settlement of Pending Litigation. In July 2015, we entered into a Settlement Agreement with

Medical Marijuana, Inc. and its affiliated companies (“MJNA Parties”) to resolve all pending litigation. The settlement

terms include a payment of $750,000 from the MJNA Parties to CannaVest which is included in the Company’s Condensed Consolidated

Statements of Operations for the three months ended September 30, 2015. |

| · | Infrastructure Investment. During the third quarter we continued our infrastructure investment

which includes our new SAP Enterprise Resource Planning system and enhanced ecommerce marketing efforts. |

Operating Results

for the three and nine months ended September 30, 2015 and 2014

The Company’s

net loss for the three months ended September 30, 2015 was $989,549 or ($0.03) per share (basic and diluted), compared to net loss

of $482,129, or ($0.01) per share (basic and diluted) for the three months ended September 30, 2014. There are significant non-cash

transactions that caused the year-over-year difference which are explained in the Non-GAAP Financial Measures below.

Selling, general and administrative

expenses for the three months ended September 30, 2015 were $4,000,289 compared to $1,350,639 for the three months ended September

30, 2014. The increase is primarily driven by the continued growth of Company operations, with a significant increase in our headcount,

implementation costs related to the Company’s new computer systems, an increased reserve for bad debt expense related to

notes receivable and increased sales and marketing expense to support our expanded distribution to multiple sales channels. SG&A

expense for the three months ended September 30, 2015 includes $1,746,440 of stock-based compensation, a non-cash expense. There

was no stock-based compensation expense for the three months ended September 30, 2014.

Research and development expenses for the three

months ended September 30, 2015 were $228,822 compared to $262,065 for the three months ended September 30, 2014. The decrease

for the three months ended September 30, 2015 over 2014 relates primarily to a lower employee headcount during the third quarter

of 2015. The lower employee headcount relates to several positions that were vacated during the quarter and are in process of being

refilled. Research and development expense during the three months ended 2015 includes $7,364 of stock-based compensation, a non-cash

expense.

Balance Sheet

Highlights

As of September 30,

2015, the Company had cash of approximately $1.1 million. The Company has sufficient cash reserves and access to capital to meet

its working capital requirements. Stockholders equity amounted to approximately $22.4 million as of September 30, 2015.

Non-GAAP Financial

Measures

The Company reports

EBITDA and Adjusted EBITDA to present information about its operating performance and financial position. We currently focus on

EBITDA and Adjusted EBITDA to evaluate our business relationships and our resulting operating performance. EBITDA and Adjusted

EBITDA are defined as (net income plus interest expense, income tax expense, depreciation and amortization), further adjusted to

exclude certain non-cash expenses and other adjustments as set forth below. We present Adjusted EBITDA because we consider it an

important measure of our performance and it is a meaningful financial metric in assessing our operating performance from period

to period by excluding certain items that we believe are not representative of our core business, such as certain non-cash items

and other adjustments. We believe that EBITDA and Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported results

in accordance with accounting principles generally accepted in the United States (“GAAP”), provides useful information

to investors regarding our performance for the following reasons:

| · | because non-cash equity grants made to employees and non-employees at a certain price and point in

time do not necessarily reflect how our business is performing at any particular time, stock-based compensation expense is not

a key measure of our operating performance; and |

| · | revenues and expenses associated with acquisitions, dispositions, equity issuance and related offering

costs can vary from period to period and transaction to transaction and are not considered a key measure of our operating performance. |

The reconciliation

from net income to EBITDA and Adjusted EBITDA, both non-GAAP measures, for the periods presented is as follows:

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Net loss | |

$ | (989,549 | ) | |

$ | (482,129 | ) | |

$ | (5,641,426 | ) | |

$ | 7,439,884 | |

| Interest income | |

| (36,939 | ) | |

| (8,156 | ) | |

| (107,427 | ) | |

| (8,156 | ) |

| Interest expense | |

| 116,509 | | |

| – | | |

| 132,633 | | |

| 606,112 | |

| Amortization of purchased intangible assets | |

| 205,500 | | |

| 205,500 | | |

| 616,500 | | |

| 616,500 | |

| Depreciation of property & equipment | |

| 47,678 | | |

| 36,603 | | |

| 141,222 | | |

| 70,171 | |

| EBITDA | |

| (656,801 | ) | |

| (248,182 | ) | |

| (4,858,498 | ) | |

| 8,724,511 | |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation expense (1) | |

| 1,756,786 | | |

| – | | |

| 3,477,592 | | |

| – | |

| Litigation settlement income (4) | |

| (756,714 | ) | |

| – | | |

| (756,714 | ) | |

| – | |

| KannaLife Sciences disposition related revenues (2) | |

| – | | |

| – | | |

| – | | |

| (7,899,306 | ) |

| Allocated loss on KannaLife Sciences equity investment (3) | |

| – | | |

| – | | |

| – | | |

| 38,552 | |

| Total EBITDA Adjustments | |

| 1,000,072 | | |

| – | | |

| 2,720,878 | | |

| (7,860,754 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 343,271 | | |

$ | (248,182 | ) | |

$ | (2,137,620 | ) | |

$ | 863,757 | |

| (1) | Represents stock-based compensation expense related to stock options and stock grants awarded to employees,

consultants and non-executive directors based on the grant date fair value under the Black-Scholes valuation model. |

| (2) | Represents non-cash revenues related to sale of KannaLife Sciences, Inc. equity investment. |

| (3) | Represents allocated losses related to KannaLife Sciences investment. |

| (4) | Represents income from settlement with Medical Marijuana, Inc. (“MJNA”) and certain MJNA

parties. |

EBITDA and Adjusted EBITDA are non-GAAP measures

and do not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities

as a measure of liquidity. The terms EBITDA and Adjusted EBITDA are not defined under GAAP, and EBITDA and Adjusted EBITDA are

not measures of net income (loss), operating income or any other performance measure derived in accordance with GAAP.

EBITDA and Adjusted EBITDA have limitations

as analytical tools and should not be consider in isolation or as a substitute for analysis of our results as reported under GAAP.

Some of these limitations are:

| · | EBITDA and Adjusted EBITDA do not reflect all cash expenditures, future requirements for capital expenditures

or contractual requirements; |

| · | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, working capital needs;

and |

| · | EBITDA and Adjusted EBITDA can differ significantly from company to company depending on strategic

decisions regarding capital structure, the tax jurisdictions in which companies operate, the level of capital investment, thus,

limiting their usefulness as comparative measures. |

EBITDA and Adjusted EBITDA should not be considered

as measures of discretionary cash available to us for investment in our business. We compensate for these limitations by relying

primarily on GAAP results and using EBITDA and Adjusted EBITDA as supplemental information.

For further discussion

of the Company’s financial results for the third quarter of 2015, please refer to the Company’s consolidated financial

statements and related Management Discussion and Analysis, which can be found at www.cannavest.com or EDGAR at www.sec.gov/edgar/searchedgar/webusers.htm

in the Company’s Quarterly Report on Form 10-Q as filed with the U.S. Securities and Exchange Commission on November 16,

2015.

About CannaVest

Corp.

CannaVest Corp. (OTCBB:CANV)

is a leader in the procurement and wholesale of the hemp plant extract cannabidiol (CBD), and the development, marketing and sale

of end consumer products containing CBD, which is refined into its own PlusCBD Oil™ brand. CannaVest resells raw industrial

hemp product to third parties, acquired through supply relationships in Europe. CannaVest has primary offices and facilities in

Las Vegas, Nevada and San Diego, California. Additional information is available from OTCMarkets.com or by visiting www.cannavest.com.

CannaVest Corp.’s

subsidiaries include CannaVest Laboratories, LLC, which facilitates leading research and develops nutraceutical and food products,

containing cannabidiol (CBD) oil, and is the developer and manufacturer of CannaVest’s own award winning CBD Simple ™,

and US Hemp Oil, LLC, which provides seed procurement, cultivation, processing, and production consultation, and equipment to support

U.S. farmers, researchers and businesses to cultivate and process industrial hemp in the U.S.

FORWARD-LOOKING

DISCLAIMER

This press release

may contain certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and is subject to the Safe Harbor created by those sections.

This material contains statements about expected future events and/or financial results that are forward-looking in nature and

subject to risks and uncertainties. Such forward-looking statements by definition involve risks, uncertainties.

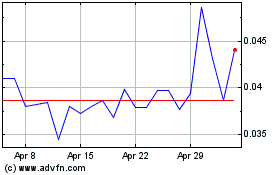

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024