UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: November 12, 2015

(Date of earliest event reported)

AKAMAI TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 04-3432319 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

150 Broadway

Cambridge, MA 02142

(617) 444-3000

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On November 12, 2015, the Compensation Committee of the Board of Directors of Akamai Technologies, Inc. (“Akamai” or the “Company”) approved amendments to the form of change in control agreement (the “CIC Agreement”) for its executive officers (excluding the Chief Executive Officer) and other members of senior management. It is anticipated that all of such individuals will enter into a CIC Agreement with the Company to replace existing agreements terminated by the Company effective in December 2015..

The CIC Agreement has been amended to eliminate “single trigger” vesting for restricted stock units (“RSUs”) with performance-based vesting conditions granted after November 12, 2015 unless such RSUs are not assumed by the acquirer. As provided in the newly-adopted form of performance RSU agreement approved by the Compensation Committee (the “RSU Agreement”), upon the occurrence of an Acquisition Event (as defined in the Akamai Technologies, Inc. 2013 Stock Incentive Plan, as amended), RSUs with performance-based vesting

conditions assumed by an acquiring or succeeding entity will convert into time-based vesting RSUs on the same vesting schedule but without reference to any performance-based conditions (a “Replacement Award”). Under the provisions of the CIC Agreement, in the event that the executive’s employment is subsequently terminated by the acquiring or succeeding entity for a reason other than Cause (as defined in the CIC Agreement) or by the executive for Good Reason (as defined in the CIC Agreement), in either case within twelve months after a Change in Control Event (as defined in the CIC Agreement), all of the remaining unvested portion of the Replacement Award will become vested as of the date of the executive’s termination of employment.

The CIC Agreement has also been amended to provide that, in the event that the executive’s employment is terminated by the acquiring or succeeding entity for a reason other than Cause or by the employee for Good Reason, in either case within twelve months after a Change in Control Event, he or she will be entitled to a lump sum payment equal to the annual incentive bonus at target that would have been payable to the executive under the Company’s Executive Bonus Plan in effect immediately before the Change in Control Event pro-rated based on the date on which the Change in Control Event occurred.

The foregoing descriptions of the CIC Agreement and the RSU Agreement are qualified in their entirety by the full text of the CIC Agreement and the RSU Agreement, respectively, set forth in Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated herein by reference.

On November 12, 2015, the Compensation Committee also approved an amendment to the employment agreement between the Company and F. Thomson Leighton, its Chief Executive Officer, who will not be party to a CIC Agreement (“Employment Agreement Amendment”). The Employment Agreement Amendment provides for the same treatment of Dr. Leighton’s performance RSUs and payment of a pro-rated bonus following a termination for Cause (as defined therein) or resignation for Good Reason (as defined therein) under the circumstances described above. The foregoing description of the Employment Agreement Amendment is qualified in its entirety by the full text of the Employment Agreement Amendment set forth in Exhibit 99.3 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| |

99.1 | Form of 2015 Executive Change in Control and Severance Agreement |

| |

99.2 | Form of Performance-Based Vesting Restricted Stock Unit Agreement |

| |

99.3 | Amendment to Employment Agreement between Akamai Technologies, Inc. and F. Thomson Leighton |

| |

99.4 | Akamai Technologies, Inc. 2013 Stock Incentive Plan, as amended |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Date: November 17, 2015 | AKAMAI TECHNOLOGIES, INC. |

By: | /s/ Melanie Haratunian |

| Melanie Haratunian, Executive Vice President and General Counsel |

EXHIBIT INDEX

| |

99.1 | Form of 2015 Executive Change in Control and Severance Agreement |

| |

99.2 | Form of Performance-Based Vesting Restricted Stock Unit Agreement |

| |

99.3 | Amendment to Employment Agreement between Akamai Technologies, Inc. and F. Thomson Leighton |

| |

99.4 | Akamai Technologies, Inc. 2013 Stock Incentive Plan, as amended (1) |

________________

(1) Filed as Exhibit 99.1 to the Company’s Registration Statement on Form S-8 as filed with the Securities and Exchange Commission on May 15, 2015 (File No. 333-204208).

EXHIBIT 99.1

AKAMAI TECHNOLOGIES, INC.

FORM OF CHANGE IN CONTROL AND SEVERANCE AGREEMENT

This Change in Control and Severance Agreement (the “Agreement”) is made and entered into by and between ______________________________ (the “Executive”) and Akamai Technologies, Inc. (the “Company”), effective as of the last date set forth by the signatures of the parties below (the “Effective Date”).

RECITALS

A. It is expected that the Company from time to time will consider the possibility of its acquisition by another company or another Change in Control Event (as defined below). The Board of Directors of the Company, acting through its Compensation Committee (the “Board”), recognizes that such consideration, and the possibility that the Executive’s employment could be terminated by the Company for a reason other than for Cause following such a transaction, can be distractions to the Executive and can cause the Executive to consider alternative employment opportunities. The Board has determined that it is in the best interests of the Company and its stockholders to assure that the Company will have the continued dedication and objectivity of the Executive, notwithstanding the possibility, threat or occurrence of a Change in Control Event.

B. The Board believes that it is in the best interests of the Company and its stockholders to provide the Executive with an incentive to continue his or her employment with the Company, or a wholly-owned subsidiary of the Company, as the case may be, and to motivate the Executive to maximize the value of the Company upon a Change in Control Event for the benefit of its stockholders.

C. The Board believes that it is imperative to provide the Executive with certain benefits upon a Change in Control Event or the termination of the Executive’s employment following a Change in Control Event for a reason other than Cause, thereby encouraging the Executive to remain with the Company notwithstanding the possibility of a Change in Control Event or termination of employment thereafter for a reason other than for Cause.

The Company and the Executive hereby agree as follows:

1. Term of Agreement. Subject to Section 8(f), this Agreement shall terminate upon the date that all obligations of the Company and the Executive with respect to this Agreement have been satisfied.

2. At-Will Employment. The Company and the Executive acknowledge that the Executive’s employment is and shall continue to be at-will, as defined under applicable law, and may be terminated at any time by either party, with or without cause.

3. Effect of a Change in Control Event.

If the Executive is employed by the Company as of the date of a Change in Control Event and at such time participates in the executive compensation program overseen by the Compensation Committee of the Board of Directors of the Company, then effective immediately prior to the occurrence of such Change in Control Event, the Executive shall be entitled to pro-rated vesting of any then-unvested restricted stock units or similar equity awards issued prior to the Effective Date and the vesting of which is subject to the achievement of performance targets (“Performance RSUs”) as follows: the number of Performance RSUs that vest shall be equal to 100% of the then-outstanding number of unvested RSUs issuable upon achievement of target level performance of applicable metrics, pro-rated based on the percentage of the vesting period that has elapsed as of the closing date of the Change in Control Event since the grant date of the Performance RSUs (e.g., if the closing date of the Change in Control Event were April 1, 2020 and the vesting date for a three year vesting period was October 1, 2021, then the number of Performance RSUs that vest would be 50% of the Performance RSUs that would vest at target performance (18 months/36 months = 50%)).

4. Effect of Termination Following a Change in Control Event.

(a) If the Executive is employed by the Company as of the date of a Change in Control Event and at such time participates in the executive compensation program overseen by the Compensation Committee of the Board of Directors of the Company, and within one year of the Change in Control Event the Executive’s employment is terminated by the surviving entity for any reason other than for Cause, including the Executive’s voluntary termination for Good Reason, then the Executive shall be entitled to:

| |

(i) | full acceleration of the vesting of the Executive’s stock options outstanding on the termination date so that all of such stock options become 100% vested; |

| |

(ii) | full acceleration of the vesting of the Executive’s RSUs or similar equity awards outstanding on the termination date to the extent that the vesting conditions in place at the time of the Change in Control Event are based solely on the continued employment at the Company or its successor (including RSUs issued after the Effective Date that originally had performance-based vesting that converted into time-based vesting RSUS upon the Change in Control Event) so that all of such RSUs become 100% vested; |

| |

(iii) | (A) a lump sum payment equal to the annual incentive bonus at target that would have been payable to the Executive under the Company’s Executive Bonus Plan in effect immediately before the Change in Control Event, if any, in the year of the Executive’s termination had both the Company and the Executive achieved the target bonus objectives set forth in such Executive’s Bonus Plan during such year multiplied by (B) a fraction of which the numerator is the day of the year on which the effective date of termination falls (e.g., a February 15th termination date would be the 46th day) and the denominator is the number of days in such year; and |

| |

(iv) | severance pay and benefits, all of which shall be paid less applicable withholdings for taxes and other deductions required by law, consisting of: |

(A)A lump sum payment equal to one year of the Executive’s then-current base salary;

(B) A lump sum payment equal to the annual incentive bonus at target that would have been payable to the Executive under the Company’s Executive Bonus Plan in effect immediately before the Change in Control Event, if any, in the year of the Executive’s termination had both the Company and the Executive achieved the target bonus objectives set forth in such Executive’s Bonus Plan during such year; and

(C) Reimbursement for up to 12 months of the amount paid by the Executive for continued health and dental insurance coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA). In order to receive this benefit, the Executive must timely elect COBRA continuation coverage in accordance with the Company’s or surviving entity’s usual COBRA procedures. If you are not employed in the United States such that COBRA is inapplicable to you, you shall be entitled to an equivalent amount of health and dental benefits under procedures that are applicable under the laws of the country of which you are resident or, absent any applicable laws, procedures substantially equivalent to COBRA procedures.

Subject to Section 5 below, the payments and benefits described in Section 4(a)(iii)-(iv) above shall be provided within five days after the Executive’s termination of employment; vesting acceleration shall be effective immediately upon termination of employment. The Executive’s acceptance and receipt of the benefits set forth in this Section 4 shall represent full accord and satisfaction of all claims by the Executive related to his or her termination of employment.

(b) If the Executive is employed by the Company as of the date of a Change in Control Event but at such time is not a participant in the executive compensation program overseen by the Compensation Committee of the Board of Directors of the Company and his or her employment with the Company terminates following a Change in Control Event, then (i) the treatment of equity awards held by the Executive shall be as set forth in the grant agreements entered into with the Company governing such awards and (ii) and the Executive shall be entitled to such other benefits to which he or she is eligible under non-executive severance plans, if any, the Company has in place at such time.

5. Compliance with Section 409A. Subject to the provisions in this Section 5, any severance payments or benefits under Section 4 of this Agreement shall begin only upon the date of the Executive’s “separation from service” (determined as set forth below) which occurs on or after the date of termination of the Executive’s employment. The following rules shall apply with respect to distribution of the payments and benefits, if any, to be provided to the Executive under Section 4 of this Agreement:

(a) It is intended that each installment of the severance payments and benefits provided under this Agreement shall be treated as a separate “payment” for purposes of Section 409A of the Code and the guidance issued thereunder (“Section 409A”). Neither the Executive nor the Company shall have the right to accelerate or defer the delivery of any such payments or benefits except to the

extent specifically permitted or required by Section 409A.

(b) If, as of the date of the Executive’s “separation from service” from the Company, the Executive is not a “specified employee” (within the meaning of Section 409A), then each installment of the severance payments and benefits shall be made on the dates and terms set forth in Section 4.

(c) If, as of the date of the Executive’s “separation from service” from the Company, the Executive is a “specified employee” (within the meaning of Section 409A), then:

(i) Each installment of the severance payments and benefits due under this Agreement that, in accordance with the dates and terms set forth herein, will in all circumstances, regardless of when the separation from service occurs, be paid within the period of time permitted under Section Treasury Regulation Section 1.409A-1(b)(4) shall be treated as a short-term deferral within the meaning of such Section to the maximum extent permissible; and

(ii) Each installment of the severance payments and benefits due under Section 4 that is not described in Section 5(c)(i) above and that would, absent this subsection, be paid within the six-month period following the Executive’s “separation from service” from the Company shall not be paid until the date that is six months and one day after such separation from service (or, if earlier, the Executive's death), with any such installments that are required to be delayed being accumulated during the six-month period and paid in a lump sum on the date that is six months and one day following your separation from service and any subsequent installments, if any, being paid in accordance with the dates and terms set forth herein; provided, however, that the preceding provisions of this sentence shall not apply to any installment of severance payments and benefits if and to the maximum extent that such installment is deemed to be paid under a separation pay plan that does not provide for a deferral of compensation by reason of the application of Treasury Regulation 1.409A-1(b)(9)(iii) (relating to separation pay upon an involuntary separation from service). Any installments that qualify for the exception under Treasury Regulation Section 1.409A-1(b)(9)(iii) must be paid no later than the last day of the second taxable year following the taxable year in which the separation from service occurs.

(d) The determination of whether and when the Executive’s separation from service from the Company has occurred shall be made and in a manner consistent with, and based on the presumptions set forth in, Treasury Regulation Section 1.409A-1(h). Solely for purposes of this Section 5(d), “Company” shall include all persons with whom the Company would be considered a single employer under Section 414(b) and 414(c) of the Code.

(e) All reimbursements and in-kind benefits provided this Agreement shall be made or provided in accordance with the requirements of Section 409A to the extent that such reimbursements or in-kind benefits are subject to Section 409A, including, where applicable, the requirements that (i) any reimbursement is for expenses incurred during the Executive’s lifetime (or during a shorter period of time specified in this Agreement), (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred and (iv) the right to reimbursement is not subject to set off or liquidation or exchange for any other benefit.

(f) Notwithstanding anything herein to the contrary, the Company shall have no liability to the Executive or to any other person if the payments and benefits provided in this Agreement that are intended to be exempt from or compliant with Section 409A are not so exempt or compliant.

6. Definitions.

(a)For the purposes of this Agreement, “Change in Control Event” is defined as set forth in Section 9(c)(1)(b) of the Akamai Technologies, Inc. 2013 Stock Incentive Plan as in effect on the Effective Date (and any successor plan), which definition is incorporated herein by reference.

(b)For the purposes of this Agreement, “Cause” is defined as (i) any act or omission by the Executive that has a significant adverse effect on Akamai’s business or on the Executive’s ability to perform services for Akamai, including, without limitation, the commission of any crime (other than ordinary traffic violations), or (ii) refusal or failure to perform assigned duties, serious misconduct, or excessive absenteeism, or (iii) refusal or failure to comply with Akamai’s Code of Business Ethics.

(c)For the purposes of this Agreement, “Good Reason” is defined as (i) a material reduction in the Executive’s compensation and benefits (including without limitation any bonus plan or indemnity agreement) not agreed to in writing by the Executive; (ii) the assignment to the Executive of duties and/or responsibilities that are materially inconsistent with those associated with the Executive’s position; or (iii) a requirement, not agreed to in writing by the Executive, that the Executive relocate to, or perform his or her principal job functions at, an office that is more than twenty-five (25) miles from the office at which the Executive was previously performing his or her principal job functions.

7. Successors.

(a) Company’s Successors. Any successor to the Company (whether direct or indirect and whether by purchase, merger, consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets shall assume the obligations under this Agreement and agree expressly to perform the obligations under this Agreement in the same manner and to the same extent as the Company would be required to perform such obligations in the absence of a succession. For all purposes under this Agreement, the term “Company” shall include any successor to the Company’s business and/or assets which executes and delivers the assumption agreement described in this Section 7(a), or which becomes bound by the terms of this Agreement by operation of law.

(b) Executive’s Successors. The terms of this Agreement and all rights of the Executive hereunder shall inure to the benefit of, and be enforceable by, the Executive’s personal or legal representatives, executors, administrators, heirs, distributees, devisees and legatees.

8. Miscellaneous Provisions.

(a) Waiver. No provision of this Agreement shall be modified, waived or discharged unless the modification, waiver or discharge is agreed to in writing and signed by the Executive and by an authorized officer of the Company (other than the Executive). No waiver by either party of any breach of, or of compliance with, any

condition or provision of this Agreement by the other party shall be considered a waiver of any other condition or provision or of the same condition or provision at another time.

(i)No agreements, representations or understandings (whether oral or written and whether express or implied) which are not expressly set forth in this Agreement have been made or entered into by either party with respect to the subject matter hereof.

(ii)This Agreement represents the entire understanding of the Company and the Executive with respect to the effect of a Change in Control on equity held by the Executive and the effect of a termination of employment following a Change in Control Event; therefore, this Agreement supersedes all prior and future agreements, arrangements and understandings regarding such subject matter except that (A) this Agreement shall not be deemed to terminate or replace provisions that relate to the effect of a termination of employment following a Change in Control Event in RSU agreements entered into with the Executive prior to the Effective Date Date or the effect of the failure of an acquiring entity to assume such RSUs in connection with the Change in Control Event and (B) this Agreement shall not be deemed to terminate or replace, but shall be deemed to supplement, provisions in stock option grant agreements entered into with the Executive prior to the Effective Date that relate to the effect of a termination of employment following a Change in Control Event.

(iii)If equity award vesting acceleration is triggered and severance is paid pursuant to this Agreement, the Executive acknowledges and agrees that he or she shall not be entitled to any additional or duplicative equity award vesting or severance payment pursuant to any prior agreement, arrangement or understanding or pursuant to any other severance pay plan, including, but not limited to, the Akamai Technologies, Inc. Executive Severance Pay Plan and Summary Plan Description.

(c) Choice of Law. The validity, interpretation, construction and performance of this Agreement shall be governed by the laws of the Commonwealth of Massachusetts.

(d) Severability. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision hereof, which shall remain in full force and effect.

(e) Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together will constitute one and the same instrument.

(f) Term. This Agreement shall have an initial term commencing on the Effective Date and ending on December 31, 2017. The term automatically renews for successive terms of two (2) years unless either party notifies the other of its intent to not renew at least six (6) months prior to the expiration of the applicable term; provided, however, that in the event of a Change in Control, if the term is scheduled to expire within one year following the Change in Control, the term shall automatically be extended to 30 days following the first anniversary of the Change in Control.

[signature page follows]

IN WITNESS WHEREOF, each of the parties has executed this Agreement, in the case of the Company by its duly authorized officer, as of the day and year set forth below.

AKAMAI TECHNOLOGIES, INC. EXECUTIVE

____________________________________ __________________________________

Signature Signature

__________________________________

Print Name

____________________________________

Title:

Dated: _____________, 20__ Dated: _____________, 20__

EXHIBIT 99.2

AKAMAI TECHNOLOGIES, INC.

Form of Performance-Based Restricted Stock Unit Agreement

Granted Under the 2013 Stock Incentive Plan

1.Grant of Award.

This Agreement evidences the grant by Akamai Technologies, Inc., a Delaware corporation (the “Company”) on ____________ __, 20__ (the “Grant Date”) to you (the “Participant”) of restricted stock units of the Company (individually, an “RSU” and collectively, the “RSUs”), subject to the terms and conditions set forth in this Restricted Stock Unit Agreement (the “Agreement”) and the Company’s 2013 Stock Incentive Plan (the “Plan”). Each RSU represents the right to receive one share of the common stock, par value $.01 per share, of the Company (“Common Stock”) as provided in this Agreement. The maximum number of shares issuable is _____________ (the “Maximum Number of Shares”). The number shares of Common Stock that are issuable upon vesting of the RSUs shall be calculated pursuant to the provisions of Schedule 1 and are referred to in this Agreement as “Shares.” Capitalized terms used but not defined in this Agreement shall have the meanings specified in the Plan.

2.Vesting; Forfeiture.

(a) Subject to the terms and conditions of this Agreement including, without limitation, Paragraph 2(b) below and Section 6 below, the number of Shares issuable pursuant to the calculation set forth in Schedule 1 to this Agreement shall vest ____________________. Such date or any other date on which shares vest under this Agreement may be referred to herein as a “Vesting Date.”

(b) Except as otherwise provided in Schedule 1, RSUs shall not continue to vest unless the Participant is, and has been at all times since the Grant Date, an employee, officer or director of, or consultant or advisor to, the Company. For purposes of this Agreement, employment with the Company shall include employment with a parent, subsidiary, affiliate or division of the Company.

3.Distribution of Shares.

(a)The Company will distribute to the Participant the Shares of Common Stock represented by vested RSUs as follows: within 30 days of the Vesting Date.

(b)The Company shall not be obligated to issue to the Participant the Shares upon the vesting of any RSU (or otherwise) unless the issuance and delivery of such Shares shall comply with all relevant provisions of law and other legal requirements including, without limitation, any applicable federal or state securities laws and the requirements of any stock exchange upon which shares of Common Stock may then be listed.

(c) Neither the Company nor the Participant shall have the right to accelerate or defer the delivery of any shares under this Agreement except to the extent specifically permitted under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and in no event shall the Participant have the right to designate the tax year in which the RSUs are delivered.

4.Restrictions on Transfer.

The Participant shall not sell, assign, transfer, pledge, hypothecate or otherwise dispose of, by operation of law or otherwise (collectively “transfer”) any RSUs, or any interest therein, except by will or the laws of descent and distribution.

5.Dividend and Other Shareholder Rights.

Except as set forth in the Plan, neither the Participant nor any person claiming under or through the Participant shall be, or have any rights or privileges of, a stockholder of the Company in respect of the Shares issuable pursuant to the RSUs granted hereunder until the Shares have been delivered to the Participant.

6.Provisions of the Plan; Acquisition Event or Change in Control Event .

(a)This Agreement is subject to the provisions of the Plan, a copy of which is made available to the Participant with this Agreement.

(b)Upon the occurrence of an Acquisition Event (as defined in the Plan), the vesting and forfeiture provisions applicable to each RSU (whether vested or unvested) shall inure to the benefit of the Company’s successor and shall apply to the cash, securities or other property which the Common Stock was converted into or exchanged for pursuant to such Acquisition Event in the same manner and to the same extent as they applied to the Common Stock subject to such RSU.

(c)Subject to Sections 6(d) and (e) hereof, upon the occurrence of a Change in Control Event (regardless of whether such event also constitutes an Acquisition Event but provided that such event constitutes a “change in control event” within the meaning of Treasury Regulation Section 1.409A-3(i)(5)(i)), the acquiring or succeeding entity (or an affiliate thereof) shall assume each outstanding RSU such that, following the consummation of the Change in Control Event, the RSU confers the Participant with the right to receive, for each share of Common Stock subject to the Award, the consideration (whether cash, securities or other property) received by each holder of Common Stock immediately prior to the Change in Control Event (the “Replacement Award”), provided that (i) such Replacement Award shall only be subject to the continued service requirement in Section 2(b) hereof until the Vesting Date(s) and shall not, for the avoidance of doubt, be subject to achievement of the performance goals set forth in Schedule I and (ii) the amount of cash, securities or other property subject to such Replacement Award shall be determined assuming that the number of shares subject to the RSU is 50% of the Maximum Number of Shares subject to the RSU.

(d)In the event that Participant’s employment is terminated by the acquiring or succeeding entity (or an affiliate thereof) for a reason other than Cause (as defined below) or by the for Good Reason (as defined below), in either case within twelve months after a Change in Control Event, all the remaining unvested portion of the Replacement Award shall become vested as of the date of the Participant’s termination of employment. “Cause” shall mean (i) any act or omission by the Participant that has a significant adverse effect on Akamai’s business or on the Participant’s ability to perform services for Akamai, including, without limitation, the commission of any crime (other than ordinary traffic violations), or (ii) refusal or failure to perform assigned duties, serious misconduct, or excessive absenteeism, or (iii) refusal or failure to comply with Akamai’s Code of Business Ethics. “Good Reason” shall mean (i) a material reduction in the Participant’s compensation and benefits (including without limitation any bonus plan or indemnity agreement not agreed to in writing by the Participant, (ii) the assignment to the Participant of duties and/ or responsibilities that are materially inconsistent with those associated with the Participant’s position or (iii) a requirement, not agreed to in writing by the Participant, that the Participant relocate to, or perform his or her principal job functions at, an office that is more than twenty-five (25) miles from the office at which the Participant was previously performing his or her principal job functions.

(e)Notwithstanding the foregoing, in the event that the acquiring or succeeding entity (or an affiliate thereof) refuses to assume the RSUs and grant Replacement Awards in connection with a Change in Control Event, this Award shall become vested, immediately prior to the Change in Control Event, with respect to 50% of the Maximum Number of Shares subject to this Award.

7.Taxes.

(a) Regardless of any action the Company or the Participant’s employer (“Employer”) takes with respect to any or all income tax, social insurance, payroll tax, payment on account or other tax-related withholding (“Tax-Related Items”), the Participant acknowledges that the ultimate liability for all Tax-Related Items legally due by him or her is and remains the Participant’s responsibility and that the Company and/or the Employer (1) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the Restricted Stock Unit award, including the grant and vesting of the Restricted Stock Units, the receipt of cash or any dividends or dividend equivalents; and (2) do not commit to structure the terms of the award or any aspect of the Restricted Stock Units to reduce or eliminate the Participant’s liability for Tax-Related Items.

(b) In the event that the Company, subsidiary, affiliate or division is required to withhold any Tax-Related Items as a result of the award or vesting of the Restricted Stock Units, or the receipt of cash or any dividends or dividend equivalents, the Participant shall pay or make adequate arrangements satisfactory to the

Company, subsidiary, affiliate or division to satisfy all withholding and payment on account obligations of the Company, subsidiary, affiliate or division. The obligations of the Company under this Agreement, including the delivery of shares upon vesting, shall be conditioned on compliance by the Participant with this Section 7. In this regard, the Participant authorizes the Company and/or the Employer to withhold all applicable Tax-Related Items legally payable by the Participant from his or her wages or other cash compensation paid to the Participant by the Company and/or the Employer. Alternatively, or in addition, if permissible under local law, the Company may withhold in shares of Common Stock an amount of shares sufficient to cover the Participant’s tax liability.

(c) The Participant will pay to the Company or the Employer any amount of Tax-Related Items that the Company or the Employer may be required to withhold as a result of the Participant’s participation in the Plan or the Participant’s award that cannot be satisfied by the means previously described.

(d) As a condition to receiving any Shares, on the date of this Agreement, Participant must execute the Irrevocable Standing Order to Sell Shares attached hereto, which authorizes the Company and Charles Schwab & Co., Inc. (or such substitute brokerage firm as is contracted to manage the Company’s employee equity award program, the “Broker”) to take the actions described in Section 7(b) and this Section 7(d) (the “Standing Order”).

(e) Participant understands and agrees that the number of Shares that the Broker will sell will be based on the closing price of the Common Stock on the last trading day before the applicable Vesting Date. The Participant agrees to execute and deliver such documents, instruments and certificates as may reasonably be required in connection with the sale of the Shares pursuant to this Section 7.

(f) Participant agrees that the proceeds received from the sale of Shares pursuant to Section 7(d) will be used to satisfy the Tax-Related Items and, accordingly, Participant hereby authorizes the Broker to pay such proceeds to the Company for such purpose. Participant understands that to the extent that the proceeds obtained by such sale exceed the amount necessary to satisfy the Tax-Related Items, such excess proceeds shall be deposited into the Participants account with Broker. Participant further understands that any remaining Shares shall be deposited into such account.

(g) The Participant represents to the Company that, as of the date hereof, he is not aware of any material nonpublic information about the Company or the Common Stock. The Participant and the Company have structured this Agreement to constitute a “binding contract” relating to the sale of Common Stock pursuant to this Section 7, consistent with the affirmative defense to liability under Section 10(b) of the Securities Exchange Act of 1934 under Rule 10b5-1(c) promulgated under such Act.

(h) This Agreement is intended to be exempt from or to comply with Section 409A of the Code and shall be interpreted consistently therewith. If and to the extent (X) any portion of RSUs constitute “nonqualified deferred compensation” within the meaning of Section 409A of the Code, (Y) such portion of the RSUs becomes payable upon the Participant’s separation from service pursuant to the terms of the Plan and this Agreement and (Z) the Participant is a specified employee as defined in Section 409A(a)(2)(B)(i) of the Code, as determined by the Company in accordance with its procedures, by which determination the Participant (through accepting the Award) agrees that he or she is bound, such portion of RSUs shall not be paid before the day that is six months plus one day after the date of “separation from service” (as determined under Code Section 409A) (the “New Payment Date”), except as Code Section 409A may then permit. The aggregate of any RSUs that otherwise would have been paid to the Participant during the period between the date of separation from service and the New Payment Date shall be paid to the Participant in a lump sum on such New Payment Date. The Company shall have no liability to a Participant, or any other Party if this Agreement is not exempt from, or compliant with, Section 409A.

8.Miscellaneous.

(a)No Rights to Employment. The Participant acknowledges and agrees that the vesting of the RSUs pursuant to Section 2 hereof is earned only by continuing service as an employee at the will of the Company (not through the act of being hired or purchasing shares hereunder). The Participant further acknowledges and

agrees that the transactions contemplated hereunder and the vesting schedule set forth herein do not constitute an express or implied promise of continued engagement as an employee or consultant for the vesting period, for any period, or at all.

(b)Severability. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement, and each other provision of this Agreement shall be severable and enforceable to the extent permitted by law.

(c)Waiver. Any provision for the benefit of the Company contained in this Agreement may be waived, either generally or in any particular instance, by the Board of Directors of the Company.

(d)Binding Effect. This Agreement shall be binding upon and inure to the benefit of the Company and the Participant and their respective heirs, executors, administrators, legal representatives, successors and assigns, subject to the restrictions on transfer set forth in Section 4 of this Agreement.

(e)Notice. All notices required or permitted hereunder shall be in writing and deemed effectively given upon personal delivery or five days after deposit in the United States Post Office, by registered or certified mail, postage prepaid, addressed to the other party hereto at the address shown beneath his or its respective signature to this Agreement, or at such other address or addresses as either party shall designate to the other in accordance with this Section 8(e).

(f)Pronouns. Whenever the context may require, any pronouns used in this Agreement shall include the corresponding masculine, feminine or neuter forms, and the singular form of nouns and pronouns shall include the plural, and vice versa.

(g)Entire Agreement; Conflicts and Interpretation. This Agreement and the Plan constitute the entire agreement between the parties and supersede all prior agreements and understandings relating to the subject matter of this Agreement. In the event of any conflict between this Agreement and the Plan, the Plan shall control. In the event of any ambiguity in this Agreement, or any matters as to which this Agreement is silent, the Plan shall govern including, without limitation, the provisions thereof pursuant to which the Board of Directors (or a committee thereof) has the power, among other things, to (i) interpret the Plan, (ii) prescribe, amend and rescind rules and regulations relating to the Plan and (iii) make all other determinations deemed necessary or advisable for the administration of the Plan.

(h)Amendment. The Company may modify, amend or waive the terms of this Agreement prospectively or retroactively, but no such modification, amendment or waiver shall impair the rights of the Participant without his or her consent, except as required by applicable law, NASDAQ or stock exchange rules, tax rules or accounting rules. Any provision for the benefit of the Company contained in this Agreement may be waived, either generally or in any particular instance, by the Board of Directors (or a committee thereof) of the Company. The waiver by either party of compliance with any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by such party of a provision of this Agreement.

(i)Governing Law. This Agreement shall be construed, interpreted and enforced in accordance with the internal laws of the State of Delaware without regard to any applicable conflicts of laws.

(j)Unfunded Rights. The right of the Participant to receive Common Stock pursuant to this Agreement is an unfunded and unsecured obligation of the Company. The Participant shall have no rights under this Agreement other than those of an unsecured general creditor of the Company.

(k) Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to the RSUs awarded under and participation in the Plan or future options that may be awarded under the Plan by electronic means or to request the Participant’s consent to participate in the Plan by electronic

means. The Participant hereby consents to receive such documents by electronic delivery and, if requested, to agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or another third party designated by the Company.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the day and year first above written. Electronic acceptance of this Agreement pursuant to the Company’s instructions to Participant (including through an online acceptance process managed by the Company’s agent) is acceptable.

AKAMAI TECHNOLOGIES, INC.

By:___________________________

Name:

Title:

_____________________________

[Name of Participant]

Address:

IRREVOCABLE STANDING ORDER TO SELL SHARES

The Participant has been granted restricted stock units (“RSUs”) by Akamai Technologies, Inc. (“Akamai”), which is evidenced by a restricted stock unit agreement between me and Akamai (the “Agreement,” copy attached). Provided that I remain employed by Akamai on each vesting date, the shares vest according to the provisions of the Agreement.

I understand that on each vesting date, the shares issuable in respect of vested RSUs (the “Shares”) will be deposited into my account at Charles Schwab & Co., Inc. (“Schwab”) and that I will recognize taxable ordinary income as a result. Pursuant to the terms of the Agreement and as a condition of my receipt of the Shares, I understand and agree that, for each vesting date, I must sell a number of shares sufficient to satisfy all withholding taxes applicable to that ordinary income. Therefore, I hereby direct Schwab to sell, at the market price and on each vesting date listed above (or the first business day thereafter if a vesting date should fall on a day when the market is closed) or as soon as practicable thereafter, the number of Shares that Akamai informs Schwab is sufficient to satisfy the applicable withholding taxes, which shall be calculated based on the closing price of Akamai’s common stock on the last trading day before each vesting date. I understand that Schwab will remit the proceeds to Akamai for payment of the withholding taxes.

I hereby agree to indemnify and hold Schwab harmless from and against all losses, liabilities, damages, claims and expenses, including reasonable attorneys’ fees and court costs, arising out of any (i) negligent act, omission or willful misconduct by Akamai in carrying out actions pursuant to the third sentence of the preceding paragraph and (ii) any action taken or omitted by Schwab in good faith reliance upon instructions herein or upon instructions or information transmitted to Schwab by Akamai pursuant to the third sentence of the preceding paragraph.

I understand and agree that by signing below or effecting an online acceptance of the Agreement, I am making an Irrevocable Standing Order to Sell Shares which will remain in effect until all of the shares have vested. I also agree that this Irrevocable Standing Order to Sell Shares is in addition to and subject to the terms and conditions of any existing Account Agreement that I have with Schwab.

_____________________________________

Signature

_____________________________________

Print Name

AKAMAI CONFIDENTIAL

SCHEDULE 1

VESTING CRITERIA FOR RSUs

EXHIBIT 99.3

AKAMAI TECHNOLOGIES, INC.

150 BROADWAY

CAMBRIDGE, MA 02142

November 12, 2015

Dr. F. Thomson Leighton

[Address]

Re: Amendment to Employment Agreement

Dear Tom:

In accordance with Section 9 of your February 25, 2013 Employment Agreement with Akamai Technologies, Inc. (the “Company”), the following sets forth an amendment thereto.

Section 5(c) is hereby amended in its entirety to read as follows:

(c) If you are employed by the Company as of the date of a Change in Control Event, then effective immediately prior to the occurrence of such Change in Control Event, you shall be entitled to pro-rated vesting of any then-unvested restricted stock units (“RSUs”) issued prior to November 12, 2015, the vesting of which is subject to the achievement of performance targets (“Performance RSUs”), as follows: the number of Performance RSUs that vest shall be equal to 100% of the then-outstanding number of unvested RSUs issuable upon achievement of target level performance of applicable metrics, pro-rated based on the percentage of the vesting period that has elapsed as of the closing date of the Change in Control Event since the grant date of the Performance RSUs. Notwithstanding the foregoing, in the event that the acquiring or succeeding entity (or an affiliate thereof) refuses to assume the unvested Performance RSUs and convert them into time-based vesting RSUs in connection with a Change in Control Event, 100% of such RSUs shall become vested, immediately prior to the Change in Control Event, at the target level performance of applicable metrics. In the event that the acquiring or succeeding entity (or an affiliate thereof) refuses to assume any time-based vesting RSUs in connection with a Change in Control Event, 100% of such RSUs shall become vested, immediately prior to the Change in Control Event.

If you are employed as of the date of a Change of Control of the Company and within twelve (12) months following such Change of Control, your employment is terminated by the surviving entity for any reason other than Cause or you resign for Good Reason:

(i)you shall be entitled to a lump sum cash payment equal to the sum of: (A) one year of your then-current annualized base salary, (B) your then-applicable annual incentive bonus at target and (C) your then-applicable incentive bonus at target multiplied by a fraction of which the numerator is the day of the year on which the effective date of termination falls (e.g., a February 15th termination date would be the 46th day) and the denominator is the number of days in such year. For purposes of this Agreement, “bonus at target” shall be as set forth in the terms of the then-applicable annual incentive bonus plan;

(ii)notwithstanding anything to the contrary in any current or future grant agreement governing the award of stock options, you shall be entitled to 100% vesting of all outstanding unvested stock options held by you on the date of termination;

(iii) you shall be entitled to 100% vesting of all unvested restricted stock units held by you on the date of termination (including RSUs issued after November 12, 2015 that originally had performance-based vesting that converted into time-based vesting RSUS upon the Change in Control Event); and

(iv) you shall be entitled to a lump sum payment of an amount equal to 12 times the monthly premium for continued health and dental insurance coverage paid by the Company on your behalf in the month preceding your termination.

Except as set forth herein, the terms of the Employment Agreement remain in full force and effect, without amendment. Please sign below to indicate your acceptance of the terms of this amendment to your Employment Agreement.

Very truly yours,

AKAMAI TECHNOLOGIES, INC.

By: __/s/ James Gemmell_________________________

James Gemmell

EVP - CHRO

I accept the foregoing amendment to my Employment Agreement with the Company.

___/s/ F. Thomson Leighton_______________________

F. Thomson Leighton

Date: November 12, 2015

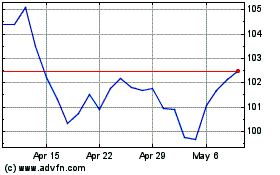

Akamai Technologies (NASDAQ:AKAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akamai Technologies (NASDAQ:AKAM)

Historical Stock Chart

From Apr 2023 to Apr 2024