UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 16, 2015

VAPOR

CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36469 |

|

84-1070932 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

3001

Griffin Road

Dania

Beach, Florida 33312

(Address

of Principal Executive Office) (Zip Code)

(888)

766-5351

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

2.02 Results of Operations and Financial Condition

On

November 16, 2015, Vapor Corp. (the “Company”) issued a press release announcing the results of operations for the

Company for the three months ended September 30, 2015. A copy of such press release is furnished as Exhibit 99.1 to this report.

The

information in Item 2.02 of this report, including the information in the press release attached as Exhibit 99.1 to this report,

is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Furthermore, the information in Item

2.02 of this report, including the information in the press release attached as Exhibit 99.1 to this report, shall not be deemed

to be incorporated by reference in the filings of the registrant under the Securities Act of 1933.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

| Exhibit

No. |

|

Exhibit |

| |

|

|

| 99.

1 |

|

Press

release dated November 16, 2015 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

VAPOR

CORP. |

| |

|

|

| Date:

November 16, 2015 |

By: |

/s/ Jeffrey Holman |

| |

Name: |

Jeffrey Holman |

| |

Title: |

Chief Executive Officer |

Exhibit

99.1

Vapor

Corp. Reports Third Quarter 2015 Results

Gross

Profit increases 57% to $1 million

Opened

and acquired eleven new retail locations in past three months

DANIA

BEACH, Fla. – November 16, 2015 – Vapor Corp. (NASDAQ CM: VPCO, VPCOU) (“Vapor” or the “Company”),

a leading U.S.-based distributor and retailer of vaporizers, e-liquids and e-cigarettes, today announced its financial and operating

results for the third quarter ended September 30, 2015.

Third

Quarter 2015 Financial Highlights

On

July 29, 2015, the Company closed a public offering for net proceeds of $38.7 million.

Gross

profit grew $370,000 or 57% to $1,018,000 in the third quarter of 2015 compared to $648,000 in the third quarter of 2014. Gross

profit from retail stores grew to $640,000 in the third quarter of 2015. The improved operating profit was attributable to the

Company’s acquisition and opening retail store locations in 2015.

| |

● |

Retail Store

Revenue grew to $984,000 in Q3 2015 |

Retail

store revenue represented 34% of the Company’s total revenues for the three months ended September 30, 2015. Retail store

revenue grew to $984,000 in the third quarter of 2015. This increase was primarily due to the Company’s retail vape store

expansion strategy. As the Company acquires more stores, management expects retail sales to increase in the future.

| |

● |

Net Loss

Reduced by $393,000 or 8% in Q3 2015 vs Q3 2014 |

Net

loss allocable to common shareholders decreased by $393,000 or 8% to $4,443,000 for the third quarter 2015 compared to a net loss

of $4,836,000 for the third quarter 2014. Adjusted EBITDA loss, a non-GAAP financial measure, declined to $2,224,800 for the third

quarter 2015 compared to an Adjusted EBITDA of $2,253,000 for the third quarter 2014. This reduction was a result of a benefit

from operating more vape stores for the third quarter. Operating loss increased $227,000, or 9%, to $2,878,000 for the third quarter

2015 compared to a net loss of $2,651,000 for the third quarter 2014. The increase was due to higher labor costs for the retail

locations acquired and opened in 2015, and the costs for closing retail kiosks.

Exhibit

99.1

“We

have delivered on our expansion strategy by opening and acquiring 11 additional vape retail stores, further strengthening our

position in this vast growing industry. We currently operate a total of 21 retail locations, with each new store contributing

to the growth of our revenue and putting us on the path towards profitability. As we achieved a higher gross profit during

the quarter, we are continuing to invest and build out our retail footprint,” said Jeff Holman, Chief Executive Officer

of Vapor Corp.

Gina

Hicks, Chief Financial Officer of Vapor Corp, added, “With effective management of our retail store expansion and cost control,

the Company’s gross profit has grown during this quarter. Retail store sales represented 52% of our total quarterly net

sales, and with the addition of retail stores we anticipate the retail sales will continue to grow”.

Recent

Business Highlights

| |

● |

The opening and

acquisition of 11 new stores across four states is key to the Company’s aggressive expansion efforts to develop a national

infrastructure throughout the country. |

| |

● |

Acquired Vulcan Vape in November 2015, an established three-store

retail vape chain with locations in Birmingham, AL., Atlanta, GA., and Nashville, TN. The Vulcan Vape stores opened in Birmingham

in May 2011, Atlanta in September 2013, and Nashville in April 2013. |

| |

|

|

| |

● |

Acquired three established retail stores located in Atlanta, GA.

in October 2015. The Atlanta stores opened in February 2014, April 2014 and September 2015. |

| |

|

|

| |

● |

Acquired an established vape store located in Fort Myers, FL, in

September 2015. We now operate seven retail stores in southwest Florida. |

| |

|

|

| |

● |

Acquired two established retail vape stores, located in Gainesville,

FL in September 2015. |

| |

|

|

| |

● |

Opened two new retail stores in Orlando, FL in August 2015. |

Non-GAAP

Financial Measure

This

press release includes both financial measures in accordance with Generally Accepted Accounting Principles, or GAAP, as well as

a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance,

financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most

directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures should be viewed as

supplemental to, and should not be considered as alternatives to net income (loss), operating income (loss), and cash flows from

operating activities, liquidity or any other financial measures. They may not be indicative of the historical operating results

of Vapor nor are they intended to be predictive of potential future results. Investors should not consider non-GAAP financial

measures in isolation or as substitutes for performance measures calculated in accordance with GAAP.

Exhibit

99.1

Our

management uses and relies on Adjusted EBITDA, a non-GAAP financial measure, we define as net loss allocable to common shareholders

before interest expense, income taxes, depreciation and amortization, stock-based compensation, non-cash change in fair value

of derivatives, non-recurring acquisition, offerings, restructuring, or other expenses, loss on debt extinguishment, loss on sale

or abandonment of assets, and goodwill impairment, if any. We believe that both management and shareholders benefit from referring

to the following non-GAAP financial measure in planning, forecasting and analyzing future periods. Our management uses this non-GAAP

financial measure in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparison.

Our management recognizes that the non-GAAP financial measure has inherent limitations because of the excluded items described

below.

We

have included a reconciliation of our non-GAAP financial measure to the most comparable financial measures calculated in accordance

with GAAP. We believe that providing the non-GAAP financial measure, together with the reconciliation to GAAP, helps investors

make comparisons between Vapor and other companies. In making any comparisons to other companies, investors need to be aware that

companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the

specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each

company under applicable SEC rules.

About

Vapor Corp.

Vapor

Corp., a NASDAQ company, is a U.S. based distributor and retailer of vaporizers, e-liquids and electronic cigarettes. It recently

acquired the retail store chain “The Vape Store” as part of a merger with Vaporin, Inc. The Company’s innovative

technology enables users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor Corp. has a streamlined supply

chain, marketing strategies and wide distribution capabilities to deliver its products. The Company’s brands include VaporX®,

Krave®, Hookah Stix® and Vaporin™ and are distributed to retail stores throughout the U.S. and Canada. The Company

sells direct to consumer via e-commerce and Company-owned brick-and-mortar retail locations operating under “The Vape Store”

brand.

Safe

Harbor Statement

This

press release includes forward-looking statements including statements regarding future profitability, opening up to 20-30 new

vape stores and minimizing future product returns. The words “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “could,”

“target,” “potential,” “is likely,” “will,” “expect” and similar expressions,

as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely

on our current expectations and projections about future events and financial trends that we believe may affect our financial

condition, results of operations, business strategy and financial needs. The results anticipated by any or all of these forward-looking

statements might not occur. Important factors that could cause actual results to differ from those in the forward-looking statements

include a shift in consumer preferences, contractual difficulties which adversely affect Vapor’s acquisition strategy and

future federal and/or state regulation regarding vaporizers and tobacco alternatives. Further information on our risk factors

is contained in our filings with the SEC, including the Prospectus dated July 23, 2015. We undertake no obligation to publicly

update or revise any forward-looking statements, whether as the result of new information, future events or otherwise.

Contacts:

Media

Relations: Caitlin Kasunich

KCSA

Strategic Communications

ckasunich@kcsa.com

/ (212) 896-1241

Investor

Relations: Jeffrey Goldberger / Garth Russell

KCSA

Strategic Communications

jgoldberger@kcsa.com

/ grussell@kcsa.com

(212)

896-1249 / (212) 896-1250

Exhibit

99.1

| | |

For the Three Months Ended | | |

| |

| | |

September 30, | | |

| |

| | |

2015 | | |

2014 | | |

2015 to 2014

Change $ | |

| | |

(Unaudited) | | |

(Unaudited) | | |

| |

| SALES: | |

| | | |

| | | |

| | |

| Wholesale and online sales, net | |

$ | 1,894,822 | | |

$ | 2,673,926 | | |

$ | (779,104 | ) |

| Retail sales, net | |

| 984,323 | | |

| - | | |

| 984,323 | |

| Total Sales | |

| 2,879,145 | | |

| 2,673,926 | | |

| 205,219 | |

| | |

| | | |

| | | |

| | |

| Cost of sales wholesale and online | |

| 1,517,327 | | |

| 2,026,422 | | |

| (509,095 | ) |

| Cost of sales retail | |

| 343,528 | | |

| - | | |

| 343,528 | |

| GROSS PROFIT | |

| 1,018,290 | | |

| 647,504 | | |

| 370,786 | |

| | |

| | | |

| | | |

| | |

| EXPENSES: | |

| | | |

| | | |

| | |

| Advertising | |

| 101,088 | | |

| 671,817 | | |

| (570,729 | ) |

| Selling, general and administrative | |

| 3,364,475 | | |

| 2,626,638 | | |

| 737,837 | |

| Retail kiosk closing cost | |

| 430,334 | | |

| - | | |

| 430,334 | |

| Total operating expenses | |

| 3,895,897 | | |

| 3,298,455 | | |

| 597,442 | |

| Operating loss | |

| (2,877,607 | ) | |

| (2,650,951 | ) | |

| (226,656 | ) |

| | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSES): | |

| | | |

| | | |

| | |

| Costs associated with underwritten offering | |

| (5,279,003 | ) | |

| - | | |

| (5,279,003 | ) |

| Amortization of debt discounts | |

| (67,797 | ) | |

| - | | |

| (67,797 | ) |

| Amortization of deferred financing costs | |

| (32,857 | ) | |

| - | | |

| (32,857 | ) |

| Loss on debt extinguishment | |

| (1,544,044 | ) | |

| - | | |

| (1,544,044 | ) |

| Non-cash change in fair value of derivatives | |

| 45,209,758 | | |

| - | | |

| 45,209,758 | |

| Stock-based expense in connection with waiver agreements | |

| (1,757,420 | ) | |

| - | | |

| (1,757,420 | ) |

| Interest income | |

| 7,183 | | |

| - | | |

| 7,183 | |

| Interest expense | |

| (23,244 | ) | |

| (8,107 | ) | |

| (15,137 | ) |

| Interest expense-related party | |

| (10,212 | ) | |

| - | | |

| (10,212 | ) |

| Total other income (expense) | |

| 36,502,364 | | |

| (8,107 | ) | |

| 36,510,471 | |

| | |

| | | |

| | | |

| | |

| Income (loss) before for income tax benefit | |

| 33,624,757 | | |

| (2,659,058 | ) | |

| 36,283,815 | |

| Income tax benefit (expense) | |

| - | | |

| (2,177,057 | ) | |

| 2,177,057 | |

| NET INCOME (LOSS) | |

| 33,624,757 | | |

| (4,836,115 | ) | |

| 38,460,872 | |

| | |

| | | |

| | | |

| | |

| Deemed dividend | |

| (38,068,021 | ) | |

| - | | |

| (38,068,021 | ) |

| NET LOSS ALLOCABLE TO COMMON SHAREHOLDERS | |

$ | (4,443,264 | ) | |

$ | (4,836,115 | ) | |

$ | 392,851 | |

Exhibit

99.1

| | |

For the Three Months Ended | |

| | |

September 30, | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Reconciliation of Adjusted EBITDA to net loss allocable to common stockholders: | |

| | | |

| | |

| NET LOSS ALLOCABLE TO COMMON SHAREHOLDERS | |

$ | (4,443,264 | ) | |

$ | (4,836,115 | ) |

| Interest | |

| 33,456 | | |

| 8,107 | |

| Income tax benefit (expense) | |

| - | | |

| 2,177,057 | |

| Depreciation and Amortization | |

| 139,971 | | |

| 6,937 | |

| Costs associated with underwritten offering | |

| 5,279,003 | | |

| - | |

| Deemed dividend | |

| 38,068,021 | | |

| - | |

| Non-cash change in fair value of derivatives | |

| (45,209,758 | ) | |

| - | |

| Stock-based expense in connection with waiver agreements | |

| 1,757,420 | | |

| - | |

| Loss on debt extinguishment | |

| 1,544,044 | | |

| - | |

| Amortization of debt discounts and deferred financing costs | |

| 100,654 | | |

| - | |

| Stock-based compensation expense | |

| 75,313 | | |

| 391,236 | |

| Retail kiosk closing costs | |

| 430,334 | | |

| - | |

| Adjusted EBITDA | |

$ | (2,224,806 | ) | |

$ | (2,252,778 | ) |

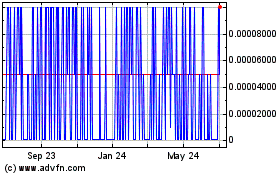

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

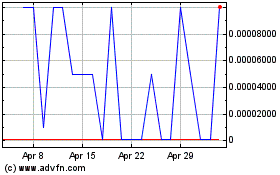

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024