Current Report Filing (8-k)

November 16 2015 - 6:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 13, 2015

Gevo, Inc.

(Exact Name

of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35073 |

|

87-0747704 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

345 Inverness Drive South, Building C, Suite 310, Englewood, CO 80112

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (303) 858-8358

N/A

(Former Name, or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On November 13, 2015, Gevo, Inc. (the “Company”) entered into a privately-negotiated exchange agreement (the “Agreement”) with one

investor holding the Company’s 7.5% Convertible Senior Notes due 2022 (“Notes”). Pursuant to the Agreement, the investor will exchange $2.5 million aggregate principal amount of outstanding Notes (the “Exchanged Notes”) for

1,107,833 shares of the Company’s common stock, par value $0.01 (“Exchange Shares”), which represents an effective exchange price of approximately $2.26 per Exchange Share. The investor has agreed to waive any accrued but unpaid

interest on the Exchanged Notes. The transactions contemplated by the Agreement are anticipated to close on November 19, 2015.

The Exchange Shares

will be issued in reliance on the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended, as securities exchanged by the Company with its existing security holders exclusively where no commission or

other remuneration is paid or given directly or indirectly for soliciting the exchange.

The foregoing description of the Agreement does not purport to be

complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which will be filed with the Securities and Exchange Commission as an exhibit to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2015.

Item 3.02. Unregistered Sale of Equity Securities.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

Forward-Looking Statements

Certain statements in this Current

Report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to a variety of matters, including, without limitation, the anticipated

closing date of the transactions contemplated by the Agreement and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the

management of the Company and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made,

and the Company undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| Gevo, Inc. |

|

|

| By: |

|

/s/ Mike Willis |

|

|

Mike Willis |

|

|

Chief Financial Officer |

Date: November 16, 2015

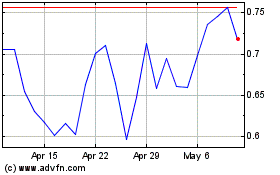

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

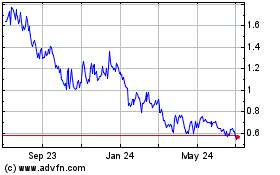

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024