UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-K

_______________________________________________

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2015

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______.

Commission File Number: 000-53551

______________________________________________

|

|

|

NUTRANOMICS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

98-0603540

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

11487 South 700 East

Salt Lake City, UT 84020

|

|

(Address of principal executive offices, including zip code)

|

|

|

|

(801) 576-8350

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

_________________________________________

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 Par Value

(Title of class)

____________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☐ Non-Accelerated Filer ☐ Smaller Reporting Company ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

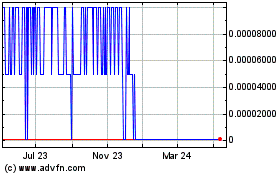

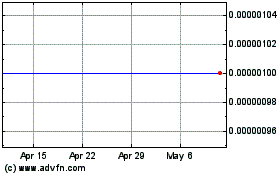

On January 31, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $515,376, based upon the closing price on that date of the common stock of the registrant on the OTC Markets system of $0.0125. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

As of November 11, 2015, the registrant had outstanding 533,165,512 shares of common stock, $0.001 par value.

| |

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

Item 1.

|

|

|

3

|

|

Item 1.A.

|

|

|

12

|

|

Item 1.B.

|

|

|

17

|

|

Item 2.

|

|

|

17

|

|

Item 3.

|

|

|

17

|

|

Item 4.

|

|

|

18

|

|

|

|

|

|

|

|

|

|

|

|

Item 5.

|

|

|

18

|

|

Item 6.

|

|

|

20

|

|

Item 7.

|

|

|

20

|

|

Item 7A.

|

|

|

26

|

|

Item 8.

|

|

|

27

|

|

Item 9.

|

|

|

47

|

|

Item 9A.

|

|

|

47

|

|

Item 9B.

|

|

|

48

|

|

|

|

|

|

|

|

|

|

|

|

Item 10.

|

|

|

48

|

|

Item 11.

|

|

|

50

|

|

Item 12.

|

|

|

51

|

|

Item 13.

|

|

|

52

|

|

Item 14.

|

|

|

52

|

|

|

|

|

|

|

|

|

|

|

|

Item 15.

|

|

|

53

|

|

|

|

|

|

|

|

|

|

54

|

|

|

|

|

|

|

|

Exhibits

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

|

·

|

our anticipated growth strategies and our ability to manage the expansion of our business operations effectively;

|

|

·

|

our ability to keep up with rapidly changing technologies and evolving industry standards;

|

|

·

|

our ability to source our needs for skilled labor, machinery and materials economically;

|

|

·

|

the loss of key members of our senior management; and

|

|

·

|

uncertainties with respect to the legal and regulatory environment surrounding our treatments.

|

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Our Corporate History and Background

We were incorporated in the State of Nevada on March 15, 2007. We were incorporated to engage in the search for gold and related minerals. We were not able to establish mining operations and did not generate any revenues. We incurred losses since inception and needed to raise additional capital to fund our operations. Our sole asset was a 100% interest in the Sigatoka Gold claim located in the Republic of Fiji. We acquired the Sigatoka Gold claim for the sum of $5,000 from an unrelated third party on May 1, 2007. We were not able to raise the capital needed to carry out our business plan and then investigated merger and acquisition opportunities, which resulted in the share exchange transaction with Health Education. Our principal offices are located at 11487 South 700 East, Salt Lake City, UT 84020. Our telephone number is 801-576-8350. Our year end is July 31.

On September 13, 2013, we entered into a share exchange agreement with Health Education Corporation, a Utah corporation (“Health Education”), and its shareholders. Pursuant to the terms of the share exchange agreement, we agreed to acquire all 8,994,800 of the issued and outstanding shares of Health Education’s common stock in exchange for the issuance by our company of 25,005,544 shares of our common stock to the shareholders of Health Education. On September 19, 2013, we closed the share exchange by issuing the required 25,005,544 common shares to the Health Education shareholders. Concurrently, our former directors and officers, Ritesh Chandra Singh and Ranjana Bharat cancelled 25,000,000 shares of our common stock. As a result of these transactions, we changed our name to Nutranomics, Inc. and had 46,505,544 issued and outstanding common shares upon the closing of the share exchange with Health Education.

In the following description of our business, “we”, “us” and “our” refer to the registrant, Nutranomics, Inc., formerly Buka Ventures Inc., a Nevada corporation, from September 19, 2013, and Health Education Corporation dba NutraNomics, a Utah corporation, prior to September 19, 2013.

Overview of our Current Business

As a result of the closing of the share exchange agreement with Health Education, Health Education has become our wholly owned subsidiary, and we now carry on the business of research, development and sales of nutritional food products. Health Education was founded in 1995 by our Chairman of the Board of Directors, Dr. Tracy K. Gibbs, and by 1997 produced and branded its own product line. Since then, we have formulated more than 480 nutritional supplements, including formulating vitamin, mineral, herbal, and probiotic supplements, and we have expanded our own product range to include 14 separate products, described below, as well as an array of complementary services and education programs. To distribute our products, we have engaged sales representatives throughout North America and Asia.

In addition to creating supplement formulations for other nutrition companies and marketing our own products, our operations have incorporated two recent important innovations, one of which was developed by Dr. Gibbs: Nutritional Blood Analysis (NBA), which quantifies a customer’s nutritional profile from a single drop of blood; and the patented Assimilation Enhancing System (AES™, US Patent Number 7,235,390), which was designed by Dr. Gibbs to improve the absorption of nutrients. The AES™ is a combination of enzymes and their co-factors that are designed to break down or digest nutrients more quickly so that the nutrients can be absorbed faster and more completely into the blood stream than if the AES™ were not present.

We use all-natural products and no fillers, and, to our knowledge, are one of the few supplement companies to exclusively use carcinogen-free 100%-pure cellulose capsules for our products. Despite these additional expenses, our products are competitively priced to provide value to consumers who are seeking the highest quality products rather than the lowest price.

Products and Services

We offer a number of nutritional products as well as educational services, including several types of analyses, trainings, certifications, and group presentations to individuals and industry professionals. Although our educational services are not directly responsible for any of our total revenues, the services do provide an excellent marketing tool. Following is a brief overview of some of these products and services.

The Works

|

· |

The Works is a whole food, multi-vitamin and mineral blend, containing vitamins and minerals |

|

· |

Contains the patented AES™ |

|

· |

Contains the patented Glycoprotein Matrix® (GPM, Patent #6,864,231, #6,942,856, & #7,138,113) |

|

· |

Capsules are 100% Pure Hypromellose Capsules (HPMC). They are SLS-free (free of Sodium Lauryl Sulfate), TiO2-free (free of titanium dioxide), and do not contain carcinogens. |

Mobility and Flexibility Complex

|

· |

A natural supplement that may aid with inflammation |

|

· |

Contains the clinically studied ingredient Wokvel® (Boswellia Serrata Extract) |

|

· |

Contains the patented AES™ |

|

· |

Capsules are 100% Pure Hypromellose Capsules (HPMC). They are SLS-free, TiO2-free, and do not contain carcinogens. |

PhytoNutrient

|

· |

A natural supplement containing several antioxidants |

|

· |

Contains the patented AES™ |

|

· |

Contains the patented Pomella® of Verdure Sciences, Inc. (Patent #7,638,640, #7,897,791, & #7,919,536) |

Immune Modulating Complex

|

· |

A supplement designed to be used on a daily basis that may modulate the lymphatic and glandular system |

|

· |

Contains the patented AES™ |

|

· |

Capsules are 100% Pure Hypromellose Capsules (HPMC). They are SLS-free, TiO2-free, and do not contain carcinogens. |

Total Body Detox

|

· |

A supplement designed to be used on a daily basis |

|

· |

Contains the patented AES™ |

|

· |

Capsules are 100% Pure Hypromellose Capsules (HPMC). They are SLS-free, TiO2-free, and do not contain carcinogens. |

***The statements included in the above product descriptions have not been evaluated by the Food and Drug Administration. These products are not intended to diagnose, treat, cure or prevent any disease.***

Nutritional Blood Analysis

Our Nutritional Blood Analysis is a powerful tool that one of our technicians and a customer can use to examine the customer’s blood cells on a video monitor, live, in real time. Using a single drop of blood, a trained technician can pinpoint several nutritional deficiencies in a 30-minute to 1-hour one-on-one session with the customer. Nutritional Blood Analysis empowers customers to understand their own unique nutritional profiles and needs, and bridges the gap between seeing a nutritional specialist and conducting general online research.

Lectures and Seminars

Educating potential and existing customers remains one of our primary marketing tools. Dr. Gibbs and other members of our staff are active keynote speakers at events and seminars targeted at medical professionals, health store operators, and individuals. The Company’s speakers and health educators have presented at numerous meetings and shows, including women’s associations, health shows, and private organizations.

Educational Courses and Materials

We have an educational course available on the subject of Live Cell Morphology.

Raw Materials, Production and Fulfillment

We outsource all of our production and fulfillment in order to maintain management’s focus on new product and market development. However, our commitment to the quality and consistency of our products is reflected in the selection of all aspects of production. All of our supplements are processed by manufacturers with which we have longstanding relationships. To our knowledge, each follows the strictest Good Manufacturing Practices (GMPs) and quality controls to ensure purity in all of our products. We use facilities around the world to ensure that production will continue in the event of a disturbance in operation at any given location, and we source some of our raw materials directly.

Sales and Marketing

The highly fragmented, competitive nature of the nutraceutical market makes sales and marketing efforts within the sector largely relationship driven. We use a number of tools to establish and maintain these relationships with consumers, including lectures, blood tests, internet questionnaires, and point systems. We have introduced an employee incentive program and brought in motivational sales trainers to build morale and keep employees focused on sales.

Direct Retail Sales

Direct retail sales generate our largest profit margin. Whereas many companies spend millions of dollars on magazine ads, commercials, and internet marketing to effectively saturate the market with their product name, our education-based marketing utilizes three tools to drive direct consumer sales.

The first of these tools is Nutritional Blood Analysis. For a fee of $60, customers receive a 30-minute to 1-hour consultation and analysis of their blood. Upon completion of the session, customers receive a written summary of the results and a recommended regimen. Many of our customers who receive a Nutritional Blood Analysis purchase our supplements.

The second tool is social media. We have a dedicated Social Media Manager that promotes Nutranomics products, multiple times daily, through Facebook, Twitter, LinkedIn, Pinterest, and other social media sites. Through this medium we are able to obtain referral customers, new customers, and educate our customers.

The third tool is email campaigns. We use proprietary software to email our customer lists newsletters, pricing updates, and promotional offers resulting in increased sales.

Wholesale/Outlet

Wholesale sales currently constitute approximately 15% of our revenue. However, with only approximately 163 retail stores out of thousands of health/food store outlets in the market carrying our products, the potential for growth is substantial.

Although product placement in such outlets is typically controlled by large distributors, we have circumvented this channel and gone direct to retailers using the Nutritional Blood Analysis program. In addition to serving as a lead generator for the retail outlet, the Nutritional Blood Analysis service is a profit center for our company. Not only does it have a high conversion-to-sale rate, Nutritional Blood Analysis is also a valuable tool for monitoring the success of the program for customers.

While this method is slower than going in through distributors, we believe that the educational component is critical to our long-term success. Not only does it provide customers with a true “value,” but it also enables participating retailers to differentiate themselves from competitors. Our marketing focus is on contrasting our products with our competitors’ as we are dedicated to using all-natural ingredients and 100% carcinogen-free capsules. Once our representative has established a relationship with the retail operator, our approach is to ask store owners to highlight the advantages of our product line—all natural, the AES feature, and carcinogen-free capsules—then encourage them to drop any product that cannot compare favorably with our products. This approach has proven effective, and the costs of placing our products in retail locations have been minimized as compared to using a large distributor.

International Sales

International sales have come primarily as a result of the efforts of Dr. Gibbs and his relationships within these markets. We currently sell products in 19 countries, with the majority of international sales generated in Japan and Taiwan. Our success in Japan, one of the only regulated nutraceutical markets in the world, has resulted in entry to neighboring Taiwan, the Philippines, Malaysia, Singapore, and Thailand. In July 2013, the company hired a Sales Director to increase sales in Asia, which increased sales in Cambodia, Singapore, and the Philippines. We also have sales in Korea, Czech Republic, Manila, Sweden, and Trinadad.

Private Labeling

We can re-brand any NutraNomics product with a private label as long as the customer is selling the product in a territory or country where our products are not being sold. If desired, we can assist with the design, production, and shipping of packages.

Custom Formulations

We can develop a product line specifically tailored to a customer’s needs. To date, we have formulated products for numerous OEM clients, including vitamins, enzymes, antioxidants, minerals, amino acids, cosmetics, and toiletries. In addition to the custom formulas we provide these clients, we incorporate our patented AES™ system.

Growth Strategy

Our management has developed a multi-lateral strategy for growth, comprised of the following tactics:

|

· |

Increase Sales of Existing Products in Existing Market |

|

· |

Execute Launch of International Partnerships |

|

o |

We believe that a real opportunity for growth is in the international community, where the markets are still nascent and overall economic growth is expected to outpace that of the United States. We will be focusing our efforts on Malaysia, the Philippines, China, Brazil, and Japan. |

|

· |

Expand Product and Service Offerings |

|

o |

We believe that future candidates for product line expansion will come through a variety of sources, including internal research and development, market trends, customer demand, third-party contract work, and acquisition. |

|

· |

Establish Royalty Agreements for AESTM Delivery System |

|

· |

Continue to Build the OEM Division |

|

o |

We believe that an opportunity exists in the competitive Direct Sales and Network Marketing sector. For a company to be successful in this market, we believe it is important for them to supply their distributors with quality products and innovative marketing ideas. Many new and existing Multi-Level and Network Marketing companies may not have money to fund R&D departments, and most large contract manufacturers may rarely customize a formula for a small company. Without the ability to bring on new and unique products, many of these companies may fail. For this reason, our custom formulation services may be attractive for MLM firms, giving us a competitive advantage. |

Market

According to a market report published by Transparency Market Research, Nutraceuticals Product Market: Global Market Size, Segment and Country Analysis & Forecasts (2007-2017), the global nutraceutical product market reached $142.1 billion in 2011 and is expected to reach $204.8 billion by 2017, growing at a CAGR of 6.3% from 2012 to 2017. Asia Pacific (including Japan) is expected to have the second largest market share after North America by 2017.

In 2011, the functional food and beverage market reached $93.0 billion, registering a growth rate of 6.0% from 2007 to 2011. North America enjoyed the highest market share for nutraceutical products at $56.4 billion in 2011.

Nutraceuticals may provide health benefits and help in healing and prevention of diseases. The global nutraceuticals product market is primarily categorized on the basis of functional food, functional beverages and dietary supplements. The global nutraceutical market is growing primarily on account of growth in the dietary supplement segment. North America has the highest market share for the nutraceutical product market, which is primarily supported by the U.S. health-conscious consumers segment.

The global nutraceutical market is estimated to have a growth rate of 6.6% during the forecasted period (2012-2017) in protein and peptides segment of dietary supplement market. The non-herbal segment of dietary supplement market is estimated to have a growth rate of 6.3% from 2012 to 2017. The omega fatty acid fortified food segment of functional food market is estimated to have a growth rate of 6.7% during the forecasted period.

The North America and Asia Pacific nutraceutical market is expected to have a market share of 39.2% and 30.4%, respectively in 2017. The dietary supplement market will be the fastest growing market from 2012 to 2017 as it may help in improving the body’s ability to heal and protect itself. This report categorizes the nutraceutical market into six geographic regions, namely North America, Western Europe, Eastern Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Competition

The U.S. nutritional supplements retail industry is a large, highly fragmented and growing industry, with no single industry participant accounting for a majority of total industry retail sales. We believe competition is based on price, quality and assortment of products, customer service, marketing support and availability of new products. In addition, the market is highly sensitive to the introduction of new products.

We compete with both publicly and privately owned companies, which are highly fragmented in terms of geographical market coverage and product categories. We also compete with other specialty retailers, supermarkets, drugstores, mass merchants, multi-level marketing organizations, mail-order companies, other internet sites and a variety of other smaller participants. We believe that the market is highly sensitive to the introduction of new products. In the United States, many of our competitors have national brands that are heavily advertised and are manufactured by large pharmaceutical and food companies and other retailers. Most supermarkets, drugstores and mass merchants have narrow product offerings limited primarily to simple vitamins, herbs and popular third-party diet products. Our international competitors also include large international pharmacy chains and major international supermarket chains, as well as other large U.S.-based companies with international operations.

Many of our competitors have had longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry, we will need to develop our brand, leverage our management’s contacts and business experience to develop a wider customer base, develop a comprehensive marketing system for retail clients, and increase our financial resources.

However, there can be no assurance that even if we do these things, we will be able to compete effectively with the other companies in our industry. As we are a relatively small company, we face the same problems as other small companies in any industry, including the lack of available funds, lack of established distribution channels or large customer base. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Intellectual Property

We originally acquired the rights, via license with our founder, to US patent #7,235,390 B2 for the Assimilation Enhancing System (AES™) (there is also a patent pending for the AES™ in Japan). The AES™ is a combination of enzymes and their co-factors that are designed to break down or digest nutrients more quickly so that the nutrients can be absorbed faster and more completely into the blood stream than if the AES™ were not present. We also have various trademarks and logo registrations in several countries (e.g., China trademark for NutraNomics logo, application #9729947).

We own the rights to our website: www.nutranomics.com.

We also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position. We protect our intellectual property rights through a variety of methods, including trademark, patent and trade secret laws, as well as confidentiality agreements and proprietary information agreements with vendors, employees, consultants and others who have access to our proprietary information. Protection of our intellectual property often affords us the opportunity to enhance our position in the marketplace by precluding our competitors from using or otherwise exploiting our technology and brands. We are also a party to the following two intellectual property license agreements relating to certain of our future products.

On March 10, 2013, we (Health Education) entered into License and Distribution Agreement with Nutriband USA, LLC (“Nutriband”) to nonexclusively research and develop a dermal patch nutrient delivery system, and exclusively license and distribute nutritional supplement dermal patches (the “Nutriband Products”) in the United States and Canada, for which Nutriband would receive a 10% royalty on our gross sales of any Nutriband Products. The license would only be terminated by the agreement of both parties.

On November 18, 2013, our wholly owned subsidiary, Health Education, entered into a License with Genesar Nutraceuticals, LLC dba Genesar Nutraceuticles, a Utah limited liability company (“Genesar”), wherein Health Education received a worldwide exclusive license to all rights relating to, and intellectual property regarding, GenEpic™, a dietary supplement, and Genesar was entitled to receive 100,000 restricted shares of Company common stock, a royalty fee of $4/box of 30 sachets of GenEpic sold by Health Education beginning after 4,000 boxes of product had been sold, and a payment of $160,000, due by December 1, 2013. The agreement included Company exclusivity rights in a multitude of Pac/Asia countries, as well as first rights of refusal to global distribution. The License Agreement had an initial term of 36 months, with the term renewing for another 36-month term unless terminated by either party providing 90 days written notice to the other party prior to the end of the term. On August 5, 2014, as we had only paid $140,000 of the required $160,000 payment to Genesar, the Company and Genesar amended the agreement to (1) adjust the royalty fee from $4/box to $5/box, (2) require royalty payments to be paid on the 20th of each month following the end of each of the Company’s fiscal quarters, (3) add a minimum royalty payment of $25,000 per year, and (4) restructure the $140,000 paid to Genesar from being considered an advance on royalties into a one-time license payment. Our founder, former CEO, and current director, Dr. Gibbs, is a non-managing minority member of Genesar.

On January 26, 2015, we entered into a Share Exchange Agreement with Nutriband’s owner, Nutriband Ltd., an Irish private limited company ("Nutriband Ireland"), and its shareholders to acquire 100% of Nutriband Ireland in exchange for (1) the issuance of 3,172,554 shares of the Company's common stock to Nutriband Ireland's shareholder, Gareth Sheridan, and (2) the payment of a perpetual 10% royalty on gross global sales of all Nutriband products to the Nutriband Ireland shareholders. We have not yet sold any Nutriband Products.

Also on January 26, 2015, our subsidiary, Health Education entered into a Bill of Sale and Assignment (the "Assignment") to purchase from Dr. Tracy Gibbs, our former CEO and current director, 100% of his rights, title and interest in and to the Assimilation Enhancing System (AES™) and related patent (US Patent Number 7,235,390) and intellectual property, in exchange for the issuance of 44,117,647 shares of the Company's common stock. The Assignment terminated the AES License and Royalty Agreement between Health Education and Dr. Gibbs dated as of June 14, 2007, and the issuance of the shares to Dr. Gibbs under the assignment satisfied outstanding royalties owed to Dr. Gibbs.

On August 25, 2015, the prior agreements between Heath Education and Genesar were superseded by a new license agreement between the Company and Genesar , wherein the Company received a worldwide exclusive license to all rights relating to, and intellectual property regarding, GenEpic™, a dietary supplement, conditionally based on the Company selling 10,000 units of GenEpic between the last quarter of 2015 and 2016, 20,000 units in 2017, 40,000 units in 2018, 50,000 units in 2019, 60,000 units in 2020 and 65,000 units ongoing annually from 2021 on. The Company agreed to pay Genesar a royalty equal to $6.50 per box sold by the Company with the exception of sales for clinical trials. The license agreement shall be perpetual except by mutual written consent of the parties, or may be terminated if the other party breaches the agreement and fails to cure such breach within 30 days of the date that written notice of the breach is given.

The duration of our trademark registrations is generally 10, 15 or 20 years, depending on the country in which the marks are registered, and the registrations can be renewed by us. The scope and duration of our intellectual property protection varies throughout the world by jurisdiction and by individual product.

Government Regulations

Domestic

The manufacture, packaging, labeling, advertising, promotion, distribution and sale of our products are subject to regulation by one or more federal agencies, including the FDA, Consumer Product Safety Commission, or CPSC, and the U.S. Department of Agriculture, or USDA. Advertising and other forms of promotion and methods of marketing are subject to regulation primarily by the U.S. Federal Trade Commission, or FTC, which regulates these activities under the Federal Trade Commission Act, or FTCA. The foregoing matters regarding our products are also regulated by various state and local agencies as well as those of each foreign country to which we distribute our products.

The Dietary Supplement Health and Education Act of 1994, or DSHEA, amended the Federal Food, Drug, and Cosmetic Act, or FFDC Act, to establish a new framework governing the composition, safety, labeling, manufacturing and marketing of dietary supplements. All of the products we market are regulated as dietary supplements under the FFDC Act.

Generally, under the FFDC Act, dietary ingredients that were marketed in the United States prior to October 15, 1994 may be used in dietary supplements without notifying the FDA. “New” dietary ingredients (i.e., dietary ingredients that were “not marketed in the United States before October 15, 1994”) must be the subject of a new dietary ingredient notification submitted to the FDA unless the ingredient has been “present in the food supply as an article used for food” without being “chemically altered”. A new dietary ingredient notification must provide the FDA with evidence of a “history of use or other evidence of safety” establishing that use of the dietary ingredient “will reasonably be expected to be safe”. A new dietary ingredient notification must be submitted to the FDA at least 75 days before it is initially marketed. The FDA may determine that a new dietary ingredient notification does not provide an adequate basis to conclude that the ingredient is reasonably expected to be safe. Such a determination could prevent the marketing of the dietary ingredient. The FDA recently issued draft guidance governing the notification for new dietary ingredients. Although FDA guidance is not mandatory, and companies are free to use an alternative approach if the approach satisfies the requirements of applicable laws and regulations, FDA guidance is a strong indication of the FDA’s “current thinking” on the topic discussed in the guidance, including its position on enforcement. At this time, it is difficult to determine whether the draft guidance, if finalized, would have a material impact on our operations. However, if the FDA were to enforce the applicable statutes and regulations in accordance with the draft guidance as written, this manner of enforcement could require us to incur additional expenses, which could be significant, and negatively impact our business in several ways, including, but not limited to, enjoining the manufacturing of our products until the FDA determines that we are in compliance and can resume manufacturing, which could increase our liability and reduce our growth prospects.

The Dietary Supplement Labeling Act of 2011, which was introduced in July 2011 (S1310), would amend the FFDC Act to, among other things, (i) require dietary supplement manufacturers to register the dietary supplements that they manufacture with the FDA (and provide a list of the ingredients in and copies of the labels and labeling of the supplements), (ii) mandate the FDA and the Institute of Medicine (a non-governmental, nonprofit organization that provides advice to the public and decision makers, such as the FDA, concerning health issues) to identify dietary ingredients that cause potentially serious adverse effects, (iii) require warning statements for dietary supplements containing potentially unsafe ingredients and (iv) require that the FDA define the term “conventional food”. If the bill is reintroduced and enacted, it could restrict the number of dietary supplements available for sale, increase our costs, liabilities and potential penalties associated with manufacturing and selling dietary supplements, and reduce our growth prospects.

The Dietary Supplement Safety Act (S3002) was introduced in February 2010 and would repeal the provision of DSHEA that permits the sale of all dietary ingredients sold in dietary supplements marketed in the United States prior to October 15, 1994, and instead permit the sale of only those dietary ingredients included on a list of Accepted Dietary Ingredients to be issued and maintained by the FDA. The bill also would allow the FDA to: impose a fine of twice the gross profits earned by a distributor on sales of any dietary supplement found to violate the law; require a distributor to submit a yearly report on all non-serious adverse event reports received during the year to the FDA; and allow the FDA to recall any dietary supplement it determines with “a reasonable probability” would cause serious adverse health consequences or is adulterated or misbranded. The bill also would require any dietary supplement distributor to register with the FDA and submit a list of the ingredients in and copies of the labels of its dietary supplements to the FDA and thereafter update such disclosures yearly and submit any new dietary supplement product labels to the FDA before marketing any dietary supplement product. If this bill is reintroduced and enacted, it could severely restrict the number of dietary supplements available for sale and increase our costs and potential penalties associated with selling dietary supplements.

The FDA or other agencies could take actions against products or product ingredients that in its determination present an unreasonable health risk to consumers that would make it illegal for us to sell such products. In addition, the FDA could issue consumer warnings with respect to the products or ingredients in such products at the point they are sold to end users. Such actions or warnings could be based on information received through FFDC Act-mandated reporting of serious adverse events. The FDA in recent years has applied these procedures to require that consumers be warned to stop using certain dietary supplements. For businesses that have been subjected to these regulatory actions, sales have been reduced and the businesses have been required to pay refunds for recalled products.

In general, we seek representations and warranties, indemnification and/or insurance from our vendors. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products. In addition, the failure of such products to comply with applicable regulatory and legislative requirements could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operations.

Under the current provisions of the FFDC Act, there are four categories of claims that pertain to the regulation of dietary supplements. First are health claims that describe the relationship between a nutrient or dietary ingredient and a disease or health related condition and can be made on the labeling of dietary supplements if supported by significant scientific agreement and authorized by the FDA in advance via notice and comment rulemaking. Second are nutrient content claims which describe the nutritional value of the product and may be made if defined by the FDA through notice and comment rulemaking and if one serving of the product meets the definition. Third are statements of nutritional support or product performance. The FFDC Act permits “statements of nutritional support” to be included in labeling for dietary supplements without FDA pre-market approval. These statements must be submitted to the FDA within 30 days of marketing and may describe how a particular dietary ingredient affects the structure, function or general well-being of the body, or the mechanism of action by which a dietary ingredient may affect body structure, function or well-being, but may not expressly or implicitly represent that a dietary supplement will diagnose, cure, mitigate, treat or prevent a disease. A company that uses a statement of nutritional support in labeling must possess scientific evidence substantiating that the statement is truthful and not misleading. The fourth category are drug claims, representations that a product is intended to diagnose, mitigate, treat, cure or prevent a disease, are prohibited from use in the labeling of dietary supplements, and we make no drug claims regarding our products.

We may make claims for our dietary supplement products regarding three of the four categories, that are statements of nutritional support, health claims and nutrient content claims when authorized by the FDA, or that otherwise are allowed by law. The FDA’s interpretation of what constitutes an acceptable statement of nutritional support may change in the future, thereby requiring that we revise our labeling. These regulatory activities include those discussed above concerning products marketed before October 15, 1994 or afterwards, and the requirements of 75 days advance notice to the FDA before marketing products containing new dietary ingredients. There is no assurance that the FDA will accept the evidence of safety for any new dietary ingredients that we may wish to market, and the FDA’s refusal to accept that evidence could prevent the marketing of the new dietary ingredients and dietary supplements containing a new dietary ingredient. If the FDA determines that a particular statement of nutritional support is an unacceptable drug claim, conventional food claim or an unauthorized version of a “health claim”, or, if the FDA determines that a particular claim is not adequately supported by existing scientific data or is false or misleading, we would be prevented from using the claim.

In addition, DSHEA provides that so-called “third-party literature”, e.g., a reprint of a peer-reviewed scientific publication linking a particular dietary ingredient with health benefits, may be used “in connection with the sale of a dietary supplement to consumers” without the literature being subject to regulation as labeling. The literature: (1) must not be false or misleading; (2) may not “promote” a particular manufacturer or brand of dietary supplement; (3) must present a balanced view of the available scientific information on the subject matter; (4) if displayed in an establishment, must be physically separate from the dietary supplements; and (5) should not have appended to it any information by sticker or any other method. If the literature fails to satisfy each of these requirements, we may be prevented from disseminating such literature with our products, and any dissemination could subject our product to regulatory action as an illegal drug.

Our dietary supplements must also comply with the Dietary Supplement and Nonprescription Drug Consumer Protection Act, which became effective on December 22, 2007. This law amends the FFDC Act to mandate that we report to the FDA any reports of serious adverse events that we receive. Under the law, an “adverse event” is any health-related event associated with the use of a dietary supplement that is adverse, and a “serious adverse event” is any adverse event that results in death, a life-threatening experience, inpatient hospitalization, a persistent or significant disability or incapacity, or a congenital anomaly or birth defect, or requires, based on reasonable medical judgment, a medical or surgical intervention to prevent one of these outcomes. Serious adverse event reports received through the address or phone number on the label of a dietary supplement, as well as all follow-up reports of new medical information received within one year after the initial report, must be submitted to the FDA no later than 15 business days after the report is received. The law also requires recordkeeping for reports of non-serious adverse events as well as serious adverse events for six years following the event, and these records are subject to FDA inspection.

In June 2007, pursuant to the authority granted by the FFDC Act as amended by DSHEA, the FDA published detailed current good manufacturing practice, or cGMP, regulations that govern the manufacturing, packaging, labeling and holding operations of dietary supplement manufacturers. The cGMP regulations, among other things, impose significant recordkeeping requirements on manufacturers. The cGMP requirements are in effect for all manufacturers, and the FDA is conducting inspections of dietary supplement manufacturers pursuant to these requirements. There remains considerable uncertainty with respect to the FDA’s interpretation of the regulations and their actual implementation in manufacturing facilities. The failure of a manufacturing facility to comply with the cGMP regulations renders products manufactured in such facility “adulterated”, and subjects such products and the manufacturer to a variety of potential FDA enforcement actions.

The FDA has also announced its intention to promulgate new cGMPs specific to dietary supplements, to fully enforce DSHEA and monitor compliance with the Bioterrorism Act of 2002. We intend to comply with the new cGMPs once they are adopted. The new cGMPs, predicted to be finalized shortly, would be more detailed and stringent than the cGMPs that currently apply to dietary supplements and may, among other things, require dietary supplements to be prepared, packaged, produced and held in compliance with regulations similar to the cGMP regulations for drugs. There can be no assurance that, if the FDA adopts cGMP regulations for dietary supplements, we will be able to comply with the new regulations without incurring a substantial expense.

In addition, under the Food Safety Modernization Act, or FSMA, which was enacted on January 4, 2011, the manufacturing of dietary ingredients contained in dietary supplements will be subject to similar or even more burdensome manufacturing requirements, which will likely increase the costs of dietary ingredients and will subject suppliers of such ingredients to more rigorous inspections and enforcement. The FSMA will also require importers of food, including dietary supplements and dietary ingredients, to conduct verification activities to ensure that the food they might import meets applicable domestic requirements.

The FDA has broad authority to enforce the provisions of federal law applicable to dietary supplements, including powers to issue a public warning or notice of violation letter to a company, publicize information about illegal products, detain products intended for import, require the reporting of serious adverse events, require a recall of illegal or unsafe products from the market, and request the Department of Justice to initiate a seizure action, an injunction action or a criminal prosecution in the U.S. courts. The FSMA expands the reach and regulatory powers of the FDA with respect to the production and importation of food, including dietary supplements. The expanded reach and regulatory powers include the FDA’s ability to order mandatory recalls, administratively detain domestic products, require certification of compliance with domestic requirements for imported foods associated with safety issues and administratively revoke manufacturing facility registrations, effectively enjoining manufacturing of dietary ingredients and dietary supplements without judicial process. The regulation of dietary supplements may increase or become more restrictive in the future.

Our failure to comply with applicable FDA regulatory requirements could result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions.

Our advertising of dietary supplement products is subject to regulation by the FTC under the FTCA. Section 5 of the FTCA empowers the FTC to prohibit unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce. Section 12 of the FTCA provides that the dissemination of any false advertisement for the purpose of inducing, directly or indirectly, the purchase of drugs or foods, which would include dietary supplements, is an unfair or deceptive act or practice. Additionally, under the FTC’s Substantiation Doctrine, an advertiser is required to have a “reasonable basis” for all objective product claims before the claims are made. Failure to adequately substantiate claims may also be considered an unfair or deceptive practice. Pursuant to this FTC requirement, we are required to have adequate substantiation for all material advertising claims made for our products.

On November 18, 1998, the FTC issued “Dietary Supplements: An Advertising Guide for Industry.” This guide provides marketers of dietary supplements with guidelines for applying FTC law to dietary supplement advertising and reiterates and explains the FTC’s “reasonable basis” determination. It includes examples of the principles that should be used when interpreting and substantiating dietary supplement advertising. Although the guide provides additional explanation, it does not substantively change the FTC’s existing policy that all supplement marketers have an obligation to ensure that claims are presented truthfully and to verify that such claims are adequately substantiated.

The FTC has a variety of processes and remedies available to it for enforcement, both administratively and judicially, including compulsory process, cease and desist orders and injunctions. FTC enforcement can result in orders requiring, among other things, limits on advertising, corrective advertising, consumer redress, divestiture of assets, rescission of contracts and such other relief as may be deemed necessary. Any violation could have a material adverse effect on our business, financial condition and results of operations.

As a result of our efforts to comply with applicable statutes and regulations in the United States and elsewhere, we have from time to time reformulated, eliminated or relabeled certain of our products and revised certain advertising claims. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative orders, when and if promulgated, would have on our business in the future. They could, however, require the reformulation of certain products to meet new standards, the recall or discontinuance of certain products not capable of reformulation, additional record keeping, expanded documentation of the properties of certain products, expanded or different labeling, and/or scientific substantiation. Any or all of such requirements could have a material adverse effect on our business, financial condition and results of operations.

Advertising and labeling for dietary supplements and conventional foods are also regulated by state, county and other local governmental authorities. Some states also permit these laws to be enforced by private attorney generals. These private attorney generals may seek relief for consumers, seek class action certifications, seek class-wide damages, seek class-wide refunds and product recalls of products sold by us. There can be no assurance that state and local authorities will not commence regulatory action, which could restrict the permissible scope of our product advertising claims, or products that can be sold in the future.

Foreign

Our products which we sell or may make plans to sell in foreign countries are also subject to regulation under various national, local and international laws that include provisions governing, among other things, the formulation, manufacturing, packaging, labeling, advertising and distribution of dietary supplements and over-the-counter drugs. These regulations may prevent or delay entry into the market or prevent or delay the introduction, or require the reformulation, of certain of our products. Compliance with such foreign governmental regulations is generally the responsibility of our distributors for those countries. These distributors are independent contractors over whom we have limited control.

Possible New Legislation or Regulation

Legislation may be introduced which, if passed, would impose substantial new regulatory requirements on dietary supplements. For example, although not yet reintroduced in this session of Congress, bills have been repeatedly proposed in past sessions of Congress which would subject the dietary ingredient dehydroepiandrosterone, or DHEA, to the requirements of the Controlled Substances Act, which would prevent the sale of products containing DHEA. In March 2009, the General Accounting Office, or GAO, issued a report that made four recommendations to enhance the FDA’s oversight of dietary supplements. The GAO recommended that the Secretary of the Department of Health and Human Services direct the Commissioner of the FDA to: (1) request authority to require dietary supplement companies to identify themselves as a dietary supplement company and update this information annually, provide a list of all dietary supplement products they sell and a copy of the labels and update this information annually, and report all adverse events related to dietary supplements, not just serious adverse events; (2) issue guidance to clarify when an ingredient is considered a new dietary ingredient, the evidence needed to document the safety of new dietary ingredients, and appropriate methods for establishing ingredient identity; (3) provide guidance to industry to clarify when products should be marketed as either dietary supplements or conventional foods formulated with added dietary ingredients; and (4) coordinate with stakeholder groups involved in consumer outreach to identify additional mechanisms for educating consumers about the safety, efficacy, and labeling of dietary supplements, implement these mechanisms, and assess their effectiveness. These recommendations could lead to increased regulation by the FDA or future legislation concerning dietary supplements.

We cannot determine what effect additional domestic or international governmental legislation, regulations, or administrative orders, when and if promulgated, would have on our business in the future. New legislation or regulations may require the reformulation of certain products to meet new standards, require the recall or discontinuance of certain products not capable of reformulation, impose additional record keeping or require expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

Environmental Compliance

We are subject to numerous federal, state, local and foreign environmental and health and safety laws and regulations governing its operations, including the handling, transportation and disposal of our non-hazardous and hazardous substances and wastes, as well as emissions and discharges from its operations into the environment, including discharges to air, surface water and groundwater. Failure to comply with such laws and regulations could result in costs for remedial actions, penalties or the imposition of other liabilities. New laws, changes in existing laws or the interpretation thereof, or the development of new facts or changes in their processes could also cause us to incur additional capital and operating expenditures to maintain compliance with environmental laws and regulations and environmental permits. We are also subject to laws and regulations that impose liability and cleanup responsibility for releases of hazardous substances into the environment without regard to fault or knowledge about the condition or action causing the liability. Under certain of these laws and regulations, such liabilities can be imposed for cleanup of previously owned or operated properties, or for properties to which substances or wastes that were sent in connection with current or former operations at its facilities. The presence of contamination from such substances or wastes could also adversely affect our ability to sell or lease our properties, or to use them as collateral for financing. From time to time, we have incurred costs and obligations for correcting environmental and health and safety noncompliance matters and for remediation at or relating to certain of our properties or properties at which our waste has been disposed. However, compliance with the provisions of national, state and local environmental laws and regulations has not had a material effect upon our capital expenditures, earnings, financial position, liquidity or competitive position. We believe we have complied with, and are currently complying with, our environmental obligations pursuant to environmental and health and safety laws and regulations and that any liabilities for noncompliance will not have a material adverse effect on our business, financial performance or cash flows. However, it is difficult to predict future liabilities and obligations, which could be material.

Costs of Environmental Compliance

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

In addition to conducting research and development for our own products, the research and development division is regularly solicited to create or formulate products for third parties. Beyond the revenue stream provided by these services, the activities of the research and development division generate significant intellectual property for us. In some cases, we retain sole ownership of the formulations created, and in others we benefit from data that can be applied to our future projects as well as from royalties extracted for the use of the formulations.

We incurred $2,093 and $32,233 in research and development expenses during the years ended July 31, 2015 and 2014, respectively.

As of July 31, 2015, we had 6 full-time employees. We also currently engage independent contractors in the areas of accounting, legal and auditing services, corporate finance, as well as marketing and business development. The remuneration paid to our officers and directors is more completely described elsewhere in this report in the “Executive Compensation” section.

Available Information

All reports of the Company filed with the SEC are available free of charge through the SEC’s web site at www.sec.gov. In addition, the public may read and copy materials filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

The following important factors, among others, could cause our actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this Form 10-K or presented elsewhere by management from time to time.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this report that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risks Related to Our Business

There is doubt about our ability to continue as a going concern due to our operating history of net losses after consideration of income taxes, negative working capital and insufficient cash flows, and lack of liquidity to pay our current obligations, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements, at this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the generation of revenue, the sale of our common stock, or through financing to sustain the company over the next twelve months. We do not have enough cash on hand to meet our obligations over the next twelve months. As discussed in Note 2 to our financial statements for the years ended July 31, 2015 and 2014, the fact that we have generally had net losses, that we had negative working capital and insufficient cash flows from operation as of July 31, 2015, and do not have the requisite liquidity to pay our current obligations, raise substantial doubt about our ability to continue as a going concern.

We sell our products and services in highly competitive markets, which results in pressure on our profit margins and limits our ability to maintain or increase the market share of our services.

The nutraceutical industry is subject to significant competition and pricing pressures. We experience significant competitive pricing pressures as well as competitive products. Several significant competitors offer products with prices that match or are lower than ours. We believe that the products we offer are generally competitive with those offered by other supplement and nutraceutical companies. It is possible that one or more of our competitors could develop a significant research advantage over us that allows them to provide superior products or pricing, which could put us at a competitive disadvantage. Continued pricing pressure or improvements in research and shifts in customer preferences away from natural supplements could adversely impact our customer base or pricing structure and have a material and adverse effect on our business, financial condition, results of operations and cash flows.

Our future growth is largely dependent upon our ability to successfully compete with new and existing competitors by developing or acquiring new products that achieve market acceptance with acceptable margins.

Our business operates in markets that are characterized by rapidly changing products, evolving industry standards and potential new entrants. For example, a number of new companies with innovative products, which promise significant health benefits are established every year and are competitive with our products. If these companies gain market acceptance, our ability to grow our business could be materially and adversely affected. Accordingly, our future success depends upon a number of factors, including our ability to accomplish the following: identify emerging health trends in our target end-markets; develop, acquire and maintain competitive products; enhance our products by adding innovative features that differentiate us from our competitors; and develop or acquire and bring products to market quickly and cost-effectively. Our ability to develop or acquire new products based on quality research can affect our competitive position and requires the investment of significant resources. These acquisitions and development efforts divert resources from other potential investments in our businesses, and they may not lead to the development of new research or products on a timely basis. New or enhanced products may not satisfy consumer preferences and potential product failures may cause consumers to reject these products. As a result, these products may not achieve market acceptance and our brand image could suffer. In addition, our competitors may introduce superior designs or business strategies, impairing our brand and the desirability of our products, which may cause consumers to defer or forego purchases of our products. Also, the markets for our products and services may not develop or grow as we anticipate. The failure of our products to gain market acceptance, the potential for product defects or the obsolescence of our products could significantly reduce our revenue, increase our operating costs or otherwise adversely affect our business, financial condition, results of operations or cash flows.

Adverse publicity or consumer perception of our products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues.

We believe we are highly dependent upon positive consumer perceptions of the safety and quality of our products as well as similar products distributed by other nutrition supplement companies. Consumer perception of nutrition supplements and our products in particular can be substantially influenced by scientific research or findings, national media attention and other publicity about product use. Adverse publicity from these sources regarding the safety, quality or efficacy of nutritional supplements and our products could harm our reputation and results of operations. The mere publication of news articles or reports asserting that such products may be harmful or questioning their efficacy could have a material adverse effect on our business, financial condition and results of operations, regardless of whether such news articles or reports are scientifically supported or whether the claimed harmful effects would be present at the dosages recommended for such products.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel, hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization, particularly sales and marketing. Competition in our industry for qualified employees is intense. In addition, our compensation arrangements, such as our bonus programs, may not always be successful in attracting new employees or retaining and motivating our existing employees. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many of which may be outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date, and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Each of the following factors may affect our operating results:

| |

·

|

our ability to deliver products in a timely manner in sufficient volumes;

|

| |

·

|

our ability to recognize product trends;

|

| |

·

|

our loss of one or more significant customers;

|

| |

·

|

the introduction of successful new products by our competitors; and

|

| |

·

|

adverse media reports on the use or efficacy of nutritional supplements.

|

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results.

We have a single customer that accounts for a substantial portion of our revenues, and three vendors that are our major suppliers, and our business would be harmed were we to lose this customer or these vendors.

One of our customers makes up approximately 21% and 38% of our total sales for the years ending July 31, 2015 and 2014, and five of our suppliers make up approximately 47% and 63% of our total purchases for the years ending July 31, 2015 and 2014. We do not have purchase or supply agreements with this customer or these suppliers governing future orders, and were we to lose this customer or these suppliers, our business would be harmed. Our revenues would significantly decline were we to lose this customer, and our cost of goods sold would increase were we to lose these suppliers.

We may be exposed to material product liability claims, which could increase our costs and adversely affect our reputation and business.

As a marketer and distributor of products designed for human consumption, we could be subject to product liability claims if the use of our products is alleged to have resulted in injury. Our products consist of vitamins, minerals, herbs and other ingredients that are classified as dietary supplements and in most cases are not subject to pre-market regulatory approval in the United States or internationally. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur.

We have not had any product liability claims filed against us, but in the future we may be subject to various product liability claims, including among others that our products had inadequate instructions for use, or inadequate warnings concerning possible side effects and interactions with other substances. The cost of defense can be substantially higher than the cost of settlement even when claims are without merit. The high cost to defend or settle product liability claims could have a material adverse effect on our business and operating results.

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate needing significant capital to fulfill our contractual obligations, complete the research and development of our planned services, obtain regulatory approvals, and execute our business plan, generally. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled employees and professionals and adequate funds in a timely manner.

Our business strategy includes making acquisitions and investments that complement our existing business. These acquisitions and investments could be unsuccessful or consume significant resources, which could adversely affect our operating results.

We will continue to analyze and evaluate the acquisition of strategic businesses or product lines with the potential to strengthen our industry position or enhance our existing set of products and service offerings. We cannot assure you that we will identify or successfully complete transactions with suitable acquisition candidates in the future. Nor can we assure you that completed acquisitions will be successful.

Acquisitions and investments may involve significant expenditures, debt incurrence, operating losses and expenses that could have a material adverse effect on our business, financial condition, results of operations and cash flows. Acquisitions involve numerous other risks, including:

|

|

•

|

|

diversion of management time and attention from daily operations;

|

|

|

•

|

|

difficulties integrating acquired businesses, technologies and personnel into our business;

|

|

|

•

|

|

difficulties in obtaining and verifying the financial statements and other business information of acquired businesses;

|

|

|

•

|

|

inability to obtain required regulatory approvals and/or required financing on favorable terms;

|

|

|

•

|

|

potential loss of key employees, key contractual relationships or key customers of acquired companies or of us;

|

|

|

•

|

|

assumption of the liabilities and exposure to unforeseen liabilities of acquired companies; and

|

|

|

•

|

|

dilution of interests of holders of shares of our common stock through the issuance of equity securities or equity-linked securities.

|

It may be difficult for us to complete transactions quickly and to integrate acquired operations efficiently into our current business operations. Any acquisitions or investments may ultimately harm our business or financial condition as such acquisitions may not be successful and may ultimately result in impairment charges.

Our insurance coverage or third party indemnification rights may not be sufficient to cover our legal claims or other losses that we may incur in the future.

We maintain insurance, including property, general and product liability, and workers’ compensation to protect ourselves against potential loss exposures. In the future, insurance coverage may not be available at adequate levels or on adequate terms to cover potential losses, including on terms that meet our customer’s requirements. If insurance coverage is inadequate or unavailable, we may face claims that exceed coverage limits or that are not covered, which could increase our costs and adversely affect our operating results.