SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

____________________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported: November 12, 2015

OptimizeRx Corporation

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-53605 |

|

26-1265381 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 400 Water Street, Suite 200, Rochester, MI |

|

48307 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: 248.651.6568

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION

2 – Financial Information

Item

2.02 Results of Operations and Financial Condition.

On November

12, 2015, we issued a press release announcing the results of operations for the quarter ended September 30, 2015.

The press

release is furnished with this Current Report on Form 8-K as Exhibit 99.1. The information furnished under this Item 2.02 and

Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor

shall it be deemed incorporated by reference in any registration statement or other filing under the Securities Act of 1933, as

amended, regardless of any general incorporation by reference language in such filing, except as shall be expressly set forth

by specific reference in any such filing.

SECTION

9 – Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

| Exhibit No. | |

Description |

| 99.1 | |

Press release, dated November 12, 2015 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

OptimizeRx

Corporation

| |

|

Douglas

Baker

Chief

Financial Officer |

|

| |

|

| Date:

November 13, 2015 |

|

3

Exhibit 99.1

OptimizeRx

Corporation Reports Record Third Quarter 2015 Results

Strategic

Investment by WPP and Expanded Partnership with Allscripts Supports Continued Growth and Profitability into 2016

ROCHESTER,

MI – November 12, 2015 – OptimizeRx Corp. (OTCQB: OPRX), a software company whose premier content-delivery

platform enables pharmaceutical companies to provide on-demand patient-care services, reported results for the third quarter ended

September 30, 2015.

Q3

2015 Highlights

| ● | Record

quarterly net revenue of $2.0 million, up 10% vs. year-ago quarter. |

| | | |

| ● | Achieved

profitability, with net income of $88,000, as opposed to a loss of $295,000 in the year-ago

quarter |

| | | |

| ● | WPP,

the largest marketing services company in the world, acquired a minority interest in

OptimizeRx for $4.7 million. WPP will assist OptimizeRx in acquiring more brands by leveraging

its expansive network of pharmaceutical clients it provides marketing services to. In

addition, WPP and OptimizeRx will co-develop new platforms to deliver vital information

to physicians and patients, and help expand the electronic health record (EHR) network. |

| | | |

| ● | Expanded

exclusive partnership with Allscripts Healthcare Solutions, a global leader in healthcare

information technology solutions, to automate voucher and copay savings support within

its Touchworks® EHR platform. |

| | | |

| ● | Grey

Healthcare Group, a subsidiary of WPP, CEO Lynn Vos joined OptimizeRx’s board as

a director and is leading the relationship between OptimizeRx and WPP, the largest marketing

services company in the world with 3,000 offices and 170,000 associates. |

Q3 2015

Financial Summary

Net revenue

in the third quarter of 2015 increased 10% to a record $2.0 million from $1.8 million in the same year-ago quarter. The increase

was due to both increased promotion of pharmaceutical brands and expanded distribution channels.

Operating

expenses were $0.9 million in the third quarter of 2015, as compared to $1.2 million in the same year-ago quarter.

Net income

was $88,000, as compared to a loss of $295,000 in the same year-ago quarter.

Cash and

cash equivalents totaled $8.2 million as of September 30, 2015, as compared to $3.4 million as of December 31, 2014, and the company

continues to operate debt-free. The increase in cash and equivalents was primarily due to the strategic investment of $4.7 million

by WPP, and the company also generated positive cash flow from operations of approximately $0.5 million.

First

Nine Months 2015 Financial Summary

Net revenue

in the first nine months of 2015 increased 15% to a record $5.2 million from $4.5 million in the same year-ago period.

Operating

expenses decreased to $2.7 million as compared to $3.5 million in the same year-ago period. The decrease was primarily due to

a $400,000 legal settlement that occurred in the year-ago period, as well as the reduction in stock-based compensation.

Net loss

totaled $180,000 or $(0.01) per share, as compared to a loss of $1.3 million or $(0.05) per basic share in the same year-ago period.

Management

Commentary

“During

the third quarter, we achieved record revenue and attained profitability through continued progress in both segments of our business,”

said David Harrell, CEO of OptimizeRx. “This included adding new brands to our channel and expanding agreements with pharmaceutical

companies who are looking for new ways to market their products and reach doctors and patients at ‘point-of-prescribe.’

“We

expanded our networks with Allscripts to work with us exclusively to manage their patient savings across all of their EHR platforms,

including their largest platform, Touchworks, which will be integrated in 2016,” continued Harrell. “With Allscripts,

we now are the exclusive delivery platform for more than 200 EHRs, with this exclusivity representing about two thirds of

our network. This will insure our leadership as innovators in the space and provide key competitive barriers to entry.

“OptimizeRx

has now created the largest network of its kind, with promotional programs incorporated into more than 350 leading EHRs and engaging

more healthcare providers at ‘point-of-prescribe’ than any other network. This broad market reach and exclusivity

provides a substantial competitive barrier to entry.

“We

anticipate our deeper relationship with GHG/WPP and their investment to help expand our point-of-care EHR promotional network

and service offerings, increase the number of participating brands, as well as enhance our management and infrastructure. Through

this relationship, we now have access to virtually every pharmaceutical company in the world. As announced today, we appointed

David Smith as VP of Client Services to leverage this relationship and focus on monetization strategies.

In all, we see this key partnership supporting our continued growth and profitability in the current quarter and beyond.”

Conference

Call

OptimizeRX

will host a conference call today to discuss the third quarter of 2015, followed by a question and answer period.

Date: Thursday,

November 12, 2015

Time: 4:30

p.m. Eastern time (2:30 p.m. Mountain time)

Toll-free

dial-in number: +1 (888) 539-3612

Toll dial-in

number: +1 (719) 457-2664

Conference ID: 568874

A replay

of the call will be available through December 3, 2015.

Replay number:

+1 (719) 457-0820

Replay ID:

568874

The company

expects to file its quarterly report on Form 10Q today.

About

OptimizeRx Corp

OptimizeRx Corporation (OTCQB: OPRX) provides unique consumer and

physician platforms to help patients better afford and comply with their medicines and healthcare products, while offering

pharmaceutical and healthcare companies effective ways to expand awareness, access and adherence to their medications.

Our

core product, SampleMD, replaces drug samples with electronic trial vouchers and copay coupon savings that are electronically

added to an e-Prescription and sent electronically to the pharmacy and is integrated within leading Electronic Health Record (EHR)

platforms in the country, including Allscripts, Quest Diagnostics, Practice Fusion and over 350 other EHRs to reach over 250,000

healthcare providers. In turn, we promote patient savings and support from the world’s largest pharmaceutical companies,

including Pfizer, Lilly, Novartis, AstraZeneca and many others. For more information, please go to www.optimizerxcorp.com.

Important

Cautions Regarding Forward Looking Statements

This press release contains forward-looking statements within the definition

of Section 27A of the Securities Act of 1933, as amended and such section 21E of the Securities Act of 1934, amended. These forward-looking

statements should not be used to make an investment decision. The words 'estimate,' 'possible' and 'seeking' and similar expressions

identify forward-looking statements, which speak only as to the date the statement was made. The company undertakes no obligation

to publicly update or revise any forward-looking statements, whether because of new information, future events, or otherwise.

Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified.

Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking

statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect

of government regulation, competition and other material risks.

OPTIMIZERx

CORPORATION

CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS

OF SEPTEMBER 30, 2015 AND DECEMBER 31, 2014

| | |

September 30, 2015 | | |

December 31, 2014 | |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 8,174,409 | | |

$ | 3,446,973 | |

| Accounts receivable | |

| 2,740,104 | | |

| 2,100,381 | |

| Prepaid expenses | |

| 86,796 | | |

| 28,093 | |

| Total Current Assets | |

| 11,001,309 | | |

| 5,575,447 | |

| Property and equipment, net | |

| 10,104 | | |

| 12,813 | |

| Other Assets | |

| | | |

| | |

| Patent rights, net | |

| 889,184 | | |

| 930,854 | |

| Web development costs, net | |

| 414,066 | | |

| 504,643 | |

| Security deposit | |

| 5,049 | | |

| 5,049 | |

| Total Other Assets | |

| 1,308,299 | | |

| 1,440,546 | |

| TOTAL ASSETS | |

$ | 12,319,712 | | |

$ | 7,028,806 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable - trade | |

$ | 174,924 | | |

$ | 200,372 | |

| Accounts payable - related party | |

| 570,000 | | |

| 570,000 | |

| Accrued expenses | |

| 45,005 | | |

| 25,459 | |

| Revenue share payable | |

| 1,996,969 | | |

| 1,502,761 | |

| Deferred revenue | |

| 293,112 | | |

| 120,130 | |

| Total Liabilities | |

| 3,080,010 | | |

| 2,418,722 | |

| Stockholders' Equity | |

| | | |

| | |

| Common stock, $.001 par value, 500,000,000 shares authorized, 29,018,425 and 22,867,319 shares issued and outstanding, respectively | |

| 29,018 | | |

| 22,867 | |

| Preferred stock, $.001 par value, 10,000,000 shares authorized, no shares issued and outstanding | |

| - | | |

| - | |

| Stock warrants | |

| 2,342,645 | | |

| 2,153,295 | |

| Additional paid-in-capital | |

| 32,075,631 | | |

| 27,595,609 | |

| Stock payable | |

| 1,132,148 | | |

| 963,063 | |

| Deferred stock compensation | |

| (34,500 | ) | |

| - | |

| Accumulated deficit | |

| (26,305,240 | ) | |

| (26,124,750 | ) |

| Total Stockholders' Equity | |

| 9,239,702 | | |

| 4,610,084 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 12,319,712 | | |

$ | 7,028,806 | |

OPTIMIZERx

CORPORATION

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30 | | |

September 30 | |

| | |

2015 | | |

Restated

2014 | | |

2015 | | |

Restated

2014 | |

| | |

| | |

| | |

| | |

| |

| NET REVENUE | |

$ | 2,007,409 | | |

$ | 1,819,421 | | |

$ | 5,200,419 | | |

$ | 4,535,657 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF SALES | |

| 1,044,415 | | |

| 958,334 | | |

| 2,683,183 | | |

| 2,249,885 | |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS MARGIN | |

| 962,994 | | |

| 861,087 | | |

| 2,517,236 | | |

| 2,285,772 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| 875,425 | | |

| 1,155,933 | | |

| 2,698,694 | | |

| 3,542,680 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) FROM OPERATIONS | |

| 87,569 | | |

| (294,846 | ) | |

| (181,458 | ) | |

| (1,256,908 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 368 | | |

| 303 | | |

| 968 | | |

| 632 | |

| | |

| | | |

| | | |

| | | |

| | |

| TOTAL OTHER INCOME (EXPENSE) | |

| 368 | | |

| 303 | | |

| 968 | | |

| 632 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES | |

| 87,937 | | |

| (294,543 | ) | |

| (180,490 | ) | |

| (1,256,276 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) | |

$ | 87,937 | | |

$ | (294,543 | ) | |

$ | (180,490 | ) | |

$ | (1,256,276 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERGE NUMBER OF SHARES OUTSTANDING | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC | |

| 23,259,837 | | |

| 23,362,377 | | |

| 23,060,787 | | |

| 21,089,514 | |

| DILUTED | |

| 24,348,551 | | |

| N/A | | |

| N/A | | |

| N/A | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) PER SHARE | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.05 | ) |

| DILUTED | |

| 0.00 | | |

$ | N/A | | |

| N/A | | |

| N/A | |

Company

Contact:

OptimizeRx

Doug Baker

dbaker@samplemd.com

248-651-6568 x807

Investor

Relations Contact:

Liolios

Group

Ron Both,

Senior Managing Director

oprx@liolios.com

949-574-3860

6

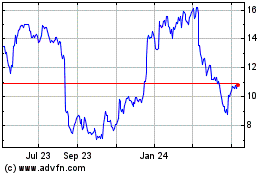

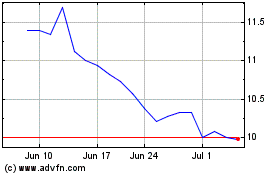

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Apr 2023 to Apr 2024