UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) November 13, 2015 (November 13, 2015)

_______________

MINERCO, INC.

(Exact name of registrant as specified in its charter)

_______________

|

| | |

NEVADA | 333-156059 | 27-2636716 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

800 Bering Drive

Suite 201

Houston, TX 77057

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 8.01. OTHER EVENTS

On November 13, 2015, the Company released a Press Release to discuss the Company's operations and business outlook. A copy of the press release is furnished as Exhibit 99.1, to this Current Report on Form 8-K filed with the Securities and Exchange Commission.

The information in this Item 8.01 and Exhibit 99.1 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Current Report, and its Exhibit(s), shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

| | | | | | |

| | Incorporated by reference | |

Exhibit | Document Description | Form | | Date | Number | Filed herewith |

99.1 | Press Release, dated November 13, 2015 | | | | | X |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| MINERCO, INC. | |

| | | |

Date: 11/13/2015 | By: | /s/ V. Scott Vanis | |

| | | |

| | | |

| | | |

V. Scott Vanis

Minerco's Chairman and CEO

A Letter from the Chairman

November 13, 2015

Dear Shareholders,

We just filed our audited Annual Report on Form 10-K for Fiscal Year (FY) 2015. Since our last financial report in June, 2015, many constructive changes have occurred in and for our company. While most all of the changes have been positive and demonstrate tremendous progress as a company, a few of the changes have been viewed as negative by a subset of shareholders. I firmly believe this subset’s reaction is a matter of perspective, investment goals and timelines.

In FY 2015, we transitioned from a Development Stage company to an Operating company. In FY 2014, we booked $12,400 in annual revenues; and in FY 2015 (ending 7/31/2015), we booked over $2,452,000 in annual revenues representing an almost 200 fold realized increase (over 19,000%) in revenues. This staggering increase is directly due to the acquisition of Avanzar Sales & Distribution, LLC and the launch of our flagship brand, VitaminFIZZ.

VitaminFIZZ Acquisition

When we acquired the licensing rights for VitaminFIZZ® in 2013, we were a startup beverage company. As a young company, we entered into a licensing agreement (with only satisfactory terms) for VitaminFIZZ with some of the biggest names in the beverage industry. This partnership / agreement was instrumental in establishing Athena Brands as a viable beverage company. Since launching VitaminFIZZ, we have grown from a startup into a proven beverage company doing over $2,400,000 in sales and revenues. As we grew out of the startup classification, we experienced some challenges and growing pains.

One of the challenges we faced was the management and ownership of VitaminFIZZ which was compounded by growth exceeding expectations. While our company did not invent VitaminFIZZ, our shareholders did build VitaminFIZZ and make it what it is today. Once the “game changing” account was solidified, the debate over management and ownership with our VitaminFIZZ partners became imperative. After over three months of serious debate and firm negotiation which included the demand for a more secure share structure, we were able to acquire 100% ownership of the VitaminFIZZ brand while maintaining the support of some of the biggest names in the beverage industry.

From the company’s and a long term shareholder’s perspective, the short term growing pains caused by the VitaminFIZZ negotiation this past summer are far outweighed by the long term outcome of controlling and owning our future. The “game changing” account placement is still valid, and we plan to place VitaminFIZZ in the next national schematic (planogram) after the Holidays. In perspective, we were delayed approximately 4 months on the placement; however, we now forever get 100% of the revenue from the placement, and the product placements that follow.

FY 2015 Financials

While we have achieved many goals and reached many milestones, we still have much to accomplish. This is my list of highlights and opportunities for improvement based on our latest audited Annual Report on Form 10-K for the period ending 7/31/2015.

Highlights:

| |

1. | Realized revenues by shareholders increased from $12,400 in FY 2014 (prior to Avanzar acquisition) to over $2,452,000 in FY 2015. This almost 200 fold (over 19,000%) increase in revenues is directly attributable to the acquisition of Avanzar and successful launch of VitaminFIZZ. |

| |

2. | Realized assets increased year over year from $768,684 in FY 2014 to over $1,779,000 in FY 2015. The 130% increase is attributable to the initial Avanzar acquisition. This increase would be much larger had we been able to book assets for the incremental purchase percentages of Avanzar. The total unquantified asset value is approximately $3,930,000 representing an asset gain of over 400%. We currently own 75% of Avanzar and expect to acquire 100% in the future. |

| |

Note: | As of the end of FY 2014, we had approximately 2.5 billion shares outstanding versus 3.37 billion at the end of FY 2015, representing an increase of approximately 35%. Year over year, for a 35% increase in outstanding shares, shareholders realized an over 400% increase in asset value and an almost 200 fold (over 19,000%) increase in revenues. |

| |

3. | Derivative liabilities are down year over year from ~$650,000 in FY 2014 to ~$352,000 in FY 2015. The decrease is mostly due to the paying down or settlement of all toxic convertible notes. |

| |

4. | As reflected in the Financials, as of 7/31/2015, we had returned approximately 55,000,000 (pre-split) shares of our common stock to treasury. As of today, we have returned a total of approximately 75,000,000 (pre-split) shares to treasury. |

| |

5. | While not reflected in the Financials, the Avanzar distribution rights for Outlaw Energy was a very significant intangible addition for the company. Outlaw Energy is a startup founded by experienced beverage entrepreneur Lance Collins with initial startup funding in the millions (side note: Outlaw intends to give away approximately 50% of its brand for this funding) with focus on Southern California and the rest of the Southwest. With Avanzar being the major distributor in the region, a portion of this capital will be used to support Avanzar’s infrastructure and most sales in the region will flow through Avanzar. |

Opportunities for Improvement:

| |

1. | Service revenue was down year over year by $242,000 for Avanzar. The reason for the decrease was mainly due to the shift in focus from third party service to VitaminFIZZ service. We strive to adjust this in this FY by hiring more Athena dedicated sales and service staff. |

| |

2. | Cost of Goods Sold (COGS) increased by approximately $317,000 and is mostly attributable to the launch and growth of VitaminFIZZ which included promotional activities. As our footprint and production runs get larger, the COGS should decrease significantly. In addition, a manufacturing asset or partnership could help us improve this area. |

| |

3. | Operating Expenses increased by approximately $2,000,000 year over year which is in line with running 2 large scale, rapid growth business lines, Avanzar and VitaminFIZZ. In perspective, in FY 2014, we were only running 1 small scale business line. While we feel we have effectively controlled costs, there are always opportunities to improve. |

| |

4. | VitaminFIZZ placed slightly over 30,000 cases in the Quarter ending 7/31/2015. With the addition of a few more Key Accounts, we feel we can drastically improve our VitaminFIZZ placement and sales in 2016. Note: The majority of VitaminFIZZ sales are consolidated into the Avanzar sales numbers. |

| |

5. | While not reflected in Financials, we know we need to deliver more net revenues to the bottom line. One of steps in achieving this necessity is the acquisition of our new “workhorse” brand. |

Workhorse Brand

The current situation for Minerco and its portfolio of companies is that only Avanzar delivers a positive bottom line, but this profit is reinvested in the constant expansion of Avanzar. VitaminFIZZ was always scheduled to be profitable late in year three, and we are just beginning year two. In early summer, even

before the VitaminFIZZ negotiation began, we started exploring the possibility of a workhorse brand which will reach profitability in its first year to cover all general and administrative expenses (corporate overhead on all levels). By utilizing our unique advantage of owning our distributor, we were able to identify and secure rights to a brand that matched all of the criteria including: 1.) already developed, 2.) established branding, 3.) cash flow positive in year one, and 4.) easily integrated into our existing infrastructure network. The deal has been fully negotiated and is virtually complete except for the extension of the licensing agreement.

Avanzar Update

Avanzar is a key piece of our business model. Tactically, Avanzar positions our brands to efficiently start, test, grow and expand in the friendly confines of Southern California where we have existing infrastructure. Once our brands are established, Avanzar’s relationships and expanded broker network do / will allow our brands to transition onto the national stage. Our advantage is that we have battle tested brands with a perfected model before they go national. This makes national buyers happy and saves us money.

Strategically, Avanzar allows us to identify emerging trends and growing brands in the space very early in the process. This strategic advantage is exactly how we identified and secured our new workhorse brand.

Furthermore, our unique relationship between our distributor and our brands allows us to combine and comingle resources, staff and operations, providing a level of cost efficiency which is highly unusual for a company of our size. This advantage will be further amplified by the relationship between Avanzar and Outlaw Energy.

In closing, we have firmly placed our foot back on the VitaminFIZZ gas pedal and our workhorse brand is in the starting gate. We will continue to work through some growing pains but that is part of the deal. Our revenue and asset growth, year over year, was impressive; however, we have set the goal very high for FY 2016. As the Chief Executive of Minerco, it is my job to grow the business responsibly, protect shareholders’ long term interests and navigate through the ever changing challenges and opportunities.

As always, we appreciate your confidence and support.

Sincerely,

/s/ V. Scott Vanis

Minerco, Inc. (OTC: MINE)

http://minerco.com/

Minerco Company Background: Minerco, Inc. (OTC:MINE) is an emerging growth company specializing in the food and beverage industry. Its portfolio includes Athena Brands, Inc., The Herbal Collection™ and Coffee Boost™. Athena Brands, Inc. is a specialty beverage company that develops, produces, markets and distributes a diversified collection of forward-thinking, healthful consumer brands. The Athena Brands portfolio includes Avanzar Sales & Distribution, LLC, VitaminFIZZ®, Vitamin Creamer® and Island Style™. http://minerco.com

Recent Media Coverage: Food Navigator, Bevnet, Orange County Business Journal, ConvenienceStoreNews

Safe Harbor Statement: This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events. Although we believe that the expectations and assumptions upon which they are based are reasonable, we can give no assurance that such expectations and assumptions will prove to have been correct. Some of these uncertainties include, without limitation, the company's ability to perform under existing contracts or to procure future contracts. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties, including without limitation, successful implementation of our business strategy and competition, any of which may cause actual results to differ materially from those described in the statements. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward-looking statements.

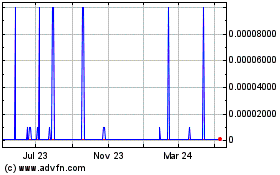

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Mar 2024 to Apr 2024

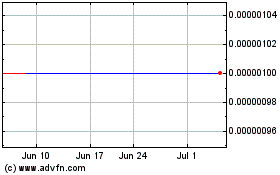

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Apr 2023 to Apr 2024