UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 10, 2015

JAMMIN JAVA CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation)

|

000-52161

(Commission File

Number)

|

264204714

(IRS Employer Identification No.)

|

4730 Tejon St., Denver, Colorado 80211

(Address of principal executive offices and Zip Code)

323-556-0746

Registrant's telephone number, including area code:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

All statements that are included in this Report and the exhibits hereto other than statements of historical fact, are forward-looking statements. Forward-looking statements involve known and unknown risks, assumptions, uncertainties, and other factors. Statements made in the future tense, and statements using words such as “may,” “can,” “could,” “should,” “predict,” “aim’” “potential,” “continue,” “opportunity,” “intend,” “goal,” “estimate,” “expect,” “expectations,” “project,” “projections,” “plans,” “anticipates,” “believe,” “think,” “confident” “scheduled” or similar expressions are intended to identify forward-looking statements. Forward-looking statements are not a guarantee of performance and are subject to a number of risks and uncertainties, many of which are difficult to predict and are beyond our control. These risks and uncertainties could cause actual results to differ materially from those expressed in or implied by the forward-looking statements, and therefore should be carefully considered. We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this Report. We disclaim any obligation to update any of these forward-looking statements as a result of new information, future events, or otherwise, except as expressly required by law.

Item 2.02 Results of Operations and Financial Condition.

On November 10, 2015, Jammin Java Corp. (the “Company”) issued a press release, which included preliminary unaudited financial results of operations for the three months ended October 31, 2015, projections for the remainder of the 2016 fiscal year, and various other matters. A copy of the press release is furnished as Exhibit 99.1 hereto.

The financial information included in the press release, including the preliminary anticipated results of operations are unaudited, remain subject to review by the Company’s independent auditors, and while such financial information represents the Company’s good faith estimates of its results of operations and balance sheet totals for the items presented therein, such results of operations and balance sheet totals as subsequently filed in the Company’s Quarterly Report on Form 10-Q for the quarter ended October 31, 2015, may ultimately be materially different (either more or less favorable) than those presented in the press release. Readers should keep in mind that the anticipated results and other matters disclosed in the press release have not been reviewed or audited, are not final and are subject to adjustment prior to the filing of the Company’s Form 10-Q. Readers are encouraged to read and review the Company’s prior Annual Report Form 10-K for the year ended July 31, 2015 and the Company’s Quarterly Reports on Form 10-Q for the periods ended April 30, 2015 and July 31, 2015 (including, but not limited to the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” set forth therein), as well as the Company’s upcoming Quarterly Report on Form 10-Q for the quarter ended October 31, 2015, once filed, for more information on the Company, risks affecting the Company, its results of operations and financial condition.

The information contained in this Current Report, including this Item 2.02 and Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

The discussion of the press release described in Item 2.02 above including the preliminary anticipated results of operations and projections for the remainder of fiscal 2016 contained in the press release are incorporated in this Item 7.01 by reference.

The information responsive to Item 7.01 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of this Report is not intended to constitute a determination by the Company that the information is material or that the dissemination of the information is required by Regulation FD.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

| |

|

|

Exhibit No.

|

Description

|

| |

|

|

99.1**

|

Press Release, dated November 10, 2015

|

**Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Jammin Java Corp.

|

|

| |

|

|

|

|

Date: November 10, 2015

|

By:

|

/s/ Anh Tran

|

|

| |

|

Anh Tran

|

|

| |

|

President

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

| |

|

|

99.1**

|

Press Release, dated November 10, 2015

|

**Furnished herewith.

Exhibit 99.1

Marley Coffee Announces Anticipated Results of Operations for Its Third Fiscal Quarter – Growth Anchored by 35% National ACV/ ~11,000+ Grocery Retail Stores

18 consecutive quarters of growth

DENVER, Colorado, November 11, 2015 -- Jammin Java Corp. (d/b/a Marley Coffee) (OTCQB:JAMN) (www.marleycoffee.com), the sustainably grown, ethically farmed and artisan-roasted gourmet coffee company, provides a summary of its unaudited anticipated financial results for the three months ended October 31, 2015 and its plans for the remainder of the current fiscal year.

We believe we are in a great place in terms of positioning the company for continued growth. According to syndicated data, our ACV has grown to 35% nationally, which represents ~11,000 US grocery stores where our products are sold. With this widespread footprint, the objective for the rest of this year and into 2016 is to continue expanding by adding more SKUs to our existing accounts, increasing consumer pull through and developing new channels.

Our recyclable EcoCup capsules started shipping at the very end of July and we have almost cycled through most of the old packaging at retail. This has taken a little bit longer than we anticipated, but based on the positive feedback from retailers and customers as well as some preliminary sales information, EcoCup has had a very positive impact on the business. We’ve even been nominated by the Nexty Awards and Beverage Awards for our innovation and packaging. Our preliminary data has shown that EcoCup by themselves have helped with incremental growth in accounts like Market Basket and Kroger.

We’ve got lots of planned marketing activities for EcoCup in Q4, specifically at store level with shopper marketing programs such as aisle tags, larger signage coupled with an array of digital marketing campaigns.

Preliminary Anticipated Financial Highlights for the Fiscal Second Quarter (three months ended Oct 31, 2015):

Financial Highlights

|

|

·

|

Continued Revenue Growth - Revenue is anticipated to be ~$3.25 million for the quarter ended October 31, 2015, which is approximately a 14% increase year-over-year from the quarter ended October 31, 2014. This is the 18th quarter in a row of year-over-year revenue growth and our largest quarter to date in sales revenue. This increase was driven by the expansion of the company’s retail base and the launch of EcoCup.

|

|

|

·

|

Net Revenue – Net revenue is anticipated to be ~$2.9 million for the quarter ended October 31, 2015, which is an increase of 15% from the same period last year.

|

|

|

·

|

Increased Gross Profit and Future Margin Upside - Gross profit is anticipated to be ~$655,000 for the quarter ended October 31, 2015 or a 13% decrease year over-year. Our gross profit as a percentage of net revenue for the quarter is anticipated to be ~20%. Gross profit was not as strong as in our previous quarter as we were promoting our products more heavily through retailers to move out old RealCup packaging into our new Recyclable EcoCup packaging. We have taken many steps to make meaningful improvements to our gross margins across the board. Specifically, we anticipate a 6% reduction in cost of goods sold (COGs) from coffee futures purchases as well as price reductions in some of our other COGs and that our reductions in COGs should hold for the upcoming quarters. We also anticipate that some of our larger accounts will be moving from a distributor distribution model to a direct distribution model in the following quarters, which we estimate will increase our gross profits by 15% on those accounts. We also expect Q4 gross profits to rise substantially.

|

|

|

·

|

Improved Operational Efficiency – Total operating expenses are expected to be ~$1.8 million for the quarter ended October 31, 2015, which is down 20% from the same period last year even while revenues are increasing. Additionally, we’ve made additional significant improvements that should reduce our operational expenses even further in the following quarter.

|

|

|

·

|

Narrowing losses - Net losses are anticipated to come in at about ($1.2M) or a 59% improvement from the same period a year prior. Net losses before interest, depreciation and stock compensation (non-cash expenses) are expected to be ~$666,200. Though this was higher than Q2, we had several items that were one time hits against our profit and loss in this quarter. Those include an uptick in slotting fees for new accounts as well as some items that were discontinued from 2014. The goal is still to get the company to cash flow positive based on cash based expenses during Q4. We believe the key to getting there is to going to be by increasing revenues and being more efficient with our promotional activity. Additionally, we are still trying to reduce our operating cost through efficiency. We still anticipate being cash flow positive for fiscal Q4.

|

|

|

·

|

Revenue projections - Revenue projections for Q4 will be between approximately $3.5-$4M, which would put our annual revenues between $12.5-$13M or approximately 32%-37% total year over year growth. Total revenue projections came in lower than the $15M previously anticipated at the beginning of the fiscal year. This was primarily due to the late start of EcoCup shipments as well as a key new account not coming on board this fiscal year.

|

Other Highlights

|

|

·

|

Directional ACV Growth - According to the latest syndicated data, we had an ACV of 31% a year ago, which represents ~10,000 grocery retail locations a year ago. At the end of the third fiscal quarter, we grew our ACV to 35% of US grocery which represents ~11,000 stores. Our largest distribution growth occurred between calendar 2013-2014, where we went from ~2,000 stores to ~7,500 stores and then to ~10,000 stores by the end of 2014. This is reflective of our budget as we spent ~$1.04M on new account slotting in calendar 2014 and ~$443,000 in calendar 2015 to date.

|

|

|

·

|

In the last four years, we were the 21st ranked company for revenue in the entire Single Cup category in grocery retail stores based on syndicated data.

|

|

|

·

|

Of the top 21 brands in the Single Cup category, year to date we are the 6th fastest growing company with a 73% year-over-year growth. Competition is fierce in the category. All of the top 20 companies that are larger than us are either part of a multibillion-dollar corporation or have been in the industry for greater than 50 years. With our limited resources, we’re exceptionally proud of the gains we’ve made in the space to date.

|

|

|

·

|

New Account Additions - In fiscal Q3 we added new accounts or increased distribution at: Safeway/ Randalls, Acme, Rouses Markets, Price Chopper and Meijer. Between fiscal Q4 (this quarter) and fiscal Q1 2016, we believe we will see the largest growth in new stores and SKUs added to stores to date. We anticipate adding ~1,200 new stores with an average of 4 SKUs per store during this period. Specifically, we anticipate a further expansion at Safeway and gaining new distribution at Sprouts.

|

|

|

·

|

Expansion in 2016 - Over the last 12 months, we’ve focused primarily on opening opportunities in the existing accounts that we’re in while growing the base in key accounts. This includes improving the quality of our promotions and creating marketing programs with the goal of embedding our company deeper into the minds of our consumers. With EcoCups getting into full distribution during this quarter, we’re working to get back into high growth mode in the upcoming year, with a focus on adding more SKUs to the stores that we’re in already and aggressively getting into other channels such as Mass, Pharmacy and Specialty.

|

| |

·

|

Broncos/ King Soopers Partnership - One of the biggest successes we saw was our local partnership with the Denver Broncos and King Soopers, a division of Kroger, in the first four weeks in the market over 7,000 units have of Mile High Blend 8oz bags scanned at retail

|

|

|

·

|

Canada – has been growing at an exceptionally rapid pace. The velocity of products in Canada is at about 3 units per store per week per SKU, which is more than double what it is here in the U.S. nationwide.

|

| |

·

|

Korea – is growing at a steady pace with their 7 cafes and distribution business. In 2016, our partners are looking at distribution expansion into other parts of Asia, specifically China.

|

| |

·

|

Europe – We announced during the quarter an extended agreement with our partners in Europe. The business is still growing across multiple channels, including retail, foodservice, hospitality, and online sales. Current distribution in Europe includes the U.K., Ireland, France, Norway, Sweden, Finland, Iceland, the Czech Republic, Hungary and Russia, with more European distribution deals planned to be announced shortly. We are anticipating with the advent of the Nespresso compatible capsules launch, we will be able to get much wider distribution in Europe in future periods.

|

| |

·

|

Chile - continues to market the brand right and shows no sign of slowing down. Our distributor anticipates launching within 106 Walmart stores in Q4 with our 8oz bags.

|

There has been a lot of M&A activity and investment activity in the premium coffee space in the last year. We’ve seen big investments in companies like Blue Bottle Coffee and Philz Coffee. We’ve also seen third wave companies like La Colombe, Intelligentsia and Stumptown acquired. It’s a very exciting time again for the space. We have talked to numerous investors over the last two years and we’ve tried to be very diligent and patient with how we’ve brought money into the company to grow our business. Two years ago we took in strategic financing from Mother-Parkers for $2.5M. Over the last two quarters, we took on ~$1.5M in debt. The debt as we’ve mentioned is short-term and we have every intention of repaying the convertible notes before such notes become convertible. We are still actively talking to traditional banks to bring in loans and we’re talking to several strategic investors to bring in capital as well, provided that we have not entered into any definitive agreements to date. We believe that we have all of the qualities that investors are looking for; significant year-over-year growth in grocery with room for even more sector growth, a strong management team, a brand that clearly has global legs and the playbook to build a successful coffee house business here in the United States and abroad.

About Jammin Java Corp., d/b/a Marley Coffee

Jammin Java Corp., d/b/a Marley Coffee is a U.S.-based company that provides premium, artisan roasted coffee to the grocery, retail, online, service, hospitality, office coffee service and big box store industry. Under its exclusive licensing agreement with Fifty-Six Hope Road Music Limited, the company continues to develop its coffee lines under the ‘Marley Coffee’ brand. The company is a fully reporting company quoted on the OTCQB market under the symbol "JAMN." For additional information, follow Marley Coffee on Facebook, Twitter and visit MarleyCoffee.com or visit the Investor Relations section at Investor.MarleyCoffee.com.

Media Contact:

Maian Tran

Marley Coffee

303.396.1756

pr@marlycoffee.com

Preliminary Anticipated Financial Results

The financial information included in this press release, including the preliminary anticipated results of operations for the quarter ended October 31, 2015, are unaudited, remain subject to review by the company’s independent auditors, and while such financial information represents the company’s good faith estimates of its results of operations and balance sheet totals for the items presented herein, such results of operations and balance sheet totals as subsequently filed in the company’s Quarterly Report on Form 10-Q for the quarter ended October 31, 2015, may ultimately be materially different (either more or less favorable) than those presented in this press release. Readers should keep in mind that the anticipated results and other matters disclosed above have not been reviewed or audited, are not final and are subject to adjustment prior to the filing of the company’s Form 10-Q. Readers are encouraged to read and review the company’s prior Annual Report Form 10-K for the year ended January 31, 2015 and the company’s Quarterly Reports on Form 10-Q for the periods ended April 30, 2015 and July 31, 2015 (including, but not limited to the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Financial Statements and Supplementary Data” included therein), as well as the company’s upcoming Quarterly Report on Form 10-Q for the quarter ended October 31, 2015, once filed, for more information on the company, risks affecting the company, its results of operations and financial condition.

Forward-Looking Statements

This Press Release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the "Acts"). In particular, the words "believe," "may," "could," "should," "expect," "anticipate," "estimate," "project," "propose," "plan," "intend," and similar conditional words and expressions are intended to identify forward-looking statements and are subject to the safe harbor created by these Acts. Any statements made in this news release about an action, event or development, are forward-looking statements. Such statements are based upon assumptions that in the future may prove not to have been accurate and are subject to significant risks and uncertainties. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the company. These risks and others are included from time to time in documents we file with the Securities and Exchange Commission ("SEC"), including but not limited to, our Form 10-Ks, Form 10-Qs and Form 8-Ks. Other unknown or unpredictable factors also could have material adverse effects on our future results. Accordingly, you should not place undue reliance on these forward-looking statements. Although the company believes that the expectations reflected in the forward-looking statements are reasonable, it can give no assurance that its forward-looking statements will prove to be correct. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking statements herein are made as of the date hereof. Actual results may differ from anticipated results sometimes materially, and reported results should not be considered an indication of future performance. The company takes no obligation to update or correct its own forward-looking statements, except as required by law or those prepared by third parties that are not paid by the company. The company's SEC filings are available at http://www.sec.gov.

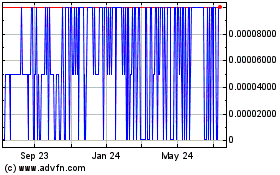

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

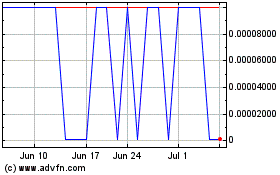

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Apr 2023 to Apr 2024