Dish Loses More Viewers

November 10 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/10/15)

By Ezequiel Minaya and Shalini Ramachbyran

Dish Network Corp. said Monday that its pay-TV subscriber losses

accelerated in the third quarter, although its profit topped Wall

Street expectations.

Dish said it lost 23,000 net pay-TV subscribers in the quarter,

compared with a loss of 12,000 a year earlier.

Because Dish reports a combined number for its Sling TV and

satellite TV customers, its results offer little clarity on how

fast the $20-a-month Sling TV streaming service is growing or how

quickly the traditional business is declining. Wells Fargo and Wall

Street research firm MoffettNathanson LLC pegged Sling TV additions

in the 150,000 range, with satellite TV drop-offs exceeding

170,000.

On a conference call with analysts, Dish Chief Executive Charlie

Ergen expressed optimism that Sling TV additions will eventually

offset satellite TV's decline. "We hope that our subscriber counts

grow positive in the future as opposed to negative," Mr. Ergen

said.

Industrywide, traditional pay-TV's net losses accelerated in the

third quarter to 357,000 customers from 184,000 in the year-ago

period, according to MoffettNathanson. The results are unlikely to

calm investors' fears after some media companies lowered their

profit forecasts and admitted pressure on their lucrative

television businesses in recent quarters.

Mr. Ergen on Monday highlighted Sling TV as a way for media

companies that are worried about cord-cutting to "put the genie

back in the bottle" by licensing content to a traditional pay-TV

partner instead of Netflix and its ilk.

At the end of the third quarter, Dish's pay-TV service had

13.909 million subscribers, down about 1% from 14.041 million a

year earlier. MoffettNathanson estimated that Sling TV had about

394,000 subscribers at the end of the quarter.

Average monthly revenue per subscriber rose to $86.33 from

$84.39 a year earlier. Its churn rate, or the rate at which

subscribers canceled service, grew to 1.86% from 1.67% a year

ago.

Overall, the company posted a profit of $196 million, or 42

cents a share, up from $146 million, or 31 cents a share, a year

earlier.

Revenue inched up 1.4% to $3.73 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

at 39 cents a share on revenue of $3.79 billion.

Dish shares fell 1% to $63.09.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

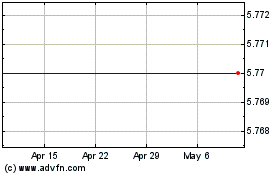

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

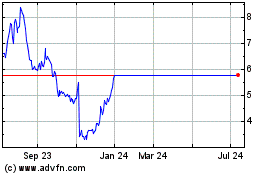

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024