UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 9, 2015

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-33958 | | 20-8099512 |

(State or other jurisdiction of incorporation or organization) | | (Commission

File Number)

| | (I.R.S. Employer

Identification No.) |

| | | | |

| | 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583 (855) 855-4253

| | |

| | (Address of Principal Executive Offices) (Zip Code)

| | |

| | | | |

Registrant’s telephone number, including area code: (855) 855-4253

|

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On November 9, 2015, Galena Biopharma, Inc. (“we,” “us,” “our” and the “company”) issued a press release announcing our financial results for the third quarter ended September 30, 2015 and providing an update on recent business developments. A copy of the press release is attached to this Report as Exhibit 99.1 and is incorporated herein by reference. The slides from the presentation will be referenced below are incorporated by reference.

The information furnished under this Item 2.02, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed to be incorporated by reference in any filing by the company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

|

| |

Item 7.01 | Regulation FD Disclosure. |

On November 9, 2015, the Company will host a conference call with investors to discuss the Company's financial and operating results for the quarter ended September 30, 2015. The conference call including slides will be made available to the public via conference call and webcast. The slides from the presentation are being furnished as Exhibit 99.2 to this Current Report on Form 8-K. The information in this Item 7.01 and Exhibits 99.2 to this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | |

| | |

Exhibit No. | | Description |

| |

99.1 |

| | Press Release of Galena Biopharma, Inc. dated November 9, 2015. |

99.2 |

| | The corporate update presentation slides dated November 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | GALENA BIOPHARMA, INC. |

| | | | |

Date: | | November 9, 2015 | | | | By: | | /s/ Mark W. Schwartz |

| | | | | | | | Mark W. Schwartz Ph.D. President and Chief Executive Officer |

Galena Biopharma Reports Third Quarter 2015 Financial Results and

Announces Exclusive Focus on its Clinical Development Programs with Planned Divestiture of the Commercial Business

| |

• | Clinical development immunotherapy programs make significant advances with new trials including a NeuVax™ Phase 2 clinical trial in DCIS and encouraging Phase 2a data for GALE-301 |

| |

• | Commercial operations and products, Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble to be divested |

| |

• | Webcast and conference call scheduled for today at 2:00 p.m. P.T. / 5:00 p.m. E.T. |

San Ramon, California, November 9, 2015 - Galena Biopharma, Inc. (NASDAQ: GALE), a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical needs, today reported its financial results for the quarter ended September 30, 2015. The Company also announced it has completed a strategic review of the organization and has elected to focus its efforts and financial resources exclusively on the continued development of its high value oncology pipeline led by NeuVax™ (nelipepimut-S), and divest its commercial business which consists of Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film.

For financial and accounting purposes, Galena has classified its commercial business activities as discontinued operations effective as of the third quarter, and the Company removes all revenue and expense guidance as it relates to its commercial business. Galena has engaged a financial advisor to provide strategic advice and a process to divest the commercial business, and the Company anticipates exiting the commercial business by the end of the first quarter of next year. Providers and patients will have ongoing access to both drugs until we have transitioned out of the business.

“Led by NeuVax, Galena has an extremely robust clinical development pipeline targeting areas of high unmet medical need that represent significant high-value market opportunities for the company,” said Mark W. Schwartz, Ph.D., President & CEO. “Over the past year, we have met several key development milestones while also expanding our clinical pipeline to four assets in eight ongoing or planned clinical trials. Our strategy going forward is to advance these programs while exploring additional indications in the immuno-oncology field where our assets can potentially make a difference in the treatment of cancer or in addressing the rapidly growing patient population of cancer survivors by harnessing the power of the immune system to prevent their cancer recurrence.”

Dr. Schwartz continued, “When I assumed the position of President and CEO of Galena, I, along with our executive team, began a careful examination of our operations and assets to determine the optimal strategy for Galena that would enable the greatest opportunity for growth, while maximizing shareholder value. As a result of this analysis and review by our Board of Directors, we have concluded that it is in the best interest of our patients, our shareholders, and the long-term success of our company to focus our energy and resources exclusively on our clinical development programs. Since acquiring the products we have significantly grown the sales of Abstral and successfully launched Zuplenz, and I believe that each has strong commercial potential and offers significant benefits to their respective patient populations. However, the foundation of Galena has always been our cancer immunotherapy programs, which are now rapidly advancing towards several key inflection points. Therefore, we believe it is important for Galena to focus on our core expertise and the successful advancement of our late and mid stage clinical pipeline. We appreciate the dedication and hard work of the commercial team as we transition out of the commercial business and are extremely grateful for all of their efforts.”

Dr. Schwartz concluded, “For both patients and shareholders of Galena, there is a much greater opportunity to generate value if we dedicate all of our resources to our clinical programs, and we are eager to move the company in this new direction. As part of this renewed focus, we have officially consolidated at our new headquarters in San Ramon, California. We look forward to discussing these advances in more detail during our third quarter earnings webcast this afternoon.”

Galena will host a webcast and conference call today at 2:00 p.m. P.T./5:00 p.m. E.T. to discuss financial and business results. The live webcast will include slides that can be accessed on the Company's website under the Investors section/Events and Presentations: http://investors.galenabiopharma.com/events.cfm. The conference call can be accessed by dialing (844) 825-4413 toll-free in the U.S., or (973) 638-3403 for participants outside the U.S. The Conference ID number is: 54883466. The archived webcast replay will be available on the Company's website for 90 days.

FINANCIAL HIGHLIGHTS AND GUIDANCE

As a result of our strategic decision to divest our commercial business, our commercial activities are classified as discontinued operations in our third quarter financial statements.

Operating loss from continuing operations for the third quarter of 2015 was $8.6 million, including $0.6 million in stock based compensation, compared to an operating loss from continuing operations of $10.6 million, including $1.1 million in stock-based compensation for the same period in 2014. Operating loss from continuing operations through the third quarter of 2015 was $26.6 million, including $1.3 million in stock based compensation, compared to an operating loss from continuing operations of $34.2 million, including $3.9 million in stock-based compensation for the same period in 2014. The decrease in net operating loss year-over-year is primarily the result of the completion of enrollment in our Phase 3 PRESENT trial for NeuVax, as well as the decrease in stock based compensation, and a reduction in legal expenses associated with ongoing litigation and legal proceedings.

Non-operating income or expenses include non-cash charges related to changes in the fair value estimates of the company’s warrant liabilities, contingent purchase price liability, and interest expense. The non-cash income related to the changes in the value of our warrant liability for the third quarter of 2015 was $2.1 million versus $6.7 million for the same period in 2014, respectively. The non-cash expense related to the changes in the value of our warrant liability through the third quarter of 2015 was $1.0 million versus a non-cash income of $13.2 million for the same period in 2014, respectively.

Loss from continuing operations for the third quarter of 2015 was $6.4 million, including $2.1 million in non-cash income described above, or $0.04 per basic and diluted share. Loss from continuing operations for the third quarter of 2014 was $3.5 million, including a $6.7 million in non-cash income described above, or $0.03 per basic and diluted share. Loss from continuing operations through the third quarter of 2015 was $28.2 million, including $1.0 million in non-cash expense described above, or $0.18 per basic and diluted share. Loss from continuing operations through the third quarter of 2014 was $22.0 million, including $13.2 million in non-cash income described above, or $0.19 per basic and diluted share.

Loss from discontinued operations for the third quarter of 2015 was $11.7 million, or $0.07 per basic and diluted share, compared to $2.6 million, or $0.02 per basic and diluted share, for the same period of 2014. Loss from discontinued operations through the third quarter of 2015 was $16.1 million, or $0.11 per basic and diluted share, compared to $6.6 million, or $0.06 per basic and diluted share, for the same period of 2014. Loss from discontinued operations include a $8.1 million non-cash impairment charge from classification of assets held for sale for the three and nine months ended September 30, 2015.

As of September 30, 2015, Galena had cash and cash equivalents of $34.8 million, compared with $23.7 million as of December 31, 2014. The $11.1 million increase in cash through the third quarter of 2015 represents $47.4 raised from issuance of common stock, partially offset by $27.8 million used in continuing operating activities, $5.0 million used in discontinued operating activities, $0.5 million milestone payment for Zuplenz, and $3.0 million in debt service payments.

THIRD QUARTER AND RECENT HIGHLIGHTS

Presented GALE-302 Preliminary Immunological Data Optimizing GALE-301 at the Society for Immunotherapy of Cancer (SITC) 30th Anniversary Annual Meeting. The poster, entitled, "Preliminary report of a clinical trial supporting the sequential use of an attenuated E39 peptide (E39’) to optimize the immunologic response to the FBP (E39+GM-CSF) vaccine," compared three primary vaccine series (PVS) sequences of GALE-301 (E39) and GALE-302 (E39’) in ovarian and breast cancer patients to optimize the ex vivo immune responses, local reactions (LR), and delayed type hypersensitivity (DTH) reactions. The data demonstrated that the in vivo immune response is enhanced with the use of the attenuated E39’ (GALE-302) after E39 (GALE-301). The optimal vaccination sequence utilizing three inoculations of GALE-301 followed by three inoculations of GALE-302 produced the most prominent and statistically significant LR and DTH responses.

Announced the collaboration with the National Cancer Institute (NCI) to initiate a new, Phase 2 Clinical Trial With NeuVax in Ductal Carcinoma in Situ (DCIS) Patients. The trial will be entitled, VADIS: Phase 2 trial of the Nelipepimut-S Peptide VAccine in Women with DCIS of the Breast, and The University of Texas M.D. Anderson Cancer Center (MDACC) Phase I and II Chemoprevention Consortium is the lead for this multi-center trial. The Consortium is funded through the Division of Cancer Prevention at NCI, which will provide financial and administrative support for the trial. Galena will provide NeuVax, as well as additional financial and administrative support. The trial is expected to initiate in the fourth quarter of 2015.

Presented Positive GALE-301 Phase 2a Clinical Trial Data at the European Cancer Congress 2015. Poster #P427 (abstract #2764), entitled "Preliminary results of the phase I/IIa dose finding trial of a folate binding protein vaccine GALE-301 (E39) + GM-CSF in ovarian and endometrial cancer patients to prevent recurrence," provided updated data for all patients who had received at least twelve months of treatment. As presented, the clinical recurrence rate based on all treatment cohorts was 41% in the Vaccine Group (VG) (n=29) versus 55% in the Control Group (CG) (n=22), p=0.41. However, in the 1000 mcg VG cohort (n=15), there have only been two clinical recurrences (13.3% versus 55% CG, p=0.02), and the two-year Disease Free Survival (DFS) estimate is 85.7% versus 33.6% in the CG, p < 0.02, as compared by Kaplan-Meir and Log rank tests. Demographic, safety, immunologic, and clinical recurrence data are continuing to be collected.

The Independent Data Safety Monitoring Committee (IDMC) Recommended Reduction of Cardiac Toxicity Monitoring for the NeuVax PRESENT (Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) Clinical Trial. Following its most recent IDMC meeting in June 2015, the IDMC recommended routine cardiac monitoring could be reduced in the PRESENT trial and that such a reduction is justified and consistent with the pre-specified Cardiac Toxicity Monitoring Stopping Rules defined in the study protocol. The IDMC concluded that cardiac toxicity monitoring by echocardiogram (ECHO) or multiple-gated acquisition (MUGA) scans could be reduced. The IDMC had no other suggestions and recommended the trial continue as planned.

CORPORATE HIGHLIGHTS

Appointed Bijan Nejadnik, M.D., as Executive Vice President and Chief Medical Officer. Dr. Nejadnik will be responsible for managing all of Galena's clinical development programs and joins Galena from Jazz Pharmaceuticals where he was the Executive Director, Hematology-Oncology and led the clinical team towards a recently filed new drug application. Prior to Jazz, Dr. Nejadnik was at Johnson & Johnson and spent more than 13 years in teaching, research and caring for patients at world-renowned academic institutions. Dr. Nejadnik graduated from the University of Louvain in Belgium for both his undergraduate degree in premedical studies and his medical degree, and completed his internship and residency programs specializing in internal medicine focused on hematology-oncology at the University of Louvain and Oregon Health Sciences University. He completed his fellowships at Cornell University's Weill Medical College and Johns Hopkins University School of Medicine. Dr. Nejadnik has led or participated in more than 20 peer-reviewed publications.

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(Amounts in thousands, except share and per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Operating expenses: | | | | | | | |

Research and development | $ | 5,740 |

| | $ | 7,025 |

| | $ | 18,762 |

| | $ | 21,463 |

|

General and administrative | 2,895 |

| | 3,542 |

| | 7,869 |

| | 12,744 |

|

Total operating expenses | 8,635 |

| | 10,567 |

| | 26,631 |

| | 34,207 |

|

Operating loss | (8,635 | ) | | (10,567 | ) | | (26,631 | ) | | (34,207 | ) |

Non-operating income (expense): | | | | | | | |

Change in fair value of warrants potentially settleable in cash | 2,134 |

| | 6,735 |

| | (981 | ) | | 13,174 |

|

Interest income (expense), net | (158 | ) | | (297 | ) | | (607 | ) | | (925 | ) |

Other income (expense) | 307 |

| | 597 |

| | 69 |

| | (59 | ) |

Total non-operating income (expense), net | 2,283 |

| | 7,035 |

| | (1,519 | ) | | 12,190 |

|

Loss before income taxes | (6,352 | ) | | (3,532 | ) | | (28,150 | ) | | (22,017 | ) |

Income tax expense (benefit) | — |

| | — |

| | — |

| | — |

|

Loss from continuing operations | $ | (6,352 | ) | | $ | (3,532 | ) | | $ | (28,150 | ) | | $ | (22,017 | ) |

Discontinued operations | | | | | | | |

Loss from discontinued operations, including $8,071 impairment charge from classification as held for sale for three and nine months ended September 30, 2015

| (11,674 | ) | | (2,641 | ) | | (16,074 | ) | | (6,633 | ) |

Net loss | $ | (18,026 | ) | | $ | (6,173 | ) | | $ | (44,224 | ) | | $ | (28,650 | ) |

| | | | | | | |

Net loss per common share: | | | | | | | |

Basic and diluted net loss per share, continuing operations | $ | (0.04 | ) | | $ | (0.03 | ) | | $ | (0.18 | ) | | $ | (0.19 | ) |

Basic and diluted net loss per share, discontinued operations | $ | (0.07 | ) | | $ | (0.02 | ) | | $ | (0.11 | ) | | $ | (0.06 | ) |

Basic net loss per share | $ | (0.11 | ) | | $ | (0.05 | ) | | $ | (0.29 | ) | | $ | (0.25 | ) |

Weighted-average common shares outstanding: basic and diluted | 161,857,522 |

| | 119,038,656 |

| | 153,000,857 |

| | 117,767,791 |

|

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(Amounts in thousands)

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 34,812 |

| | $ | 23,650 |

|

Restricted cash | 401 |

| | 200 |

|

Prepaid expenses and other current assets | 1,174 |

| | 1,237 |

|

Current assets held for sale, net | 17,801 |

| | 27,013 |

|

Total current assets | 54,188 |

| | 52,100 |

|

Equipment and furnishings, net | 288 |

| | 285 |

|

In-process research and development | 12,864 |

| | 12,864 |

|

GALE-401 rights | 9,255 |

| | 9,255 |

|

Goodwill | 5,898 |

| | 5,897 |

|

Deposits | 176 |

| | 87 |

|

Total assets | $ | 82,669 |

| | $ | 80,488 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 1,238 |

| | $ | 1,886 |

|

Accrued expense and other current liabilities | 7,329 |

| | 8,885 |

|

Current maturities of capital lease obligations | — |

| | — |

|

Fair value of warrants potentially settleable in cash | 16,661 |

| | 5,383 |

|

Current portion of long-term debt | 4,166 |

| | 3,910 |

|

Current liabilities held for sale | 7,697 |

| | 7,169 |

|

Total current liabilities | 37,091 |

| | 27,233 |

|

Capital lease obligations, net of current maturities | — |

| | — |

|

Deferred tax liability, non-current | 5,053 |

| | 5,053 |

|

Contingent purchase price consideration, net of current portion | 6,582 |

| | 6,651 |

|

Long-term debt, net of current portion | 1,526 |

| | 4,492 |

|

Total liabilities | 50,252 |

| | 43,429 |

|

Stockholders’ equity: | 32,417 |

| | 37,059 |

|

Total liabilities and stockholders’ equity | 82,669 |

| | 80,488 |

|

(1) Derived from the audited consolidated financial statements as of December 31, 2014.

About Galena Biopharma

Galena Biopharma, Inc. is a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical needs. Galena’s development portfolio is focused primarily on addressing the rapidly growing patient populations of cancer survivors by harnessing the power of the immune system to prevent cancer recurrence. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including novel cancer immunotherapy programs led by NeuVax™ (nelipepimut-S) and GALE-301. NeuVax is currently in a pivotal, Phase 3 clinical trial with several concurrent Phase 2 trials ongoing both as a single agent and in combination with other therapies. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancer. For more information, visit www.galenabiopharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2015 revenue from the sale of Abstral®, our launch of Zuplenz®, the divestiture of the commercial operations including the two commercial products, the issuance and exclusivity of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2014 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward-looking statements. Galena does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release.

NeuVax™ and Abstral® are trademarks of Galena Biopharma, Inc. All other trademarks are the property of their respective owners.

Contact:

Remy Bernarda

SVP, Investor Relations & Corporate Communications

(925) 498-7709

rbernarda@galenabiopharma.com

Q3, 2015 Earnings Report & Business Update

FORWARD LOOKING STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2015 revenue from the sale of Abstral®, our launch of Zuplenz®, the divestiture of the commercial operations including the two commercial products, the issuance and exclusivity of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2014 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward-looking statements. Galena does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release. 2

EARNINGS CALL PARTICIPANTS Presenters Mark W. Schwartz, Ph.D. President & Chief Executive Officer Bijan Nejadnik, M.D. Executive Vice President, Chief Medical Officer Gavin Choy, PharmD Senior Vice President, Clinical Sciences and Operations Ryan Dunlap, CPA Vice President & Chief Financial Officer Other Participants Remy Bernarda, MBA SVP, Investor Relations & Corporate Communications Tom Knapp, Esq Interim General Counsel 3

OVERVIEW Mark W. Schwartz, Ph.D. President & Chief Executive Officer

NOVEMBER 2012 DEVELOPMENT PIPELINE Product Therapeutic Area Phase 1 Phase 2 Phase 3 BLA / NDA NeuVax™ Node-positive HER2 IHC 1+/2+ NeuVax™ + Herceptin® Node-positive or node negative/triple negative HER2 IHC 1+/2+ GALE-301 Ovarian & Endometrial PRESENT *NeuVax is an investigational product. Efficacy has not been established. Herceptin is a registered trademark of Genentech. Ongoing Planned 5

NOVEMBER 2015 DEVELOPMENT PIPELINE Product Therapeutic Area Phase 1 Phase 2 Phase 3 BLA / NDA Immunotherapy: Breast Cancer NeuVax™ Node-positive HER2 IHC 1+/2+ NeuVax™ + Herceptin® Node-positive or node negative/triple negative HER2 IHC 1+/2+ NeuVax™ + Herceptin® High risk, node-positive or negative, HER2 IHC 3+ NeuVax™ Ductal Carcinoma in Situ (DCIS) Immunotherapy: Gastric Cancer NeuVax™ Gastric, HER2 IHC 1+/2+/3+ Immunotherapy: Gynecological Cancer GALE-301 Ovarian & Endometrial GALE-301 + GALE-302 Ovarian & Breast Hematology GALE-401 (Anagrelide CR) MPN-related thrombocytosis PRESENT *NeuVax is an investigational product. Efficacy has not been established. Herceptin is a registered trademark of Genentech. Ongoing Planned VADIS 6

FINANCE Ryan Dunlap, CPA Vice President & CFO 7

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS (in 000s)(unaudited) 8

Q3 2015 CASH ROLL-FORWARD (000s rounded) Beginning Cash, January 1, 2015 $23,700 Financing Activities $47,600 Operating Burn – Continuing Operations ($27,800) Operating Burn – Discontinued Operations ($5,000) Investing Burn – Continuing Operations ($300) Investing Burn – Discontinued Operations ($500) Debt Service ($2,900) Ending Cash, September 30, 2015 $34,800 9

INTRODUCTION Bijan Nejadnik, M.D. Executive Vice President, Chief Medical Officer 10

UNIQUELY POSITIONED 14.5 million cancer survivors in US (NCI Cancer Survivorship) • Projected to 19 million survivors in 2024 Increase in survival due to decades of productive research, improved screening/prevention, and effective treatments Survival leads to patients living longer • 64% alive after 5 years of diagnosis • 41% alive after 10 years of diagnosis • 15% alive after 20 years or longer Galena peptide vaccines – NeuVax and GALE-301 and GALE-302 are uniquely positioned to maintain survivorship Source: 1DeSantis CE et al. CA Cancer J Clin 2014: 64:252-271 11

CLINICAL DEVELOPMENT Gavin Choy, PharmD Senior Vice President, Clinical Sciences and Operations 12

NEUVAX: BREAST CANCER PROGRAMS Phase Treatment Cancer Type Indication Status Protocol Defined # of Patients Collaborations 3 Single agent PRESENT Study Breast Node Positive HER2 1+, 2+ HLA A2/A3+ Enrolled 13 countries ~140 centers 700 (enrolled 758) 2b Combination with trastuzumab Breast Node Positive or High Risk Node Negative HER2 1+, 2+ HLA A2/A3/A24/A26+ Enrolling U.S. only 34 centers 300 2 Combination with trastuzumab Breast Node Positive HER2 3+ (high risk) HLA A2/A3+ Enrolling U.S. only 30 centers 100 2 Single agent VADIS Study Breast Ductal Carcinoma in Situ (DCIS) HER2 1+, 2+, 3+ HLA A2+ Planned 4 U.S. sites 48 13

GALE-301 & GALE-302: CURRENT CLINICAL DEVELOPMENT 14 Phase Treatment Cancer Type Target Indication Current Status # of Enrolled Patients 1/2a GALE-301 Ovarian, Endometrial HLA A2+ Ovarian Enrolled 51 1b GALE-301 & GALE-302 Ovarian, Breast HLA A2+ Ovarian Enrolled 39

GALE-301: PHASE 1/2a TRIAL 1 2 3 4 Dosing by Month + 1 booster dose every 6 months thereafter 5 6 Disease free (NED) ovarian and endometrial after SoC Rx Node positive HLA A2+ - Vaccine HLA A2- Control N = 51 Study Population GALE-301 + GM-CSF 100 mg GALE-301 + GM-CSF 500 mg GALE-301 + GM-CSF 1000 mg Phase 1 Dose Escalation GALE-301 + GM-CSF Phase 2 Optimal Dose Source: ClinicalTrials.gov Identifier: NCT01580696) 15

PHASE 1/2a TRIAL RESULTS: OPTIMAL DOSE GROUP PRELIMINARY EFFICACY 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Vaccine Control % of Subj e ct s Recurrence 24.0% 13.3% Source: Greene et al, ECC 2015 16 Phase 1: Determined optimal dose and demonstrated safety and potent immune response Phase 2a: Preliminary data in 1000 mcg dose group: • At 12 months median follow-up: Vaccine group: 2 clinical recurrences (13.3%) n=15 Control group: 12 recurrences (55%) n=22 • 2 year DFS estimate in 1000 mcg dose group is 85.7% vaccine vs. 33.6% control (p<0.02) • GALE-301 plus GM-CSF is well tolerated and elicits a strong in vivo immune response with primarily Grade 1 and Grade 2 toxicities

GALE-301 (E39) & GALE-302 (E39’): PHASE 1b TRIAL 1 2 3 4 Dosing by Month + 1 booster dose every 6 months x2 5 6 Disease free (NED) ovarian and breast cancer after SoC Rx Node positive HLA A2+ (Vaccine) HLA A2- (Control) Post menopausal N = 39 Study Population GALE-301 + GM-CSF x 6 Phase 1 Primary Vaccination Series Endpoints: • Immunologic response assessed by local reaction (LR) after each vaccination • Delayed-type hypersensitivity (DTH) reaction after completion Source: ClinicalTrials.gov Identifier: NCT020196524 GALE-302+ GM-CSF x 3 GALE-301 + GM-CSF x 3 GALE-301+ GM-CSF x 3 by GALE-302 + GM-CSF x 3 17

GALE-301 & GALE 302: DELAYED-TYPE HYPERSENSITIVITY 18 LEGEND EE = E39 (GALE-301) x 6 inoculations (n=12) EE’ = E39 (GALE-301) x 3 inoculations followed by E39’ (GALE-302) x 3 inoculations (n=14) E’E = E39’ (GALE-302) x 3 inoculations followed by E39 (GALE-301) x 3 inoculations (n=13) R0 = baseline (pre-vaccination) RC1 = 1 month after completion of the PVS RC6 = 6 months after completion of the PVS and pre-booster

THANK YOU Mark W. Schwartz, Ph.D. President and Chief Executive Officer 19

UPCOMING MILESTONES NeuVax™ Enroll N=700 into PRESENT trial Complete enrollment in Phase 3 PRESENT trial • Initiate DCIS trial (1Q16) • PRESENT: reach 70 events (1Q16) • PRESENT: interim analysis (2Q16) GALE-301 GALE- 302 Report Top-Line Phase 2a clinical data Report 1-Year Phase 2a analysis Report GALE-301 + GALE-302 Phase 1b data GALE-401 (anagrelide CR) Report Top-Line efficacy and safety data • Report Final Phase 2 data 20

WHY WE’RE HERE Source: E75 vaccine's final tests start in S.A. By Don Finley, January 22, 2012; Photo credit: Kin Man Hui/San Antonio Express-News/ZUMAPress “I've had several friends who've had (breast cancer) and then…it came back and they had to go through treatment again. So this would be wonderful, not to have to come back.” – First NeuVax Phase 3 patient 21

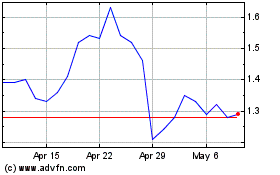

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

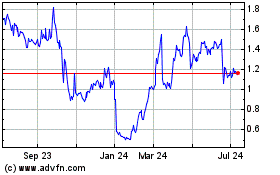

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024