UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2015

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50865 |

|

13-3607736 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 25134 Rye Canyon Loop, Suite 300

Valencia, California |

|

91355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (661) 775-5300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. of Form 8-K):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

The description of the stock purchase agreements and escrow

agreements under Item 8.01 of this report are incorporated by reference under this Item 1.01.

On November 9, 2015, MannKind Corporation (the “Company”) entered into a

series of stock purchase agreements to sell up to an aggregate of 50,000,000 shares of its common stock in a registered direct offering to selected investment funds (the “purchasers”) in Israel that hold securities included within certain

stock indexes of the Tel Aviv Stock Exchange (the “TASE”). Pursuant to the stock purchase agreements, the shares of common stock will be sold at a price per share equal to 97% of the closing price of the Company’s common stock on the

TASE on November 12, 2015, which is the trading day immediately preceding the first day on which the Company’s common stock will enter specified TASE stock indexes. The actual number of shares to be sold in the offering will be based on

the number of shares of the Company’s common stock the purchasers are required to hold upon the Company’s common stock entering into the specified indexes on the TASE, subject to reduction on a pro rata basis among the purchasers based on

their respective purchase commitments if the aggregate number of shares to be sold in the offering would otherwise exceed 50,000,000 shares.

Union Bank

Trust Co. Ltd. will serve as escrow agent for the deposit and disbursement of the purchase price of the shares sold in the offering pursuant to separate escrow agreements among the Company, each applicable purchaser and Union Bank.

The stock purchase agreements and escrow agreements contain customary representations, warranties and agreements of the parties, customary conditions to

closing, and indemnification obligations. The representations, warranties and covenants contained in these agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such

agreements, and may be subject to limitations agreed upon by the contracting parties.

Sunrise Securities Corp. acted as the Company’s exclusive

placement agent in connection with the offering. The Company will pay Sunrise Securities Corp. a placement agent fee equal to 3.5% of the total purchase price of the shares sold in the offering and will issue Sunrise Securities Corp. and/or its

designee(s), in a separate private placement exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, one or more restricted warrant(s) to purchase a number of shares of the Company’s common stock in

the aggregate equal to 1.15% of the aggregate shares sold in the offering at an exercise price per share equal to the price paid by the purchasers under the stock purchase agreements. The Company has agreed to register for resale the shares of

common stock issuable upon exercise of the warrant(s).

The closing of the offering is expected to occur on or about November 12, 2015, subject to

the satisfaction of customary closing conditions.

The offer and sale of shares of the Company’s common stock pursuant to the stock purchase

agreements is being made under the Company’s effective Registration Statement on Form S-3 (Registration No. 333-206778) and a related prospectus supplement, each of which has been filed with the Securities and Exchange Commission.

The foregoing descriptions of the stock purchase agreements and the escrow agreements do not purport to be complete and are qualified in their entirety by

reference to the stock purchase agreements and escrow agreements, respectively, forms of which are attached to this report as Exhibit 99.1 and Exhibit 99.2, respectively. A copy of the opinion of Cooley LLP, relating to the legality of the issuance

and sale of the shares in the offering is attached to this report as Exhibit 5.1.

This report shall not constitute an offer to sell or the

solicitation of an offer to buy the shares discussed above, nor shall there be any offer, solicitation or sale of the shares in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Cooley LLP. |

|

|

| 99.1 |

|

Form of Stock Purchase Agreement. |

|

|

| 99.2 |

|

Form of Escrow Agreement. |

|

|

| 23.1 |

|

Consent of Cooley LLP (included in Exhibit 5.1). |

Forward-Looking Statements

Statements in this report that are not strictly historical in nature are forward-looking statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. These forward-looking statements include, without limitation, statements regarding the completion, timing, size and potential proceeds of the registered direct offering, and involve risks and uncertainties. Words

such as “believes”, “anticipates”, “plans”, “expects”, “intends”, “will”, “potential” and similar expressions are intended to identify forward-looking statements. These

forward-looking statements are based upon our current expectations. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which

include, without limitation, risks associated with the satisfaction of customary closing conditions related to the proposed offering, stock price volatility, whether the Company’s common stock is included within various indexes of the TASE and

other risks detailed in the Company’s filings with the Securities and Exchange Commission, including its quarterly report on Form 10-Q for the quarter ended September 30, 2015. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this report. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update any forward-looking

statements to reflect events or circumstances after the date of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: November 9, 2015 |

|

|

|

MANNKIND CORPORATION |

|

|

|

|

|

|

|

|

By: |

|

/s/ David Thomson |

|

|

|

|

|

|

David Thomson, Ph.D., J.D. |

|

|

|

|

|

|

Corporate Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Cooley LLP. |

|

|

| 99.1 |

|

Form of Stock Purchase Agreement. |

|

|

| 99.2 |

|

Form of Escrow Agreement. |

|

|

| 23.1 |

|

Consent of Cooley LLP (included in Exhibit 5.1). |

Exhibit 5.1

Sean M. Clayton

T: +1 858

550 6034

sclayton@cooley.com

November 9, 2015

MannKind Corporation

25134 Rye Canyon Loop, Suite 300

Valencia, CA 91355

Ladies and Gentlemen:

You have requested our opinion, as counsel to MannKind Corporation, a Delaware corporation (the “Company”), with respect to certain

matters in connection with the offering by the Company of up to 50,000,000 shares of the Company’s common stock, par value $0.01 (the “Shares”), pursuant to a Registration Statement on Form S-3 (No. 333-206778) (the

“Registration Statement”), filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the

“Act”), the prospectus included within the Registration Statement (the “Base Prospectus”), and the prospectus supplement dated November 9, 2015, filed with the Commission pursuant to Rule 424(b)

of the Rules and Regulations of the Act (the “Prospectus Supplement”). The Base Prospectus and the Prospectus Supplement are collectively referred to as the “Prospectus.” The Shares are to be sold by

the Company in accordance with certain Stock Purchase Agreements, each dated on or about November 9, 2015, between the Company and the purchasers identified therein (the “Purchase Agreements”), as described in the Prospectus.

In connection with this opinion, we have examined and relied upon the Registration Statement and the Prospectus, the Purchase Agreements, the

Company’s Amended and Restated Certificate of Incorporation, as amended, its Amended and Restated Bylaws, and the originals or copies certified to our satisfaction of such records, documents, certificates, memoranda and other instruments as in

our judgment are necessary or appropriate to enable us to render the opinion expressed below. In rendering this opinion, we have assumed the genuineness and authenticity of all signatures on original documents; the genuineness and authenticity of

all documents submitted to us as originals; the conformity to originals of all documents submitted to us as copies; and the accuracy, completeness and authenticity of certificates of public officials.

Our opinion herein is expressed solely with respect to the General Corporation Law of the State of Delaware. Our opinion is based on these laws as in effect

on the date hereof. We express no opinion as to whether the laws of any particular jurisdiction other than that identified above are applicable to the subject matter hereof.

On the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when sold and issued against payment therefor in accordance

with the Purchase Agreements, the Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable.

4401 EASTGATE MALL,

SAN DIEGO, CA 92121 T: (858) 550-6000 F: (858) 550-6420 WWW.COOLEY.COM

MannKind Corporation

November 9, 2015

Page Two

We consent to the reference to our firm under the caption “Legal Matters” in the Prospectus and to

the filing of this opinion as an exhibit to the Company’s Current Report on Form 8-K to be filed with the Commission for incorporation by reference into the Registration Statement.

Very truly yours,

Cooley LLP

|

|

|

| By: |

|

/s/ Sean M. Clayton |

|

|

Sean M. Clayton |

4401 EASTGATE MALL, SAN DIEGO, CA 92121 T: (858) 550-6000 F: (858)

550-6420 WWW.COOLEY.COM

Exhibit 99.1

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this “Agreement”) is entered into as of November , 2015 by and between

MannKind Corporation, a public corporation incorporated in Delaware, U.S.A (the “Company”) and the undersigned identified on the signature page attached hereto (“Purchaser”).

ARTICLE 1.

PURCHASE AND

SALE OF SHARES

1.1 Purchase and Sale of Shares. Purchaser hereby irrevocably agrees to purchase from the Company, and the

Company irrevocably agrees to sell to Purchaser pursuant to the Registration Statement (as defined below) a number of common shares, $0.01 par value each, (“Shares”) that Purchaser is required to hold upon the Company’s common stock

entering the following TASE Indexes: TA-75, TA-100, TA-Composite, TA-Biomed, TA-BlueTech, TA-Tech – Elite, or such lesser number as provided in Section 1.2 below, at a price per Share equal to ninety-seven percent (97%) of the closing

price of the Shares on the Tel Aviv Stock Exchange (“TASE”) on November 12, 2015, that is the TASE trading day immediately preceding the first day on which the Company’s common stock enters the TASE Indexes (the “Price Per

Share” or “PPS”).

1.2 Adjustment to Number of Shares Sold. Purchaser shall provide the Company and Sunrise

Securities Corp., the exclusive placement agent (the “Placement Agent”), with the exact number of Shares to be purchased in accordance with Purchaser’s obligation in Section 1.1. above by November 11, 2015, at 6:00 p.m.,

Israel time, and the Company will then notify Purchaser by November 12, 2015, at 12:00 p.m., Israel time, whether the Company accepts all or part of the share subscription in accordance with Section 1.2(b) below (the “Share

Amount”). The number of Shares that Purchaser shall purchase under this Agreement may be subject to reduction as provided in this Section.

| (a) |

For purposes of Section 1.1 and this Section 1.2, any Shares purchased by Purchaser from sources other than the Company shall not reduce the number of Shares that Purchaser is required to purchase from

the Company under this Agreement. |

| (b) |

Purchaser acknowledges and agrees that the Shares being offered to Purchaser under this Agreement by the Company are part of an allotment of Shares

that are being offered to other sophisticated investors (“Sophisticated Investor”). The total number of Shares available to all Sophisticated Investors including Purchaser will not exceed the lowest of: (a) 20% of the issued and

outstanding common stock of the Company; or (b) 50,000,000 Shares ( (a) or (b), the “Maximum Shares”). To the extent that the number of Shares that Purchaser is committing to purchase from the Company under Section 1.1 of

this Agreement plus the total number of Shares that other Sophisticated Investors are committing to purchase under separate agreements with the Company exceeds the Maximum Shares, the Company will allocate Shares among Purchaser and the other

Sophisticated Investors on a pro rata basis based on the respective number of Shares that Purchaser and the other Sophisticated Investors have agreed to purchase from the |

| |

Company, so that the total number of Shares sold by the Company to Purchaser and the other Sophisticated Investors does not exceed the Maximum Shares. In the event that the Company reduces the

number of Shares to be sold to Purchaser as provided in this Section 1.2(b), the Company will promptly, and no later than November 12, 2015 at 12:00 p.m. Israel time, notify Purchaser of the Share Amount. |

| (c) |

A reduction in the number of Shares sold to Purchaser pursuant to this Section 1.2 will not change the PPS. |

ARTICLE 2.

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

| 2.1 |

Registration Statement. |

| (a) |

The Company has prepared and filed with the United States Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-3 (File No. 333-206778) (the “Registration Statement”)

under the Securities Act of 1933, as amended (the “Securities Act”) registering the offer and sale of the Shares. The Registration Statement is effective under the Securities Act and no stop order preventing or suspending the effectiveness

of the Registration Statement or suspending or preventing the use of the prospectus contained therein has been issued by the SEC and no proceedings for that purpose have been instituted or, to the knowledge of the Company, are threatened by the SEC.

The Company shall file a prospectus supplement with the SEC in accordance with Rule 424(b) under the Securities Act describing the offer of the Shares (the “Prospectus Supplement”) prior to Closing within the time periods prescribed by

such rule. |

| (b) |

The Registration Statement, and the base prospectus together with the Prospectus Supplement, will not contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the

statements contained therein, in light of the circumstances under which they were made, not misleading. |

| (c) |

When issued pursuant to this Agreement and the Registration Statement at Closing, the Shares will conform to the descriptions thereof in the Registration Statement and the Prospectus Supplement; and the issuance of the

Shares is not subject to any preemptive or similar rights. Assuming the accuracy of the representations and warranties of Purchaser in Article 3 hereof, and assuming that Purchaser is not an affiliate of the Company, the Shares will not constitute

“restricted securities” under the Securities Act and will not bear any restrictive legends prohibiting transfer under the Securities Act. |

| 2.2 |

Valid Issuance of Shares. The Shares that are being purchased by Purchaser hereunder, when issued, sold and delivered in accordance with the terms of this Agreement, including payment of the Purchase Price, will

be duly and validly issued, fully paid, and nonassessable. |

2

| 2.3 |

Listing and Maintenance Requirements. The common stock of the Company has been listed on the Nasdaq Global Market and the TASE. |

| 2.4 |

Disclosure Documents; Financial Statements. The Company has filed all reports required to be filed by it under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including pursuant to

Section 13(a) or 15(d) thereof, during the twelve (12) months prior to the date hereof. |

| 2.5 |

Organization. The Company is a corporation duly organized, validly existing and in good standing under the laws of the state of Delaware. |

| 2.6 |

Authority; Enforceability. The Company has the power and authority to execute and deliver this Agreement and to perform all of its obligations hereunder. This Agreement has been duly authorized, executed and

delivered by the Company and is the valid and binding agreement of the Company, enforceable in accordance with its terms subject to: (i) laws of general application relating to bankruptcy, insolvency and the relief of debtors; and

(ii) general principles of equity. |

| 2.7 |

No Conflict. Assuming the truth and accuracy of the Purchaser’s representations and warranties in Article 3, the execution and delivery of this Agreement and consummation of the sale of the Shares

contemplated by this Agreement do not and will not violate any provisions of (i) the Securities Act or the Exchange Act or any rule or regulation thereunder, or the Israeli Securities Law, (ii) the Delaware General Corporation Law or the

terms of any order, writ or decree of any court or judicial or regulatory authority or body by which the Company is bound, (iii) the Articles of Incorporation or bylaws of the Company, or (iv) the rules and regulations of the Nasdaq Global

Market or the TASE applicable to the listing of the Company’s common stock. |

| 2.8 |

No Litigation. There is no lawsuit, arbitration proceeding, or administrative action or proceeding pending or threatened against the Company which questions the validity of this Agreement or any action taken or

to be taken by the Company in connection with this Agreement or the issue and sale of the Shares hereunder. |

ARTICLE 3.

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Purchaser hereby represents and warrants to the Company the following:

3.1 Organization. Purchaser, if not a natural person, is either a corporation, limited liability company, partnership, trust or other

entity duly organized, validly existing and in good standing under the laws of the state or other jurisdiction in which it is incorporated or otherwise organized.

3

3.2 Authority; Enforceability. Purchaser has the power and authority to execute and

deliver this Agreement and to perform all of its obligations under this Agreement. This Agreement has been duly authorized and executed by Purchaser and is the valid and binding agreement of Purchaser enforceable in accordance with its terms,

subject to: (i) laws of general application relating to bankruptcy, insolvency and the relief of debtors; and (ii) general principles of equity..

3.3 No Conflict. The execution and delivery of this Agreement, and consummation of the transactions contemplated hereunder, including

the purchase of the Shares, by Purchaser do not and will not violate any provisions of (i) any rule, regulation, statute, or law applicable to Purchaser or (ii) the terms of any order, writ, or decree of any court or judicial or regulatory

authority or body by which Purchaser is bound, or (iii) the articles of incorporation, bylaws, or similar charter or governing documents of Purchaser.

3.4 Classified Investor. The Purchaser hereby declares that it is not a “Classified Investor” as defined by the Israeli

Secutrities Law.

3.5 No Short Sales. Purchaser has not, nor has any person or entity acting on behalf of or pursuant to any

understanding, agreement, or arrangement with Purchaser, directly or indirectly executed any “short sale,” as defined in SEC Rule SHO, of the common stock of the Company since June 30, 2015.

3.6 Place of Business or Residence. Purchaser represents and warrants that Purchaser’s principal place of business or residence is

as set forth on the signature page of this Agreement.

3.7 Access to Information. Purchaser acknowledges having the opportunity to

review the Registration Statement (including the prospectus contained therein) and, the Prospectus Supplement , including the opportunity to review the documents and information incorporated by reference therein (including the Company’s Form

10-Q for the quarter ended September 30, 2015), prior to entering into this Agreement. Purchaser, in connection with its decision to enter into this Agreement, relied only upon the representations and warranties of the Company contained herein.

4

ARTICLE 4.

CLOSING

4.1 Time and

Place of Closing. The consummation of the entire purchase and sale of the Shares (the “Closing”) shall take place on the date (the “Closing Date”) which shall be no later than the third Business Day after November 11,

2015, on which the TASE announces the number of the Company’s common shares required for the Indexes (the “Index Calculation Date”), and in any event no later than November 15, 2015, at 09:30 a.m., Israel time, but in the event

that the Evaluated Purchase Price divided by PPS represents the exact or more than the Share Amount- the Closing shall take place no later than November 13, 2015. The Closing shall occur at the principal office of the Company or at such other

place as the parties may agree. A “Business Day” shall be any day on which the banks in New York are not required or permitted to close.

4.2 Escrow Agent. Union Bank Trust Co. Ltd. will be appointed by the parties as the Escrow Agent (the “Escrow Agent”)

in order to complete the transaction herein. The Company and Purchaser shall enter into an Escrow Agreement with the Escrow Agent for such purpose, a copy of which is attached as Exhibit A. The Escrow Agent shall hold cash consideration from

Purchaser for the Shares in escrow and release such cash consideration to the Company and to the Placement Agent in accordance with the terms and conditions of the Escrow Agreement, as follows:

(a) At the close of the Index Calculation Date on TASE, that is November 11, 2015, and no later than November 12, 2015 at

12:00 p.m. Israel time, Purchaser shall deliver to the trust bank account to be established in the name of the escrow by wire transfer an amount in New Israeli Shekels (NIS) in immediately available funds that is equal to the Share Amount multiplied

by the a price per share that is 110% of the TASE closing Share price on November 11, 2015 (the “Evaluated Purchase Price”).

(b) The Escrow Agent shall immediately notify the Company, the Placement Agent and the Purchaser in writing of receipt of the Evaluated

Purchase Price from Purchaser (the “Written Notification”).

(c) At the close of the trading day on TASE on

November 12, 2015, the Placement Agent will notify the Parties and the Escrow Agent of the PPS and the final purchase price, that is equal to the Share Amount multiplied by the PPS (the “Final Purchase Price”). The Parties hereby

waive and release the Placement Agent from any claims regarding the PPS and the calculation of the Final Purchase Price.

(d) As

soon as practical following the receipt of a Written Notification and PPS, and no later than November 12, 2015, if such Written Notification was received prior to or on November 12, 2015, the Company shall transfer an amount of Shares to

Purchaser that is equal to the Evaluated Purchase Price divided by the PPS and rounded down to the nearest whole share, but no more than the Share Amount. Immediately following such transfer, the Shares will be available

5

for pick up by Purchaser and no later than November 13, 2015. It is hereby clarified, that in accordance with Section 2.2 to this Agreement, the Company shall not issue shares unless

the shares have been fully paid by Purchaser, and the Company received a Written Notification.

(e) After the Company has

transferred the amount of Shares in Section 4.2(d) directly to an account designated by the Purchaser as provided in Section 4.3(b) and the Company has delivered a confirmation of such transfer from the Company’s transfer agent and

the Purchaser confirmed the Escrow Agent of the receipt of shares, the Escrow Agent will release the Evaluated Purchase Price to the Company and to the Placement Agent in accordance with the Escrow Agreement.

(f) In the event the Evaluated Purchase Price delivered by Purchaser is higher than the Final Purchase Price, the Escrow Agent shall

return the difference to the Purchaser within 3 business days of such deposit. In the event the Evaluated Purchase Price is lower than the Final Purchase Price, Purchaser shall deliver the difference no later than on November 13, 2015 at 10:00

a.m., Israel time, to the trust bank account to be established in the name of the escrow by wire transfer in New Israeli Shekels (NIS) in immediately available funds. As soon as practical following the receipt of a written notification from the

Escrow Agent regarding the receipt of the Final Purchase Price, and no later than November 13, 2015 at 5:00 p.m. Eastern time, the Company shall transfer an amount of Shares to Purchaser that is equal to the difference, but in any event no more

than the Share Amount. Immediately following such transfer, the Shares will be available for pick up by Purchaser.

(g) After the

Company has transferred an amount of Shares in Section 4.2(f) directly to an account designated by the Purchaser as provided in Section 4.3 and the Company has delivered a confirmation of such transfer from the Company’s Transfer

Agent, the Escrow Agent will release the difference between the Final Purchase Price and the Evaluated Purchase Price to the Company and to the Placement Agent in accordance with the Escrow Agreement.

(h) Expense Reimbursement. All fees and expenses payable to the Escrow Agent under the Escrow Agreement shall be borne by the

Company, except for indemnification payments should any arise, which shall be paid in accordance with the Escrow Agreement.

4.3

Deliver of Shares By the Company.

The Shares purchased by Purchaser shall be delivered electronically via The Depository Trust Company

Deposit/Withdrawal at Custodian system (“DWAC”) to an account designated by Purchaser. No later than November 10, 2015, Purchaser shall provide the Company with the DWAC identification and number of the account to which the Shares

will be transferred and a properly completed Form W-8-BEN. Confirmation from Computershare Shareowner Services (the “Transfer Agent”) and registrar of the Shares that the Shares purchased by Purchaser have been issued as provided by this

paragraph shall be sufficient evidence that the Shares have been issued to Purchaser and that the Escrow Agent may release the Purchase Price to the Company and the Placement Agent.

6

4.4 Conditions of the Company’s Obligation to Close. The obligation of the Company to

sell the Shares to Purchaser on the Closing Date is conditioned upon the following:

(a) Payment and Delivery. The

Company’s receipt of the entire cash consideration for all of the Shares being sold to Purchaser.

(b) Representations and

Warranties. The representations and warranties made by Purchaser in ARTICLE 3 of this Agreement shall be true and correct in all material respects when made and on the Closing Date; provided, that any representation and warranty that it is

itself qualified by a materiality standard shall be true and correct in all respects.

(c) Performance of Covenants. Purchaser

shall have fully performed all covenants and agreements required to be performed by Purchaser on or before the Closing Date.

(d)

Nasdaq Global Market Approval. If applicable, the Nasdaq Global Market shall have approved the Company’s additional listing application for the Shares to be sold to Purchaser.

(e) TASE Approval. The TASE shall have approved the Company’s application to list the Shares on the TASE.

(f) No Shareholder Vote Required. Under the rules and regulations of the Nasdaq Global Market, the issue and sale of the Shares to

Purchaser and the other Sophisticated Investors shall not require approval by a vote or consent of the Company’sstockholders.

4.5

Conditions of Purchaser’s Obligation to Close. The obligation of Purchaser to purchase the Shares from the Company on theClosing Date is conditioned upon the following:

(a) Delivery. Purchaser’s receipt of the items required to be delivered by the Company under Section 4.2 above.

(b) Representations and Warranties. The representations and warranties made by the Company in ARTICLE 2 of this Agreement shall

be true and correct in all material respects when made and on the Closing Date, unless made as of a specific date in which case they shall be accurate as of such date; provided, that any representation and warranty that it is itself qualified by a

materiality standard shall be true and correct in all respects.

(c) Performance. The Company shall have performed and

complied with all agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by it on or before the Closing Date.

7

(d) Bankruptcy; Insolvency. The Company shall not be subject to (i) any order

for relief, or subject to any pending proceeding for reorganization or liquidation, under the United States Bankruptcy Code, as amended, or under any other law pertaining to insolvency of the Company or creditor’s rights generally,

(ii) any appointment of a receiver for the Company or any of its assets, or (iii) any plan or action of dissolution or liquidation of the Company or its business.

(e) Listing. The Company’s common stock shall remain listed for trading on the Nasdaq Global Market and TASE, and such

listings and trading shall not have been suspended, nor shall suspension by the SEC or the Nasdaq Global Market or TASE have been threatened, as of the Closing Date, in writing by the SEC, the Nasdaq Global Market, or the TASE.

(f) Inclusion in Indexes. The Company’s Shares shall be included in one or more of the Indexes.

ARTICLE 5.

ADDITIONAL

COVENANTS

5.1 Further Assurances. Each party will execute, acknowledge, and deliver such additional certificates and documents

and will take such additional actions as the other party may reasonably request on or after a Closing Date to effect, complete or perfect the issue and sale of the Shares to Purchaser.

5.2 Purchasers’ Market Activity. Purchaser agrees that Purchaser shall not, prior to the completion of the purchase and sale of

the Shares on the Closing Date, engage in any short sale (as defined in SEC Rule SHO) of the Company’s common stock, directly or through or in arrangement with and any entity in control of, or under common control with Purchaser. Purchaser

covenants and agrees that until such time as the transactions contemplated by this Agreement are publicly disclosed by the Company pursuant to a press release, Purchaser will maintain the confidentiality of the existence and terms of this Agreement.

5.3 Public Disclosure by the Company. The Company may issue one or more press releases and file one or more Current Reports on

Form 8-K under the Exchange Act describing the terms of the transactions contemplated by this Agreement, in the form required by the Exchange Act and attaching this Agreement as an exhibit to such filing. The Purchaser name will not be mentioned in

the above said press releases.

5.4 Publicity. Purchaser shall not issue any press release or make any similar public statement or

communication disclosing the terms of this Agreement or the transactions hereunder without the prior written consent of the Company, provided that the Company’s consent shall not unreasonably be withheld or delayed if such disclosure is

required by law and Purchaser shall have provided the Company with a copy of the proposed press release or other public statement or communication a reasonable time prior to the public release or dissemination thereof.

8

ARTICLE 6.

MISCELLANEOUS

6.1

Governing Law. This Agreement shall be construed and governed in all respects by the internal laws of the State of New York without giving effect to any choice of law rule that would cause the application of the laws of any jurisdiction other

than the internal laws of the State of New York to the rights and duties of the parties. All disputes and controversies arising out of or in connection with this Agreement shall be resolved non-exclusively by the state and federal courts located in

the State of New York or the State of California, and each party agrees to submit to the jurisdiction of said courts.

6.2 Successors

and Assigns. The parties may not assign their rights or obligations under this Agreement, directly or by operation of law, without the consent of the other party. The provisions of this Agreement shall inure to the benefit of, and be binding

upon, the respective successors, assigns, heirs, executors and administrators of Purchaser and the Company.

6.3 Entire Agreement;

Amendment. This Agreement constitutes the full and entire understanding and agreement among the parties with regard to the subject matter of this Agreement. This Agreement and any term of this Agreement may be amended, waived, discharged or

terminated only by a written instrument signed by the parties.

6.4 Notices, etc. All notices and other communications required or

permitted to be given pursuant to this Agreement shall be in writing and shall be deemed given (a) four (4) days after being deposited in the mail, certified air postage prepaid, return receipt requested, or (b) when delivered by

hand, by messenger or overseas express air freight service (such as DHL), or (c) on the date of facsimile transmission (FAX) or electronic mail (email) if sent at or prior to 5:30 p.m. (New York City time) on a Business Day, or the next

Business Day after the date of facsimile or email transmission, if sent on a day that is not a Business Day or later than 5:30 p.m. (New York City time) on a Business Day, in any case addressed as follows:

|

|

|

|

|

| To any Purchaser: |

|

|

|

At the address or FAX number or email address of Purchaser shown on the signature page of this Agreement |

|

|

|

| To the Company: |

|

|

|

MannKind Corporation Attention: Chief

Financial Officer FAX: Email: |

9

Any party may change its address for the purpose of this Agreement by giving notice to each other

party in accordance with this Section.

6.5 Expenses. Purchaser and the Company shall bear their own expenses, including fees and

expenses of their own advisers, counsel, accountants and other experts, if any, and all other expenses incurred by the party incident to the negotiation, preparation, execution, delivery and performance of this Agreement. The Company shall pay all

stamp taxes and other taxes and duties levied in connection with the delivery of the Shares to Purchaser.

6.6 Brokers. The

Purchaser shall have no liability to any broker, finder, investment banker, or other advisor retained or engaged by the Company or any subsidiary of the Company in connection with the transactions contemplated by this Agreement. The fees of the

Placement Agent, comprised of 3.5% of the Final Purchase Price and five year warrants of 1.15% of the total Share Amount at an exercise price equal to the PPS and Escrow Agent total fee that is NIS 60,000 (regardless of the number of Purchasers the

Company entered into an Agreement) shall be fully borne and paid by the Company.

6.7 Titles and Subtitles. The titles or headings

of the Articles and Sections of this Agreement are for convenience of reference only and are not to be considered in construing this Agreement.

6.8 Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, each such

unenforceable provision shall be excluded from this Agreement and the balance of this Agreement shall be interpreted as if each such unenforceable provision were so excluded, and the balance of this Agreement as so interpreted shall be enforceable

in accordance with its terms.

6.9 Counterparts. This Agreement may be executed in any number of counterparts, each of which shall

be an original, but all of which together shall constitute one instrument. This Agreement may be executed with signatures transmitted among the parties by facsimile or by email delivery of a pdf format data file, and no party shall deny the validity

of a signature or this Agreement signed and so transmitted on the basis that a signed document is represented by a copy or facsimile or pdf format data file and not an original.

[Signatures on following page]

10

IN WITNESS WHEREOF, the undersigned parties have executed this Agreement as of the date first

above written.

COMPANY:

MannKind Corporation

11

Exhibit 99.2

ESCROW AGREEMENT

This ESCROW

AGREEMENT (hereinafter referred to as this “Agreement”) is entered into as of November , 2015, by and among

(“Purchaser”), MannKind Corporation, a public corporation incorporated in Delaware, U.S.A (the “Company”), and Union Bank Trust Co. Ltd. (the “Escrow Agent”). (Each of Purchaser, the Company, and

Escrow Agent, a “Party”, and collectively the “Parties”).

W I T N E S S E T H

|

|

|

| WHEREAS |

|

the Company and Purchaser have entered into a Stock Purchase Agreement (the “Purchase Agreement”) pursuant to which the Company shall sell Purchaser common stock of the Company, $0.01 par value each (the

“Shares”), in exchange for the Final Purchase Price (as defined in the Purchase Agreement); |

|

|

| WHEREAS |

|

the Company and Purchaser have agreed that the Closing (as defined in the Purchase Agreement) will take place in accordance with the terms and provisions of this Agreement; |

|

|

| WHEREAS |

|

The Parties wish to appoint Union Bank Trust Co. Ltd to hold the cash consideration delivered by the Purchaser in accordance with the Purchase Agreement for the purpose of ensuring the delivery of the Shares against receipt of the

Final Purchase Price, in accordance with the terms of this Agreement and the share price as defined below; |

NOW, THEREFORE, in furtherance of the Purchase Agreement and in consideration of the terms and conditions

contained herein, the Parties intending to be legally bound agree as follows:

| 1. |

All Capitalized terms used in this Agreement but not defined herein have the meanings assigned to them in the Purchase Agreement. |

| 2. |

The Company and the Purchaser hereby appoint Union Bank Trust Co. Ltd as the “Escrow Agent” under this Agreement to hold and release the cash consideration delivered by the Purchaser in accordance with the

Purchase Agreement and this Agreement, and Escrow Agent accepts such designation and appointment and agrees to act in accordance with the terms of this Agreement. The Escrow Agent agrees that upon receipt of any cash consideration in accordance with

Section 3 below, the Escrow Agent shall hold and release such cash consideration to the Company and Sunrise Securities Corp., the exclusive placement agent (the “Placement Agent”) in accordance with this Agreement. It is

hereby clarified that the Escrow Agent is not a party to the Purchase Agreement. |

| 3. |

Term of Escrow; Deposit and/or release of the shares and the Purchase Price. |

| 3.1. |

At the close of the Index Calculation Date on TASE, which is November 11, 2015, and no later than the November 12, 2015 at 12:00 p.m. (Israel time), the Purchaser shall deliver the Evaluated Purchase Price

(that is 110% of the TASE closing Share price on November 11, 2015) to the Escrow Agent by wire transfer to the bank account designated by the Escrow Agent to the Company and Purchaser and by sending a proper documentation of such wire transfer

to and and (“Email

Delivery”). The Evaluated Purchase Price shall be paid in Israeli New Shekels (NIS) and in immediately available funds. |

| 3.2. |

The Escrow Agent shall immediately notify the Company, the Placement Agent and the Purchaser, in writing, to email addresses as will be provided by the Company and the Placement Agent, of receipt of any cash

consideration amount (the “Written Notification”). |

| 3.3. |

At the close of the trading day on TASE on November 12, 2015, the Placement Agent will notify the Escrow Agent of the PPS, which is equal to ninety-seven percent (97%) of the closing price of the shares on the

Tel Aviv Stock Exchange (“TASE”) on November 12, 2015, that is the TASE trading day immediately preceding the first day on which the Company’s common stock enters the TASE Indexes (the “PPS”) and the Final

Purchase Price (the “PPS Notification”). The Parties hereby waive and release the Placement Agent from any claims regarding the PPS and the calculation of the Final Purchase Price. It is hereby also clarified that the Escrow Agent

will not be responsible to calculate the PPS or the amount of Shares to be issued by the Company. |

| 3.4. |

Purchaser acknowledges and agrees to provide the Company and the Placement Agent in writing with the proper Depository Trust Company Deposit/Withdrawal at Custodian system (“DWAC”) number for the

account into which Purchaser’s Shares are to be issued. Purchaser shall provide in writing by November 10, 2015 to the Company, the, all information and documentation that Computershare Shareowner Services (the “Transfer Agent”)

requires to issue the Shares. |

| 3.5. |

As soon as practical following the receipt of a Written Notification and PPS, the Company shall transfer an amount of Shares to Purchaser that is equal to the Evaluated Purchase Price divided by the PPS, rounded down to

the nearest whole Share, but no more that the Share Amount. It is hereby clarified, that in accordance with Section 2.2 to the Purchase Agreement, the Company shall not issue Shares unless the Shares have been fully paid by Purchaser, and the

Company received a Written Notification. |

| 3.6. |

Immediately following delivery of the Shares to Purchaser’s DTC account as provided in Section 3.4 above, the Company shall provide a written confirmation from the Transfer Agent of delivery of the Shares,

including the number of Shares by email to the Escrow Agent, Placement Agent and to the Purchaser which will confirm the Escrow Agent the receiving of Shares , than the Escrow Agent shall release and deliver the Evaluated Purchase Price, deducted by

Escrow fees as defined in Section 5 below, and deducted by 3.5% of the total Evaluated Purchase Price (financing fee that will be wire transferred to the Placement Agent account number to be provided to the Escrow Agent attached as Annex A) by

wire transfer to a bank account of the Company designated in writing by the Company attached as Annex A. Escrow Agent shall also deliver a confirmation of such transfer to the Company and Placement Agent including the identification numbers

of the respective wires. |

| 3.7. |

In the event the Final Purchase Price is lower than the Evaluated Purchase Price, the Escrow Agent shall deliver the difference, which shall be agreed upon by the parties and sent in writing to the Escrow Agent, to

Purchaser, no later than 3 business days after being deposited. |

| 3.8. |

In the event the Final Purchase Price is higher than the Evaluated Purchase Price, then the difference between the Final Purchase Price and the Evaluated Purchase Price (the “Additional Purchase

Price”), which shall be agreed upon by the parties and sent in writing to the Escrow Agent, shall be delivered by the Purchaser to the Escrow Agent by wire transfer to the Escrow Agent Account no later than on November 13, 2015 at

10:00 a.m. (Israel time). The Purchaser shall send proper documentation of such wire transfer to the Escrow Agent, the Company and the Placement Agent via Email Delivery. The Additional Purchase Price shall be paid in NIS and in immediately

available funds. Upon the Escrow Agent’s receipt of the Additional Purchase Price, the Escrow Agent shall immediately notify the Company, the Placement Agent and the Purchaser in writing (the “Additional Written Notification”).

|

| 3.9. |

As soon as practical after receiving the Additional Written Notification, the Company shall transfer an amount of Shares to Purchaser’s DTC account that is equal to the quotient of (i) Additional Purchase

Price divided by (ii) the PPS, rounded down to the nearest whole Share (the “Additional Shares”). |

| 3.10. |

As soon as practical following delivery of the Additional Shares to the Purchaser’s DTC account, the Company shall provide a confirmation from the Transfer Agent of delivery of the Additional Shares, including the

number of Shares transferred, via Email Delivery to the Escrow Agent, Placement Agent and the Purchaser, and the Escrow Agent shall release and deliver the Additional Purchase Price by wire transfer to the Company Account, as deducted by 3.5% of the

total Additional Purchase Price (which 3.5% deduction shall be transferred by the Escrow Agent via wire transfer to the Placement Agent Account). The Escrow Agent shall also deliver a confirmation of such transfer via Email Delivery to the Company

and Placement Agent, including the identification numbers of the respective wires. |

| 3.11. |

Each wire transfer made by the Escrow Agent to the Company and Placement Agent Account shall be converted from NIS to USD at the conversion rate of the Bank of Israel Representative Exchange Rate on the same day as

transfer, as published at 3:30 p.m., Israel time (the “Representative Exchange Rate”). The conversion rate provided to the Company will be the Bank of Israel Representative Exchange Rate multiplied by 1.0011. |

| 3.12. |

Notwithstanding anything to the contrary hereunder, the Escrow Agent shall not be required to release the Purchase Price Amount or the Additional Purchase Price (if applicable) unless, prior thereto, it shall have

received from the appropriate recipient: |

| |

3.12.1. |

Full bank account details (the account must be solely owned and controlled by the Company): name of bank, branch number, account number, name of account, SWIFT, IBAN/ABA; |

| |

3.12.2. |

Any applied tax forms, if applicable; and |

| |

3.12.3. |

Bank account ownership approval which would be either an official letter from the bank, approved for authenticity by either Pearl Cohen Zedek Latzer Baratz (PCZLB) directly or by PCZLB’s approval of such

certification done by a US-based law firm that regularly represents the Company, or by a scanned copy of a canceled check. |

| |

3.12.4. |

The Company declares and commits that no tax deduction is required by the Escrow Agent prior to releasing the proceeds to the Company pursuant to Section 3.6 and, if applicable, Section 3.10. The Company will

hold the Escrow Agent harmless against any and all losses, claims, damages, liabilities and expenses related to this matter. |

| 4. |

The Parties agree that the escrow account shall remain open for at least 30 days from the Closing. |

| 5. |

Escrow Fees. For the services rendered as Escrow Agent hereunder, the Escrow Agent shall be entitled to the compensation set forth in a separate side letter between Escrow Agent and the Company.

|

| 6. |

Liability of the Escrow Agent. The Escrow Agent undertakes to perform only the duties as are expressly set forth herein and no other duties and obligations (fiduciary or otherwise) shall be implied. Escrow Agent

shall have no duty to enforce any obligation of any other person to make any payment or delivery, or to direct or cause any payment or delivery to be made, or to enforce any obligation of any other person to perform any other act. The Escrow Agent

shall have no liability under and no duty to inquire as to the provisions of any agreement (even though such agreement may be referenced in this Agreement) other than this Agreement. The Escrow Agent is not a party to the Purchase Agreement, is not

bound by any of its terms, and has not undertaken in any way to effectuate, implement or comply with the Purchase Agreement. The Escrow Agent shall not be liable to any other Party hereto or to anyone else for any action taken or omitted by it in

good faith except to the extent that a court of competent jurisdiction determines that Escrow Agent’s gross negligence, willful misconduct or bad faith was the cause of any loss suffered by such Party. The Escrow Agent’s sole

responsibility shall be for the safekeeping and releasing of the cash held in the escrow account in accordance with the terms of this Agreement. In no event shall the Escrow Agent be liable for incidental, indirect, special, consequential or

punitive damages of any kind whatsoever (including lost profits), even if the Escrow Agent has been advised of the likelihood of such loss or damage and regardless of the form of action. |

| 7. |

Indemnification of the Escrow Agent. Subject to the other provisions of this Agreement, the Company agrees to indemnify and hold the Escrow Agent harmless against any and all losses, claims, damages, liabilities

and expenses, including reasonable costs of investigation, counsel fees, including allocated costs of in-house counsel and disbursements arising from any claim against Escrow Agent in connection with Escrow Agent’s performance of its duties

under this Agreement, including but not limited to any litigation arising from this Agreement or involving its subject matter. Notwithstanding the foregoing, there shall be no indemnification obligation under this Section in an event of the Escrow

Agent’s breach of this Agreement, violation of applicable laws, gross negligence, bad faith or willful misconduct. The Escrow Agent shall notify the Company and the Purchaser in writing of any written assertion of a claim against the Escrow

Agent, promptly after the Escrow Agent shall have received any such information as to the nature and basis of the claim or learns of circumstances that may bring about such claim. The Escrow Agent agrees not to settle any litigation in connection

with any claim or liability with respect to which the Escrow Agent may seek indemnification from the Company and the Purchaser without the prior written consent of the Company and the Purchaser. |

| 8. |

Notices. All notices required or permitted hereunder shall be in writing and shall be deemed effectively given: (a) upon personal delivery to the Party to be notified; (b) when sent by facsimile

or email with confirmation of transmission. All communications shall be sent to the Company, the Purchaser and the Escrow Agent at their respective facsimile numbers or email addresses set forth below. |

| 9. |

Priority. In the event of any conflict between the provisions of this Agreement, this Agreement shall be construed in a manner prescribed by the Escrow Agent acting in good faith. |

| 10. |

Governing Law. This Agreement shall be construed and governed in all respects by the internal laws of the State of Israel without giving effect to any choice of law rule that would cause the application of the

laws of any jurisdiction other than the internal laws of the State of Israel to the rights and duties of the parties. All disputes and controversies arising out of or in connection with this Agreement shall be resolved by the competent courts

located in the State of Israel, and each party agrees to submit to the jurisdiction of the said courts. |

The provisions of this Agreement may be waived, altered, amended or supplemented, in whole or in

part, only by a writing signed by all of the Parties. Neither this Agreement nor any right or interest hereunder may be assigned in whole or in part by the Escrow Agent or any Party without the prior consent of the Escrow Agent and the other

Parties.

This Agreement may be executed by facsimile signatures, which for all purposes shall be deems to constitute originals. This

Agreement may be executed in counterparts, all of which when taken together shall be deemed one original.

[Signatures on following page]

IN WITNESS WHEREOF, the undersigned parties have executed this Agreement as of the date first

above written.

|

|

|

| Title: |

|

|

| Address: |

|

|

|

|

| FAX Number: |

|

|

| Email: |

|

|

|

|

| PURCHASER: |

|

|

|

|

|

| Email: |

|

|

|

| ESCROW AGENT: |

| Union Bank Trust Co. Ltd |

|

|

| By: |

|

|

|

|

|

|

|

Amos Fargon |

| Title: Chief Operating Officer |

|

|

| Address: |

|

|

|

|

| FAX Number: |

|

|

| Email: |

|

|

Annex A

Wire Instructions

Escrow Agent:

Company:

Placement Agent:

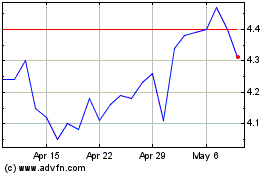

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

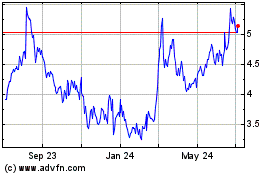

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024