UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

|

x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35996

Organovo Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

27-1488943 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

6275 Nancy Ridge Drive, Suite 110,

San Diego, CA 92121 |

|

(858) 224-1000 |

|

(Address of principal executive offices and zip code) |

|

(Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

|

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 30, 2015, a total of 92,413,710 shares of the registrant’s Common Stock, $0.001 par value, were outstanding.

ORGANOVO HOLDINGS, INC.

INDEX

PART I. FINANCIAL INFORMATION

2

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Organovo Holdings, Inc.

Condensed Consolidated Balance Sheets

(in thousands except for share data)

|

|

|

September 30, 2015 |

|

|

March 31, 2015 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

76,863 |

|

|

$ |

50,142 |

|

|

Accounts receivable |

|

|

180 |

|

|

|

— |

|

|

Inventory |

|

|

68 |

|

|

|

66 |

|

|

Prepaid expenses and other current assets |

|

|

714 |

|

|

|

1,054 |

|

|

Total current assets |

|

|

77,825 |

|

|

|

51,262 |

|

|

Fixed assets, net |

|

|

3,633 |

|

|

|

2,042 |

|

|

Restricted cash |

|

|

79 |

|

|

|

79 |

|

|

Other assets, net |

|

|

139 |

|

|

|

106 |

|

|

Total assets |

|

$ |

81,676 |

|

|

$ |

53,489 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

567 |

|

|

$ |

1,387 |

|

|

Accrued expenses |

|

|

2,421 |

|

|

|

2,257 |

|

|

Deferred rent |

|

|

1,112 |

|

|

|

759 |

|

|

Deferred revenue |

|

|

1,402 |

|

|

|

227 |

|

|

Capital lease obligation |

|

|

— |

|

|

|

5 |

|

|

Warrant liabilities |

|

|

16 |

|

|

|

126 |

|

|

Total current liabilities |

|

|

5,518 |

|

|

|

4,761 |

|

|

Deferred revenue, net of current portion |

|

|

7 |

|

|

|

32 |

|

|

Capital lease obligation, net of current portion |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

5,525 |

|

|

$ |

4,793 |

|

|

Commitments and Contingencies (Note 4) |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 150,000,000 shares authorized,

92,327,772 and 81,536,724 shares issued and outstanding at

September 30, 2015 and March 31, 2015, respectively |

|

|

92 |

|

|

|

82 |

|

|

Additional paid-in capital |

|

|

218,102 |

|

|

|

170,909 |

|

|

Accumulated deficit |

|

|

(142,043 |

) |

|

|

(122,295 |

) |

|

Total stockholders’ equity |

|

|

76,151 |

|

|

|

48,696 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

81,676 |

|

|

$ |

53,489 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands except share and per share data)

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product and service |

|

$ |

187 |

|

|

|

— |

|

|

$ |

396 |

|

|

|

— |

|

|

Collaborations |

|

|

19 |

|

|

|

45 |

|

|

|

33 |

|

|

|

114 |

|

|

Grants |

|

|

95 |

|

|

|

5 |

|

|

|

178 |

|

|

|

35 |

|

|

Total Revenues |

|

|

301 |

|

|

|

50 |

|

|

|

607 |

|

|

|

149 |

|

|

Selling, general, and administrative expenses |

|

|

6,846 |

|

|

|

5,777 |

|

|

|

11,468 |

|

|

|

9,472 |

|

|

Research and development expenses |

|

|

4,739 |

|

|

|

3,229 |

|

|

|

8,881 |

|

|

|

6,043 |

|

|

Loss from Operations |

|

|

(11,284 |

) |

|

|

(8,956 |

) |

|

|

(19,742 |

) |

|

|

(15,366 |

) |

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liabilities |

|

|

9 |

|

|

|

94 |

|

|

|

(28 |

) |

|

|

64 |

|

|

Loss on disposals of fixed assets |

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(3 |

) |

|

Interest income |

|

|

18 |

|

|

|

7 |

|

|

|

25 |

|

|

|

14 |

|

|

Total Other Income (Expense) |

|

|

27 |

|

|

|

98 |

|

|

|

(3 |

) |

|

|

75 |

|

|

Income Tax Expense |

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

Net Loss |

|

$ |

(11,257 |

) |

|

$ |

(8,858 |

) |

|

$ |

(19,748 |

) |

|

$ |

(15,291 |

) |

|

Net loss per common share—basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.19 |

) |

|

Weighted average shares used in computing net

loss per common share—basic and diluted |

|

|

92,385,150 |

|

|

|

78,933,884 |

|

|

|

87,715,217 |

|

|

|

78,589,521 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

|

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(19,748 |

) |

|

$ |

(15,291 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Loss on disposal of fixed assets |

|

|

— |

|

|

|

3 |

|

|

Depreciation and amortization |

|

|

324 |

|

|

|

208 |

|

|

Change in fair value of warrant liabilities |

|

|

28 |

|

|

|

(64 |

) |

|

Stock-based compensation |

|

|

3,952 |

|

|

|

3,634 |

|

|

Amortization of warrants issued for services |

|

|

(105 |

) |

|

|

469 |

|

|

Increase (decrease) in cash resulting from changes in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(180 |

) |

|

|

(30 |

) |

|

Inventory |

|

|

(2 |

) |

|

|

(7 |

) |

|

Prepaid expenses and other assets |

|

|

337 |

|

|

|

113 |

|

|

Accounts payable |

|

|

(820 |

) |

|

|

204 |

|

|

Accrued expenses |

|

|

164 |

|

|

|

737 |

|

|

Deferred rent |

|

|

(21 |

) |

|

|

223 |

|

|

Deferred revenue |

|

|

1,150 |

|

|

|

124 |

|

|

Net cash used in operating activities |

|

|

(14,921 |

) |

|

|

(9,677 |

) |

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

Purchases of fixed assets |

|

|

(1,550 |

) |

|

|

(576 |

) |

|

Proceeds from disposals of fixed assets |

|

|

14 |

|

|

|

— |

|

|

Purchases of intangible assets |

|

|

(35 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

|

(1,571 |

) |

|

|

(576 |

) |

|

Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock and exercise of warrants, net |

|

|

43,137 |

|

|

|

16,291 |

|

|

Proceeds from exercise of stock options |

|

|

81 |

|

|

|

188 |

|

|

Principal payments on capital lease obligations |

|

|

(5 |

) |

|

|

(4 |

) |

|

Net cash provided by financing activities |

|

|

43,213 |

|

|

|

16,475 |

|

|

Net Increase (Decrease) in Cash and Cash Equivalents |

|

|

26,721 |

|

|

|

6,222 |

|

|

Cash and Cash Equivalents at Beginning of Period |

|

|

50,142 |

|

|

|

48,167 |

|

|

Cash and Cash Equivalents at End of Period |

|

$ |

76,863 |

|

|

$ |

54,389 |

|

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

— |

|

|

$ |

— |

|

|

Income Taxes |

|

$ |

(3 |

) |

|

$ |

— |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Supplemental Disclosure of Noncash Investing and Financing Activities ($ in thousands):

During the six months ended September 30, 2015 and 2014, the warrant liability was reduced by approximately $138 and $55, respectively, as a result of warrant exercises.

During the six months ended September 30, 2015 and 2014, approximately $374 and $47, respectively, of leasehold improvements were funded by the Company’s landlord as a lease incentive. The Company capitalized these costs as property, plant and equipment, with a corresponding increase in deferred rent that will be amortized over the remaining lease term.

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Organovo Holdings, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1. Description of Business and Summary of Significant Accounting Policies

Nature of operations and basis of presentation

References in these notes to the unaudited condensed consolidated financial statements to “Organovo Holdings, Inc.,” “Organovo Holdings,” “we,” “us,” “our,” “the Company” and “our Company” refer to Organovo Holdings, Inc. and its consolidated subsidiaries. The Company is an early commercial stage company, focused on developing and commercializing functional three-dimensional (3D) human tissues that can be employed in drug discovery and development, biological research, and as therapeutic implants for the treatment of damaged or degenerating tissues and organs.

Since its inception, the Company has devoted its efforts primarily to developing and commercializing a platform technology and functional human tissues that can be employed in drug discovery and development, biological research, and as therapeutic implants for the treatment of damaged or degenerating tissues and organs. The Company has also focused efforts on raising capital and building infrastructure. In November 2014, the Company announced the full commercial release of its first product, the exVive3D ™ Human Liver Tissue for use in toxicology and other preclinical drug testing. As of September 30, 2015, the Company has not yet realized significant revenues from its planned principal operations. The Company’s activities are subject to significant risks and uncertainties including failing to successfully develop products and services based on its technology and to achieve the market acceptance necessary to generate sufficient revenues and to achieve and sustain profitability.

The accompanying interim condensed consolidated financial statements have been prepared by the Company, without audit, in accordance with the instructions to Form 10-Q and, therefore, do not necessarily include all information and footnotes necessary for a fair statement of its financial position, results of operations, stockholders’ equity and cash flows in accordance with generally accepted accounting principles (“GAAP”). The balance sheet at March 31, 2015 is derived from the Company’s audited balance sheet at that date.

In the opinion of management, the unaudited financial information for the interim periods presented reflects all adjustments, which are only normal and recurring, necessary for a fair statement of the Company’s financial position, results of operations, stockholders’ equity and cash flows. These financial statements should be read in conjunction with the financial statements included in the Company’s Annual Report filed on Form 10-K for the year ended March 31, 2015 filed with the Securities and Exchange Commission (the “SEC”) on June 9, 2015. Operating results for interim periods are not necessarily indicative of operating results for the Company’s fiscal year ending March 31, 2016.

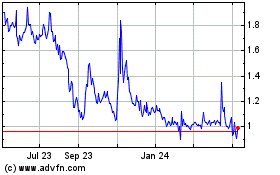

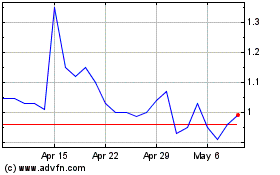

NYSE MKT Listing

On July 9, 2013, the Company announced that its common stock had been approved for listing on the NYSE MKT. Shares began trading on the NYSE MKT on July 11, 2013 under the symbol “ONVO”. Prior to that time, the Company’s shares were quoted on the OTC QX.

Liquidity

As of September 30, 2015, the Company had an accumulated deficit of approximately $142.0 million. The Company also had negative cash flows from operations of approximately $14.9 million during the six months ended September 30, 2015.

Through September 30, 2015, the Company has financed its operations primarily through the sale of convertible notes, the private placement of equity securities, the public offering of common stock, and through revenue derived from grants, product sales, collaborative research agreements and research service agreements. Based on its current operating plan and available cash resources, the Company has sufficient resources to fund its business for at least the next twelve months.

On June 23, 2015, the Company closed an underwritten public offering in which it sold an aggregate of 10,838,750 shares of common stock and raised gross proceeds of approximately $46.1 million. The Company’s future capital needs will depend on the revenues it generates through its commercialization efforts and the cash it elects to spend to pursue its product development efforts and implement its business plan. As a result, the Company cannot predict with certainty when it may be required to secure additional capital to fund its future operations.

7

The Company intends to cover its future operating expenses through cash on hand, through revenue derived from grants, product sales, collaborative research agreements and research services agreements and through the issuance of additional equity or debt securities. Depending on market conditions, we cannot be sure that additional financing will be available when needed or that, if available, financing will be obtained on terms favorable to us or to our stockholders.

Having insufficient funds may require us to delay, scale back, or eliminate some or all of our development programs or relinquish rights to our technology on less favorable terms than we would otherwise choose. Failure to obtain adequate financing could eventually adversely affect our ability to operate as a going concern. If we raise additional funds from the issuance of equity securities, substantial dilution to our existing stockholders would likely result. If we raise additional funds by incurring debt financing, the terms of the debt may involve significant cash payment obligations as well as covenants and specific financial ratios that may restrict our ability to operate our business.

Use of estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Significant estimates used in preparing the condensed consolidated financial statements include those assumed in computing the valuation of warrants, revenue recognized under the proportional performance model, the valuation of stock-based compensation expense, and the valuation allowance on deferred tax assets.

Financial instruments

For certain of the Company’s financial instruments, including cash and cash equivalents, accounts receivable, inventory, prepaid expenses and other current assets, accounts payable, accrued expenses, deferred revenue and capital lease obligations, the carrying amounts are generally considered to be representative of their respective fair values because of the short-term nature of those instruments.

Cash and cash equivalents

The Company considers all highly liquid investments with original maturities of 90 days or less to be cash equivalents.

Derivative financial instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market or foreign currency.

The Company reviews the terms of convertible debt and equity instruments it issues to determine whether there are derivative instruments, including an embedded conversion option that is required to be bifurcated and accounted for separately as a derivative financial instrument. In circumstances where a host instrument contains more than one embedded derivative instrument, including a conversion option, that is required to be bifurcated, the bifurcated derivative instruments are accounted for as a single, compound derivative instrument. Also, in connection with the sale of convertible debt and equity instruments, the Company may issue freestanding warrants that may, depending on their terms, be accounted for as derivative instrument liabilities, rather than as equity.

Derivative instruments are initially recorded at fair value and are then revalued at each reporting date with changes in the fair value reported as non-operating income or expense. When the convertible debt or equity instruments contain embedded derivative instruments that are to be bifurcated and accounted for as liabilities, the total proceeds allocated to the convertible host instruments are first allocated to the fair value of all the bifurcated derivative instruments. The remaining proceeds, if any, are then allocated to the convertible instruments themselves, usually resulting in those instruments being recorded at a discount from their face value.

The discount from the face value of the convertible debt, together with the stated interest on the instrument, is amortized over the life of the instrument through periodic charges to interest expense, using the effective interest method.

Restricted cash

As of September 30, 2015 and March 31, 2015, the Company had approximately $78,800 of restricted cash deposited with a financial institution. The entire amount is held in certificates of deposit to support a letter of credit agreement related to the Company’s facility lease.

8

Inventory

Inventories are stated at the lower of the cost or market (first-in, first-out). Inventory consisted of approximately $68,000 and $66,000 in raw materials as of September 30, 2015 and March 31, 2015, respectively, net of reserves. The Company provides inventory allowances based on excess or obsolete inventories determined based on anticipated use in the final product. The reserve for obsolete inventory at September 30, 2015 and March 31, 2015 was approximately $32,000 and $31,000, respectively.

Fixed assets and depreciation

Property and equipment are carried at cost. Expenditures that extend the life of the asset are capitalized and depreciated. Depreciation and amortization are provided using the straight-line method over the estimated useful lives of the related assets or, in the case of leasehold improvements, over the lesser of the useful life of the related asset or the remaining lease term. The estimated useful lives of the fixed assets range between three and seven years.

Impairment of long-lived assets

In accordance with authoritative guidance, the Company reviews its long-lived assets, including property and equipment and other assets, for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may not be fully recoverable. To determine recoverability of its long-lived assets, the Company evaluates whether future undiscounted net cash flows will be less than the carrying amount of the assets and adjusts the carrying amount of its assets to fair value. Management has determined that no impairment of long-lived assets has occurred through September 30, 2015.

Fair value measurement

Financial assets and liabilities are measured at fair value, which is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. The following is a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value:

|

|

· |

Level 1 — Quoted prices in active markets for identical assets or liabilities. |

|

|

· |

Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

|

|

· |

Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

The Company has issued warrants, of which some are classified as derivative liabilities as a result of the terms in the warrants that provide for down-round protection in the event of a dilutive issuance. The Company uses Level 3 inputs for its valuation methodology for the warrant derivative liabilities. The estimated fair values were determined using a Monte Carlo option pricing model based on various assumptions (see Note 2). The Company’s derivative liabilities are adjusted to reflect estimated fair value at each period end, with any decrease or increase in the estimated fair value being recorded in other income or expense accordingly, as adjustments to the fair value of derivative liabilities. Various factors are considered in the pricing models the Company uses to value the warrants, including the Company’s current stock price, the remaining life of the warrants, the volatility of the Company’s stock price, and the risk-free interest rate. Future changes in these factors may have an impact on the computed fair value of the warrant liability.

9

The estimated fair values of the liabilities measured on a recurring basis are as follows:

|

|

|

Fair Value Measurements at September 30 and March 31, 2015 (in thousands): |

|

|

|

|

Balance at

September 30, 2015 |

|

|

Quoted

Prices in

Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Other

Unobservable

Inputs

(Level 3) |

|

|

Warrant liability |

|

$ |

16 |

|

|

|

— |

|

|

|

— |

|

|

$ |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at

March 31, 2015 |

|

|

Quoted

Prices in

Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Other

Unobservable

Inputs

(Level 3) |

|

|

Warrant liability |

|

$ |

126 |

|

|

|

— |

|

|

|

— |

|

|

$ |

126 |

|

The following table presents the activity for liabilities measured at estimated fair value using unobservable inputs for the six months ended September 30, 2015:

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

|

|

Warrant

Derivative

Liability

(in thousands) |

|

|

Balance at March 31, 2015 |

$ |

126 |

|

|

Issuances |

|

— |

|

|

Adjustments to estimated fair value |

|

28 |

|

|

Warrant liability removal due to settlements |

|

(138 |

) |

|

Warrant liability reclassified to equity |

|

— |

|

|

Balance at September 30, 2015 |

$ |

16 |

|

Research and development

Research and development expenses, including direct and allocated expenses, consist of independent research and development costs, as well as costs associated with sponsored research and development. Research and development costs are expensed as incurred.

Income taxes

Deferred income taxes are recognized for the tax consequences in future years for differences between the tax basis of assets and liabilities and their financial reporting amounts at each year end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the combination of the tax payable for the year and the change during the year in deferred tax assets and liabilities.

Revenue recognition

The Company’s revenues are derived from research service agreements, product sales, collaborative research agreements, and grants from the National Institutes of Health (“NIH”), U.S. Treasury Department and private not-for-profit organizations.

The Company recognizes revenue when the following criteria have been met: (i) persuasive evidence of an arrangement exists; (ii) services have been rendered or product has been delivered; (iii) price to the customer is fixed and determinable; and (iv) collection of the underlying receivable is reasonably assured.

Billings to customers or payments received from customers are included in deferred revenue on the balance sheet until all revenue recognition criteria are met. As of September 30, 2015 and March 31, 2015, the Company had approximately $1,409,000 and $259,000, respectively, in deferred revenue related to its grants, collaborative research programs and research service agreements.

10

Revenue arrangements with multiple deliverables

The Company follows ASC 605-25 Revenue Recognition – Multiple-Element Arrangements for revenue arrangements that contain multiple deliverables. Judgment is required to properly identify the accounting units of the multiple deliverable transactions and to determine the manner in which revenue should be allocated among the accounting units. Moreover, judgment is used in interpreting the commercial terms and determining when all criteria of revenue recognition have been met for each deliverable in order for revenue recognition to occur in the appropriate accounting period. For multiple deliverable agreements, consideration is allocated at the inception of the agreement to all deliverables based on their relative selling price. The relative selling price for each deliverable is determined using vendor-specific objective evidence (“VSOE”) of selling price or third-party evidence of selling price if VSOE does not exist. If neither VSOE nor third-party evidence of selling price exists, the Company uses its best estimate of the selling price for the deliverable.

While changes in the allocation of the arrangement consideration between the units of accounting will not affect the amount of total revenue recognized for a particular sales arrangement, any material changes in these allocations could impact the timing of revenue recognition, which could affect the Company’s results of operations.

The Company periodically receives license fees for non-exclusive research licensing associated with funded research projects. License fees under these arrangements are recognized over the term of the contract or development period as it has been determined that such licenses do not have stand-alone value.

Product revenue

The Company recognizes product revenue at the time of shipment to the customer, provided all other revenue recognition criteria have been met. To date, the Company has not recognized significant revenue from commercial product sales.

As our commercial sales increase, we expect to establish a reserve for estimated product returns that will be recorded as a reduction to revenue. This reserve will be maintained to account for future return of products sold in the current period. The reserve will be reviewed quarterly and will be estimated based on an analysis of our historical experience related to product returns.

Revenue from research service agreements

For research service agreements that contain only a single or primary deliverable, the Company defers any up-front fees collected from customers, and recognizes revenue for the delivered element only when it determines there are no uncertainties regarding customer acceptance. For agreements that contain multiple deliverables, the Company follows ASC 605-25 as described above. During the six months ended September 30, 2015, the Company received a $1,000,000 up-front fee from a customer. As there were no delivered elements during the first two quarters, this amount remains in deferred revenue as of September 30, 2015.

Research and development revenue under collaborative agreements

The Company’s collaboration revenue consists of license and collaboration agreements that contain multiple elements, including non-refundable up-front fees, payments for reimbursement of third-party research costs, payments for ongoing research, payments associated with achieving specific development milestones and royalties based on specified percentages of net product sales, if any. The Company considers a variety of factors in determining the appropriate method of revenue recognition under these arrangements, such as whether the elements are separable, whether there are determinable fair values and whether there is a unique earnings process associated with each element of a contract.

The Company recognizes revenue from research funding under collaboration agreements when earned on a “proportional performance” basis as research services are provided or substantive milestones are achieved. We recognize revenue that is contingent upon the achievement of a substantive milestone in its entirety in the period in which the milestone is achieved. A milestone is considered substantive when the consideration payable to us for the milestone (i) is consistent with our performance necessary to achieve the milestone or the increase in value to the collaboration resulting from our performance, (ii) relates solely to our past performance and (iii) is reasonable relative to all of the other deliverables and payments within the arrangement. In making this assessment, we consider all facts and circumstances relevant to the arrangement, including factors such as the risks that must be overcome to achieve the milestone, the level of effort and investment required to achieve the milestone and whether any portion of the milestone consideration is related to future performance or deliverables.

The Company initially defers revenue for any amounts billed or payments received in advance of the services being performed, and recognizes revenue pursuant to the related pattern of performance, using the appropriate method of revenue recognition based on its analysis of the related contractual element(s).

11

Grant revenues

During August 2013, the Company was awarded a research grant by a private, not-for-profit organization for up to $251,700, contingent on go/no-go decisions made by the grantor at the completion of each stage of research as outlined in the grant award. Revenues from the grant are based upon internal costs incurred that are specifically covered by the grant, plus an additional rate that provides funding for overhead expenses. Revenue is recognized when the Company incurs expenses that are related to the grant. Revenue recognized under this grant was approximately $21,000 and $30,000 for the three and six months ended September 30, 2015, respectively. Revenue recognized under this grant was approximately $5,000 and $35,000 for the three and six months ended September 30, 2014, respectively.

During September 2014, the NIH awarded the Company a research grant totaling approximately $222,000. The grant provides for fixed payments based on the achievement of certain milestones. As such, revenue will be recognized upon completion of substantive milestones. Revenue recognized under this grant was approximately $74,000 and $148,000 for the three and six months ended September 30, 2015, respectively. Grant activities did not commence until the third quarter of fiscal 2015 and therefore no revenue was recognized under this grant as of September 30, 2014.

Stock-based compensation

The Company accounts for stock-based compensation in accordance with the Financial Accounting Standards Board’s (“FASB”) ASC Topic 718, Compensation — Stock Compensation, which establishes accounting for equity instruments exchanged for employee services. Under such provisions, stock-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense, under the straight-line method, over the employee’s requisite service period (generally the vesting period of the equity grant).

The Company accounts for equity instruments, including restricted stock or stock options, issued to non-employees in accordance with authoritative guidance for equity based payments to non-employees. Stock options issued to non-employees are accounted for at their estimated fair value determined using the Black-Scholes option-pricing model. The fair value of options granted to non-employees is re-measured as they vest, and the resulting increase in value, if any, is recognized as expense during the period the related services are rendered. Restricted stock issued to non-employees is accounted for at its estimated fair value as it vests.

Comprehensive income (loss)

Comprehensive income (loss) is defined as the change in equity during a period from transactions and other events and circumstances from non-owner sources. The Company is required to record all components of comprehensive income (loss) in the financial statements in the period in which they are recognized. Net income (loss) and other comprehensive income (loss), including unrealized gains and losses on investments, are reported, net of their related tax effect, to arrive at comprehensive income (loss). For the three and six months ended September 30, 2015 and 2014, respectively, the comprehensive loss was equal to the net loss.

Net loss per share

Basic and diluted net loss per share has been computed using the weighted-average number of shares of common stock outstanding during the period. The weighted-average number of shares used to compute diluted loss per share excludes any assumed exercise of stock options and warrants, the assumed release of restriction of restricted stock units, and shares subject to repurchase as the effect would be anti-dilutive. No dilutive effect was calculated for the three and six months ended September 30, 2015 or 2014, as the Company reported a net loss for each respective period and the effect would have been anti-dilutive. Common stock equivalents excluded from computing diluted net loss per share were approximately 10.5 million for the three and six months ended September 30, 2015, and 7.9 million for the three and six months ended September 30, 2014.

Note 2. Derivative Liability

During 2011 and 2012, the Company issued five-year warrants to purchase its common stock. For certain of these warrants, the exercise price is protected against down-round financing throughout the term of the warrant. Pursuant to ASC 815-15 and ASC 815-40, the fair value of the warrants was recorded as a derivative liability on the issuance dates.

The Company revalues the warrants classified as derivative liabilities as of the end of each reporting period. The estimated fair value of the outstanding warrant liabilities was less than $0.1 million and approximately $0.1 million as of September 30, 2015 and March 31, 2015, respectively. The changes in fair value of the derivative liabilities were decreases of approximately $9,000 and $94,000 for the three months ended September 30, 2015 and 2014, respectively, and an increase of approximately $28,000 and a decrease of approximately $64,000 for the six months ended September 30, 2015 and 2014, respectively, and are included in other income (expense) in the statements of operations.

12

During the three months ended September 30, 2015 and 2014, no warrants that were classified as derivative liabilities were exercised. During the six months ended September 30, 2015 and 2014, 38,234 and 8,647 warrants, respectively, that were classified as derivative liabilities were exercised. The warrants were revalued as of the settlement dates, and the change in fair value was recognized to earnings.

The derivative liabilities were valued at the end of each reporting period using a Monte Carlo valuation model with the following assumptions:

|

|

|

September 30,

2015 |

|

|

March 31,

2015 |

|

|

September 30,

2014 |

|

|

Closing price per share of common stock |

|

$ |

2.68 |

|

|

$ |

3.54 |

|

|

$ |

6.37 |

|

|

Exercise price per share |

|

$ |

1.00 |

|

|

$ |

1.00 |

|

|

$ |

1.00 |

|

|

Expected volatility |

|

|

71.60 |

% |

|

|

76.80 |

% |

|

|

76.50 |

% |

|

Risk-free interest rate |

|

|

0.33 |

% |

|

|

0.56 |

% |

|

|

0.58 |

% |

|

Dividend yield |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Remaining expected term of underlying securities

(years) |

|

|

1.46 |

|

|

|

1.96 |

|

|

|

2.46 |

|

Note 3. Stockholders’ Equity

Common stock

The Company filed a shelf registration statement on Form S-3 (File No. 333-189995), or the 2013 Shelf, with the SEC on July 17, 2013 authorizing the offer and sale in one or more offerings of up to $100,000,000 in aggregate of common stock, preferred stock, debt securities, or warrants to purchase common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units comprised of one or more of the other securities. This 2013 Shelf was declared effective by the SEC on July 26, 2013.

In May 2008, the Board of Directors of the Company approved the 2008 Equity Incentive Plan (the “2008 Plan”). The 2008 Plan authorized the issuance of up to 1,521,584 common shares for awards of incentive stock options, non-statutory stock options, restricted stock awards, restricted stock award units, and stock appreciation rights. The 2008 Plan terminates on July 1, 2018. No shares have been issued under the 2008 Plan since 2011, and the Company does not intend to issue any additional shares from the 2008 Plan in the future.

In January 2012, the Board of Directors of the Company approved the 2012 Equity Incentive Plan (the “2012 Plan”). The 2012 Plan authorized the issuance of up to 6,553,986 shares of common stock for awards of incentive stock options, non-statutory stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance shares, and other stock or cash awards. The Board of Directors and stockholders of the Company approved an amendment to the 2012 Plan in August 2013 to increase the number of shares of common stock that may be issued under the 2012 Plan by 5,000,000 shares. In addition, the Board of Directors and stockholders of the Company approved an amendment to the 2012 Plan in August 2015 to further increase the number of common stock that may be issued under the 2012 Plan by 6,000,000 shares, bringing the aggregate shares issuable under the 2012 Plan to 17,553,986. The 2012 Plan as amended and restated became effective on August 20, 2015 and terminates ten years after such date.

On August 2, 2013, the Company, entered into an Underwriting Agreement with Lazard Capital Markets LLC, acting as representative of the underwriters named in the Underwriting Agreement and joint book-runner with Oppenheimer & Co. Inc., relating to the issuance and sale of 10,350,000 shares of the Company’s common stock, which includes the issuance and sale of 1,350,000 shares pursuant to an overallotment option exercised by the Underwriters on August 5, 2013 (the “2013 Offering”). JMP Securities LLC and Maxim Group LLC each acted as co-managers for the 2013 Offering. The price to the public in the 2013 Offering was $4.50 per share, and the Underwriters purchased the shares from the Company pursuant to the Underwriting Agreement at a price of $4.23 per share. The net proceeds to the Company from the 2013 Offering were approximately $43.4 million, after deducting underwriting discounts and commissions and other offering expenses of $3.2 million payable by the Company, including the Underwriters’ exercise of the overallotment option. The transactions contemplated by the Underwriting Agreement closed on August 7, 2013.

In November 2013, the Company entered into an equity distribution agreement with an investment banking firm. Under the terms of the distribution agreement, the Company may offer and sell up to 4,000,000 shares of its common stock, from time to time, through the investment bank in “at the market” offerings, as defined by the SEC, and pursuant to the 2013 Shelf. During the three and six months ended September 30, 2015, the Company issued no shares of common stock in at the market offerings under the distribution agreement. During the three and six months ended September 30, 2014, the Company issued 2,197,768 shares of common stock in at the market offerings under the distribution agreement with net proceeds of $16.1 million. As of September 30, 2015, the Company has

13

issued 2,532,180 shares of common stock in at the market offerings under the distribution agreement, with net proceeds of $19.6 million.

In December 2014, the Company entered into an equity offering sales agreement with another investment banking firm. Under the terms of the sales agreement, the Company may offer and sell shares of its common stock, from time to time, through the investment bank in “at the market” offerings, as defined by the SEC, and pursuant to the 2013 Shelf. During the three and six months ended September 30, 2015, the Company issued no shares of common stock in at the market offerings under the sales agreement. As of September 30, 2015, the Company sold 1,000,000 shares of common stock in at the market offerings under the sales agreement, with net proceeds of approximately $6.2 million.

The Company will limit future sales under the 2013 distribution agreement and the 2014 sales agreement to ensure that it does not exceed the maximum amount available for sale under its 2013 Shelf. Based on its use of the 2013 Shelf through September 30, 2015, the Company cannot sell more than an aggregate of $26,777,785 in shares of common stock under the 2013 distribution agreement and the 2014 sales agreement.

The Company filed a second shelf registration statement on Form S-3 (File No. 333-202382), or the 2015 Shelf, with the SEC on February 27, 2015 authorizing the offer and sale in one or more offerings of up to $190,000,000 in aggregate of common stock, preferred stock, debt securities, warrants to purchase common stock, preferred stock or debt securities, or any combination of the foregoing, either individually or as units compromised one or more of the other securities. This shelf was declared effective by the SEC on March 17, 2015.

On June 18, 2015, the Company entered into an Underwriting Agreement with Jefferies LLC and Piper Jaffray & Co., acting as representatives of the underwriters named in the 2015 Underwriting Agreement and as joint book-running managers, relating to the issuance and sale of 9,425,000 shares of the Company’s common stock, par value $0.001 per share (the “2015 Offering”). The price to the public in the 2015 Offering was $4.25 per share, and the Underwriters have agreed to purchase the shares from the Company pursuant to the 2015 Underwriting Agreement at a price of $3.995 per share. Under the terms of the 2015 Underwriting Agreement, the Company granted the Underwriters an option, exercisable for 30 days, to purchase up to an additional 1,413,750 shares. The Company issued 10,838,750 shares of common stock pursuant to the 2015 Underwriting Agreement, including shares issuable upon the exercise of the over-allotment option, with net proceeds of approximately $43.1 million, after deducting underwriting discounts and commissions and expenses payable by the Company. The shares were issued pursuant to the 2015 Shelf.

No warrants were exercised during the three months ended September 30, 2015 and 2014. During the six months ended September 30, 2015 and 2014, the Company issued 30,186 and 110,600 shares of common stock upon exercise of 38,234 and 111,647 warrants, respectively.

Finally, during the three months ended September 30, 2015 and 2014, the Company issued 2,060 and 28,224 shares of common stock upon exercise of 2,060 and 28,224 stock options, respectively. During the six months ended September 30, 2015 and 2014, the Company issued 27,563 and 88,746 shares of common stock upon exercise of 27,563 and 88,746 stock options, respectively.

Restricted stock awards

During the three months ended September 30, 2015 and 2014, there were 100,692 and 103,804 shares of restricted stock, respectively, cancelled related to shares of common stock returned to the Company, at the option of the holders, to cover the tax liability related to the vesting of 187,500 and 190,000 restricted stock units, respectively. During the six months ended September 30, 2015 and 2014, there were 102,951 and 106,105 shares of restricted stock, respectively, cancelled related to shares of common stock returned to the Company, at the option of the holders, to cover the tax liability related to the vesting of 193,750 and 196,250 restricted stock units, respectively. Upon the return of the common stock, an equal number of stock options with immediate vesting were granted to the individuals at the vesting date market value strike price. A summary of the Company’s restricted stock award activity from March 31, 2015 through September 30, 2015 is as follows:

|

|

|

Number of

Shares |

|

|

Unvested at March 31, 2015 |

|

|

258,750 |

|

|

Granted |

|

|

— |

|

|

Vested |

|

|

(193,750 |

) |

|

Canceled / forfeited |

|

|

(2,500 |

) |

|

Unvested at September 30, 2015 |

|

|

62,500 |

|

14

The fair value of each restricted common stock award is recognized as stock-based compensation expense over the vesting term of the award. The Company recorded restricted stock-based compensation expense in operating expenses for employees and non-employees of approximately $74,000 and $134,000 for the three months ended September 30, 2015 and 2014, respectively, and approximately $177,000 and $267,000 for the six months ended September 30, 2015 and 2014, respectively. Stock-based compensation expense included in research and development was $3,000 and $4,000 for the three months ended September 30, 2015 and 2014, respectively, and $3,000 and $8,000 for the six months ended September 30, 2015 and 2014, respectively. Stock-based compensation expense included in general and administrative expense was $71,000 and $130,000 for the three months ended September 30, 2015 and 2014, respectively and $174,000 and $259,000 for the six months ended September 30, 2015 and 2014, respectively.

As of September 30, 2015, total unrecognized restricted stock-based compensation expense was approximately $41,000, which will be recognized over a weighted average period of 0.44 years.

Stock options

Under the 2012 Plan, 692,092 and 290,054 stock options were issued during the three months ended September 30, 2015 and 2014, respectively, and 2,454,733 and 556,855 stock options were issued during the six months ended September 30, 2015 and 2014, respectively, at various exercise prices. The stock options generally vest (i) on the one year anniversary of the grant date, (2) quarterly over a three year period, or (3) over a four-year period, with 25% vesting on either the one year anniversary of employment or the one year anniversary of the vesting commencement date, and the remainder vesting ratably over the remaining term.

A summary of the Company’s stock option activity for the six months ended September 30, 2015 is as follows:

|

|

|

Options

Outstanding |

|

|

Weighted-

Average

Exercise Price |

|

|

Aggregate

Intrinsic

Value |

|

|

Outstanding at March 31, 2015 |

|

|

7,113,548 |

|

|

$ |

5.21 |

|

|

$ |

4,969,499 |

|

|

Options granted |

|

|

2,454,733 |

|

|

$ |

4.13 |

|

|

|

|

|

|

Options canceled / forfeited |

|

|

(198,297 |

) |

|

$ |

6.28 |

|

|

|

|

|

|

Options exercised |

|

|

(27,563 |

) |

|

$ |

2.94 |

|

|

$ |

64,477 |

|

|

Outstanding at September 30, 2015 |

|

|

9,342,421 |

|

|

$ |

4.91 |

|

|

$ |

3,319,866 |

|

|

Vested and Exercisable at September 30, 2015 |

|

|

4,265,334 |

|

|

$ |

4.21 |

|

|

$ |

2,715,019 |

|

The weighted-average remaining contractual term of options exercisable and outstanding at September 30, 2015 was approximately 7.19 years.

The Company uses the Black-Scholes valuation model to calculate the fair value of stock options. Stock-based compensation expense is recognized over the vesting period using the straight-line method. The fair value of stock options was estimated at the grant date using the following weighted average assumptions:

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

September 30, 2015 |

|

|

September 30, 2014 |

|

|

Dividend yield |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Volatility |

|

|

74.26 |

% |

|

|

76.30 |

% |

|

|

74.25 |

% |

|

|

77.1 |

% |

|

Risk-free interest rate |

|

|

1.48 |

% |

|

|

1.66 |

% |

|

|

1.60 |

% |

|

|

1.61 |

% |

|

Expected life of options |

|

6.00 years |

|

|

6.00 years |

|

|

6.00 years |

|

|

6.00 years |

|

|

Weighted average grant date fair value |

|

$ |

1.39 |

|

|

$ |

5.16 |

|

|

$ |

2.70 |

|

|

$ |

5.06 |

|

The assumed dividend yield was based on the Company’s expectation of not paying dividends in the foreseeable future. Due to the Company’s limited historical data, the estimated volatility incorporates the historical and implied volatility of comparable companies whose share prices are publicly available. The risk-free interest rate assumption was based on the U.S. Treasury rates. The weighted average expected life of options was estimated using the average of the contractual term and the weighted average vesting term of the options. Certain options granted to consultants are subject to variable accounting treatment and are required to be revalued until vested.

The total stock option-based compensation recorded as operating expense was approximately $2,098,000 and $1,962,000 for the three months ended September 30, 2015 and 2014, respectively, and $3,775,000 and $3,367,000 for the six months ended September 30, 2015 and 2014, respectively. Expense included in research and development was $277,000 and $281,000 for the three months ended

15

September 30, 2015 and 2014, respectively, and $626,000 and $529,000 for the six months ended September 30, 2015 and 2014, respectively. Expense included in general and administrative was $1,821,000 and $1,681,000 for the three months ended September 30, 2015 and 2014, respectively, and $3,149,000 and $2,838,000 for the six months ended September 30, 2015 and 2014, respectively.

The total unrecognized compensation cost related to unvested stock option grants as of September 30, 2015 was approximately $17,150,000 and the weighted average period over which these grants are expected to vest is 2.79 years.

Warrants

During the three months ended September 30, 2015 and 2014, there were no cashless warrant exercises. During the six months ended September 30, 2015 and 2014, 38,234 and 8,647 warrants, respectively, were exercised through a cashless exercise provision for issuance of 30,186 and 7,600 shares of common stock, respectively. During the three and six months ended September 30, 2014, 0 and 103,000 warrants, respectively, were exercised at prices ranging from $1.00 to $2.21 for total proceeds of $0 and $224,000, respectively. In addition, during the six months ended September 30, 2015, a warrant that was previously expected to be issued to a service provider and had been expensed in prior periods at its approximate value of $130,000, was cancelled, and the amount was reversed against operating expense during the period.

Of the warrants exercised during the six months ended September 30, 2015 and 2014, 38,234 and 8,647, respectively were derivative liabilities and were valued at the settlement date. For the six months ended September 30, 2015 and 2014, respectively, approximately $138,000, and $55,000, of the warrant liability was removed due to the exercise of these warrants. (See Note 2).

During November 2013 the Company entered into an agreement with a consultant for services. In connection with the agreement, the Company issued 75,000 warrants to purchase common stock, at a price of $7.36, with a life of five years, to be earned over a twelve month service period. The fair value of the warrants was estimated to be approximately $404,000, which was recognized as a prepaid asset and has been amortized over the term of the consulting agreement. These warrants were classified as equity instruments because they do not contain any anti-dilution provisions. The Black-Scholes model, using a volatility rate of 96.90% and a risk-free interest rate factor of 0.60%, was used to determine the value. The Company recognized approximately $101,000 and $202,000 during the three and six months ended September 30, 2014, respectively, related to these services. As of December 31, 2014, these warrants were fully expensed.

Additionally, during September 2014, the Company issued 50,000 warrants to a consultant in recognition of services previously provided. These warrants were classified as equity instruments because they do not contain any anti-dilution provisions. As of December 31, 2014, the full amount of the warrants related to these services, approximately $273,000, had been recognized.

During November 2014 the Company entered into an agreement with a consultant for services. In connection with the agreement, the Company issued 145,000 warrants to purchase common stock, at a price of $6.84, with a life of five years, to be earned over a seventeen month service period ending on March 31, 2016. The final number of vested warrant shares will be determined, at the discretion of management, based on management’s judgment of the satisfaction of specific performance metrics prior to the earlier to occur of March 31, 2016 or the termination of the consulting arrangement with the Company. The initial fair value of the warrants was estimated to be approximately $309,000, which is being revalued and amortized over the term of the consulting agreement. These warrants were classified as equity instruments because they do not contain any anti-dilution provisions. The Black-Scholes model, using a volatility rate of 76.78% and a risk-free interest rate factor of 1.37%, was used to determine the value. The Company recognized an expense reduction of approximately $9,000 and expense of approximately $25,000 during the three and six months ended September 30, 2015, respectively, related to these services.

The following table summarizes warrant activity for the six months ended September 30, 2015:

|

|

|

Warrants |

|

|

Weighted-

Average

Exercise Price |

|

|

Balance at March 31, 2015 |

|

|

1,178,109 |

|

|

$ |

2.59 |

|

|

Granted |

|

|

— |

|

|

$ |

— |

|

|

Exercised |

|

|

(38,234 |

) |

|

$ |

1.00 |

|

|

Cancelled |

|

|

(37,500 |

) |

|

$ |

7.36 |

|

|

Balance at September 30, 2015 |

|

|

1,102,375 |

|

|

$ |

2.49 |

|

The warrants outstanding at September 30, 2015 are exercisable at prices between $0.85 and $7.62 per share, and have a weighted average remaining term of approximately 1.89 years.

16

Common stock reserved for future issuance

Common stock reserved for future issuance consisted of the following at September 30, 2015:

|

Common stock warrants outstanding |

|

|

1,102,375 |

|

|

Common stock options outstanding under the 2008 Plan |

|

|

622,192 |

|

|

Common stock options outstanding and reserved under the 2012

Plan |

|

|

15,490,660 |

|

|

Total |

|

|

17,215,227 |

|

Preferred stock

The Company is authorized to issue 25,000,000 shares of preferred stock. There are no shares of preferred stock currently outstanding, and the Company has no present plans to issue shares of preferred stock.

Note 4. Commitments and Contingencies

Operating leases

The Company leases office and laboratory space under a non-cancelable operating lease which was entered into in February 2012 and amended in December 2013 and March 2015, and a non-cancelable operating lease entered into on January 9, 2015, with the future minimum lease payments from the leases included below. The Company records rent expense on a straight-line basis over the life of the leases and records the excess of expense over the amounts paid as deferred rent. In addition, one of the leases provides for certain improvements made for the Company’s benefit to be funded by the landlord. Such costs, totaling approximately $518,000 to date, have been capitalized as fixed assets and included in deferred rent.

Rent expense was approximately $272,000 and $235,000 for the three months ended September 30, 2015 and 2014, respectively, and $549,000 and $470,000 for the six months ended September 30, 2015 and 2014, respectively.

On February 27, 2012, the Company entered into a facilities lease at 6275 Nancy Ridge Drive (the “Original Lease”), San Diego, CA 92121, with occupancy as of July 15, 2012. The base rent under the lease was approximately $38,800 per month with 3% annual escalators. The lease term was 48 months with an option for the Company to extend the lease at the end of the lease term.

On December 5, 2013, the Company entered into a First Amendment (the “Amendment”) to the Original Lease, together with the Amendment, (the “Amended Lease”). Pursuant to the Amendment, the Company expanded the size of its facility by approximately 15,268 square feet (the “Expansion Premises”) from approximately 15,539 square feet (the “Original Premises”) for a total of approximately 30,807 square feet. The Amended Lease provides for base rent (i) on the Original Premises to continue at approximately $38,800 per month, with annual escalators, until August 1, 2016, at which point the base rent shall be payable at the same rate per rentable square foot as the Expansion Premises and (ii) on the Expansion Premises of approximately $38,934 per month, with 3% annual escalators, not to commence until two months after the earlier of (A) the date that the landlord delivers possession of the Expansion Premises to the Company with the work in the Expansion Lab Premises (as defined in the Amendment) substantially complete and (B) the date the landlord could have delivered the Expansion Premises with the work in the Expansion Lab Premises (as defined in the Amendment) substantially complete but for certain delays of the Company. Additionally, the Company has a right of first refusal on adjacent additional premises of approximately 14,500 square feet. The term of the Amended Lease expires on the seven-year anniversary of the earlier of (A) the date that the landlord delivers possession of the Expansion Premises to the Company and (B) the date the landlord could have delivered the Expansion Premises but for certain delays of the Company (the “Expansion Premises Commencement Date”). The Expansion Premises Commencement Date was September 1, 2014. The Company also has the option to terminate the Amended Lease on the 5-year anniversary of the Expansion Premises Commencement Date. The Expansion Premises contains office, laboratory, and clean room areas.

On March 12, 2015, the Company entered into a Second Amendment to the Original Lease (the “Second Amendment), to adjust the square footage covered by Amended Lease and an additional portion of the building containing approximately 335 rentable square feet (“Second Expansion Premises”). This square footage adjustment was the result of the re-measurement of each suite and the building overall. The net adjustment to overall leased space was an increase of 88 square feet with a corresponding increase in monthly rental payments at the same rate per square foot as the Expansion Premises.

On January 9, 2015, the Company entered into an agreement to lease a second facility consisting of 5,803 rentable square feet of office and lab space located at 6310 Nancy Ridge Drive, San Diego, CA 92121. The term of the lease is 36 months, beginning on

17

February 1, 2015 and ending on January 31, 2018, with monthly rental payments of approximately $12,000 commencing on April 1, 2015. In addition, there are annual rent escalations of 3.0% on each 12-month anniversary of the lease commencement date.

Future minimum rental payments required under operating leases that have initial or remaining non-cancelable lease terms in excess of one year as of September 30, 2015, are as follows (in thousands):

|

Fiscal year ended March 31, 2016 |

|

$ |

577 |

|

|

Fiscal year ended March 31, 2017 |

|

|

1,157 |

|

|

Fiscal year ended March 31, 2018 |

|

|

1,145 |

|

|

Fiscal year ended March 31, 2019 |

|

|

1,041 |

|

|

Fiscal year ended March 31, 2020 |

|

|

1,072 |

|

|

Thereafter |

|

|

1,572 |

|

|

Total |

|

$ |

6,564 |

|

Legal Matters

In addition to commitments and obligations in the ordinary course of business, the Company is subject to various claims and pending and potential legal actions arising out of the normal conduct of its business. The Company assesses contingencies to determine the degree of probability and range of possible loss for potential accrual in its financial statements. Because litigation is inherently unpredictable and unfavorable resolutions could occur, assessing litigation contingencies is highly subjective and requires judgments about future events. When evaluating contingencies, the Company may be unable to provide a meaningful estimate due to a number of factors, including the procedural status of the matter in question, the presence of complex or novel legal theories, and/or the ongoing discovery and development of information important to the matters. In addition, damage amounts claimed in litigation against it may be unsupported, exaggerated or unrelated to possible outcomes, and as such are not meaningful indicators of its potential liability.

The Company regularly reviews contingencies to determine the adequacy of its accruals and related disclosures. During the period presented, other than as noted below, the Company has not recorded any accrual for loss contingencies associated with such claims or legal proceedings; determined that an unfavorable outcome is probable or reasonably possible; or determined that the amount or range of any possible loss is reasonably estimable. However, the outcome of legal proceedings and claims brought against the Company is subject to significant uncertainty. Therefore, although management considers the likelihood of such an outcome to be remote, if one or more of these legal matters were resolved against the Company in a reporting period, the Company’s consolidated financial statements for that reporting period could be materially adversely affected.

Spencer Trask Matter

In June 2013, the Company filed a declaratory relief action against Spencer Trask Ventures (“STV”) in the Supreme Court of New York (case #652305/2013) following claims by STV that the Company owed STV additional compensation arising from a warrant tender offer the Company completed in December 2012. The Company requested the court to declare that a Warrant Solicitation Agency Agreement (the “WSAA”) the parties had signed in February 2013 was valid and enforceable, and that STV was not entitled to additional compensation on warrants covered by that agreement. In June 2013, STV initiated an arbitration against the Company in which it alleged that the Company had breached the terms of a Placement Agent Agreement (the “PAA”) the parties had signed in connection with the private placement financings the Company completed in February and March 2012. STV claimed it was entitled to additional compensation and damages, including a cash fee and warrants to purchase common stock, as a result of the Company’s warrant tender offer in December 2012 and its warrant redemption in 2013, and damages for breach of confidentiality provisions in relation to the contacting of warrant holders who participated in the warrant tender offer. The Company denied these allegations, and requested the arbitration panel to award the Company attorneys’ fees.

In August, 2015, the parties agreed to globally resolve the pending disputes and voluntarily dismissed their claims with prejudice. In connection with this resolution, the Company made a payment to STV of $150,000. Although it believes STV’s claims are without merit, the Company determined that accepting the settlement offer was in the best interests of the Company and its stockholders because there is no assurance that the arbitrators would award the Company attorneys’ fees, which the Company would continue to incur moving forward in the arbitration, and because the Company’s counsel offered to waive a portion of its legal fees in order to help effect the settlement. The resolution of this matter did not adversely affect the Company’s business, results of operations, liquidity or financial condition.

18

Note 5. Concentrations

Credit risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of temporary cash investments. The Company maintains cash balances at various financial institutions located in the United States. Accounts at these institutions are secured by the Federal Deposit Insurance Corporation. Balances may exceed federally insured limits. The Company has not experienced losses in such accounts, and management believes that the Company is not exposed to any significant credit risk with respect to its cash and cash equivalents.

Note 6. Recent Accounting Pronouncements

In May 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers, or ASU 2014-09, which requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The standard will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective. The new standard was originally effective for public companies for annual reporting periods beginning after December 15, 2016, with no early application permitted. In August 2015, the FASB issued ASU No. 2015-14 that defers by one year the effective date for all entities, with application permitted as of the original effective date. The updated standard becomes effective for us on April 1, 2018, with early adoption permitted as of April 1, 2017. The standard permits the use of either the retrospective or cumulative effect transition method. We are evaluating the effect that ASU 2014-09 will have on our consolidated financial statements and related disclosures. We have not yet selected a transition method nor have we determined the effect of the standard on our ongoing financial reporting.