UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2015

GENERAL CANNABIS CORP

(Exact Name of Registrant as Specified in Charter)

| | |

Colorado

| 000-54457

| 90-1072649

|

(State or other jurisdiction

of incorporation)

| (Commission File Number)

| (I.R.S. Employer Identification Number)

|

| | |

6565 E. Evans Avenue

Denver, Colorado

|

| 80224

|

(Address of principal executive offices)

|

| (Zip Code)

|

Registrant’s telephone number, including area code: (303) 759-1300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[_]

Written communications pursuant to Rule 425 under the Securities Act

[_]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

[_]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

[_]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

| | |

Item 1.01

| | Entry into a Material Definitive Agreement.

|

On November 4, 2015, General Cannabis Corp. (the “Company”) entered into an Option Agreement with Infinity Capital West, LLC (“Infinity”) and GC Finance Arizona LLC (“GC Finance”). GC Finance is a wholly owned subsidiary of Infinity. Infinity is owned and controlled by Michael Feinsod who is the Company’s Chairman of the Board. Pursuant to the Option Agreement, GC and Infinity granted the Company a six month option to purchase all of GC’s interest in DB Products Arizona, LLC (“DB”) at GC’s actual cost, plus $1.00. The Interests for which the Option has been granted is GC’s 50% equity interest in the membership interests of DB and any outstanding unpaid in principal and interest owed on the promissory note(s) issued by DB in favor of GC Finance representing the loan(s) made by GC Finance to DB for up to $600,000. The Company was first given the opportunity to directly make the investment in DB. Due to a lack of resources, the Company chose not to proceed with the investment. The Company has no obligation to exercise the Option.

DB is a Delaware LLC whose equity interests are currently 50% owned by GC Finance and 50% owned by Bloom Master Fund I, LLC. GC has agreed to grant Dixie Brands, Inc. an option (the “Dixie Option”) to purchase 50% of its equity interest in DB (representing a 25% equity interest in DB). Accordingly, the Company’s option from GC Finance is subject to the Dixie Option. DB is involved in the production and distribution of Dixie Brands, Inc’s full line of medical cannabis Dixie Elixirs and Edible products in Arizona. Infinity owns approximately 1% of the capital stock of Dixie Brands, Inc.

| | |

Item 7.01

| | Regulation FD Disclosure.

|

On November 5, 2015, the Company, Dixie Brands, Inc. and Bloom issued a joint press release announcing the Agreement. A copy of the press release issued by the Company is attached hereto and incorporated by reference in its entirety as Exhibit 99.1.

The information contained in this Item 7.01 of the Company’s Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The furnishing of the information in this Current Report on Form 8-K is not intended to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained in this Current Report on Form 8-K constitutes material investor information that is not otherwise publicly available.

The Securities and Exchange Commission encourages registrants to disclose forward-looking information so that investors can better understand the future prospects of a registrant and make informed investment decisions. This Current Report on Form 8-K and exhibits may contain these types of statements, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s judgment as of the date of this Current Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results and are indicated by words or phrases such as “expects,” “should,” “will,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this Current Report on Form 8-K. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented within.

| | |

Item 9.01

| | Financial Statements and Exhibits.

|

(d)

Exhibits

The exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

|

|

|

Exhibit No.

|

|

Description

|

10.1

|

|

Option Agreement dated November 4, 2015 by and among General Cannabis Corp., Infinity Capital West, LLC and GC Finance Arizona, LLC

|

99.1

|

|

Press Release dated November 5, 2015

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: November 9, 2015

| | |

| GENERAL CANNABIS CORP

|

| | |

| | |

| By:

| /s/ Robert L. Frichtel

|

| Name:

| Robert L. Frichtel

|

| Title:

| Chief Executive Officer

|

EXHIBIT INDEX

|

|

|

Exhibit No.

|

|

Description

|

10.1

|

|

Option Agreement dated November 4, 2015 by and among General Cannabis Corp., Infinity Capital West, LLC and GC Finance Arizona, LLC

|

99.1

|

|

Press Release dated November 5, 2015

|

Exhibit 10.1

Option Agreement

This Option Agreement (the "Agreement"), effective as of November 4, 2015 (the "Effective Date"), is by and between Infinity Capital West, LLC, a Colorado limited liability corporation, (“Infinity”), GC Finance Arizona LLC, Infinity’s wholly-owned subsidiary (“GC”), and General Cannabis Corp., a Colorado corporation (the "Optionee").

WHEREAS, Michael Feinsod (“Feinsod”) gave the Optionee notice of a potential opportunity to make an investment of approximately $600,000 in a joint venture with Dixie Brands, Inc. (“Dixie”) and Bloom Master Fund I, LLC to produce market and distribute Dixie elixirs in the state of Arizona through an LLC being titled “DB Products Arizona, LLC (“DB”) (the “Opportunity”) and Optionee advised Feinsod that it did not have the financial resources to pursue the Opportunity;

WHEREAS, Feinsod decided to pursue the Opportunity individually through his entity Infinity Capital West, LLC and its wholly owned subsidiary GC and accordingly agreed to make a loan(s) to DB aggregating $600,000;

WHEREAS, GC agreed to lend Dixie $600,000 for which GC will receive a 14.0% secured promissory note (the “Note”) in the amount actually loaned and a 50% ownership interest in DB (the “Equity Interest”);

WHEREAS, GC is granting Dixie an option (the “Dixie Option”) to purchase a portion of the Equity Interest in DB.

WHEREAS, GC is offering the Optionee the right to purchase the Note and the Equity Interest, subject to the Dixie Option, pursuant to this Option Agreement on the same terms as paid by GC, plus the sum of $1.00;

NOW, THEREFORE, in consideration of the mutual covenants, terms and conditions set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.

Option. GC hereby gives the Optionee the right to purchase the Note and the Equity Interest from it in consideration for the Optionee’s repayment of all amounts paid or incurred by GC in connection with the Joint Venture plus $1.00 (the “Option Consideration”). The Option shall have a term of six (6) months from the date hereof but shall terminate earlier if Michael Feinsod is no longer the Optionee’s Chairman of the Board. For purposes of this Agreement, “Costs” shall mean all expenses incurred by Infinity in connection with the Joint Venture, including legal fees actually paid, corporate filing fees actually paid and travel expenses incurred by Infinity’s representatives in connection with travel to and from DB’s facilities. With respect to the Note, the Optionee will pay to Infinity the amount of principal and accrued and unpaid interest outstanding on the Note on the date of Optionee’s exercise of the Option and Infinity shall assign the Equity Interest and the Note to the Optionee.

2.

Representations and Warranties. Each of the parties to this agreement represents and warrants that:

(a) it is a corporation duly organized, validly existing and in good standing under the laws of the state of its incorporation;

(b) it is duly qualified to do business and is in good standing in every jurisdiction in which such qualification is required for purposes of this Agreement;

(c) it has the full right, corporate power and authority to enter into this Agreement and to perform its obligations hereunder;

(d) it is in compliance with all applicable laws relating to this Agreement, and the operation of its business;

(e) it has obtained all licenses, authorizations, approvals, consents or permits required by applicable laws, including the rules and regulations of all authorities having jurisdiction over the conduct of its business generally and to perform its obligations under this Agreement;

(f) this Agreement and performance hereunder does not violate any laws or agreements entered into by the parties hereto; and

(g) this Agreement has been duly executed and delivered and constitutes a legal, valid and binding obligation of the parties hereto, enforceable in accordance with its terms, except as may be limited by any applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws and equitable principles related to or affecting creditors' rights generally or the effect of general principles of equity.

3.

Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New York without giving effect to any choice or conflict of law provision or rules (whether of the State of New York or any other jurisdiction).

4.

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

5.

Further Assurances. Each of the parties hereto shall execute and deliver, at the reasonable request of the other party hereto, such additional documents, instruments, conveyances and assurances and take such further actions as such other party may reasonably request to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement.

[SIGNATURE PAGE FOLLOWS]

2

IN WITNESS WHEREOF, the parties have executed this Agreement to be effective as of the date first above written.

| | |

| INFINITY CAPITAL WEST, LLC

|

| | |

| By:

| /s/ Michael Feinsod |

| Name:

| Michael Feinsod

|

| Title:

| Managing Member

|

| | |

| GC FINANCE ARIZONA LLC

|

| | |

| By:

| /s/ Michael Feinsod |

| Name:

| Michael Feinsod

|

| Title:

| Managing Member

|

| | |

| GENERAL CANNABIS CORP.

|

| | |

| By:

| /s/ Robert Frichtel |

| Name:

| Robert Frichtel

|

| Title:

| President and Chief Executive Officer

|

3

Exhibit 99.1

FOR IMMEDIATE RELEASE

November 5, 2015

DIXIE BRANDS, INC., GENERAL CANNABIS CORP. AND BLOOM DISPENSARY GROUP FORM AGREEMENT TO BRING DIXIE ELIXIRS AND EDIBLES PRODUCTS TO ARIZONA

Initial Dixie Products in Arizona by End of Year as 14,000 Square Foot Kitchen is Built for Full Product Offering in 2016

DENVER, CO/PHOENIX, AZ (November 5, 2015): Dixie Brands, Inc. (Dixie), a leader in emerging cannabinoid extraction and wellness platforms, Bloom Dispensaries, Arizona’s leading group of medical marijuana dispensaries, and an affiliate of General Cannabis Corporation (OTCQB:CANN), a service provider to businesses in the regulated cannabis industry, have entered into an agreement to produce and distribute the entire line of Dixie Elixirs and Edibles products in Arizona.

The companies are in the process of building out a state-of-the-art manufacturing facility in Phoenix to bring Dixie’s entire suite of products to the Arizona medical patient. During the build out, the companies will initially roll-out two of Dixie’s most popular products: their Dixie Rolls and the entire line of tinctures, including its Synergy line of one-to-one CBD:THC ratio tinctures. Sales of these initial products to Arizona patients are expected before the end of the year.

“Arizona represents tremendous opportunity for Dixie and we could not have found better partners to help us capitalize on that opportunity,” said Chuck Smith, Dixie’s Chief Operating Officer. “Edibles currently make up less than ten percent of the Arizona cannabis market, but we believe strongly that those numbers don’t reflect the pent up demand that patients have for quality, innovative delivery systems and products. With the backing of one of the strongest dispensary groups in Arizona, and a great financial partner in General Cannabis, there is no doubt that we will drive a new era for infused products in Arizona.”

“Bloom has played an important role in the development of Arizona’s medical marijuana framework, and today’s news is our next step in that evolution,” said Edward Judice, CEO of Bloom. “We are proud to bring Dixie’s quality line of edibles, topicals and tinctures to patients throughout Arizona. Their selection and variety of delivery systems is unparalleled and when partnered with our focus on compliance and process integrity, we believe that we will see aggressive adoption of Dixie products by dispensaries and patients alike.”

“As a financial partner in this joint venture, we have great confidence in the teams that we are backing,” said Michael Feinsod, Executive Chairman of General Cannabis. “The management of both these companies, and the vision they share for creating a differentiated offering for underserved Arizona patients will provide a strong foundation for achieving success. We look forward to Dixie becoming a household name with patients throughout Arizona.”

ABOUT DIXIE BRANDS, INC.

Located in Denver, Colorado, Dixie Brands, Inc., (Dixie) through its affiliates across the country, has been formulating and producing award-winning THC and CBD-infused products since 2009. What began as a single flagship product, the Dixie Elixir (a THC-infused soda), has now expanded to over 30 different products across over 100 SKUs, representing the industry’s finest edibles, tinctures, topicals and connoisseur grade extractions. To find out more about Dixie’s innovative products, or about how Dixie is building the future of cannabis, please visit us at http://www.dixiebrands.com.

ABOUT GENERAL CANNABIS CORPORATION

General Cannabis Corporation is the all-in-one resource for the highest quality service providers available to the regulated Cannabis Industry. We are a trusted partner to the cultivation, production and retail side of the cannabis business. We do this through a combination of strong operating divisions such as real estate, consulting, security, financing and the distribution of important infrastructure products to grow facilities and dispensaries. As a synergistic holding company, our subsidiaries are able to leverage the strengths of each other, as well as a larger balance sheet, to succeed. Most recently, we acquired Chiefton Supply Co., a Denver based apparel and design company focused on modern cannabis graphic design and production. Chiefton now works in conjunction with GC subsidiaries, Iron Protection Group and Next Big Crop, to offer existing clients unique design services to further brand objectives.

We will continue to integrate partner companies in order to provide a full suite of capabilities for our customers as the regulated cannabis industry continues to expand. For more information, please visit www.generalcann.com.

ABOUT BLOOM DISPENSARY GROUP

Bloom sets the standard for Arizona’s medical marijuana program through the operation of four Dispensaries serving patients in Phoenix, Tucson, Sedona and Oracle. Bloom’s safe and comfortable healing atmosphere focuses on answering the needs of patients and empowering them with the quality of life they deserve through compassion, professionalism and first-class service. Bloom is a true “seed to sale” operation, cultivating their own medicine to ensure patients receive the highest quality product at the lowest cost in the market. In addition to serving patients, Bloom strives to become an integral part of every community they operate in through community service, volunteer work and fund-raising efforts to support local causes.

CONTACT

Joe Hodas

Dixie Brands, Chief Marketing Officer

jhodas@dixiebrands.com

303-827-6972

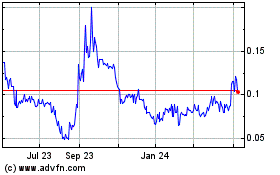

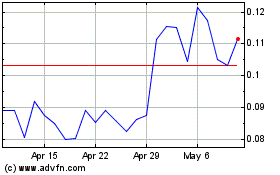

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Mar 2024 to Apr 2024

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Apr 2023 to Apr 2024