GE to Sell Australian Commercial Lending Business

November 09 2015 - 5:10AM

Dow Jones News

General Electric Co. has agreed to sell its Australian

commercial-lending operation to Sankaty Advisors, the global credit

affiliate of Bain Capital, dismantling another key piece of GE

Capital in Asia.

The deal, which will be financed by Deutsche Bank, is valued

around 1.9 billion Australian dollars (US$1.34 billion) including

debt, according to a person familiar with the situation. It also

completes GE's asset sale process in Australia and New Zealand. In

March, GE struck a deal to sell its Australia and New Zealand

consumer-lending business to a consortium including KKR & Co.

for an enterprise value of US$6.3 billion, including debt.

"We continue to make strong progress in our efforts to reduce

the size of GE Capital. To date, we have signed agreements to sell

approximately US$128 billion of GE Capital, more than 60 percent of

our overall plan," said Keith Sherin, GE Capital's chairman and

chief executive.

GE Chief Executive Jeff Immelt laid out plans earlier this year

to sell or spin off the bulk of GE's US$500 billion in global

financial assets, aiming to use the proceeds to return US$50

billion to shareholders.

GE hopes that investors will give the company a richer valuation

if it goes back to its industrial roots and delivers steadier

earnings without the volatility generated by GE Capital's

operations.

Last month, it agreed to sell its commercial lending and leasing

business in the U.S.--the largest remaining chunk of its U.S.

financial services operations—to Wells Fargo & Co.

The latest Australian deal comes as the U.S. conglomerate

considers a short list of bids for its Japanese commercial-finance

operations, which are expected to fetch several billion dollars. GE

has short listed several Japanese firms, including the leasing

units of megabanks Sumitomo Mitsui Financial Group Inc. and

Mitsubishi UFJ Financial Group Inc., according to people familiar

with the matter.

The Australian commercial lending operation specializes in loans

to midsize companies, defined as those with a revenue of 10 million

Australian dollars (US$7.9 million) to A$250 million. It also

provides equipment leasing. Its customers include camping trailer

manufacturer Jayco, winemaker Hardys, and Hastings Deering, a

distributor of Caterpillar earthmoving equipment.

In addition to the capital business, GE has substantial other

operations in Australia and New Zealand ranging from equipment for

liquefied-natural-gas projects to mining gear and wind-farm

turbines.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

Access Investor Kit for "Deutsche Bank AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0005140008

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 04:55 ET (09:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

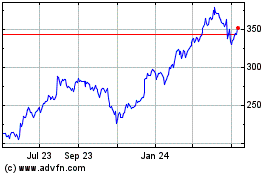

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

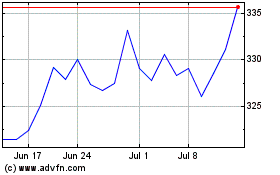

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024