ARMOUR Residential REIT, Inc. (NYSE: ARR, ARR PrA, and ARR PrB)

("ARMOUR" or the "Company") today announced financial results for

the quarter ended September 30, 2015.

Q3 2015 Highlights and Financial

Information

- Previously reported one-for-eight reverse stock split (the

"Reverse Stock Split") of ARMOUR's outstanding shares of Common

stock was effective July 31, 2015

- Q3 2015 key results:

- $52.4 million ($1.11 per Common share) Core Income including

drop income (as defined below)

- 13.22% Core Income return on stockholders' equity at the

beginning of the quarter

- $0.98 per share Common dividends for Q3

- $38.0 million ($0.78 per Common share) estimated taxable Real

Estate Investment Trust ("REIT") income

- $(221.6) million [$(5.18) per Common share] net loss under

Generally Accepted Accounting Principles ("GAAP") reflecting

$(266.1) million net unrealized loss primarily on interest rate

hedges driven by declines in swap yields

- 2.56% average yield on assets and 1.44% average net interest

margin

- 9.23% annualized average principal repayment rate (CPR)

- 1,755,618 Common shares repurchased, net

- 43,561,000 approximately weighted average diluted Common shares

- At September 30, 2015:

- $1.42 billion ($29.05 per Common share) stockholders' equity,

including accretive effect of $0.37 per Common share from Q3 share

repurchases

- 8.87 to 1 "leverage" (debt to stockholders' equity)

- $682.9 million (48.11% of stockholders' equity) liquidity in

cash and unpledged securities

- Stock outstanding:

- 42,028,278 shares Common Stock

- 2,180,572 shares Series A Cumulative Redeemable Preferred

Stock

- 5,650,000 shares Series B Cumulative Redeemable Preferred Stock

- 2,190,000 approximately additional Common shares repurchased

net in October 2015, leaving repurchase authorization of 5,041,067

Common shares at November 5, 2015

- 39,838,120 Common shares outstanding at November 5,

2015

- $0.33 monthly dividend per Common share maintained for Q4, as

previously announced

- On July 7, 2015, ARMOUR's wholly-owned insurance subsidiary,

SABRE Business Insurance LLC, became a member of the Federal Home

Loan Bank of Des Moines, as previously reported

- Additional updated information on the Company's investment,

financing and hedge positions can be found in ARMOUR Residential

REIT, Inc.'s most recent "Company Update." ARMOUR posts unaudited

and unreviewed Company Updates each month on

http://www.armourreit.com

Q3 2015 Results

Core Income, Including Drop Income

Core Income, including drop income, for the quarter

ended September 30, 2015, was approximately $52.4

million. "Core Income" represents a non-GAAP measure and is defined

as net income excluding impairment losses, gains or losses on sales

of securities and early termination of derivatives, unrealized

gains or losses on derivatives and U.S. Treasury Securities and

certain non-recurring expenses, inclusive of dollar roll

income. Core Income may differ from GAAP net income,

which includes the unrealized gains or losses of the Company's

derivative instruments and the gains or losses on Agency Securities

and U.S. Treasury Securities.

The Company entered into to-be-announced ("TBA") dollar roll

transactions that generate "drop income." Drop income is defined as

the difference in price between two TBA contracts with the same

terms but different settlement dates. Drop income is the economic

equivalent of the assumed net interest spread (yield less financing

costs) and is calculated as the difference between the spot price

for regular settlement and the forward settlement price on trade

date.

Estimated Taxable REIT Income

Estimated taxable REIT income for the quarter ended

September 30, 2015, was approximately $38.0 million, or

$0.78 per Common share. The Company's annual dividend requirement

to maintain its REIT tax status is based on ordinary taxable

income, rather than on net income calculated in accordance with

GAAP. Realized capital losses do not affect the amount of the

Company's ordinary taxable income, but will generally be available

to offset capital gains realized primarily through 2018. Taxable

REIT income and GAAP net income will generally differ primarily

because of the non-taxable unrealized changes in the value

of the Company's derivatives, which the Company uses as

economic hedges, and any other than temporary impairment of Agency

Securities to be sold in later periods. These gains/losses on

derivatives are included in GAAP net income, whereas valuation

changes are not included in taxable income.

GAAP Net Income (Loss)

For the purposes of computing GAAP net income (loss), the change

in fair value of the Company's derivatives is reflected in current

period net income, while the change in fair value of its Agency

Securities is reflected in its statement of comprehensive income

(loss). GAAP net loss for Q3 2015 was approximately $(221.6)

million, including unrealized and realized losses on derivatives of

$(266.1) million and $(17.4) million, respectively.

Dividends

The Company paid reverse split adjusted dividends of $0.32 per

Common share of record for July 2015 and $0.33 per Common share of

record for both August and September 2015, resulting in payments to

Common stockholders of approximately $42.9 million. The Company

also paid monthly dividends in Q3 2015 of $0.171875 per outstanding

share of 8.250% Series A Cumulative Redeemable Preferred Stock and

$0.1640625 per outstanding share of 7.875% Series B Cumulative

Redeemable Preferred Stock, resulting in payments to preferred

stockholders of an aggregate of approximately $3.9

million. Our board of directors determines our Common share

dividend rate based upon our REIT requirements and other relevant

considerations. Dividends in excess of taxable REIT income for the

year (including any amounts carried forward from prior years) will

generally be treated as non-taxable return of capital to Common

stockholders.

Per Share Amounts

Per Common share amounts reflect the one-for-eight reverse stock

split and are net of applicable Preferred Stock dividends and

liquidation preferences. The denominators used to calculate per

Common share amounts for the quarter ended September 30, 2015,

reflect, to the extent dilutive, the effects of 0.1 million

unvested stock awards.

Portfolio

As of September 30, 2015, the Company's portfolio consisted

of Fannie Mae, Freddie Mac and Ginnie Mae mortgage securities,

substantially all of which are fixed rate securities, and was

valued at $13.6 billion on a trade date basis. The Company also had

$1.6 billion of TBA dollar roll transactions open at

September 30, 2015. During Q3 2015, the annualized yield

on average assets was 2.56%, and the annualized cost of

funds on average liabilities (including realized cost of hedges)

was 1.12%, resulting in a net interest spread of 1.44% for Q3 2015.

During Q3 2015, the Company sold approximately $0.3 billion of

Agency Securities, resulting in losses of approximately $0.1

million.

Portfolio Financing, Leverage and Interest Rate

Hedges

As of September 30, 2015, the Company financed its

portfolio with approximately $12.6 billion of borrowings under

repurchase agreements. The Company's leverage ratio as of

September 30, 2015, was 8.87 to 1 (10.04 to 1 including

TBA Agency Securities purchased forward and excluding debt related

to forward settling sales). As of September 30, 2015, the

Company's liquidity totaled approximately $682.9 million,

consisting of approximately $276.5 million of cash and equivalents,

plus approximately $406.4 million of unpledged Agency Securities

(including Agency Securities received as collateral).

As of September 30, 2015, the Company's repurchase

agreements had a weighted-average maturity of approximately 46

days. The Company had a notional amount of approximately $12.3

billion (of which $6.4 billion become effective within 9 months) of

various maturities of interest rate swap contracts with a weighted

average swap rate of 1.76%.

Regulation G Reconciliation

Taxable REIT income is calculated according to the requirements

of the Internal Revenue Code ("the Code") rather than GAAP.

The Company plans to timely distribute at least 90% of its taxable

REIT income in order to maintain its tax qualification as a

REIT under the Code. The Company believes that taxable REIT income

is useful to investors because taxable REIT income is directly

related to the amount of dividends the Company is required to

distribute in order to maintain its REIT tax qualification status.

Core Income also excludes gains and losses on security sales.

However, because taxable REIT income and Core Income are incomplete

measures of the Company's financial performance and involve

differences from net income computed in accordance with GAAP,

taxable REIT income and Core income should be considered as

supplementary to, and not as a substitute for, the Company's net

income computed in accordance with GAAP as a measure of the

Company's financial performance.

The following table reconciles the Company's results from

operations to Core Income and estimated taxable REIT income for the

quarter ended September 30, 2015:

| |

|

|

| |

Core Income |

Estimated Taxable REIT

Income |

| |

(in

millions) |

| GAAP net income |

$ (221.6) |

$ (221.6) |

| Book to tax differences: |

|

|

| Changes in interest rate

contracts |

261.4 |

261.4 |

| TBA drop income |

12.6 |

— |

| Amortization of deferred

hedging costs |

— |

(1.8) |

| Total |

$ 52.4 |

$ 38.0 |

| |

|

|

Reverse Stock Split

As previously reported, the Reverse Stock Split took effect at

approximately 5:00 p.m. Eastern Time on July 31, 2015 (the

"Effective Time"). At the Effective Time, every eight issued and

outstanding shares of Common stock was converted into one share of

Common stock, and as a result, the number of outstanding shares of

Common stock was reduced from approximately 350,000 to

approximately 43,750. At the Effective Time, the number of

authorized shares of Common stock was also reduced, on a

one-for-eight basis, from 1,000,000 to 125,000. The par value of

each share of Common stock remained unchanged. No fractional shares

were issued in connection with the Reverse Stock Split. The Reverse

Stock Split did not affect ARMOUR's Series A Preferred Stock or

Series B Preferred Stock. All per share amounts and Common shares

outstanding amounts in this press release reflect the effect of the

Reverse Stock Split.

Common Stock

During Q3 2015, the Company repurchased 1,768,234 shares of

Common stock pursuant to its Common stock repurchase program at a

weighted average cost of $20.63 and also issued 12,616 shares of

Common stock under its stock incentive and dividend

reinvestment plans at a weighted average price of $20.18 per share.

As of September 30, 2015, there were 42,028,278 Common shares

outstanding.

The following table shows the changes in stockholders' equity

per Common share during the quarter ended September 30,

2015:

| |

|

| Stockholders' equity per Common share - June

30, 2015 |

$ 31.69 |

| Core Income |

1.11 |

| Investment net loss |

(3.14) |

| Common stock dividends |

(0.98) |

| Accretive effect of net share

repurchases |

0.37 |

| Stockholders' equity per Common share -

September 30, 2015 |

$ 29.05 |

| |

|

Commencing August 3, 2015, with the effectiveness of the Reverse

Stock Split, a total of 9 million Common shares are authorized for

repurchase under the Common stock repurchase program. During

October 2015, we repurchased approximately 2,190,000 net shares

under our Repurchase Program for an aggregate of $46.0 million. As

of November 5, 2015, we had 39,838,120 Common shares

outstanding and 5,041,067 remaining authorization under our

Repurchase Program.

Preferred Stock

As of September 30, 2015, there were 2,180,572 shares of

8.250% Series A Cumulative Redeemable Preferred Stock and 5,650,000

shares of 7.875% Series B Cumulative Redeemable Preferred Stock

outstanding.

Federal Home Loan Bank Membership

On July 7, 2015, ARMOUR's wholly-owned insurance subsidiary,

SABRE Business Insurance LLC, became a member of the Federal Home

Loan Bank of Des Moines, as previously announced.

Conference Call

As previously announced, the Company will provide an online,

real-time webcast of its conference call with equity analysts

covering Q3 2015 operating results on Monday, November 9, 2015, at

10:00 a.m. (Eastern Time). The live broadcast will be available

online and can be accessed at

https://www.webcaster4.com/Webcast/Page/896/11241. To monitor the

live webcast, please visit the website at least 15 minutes prior to

the start of the call to register, download, and install any

necessary audio software. An online replay of the event will

be available on the Company's website at

http://www.armourreit.com and continue for one year.

ARMOUR Residential REIT, Inc.

ARMOUR is a Maryland corporation that invests primarily in fixed

rate, hybrid adjustable rate and adjustable rate residential

mortgage backed securities. These securities are issued or

guaranteed by U.S. Government-sponsored entities and Ginnie Mae.

ARMOUR is externally managed and advised by ARMOUR Capital

Management LP, an investment advisor registered with the Securities

and Exchange Commission ("SEC"). ARMOUR Residential REIT, Inc.

intends to qualify and has elected to be taxed as a REIT under the

Code for U.S. federal income tax purposes.

Safe Harbor

This press release includes "forward-looking statements" within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Actual results

may differ from expectations, estimates and projections and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as "expect,"

"estimate," "project," "budget," "forecast," "anticipate,"

"intend," "plan," "may," "will," "could," "should," "believes,"

"predicts," "potential," "continue," and similar expressions are

intended to identify such forward-looking statements. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Additional information

concerning these and other risk factors are contained in the

Company's most recent filings with the SEC. All subsequent

written and oral forward-looking statements concerning the Company

are expressly qualified in their entirety by the cautionary

statements above. The Company cautions readers not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. The Company does not undertake or accept

any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in their expectations or any change in events, conditions or

circumstances on which any such statement is based, except as

required by law.

Additional Information and Where to Find It

Investors, security holders and other interested persons may

find additional information regarding the Company at the SEC's

Internet site at http://www.sec.gov, or the Company website

http://www.armourreit.com or by directing requests to: ARMOUR

Residential REIT, Inc., 3001 Ocean Drive, Suite 201, Vero Beach,

Florida 32963, Attention: Investor Relations.

CONTACT: investors@javelinreit.com

James R. Mountain

Chief Financial Officer

ARMOUR Residential REIT, Inc.

(772) 617-4340

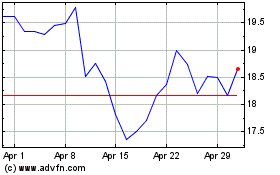

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Apr 2023 to Apr 2024