UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 3, 2015

Merit Medical Systems, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Utah | | 0-18592 | | 87-0447695 |

(State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

incorporation or organization) | | File Number) | | Identification No.) |

|

| | |

1600 West Merit Parkway | | |

South Jordan, Utah | | 84095 |

(Address of principal executive offices) | | (Zip Code) |

(801) 253-1600

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 4, 2015, the Board of Directors of Merit Medical Systems, Inc. (the “Company”), after reviewing the operations of the Company and the roles and responsibilities of the Chief Financial Officer, Treasurer, and Secretary of the Company, voted to remove Kent Stanger from the offices of Chief Financial Officer, Treasurer, and Secretary of the Company, effective as of November 4, 2015. Also on November 4, 2015, the Board of Directors of the Company elected Bernard Birkett to serve as the Company’s Chief Financial Officer, effective immediately following Kent Stanger’s removal from such office. The Company has not yet identified an individual to serve as a replacement Treasurer or Secretary of the Company.

Mr. Birkett joined the Company in 1997 and previously served as the Company’s Controller responsible for Europe, Middle East and Africa since 2000 and as the Company’s Vice President of International Finance since 2010. Mr. Birkett served as Executive Vice President Finance of the Company since January 15, 2015 pursuant to an expatriate assignment arrangement (the “Expatriate Agreement”) between the Company and Merit Medical Ireland, LTD (“Merit Ireland”) (Mr. Birkett’s direct employer and a wholly-owned subsidiary of the Company) under which Mr. Birkett would live in the United States but remain employed by Merit Ireland. Mr. Birkett is a certified accountant with a business degree from the National University of Ireland Galway and a Master’s degree in banking and finance from the University College Dublin’s Michael Smurfit Graduate Business School. He has also completed a program in Strategic Leadership at Stanford’s Graduate School of Business.

Upon his appointment as Chief Financial Officer, Mr. Birkett’s annual base salary will be €275,000, approximately $302,500 USD, which was his salary under his existing Expatriate Agreement. Additionally, Mr. Birkett will continue to be eligible to receive certain fringe benefits, including but not limited to bonus, tax equalization, and pension benefits, with an aggregate value of approximately $200,000 USD.

Also on November 4, 2015, in connection with his appointment as Chief Financial Officer of the Company, Mr. Birkett resigned from the position of Executive Vice President Finance of the Company, effective as of November 4, 2015. The Company has not identified an individual to serve as a replacement Executive Vice President of Finance of the Company.

On November 3, 2015, Greg Barnett notified the Company of his resignation from the office of Chief Accounting Officer of the Company. On November 4, 2015, the Board of Directors voted to accept the resignation of Greg Barnett from the office of Chief Accounting Officer of the Company. The Board of Directors also voted that the Company enter into a severance arrangement with Mr. Barnett. Among other terms and conditions, Mr. Barnett’s severance arrangement obligates the Company to pay Mr. Barnett the sum of $385,000 USD, and until December 31, 2016, the Company’s portion of COBRA premiums. Mr. Barnett has not yet executed a severance agreement memorializing his severance arrangement with the Company. The Company has not yet identified an individual to serve as a replacement Chief Accounting Officer of the Company.

Item 7.01. Regulation FD Disclosure.

On November 6, 2015, the Company issued a press release relating to the foregoing matters. A copy of that press release is attached to this report as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release, entitled “Merit Medical Names New Chief Financial Officer” issued by Merit Medical Systems, Inc. dated November 6, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| MERIT MEDICAL SYSTEMS, INC. |

| | |

| | |

Date: November 6, 2015 | By: | /s/ Rashelle Perry |

| | |

| | |

EXHIBIT INDEX

|

| | |

EXHIBIT NUMBER | | DESCRIPTION |

| | |

99.1 | | Press Release, entitled “Merit Medical Names New Chief Financial Officer” issued by Merit Medical Systems, Inc., dated November 6, 2015 |

Exhibit 99.1

FOR IMMEDIATE RELEASE

| |

Contact: | Anne-Marie Wright, Vice President, Corporate Communications |

| |

Phone: | (801) 208-4167 e-mail: awright@merit.com Fax: (801) 253-1688 |

MERIT MEDICAL NAMES NEW CHIEF FINANCIAL OFFICER

SOUTH JORDAN, UTAH- Merit Medical Systems, Inc. (NASDAQ: MMSI), a leading manufacturer and marketer of proprietary disposable medical devices used in interventional and diagnostic procedures, particularly in cardiology, radiology and endoscopy, today announced that it has named Bernard Birkett its Chief Financial Officer, effective immediately.

Birkett joined Merit in 1997 and has served as Merit’s Controller responsible for Europe, Middle East and Africa (EMEA) since 2000 and as Merit’s Vice President of International Finance since 2010. He has been a leader in the development of Merit’s global business and has experience in management, operations and business development. Birkett is a certified accountant with a business degree from the National University of Ireland Galway and a Master’s degree in banking and finance from the University College Dublin’s Michael Smurfit Graduate Business School. He also completed a program in Strategic Leadership at Stanford’s Graduate School of Business. Birkett recently relocated to Salt Lake City from Galway, Ireland.

Birkett assumed his new position from Kent W. Stanger, who has served as Merit’s Chief Financial Officer, Treasurer and Secretary since Merit’s founding in 1987. Stanger will continue to be employed by Merit on an interim basis, to support the transition, and will continue to serve on Merit’s Board of Directors.

“I would like to publicly thank Kent for his many years of dedicated service to Merit,” said Fred P. Lampropoulos, Merit’s Chairman and Chief Executive Officer. “Kent has been an integral force in

building this company from its beginning, and I have enjoyed working with him. I am also optimistic about the change and look forward to working with Bernard in his new role.”

ABOUT MERIT

Founded in 1987, Merit Medical Systems, Inc. is engaged in the development, manufacture and distribution of proprietary disposable medical devices used in interventional and diagnostic procedures, particularly in cardiology, radiology and endoscopy. Merit serves client hospitals worldwide with a domestic and international sales force totaling approximately 200 individuals. Merit employs approximately 3,700 people worldwide with facilities in South Jordan, Utah; Angleton, Texas; Richmond, Virginia; Malvern, Pennsylvania; Maastricht and Venlo, The Netherlands; Paris, France; Galway, Ireland; Beijing, China; Tijuana, Mexico; and Rockland, Massachusetts.

Statements contained in this release which are not purely historical, including, without limitation, statements regarding Merit's future performance, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties such as those described in Merit's Annual Report on Form 10-K for the year ended December 31, 2014. Such risks and uncertainties include risks relating to product recalls and product liability claims; potential restrictions on our liquidity or our ability to operate our business by our current credit agreement, and the consequences of any default under that agreement; possible infringement of our technology or the assertion that our technology infringes the rights of other parties; the potential imposition of fines, penalties, or other adverse consequences if our employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws or regulations; expenditures relating to research, development, testing and regulatory approval or clearance of our products and the risk that such products may not be developed successfully or approved for commercial use; greater governmental scrutiny and regulation of the medical device industry; reforms to the 510(k) process administered by the U.S. Food and Drug Administration (the "FDA"); laws targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in, or our failure to comply with, governing regulations; increases in the price of commodity components; negative changes in economic and industry conditions in the United States and other countries; termination or interruption of relationships with our suppliers, or failure of such suppliers to perform; our potential inability to successfully manage growth through acquisitions, including the inability to commercialize technology acquired through recent, proposed or future acquisitions; costs and expenses associated with our pursuit of a strategic plan to grow through acquisitions; fluctuations in Euro and GBP exchange rates; our need to generate sufficient cash flow to fund our debt obligations, capital expenditures, and ongoing operations; concentration of our revenues among a few products and procedures; development of new products and technology that could render our existing products obsolete; market acceptance of new products; volatility in the market price of our common stock; modification or limitation of governmental or private insurance reimbursement policies; changes in health care markets related to health care reform initiatives; failures to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; uncertainties associated with potential healthcare policy changes which may have a material adverse effect on Merit; introduction of products in a timely fashion; price and product competition; availability of labor and materials; cost increases; fluctuations in and obsolescence of inventory; and other factors referred to in our Annual Report on Form 10-K for the year ended December 31, 2014 and other materials filed with the Securities and Exchange Commission. All subsequent forward-looking statements attributable to Merit or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Actual results will likely differ, and may differ materially, from anticipated results. Financial estimates are subject to change and are not intended to be relied upon as predictions of future operating results, and Merit assumes no obligation to update or disclose revisions to those estimates.

# # #

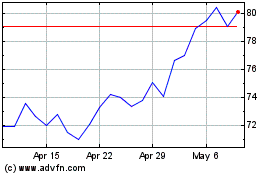

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

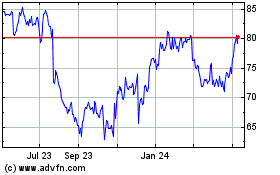

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024