UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2015.

Commission File Number 001-36204

| ENERGY

FUELS INC. |

| (Translation of registrant’s name into English) |

|

225 Union Blvd., Suite 600

Lakewood, CO 80228 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| |

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| |

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

/s/ David C. Frydenlund |

| Date: November 4,

2015 |

David C. Frydenlund

Senior Vice President, General Counsel & Corporate Secretary |

INDEX TO EXHIBITS

| 99.1 |

News release dated November 4,

2015 - Energy Fuels Acquires Remaining 50% Interest in the High-Grade Wate Uranium Project in Arizona |

Exhibit 99.1

Energy Fuels Acquires Remaining 50% Interest

in the High-Grade Wate Uranium Project in Arizona

LAKEWOOD, CO, Nov. 4, 2015 /CNW/ - Energy

Fuels Inc. (NYSE MKT:UUUU; TSX:EFR) ("Energy Fuels" or the "Company") is pleased to announce that it has

acquired the remaining 50% interest in the high-grade Wate uranium deposit (the "Wate Project") from Anfield Resources

Holding Corp. ("Anfield"). The Company previously acquired a 50% interest in Wate from VANE Minerals. As

a result of the current acquisition from Anfield, Energy Fuels now owns and controls a 100% interest in the Wate Project.

According to a March 10, 2015 technical report,

prepared in accordance with National Instrument 43-101 ("NI 43-101"), the Wate Project holds approximately 1.12 million

pounds of U3O8 contained in approximately 71,000 tons of Inferred Mineral Resources with an average grade

of 0.79% eU3O8.

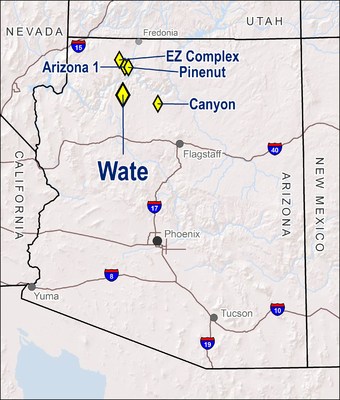

Northern Arizona, where the Wate Project is

located, contains the highest-grade uranium deposits in the United States, and some of the highest-grade uranium deposits in the

World. The Wate Project is a "breccia pipe" deposit, similar to the Company's Arizona 1, Pinenut, and Canyon mines.

The Company recently restarted shaft sinking operations at the Canyon mine, which according to a June 27, 2012 technical report,

prepared in accordance with NI 43-101, holds approximately 1.6 million pounds of U3O8 contained in approximately

83,000 tons of Inferred Mineral Resources with an average grade of 0.98% eU3O8. It is anticipated that

future production from both the Canyon mine and the Wate Project would be processed at Energy Fuels' White Mesa uranium mill in

Utah, which is currently the only operating uranium mill in the U.S.

As consideration for the transaction, Energy

Fuels paid $275,000 cash and issued 92,906 common shares to Anfield at closing. In addition, upon the Company's completion

of future permitting milestones and other conditions, the Company will make an additional cash payment of $275,000 to Anfield and

will issue to Anfield additional Energy Fuels common shares having a value of $275,000.

The Wate Project is located on land owned by

the State of Arizona and is at an advanced stage of permitting. The main permit to be issued is a mineral lease from the

State of Arizona, which holds primary permitting authority. Mineral leases in Arizona are similar to mining permits in other

jurisdictions, granting the holder the right to mine, ship ores, and conduct all support operations. The Company expects

to receive the mineral lease on the project in twelve to eighteen months, subject to the satisfaction of certain additional requirements.

Once the mineral lease is granted, the Company expects to move forward to acquire the additional State aquifer protection and air

quality permits and other approvals required to commence development and mining.

Stephen P. Antony, President and CEO of Energy

Fuels commented: "We are extremely pleased to acquire Anfield's interest in the nearly-permitted Wate Project. The

Wate Project is a well-known, high-grade breccia pipe deposit that fits nicely into our existing uranium portfolio. Due to their

high-grades, these deposits generally represent the lowest-cost sources of uranium production in our portfolio. We have a

wealth of experience mining similar deposits in Arizona, and I am proud of our Company's commitment to the safety of our workers,

the community, and the environment, as we bring uranium to the marketplace for the production of emission-free, carbon-free electricity."

Stephen P. Antony, P.E., President &

CEO of Energy Fuels, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the

technical disclosure contained in this news release.

About Energy Fuels: Energy

Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels operates

two of America's key uranium production centers, the White Mesa Mill in Utah and the Nichols Ranch Processing Facility in Wyoming.

The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a licensed capacity of over 8 million

pounds of U3O8 per year. The Nichols Ranch Processing Facility, acquired in the Company's acquisition

of Uranerz Energy Corporation, is an in situ recovery ("ISR") production center with a licensed capacity of 2 million

pounds of U3O8 per year. Energy Fuels also has the largest NI 43-101 compliant uranium resource portfolio

in the U.S. among producers, and uranium mining projects located in a number of Western U.S. states, including two producing mines,

mines on standby, and mineral properties in various stages of permitting and development. The Company's common shares are

listed on the NYSE MKT under the trading symbol "UUUU", and on the Toronto Stock Exchange under the trading symbol "EFR".

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news

release, including any information relating to the resources in the Wate project, the issuance of the state mineral lease, the

ability to mine the resources, costs of mining, future permitting, and any other statements regarding Energy Fuels' future expectations,

beliefs, goals or prospects constitute forward-looking information within the meaning of applicable securities legislation (collectively,

"forward-looking statements"). All statements in this news release that are not statements of historical fact (including

statements containing the words "expects", "does not expect", "plans", "anticipates", "does

not anticipate", "believes", "intends", "estimates", "estimates", "projects",

"potential", "scheduled", "forecast", "budget" and similar expressions) should be considered

forward-looking statements. All such forward-looking statements are subject to important risk factors and uncertainties,

many of which are beyond Energy Fuels' ability to control or predict. A number of important factors could cause actual results

or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation:

the resources in the Wate project; the issuance of the state mineral lease; the ability to mine the resources; costs of mining;

future permitting; uranium markets; the volatility of the international marketplace; future uranium prices; the ability to raise

capital to fund project development; and other risk factors as described in Energy Fuels' most recent annual information forms

and annual and quarterly financial reports.

Energy Fuels assumes no obligation to update

the information in this communication, except as otherwise required by law. Additional information identifying risks and

uncertainties is contained in Energy Fuels' filings with the various securities commissions which are available online at www.sec.gov

and www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations,

beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may

not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements,

that speak only as of the date hereof.

SOURCE Energy Fuels Inc.

Image with caption: "Northern Arizona

boasts the richest uranium deposits in the U.S., including the Wate, Canyon, Pinenut, Arizona 1 and EZ projects owned by Energy

Fuels. These low-impact mines are typically less than 20-acres in size, but can produce considerable quantities of uranium which

is used as the fuel for emission-free, carbon-free nuclear energy. Nuclear technology currently accounts for 19% of all the electricity

- and 63% of the carbon-free electricity - generated in the U.S. today. (CNW Group/Energy Fuels Inc.)". Image available at:

http://photos.newswire.ca/images/download/20151104_C8695_PHOTO_EN_536283.jpg

%CIK: 0001385849

For further information: Energy Fuels Inc., Curtis Moore,

Investor Relations, (303) 974-2140 or Toll free: 1-888-864-2125, investorinfo@energyfuels.com, www.energyfuels.com

CO: Energy Fuels Inc.

CNW 08:00e 04-NOV-15

This regulatory filing also includes additional resources:

ex991.pdf

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024