UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2015

or

| ¨ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from

to

Commission File Number 001-31895

ODYSSEY

MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

|

|

|

| Nevada |

|

84-1018684 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

5215 W. Laurel Street, Tampa, Florida 33607

(Address of principal executive offices) (Zip code)

(813) 876-1776

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark

whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for shorter

period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

|

|

|

|

|

|

|

| Large accelerated filer: |

|

¨ |

|

Accelerated filer: |

|

x |

|

|

|

|

| Non-accelerated filer: |

|

¨ (Do not check if a smaller Reporting company) |

|

Smaller reporting company: |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act): Yes ¨ No x

The number of outstanding shares of the registrant’s Common Stock, $.0001 par value, as of October 15, 2015 was 89,796,469.

2

PART I: FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ODYSSEY MARINE EXPLORATION, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

| |

|

Unaudited

September 30,

2015 |

|

|

December 31,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,840,401 |

|

|

$ |

3,143,550 |

|

| Restricted cash |

|

|

212,116 |

|

|

|

520,728 |

|

| Accounts receivable and other, net |

|

|

596,781 |

|

|

|

6,476,049 |

|

| Inventory |

|

|

335,013 |

|

|

|

674,992 |

|

| Other current assets |

|

|

495,308 |

|

|

|

655,662 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

3,479,619 |

|

|

|

11,470,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT |

|

|

|

|

|

|

|

|

| Equipment and office fixtures |

|

|

24,320,000 |

|

|

|

24,895,343 |

|

| Building and land and other |

|

|

196,381 |

|

|

|

3,758,688 |

|

| Building and land held for sale |

|

|

3,567,722 |

|

|

|

1,024,999 |

|

| Accumulated depreciation |

|

|

(22,778,808 |

) |

|

|

(22,443,492 |

) |

|

|

|

|

|

|

|

|

|

| Total property and equipment |

|

|

5,305,295 |

|

|

|

7,235,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

6,290,465 |

|

|

|

— |

|

| Inventory |

|

|

4,478,595 |

|

|

|

5,110,967 |

|

| Other non-current assets |

|

|

1,008,019 |

|

|

|

1,272,053 |

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

11,777,079 |

|

|

|

6,383,020 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

20,561,993 |

|

|

$ |

25,089,539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY/(DEFICIT) |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

2,425,425 |

|

|

$ |

5,070,973 |

|

| Accrued expenses and other |

|

|

3,687,821 |

|

|

|

2,387,962 |

|

| Deferred income |

|

|

383,148 |

|

|

|

— |

|

| Derivative liabilities |

|

|

2,482,190 |

|

|

|

2,226,445 |

|

| Mortgage and loans payable |

|

|

30,783,245 |

|

|

|

9,356,724 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

39,761,829 |

|

|

|

19,042,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

| Mortgage and loans payable |

|

|

4,385,553 |

|

|

|

11,808,157 |

|

| Deferred income and revenue participation rights |

|

|

4,643,750 |

|

|

|

4,643,750 |

|

|

|

|

|

|

|

|

|

|

| Total long-term liabilities |

|

|

9,029,303 |

|

|

|

16,451,907 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

48,791,132 |

|

|

|

35,494,011 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies (NOTE H) |

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY/(DEFICIT) |

|

|

|

|

|

|

|

|

| Preferred stock - $.0001 par value; 9,567,600 shares authorized; none outstanding |

|

|

— |

|

|

|

— |

|

| Preferred stock series D convertible - $.0001 par value; 242,400 shares authorized; 0 and 32,400 issued and outstanding,

respectively |

|

|

— |

|

|

|

3 |

|

| Common stock – $.0001 par value; 150,000,000 shares authorized; 89,796,469 and 85,582,502 issued and outstanding |

|

|

8,980 |

|

|

|

8,558 |

|

| Additional paid-in capital |

|

|

202,976,283 |

|

|

|

198,323,630 |

|

| Accumulated deficit |

|

|

(222,848,197 |

) |

|

|

(202,427,252 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity/(deficit) before non-controlling interest |

|

|

(19,862,934 |

) |

|

|

(4,095,061 |

) |

| Non-controlling interest |

|

|

(8,366,205 |

) |

|

|

(6,309,411 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity/(deficit) |

|

|

(28,229,139 |

) |

|

|

(10,404,472 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity/(deficit) |

|

$ |

20,561,993 |

|

|

$ |

25,089,539 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

ODYSSEY MARINE EXPLORATION, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS - Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Artifact sales and other |

|

$ |

1,368,795 |

|

|

$ |

95,046 |

|

|

$ |

1,689,968 |

|

|

$ |

982,912 |

|

| Exhibit |

|

|

12,500 |

|

|

|

25,000 |

|

|

|

45,852 |

|

|

|

51,484 |

|

| Expedition |

|

|

77,358 |

|

|

|

— |

|

|

|

281,667 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

1,458,653 |

|

|

|

120,046 |

|

|

|

2,017,487 |

|

|

|

1,034,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales – artifacts and other |

|

|

873,517 |

|

|

|

27,026 |

|

|

|

1,250,982 |

|

|

|

204,516 |

|

| Marketing, general and administrative |

|

|

2,630,094 |

|

|

|

2,782,362 |

|

|

|

9,000,307 |

|

|

|

8,191,210 |

|

| Operations and research |

|

|

2,306,053 |

|

|

|

5,114,499 |

|

|

|

8,557,109 |

|

|

|

14,957,889 |

|

| Common stock issued for subsidiary stock option settlement |

|

|

— |

|

|

|

— |

|

|

|

2,520,000 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

5,809,664 |

|

|

|

7,923,887 |

|

|

|

21,328,398 |

|

|

|

23,353,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) FROM OPERATIONS |

|

|

(4,351,011 |

) |

|

|

(7,803,841 |

) |

|

|

(19,310,911 |

) |

|

|

(22,319,219 |

) |

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

27 |

|

|

|

557 |

|

|

|

122 |

|

|

|

25,194 |

|

| Interest expense |

|

|

(1,206,662 |

) |

|

|

(268,892 |

) |

|

|

(2,888,386 |

) |

|

|

(931,819 |

) |

| Change in derivative liabilities fair value |

|

|

(4,732 |

) |

|

|

305,841 |

|

|

|

(255,745 |

) |

|

|

676,820 |

|

| (Loss) from unconsolidated entity |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(522,500 |

) |

| Other |

|

|

(11,944 |

) |

|

|

92,497 |

|

|

|

(22,819 |

) |

|

|

113,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income (expense) |

|

|

(1,223,311 |

) |

|

|

130,003 |

|

|

|

(3,166,828 |

) |

|

|

(638,765 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS) BEFORE INCOME TAXES |

|

|

(5,574,322 |

) |

|

|

(7,673,838 |

) |

|

|

(22,477,739 |

) |

|

|

(22,957,984 |

) |

| Income tax benefit (provision) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

481,055 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS) BEFORE NON-CONTROLLING INTEREST |

|

|

(5,574,322 |

) |

|

|

(7,673,838 |

) |

|

|

(22,477,739 |

) |

|

|

(22,476,929 |

) |

| Non-controlling interest |

|

|

994,067 |

|

|

|

258,714 |

|

|

|

2,056,794 |

|

|

|

1,247,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS) |

|

$ |

(4,580,255 |

) |

|

$ |

(7,415,124 |

) |

|

$ |

(20,420,945 |

) |

|

$ |

(21,229,763 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted (See NOTE B) |

|

$ |

(.05 |

) |

|

$ |

(.09 |

) |

|

$ |

(.23 |

) |

|

$ |

(.25 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding with participating securities per the two-class method |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

4

ODYSSEY MARINE EXPLORATION, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS - Unaudited

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss before non-controlling interest |

|

$ |

(22,477,739 |

) |

|

$ |

(22,476,929 |

) |

| Adjustments to reconcile net loss to net cash (used) by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

1,093,747 |

|

|

|

3,802,547 |

|

| Loss in unconsolidated entity |

|

|

— |

|

|

|

522,500 |

|

| Reversal of bad debt provision |

|

|

— |

|

|

|

(522,500 |

) |

| Loss on sale of building and land |

|

|

29,404 |

|

|

|

— |

|

| Loan fee amortization |

|

|

— |

|

|

|

15,046 |

|

| Change in derivatives liabilities fair value |

|

|

255,745 |

|

|

|

(676,820 |

) |

| Note payable interest accretion |

|

|

1,277,024 |

|

|

|

302,744 |

|

| Inventory markdown |

|

|

151,922 |

|

|

|

— |

|

| Common stock issued for subsidiary stock option settlement |

|

|

2,520,000 |

|

|

|

— |

|

| Senior debt interest settled with common stock |

|

|

— |

|

|

|

73,037 |

|

| Share-based compensation |

|

|

2,135,071 |

|

|

|

1,785,306 |

|

| (Increase) decrease in: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(411,197 |

) |

|

|

(6,213,432 |

) |

| Inventory |

|

|

972,352 |

|

|

|

(286,534 |

) |

| Other assets |

|

|

272,467 |

|

|

|

2,043,110 |

|

| Increase (decrease) in: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

(2,645,548 |

) |

|

|

359,400 |

|

| Accrued expenses and other |

|

|

1,446,662 |

|

|

|

(1,750,527 |

) |

|

|

|

|

|

|

|

|

|

| NET CASH (USED) BY OPERATING ACTIVITIES |

|

|

(15,380,090 |

) |

|

|

(23,023,052 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds from sale of property and equipment |

|

|

850,000 |

|

|

|

— |

|

| Purchase of property and equipment |

|

|

(42,828 |

) |

|

|

(2,830,198 |

) |

| Acquisition of subsidiary |

|

|

(2,000 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED (USED) BY INVESTING ACTIVITIES |

|

|

805,172 |

|

|

|

(2,830,198 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of loan payable |

|

|

14,750,001 |

|

|

|

12,684,514 |

|

| Restricted cash held as collateral on loans payable |

|

|

308,612 |

|

|

|

10,021,384 |

|

| Repayment of mortgage and loans payable |

|

|

(1,786,844 |

) |

|

|

(14,463,332 |

) |

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

|

13,271,769 |

|

|

|

8,242,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (DECREASE) INCREASE IN CASH |

|

|

(1,303,149 |

) |

|

|

(17,610,684 |

) |

|

|

|

| CASH AT BEGINNING OF PERIOD |

|

|

3,143,550 |

|

|

|

21,322,257 |

|

|

|

|

|

|

|

|

|

|

| CASH AT END OF PERIOD |

|

$ |

1,840,401 |

|

|

$ |

3,711,573 |

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTARY INFORMATION: |

|

|

|

|

|

|

|

|

| Interest paid |

|

$ |

1,098,719 |

|

|

$ |

648,547 |

|

| Income taxes paid |

|

$ |

— |

|

|

$ |

15,000 |

|

|

|

|

| NON-CASH TRANSACTIONS: |

|

|

|

|

|

|

|

|

| Accrued compensation paid by equity instruments |

|

$ |

— |

|

|

$ |

113,126 |

|

| Debt repayment with common shares |

|

$ |

— |

|

|

$ |

2,347,826 |

|

| Investment in unconsolidated entity per debt conversion into equity shares (see NOTE F) |

|

$ |

— |

|

|

$ |

522,500 |

|

The accompanying notes are an integral part of these financial statements.

5

ODYSSEY MARINE EXPLORATION, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE A – BASIS OF PRESENTATION

The accompanying unaudited consolidated financial statements of Odyssey Marine Exploration, Inc. and subsidiaries (the

“Company,” “Odyssey,” “us,” “we” or “our”) have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission and the instructions to Form 10-Q and, therefore,

do not include all information and footnotes normally included in financial statements prepared in accordance with generally accepted accounting principles. These interim consolidated financial statements should be read in conjunction with the

consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

In the opinion of management, these financial statements reflect all adjustments, including normal recurring adjustments, necessary for a fair

presentation of the financial position as of September 30, 2015, and the results of operations and cash flows for the interim periods presented. Operating results for the nine-month period ended September 30, 2015, are not necessarily

indicative of the results that may be expected for the full year.

NOTE B – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of the Company is presented to assist in understanding our financial

statements. The financial statements and notes are representations of the Company’s management, who are responsible for their integrity and objectivity, and have prepared them in accordance with our customary accounting practices.

Principles of Consolidation

The

consolidated financial statements include the accounts of the Company and its direct and indirect wholly owned subsidiaries, Odyssey Marine Services, Inc., OVH, Inc., Odyssey Retriever, Inc., Odyssey Marine Entertainment, Inc., Odyssey Marine

Enterprises, Ltd., Marine Exploration Holdings, LLC, Odyssey Marine Management, Ltd., Oceanica Marine Operations, S.R.L., Aldama Mining Company, S. De R.L. De C.V., Telemachus Minerals, S. De R.L. De C.V. and majority interest in Oceanica Resources,

S.R.L. and Exploraciones Oceanicas, S. De R.L. De C.V. Equity investments in which we exercise significant influence but do not control and of which we are not the primary beneficiary are accounted for using the equity method. All significant

inter-company and intra-company transactions and balances have been eliminated. The results of operations attributable to the non-controlling interest are presented within equity and net income, and are shown separately from the Company’s

equity and net income attributable to the Company. Some of the existing inter-company balances, which are eliminated upon consolidation, include features allowing the liability to be converted into equity, which if exercised, could increase the

direct or indirect interest of the Company in the non-wholly owned subsidiaries.

Use of Estimates

Management used estimates and assumptions in preparing these financial statements in accordance with generally accepted accounting principles.

Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were used.

Revenue Recognition and Accounts Receivable

In accordance with Topic A.1. in SAB 13: Revenue Recognition, exhibit and expedition charter revenue is recognized ratably when realized and

earned as time passes throughout the contract period as defined by the terms of the agreement. Expenses related to the exhibit and expedition charter revenue are recorded as incurred and presented under the caption “Operations and

research” on our Consolidated Statements of Operations.

In 2014, we were contracted by the Receiver of Recovery Limited Partnership

(RLP) to recover gold and other cargo from the shipwreck SS Central America. RLP is the salvor in possession of the shipwreck SS Central America. Our agreement allows for the reimbursement of Priority Recoupment costs, which are based

on pre-defined and quantifiable contractual amounts. Priority Recoupment relates to recoupment of operating and recovery expenses associated with this project. Operating and recovery expenses consist of mobilization costs and vessel-related expenses

such as ships’ crew, provisions, fuel and specialized off-shore equipment. These expenses are charged to the Consolidated Statements of Operations as incurred, and the priority recoupment is recorded as a benefit (credit to expense) in the

period we become assured of recoupment. These costs are recouped out of first cash proceeds from the monetization of recovered cargo items that are split 80% to us and 20% to RLP. After the Priority Recoupment is paid in full, subsequent cash

proceeds are split 45% to us and 55% to RLP, at which point in time we will record these additional proceeds as revenue. Staff Accounting Bulletin 13 requires four criteria to be present before recognizing revenue. These criteria are: collection is

probable, delivery of goods or services are complete, persuasive evidence of an

6

arrangement exists and the price or amount can be determined. Priority cost recoupment is not revenue, but the same criteria are applied when determining to recognize or not. We have recovered a

significant amount of gold and other valuable cargo, and based on an independent expert review of the recovered cargo, our Priority Recoupment as of June 30, 2015 is reasonably assured of being collected when the gold and other valuable cargo

is monetized. To the extent the appraised value exceeds our priority recoupment and we are able to accurately measure or quantify a dollar amount for our 45% interest in these additional cash proceeds, we will record revenue at that time. The value

of future monetization is based on what the market will bear, which is undeterminable at this time and, therefore, there will be no revenue recognition related to our 45% portion of proceeds in excess of the Priority Recoupment until monetization

occurs. See NOTE D regarding the SS Central America.

Bad debts are recorded as identified and, from time to time, a specific

reserve allowance will be established when required. A return allowance is established for sales that have a right of return. Accounts receivable is stated net of any recorded allowances.

Cash, Cash Equivalents and Restricted Cash

Cash, cash equivalents and restricted cash include cash on hand and cash in banks. We also consider all highly liquid investments with a

maturity of three months or less when purchased to be cash equivalents.

Inventory

Our inventory principally consists of cargo recovered from the SS Republic shipwreck, other purchased artifacts, general branded

merchandise and related packaging material. Inventoried costs of recovered cargo include the costs of recovery, conservation and administrative costs to obtain legal title to the cargo. Administrative costs are generally legal fees or insurance

settlements required in order to obtain clear title. The capitalized recovery costs include direct costs such as vessel and related equipment operations and maintenance, crew and technical labor, fuel, provisions, supplies, port fees and

depreciation. Conservation costs include fees paid to conservators for cleaning and preserving the cargo and the artifacts. We continually monitor the recorded aggregate costs of the recovered cargo in inventory to ensure these costs do not exceed

the net realizable value. Historical sales, publications or available public market data are used to assess market value.

Packaging

materials and merchandise are recorded at average cost. We record our inventory at the lower of cost or market.

Costs associated with the

above noted items are the costs included in our costs of goods. Vessel costs associated with expedition revenue as well as exhibit costs are not included in cost of goods sold. Vessel costs include, but are not limited to, charter costs, fuel, crew

and port fees. Vessel and exhibit costs are included in Operations and research in the Consolidated Statements of Operations.

Long-Lived Assets

Our policy is to recognize impairment losses relating to long-lived assets in accordance with the ASC topic for Property, Plant and

Equipment. Decisions are based on several factors, including, but not limited to, management’s plans for future operations, recent operating results and projected cash flows. Impairment losses are included in depreciation at the time of

impairment.

Property and Equipment and Depreciation

Property and equipment is stated at historical cost. Depreciation is calculated using the straight-line method at rates based on the

assets’ estimated useful lives which are normally between three and thirty years. Leasehold improvements are amortized over their estimated useful lives or lease term, if shorter. Major overhaul items (such as engines or generators) that

enhance or extend the useful life of vessel related assets qualify to be capitalized and depreciated over the useful life or remaining life of that asset, whichever is shorter. Certain major repair items required by industry standards to ensure a

vessel’s seaworthiness also qualify to be capitalized and depreciated over the period of time until the next scheduled planned major maintenance for that item. All other repairs and maintenance are accounted for under the direct-expensing

method and are expensed when incurred.

Earnings Per Share

Basic earnings per share (“EPS”) is computed by dividing income available to common stockholders by the weighted-average number of

common shares outstanding for the period. In periods when the Company has income, the Company will calculate basic earnings per share using the two-class method, if required, pursuant to ASC 260 Earnings Per Share. The two-class method was

required effective with the issuance of the Senior Convertible Note disclosed in Note I because the note qualified as a participating security, giving the holder the right to receive dividends should dividends be declared on common stock. Under the

two-class method, earnings for the period are allocated on a pro rata basis to the common stockholders and to the

7

holders of Convertible Notes based on the weighted average number of common shares outstanding and number of shares that could be converted. The Company does not use the two-class method in

periods when it generates a loss as the holder of the Convertible Notes does not participate in losses.

Diluted EPS reflects the

potential dilution that would occur if dilutive securities and other contracts to issue Common Stock were exercised or converted into Common Stock or resulted in the issuance of Common Stock that then shared in our earnings. We use the treasury

stock method to compute potential common shares from stock options and warrants and the if-converted method to compute potential common shares from Preferred Stock, Convertible Notes or other convertible securities. As it relates solely to the

Senior Convertible Note, for diluted earnings per share, the Company uses the more dilutive of the if-converted method or two-class method. When a net loss occurs, potential common shares have an anti-dilutive effect on earnings per share and such

shares are excluded from the Diluted EPS calculation.

At September 30, 2015 and 2014, weighted average common shares outstanding

year-to-date were 88,083,259 and 84,420,661, respectively. For the periods ended September 30, 2015 and 2014, in which net losses occurred, all potential common shares were excluded from diluted EPS because the effect of including such shares

would be anti-dilutive.

The potential common shares in the following tables represent potential common shares calculated using the

treasury stock method from outstanding options, stock awards and warrants that were excluded from the calculation of diluted EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| Average market price during the period |

|

$ |

0.37 |

|

|

$ |

1.22 |

|

|

$ |

0.58 |

|

|

$ |

1.69 |

|

|

|

|

|

|

| In the money potential common shares from options excluded |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| In the money potential common shares from warrants excluded |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Potential common shares from out-of-the-money options and warrants were also excluded from the computation of

diluted EPS because calculation of the associated potential common shares has an anti-dilutive effect on EPS. The following table lists options and warrants that were excluded from diluted EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| Out of the money options and warrants excluded: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options with an exercise price of $1.04 per share |

|

|

1,652,000 |

|

|

|

— |

|

|

|

1,652,000 |

|

|

|

— |

|

| Stock options with an exercise price of $1.07 per share |

|

|

50,000 |

|

|

|

— |

|

|

|

50,000 |

|

|

|

— |

|

| Stock options with an exercise price of $1.74 per share |

|

|

— |

|

|

|

51,750 |

|

|

|

— |

|

|

|

51,750 |

|

| Stock options with an exercise price of $2.20 per share |

|

|

952,444 |

|

|

|

969,610 |

|

|

|

952,444 |

|

|

|

969,610 |

|

| Stock options with an exercise price of $2.73 per share |

|

|

644,469 |

|

|

|

644,469 |

|

|

|

644,469 |

|

|

|

644,469 |

|

| Stock options with an exercise price of $2.74 per share |

|

|

609,399 |

|

|

|

633,835 |

|

|

|

609,399 |

|

|

|

633,835 |

|

| Stock options with an exercise price of $2.89 per share |

|

|

944,482 |

|

|

|

983,822 |

|

|

|

944,482 |

|

|

|

983,822 |

|

| Stock options with an exercise price of $3.25 per share |

|

|

100,000 |

|

|

|

100,000 |

|

|

|

100,000 |

|

|

|

100,000 |

|

| Stock options with an exercise price of $3.40 per share |

|

|

— |

|

|

|

100,000 |

|

|

|

— |

|

|

|

100,000 |

|

| Stock options with an exercise price of $3.43 per share |

|

|

40,000 |

|

|

|

40,000 |

|

|

|

40,000 |

|

|

|

40,000 |

|

| Stock options with an exercise price of $3.50 per share |

|

|

100,000 |

|

|

|

100,000 |

|

|

|

100,000 |

|

|

|

100,000 |

|

| Stock options with an exercise price of $3.90 per share |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

| Warrants with an exercise price of $3.60 per share |

|

|

1,562,500 |

|

|

|

1,562,500 |

|

|

|

1,562,500 |

|

|

|

1,562,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total anti-dilutive warrants and options excluded from EPS |

|

|

6,675,294 |

|

|

|

5,205,986 |

|

|

|

6,675,294 |

|

|

|

5,205,986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Potential common shares from outstanding Convertible Preferred Stock calculated on an if-converted basis

having an anti-dilutive effect on diluted earnings per share were excluded from potential common shares as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

|

|

|

|

| Potential common shares from Convertible Preferred Stock excluded from EPS |

|

|

— |

|

|

|

32,400 |

|

|

|

— |

|

|

|

32,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

The weighted average equivalent common shares relating to our unvested restricted stock awards

that were excluded from potential common shares in the earning per share calculation due to having an anti-dilutive effect are:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| Potential common shares from unvested restricted stock awards excluded from EPS |

|

|

1,526,635 |

|

|

|

630,489 |

|

|

|

1,526,635 |

|

|

|

630,489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of the numerators and denominators used in computing basic and diluted net

income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30,

2015 |

|

|

September 30,

2014 |

|

|

September 30,

2015 |

|

|

September 30,

2014 |

|

| Net income (loss) |

|

$ |

(4,580,255 |

) |

|

$ |

(7,415,124 |

) |

|

$ |

(20,420,945 |

) |

|

$ |

(21,229,763 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Numerator, basic and diluted net income (loss) available to stockholders |

|

$ |

(4,580,255 |

) |

|

$ |

(7,415,124 |

) |

|

$ |

(20,420,945 |

) |

|

$ |

(21,229,763 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computation – basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding for basic |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computation – diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding for basic |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing diluted net income per share |

|

|

89,781,577 |

|

|

|

85,271,429 |

|

|

|

88,655,418 |

|

|

|

84,707,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) per share – basic |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.25 |

) |

| Net (loss) per share – diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.25 |

) |

Income Taxes

Income taxes are accounted for using an asset and liability approach that requires the recognition of deferred tax assets and liabilities for

the expected future tax consequences attributable to differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. A valuation allowance is provided when it is more likely than not that

some portion or the entire deferred tax asset will not be realized.

Stock-based Compensation

Our stock-based compensation is recorded in accordance with the guidance in the ASC topic for Stock-Based Compensation (See NOTE J).

Fair Value of Financial Instruments

Financial instruments consist of cash, evidence of ownership in an entity, and contracts that both (i) impose on one entity a contractual

obligation to deliver cash or another financial instrument to a second entity, or to exchange other financial instruments on potentially unfavorable terms with the second entity, and (ii) conveys to that second entity a contractual right

(a) to receive cash or another financial instrument from the first entity, or (b) to exchange other financial instruments on potentially favorable terms with the first entity. Accordingly, our financial instruments consist of cash and cash

equivalents, accounts receivable, accounts payable, accrued liabilities, derivative financial instruments and mortgage and loans payable. We carry cash and cash equivalents, accounts payable and accrued liabilities, and mortgage and loans payable at

the approximate fair market value, and, accordingly, these estimates are not necessarily indicative of the amounts that we could realize in a current market exchange. We carry derivative financial instruments at fair value as is required under

current accounting standards. Redeemable preferred stock has been carried at historical cost and accreted carrying values to estimated redemption values over the term of the financial instrument.

Derivative financial instruments consist of financial instruments or other contracts that contain a notional amount and one or more underlying

variables (e.g., interest rate, security price or other variable), require no initial net investment and permit net settlement. Derivative financial instruments may be free-standing or embedded in other financial instruments. Further, derivative

financial instruments are initially, and subsequently, measured at fair value and recorded as liabilities or, in rare

9

instances, assets. See NOTE J for additional information. We generally do not use derivative financial instruments to hedge exposures to cash-flow, market or foreign-currency risks. However, we

have entered into certain other financial instruments and contracts with features that are either (i) not afforded equity classification, (ii) embody risks not clearly and closely related to host contracts, or (iii) may be net-cash

settled by the counterparty. As required by ASC 815 – Derivatives and Hedging, these instruments are required to be carried as derivative liabilities, at fair value, in our financial statements with changes in fair value reflected in our

income.

Fair Value Hierarchy

The

three levels of inputs that may be used to measure fair value are as follows:

Level 1. Quoted prices in active markets for

identical assets or liabilities.

Level 2. Observable inputs other than Level 1 prices, such as quoted prices for similar

assets or liabilities, quoted prices in markets with insufficient volume or infrequent transactions (less active markets), or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated

with observable market data for substantially the full term of the assets or liabilities. Level 2 inputs also include non-binding market consensus prices that can be corroborated with observable market data, as well as quoted prices that were

adjusted for security-specific restrictions.

Level 3. Unobservable inputs to the valuation methodology are significant to the

measurement of the fair value of assets or liabilities. Level 3 inputs also include non-binding market consensus prices or non-binding broker quotes that we were unable to corroborate with observable market data.

Redeemable Preferred Stock

If we issue

redeemable preferred stock instruments (or any other redeemable financial instrument) they are initially evaluated for possible classification as a liability in instances where redemption is certain to occur pursuant to ASC 480 –

Distinguishing Liabilities from Equity. Redeemable preferred stock classified as a liability is recorded and carried at fair value. Redeemable preferred stock that does not, in its entirety, require liability classification is evaluated for

embedded features that may require bifurcation and separate classification as derivative liabilities. In all instances, the classification of the redeemable preferred stock host contract that does not require liability classification is evaluated

for equity classification or mezzanine classification based upon the nature of the redemption features. Generally, mandatory redemption requirements or any feature that could require cash redemption for matters not within our control, irrespective

of probability of the event occurring, requires classification outside of stockholders’ equity. Redeemable preferred stock that is recorded in the mezzanine section is accreted to its redemption value through charges to stockholders’

equity when redemption is probable using the effective interest method.

Subsequent Events

We have evaluated subsequent events for recognition or disclosure through the date this Form 10-Q is filed with the Securities and Exchange

Commission. See NOTE M.

NOTE C – RESTRICTED CASH

As required by the original mortgage loan entered into with Fifth Third Bank (the “Bank”) on July 11, 2008,

$500,000 was deposited into an interest-bearing account from which principal and interest payments are made. This mortgage loan has since been amended to have a maturity date of December 17, 2015. As amended, the loan calls for a restricted

cash balance of $400,000 to be funded annually for principal and interest payments (see NOTE I). The balance in the restricted cash account is held as additional collateral by the Bank and is not available for operations. The balance in this account

at September 30, 2015, was $100,237.

During May 2014, we entered into a $10.0 million project loan facility with the Bank (see NOTE

I). Per the agreement, we deposited, from the loan proceeds, $500,000 into a restricted bank account to cover principal and interest payments. This account balance is also pledged as additional security for the loan. This loan was amended in 2015 to

have a maturity date of December 17, 2015. The balance in this account at September 30, 2015, was $111,879.

NOTE D – ACCOUNTS RECEIVABLE

Our current and non-current accounts receivable consist of the following:

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| Trade |

|

$ |

11,429,856 |

|

|

$ |

11,053,118 |

|

| Other |

|

|

88,983 |

|

|

|

54,524 |

|

| Reserve allowance |

|

|

(4,631,593 |

) |

|

|

(4,631,593 |

) |

|

|

|

|

|

|

|

|

|

| Total accounts receivable, net |

|

$ |

6,887,246 |

|

|

$ |

6,476,049 |

|

|

|

|

|

|

|

|

|

|

10

The trade receivable balance at September 30, 2015 and December 31, 2014 consists

primarily of (i) a trade receivable from Neptune Minerals, Inc. for which a reserve allowance for the full amount, $4,631,593, has been made, and (ii) a trade receivable on our right to a priority cost recoupment on the SS Central

America shipwreck project. We recorded a priority recoupment of costs in the amount $6,290,465 as a reduction to our Operations and research costs for the year ended December 31, 2014. These amounts are based on set and determinable

contractual amounts for the recovery of the SS Central America shipwreck. These determinable amounts define the fixed obligation due to us for our services rendered as it relates to Priority Recoupment. We are awaiting court approval so we

may assist in monetizing these assets permitting us to collect this receivable. During the quarter ended June 30, 2015, after reviewing the court process surrounding this case as well as reviewing the expected process in the coming months, we

reclassified this receivable as long term based on our current estimate of the timing of monetization. Based on the underlying merits of the case, we still believe this receivable is probable and reasonably assured of collectability. See revenue

recognition and accounts receivable in NOTE B.

NOTE E – INVENTORY

Our current and non-current inventory consists of the following:

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| Recovered cargo |

|

$ |

4,728,436 |

|

|

$ |

5,681,264 |

|

| Packaging |

|

|

56,236 |

|

|

|

70,560 |

|

| Merchandise |

|

|

279,959 |

|

|

|

405,467 |

|

| Merchandise reserve |

|

|

(251,023 |

) |

|

|

(371,332 |

) |

|

|

|

|

|

|

|

|

|

| Total inventory |

|

$ |

4,813,608 |

|

|

$ |

5,785,959 |

|

|

|

|

|

|

|

|

|

|

Of these amounts, $4,478,595 and $5,110,967 are classified as non-current as of September 30, 2015 and

December 31, 2014, respectively. Based on the fair market value of silver at March 31, 2015 and our inventory valuation policy, we recorded a charge to “Cost of goods sold” for the mark down of our silver Gairsoppa bars of

$151,922 to fairly represent the net realizable value.

On shipwreck recovery projects where we do not own the recovered cargo, such as

the Gairsoppa and the SS Central America projects, we do not carry any of the recovered but non-monetized cargo as inventory unless we receive cargo as payment for services, as part of our share of proceeds, or if we purchase some of

the cargo for re-sale.

NOTE F – INVESTMENTS IN UNCONSOLIDATED ENTITIES

Neptune Minerals, Inc.

We currently own 6,190,201 shares of non-voting stock in Neptune Minerals, Inc. (“NMI”). These non-voting shares are comprised of

6,184,976 of Class B Common non-voting shares and 5,225 Series A Preferred non-voting shares. This represents approximately a 28% ownership interest in NMI. During 2011, NMI acquired Dorado Ocean Resources, Ltd. (“DOR”) through a share

exchange with DOR’s shareholders. At that time, we had an approximate 41% ownership position in DOR. Since then we obtained additional shares in NMI from the conversion of convertible instruments or from marine services contracts from which we

were compensated with NMI stock.

At September 30, 2015, our estimated share of unrecognized DOR (NMI) losses are approximately $20.7

million. We have not recognized the accumulated $20.7 million in our income statement because these losses exceed our investment in DOR (NMI). Our investment has a carrying value of zero as a result of the recognition of our share of prior losses

incurred by NMI under the equity method of accounting. Based on the NMI and DOR transactions described above, we believe it is appropriate to allocate this loss carryforward of $20.7 million to any incremental NMI investment that may be recognized

on our balance sheet in excess of zero. The aforementioned loss carryforward is based on NMI’s last unaudited financial statements as of December 31, 2014. We do reasonably believe NMI’s losses for the first nine months of 2015 are

minimal. We do not have any guaranteed obligations to NMI, nor are we otherwise committed to provide financial support. Even though we were not obligated, during July 2013, we, along with a second creditor, loaned funds to NMI of which our share was

$500,000, and this indebtedness was evidenced by a convertible note. This funding was not for the purpose of funding NMI’s prior losses but for current requirements. Per ASC 323-10-35-29: Additional Investment After Suspension of Loss

Recognition, we concluded this loan did not increase our ownership nor was it to be considered in-substance stock. Based on the financial position of NMI at December 31, 2013, we reserved for this note in its entirety. This note carried an

interest rate of 6% per annum and matured on April 26, 2014. The note contained a mandatory conversion clause if the note remained unpaid at maturity. In April 2014, the note was converted into

11

5,225 shares of Series A Preferred non-voting stock. These shares are convertible into 522,500 shares of Class B non-voting common stock and require no further exchange of consideration for

conversion. As a result of this conversion of the loan into equity, we recognized $522,500 of additional investment in NMI and appropriately wrote it down to the loss in unconsolidated entity in 2014.

Although we are a shareholder of NMI, we have no representation on the board of directors or in management of NMI and do not hold any

Class A voting shares. We are not involved in the management of NMI. At September 30, 2015, the net carrying value of our investment in NMI was zero in our consolidated financial statements.

Chatham Rock Phosphate, Ltd.

During the period ended June 30, 2012, we performed deep-sea mining exploratory services for Chatham Rock Phosphate, Ltd.

(“CRP”) valued at $1,680,000. As payment for these services, CRP issued 9,320,348 of ordinary shares to us. The shares currently represent an approximate 3% equity stake in CRP. With CRP being a thinly traded stock on the New Zealand Stock

Exchange and guidance per ASC 320: Debt and Equity Securities regarding readily determinable fair value, we believe it was appropriate to not recognize this amount as an asset nor as revenue during that period. At September 30, 2015, the

net carrying value of our investment in CRP was zero in our consolidated financial statements.

NOTE G – INCOME TAXES

During the nine-month period ended September 30, 2015, we generated approximately $17.5 million of federal net

operating loss (“NOL”) carryforwards and $4.3 million of foreign NOL carryforwards. As of September 30, 2015, we had consolidated income tax NOL carryforwards for federal tax purposes of approximately $146.6 million and net operating

loss carryforwards for foreign income tax purposes of approximately $17.6 million. The federal NOL carryforwards from 2005 forward will expire in various years beginning in 2025 and ending through the year 2035.

Deferred income tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between

financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred income tax assets and liabilities are measured using enacted tax rates expected to be recovered or settled. We have recorded a net

deferred tax asset of $0 at September 30, 2015. As required by the Accounting for Income Taxes topic in the ASC, we have concluded it is more likely than not that those assets would not be realizable without the recovery and rights of

ownership or salvage rights of high value shipwrecks or substantial profits from our mining operations and thus a valuation allowance has been recorded as of September 30, 2015. There was no U.S. income tax expense for the nine months ended

September 30, 2015 due to the generation of net operating losses.

The increase in the valuation allowance as of September 30,

2015 is due to the generation of approximately $21.7 million in net operating loss carryforwards year-to-date.

The change in the

valuation allowance is as follows:

|

|

|

|

|

| September 30, 2015 |

|

$ |

66,695,223 |

|

| December 31, 2014 |

|

|

60,312,726 |

|

|

|

|

|

|

| Change in valuation allowance |

|

$ |

6,382,497 |

|

|

|

|

|

|

Our estimated annual effective tax rate as of September 30, 2015 is 31.25% while our September 30,

2015 effective tax rate is 0.0% because of the full valuation allowance.

We have not recognized a material adjustment in the liability

for unrecognized tax benefits and have not recorded any provisions for accrued interest and penalties related to uncertain tax positions. The earliest tax year still subject to examination by a major taxing jurisdiction is 2013.

NOTE H – COMMITMENTS AND CONTINGENCIES

Legal Proceedings

The

Company may be subject to a variety of claims and suits that arise from time to time in the ordinary course of business. We are currently not a party to any pending litigation.

Going Concern Consideration

We have

experienced several years of net losses and may continue to do so. Our ability to generate net income or positive cash flows for the remainder of 2015 or the following twelve months is dependent upon our success in recovering and monetizing

shipwrecks, monetizing our interests in mineral exploration entities and recovered cargo, generating income from

12

shipwreck or mineral exploration charters, collecting on amounts owed to us, generating income from other project or asset based financing, and completing the MINOSA/Penelope equity financing

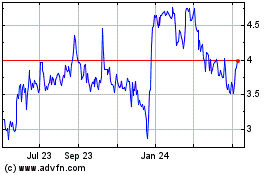

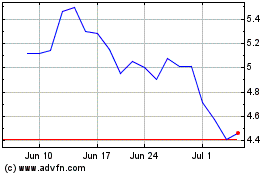

transaction approved by our stockholders on June 9, 2015. We received a letter from NASDAQ on March 9, 2015 stating that the Company’s closing bid price on the NASDAQ Capital Market had not maintained a minimum bid price of $1.00 for

30 consecutive business days and that the Company had 180 calendar days to cure the situation. The Company was unable to cure this continued listing requirement deficiency, and we received a de-listing notice from NASDAQ on September 9, 2015.

We appealed this decision, and NASDAQ subsequently agreed to grant us an extension until March 7, 2016 to cure this deficiency. The Company’s shares continue to trade normally on the NASDAQ market. If the $1.00 minimum bid price requirement is

not cured, then the Company’s shares would be de-listed from NASDAQ. Our 2015 business plan requires us to generate new cash inflows during 2015 to effectively allow us to perform our planned projects. We plan to generate new cash inflows

through the monetization of shipwreck cargo and/or our equity stakes in seabed mineral companies, financings, syndications or other partnership opportunities. One or more of the planned shipwreck or mining project monetizations, financings,

syndications or partnership opportunities may not be realized to the extent needed which may require us to curtail our desired business plan until we generate additional cash. On March 11, 2015, we entered into a Stock Purchase Agreement with

Minera del Norte S.A. de c.v. (“MINOSA”) and Penelope Mining LLC (“Penelope”), an affiliate of MINOSA, pursuant to which (a) MINOSA agreed to extend short-term, debt financing to Odyssey of up to $14.75 million, and

(b) Penelope agreed to invest up to $101 million over three years in convertible preferred stock of Odyssey. The equity financing is subject to the satisfaction of certain conditions, including the approval of our stockholders which occurred on

June 9, 2015, and MINOSA and Penelope are currently under no obligation to make the preferred share equity investments, or exercise their call option on our Oceanica shares. (See Item 7, Management’s Discussion and Analysis of

Financial Condition and Results of Operations—General Discussion 2014—Financings.) If cash inflow is not sufficient to meet our desired projected business plan requirements, we will be required to follow our contingency business plan which

is based on curtailed expenses and requires less cash inflows. Our consolidated non-restricted cash balance at September 30, 2015 was $1.8 million which is insufficient to support operations through the end of 2015. We have a working capital

deficit at September 30, 2015 of $36.3 million. During the third quarter of 2015, we amended our three bank loans, which had as a consequence that $11.8 million of bank loans mature on December 17. 2015. We also amended the $14.75 million

MINOSA loan so that it matures on December 31, 2015. The $10.0 million Monaco loan matures in installments from August through December 2016. Even though our total assets on our consolidated balance sheet are $20.6 million, the majority of

these assets are secured as collateral against our loans and the related fair market value of these assets may differ from their net carrying book value. Even though we executed the above noted financing arrangements, Penelope must purchase the

shares for us to be able to complete the equity component of the transaction. Therefore, the factors noted above raise doubt about our ability to continue as a going concern. These consolidated financial statements do not include any adjustments to

the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

NOTE I – MORTGAGE AND LOANS PAYABLE

The Company’s consolidated debt consisted of the following at September 30, 2015 and December 31, 2014:

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

|

|

|

| Term loan |

|

$ |

3,000,000 |

|

|

$ |

4,000,000 |

|

| Project term loans |

|

|

16,396,297 |

|

|

|

15,502,422 |

|

| Promissory note |

|

|

14,750,001 |

|

|

|

— |

|

| Mortgages payable |

|

|

1,022,500 |

|

|

|

1,662,459 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

35,168,798 |

|

|

$ |

21,164,881 |

|

|

|

|

|

|

|

|

|

|

Term Loan

Our current term loan with Fifth Third Bank, which is a result of amending its predecessor during July 2013 and September 2015, has a maturity

date in December 17, 2015. This facility bears floating interest at the one-month LIBOR rate as reported in the Wall Street Journal plus 500 basis points. Beginning January 2014, we were required to make semi-annual payments of $500,000.

Any prepayments made in full or in part were without premium or penalty. No restricted cash payments are required to be kept on deposit. This facility has substantially the same terms as its predecessors as disclosed in our previous Securities and

Exchange Commission’s filings.

This term loan is secured by approximately 21,962 numismatic coins recovered from the SS

Republic shipwreck, which amount will be reduced over the term by the amount of coins sold by the Company. The coins used as collateral are held by a custodian for the security of the Bank. The carrying value of the borrowing base is not to

exceed forty percent (40%) of the eligible coin inventory valued on a rolling twelve-month wholesale average value. All three of the Bank loans are cross-collateralized. The Company is required to comply with a number of customary covenants.

The significant covenants include: maintaining insurance on the inventory; ensuring the collateral is free from encumbrances without the consent of the Bank, the

13

Company cannot merge or consolidate with or into any other corporation or entity nor can the Company enter into a material debt agreement with a third party without approval. We were in

compliance with all covenants at September 30, 2015. At September 30, 2015, the outstanding loan balance for this term loan is $3,000,000.

Project Term Loans

Loan one

On August 14, 2014, we entered into a Loan Agreement with Monaco Financial, LLC (“Monaco”), a strategic marketing partner,

pursuant to which Monaco agreed to lend us up to $10.0 million, the first $5.0 million of which (the “First Tranche”) was advanced upon execution of the Loan Agreement. Subject to the satisfaction of conditions set forth in the Loan

Agreement, we had the right to borrow up to an additional $5.0 million in two separate advances of $2.5 million each, which we refer to as the “Second Tranche” and the “Third Tranche.” Each of the three advances is evidenced by

separate promissory notes (the “Notes”). The Second Tranche was advanced on October 1, 2014, and the Third Tranche was advanced on December 1, 2014. The outstanding balance of these Notes at September 30, 2015 was $10.0

million. The book carrying value of these notes was $8,711,783. The difference between the outstanding and carrying values is due to the fair value of derivatives discussed further in NOTE L.

The indebtedness evidenced by the Notes bears interest at 8.0% percent per year until the first anniversary of the note and 11% per annum

from the first anniversary through the maturity date. Principal is payable at the maturity date while interest is payable monthly. As consideration for the Notes, the Company (i) entered into a multi-year exclusive agreement in which we granted

Monaco an exclusive right to market valuable trade cargo through a marketing joint venture, (ii) assigned to Monaco 100,000 shares of Oceanica Resources S. de. R.L (“Oceanica”) and (iii) granted Monaco an option whereby Monaco

may purchase shares of Oceanica held by Odyssey at a purchase price which is the lower of (a) $3.15 per share or (b) the price per share of a contemplated equity offering of Oceanica which totals $1,000,000 or more in the aggregate. The

option may be exercised (i) by conversion of the outstanding principal, (ii) in cash for up to 50% of the initial principal amount of the Note (exercisable until the end of the term of the note) if the Note has been repaid early at the

request of Monaco, or (iii) in cash for up to 100% of the initial principal amount of the Note (exercisable until the end of the term of the note) if the Note has been repaid early at the request of the Company. For collateral, we granted the

lender a security interest in the proceeds from the sale of valuable trade cargo whenever held, in excess of the proceeds previously pledged under other arrangements, a certain quantity of our Oceanica shares based on the loan balance and certain

marine equipment and technology as evidenced by equity in two of our wholly owned subsidiaries.

Accounting considerations

We have accounted for the three Tranches as a financing transaction, wherein the net proceeds that we received were allocated to the financial

instruments issued. Prior to making the accounting allocation, we evaluated the First Tranche for proper classification under ASC 480 Distinguishing Liabilities from Equity (“ASC 480”) and ASC 815 Derivatives and Hedging

(“ASC 815”).

ASC 815 generally requires the analysis of embedded terms and features that have characteristics of derivatives to

be evaluated for bifurcation and separate accounting in instances where their economic risks and characteristics are not clearly and closely related to the risks of the host contract. The material embedded derivative feature consisted of the share

purchase option. The share purchase option was not clearly and closely related to the host debt agreement and required bifurcation.

Based

on the previous conclusions, we allocated the cash proceeds first to the derivative components at their fair values with the residual allocated to the host debt contract, as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

T1 Allocation |

|

|

T2 Allocation |

|

|

T3 Allocation |

|

| Promissory Note |

|

$ |

3,918,254 |

|