Current Report Filing (8-k)

November 05 2015 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 23, 2015

Global Digital Solutions, Inc.

(Exact name of registrant as specified

in its charter)

| New

Jersey |

|

000-26361 |

|

22-3392051 |

|

(State or other

jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

777 South Flagler Drive, Suite 800

West

West Palm Beach, Florida 33401 |

|

| |

(Address of principal executive offices, including zip code) |

|

Registrant’s telephone number,

including area code: (561) 515-6163

| |

N/A |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry Into a Material Definitive Agreement.

Revenue Based Factoring Agreement

On October 23, 2015, North American Custom Specialty Vehicles,

Inc. (“NACSV”), a wholly-owned subsidiary of Global Digital Solutions, Inc. (“GDSI”) entered into a Revenue

Based Factoring Agreement (the “Factoring Agreement”) with Power Up Lending Group, Ltd. (“Power Up”). The

Factoring Agreement was guaranteed by GDSI under the terms of a Security Agreement and Guaranty (“the Security Agreement”).

Under the terms of the Factoring Agreement, NACSV, as Merchant,

agreed to transfer to Power Up in consideration of the purchase price of $50,000.00, all of the Merchant’s future receipts,

accounts, contract rights and other obligations arising from or relating to the payment of monies from Merchant’s customers

and/or other third party payors (collectively the receipts) at the specified percentage of 24% until such time as a total of $69,000.00

is repaid. A specified daily repayment amount of $547.62 is required to be made to Power Up as a base payment to be credited against

the specified percentage due. The Factoring Agreement shall have an indefinite term that shall last until all of the Merchant’s

obligations to Power Up are fully satisfied. GDSI used the purchase price proceeds to satisfy fund operations.

The Factoring Agreement contains certain protections against

default, including prohibiting NACSV from changing its arrangement with its bank in any way that is adverse to Power Up and NACSV

interrupting the operation of its business, among others. Events of default include: (i) the violation of any term or covenant

under the agreement, (ii) the failure of NACSV to pay its debts when due and (iii) the transfer or sale of all or substantially

all of NACSV’s asset, amount others.

The foregoing descriptions of the Factoring

Agreement and the Security Agreement are summaries, and are qualified in their entirety by reference to such documents, which are

attached hereto as Exhibit 10.1 and Exhibit 10.2, respectively, and are incorporated herein by reference.

Item 2.03. Creation of a Direct Financial

Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 is incorporated herein

by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

|

Description |

| 10.1 |

|

Revenue Based Factoring Agreement dated October 23, 2015 |

| |

|

|

| 10.2 |

|

Security Agreement and Guaranty dated October 23, 2015 |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Global Digital Solutions, Inc. |

| |

|

|

| Date: November 5, 2015 |

By: |

/s/ Jerome J. Gomolski |

| |

|

Jerome J. Gomolski |

| |

|

Chief Financial Officer |

3

Exhibit 10.1

Exhibit 10.2

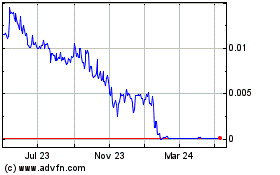

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

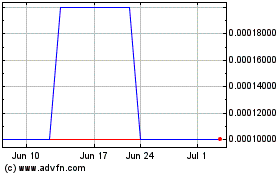

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024