UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): November 5, 2015

Jones

Soda Co.

(Exact

Name of Registrant as Specified in Its Charter)

Washington

(State

or Other Jurisdiction of Incorporation)

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

66 South Hanford Street, Suite 150, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including

Area Code)

Not Applicable

(Former Name or

Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2.

below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On November 5, 2015, Jones Soda Co. (the "Company") issued a press

release announcing its financial results for the third quarter ended

September 30, 2015. The press release is furnished as Exhibit 99.1 to

this Current Report on Form 8-K.

The Company will host a conference call to discuss the Company's

financial results for the third quarter ended September 30, 2015 on

November 5, 2015 at 4:30 p.m. Eastern time. This call will be webcast

and can be accessed by visiting our website at www.jonessoda.com

or www.jonessoda.com/company/jones-press/webcasts. Investors may

also listen to the call via telephone by dialing (913) 312-6687

(confirmation code: 8293243). In addition, a telephone replay will be

available by dialing (858) 384-5517 (confirmation code: 8293243) through

November 12, 2015, at 11:59 p.m. Eastern Time.

The information in this Current Report in Item 2.02 and Exhibit 99.1 is

being furnished to the Securities and Exchange Commission and shall not

be deemed “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934, or otherwise subject to the liabilities of that

Section, and shall not be incorporated by reference into any

registration statement or other document filed pursuant to the

Securities Act of 1933, except as shall be expressly set forth by

specific reference in such a filing.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

Exhibit Description

|

|

99.1

|

Press Release, dated November 5, 2015

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

JONES SODA CO.

|

|

|

|

|

|

Date:

|

November 5, 2015

|

By:

|

/s/ Jennifer Cue

|

|

|

|

|

Jennifer Cue, CEO

|

Exhibit 99.1

Jones

Soda Co. Reports Fiscal 2015 Third Quarter Results

Company

Reports Operating Profit for the Quarter

SEATTLE--(BUSINESS WIRE)--November 5, 2015--Jones Soda Co. (the Company)

(OTCQB: JSDA), a leader in the premium beverage category and known for

its unique branding and innovative marketing, today announced results

for the third quarter ended September 30, 2015.

For the third quarter of 2015, the Company reported revenue of $3.8

million compared to the prior year’s third quarter revenue of $4.4

million. Income from operations for the third quarter of 2015 improved

to $3,000, compared to the prior year’s third quarter net loss from

operations of $177,000. Net loss for the third quarter of 2015 improved

to $179,000 or $(0.00) per share, compared to a net loss of $233,000 or

$(0.01) per share, for the third quarter of 2014.

“We are pleased to announce that we have achieved an operating profit

for the third quarter of 2015. Our quarter over quarter volume decline

was because we did not repeat certain seasonal, lower margin, product

offerings. Profitability continues to be a guiding principal and will be

a factor in making promotional and operational decisions. Year-to-date

case volume exhibits growth and we are seeing good momentum in our core

business,” stated Jennifer Cue, CEO of Jones Soda Co.

Third Quarter Review – Comparison of Quarters Ended September 30,

2015 and 2014

-

Revenue decreased 14% to $3.8 million, compared to $4.4 million last

year.

-

Gross margin increased to 25% of revenue, compared to 24% last year.

-

Operating expenses decreased by $281,000, or 23%, to $946,000,

compared to $1.2 million last year.

-

Operating income improved by $180,000, or 102% to $3,000 compared to

an operating loss of $177,000 last year.

-

Net loss improved to $179,000 or $(0.00) per share, compared to a net

loss of $233,000 or $ (0.01) per share, last year.

Year-to-Date Review - Comparison of Nine Months Ended September 30,

2015 and 2014

-

Revenue decreased 2% to $10.9 million, compared to $11.1 million last

year.

-

Gross margin increased to 25% of revenue, compared to 24% last year.

-

Operating expenses decreased by $643,000, or 17%, to $3.1 million,

compared to $3.7 million last year.

-

Operating loss decreased by $771,000 or 71%, to $318,000, compared to

$1.1 million last year.

-

Net loss improved to $575,000 or $(0.01) per share, compared to a net

loss of $1.2 million or $ (0.03) per share, last year.

Conference Call

The Company will discuss its results for the quarter ended September 30,

2015 on its scheduled conference call today, November 5, 2015 at

4:30 p.m. Eastern time (1:30 p.m. Pacific time). This call will be

webcast and can be accessed by visiting our website at www.jonessoda.com

or www.jonessoda.com/company/jones-press/webcasts. Investors may

also listen to the call via telephone by dialing (913) 312-6687

(confirmation code: 8293243). In addition, a telephone replay will be

available by dialing (858) 384-5517 (confirmation code: 8293243) through

November 12, 2015, at 11:59 p.m. Eastern Time.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co.®

(OTCQB: JSDA) markets and distributes premium beverages under the Jones®

Soda, Jones Zilch® and Jones Stripped™

brands. A leader in the premium soda category, Jones Soda is known for

its variety of flavors, high quality ingredients (including cane sugar),

and innovative labeling technique that incorporates always-changing

photos sent in from its consumers. The diverse product line of Jones

offers something for everyone – pure cane sugar soda, zero-calorie soda

and an all-naturally sweetened sparkling beverage with only 30 calories

and 8 grams of sugar. Jones Soda is sold across North America through

traditional beverage retailers and in many retailers where you would not

expect to find carbonated beverages. For more information, visit www.jonessoda.com

or www.myjones.com.

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include all passages

containing words such as “will,” “aims,” “anticipates,” “becoming,”

“believes,” “continue,” “estimates,” “expects,” “future,” “intends,”

“plans,” “predicts,” “projects,” “targets,” or “upcoming.”

Forward-looking statements also include any other passages that are

primarily relevant to expected future events or that can only be

evaluated by events that will occur in the future. Forward-looking

statements are based on the opinions and estimates of management at the

time the statements are made and are subject to certain risks and

uncertainties that could cause actual results to differ materially from

those anticipated or implied in the forward-looking statements. Factors

that could affect the Company's actual results include, among others:

its ability to successfully execute on its operating plans for 2015; its

ability to maintain and expand distribution arrangements with

distributors, independent accounts, retailers or national retail

accounts; its ability to manage operating expenses and generate

sufficient cash flow from operations; its ability to increase revenues

and achieve case sales goals on reduced operating expenses; its ability

to develop and introduce new products to satisfy customer preferences;

its ability to market and distribute brands on a national basis; changes

in consumer demand or market acceptance for its products; its ability to

increase demand and points of distribution for its products or to

successfully innovate new products and product extensions; its ability

to maintain relationships with co-packers; its ability to maintain a

consistent and cost-effective supply of raw materials; its ability to

maintain brand image and product quality; its ability to attract, retain

and motivate key personnel; the impact of currency rate fluctuations;

its ability to protect its intellectual property; the impact of future

litigation; the impact of intense competition from other beverage

suppliers; and its ability to access the capital markets for any future

equity financing, and any actual or perceived limitations by being

traded on the OTCQB Marketplace. More information about factors that

potentially could affect the Company’s operations or financial results

is included in its most recent annual report on Form 10-K for the year

ended December 31, 2014, filed with the Securities and Exchange

Commission on March 25, 2015. Readers are cautioned not to place undue

reliance upon these forward-looking statements that speak only as to the

date of this release. Except as required by law, the Company undertakes

no obligation to update any forward-looking or other statements in this

press release, whether as a result of new information, future events or

otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

|

|

|

|

2015

|

|

|

|

2014

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

(In thousands, except share data)

|

|

Revenue

|

|

|

|

$

|

3,763

|

|

|

|

$

|

4,375

|

|

|

|

$

|

$ 10,917

|

|

$

|

11,144

|

|

|

Cost of goods sold

|

|

|

|

|

2,814

|

|

|

|

|

3,325

|

|

|

|

|

8,174

|

|

|

8,529

|

|

|

Gross profit

|

|

|

|

|

949

|

|

|

|

|

1,050

|

|

|

|

|

2,743

|

|

|

2,615

|

|

|

Gross profit %

|

|

|

|

|

25.2

|

%

|

|

|

|

24.0

|

%

|

|

|

|

25.1%

|

|

|

23.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

|

|

501

|

|

|

|

|

592

|

|

|

|

|

1,462

|

|

|

1,681

|

|

|

General and administrative

|

|

|

|

|

445

|

|

|

|

|

635

|

|

|

|

|

1,599

|

|

|

2,023

|

|

|

Total operating expenses

|

|

|

|

|

946

|

|

|

|

|

1,227

|

|

|

|

|

3,061

|

|

|

3,704

|

|

|

Income (loss) from operations

|

|

|

|

|

3

|

|

|

|

|

(177

|

)

|

|

|

|

(318)

|

|

|

(1,089

|

)

|

|

Other (expense) income, net

|

|

|

|

|

(182

|

)

|

|

|

|

( 30

|

)

|

|

|

|

(240)

|

|

|

(38

|

)

|

|

Loss before income taxes

|

|

|

|

|

(179

|

)

|

|

|

|

(207

|

)

|

|

|

|

(558)

|

|

|

(1,127

|

)

|

|

Income tax expense, net

|

|

|

|

|

-

|

|

|

|

|

(26

|

)

|

|

|

|

(16)

|

|

|

(74

|

)

|

|

Net loss

|

|

|

|

$

|

(179

|

)

|

|

|

$

|

(233

|

)

|

|

|

$

|

$ (575)

|

|

$

|

(1,201

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted

|

|

|

|

$

|

(0.00

|

)

|

|

|

$

|

(0.01

|

)

|

|

|

$

|

$ (0.01)

|

|

$

|

(0.03

|

)

|

|

Weighted average basic and diluted common shares outstanding

|

|

|

|

|

41,314,894

|

|

|

|

39,850,694

|

|

|

|

|

41,122,357

|

|

|

39,215,288

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

Case sale data (288-ounce equivalent)

|

|

|

|

2015

|

|

|

|

2014

|

|

|

|

2015

|

|

|

2014

|

|

|

Finished product cases

|

|

|

|

|

289,000

|

|

|

|

|

330,000

|

|

|

|

|

827,000

|

|

|

821,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2015

|

|

|

December 31, 2014

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

(In thousands, except share data)

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

$

|

491

|

|

|

|

$

|

857

|

|

|

Accounts receivable, net of allowance of $33 and $49

|

|

|

|

|

2,158

|

|

|

|

|

1,237

|

|

|

Inventory

|

|

|

|

|

3,253

|

|

|

|

|

2,603

|

|

|

Prepaid expenses and other current assets

|

|

|

|

|

123

|

|

|

|

|

121

|

|

|

Total current assets

|

|

|

|

|

6,025

|

|

|

|

|

4,818

|

|

|

Fixed assets, net of accumulated depreciation of $902 and $1,399

|

|

|

|

|

41

|

|

|

|

|

25

|

|

|

Other assets

|

|

|

|

|

21

|

|

|

|

|

31

|

|

|

Total assets

|

|

|

|

$

|

6,087

|

|

|

|

$

|

4,874

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

|

$

|

2,642

|

|

|

|

$

|

1,375

|

|

|

Accrued expenses

|

|

|

|

|

816

|

|

|

|

|

814

|

|

|

Line of credit

|

|

|

|

|

329

|

|

|

|

|

—

|

|

|

Taxes payable

|

|

|

|

|

19

|

|

|

|

|

23

|

|

|

Other current liabilities

|

|

|

|

|

2

|

|

|

|

|

38

|

|

|

Total current liabilities

|

|

|

|

|

3,808

|

|

|

|

|

2,250

|

|

|

Long-term liabilities — other

|

|

|

|

|

14

|

|

|

|

|

2

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

Common stock, no par value:

|

|

|

|

|

|

|

|

|

|

|

Authorized — 100,000,000; issued and outstanding shares — 41,314,894

and 40,972,394 shares, respectively

|

|

|

|

|

53,764

|

|

|

|

|

53,650

|

|

|

Additional paid-in capital

|

|

|

|

|

8,388

|

|

|

|

|

8,234

|

|

|

Accumulated other comprehensive income

|

|

|

|

|

244

|

|

|

|

|

295

|

|

|

Accumulated deficit

|

|

|

|

|

(60,131

|

)

|

|

|

|

(59,557

|

)

|

|

Total shareholders’ equity

|

|

|

|

|

2,265

|

|

|

|

|

2,622

|

|

|

Total liabilities and shareholders’ equity

|

|

|

|

$

|

6,087

|

|

|

|

$

|

4,874

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:

Jones Soda Co.

Gina Salters, 206-624-3357

Interim

Controller

finance@jonessoda.com

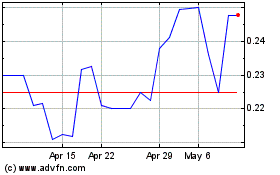

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

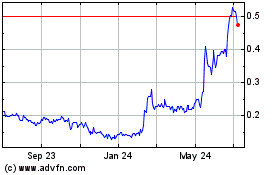

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024