UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

November 2, 2015

|

StemCells, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

000-19871

|

94-3078125

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

7707 Gateway Blvd, Suite 140, Newark, California

|

|

94560

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

510.456.4000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2015, StemCells, Inc. (the "Company") issued a press release announcing its financial results for three months ended September 30, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release, dated November 2, 2015, announcing the Company’s financial results for the three months ended September 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

StemCells, Inc.

|

|

|

|

|

|

|

|

October 2, 2015

|

|

By:

|

|

Kenneth Stratton

|

|

|

|

|

|

|

|

|

|

|

|

Name: Kenneth Stratton

|

|

|

|

|

|

Title: General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release dated November 2, 2015

|

StemCells, Inc. Reports Third Quarter 2015 Financial Results

Company to Host Call to Provide Interim Results from the First Cohort in its Phase II Pathway™

Study in Cervical Spinal Cord Injury

NEWARK, CA, November 2, 2015 (GLOBE NEWSWIRE) — StemCells, Inc. (NASDAQ: STEM), a world leader

in the research and development of cell-based therapeutics for the treatment of disorders of the

central nervous system, today reported its financial and operating results for the three months

ended September 30, 2015.

“We continue to advance our HuCNS-SC® human neural stem cells platform through Phase II

clinical programs in both spinal cord injury and age-related macular degeneration,” reported

StemCells CEO Martin McGlynn. “Later this month, we look forward to providing an update on the

progress of the Phase II Pathway study, as well as a summary of interim data from Cohort I of the

study. Cohort I is an open-label six-patient cohort designed to assess the safety and clinical

effect of three ascending doses of cells into the cervical region of the spinal cord.”

Financial Results for the Quarter Ended September 30, 2015

Total revenue from continuing operations during the third quarter of 2015 was $37,000, compared to

$82,000 in the same period of 2014. Revenue from continuing operations is primarily from royalties

received under various licensing agreements.

For the third quarter of 2015, cash used in operations totaled $7,266,000, compared to $6,683,000

in the third quarter of 2014.

Total operating expenses in the third quarter of 2015 were $10,025,000, compared to $6,462,000 in

the third quarter of 2014. The increased operating expenses were primarily attributable to: (i) an

increase in employee related costs to support our Phase II clinical trials, including an increase

in non-cash stock-based compensation, (ii) increases in expenses related to our clinical studies

which includes costs incurred to initiate the follow-on Phase II randomized, controlled

proof-of-concept study in dry AMD, and (iii) an increase in other expenses related to

manufacturing, quality control and process development activities to support our preclinical and

clinical programs.

Other income, net in the third quarter of 2015 was $345,000, compared to other income, net of

$3,760,000 in the third quarter of 2014. The change in the third quarter of 2015 when compared to

the similar quarter in 2014 was primarily attributable to non-cash charges associated with a change

in the estimated fair value of our warrant liability.

For the third quarter of 2015, the Company reported a net loss of $9,643,000 or $(0.09) per share.

In comparison, for the third quarter of 2014, the Company reported a GAAP net loss of $2,757,000 or

$(0.04) per share.

Excluding certain non-cash charges associated with stock based compensation, depreciation and

amortization and changes in the fair value of our warrant liability, for the third quarter of 2015,

the Company reported a non-GAAP net loss of $8,349,000 or $(0.08) per share. In comparison, for the

third quarter of 2014, the Company reported a non-GAAP net loss of $6,003,000 or $(0.09) per share.

The approximately $2,346,000 increase was primarily associated with increased levels of clinical

activity and process development. Management believes that these non-GAAP financial measures

provide important insight into our operational results.

From June to August 2015, in connection with new employee hires, we awarded an aggregate total of

250,000 restricted stock units (RSUs) and 105,000 options pursuant to our 2012 Commencement

Incentive Plan and in accordance with Nasdaq Listing Rule 5635(c)(4) concerning inducement grants

to new employees. Each RSU gives the holder the right to receive upon vesting, without cash

payment, one share of our common stock. Each option gives the holder the right to receive upon

vesting one share of our common stock for a price per share equal to the Company’s trading price at

the time of grant. In all cases these granted RSUs and options have performance based vesting tied

either to timely and successful process development activities or to the timely and successful

conduct and completion of the Company’s Phase II clinical studies in spinal cord injury and dry

AMD. As comparison, in 2014 we awarded no options to non-executive officers pursuant to our 2012

Commencement Incentive Plan and we awarded an aggregate total of 630,000 RSUs, all of which had

time-based vesting.

About StemCells, Inc.

StemCells, Inc. is currently engaged in clinical development of its HuCNS-SC® platform

technology (purified human neural stem cells) as a potential treatment for both neurological and

retinal disorders. Top-line data from the Company’s Phase I/II clinical trial in thoracic spinal

cord injury (SCI) showed measurable gains involving multiple sensory modalities and segments,

including the conversion of two of seven patients enrolled in the study with complete injuries to

incomplete injuries, post-transplant. The Company’s Pathway™ Study, a Phase II proof-of-concept

trial in cervical SCI is actively enrolling at twelve sites and interim data from the first cohort

of six patients is anticipated to be forthcoming in Q4 2015. StemCells, Inc. has also completed its

Phase I/II clinical trial in GA-AMD. Top-line results from this study show a positive safety

profile and favorable preliminary efficacy data. The Company’s Radiant™ Study, a Phase II

multi-center proof-of-concept trial in GA-AMD is now actively enrolling at three sites. In a Phase

I clinical trial in Pelizaeus-Merzbacher disease (PMD), a fatal myelination disorder in children,

the Company showed preliminary evidence of progressive and durable donor-derived myelination by

MRI.

Further information about StemCells, Inc. is available at http://www.stemcellsinc.com.

Apart from statements of historical fact, the text of this press release constitutes

forward-looking statements within the meaning of the U.S. securities laws, and is subject to the

safe harbors created therein. These statements include, but are not limited to, statements

regarding the future business operations of StemCells, Inc. (the “Company”) and the prospect for

continued clinical development of the Company’s HuCNS-SC cells in CNS disorders. These

forward-looking statements speak only as of the date of this news release. The Company does not

undertake to update any of these forward-looking statements to reflect events or circumstances that

occur after the date hereof. Such statements reflect management’s current views and are based on

certain assumptions that may or may not ultimately prove valid. The Company’s actual results may

vary materially from those contemplated in such forward-looking statements due to risks and

uncertainties to which the Company is subject, including uncertainties about whether preliminary

data in any Phase I or Phase II clinical study will prove to be reproducible or biologically

meaningful in any future clinical study; risks whether the FDA or other applicable regulatory

agencies, including applicable institutional review boards at one or more clinical trial sites,

will permit the Company to continue clinical testing or conduct future clinical trials;

uncertainties regarding the Company’s ability to obtain the increased capital resources needed to

continue its current and planned research and development operations; uncertainty as to whether

HuCNS-SC cells and any products that may be generated in the future in the Company’s cell-based

programs will prove safe and clinically effective and not cause tumors or other adverse side

effects; uncertainties regarding whether results in preclinical research in animals will be

indicative of future clinical results in humans; uncertainties regarding the Company’s

manufacturing capabilities given its increasing preclinical and clinical commitments; uncertainties

regarding the validity and enforceability of the Company’s patents; uncertainties as to whether the

Company will become profitable; and other factors that are described under the heading “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and in

its subsequent reports on Forms 10-Q and 8-K.

CONTACT:

Greg Schiffman, Chief Financial Officer StemCells, Inc.

(510) 456-4128

Lena Evans

Russo Partners

(212) 845-4262

— more —

1

StemCells, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30 |

|

September 30 |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from licensing agreements |

|

$ |

37 |

|

|

$ |

82 |

|

|

$ |

88 |

|

|

$ |

129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

7,720 |

|

|

|

4,397 |

|

|

|

21,251 |

|

|

|

14,866 |

|

General and administrative |

|

|

2,305 |

|

|

|

2,065 |

|

|

|

7,058 |

|

|

|

6,445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

10,025 |

|

|

|

6,462 |

|

|

|

28,309 |

|

|

|

21,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(9,988 |

) |

|

|

(6,380 |

) |

|

|

(28,221 |

) |

|

|

(21,182 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liability |

|

|

428 |

|

|

|

4,076 |

|

|

|

1,069 |

|

|

|

(95 |

) |

Interest expense, net |

|

|

(105 |

) |

|

|

(309 |

) |

|

|

(433 |

) |

|

|

(1,029 |

) |

Other income (expense), net |

|

|

22 |

|

|

|

(7 |

) |

|

|

130 |

|

|

|

(38 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income (expense), net |

|

|

345 |

|

|

|

3,760 |

|

|

|

766 |

|

|

|

(972 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

|

(9,643 |

) |

|

|

(2,620 |

) |

|

|

(27,455 |

) |

|

|

(22,154 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations |

|

|

— |

|

|

|

(137 |

) |

|

|

— |

|

|

|

(339 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations |

|

|

— |

|

|

|

(137 |

) |

|

|

— |

|

|

|

(339 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(9,643 |

) |

|

$ |

(2,757 |

) |

|

$ |

(27,455 |

) |

|

$ |

(22,493 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.38 |

) |

Net loss from discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

$ |

(0.09 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.38 |

) |

Shares used to compute basic and diluted |

|

|

108,478,361 |

|

|

|

66,535,000 |

|

|

|

91,106,853 |

|

|

|

59,224,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

StemCells, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2015 |

|

|

|

|

|

December 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

(unaudited) |

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash & cash equivalents |

|

$ |

21,185 |

|

|

|

|

|

|

$ |

24,988 |

|

Other current assets |

|

|

1,088 |

|

|

|

|

|

|

|

1,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

22,273 |

|

|

|

|

|

|

|

26,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

5,441 |

|

|

|

|

|

|

|

5,187 |

|

Intangible assets, net |

|

|

294 |

|

|

|

|

|

|

|

357 |

|

Other assets, non-current |

|

|

374 |

|

|

|

|

|

|

|

375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

28,382 |

|

|

|

|

|

|

$ |

32,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

Loan payable net of discount, current |

|

$ |

2,453 |

|

|

|

|

|

|

$ |

4,686 |

|

Other current liabilities |

|

|

7,182 |

|

|

|

|

|

|

|

6,811 |

|

Fair value of warrant liability |

|

|

616 |

|

|

|

|

|

|

|

1,685 |

|

Loan payable net of discount, non-current |

|

|

8,917 |

|

|

|

|

|

|

|

10,334 |

|

Other non-current liabilities |

|

|

2,105 |

|

|

|

|

|

|

|

3,040 |

|

Stockholders’ equity |

|

|

7,109 |

|

|

|

|

|

|

|

5,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

28,382 |

|

|

|

|

|

|

$ |

32,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

StemCells, Inc.

Unaudited Reconciliation of GAAP to NON-GAAP Net Loss

(in thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30 |

|

September 30 |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

GAAP net loss as per our condensed

consolidated statement of operations |

|

$ |

(9,643 |

) |

|

$ |

(2,757 |

) |

|

$ |

(27,455 |

) |

|

$ |

(22,493 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

1,427 |

|

|

|

509 |

|

|

|

4,087 |

|

|

|

1,544 |

|

Depreciation and amortization |

|

|

295 |

|

|

|

321 |

|

|

|

841 |

|

|

|

993 |

|

Change in fair value of warrant liability |

|

|

(428 |

) |

|

|

(4,076 |

) |

|

|

(1,069 |

) |

|

|

(95 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non GAAP net loss |

|

|

(8,349) |

|

|

|

(6,003 |

) |

|

|

(23,596 |

) |

|

|

(20,051 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP basic and diluted net loss per share |

|

|

(0.08 |

) |

|

|

(0.09 |

) |

|

|

(0.26 |

) |

|

|

(0.34 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used to compute basic and diluted |

|

|

108,478,361 |

|

|

|

66,535,000 |

|

|

|

91,106,853 |

|

|

|

59,224,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above table provides certain non-GAAP financial measures that include adjustments to GAAP

figures. StemCells, Inc. believes that these non-GAAP financial measures, when considered together

with the GAAP figures, can enhance an overall understanding of StemCells, Inc.’s financial

performance and its prospects for the future. The non-GAAP financial measures are included with the

intent of providing investors with a more complete understanding of operational results and trends.

We believe excluding these items provides important insight into our operational results, important

for a company at our stage in development. In addition, these non-GAAP financial measures are among

the indicators StemCells, Inc. management uses for planning and forecasting purposes and measuring

the Company’s performance. These non-GAAP financial measures are not intended to be considered in

isolation or as a substitute for GAAP figures.

#####

4

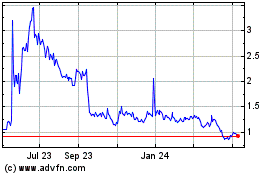

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

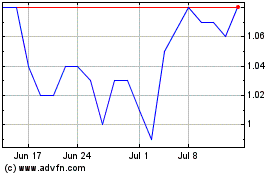

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Apr 2023 to Apr 2024