SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

(Amendment No. ___)*

Searchlight Minerals Corp.

(Name of Issuer)

Common Stock, par value $.001

(Title of Class of Securities)

812224202

(CUSIP Number)

Martin B. Oring

7582 Hawks Landing Drive, West Palm Beach,

FL 33412

(561) 624-9897

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 20, 2015

(Date of Event which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box x.

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are

to be sent.

*The remainder of this cover page shall be filled out for a

reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| 1. |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Martin B. Oring |

| |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

(a) o |

| |

(b) x |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS* |

| |

PF, OO |

| |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS |

| |

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Florida |

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

| |

|

| 7. |

SOLE VOTING POWER |

| |

4,841,500 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

4,219,286 |

| |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

4,841,500 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

4,219,286 |

| |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

9,060,786 |

| |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES* o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

5.40% |

| |

|

| 14. |

TYPE OF REPORTING PERSON* |

| |

IN |

*SEE INSTRUCTIONS BEFORE FILLING OUT!

| 1. |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Martin Oring Financial Trust, Dated December 20,

2006 |

| |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

(a) o |

| |

(b) x |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS* |

| |

PF, OO |

| |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS |

| |

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Florida |

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

971,410 |

| |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

971,410 |

| |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

971,410 |

| |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES* o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0.60% |

| |

|

| 14. |

TYPE OF REPORTING PERSON* |

| |

OO |

*SEE INSTRUCTIONS BEFORE FILLING OUT!

| 1. |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Wealth Preservation Defined Benefit Plan |

| |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

(a) o |

| |

(b) x |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS* |

| |

PF, OO |

| |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS |

| |

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

New Jersey |

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

2,430,110 |

| |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

2,430,110 |

| |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

2,430,110 |

| |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES* o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

1.50% |

| |

|

| 14. |

TYPE OF REPORTING PERSON* |

| |

OO |

*SEE INSTRUCTIONS BEFORE FILLING OUT!

| 1. |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Wealth Preservation, LLC |

| |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

(a) o |

| |

(b) x |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS* |

| |

OO |

| |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS |

| |

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

New Jersey |

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

1,609,176 |

| |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

1,609,176 |

| |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

1,609,176 |

| |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES* o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0.99% |

| |

|

| 14. |

TYPE OF REPORTING PERSON* |

| |

OO |

*SEE INSTRUCTIONS BEFORE FILLING OUT!

| 1. |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| |

Olivia Oring |

| |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

| |

(a) o |

| |

(b) x |

| |

|

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS* |

| |

PF, OO |

| |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS |

| |

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) o |

| |

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Florida |

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

| |

|

| 7. |

SOLE VOTING POWER |

| |

0 |

| |

|

| 8. |

SHARED VOTING POWER |

| |

5,190,696 |

| |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| |

|

| 10. |

SHARED DISPOSITIVE POWER |

| |

5,190,696 |

| |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

5,190,696 |

| |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES* o |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

3.17% |

| |

|

| 14. |

TYPE OF REPORTING PERSON* |

| |

IN |

*SEE INSTRUCTIONS BEFORE FILLING OUT!

ITEM 1. Security and Issuer.

This statement relates to the shares of common stock, $.001

par value, ("Common Stock") of Searchlight Minerals Corp. (the "Issuer"). The Issuer's principal

executive office is located at #120 - 2441 West Horizon Ridge Pkwy., Henderson, Nevada 89052.

ITEM 2. Identity and Background.

(a)-(c) and (f) The names of the persons filing this statement

on Schedule 13D are (collectively, the “Reporting Persons”):

| |

• |

Martin B. Oring, a United States citizen (“Mr. Oring”); |

| |

• |

Olivia Oring, a United States citizen (“Mrs. Oring”); |

| |

• |

Wealth Preservation Defined Benefit Plan, a defined benefit plan of Wealth Preservation, LLC (the “Benefit Plan”); |

| |

• |

Wealth Preservation, LLC, a limited liability company originally formed in New Jersey (“Wealth Preservation, LLC”); and |

| |

• |

Martin Oring Financial Trust, Dated December 20, 2006, an irrevocable trust (the “Financial Trust”). |

Mr. Oring is the President, Chief Executive

Officer and a member of the board of directors of the Issuer. Mr. Oring is married to Mrs. Oring. The principal address of Mr.

and Mrs. Oring is 7582 Hawks Landing Drive, West Palm Beach, FL 33412. Mrs. Oring is a trustee of the Financial Trust, which is

an irrevocable trust created for the benefit of Mr. Oring’s children and grandchildren. The Financial Trust’s business

address is 7582 Hawks Landing Drive, West Palm Beach, FL 33412. Mr. and Mrs. Oring are the sole members of Wealth Preservation,

LLC, and Mr. Oring is the managing member. Wealth Preservation, LLC is a private company that engages in the consulting and investing

services of Mr. Oring. Wealth Preservation, LLC’s business address is 7582 Hawks Landing Drive, West Palm Beach, FL 33412.

Mr. and Mrs. Oring are the trustees and sole beneficiaries of the Benefit Plan, which is a defined benefit plan of Wealth Preservation,

LLC. The Benefit Plan’s business address is 7582 Hawks Landing Drive, West Palm Beach, FL 33412.

Mr. and Mrs. Oring may each be deemed to

have voting and dispositive power with respect to the securities held by the Wealth Preservation, LLC and the Benefit Plan. Mr.

Oring may be deemed to have voting and dispositive power with respect to the securities held in his name. Mrs. Oring may be deemed

to have voting and dispositive power with respect to the securities held by Financial Trust, and the securities held in her name.

(d) During the last five years, none of the Reporting Persons

has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, none of the Reporting Persons

has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

ITEM 3. Source and Amount of Funds or Other Consideration.

All shares of Common Stock, warrants to purchase Common Stock,

shares of restricted Common Stock, and options to purchase Common Stock beneficially owned by the Reporting Persons were granted

to the Reporting Persons by the Issuer in respect of the Mr. Oring’s services as an officer and/or director of the Issuer,

and shares either granted or issuable pursuant to certain financings in the Issuer that one or more of the Reporting Person’s

has participated in, which is described in Item 6 below. As to the Reporting Persons’ participations in financings of the

Issuer, the source of funds has been the Reporting Persons personal funds. No loans were taken out by the Reporting Persons to

support the acquisition of securities in the Issuer.

ITEM 4. Purpose of Transaction.

Mr. Oring is the Issuers Chief Executive Officer and President,

and a member of the Issuer’s board of directors. All of the shares of Common Stock reported herein as being beneficially

owned by the Reporting Persons were acquired for investment purposes and/or as compensation for Mr. Oring’s services as a

director and officer of the Issuer.

The Reporting Persons may, from time to time, depending on market

conditions and other factors deemed relevant by the Reporting Persons, acquire additional equity of the Issuer or dispose of the

equity of the Issuer. The Issuer may, from time to time, grant additional equity to the Reporting Persons in consideration of Mr.

Oring’s services to the Issuer. The Reporting Persons reserve the right to, and may in the future choose to, change their

purposes with respect to their investments and take such action as they deem appropriate in light of the circumstances, including

without limitation, to dispose of, in the open market, in a private transaction or by gift, all or a portion of the Issuer equity

which the Reporting Person owns or may hereafter acquire.

All of the acquisitions by the Reporting Persons of the Issuer’s

securities have also been contemporaneously disclosed in Form 4s filed by Mr. Oring over the years as necessary. On December 19,

2015, Mr. Oring will become eligible to exercise 2,000,000 options of the Issuer. As of October 20, 2015, Mr. Oring is within sixty

days of being able to exercise such options, and is thus deemed a beneficial owner for reporting purposes, as of that date, of

an aggregate total of approximately 5.40% of the total issued and outstanding shares of Common Stock, triggering this filing.

Except as described herein, the Reporting Persons do not have

any present plans or proposals that relate to, or would result in, the acquisition of additional securities of the Issuer, the

disposition of securities of the Issuer, an extraordinary corporate transaction involving the Issuer or any of its subsidiaries,

a sale or transfer of a material amount of the Issuer’s or any of its subsidiaries’ assets, a change in the present

board of directors or management of the Issuer, a material change in the present capitalization or dividend policy of the Issuer,

any other material change to the Issuer’s business or corporate structure, a change in the Issuer’s charter or bylaws

or other actions which may impede the acquisition of control of the Issuer by any person, the delisting or deregistration of any

of the Issuer’s securities or any action similar to the listed actions.

ITEM 5. Interest in Securities of the Issuer.

(a) The Reporting Persons beneficially own:

(i) Mr. Oring may be deemed to beneficially own

9,060,756 shares of Common Stock representing 5.40% of all of the outstanding shares of Common Stock. The 9,055,036 shares consist

of: (1) 305,000 shares of Common Stock, of which 130,000 are jointly owned with Mrs. Oring, and 50,000 are owned by Mrs. Oring;

(2) 4,654,000 options to purchase Common Stock; (3) 62,500 warrants exercisable into Common Stock; (4) 22,550 shares of Common

Stock beneficially owned by the Benefit Plan; (5) Convertible Notes beneficially owned by the Benefit Plan, convertible into 147,435

shares of Common Stock; (6) 260,125 warrants exercisable into shares of Common Stock beneficially owned by the Benefit Plan; (7)

2,000,000 options to purchase Common Stock beneficially owned by the Benefit Plan; (8) 500,000 shares of Common Stock beneficially

owned by Wealth Preservation, LLC; and (9) 1,109,176 options to purchase Common Stock beneficially owned by Wealth Preservation,

LLC.

(ii) Mrs. Oring may be deemed to beneficially own 5,190,696

shares of Common Stock representing approximately 3.17% of all of the outstanding shares of Common Stock. The 5,184,946 shares

consist of: (1) 180,000 shares of Common Stock, of which 130,000 are jointly owned with Mr. Oring; (2) 22,550 shares of Common

Stock beneficially owned by the Benefit Plan; (3) Convertible Notes beneficially owned by the Benefit Plan, convertible into 147,435

shares of Common Stock; (4) 260,125 warrants exercisable into shares of Common Stock beneficially owned by the Benefit Plan; (5)

2,000,000 options to purchase Common Stock beneficially owned by the Benefit Plan; (6) ) 500,000 shares of Common Stock beneficially

owned by Wealth Preservation, LLC; (7) 1,109,176 options to purchase Common Stock beneficially owned by Wealth Preservation, LLC;

(8) 388,435 shares of Common Stock beneficially owned by the Financial Trust; (9) Convertible Notes beneficially owned by the Financial

Trust, convertible into 545,512 shares of Common Stock; and (10) 37,463 warrants exercisable into Common Stock beneficially owned

by the Financial Trust.

(iii) The Benefit Plan may be deemed to beneficially

own 2,430,110 shares of Common Stock representing approximately 1.50% of all of the outstanding shares of Common Stock. The 2,430,110

shares consist of: (1) 22,550 shares of Common Stock; (2) Convertible Notes convertible into 147,435 shares of Common Stock; (3)

260,125 warrants exercisable into shares of Common Stock; and (4) 2,000,000 options to purchase Common Stock.

(iv) Wealth Preservation, LLC may be deemed to beneficially

own 1,609,176 shares of Common Stock representing approximately 0.99% of all of the outstanding shares of Common Stock. The 1,609,176

shares consist of: (1) 500,000 shares of Common Stock; and (2) 1,109,176 options to purchase Common Stock.

(v) The Financial Trust may be deemed to beneficially

own 971,410 shares of Common Stock representing 0.60% of all of the outstanding shares of Common Stock. The 971,410 shares consist

of: (1) 388,435 shares of Common Stock; (2) Convertible Notes convertible into 545,512 shares of Common Stock; and (3) 37,463 warrants

exercisable into Common Stock.

(b) The Reporting Persons have voting power

as described below:

(i) Mr. Oring has sole power to vote or direct the vote

of (1) 125,000 shares of Common Stock; (2) 4,654,000 options to purchase Common Stock; and (3) 62,500 warrants exercisable into

Common Stock.

(ii) Mr. and Mrs. Oring have shared power to vote or

direct the vote of 130,000 shares of Common Stock, and the 50,000 shares of Common Stock owned by Ms. Oring.

(iii) Mr. Oring, Mrs. Oring, and the Benefit Plan have

shared power to vote or direct the vote of the 2,430,110 shares of Common Stock beneficially owned by the Benefit Plan.

(iv) Mr. Oring, Mrs. Oring and Wealth Preservation,

LLC have shared power to vote or direct the vote of the 1,609,176 shares of Common Stock beneficially owned by Wealth Preservation,

LLC.

(v) Mrs. Oring and the Financial Trust have shared power

to vote or direct the vote of the 971,410 shares of Common Stock beneficially owned by the Financial Trust.

(c) Except for 2,000,000 options to purchase common stock that

were granted to the Benefit Plan on August 28, 2015, and become vested and exercisable on December 19, 2015, and the September

18, 2015, interest payment on the Convertible Notes, both of which are described in Item 6 below, there have been no transactions

effected by the Reporting Persons during the past sixty (60) days.

(d) Not applicable.

(e) Not applicable.

| ITEM 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Pursuant to a private placement of the Issuer completed on January

18, 2006, Mr. Oring purchased one (1) unit at a price of $45,000 per unit, with each unit consisting of 100,000 shares of the Issuer’s

Common Stock and Common Stock purchase warrants entitling the stockholder to purchase 100,000 additional shares of Common Stock

at a price of $0.65 per share.

Pursuant to a private placement

of the Issuer completed on February 23, 2007 Mr. Oring purchased units at a price of $3.00 per unit, with each unit consisting

of one share of our common stock and one half of one share purchase warrant. Mr. Oring purchased 155,000 units in the offering,

consisting of 155,000 shares of Common Stock, and 62,500 warrants, currently exercisable into Common Stock at $1.85 per share.

From time to time, the Reporting Persons received options to

purchase Common Stock in the Issuer in consideration for Mr. Oring’s services to the Issuer as an officer and director, pursuant

to various incentive plans of the Issuer. Pursuant to the 2007 Plan (the “2007 Plan”), Wealth Preservation,

LLC was granted the following options to purchase Common Stock: (1) 150,000 options at an exercise price of $1.45, issued on October

2, 2008; and (2) 100,000 options at an exercise price of $1.22, issued September 21, 2011. Under the terms of the 2007 Plan, options

to purchase up to 4,000,000 shares of Common Stock may be granted to eligible participants. Under the 2007 Plan, the option price

for incentive stock options is the fair market value of the stock on the grant date and the option price for non-qualified stock

options shall be no less than 85% of the fair market value of the Common Stock on the grant date. The maximum term of the options

under the 2007 Plan is ten years from the grant date. The 2007 Plan was approved by the Issuer’s stockholders on June 15,

2007.

Pursuant to the 2009 Directors Plan (the “2009 Directors

Plan”), Wealth Preservation, LLC was granted the following option to purchase Common Stock: (1) 15,000 options at an

exercise price of $1.20, issued on March 31, 2010; (2) 25,714 options at an exercise price of $0.70, issued June 30, 2010; and

(3) 18,462 options at an exercise price of $0.975, issued on September 30, 2010. The terms of the 2009 Directors Plan, as amended,

allow for up to 2,750,000 options to be issued to eligible participants. Under the 2009 Directors Plan, the exercise price may

not be less than 100% of the fair market value of the Issuer’s Common Stock on the grant date and the term may not exceed

ten years. No participants shall receive more than 250,000 options under the 2009 Directors Plan in any one calendar year. The

plan was approved by the Issuer’s stockholders on December 15, 2009 and the amendment was approved by the Isssuer’s

stockholders on May 8, 2012.

Pursuant to the 2009 Incentive Plan (the “2009 Incentive

Plan”), on September 21, 2011, Wealth Preservation, LLC was granted options to purchase 500,000 shares of Common Stock,

exercisable at $1.22 per share. The terms of the 2009 Incentive Plan, as amended, allow for up to 7,250,000 options to be issued

to eligible participants. Under the 2009 Incentive Plan, the exercise price is generally equal to the fair market value of the

Issuer’s Common Stock on the grant date and the maximum term of the options is generally ten years. No participants shall

receive more than 500,000 options under this plan in any one calendar year. For grantees who own more than 10% of the Issuer’s

Common Stock on the grant date, the exercise price may not be less than 110% of the fair market value on the grant date and the

term is limited to five years. The plan was approved by the Issuer’s stockholders on December 15, 2009 and the amendment

was approved by the Company’s stockholders on May 8, 2012.

On March 3, 2009, Mr. Oring transferred 105,000 shares of Common

Stock, at $1.60 per share, to the Financial Trust. On June 17, 2010, Mr. Oring gifted 200,000 shares of Common Stock, at $0.70

per share, to the Financial Trust.

On October 1, 2010, Wealth Preservation, LLC was issued options

to purchase 300,000 shares of Common Stock, exercisable at $0.91.

As of May 21, 2012, Mr. Oring held 255,000 shares of Common

Stock, 130,000 shares of which are jointly held with Mrs. Oring. On May 21, 2012, Mrs. Oring purchased an aggregate of 50,000 shares

of Common Stock. 2,500 shares were purchased for $0.945 per share, 10,000 were purchased for $0.95 per share, and 37,500, were

purchased for $0.96 per share.

On September 18, 2013, the Issuer completed a private placement

(the "Offering") of secured convertible promissory notes, convertible into shares of Common Stock at a conversion

price of $0.39 per share, as adjusted (the "Convertible Notes"). The Convertible Notes contain anti-dilution rights.

The purchase agreement for the Convertible Notes contains representations and warranties that are customary for transaction of

the type contemplated in connection with the sale of the Convertible Notes. The Convertible Notes are (i) guaranteed by two wholly-owned

subsidiaries of the Issuer (the “Subsidiary Guarantors”) pursuant to the terms of subsidiary guaranties; (ii) secured

by certain collateral of the Issuer and the Subsidiary Guarantors pursuant to a Pledge and Security Agreement; and (iii) secured

by deeds of trust with respect to property located in Arizona and Nevada by the Subsidiary Guarantors owned such properties.

Pursuant to the registration rights agreement (the “Note

Share Registration Rights Agreement”), the Issuer agreed to file a registration statement covering the resale of the

shares of Common Stock issuable upon conversion of the Convertible Notes. The issuer also agreed to file and keep continuously

effective such additional registration statements until all of the shares of Common Stock registered thereunder have been sold

or may be sold without volume restrictions pursuant to Rule 144 of the Securities Act. The purchasers of the Convertible Notes

will also be granted piggyback registration rights with respect to such shares. Pursuant to the Note Shares Registration Rights

Agreement, the Issuer must pay certain partial liquidated damages to the Note Purchasers if the registration statement is not filed

with, or declared effective by, the Securities and Exchange Commission (“SEC”) within certain prescribed periods.

The Financial Trust and the Benefit Plan purchased an aggregate

of $235,000 of Convertible Notes (the "Initial Investment"). Pursuant to the terms of the transaction documents

governing the Offering, The Financial Trust and the Benefit Plan had the right purchase an additional principal amount of 7% Convertible

Notes in the aggregate amount of not greater than fifteen percent (15%) of the Initial Investment, during the one year period following

the closing of the Offering. Convertible Notes in the amount of $185,000 (convertible into approximately 474,359 shares) were initially

purchased by the Financial Trust, which had the right to purchase an additional $27,750 of Convertible Notes (convertible into

approximately 71,153 shares). Convertible Notes in the amount of $50,000 (convertible into approximately 128,205 shares) were initially

purchased by the Benefit Plan, which had the right to purchase an additional $7,500 of Convertible Notes (convertible into approximately

19,230 shares). On September 9, 2014, the Financial Trust and the Benefit Plan exercised such options and purchased an aggregate

of $35,250 in additional Convertible Notes.

On September 18, 2014, certain “Units” each

consisting of one share of common stock and one half of a common stock purchase warrant, where each full warrant will entitle the

warrant holder to purchase one share of the Company's common stock at an exercise price of $0.30 per share, were purchase by the

Financial Trust and the Benefit Plan. 32,375 Units, which include 32,375 shares of Common Stock and 16,188 warrants, were purchased

by the Financial Trust for $0.20 per Unit in consideration for the cancellation of $6,475 in debt owing by the Issuer to the Financial

Trust for September 18, 2014 interest payments due on the Convertible Notes. 8,750 Units, which include 8,750 shares of Common

Stock and 4,375 warrants, were purchased by the Benefit Plan for $0.20 per Unit in consideration for the cancellation of $1,750

in debt owing by the Issuer to the Benefit Plan for September 18, 2014 interest payments due on the Convertible Notes. On October

7, 2014, and additional 500,000 Units, which include 500,000 shares of Common Stock and 250,000 warrants, were purchased by the

Benefit Plan for $0.20 per Unit in cash.

On December 18, 2014, Mr. Oring was granted options to purchase

up to 3,500,000 shares of Common Stock, at an exercise price of $0.41 per share, for his service as a director of the Company.

Of these 3,500,000 options, 500,000 were granted pursuant to the 2009 Incentive Plan, and 1,500,000 were granted pursuant to the

2007 Plan. On December 23, 2014, Mr. Oring was granted options to purchase up to 1,154,000 shares of Common Stock, at an exercise

price of $0.50 per share. All options are vested and expire on the five year anniversary of the date of grant.

On March 18, 2015, 8,025 shares of Common Stock were purchased

by the Benefit Plan for $0.25 per share in consideration for the cancellation of $2,013 in debt owing by the Issuer to the Benefit

Plan for March 18, 2015 interest payments due on the Convertible Notes.

On March 18, 2015, 29,785 shares of Common Stock were purchased

by the Financial Trust for $0.25 per share in consideration for the cancellation of $7,446 in debt owing by the Issuer to the Financial

Trust for March18, 2015 interest payments due on the Convertible Notes.

On August 28, 2015, the Benefit Plan was granted options to

purchase up to 2,000,000 shares of Common Stock, at an exercise price equal to the greater of: (i) $0.50; and (ii) the fair market

value of the Issuer’s Common Stock based on the closing price on December 18, 2015. The options shall vest and become exercisable,

in whole or in part, from and after December 19, 2015, so long as Mr. Oring has continually provided services to the Issuer in

the same capacity from the date of the issuance through December 19, 2015.

On September 18, 2015, the Issuer made an interest payment on

the Convertible Notes. 21,275 Units, which include 21,275 shares of Common Stock and 21,275 warrants, were purchased by the Financial

Trust for $0.35 per Unit in consideration for the cancellation debt owing by the Issuer to the Financial Trust for September 18,

2015 interest payments due on the Convertible Notes. 5,750 Units, which include 5,750 shares of Common Stock and 5,750 warrants,

were purchased by the Benefit Plan for $0.35 per Unit in consideration for the cancellation debt owing by the Issuer to the Benefit

Plan for September 18, 2015 interest payments due on the Convertible Notes.

As of October 30, 2015, the registrant had 159,364,966 outstanding

shares of Common Stock. On December 19, 2015, the Benefit Plan will become eligible to exercise 2,000,000 options of the Issuer.

As of October 20, 2015, Mr. Oring is within sixty days of being able to exercise such options, and is thus deemed a beneficial

owner for reporting purposes, as of that date, of an aggregate total of approximately 5.40% of the total issued and outstanding

shares of Common Stock, triggering this filing.

All of the aforementioned information has also been contemporaneously

disclosed in Form 4s filed by Mr. Oring over the years as necessary. The descriptions of the certain agreements, plans and other

contracts referenced herein are not intended to be complete and are qualified in their entirety by the text of such agreements,

filed as exhibits to the Issuer’s publically available filings with the SEC.

| ITEM 7. |

Material to be Filed as Exhibits. |

| · | Exhibit A - Joint Filing Agreement |

| · | Exhibit B - Note Purchase Agreement, dated as of September 18, 2013 (incorporated by reference to Exhibit 10.1 to the Issuer’s

Form 8-K, filed with the SEC on September 24, 2013) |

| · | Exhibit C - Form of Convertible Note (incorporated by reference to Exhibit 10.2 to the Issuer’s Form 8-K filed with the

SEC on September 24, 2013) |

| · | Exhibit D – Note Share Registration Rights Agreement, dated as of September 18, 2013 (incorporated by reference to Exhibit

10.3 to the Issuer’s Form 8-K filed with the SEC on September 24, 2013) |

SIGNATURES

After reasonable inquiry and to the best of its knowledge and

belief, the undersigned each certifies that the information with respect to it set forth in this statement is true, complete and

correct.

Dated: October 30, 2015

Martin B. Oring

By: /s/ Martin B. Oring

Olivia Oring

By: /s/ Olivia Oring

Martin Oring

Financial Trust, Dated December 20, 2006

By: /s/ Olivia Oring

Martin B. Oring

Co-Trustee

Wealth Preservation

Defined Benefit Plan

By: /s/ Martin B. Oring

Martin B. Oring

Co-Trustee

By: /s/ Olivia Oring

Martin B. Oring

Co-Trustee

Wealth Preservation,

LLC

By: /s/ Martin B. Oring

Martin B. Oring

Managing Member

EXHIBIT A

JOINT FILING AGREEMENT

The undersigned hereby agree that the statement on Schedule

13D with respect to the Common Stock of Searchlight Minerals Corp. dated as of October 30, 2015 is, and any further amendments

thereto signed by each of the undersigned shall be, filed on behalf of each of the undersigned pursuant to and in accordance with

the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended.

Dated: October 30, 2015

Martin B. Oring

By: /s/ Martin B. Oring

Olivia Oring

By: /s/ Olivia Oring

Martin Oring

Financial Trust, Dated December 20, 2006

By: /s/ Olivia Oring

Martin B. Oring

Co-Trustee

Wealth Preservation

Defined Benefit Plan

By: /s/ Martin B. Oring

Martin B. Oring

Co-Trustee

By: /s/ Olivia Oring

Martin B. Oring

Co-Trustee

Wealth Preservation,

LLC

By: /s/ Martin B. Oring

Martin B. Oring

Managing Member

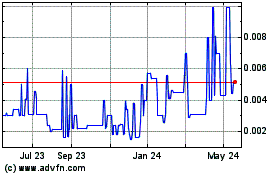

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

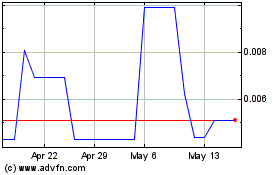

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024