UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): October 27, 2015

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction

of Incorporation)

|

| | |

| | |

001-16435 | | 59-2389435 |

(Commission File Number) | | (IRS Employer Identification No.) |

| |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On October 28, 2015, Chico’s FAS, Inc., (the “Company”), announced that David F. Dyer resigned as President and Chief Executive Officer of the Company, effective as of December 1, 2015, the date on which a successor President and Chief Executive Officer will assume the position, as described below. Effective December 1, 2015, Mr. Dyer will become Vice Chair of the Board of Directors.

(c) On October 28, 2015, the Company announced that its Board of Directors has appointed Shelley Broader as the Company’s new President and Chief Executive Officer, effective as of December 1, 2015. Ms. Broader, 51, is joining the Company after having served as President and Chief Executive Officer of the Wal-Mart Stores, Inc. ("Walmart") Europe, Middle East and Sub-Saharan Africa ("EMEA") region since 2014. Previously she served Walmart in various roles since 2010, including as President and Chief Executive Officer of Walmart Canada from 2011 to 2014, Chief Merchandising Officer for Walmart Canada from 2010 to 2011, and Senior Vice President for Sam’s Club in 2010. Prior to joining Walmart in 2010, Ms. Broader was President and Chief Operating Officer of The Michaels Companies, Inc. ("Michaels") from 2008 to 2009. Before joining Michaels, Ms. Broader enjoyed a 17-year career with Delhaize Group where, under the Hannaford banner, she held a range of leadership roles across the Company’s operations, merchandising, distribution, strategy and marketing divisions. Ms. Broader is a member of the board of directors of Raymond James Financial, Inc. In connection with Ms. Broader's appointment, the Chico's FAS Board of Directors was assisted in its previously announced CEO search process by leading executive search firm, Herbert Mines Associates.

There is no arrangement or understanding between Ms. Broader and any other persons pursuant to which Ms. Broader was selected as an officer. Neither Ms. Broader nor any related person of Ms. Broader has a direct or indirect material interest in any existing or currently proposed transaction to which the Company is or may become a party. Ms. Broader is not related to any of the executive officers or directors of the Company.

The Company has entered into a letter agreement on October 27, 2015 with Ms. Broader, which provides for an annual salary and certain other benefits. Pursuant to the letter agreement, Ms. Broader’s base salary is $1,100,000 and is subject to annual increases as set from time to time by the Company’s Board of Directors. Upon commencement of employment, Ms. Broader will be awarded a sign-on bonus of $1,030,000, which is subject to repayment terms if she voluntarily resigns from the Company within 24 months of her start date. Additionally, Ms. Broader will be awarded a sign-on grant of restricted shares of the Company’s common stock on the first business day of the month after her employment commencement date with a fair market value of $3,000,000, which will vest 25% on the first anniversary of the grant date, 25% on the second anniversary of the grant date, and the remaining 50% on the third anniversary of the grant date. Ms. Broader is also eligible for an annual bonus under the Company’s Amended and Restated Cash Bonus Incentive Plan with a target of 150% of her base salary, with a range from 0% to 175% of her target, if earned, provided that she is entitled to minimum guaranteed bonuses of $275,000 for fiscal 2015 and $1,375,000 for fiscal 2016. Ms. Broader will be awarded an equity grant on March 1, 2016 with a fair market value of $6,500,000, which will be comprised of 50% restricted shares of the Company’s common stock and 50% performance share units, which, if earned, will vest in equal annual amounts over a period of three years. Under the terms of the Company’s Executive Severance Plan, if employment is terminated at any time without good cause, Ms. Broader would be entitled to receive benefits, including among other benefits, continuation of base salary for 24 months as described in the Company’s Executive Severance Plan. A copy of the Executive Severance Plan, revised as of October 15, 2015 is included as Exhibit 10.2 to this Form 8-K.

The foregoing description of the letter agreement is not complete and is qualified in its entirety by reference to the full text of such agreement included as Exhibit 10.1 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

|

| | |

| | |

Exhibit 10.1 | | Employment letter agreement between the Company and Shelley Broader |

Exhibit 10.2 | | Fifth Amendment to Chico's FAS, Inc. Executive Severance Plan |

Exhibit 99.1 | | Chico’s FAS, Inc. Press Release dated October 28, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | CHICO’S FAS, INC. |

| | | |

Date: October 30, 2015 | | | | By: | | /s/ Todd E. Vogensen |

| | | | | Todd E. Vogensen |

| | | | | | Executive Vice President, Chief Financial Officer and Assistant Corporate Secretary |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| |

Exhibit 10.1 | | Employment letter agreement between the Company and Shelley Broader |

Exhibit 10.2 | | Fifth Amendment to Chico's FAS, Inc. Executive Severance Plan |

Exhibit 99.1 | | Chico’s FAS, Inc. Press Release dated October 28, 2015 |

Shelley Broader

October 26, 2015

Page -1-

Exhibit 10.1

October 26, 2015

Shelley Broader

XXXXXXXXXX

XXXXX, XX XXX-XXX

Re: Offer Letter

Dear Shelley:

I am pleased to offer you employment as Chief Executive Officer and President of Chico’s FAS, Inc. (“Chico’s”). This letter sets forth the terms and conditions of your employment with Chico’s commencing December 1, 2015. Your signature where indicated signifies your acceptance of the following:

| |

1) | Position. Your position will be as Chief Executive Officer and President (collectively, “CEO”) of Chico’s FAS, Inc. You will be expected to devote your full working time to the successful conduct of the business of Chico’s. In your capacity as CEO, you will report directly to Chico’s FAS, Inc.’s Board of Directors and will be the highest reporting officer in Chico’s. Your authority and duties will be commensurate with those customarily exercised by the chief executive officer of a company. Your specific duties will be determined by Chico’s FAS, Inc.’s Board of Directors. |

You may continue to serve on Raymond James Financial, Inc.’s Board of Directors. Additionally, subject to the approval of Chico’s FAS, Inc.’s Board, you may serve on one or more outside boards of directors or trustees for private companies or charitable organizations.

| |

a) | Base Salary. For all services rendered by you to Chico’s during the period of your employment, you shall receive base salary at a rate of $1,100,000 per year (“Base Salary”), payable in accordance with Chico’s then existing payroll practices, less such deductions as are authorized or required by law. Your Base Salary shall be subject to periodic review on the same cycle as occurs with other Chico’s senior executives with any future increases to be made at the discretion of the Compensation and Benefits Committee of Chico’s FAS, Inc.’s Board of Directors. |

Chico's FAS Inc. · 11215 Metro Parkway · Fort Myers, Florida 33966 · (239) 277-6200

Shelley Broader

October 26, 2015

Page -2-

| |

b) | Incentive Cash Bonus. Your Cash Bonus at Target is 150% of Base Salary. Actual bonus may range from 0 - 175% of Target, contingent upon the achievement of certain performance goals consistent with the goals for other Chico's executives as established each year by the Compensation and Benefits Committee of Chico’s FAS, Inc.’s Board of Directors. Company performance below established levels will result in no bonus payout. Achievement of results at Threshold is 25% of Target (37.5% of Base Salary). Achievement of results beyond Target may pay up to 175% of Target. Payouts normally occur at or around the time of Chico’s earnings release in early March. The terms of the bonus, including eligibility, payouts and objectives, may be modified from time to time. For fiscal year 2015, you are guaranteed a minimum incentive bonus of $275,000. For fiscal year 2016, you are guaranteed a minimum bonus of $1,375,000 with a maximum bonus opportunity of 175% of Target depending upon Chico’s overall financial results. These guaranteed bonuses may not be modified without your consent. |

| |

3) | Equity Award. Following your commencement of employment with Chico’s, you will receive an equity award designed to deliver approximately $6.5 million in value on the grant date. The grant date will be March 1, 2016 and the grant price will be the closing price of Chico’s FAS, Inc.’s stock on the grant date. The actual number of shares awarded will depend on the share price on the grant date. Approximately 50% of the equity award will be in the form of restricted stock (“RSAs”). The restricted stock will vest over a 3-year period with one-third of the restricted stock grant vesting on each anniversary of the grant date. The balance of the equity award will be in the form of performance share units (“PSUs”). The PSUs will also vest over a three-year period, contingent upon the achievement of corporate financial objectives. You will have the opportunity to earn between 0% - 150% of the target PSUs awarded with the actual number of PSUs earned based on fiscal year 2016 RONA performance. If threshold RONA is not achieved, no PSUs will be earned. If earned, the PSUs will vest over a 3-year period with one-third of the earned PSUs vesting on each anniversary of the grant date. All PSUs and RSAs are governed by and subject to the terms and conditions of Chico’s FAS, Inc.’s 2012 Omnibus Stock and Incentive Plan, as amended (“Stock Plan”). You will be eligible for future equity awards at the discretion of the Compensation and Benefits Committee of the Chico’s FAS, Inc. Board of Directors. |

| |

4) | Sign-On Cash Bonus. You will receive a $1,030,000 million bonus, less applicable taxes, payable to you in a single, lump sum payment, but only if you establish residency for you and your family within the United States, and relocate your and your family’s residency to the Fort Myers, Florida area. Payment is due 30 days after both have occurred. You will be required to repay 100% of the cash sign-on bonus if you resign employment with Chico’s without “Good Reason” (as defined in Chico’s FAS, Inc. Executive Severance Plan, Effective March 1, 2008, as amended (“Severance Plan”)) prior to the first anniversary of the date of your initial employment with Chico’s. If you resign employment with Chico’s without Good Reason after the first anniversary of the date of your initial employment with Chico’s, but |

Chico's FAS Inc. · 11215 Metro Parkway · Fort Myers, Florida 33966 · (239) 277-6200

Shelley Broader

October 26, 2015

Page -3-

prior to the second anniversary of the date of your initial employment with Chico’s, you will be required to repay 50% of the cash sign-on bonus.

| |

5) | Sign-On Grant of Restricted Stock. You will also receive a sign-on equity award in the form of restricted stock designed to deliver approximately $3 million in value on the grant date. The grant date will be the first business day of the month after your employment commencement date and the grant price will be the closing price of Chico’s FAS, Inc. stock on the grant date. The restricted stock will vest over a 3-year period, with 25% of the restricted stock grant vesting on the first anniversary of the grant date, 25% of the restricted stock grant vesting on the second anniversary of the grant date, and the remaining 50% of the restricted stock grant vesting on the third anniversary of the grant date. The actual number of shares awarded will depend on the share price on the grant date. Should you resign employment for “Good Reason” (as defined in the Severance Plan), or be terminated without “Cause” (as defined by the Restricted Stock Agreement for the Stock Plan), any unvested restricted stock provided in this Paragraph shall become 100% vested. Except as otherwise provided in this Paragraph, all restricted stock awards are governed by and subject to the terms and conditions of the Stock Plan. |

| |

6) | Benefits. You will be entitled to participate in the various employee benefit plans and policies (including paid time off and holidays, 401k, stock purchase, health, life, and disability) which Chico’s may establish and modify from time to time for the benefit of other Chico’s executive employees, if and when you satisfy the eligibility requirements for such employee benefit plans and policies. Chico’s retains the right to amend, modify or terminate any employee benefits plans and policies in its sole discretion. |

| |

7) | Relocation Related Expenses. You will be relocating from Canada to the Fort Myers, Florida area by July 31, 2016. In connection with that relocation, Chico’s will reimburse you as follows: |

| |

a) | Relocation Expenses. Chico’s will reimburse you for relocation costs you incur with respect to your move from Canada to Florida, based on Chico’s Tier 1 relocation policy and subject to repayment as described in such policy. In light of the fact that you will be residing in Florida while your spouse and children temporarily remain in Canada so that your children may complete the school year already in progress, benefits outlined in the Tier 1 relocation policy will be modified so that: (i) Temporary Living will be extended through July 31, 2016; (ii) you will be provided up to 8 trips between Florida and Canada; and (iii) we will cover expenses both for your move and for your spouse and children’s move, if separate. |

| |

b) | Tax Preparation Services Reimbursement. You will be reimbursed for the cost of preparation of your 2015 and 2016 Canadian and United States tax returns by your tax accountant, which tax accountant will be approved by Chico’s. |

| |

c) | Mitigation of Taxes/Currency Exchange. Chico’s will reimburse you, grossed up for any US taxes: (i) for amounts you are required to pay in Canada as income tax |

Chico's FAS Inc. · 11215 Metro Parkway · Fort Myers, Florida 33966 · (239) 277-6200

Shelley Broader

October 26, 2015

Page -4-

associated with the deemed distribution of assets at the time your and your family’s residency in Canada is terminated; and (ii) in conjunction with the sale of your personal residence in Canada: (A) for income tax liability, if any, in the United States (and any state) because you are required to recognize discharge of indebtedness income as a result of the exchange rate between the US Dollar and the Canadian Dollar at the time of such sale, and (B) the loss to you, in US Dollars, on the value of your down-payment because the Canadian Dollar has decreased in value compared to the US Dollar between the date you purchased the home and the date you sell it. The reimbursement payment under this Paragraph will be net of any foreign tax credit utilized by you in the United States based upon the sourcing of income as between United States and Canada and will not exceed US$750,000.

| |

8) | Severance. You will be a participant in, and eligible for benefits under, the Severance Plan. For purposes of this offer letter, the definition of “Good Reason” in Section 3.02(e) of the Severance Plan shall be deemed amended by adding the following at the conclusion of the Section: “or (4) the Company’s fraudulent, criminal or other serious misconduct which would have a material adverse effect on the Company and which occurred prior to your becoming Chief Executive Officer and President of the Company.” Furthermore, a “Change in Control” as defined in the Stock Plan shall constitute “Good Reason” under Section 3.02(e)(1) of the Severance Plan. Any modification of the Severance Plan will not result in a lesser severance benefit to you, whether paid inside or outside of the Severance Plan. Your rights under the Stock Plan, including but not limited to your rights under Paragraph 5 hereof, will survive any separation and release agreement entered into pursuant to Exhibit A of the Severance Plan. |

| |

9) | 409A Compliance. Notwithstanding any provisions of this letter to the contrary and, to the extent applicable, this letter shall be interpreted, construed, and administered (including with respect to any amendment, modification, or termination of the letter), in such a manner so as to comply with the provisions of Code Section 409A and any related Internal Revenue Service guidance promulgated thereunder. In addition, for purposes of this letter, each amount to be paid or benefit to be provided to you pursuant to the letter, which constitutes deferred compensation subject to Code Section 409A, shall be construed as a separate identified payment for purposes of Code Section 409A. Notwithstanding anything in this letter to the contrary, in the event that you are a “specified employee” (as such term is defined in Section 409A(a)(2)(B)(i) of the Code), to the extent required in order to avoid accelerated taxation and/or tax penalties under Section 409A of the Code, any payment due and payable to you hereunder as a result of your severance from service with Chico’s shall not be made before the date which is six (6) months after such severance from service. |

Chico’s is an at-will employer. That means that either you or Chico’s are free to end the employment relationship at any time, with or without notice or cause. By accepting our offer of employment, you acknowledge the at-will nature of our relationship. Additionally, you represent that you are not a party to any agreement that would bar or limit the scope of your employment with Chico’s.

Chico's FAS Inc. · 11215 Metro Parkway · Fort Myers, Florida 33966 · (239) 277-6200

Shelley Broader

October 26, 2015

Page -5-

This letter contains the terms and conditions of our offer of employment to you and supersedes and cancels any prior or contemporaneous written or verbal agreements. This offer is valid until October 27, 2015, 5 p.m., Eastern Time. I look forward to receiving your confirmation as soon as possible. Should you accept this offer we would expect your start date to be on or before December 1, 2015.

Please indicate your acceptance of the above by signing below and returning to my attention.

Sincerely,

/s/ David F. Walker

David F. Walker

Chairman, Board of Directors

Chico’s FAS, Inc.

Accepted By: /s/ Shelley Broader

Shelley Broader

Date: 10/27/2015

Chico's FAS Inc. · 11215 Metro Parkway · Fort Myers, Florida 33966 · (239) 277-6200

Exhibit 10.2

FIFTH AMENDMENT

TO

CHICO’S FAS, INC. EXECUTIVE SEVERANCE PLAN

WHEREAS, Chico’s FAS, Inc. (the “Employer”) maintains the Chico’s FAS, Inc. Executive Severance Plan (the “Plan”) for the benefit of its eligible employees;

WHEREAS, the Employer deems it necessary and desirable to amend the Plan to provide that the Chief Executive Officer of the Employer is eligible to participate in the Plan; and

WHEREAS, this Fifth Amendment shall supersede the provisions of the Plan to the extent those provisions are inconsistent with the provisions of the amendment;

NOW, THEREFORE, by virtue of the authority reserved to the Employer by Section 7.01 of the Plan, the Plan is hereby amended, effective October 15, 2015, as follows:

| |

1. | The first paragraph of Section 3.01of the Plan is hereby amended in its entirety to read as follows: |

The Chief Executive Officer of the Sponsor and all Executive Vice Presidents, Senior Vice Presidents and Group Vice Presidents of Sponsor or Affiliate shall be eligible to participate in the Plan and to receive Benefits under the Plan, provided that they meet all the requirements stated herein, as determined by the Plan Administrator on a case-by-case basis and, further provided, that such Chief Executive Officer of the Sponsor and Executive Vice Presidents, Senior Vice Presidents and Group Vice Presidents of Sponsor or Affiliate are not already subject to an employment agreement or another arrangement with Sponsor or Affiliate that provides for severance benefits.

| |

2. | Section 4.01(a) of the Plan is hereby amended to add a new sentence to the end thereto which shall read as follows: |

Notwithstanding the preceding, a Terminated Employee who was the Chief Executive Officer of the Sponsor shall receive an amount equal to 24 months of the Employee’s Annual Base Salary.

| |

3. | Section 4.01(c) of the Plan is hereby amended in its entirety to read as follows: |

(c) COBRA Benefits.

For each Terminated Employee (other than the Chief Executive Officer of the Sponsor) who, upon such Employee’s Employment Termination Date, is enrolled in Sponsor or Affiliate’s Medical and Dental Insurance plans and, as a result is entitled to elect continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), Sponsor or Affiliate will fully subsidize the COBRA premium cost during the Severance Period. Thereafter, the Terminated Employee shall be responsible for paying 100% of the COBRA premium costs. The Chief Executive Officer of the Sponsor will receive a cash lump sum payment equal to the aggregate COBRA healthcare plan premium costs over the Severance Period regardless of whether the Chief Executive Officer of the Sponsor elects COBRA, with payment of such lump sum amount to be made in accordance with Section 5.01 of the Plan.

| |

4. | The second paragraph of Section 4.b. of Appendix A is hereby amended in its entirety to read as follows: |

During the twelve (12) month period [twenty-four (24) month period in the case of the Chief Executive Officer of the Sponsor] following Employee’s Employment Termination Date, Employee will not, directly or indirectly, for Employee or for others in any geographic area where Company engages or plans to engage in business:

i. perform any job, task, function, skill, or responsibility for a Competing Business that Employee has provided for Company in the 12-month period [24-month period in the case of the Chief Executive Officer of the Sponsor] preceding the Employee’s Employment Termination Date (for purposes herein, a Competing Business shall mean the following companies: __________________) [for purposes herein, in the case of the Chief Executive Officer of the Sponsor, Competing Business shall mean any direct competitor of Company which, in general terms, means a specialty retailer of better women’s apparel or better women’s intimate apparel, sleepwear and bath and body products]; or

ii. render advice or services to, or otherwise assist, any other person, association or entity in the business of “i” above.

| |

5. | Section 4.c. of Appendix A is hereby amended in its entirety to read as follows: |

c. Non-Solicitation of Employees. During the twelve (12) month period [twenty-four (24) month period in the case of the Chief Executive Officer of the Sponsor] following the Employee’s Employment Termination Date for any reason, Employee will not, either directly or indirectly, call on, solicit, or induce any other employee or officer of the Company whom Employee had contact with, knowledge of, or association with in the

course of employment with Company to terminate his or her employment, and will not assist any other person or entity in such a solicitation.

IN WITNESS WHEREOF, the Employer has caused this amendment to be executed by a duly authorized representative this 15th day of October, 2015.

Chico’s FAS, Inc.

By: /s/ Sara Stensrud

Its: EVP/Chief Human Resources Officer

Firmwide:136395216.1 049970.1002

Exhibit 99.1

Chico's FAS Announces Appointment of Shelley Broader as President and Chief Executive Officer

Broader Brings Over 25 Years of Experience Leading Premier Retail Businesses

Strong Record of Strategic Execution and Inspiring Superior Customer Experiences

FORT MYERS, Fla., October 28, 2015 -- Chico's FAS, Inc. (NYSE: CHS) today announced that Shelley Broader has been appointed President and Chief Executive Officer of Chico’s FAS, effective December 1, 2015. She will also join the Chico’s FAS Board of Directors at that time. Ms. Broader succeeds David F. Dyer, who will become Vice Chair of the Board of Directors.

Ms. Broader is a proven executive with over 25 years of experience leading premier global and regional retail businesses, including Walmart, Michael’s Stores, and several banners with Delhaize Group. In her most recent role as President and Chief Executive Officer of Walmart’s EMEA region, Ms. Broader was responsible for retail operations and business development across Europe, the Middle East, Sub-Saharan Africa and Canada, leading 1,345 retail units and more than 285,000 associates. Previously she served as President and Chief Executive Officer of Walmart Canada, Chief Merchandising Officer for Walmart Canada, and Senior Vice President for Sam’s Club, Walmart’s membership-warehouse format in the U.S.

“As we thank Dave for his years of fine service, we are also delighted to welcome Shelley to the Chico’s FAS team. She brings a remarkable track record, with a global perspective and a keen understanding of how to engage consumers and partner with suppliers to drive profitable growth in a competitive retail environment,” said David F. Walker, Chair of the Chico’s FAS Board of Directors. “The Company conducted an extensive CEO search and interviewed a number of highly qualified candidates. Shelley distinguished herself as our top choice, having the extensive retail industry expertise, leadership skills and appreciation for superior service that we believe will take Chico’s FAS and each of our brands into our next phase of growth and value creation.”

“It is an honor to be named President and CEO of Chico’s FAS. I am thrilled to lead such a dynamic team,” Ms. Broader said. “The Company has made great strides in improving its operating foundation and benefits from a powerful portfolio of brands, each with a unique identity and opportunity for growth. I look forward to working with the Chico’s FAS Board, its Brand Presidents, members of the Executive Committee, and team of associates. I share their passion for superior customer service and applaud the technology and other initiatives underway to improve service and efficiencies. Given the Company’s many strengths, I have great confidence that we can continue to grow and succeed, driving value for our shareholders and delivering on our brand promise to customers through Chico’s FAS’s dedicated employees.”

About Shelley Broader

Ms. Broader’s leadership experience across the North American retail industry spans over 25 years. Prior to joining Walmart in 2010, Ms. Broader was President and Chief Operating Officer of Michael’s,

the world’s largest retailer of arts and crafts, and was responsible for the chain’s 1,000 stores in the United States and Canada. In this role, she worked to standardize processes, disciplines and metrics, and better align store operations and resources with the seasonal buying patterns of the retailer’s customer base.

Before joining Michael’s, Ms. Broader enjoyed a 17-year career with Delhaize Group where, under the Hannaford banner, she held a range of leadership roles across the Company’s operations, merchandising, distribution, strategy and marketing divisions. She was promoted to President and Chief Operating Officer of Delhaize Group’s Kash n’ Karry chain, where she is credited with a significant financial and operational turnaround that included a complete re-branding of the business into Sweetbay Supermarkets. She then served as President and Chief Executive Officer of Sweetbay until joining Michael’s.

Ms. Broader began her career in the investment banking sector, holding roles at Massachusetts Financial Services Company and First Albany Corporation.

Ms. Broader is a member of the board of directors of Raymond James Financial, Inc. She obtained a Bachelor of Arts degree from Washington State University.

In connection with Ms. Broader’s appointment, the Chico’s FAS Board of Directors was assisted by leading executive search firm, Herbert Mines Associates.

ABOUT CHICO'S FAS, INC.

The Company, through its brands – Chico's, White House | Black Market, Soma, and Boston Proper, is a leading omni-channel retailer of women's private branded, sophisticated, casual-to-dressy clothing, intimates, complementary accessories, and other non-clothing items.

As of August 1, 2015, the company operated 1,548 stores in the US and Canada and sold merchandise through franchise locations in Mexico. The Company's merchandise is also available at www.chicos.com, www.whbm.com, www.soma.com, and www.bostonproper.com. For more detailed information on Chico's FAS, Inc., please go to our corporate website at www.chicosfas.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 Certain statements contained herein, including without limitation, statements addressing the beliefs, plans, objectives, estimates or expectations of the Company or future results or events constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements involve known or unknown risks, including, but not limited to, general economic and business conditions, and conditions in the specialty retail industry. There can be no assurance that the actual future results, performance, or achievements expressed or implied by such forward-looking statements will occur. Investors using forward-looking statements are encouraged to review the Company's latest annual report on Form 10-K, its filings on Form 10-Q, management's discussion and analysis in the Company's latest annual report to stockholders, the Company's filings on Form 8-K, and other federal securities law filings for a description of other important factors that may affect the Company's business, results of operations and financial condition. The Company does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that projected results expressed or implied in such statements will not be realized.

Executive Contact:

Jennifer Powers Adkins

Vice President -- Investor Relations

Chico's FAS, Inc.

(239) 346-4199

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

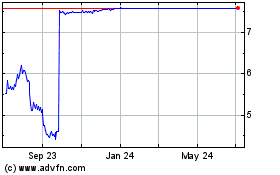

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024