UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 29, 2015

TERRITORIAL BANCORP INC.

(Exact Name of Registrant as Specified in its Charter)

|

Maryland |

|

1-34403 |

|

26-4674701 |

|

(State or Other Jurisdiction

Identification No.) |

|

(Commission File No.) |

|

(I.R.S. Employer of Incorporation) |

|

1132 Bishop Street, Suite 2200, Honolulu, Hawaii |

|

96813 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (808) 946-1400

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On October 29, 2015, Territorial Bancorp Inc. issued a press release announcing earnings for the three-month period ending September 30, 2015. A copy of the press release is attached as Exhibit 99 to this report.

The press release attached as an exhibit to this Current Report pursuant to this Item 2.02 is being furnished to, and not filed with, the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits

(a) Not Applicable.

(b) Not Applicable.

(c) Not Applicable.

(d) Exhibits.

|

Exhibit No. |

|

Exhibit |

|

|

|

|

|

99 |

|

Press release dated October 29, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

Territorial Bancorp Inc. |

|

|

|

|

|

|

|

DATE: October 29, 2015 |

By: |

/s/ Vernon Hirata |

|

|

Vernon Hirata |

|

|

Vice Chairman, Co-Chief Operating Officer and Secretary |

3

Exhibit 99

PRESS RELEASE

FOR IMMEDIATE RELEASE

Contact: Walter Ida

(808) 946-1400

Territorial Bancorp Inc. Announces Third Quarter 2015 Results

· Earnings per share for the three months ended September 30, 2015 rose to $0.40 per diluted share compared to $0.37 per diluted share for the three months ended September 30, 2014.

· Net income for the three months ended September 30, 2015 was $3.69 million compared to $3.46 million for the three months ended September 30, 2014, an increase of 6.5%.

· Net interest income for the three months ended September 30, 2015 was $14.34 million, compared to $13.44 million for the three months ended September 30, 2014, an increase of 6.7%.

· New loan originations for the nine months ended September 30, 2015 totaled $364.01 million and $168.56 million for the first nine months of 2014, an increase of 116.0%.

· Loans receivable grew by $195.08 million or 20.1% as compared to December 31, 2014.

· Board of Directors approved a quarterly cash dividend of $0.17 per share. This is Territorial Bancorp Inc.’s 23rd consecutive quarterly dividend.

Honolulu, Hawaii, October 29, 2015 - Territorial Bancorp Inc. (NASDAQ: TBNK) (the “Company”), headquartered in Honolulu, Hawaii, the holding company parent of Territorial Savings Bank, announced net income of $3.69 million or $0.40 per diluted share for the three months ended September 30, 2015, compared to $3.46 million or $0.37 per diluted share for the three months ended September 30, 2014.

The Company also announced that its Board of Directors approved a quarterly cash dividend of $0.17 per share. The dividend is expected to be paid on November 27, 2015 to stockholders of record as of November 12, 2015.

Allan Kitagawa, Chairman and Chief Executive Officer, said, “Our loan portfolio grew by 20.1% during the first nine months of 2015. The growth in our loan portfolio allowed our net interest income to increase by 6.7% for the three months ended September 30, 2015 as compared to the three months ended September 30, 2014. Our net income for the three months ended September 30, 2015 has grown by 6.5% compared to the three months ended September 30, 2014 while our fully-diluted earnings per share rose to $0.40 per share from $0.37 per share. Our strong performance will allow us to pay our 23rd consecutive quarterly dividend on November 27, 2015.”

Interest Income

Net interest income after provision for loan losses increased to $14.27 million for the three months ended September 30, 2015 from $13.42 million for the three months ended September 30, 2014. Total interest and dividend income was $15.97 million for the three months ended September 30, 2015 compared to $14.99 million for the three months ended September 30, 2014. The $981,000 growth in interest and dividend income was primarily due to a $1.79 million increase in interest earned on loans which resulted from the increase in loans receivable. The increase in interest income on loans was offset by a $797,000 decline in interest income from investment securities due to a net reduction in our investment securities portfolio as repayments exceeded securities purchased.

Interest Expense and Provision for Loan Losses

Total interest expense increased to $1.63 million for the three months ended September 30, 2015 from $1.55 million for the three months ended September 30, 2014. Total interest expense on deposits increased to $1.20 million for the three months ended September 30, 2015 from $1.14 million for the three months ended September 30, 2014 due to an increase in total deposits. Interest expenses on advances from the Federal Home Loan Bank rose by $144,000 due to an increase in Federal Home Loan Bank advances. Interest expense on securities sold under agreements to repurchase declined by $125,000 because of a decrease in these borrowings. During the quarter ended September 30, 2015, the provision for loan losses was $71,000 compared to a $23,000 provision for the three months ended September 30, 2014.

Noninterest Income

Noninterest income was $1.19 million for the three months ended September 30, 2015 compared to $1.40 million for the three months ended September 30, 2014. The reduction in noninterest income was primarily due to a $392,000 decrease in the gain on sale of investment securities that occurred because there were no securities sold during the three months ended September 30, 2015.

Noninterest Expense

Noninterest expense was $9.37 million for the three months ended September 30, 2015 compared to $9.08 million for the three months ended September 30, 2014. Salaries and employee benefits was $5.60 million for the three months ended September 30, 2015 compared to $5.40 million for the three months ended September 30, 2014. The increase in salaries and employee benefits expense is primarily due to higher loan officer compensation that occurred primarily because of the increase in new loan originations and the hiring of additional staff to originate loans and to handle the additional workload associated with an increase in regulatory requirements. The rise in these expenses was offset by an increase in the direct costs of new loan originations.

Assets and Equity

Total assets increased to $1.784 billion at September 30, 2015 from $1.692 billion at December 31, 2014. Loans receivable grew by $195.08 million or 20.1% to $1.163 billion at September 30, 2015 from $968.21 million at December 31, 2014 as residential mortgage loan originations exceeded loan repayments and sales. The growth in loans receivable was funded primarily by a $53.32 million increase in deposits, a $35.59 million decrease in cash and cash equivalents, $64.18 million received from the net repayments and sales of investment securities and a $49.00 million increase in Federal Home Loan Bank advances. Securities sold under agreements to repurchase decreased to $55.00 million at September 30, 2015 from $72.00 million at December 31, 2014. Deposits increased to $1.413 billion at September 30, 2015 from $1.360 billion at December 31, 2014. Total stockholders’ equity increased to $218.37 million at September 30, 2015 from $216.38 million at December 31, 2014. The increase in stockholders’ equity occurred as the Company’s net income for the year exceeded share repurchases and dividends paid to shareholders.

Share Repurchases

Through September 30, 2015, the Company has repurchased 3,060,518 shares of stock or 25.02% of the shares issued in its initial public offering in 2009. The Company uses share repurchases as part of its overall program to enhance shareholder value. The Company also considers the effect of repurchases on its tangible book value per share. At the Company’s current share price level, the amount of dilution to tangible book value may limit the Company’s repurchasing of shares. The Company will closely monitor this issue and conduct repurchases as it makes financial sense, depending on market and other conditions at any given time.

Asset Quality

Total delinquent loans 90 days or more past due and not accruing totaled $1,516,000 (5 loans) at September 30, 2015, compared to $758,000 (4 loans) at December 31, 2014. Non-performing assets totaled $5.39 million at September 30, 2015 compared to $4.45 million at December 31, 2014. The ratio of non-performing assets to total assets rose to 0.30% at September 30, 2015 from 0.26% at December 31, 2014 but continues to remain one of the lowest in the country. The allowance for loan losses at September 30, 2015 was $2.06 million and represented 0.18% of total loans compared to $1.69 million and 0.17% of total loans as of December 31, 2014.

About Us

Territorial Bancorp Inc., headquartered in Honolulu, Hawaii, is the stock holding company for Territorial Savings Bank. Territorial Savings Bank is a state chartered savings bank which was originally chartered in 1921 by the Territory of Hawaii. Territorial Savings Bank conducts business from its headquarters in Honolulu, Hawaii and has 28 branch offices in the state of Hawaii. For additional information, please visit the Company’s website at: https://www.territorialsavings.net.

Forward-looking statements - this earnings release contains forward-looking statements, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect,” “will,” “may” and words of similar meaning. These forward-looking statements include, but are not limited to:

· statements of our goals, intentions and expectations;

· statements regarding our business plans, prospects, growth and operating strategies;

· statements regarding the asset quality of our loan and investment portfolios; and

· estimates of our risks and future costs and benefits.

These forward-looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. We are under no duty to and do not take any obligation to update any forward-looking statements after the date of this earnings release.

The following factors, among others, including those set forth in the Company’s filings with the Securities and Exchange Commission, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

· general economic conditions, either nationally, internationally or in our market areas, that are worse than expected;

· competition among depository and other financial institutions;

· inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments;

· adverse changes in the securities markets;

· changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements;

· our ability to enter new markets successfully and capitalize on growth opportunities;

· our ability to successfully integrate acquired entities, if any;

· changes in consumer spending, borrowing and savings habits;

· changes in market and other conditions that would affect our ability to repurchase our shares of common stock.

· changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission and the Public Company Accounting Oversight Board;

· changes in our organization, compensation and benefit plans;

· changes in our financial condition or results of operations that reduce capital available to pay dividends; and

· changes in the financial condition or future prospects of issuers of securities that we own.

Because of these and a wide variety of other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements.

TERRITORIAL BANCORP INC. AND SUBSIDIARIES

Consolidated Statements of Income (Unaudited)

(Dollars in thousands, except per share data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

9/30/2015 |

|

9/30/2014 |

|

9/30/2015 |

|

9/30/2014 |

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

11,809 |

|

$ |

10,020 |

|

$ |

33,761 |

|

$ |

29,320 |

|

|

Investment securities |

|

4,098 |

|

4,895 |

|

12,895 |

|

15,055 |

|

|

Other investments |

|

64 |

|

75 |

|

213 |

|

153 |

|

|

Total interest and dividend income |

|

15,971 |

|

14,990 |

|

46,869 |

|

44,528 |

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

Deposits |

|

1,198 |

|

1,138 |

|

3,486 |

|

3,332 |

|

|

Advances from the Federal Home Loan Bank |

|

211 |

|

67 |

|

438 |

|

199 |

|

|

Securities sold under agreements to repurchase |

|

221 |

|

346 |

|

776 |

|

1,032 |

|

|

Total interest expense |

|

1,630 |

|

1,551 |

|

4,700 |

|

4,563 |

|

|

Net interest income |

|

14,341 |

|

13,439 |

|

42,169 |

|

39,965 |

|

|

Provision for loan losses |

|

71 |

|

23 |

|

366 |

|

188 |

|

|

Net interest income after provision for loan losses |

|

14,270 |

|

13,416 |

|

41,803 |

|

39,777 |

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

Service fees on loan and deposit accounts |

|

590 |

|

555 |

|

1,577 |

|

1,578 |

|

|

Income on bank-owned life insurance |

|

259 |

|

265 |

|

770 |

|

797 |

|

|

Gain on sale of investment securities |

|

— |

|

392 |

|

476 |

|

1,047 |

|

|

Gain on sale of loans |

|

201 |

|

118 |

|

440 |

|

283 |

|

|

Other |

|

138 |

|

68 |

|

419 |

|

330 |

|

|

Total noninterest income |

|

1,188 |

|

1,398 |

|

3,682 |

|

4,035 |

|

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

5,596 |

|

5,402 |

|

15,759 |

|

16,062 |

|

|

Occupancy |

|

1,483 |

|

1,474 |

|

4,348 |

|

4,305 |

|

|

Equipment |

|

1,025 |

|

956 |

|

2,923 |

|

2,775 |

|

|

Federal deposit insurance premiums |

|

214 |

|

202 |

|

634 |

|

602 |

|

|

Other general and administrative expenses |

|

1,048 |

|

1,045 |

|

3,449 |

|

2,946 |

|

|

Total noninterest expense |

|

9,366 |

|

9,079 |

|

27,113 |

|

26,690 |

|

|

Income before income taxes |

|

6,092 |

|

5,735 |

|

18,372 |

|

17,122 |

|

|

Income taxes |

|

2,406 |

|

2,273 |

|

7,323 |

|

6,479 |

|

|

Net income |

|

$ |

3,686 |

|

$ |

3,462 |

|

$ |

11,049 |

|

$ |

10,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.41 |

|

$ |

0.38 |

|

$ |

1.22 |

|

$ |

1.16 |

|

|

Diluted earnings per share |

|

$ |

0.40 |

|

$ |

0.37 |

|

$ |

1.19 |

|

$ |

1.15 |

|

|

Cash dividends declared per common share |

|

$ |

0.17 |

|

$ |

0.15 |

|

$ |

0.49 |

|

$ |

0.44 |

|

|

Basic weighted-average shares outstanding |

|

9,085,725 |

|

9,218,745 |

|

9,086,481 |

|

9,190,476 |

|

|

Diluted weighted-average shares outstanding |

|

9,301,500 |

|

9,323,306 |

|

9,250,835 |

|

9,283,425 |

|

TERRITORIAL BANCORP INC. AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited)

(Dollars in thousands, except share data)

|

|

|

9/30/2015 |

|

12/31/2014 |

|

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

39,466 |

|

$ |

75,060 |

|

|

Investment securities held to maturity, at amortized cost (fair value of $520,534 and $586,710 at September 30, 2015 and December 31, 2014, respectively) |

|

508,747 |

|

572,922 |

|

|

Loans receivable, net |

|

1,163,292 |

|

968,212 |

|

|

Loans held for sale |

|

225 |

|

1,048 |

|

|

Federal Home Loan Bank stock, at cost |

|

4,590 |

|

11,234 |

|

|

Federal Reserve Bank stock, at cost |

|

2,989 |

|

2,925 |

|

|

Accrued interest receivable |

|

4,742 |

|

4,436 |

|

|

Premises and equipment, net |

|

5,026 |

|

5,629 |

|

|

Bank-owned life insurance |

|

42,072 |

|

41,303 |

|

|

Current income taxes receivable |

|

1,523 |

|

— |

|

|

Deferred income taxes receivable |

|

8,366 |

|

7,254 |

|

|

Prepaid expenses and other assets |

|

2,477 |

|

1,874 |

|

|

Total assets |

|

$ |

1,783,515 |

|

$ |

1,691,897 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

Deposits |

|

$ |

1,412,997 |

|

$ |

1,359,679 |

|

|

Advances from the Federal Home Loan Bank |

|

64,000 |

|

15,000 |

|

|

Securities sold under agreements to repurchase |

|

55,000 |

|

72,000 |

|

|

Accounts payable and accrued expenses |

|

28,582 |

|

24,098 |

|

|

Current income taxes payable |

|

1,476 |

|

826 |

|

|

Advance payments by borrowers for taxes and insurance |

|

3,094 |

|

3,916 |

|

|

Total liabilities |

|

1,565,149 |

|

1,475,519 |

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

Preferred stock, $.01 par value; authorized 50,000,000 shares, no shares issued or outstanding |

|

— |

|

— |

|

|

Common stock, $.01 par value; authorized 100,000,000 shares; issued and outstanding 9,698,420 and 9,919,064 shares at September 30, 2015 and December 31, 2014, respectively |

|

97 |

|

99 |

|

|

Additional paid-in capital |

|

70,295 |

|

75,229 |

|

|

Unearned ESOP shares |

|

(6,484 |

) |

(6,851 |

) |

|

Retained earnings |

|

159,785 |

|

153,289 |

|

|

Accumulated other comprehensive loss |

|

(5,327 |

) |

(5,388 |

) |

|

Total stockholders’ equity |

|

218,366 |

|

216,378 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,783,515 |

|

$ |

1,691,897 |

|

TERRITORIAL BANCORP INC. AND SUBSIDIARIES

Selected Financial Data (Unaudited)

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

Performance Ratios (annualized): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

0.83 |

% |

0.83 |

% |

|

Return on average equity |

|

6.64 |

% |

6.38 |

% |

|

Net interest margin on average interest earning assets |

|

3.39 |

% |

3.37 |

% |

|

|

|

At September |

|

At December |

|

|

|

|

30, 2015 |

|

31, 2014 |

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share (1) |

|

$ |

22.52 |

|

$ |

21.81 |

|

|

Stockholders’ equity to total assets |

|

12.24 |

% |

12.79 |

% |

|

|

|

|

|

|

|

|

Asset Quality |

|

|

|

|

|

|

(Dollars in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Delinquent loans 90 days or more past due and not accruing (2) |

|

$ |

1,516 |

|

$ |

758 |

|

|

Non-performing assets (2) |

|

$ |

5,389 |

|

$ |

4,453 |

|

|

Allowance for loan losses |

|

$ |

2,062 |

|

$ |

1,691 |

|

|

Non-performing assets to total assets |

|

0.30 |

% |

0.26 |

% |

|

Allowance for loan losses to total loans |

|

0.18 |

% |

0.17 |

% |

|

Allowance for loan losses to non-performing assets |

|

38.26 |

% |

37.97 |

% |

Note:

(1) Book value per share is equal to stockholders’ equity divided by number of shares issued and outstanding

(2) Amounts are net of charge-offs

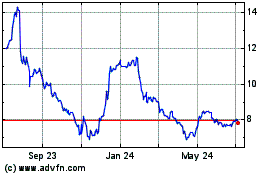

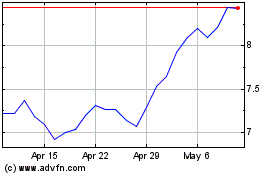

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From Apr 2023 to Apr 2024