As filed with the Securities and Exchange

Commission on October 29, 2015

Registration No. 333-199838

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Post-Effective Amendment No. 1

to

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMARU, INC.

(Exact name of registrant as specified in

its charter)

| |

|

|

| Nevada |

|

88-0490089 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

35 Tai Seng Street, # 01-01,

Tata Communications Exchange, Singapore |

|

534103 |

| (Address of principal executive offices) |

|

(Zip Code) |

AMARU, INC. 2013 EQUITY COMPENSATION

PLAN

(Full title of plans)

(Copy to:)

| |

|

|

| Chua Leong Hin |

|

Iwona J. Alami, Esq. |

| AMARU, INC. |

|

Law Office of Iwona J. Alami |

| 35 Tai Seng Street, #01-01 |

|

620 Newport Center Dr., Suite 1100 |

|

Tata Communications Exchange

Singapore 534103

|

|

Newport Beach, CA 92660 |

| Tel: (65) 6309-3059 |

|

Tel: (949) 760-6880 |

| |

|

|

| (Name, address and telephone number of agent for service) |

|

|

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one)

| |

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| |

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

x |

EXPLANATORY NOTE

Pursuant to Rule 429 of the Securities

Act of 1933, as amended (the “Securities Act”), this Post-Effective Amendment No. 1 to Registration Statement

on Form S-8, File No. 333-199838, of AMARU, INC. (“Amaru”, the “Company,” “we”, “us”

or “our”).

This Post-Effective Amendment No. 1

to Form S-8 is being filed solely for the purpose of filing the reoffer prospectus that forms a part of this Post-Effective Amendment

relating to the resale of control securities acquired or to be acquired by selling stockholders pursuant to the Company’s

2013 Equity Compensation Plan (the “Plan”). The reoffer prospectus contained herein is intended to be a combined prospectus

under Rule 429 of the Securities Act, and has been prepared in accordance with the requirements of General Instruction C of Form

S-8 and Part I of Form S-3, to be used in connection with reoffers and resales of control securities that have been or will be

acquired by the selling stockholders.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

The Company has sent or given or will send

or give documents containing the information specified by Part I of this Registration Statement to participants in the Plan, as

specified in Rule 428(b)(1)(i) promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities

Act. The Company is not filing such documents with the SEC, but these documents constitute (along with the documents incorporated

by reference into this Registration Statement pursuant to Item 3 of Part II hereof) a prospectus that meets the requirements

of Section 10(a) of the Securities Act.

Upon written or oral request, any of the

documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated

by reference in this Section 10(a) Prospectus), and other documents required to be delivered to eligible employees, non-employee

directors and consultants, pursuant to Rule 428(b) are available without charge by contacting:

CEO and President

AMARU, INC.

35 Tai Seng Street, #01-01, Tata Communications

Exchange

Singapore 534103

Telephone: (65) 6309-3059

REOFFER PROSPECTUS

Amaru, Inc.

30,000,000 Shares of Common Stock

This prospectus relates to the public resale,

from time to time, of an aggregate of 30,000,000 shares (the “Shares”) of our common stock, $.001 par value per

share, by certain stockholders identified below in the section entitled “The Selling Stockholders.” These Shares have

been or may be acquired upon the issuance of the Shares pursuant to our 2013 Equity Compensation Plan (the “Plan”).

We will not receive any of the proceeds

from the sale by the Selling Stockholders of the Shares covered by this prospectus.

We have not

entered into any underwriting arrangements in connection with the sale of Shares. The Shares may be sold from time to time by the

Selling Stockholders or by permitted pledgees, donees, transferees or other permitted successors in interest and may be made on

the over-the-counter Bulletin Board market at prices and at terms then prevailing or at prices related

to the then current market price, or in negotiated transactions.

Our common stock is listed on the Financial

Industry Regulatory Authority ("FINRA") over-the-counter Bulletin Board market ("OTCBB") under the symbol "AMRU.

On September 15, 2015, the closing bid price for our common stock on OTCBB was $0.02 per share.

Investing in our securities involves

a high degree of risk. See “ Risk Factors, ” beginning on page 2 of this prospectus to read about factors you should

consider before buying the securities offered by this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

October 29, 2015

TABLE OF CONTENTS

| About This Prospectus |

|

|

1 |

|

| |

|

| Prospectus Summary |

|

|

1 |

|

| |

|

| Forward-Looking Statements |

|

|

2 |

|

| |

|

| Risk Factors |

|

|

2 |

|

| |

|

| Use of Proceeds |

|

|

3 |

|

| |

|

| Selling Stockholders |

|

|

3 |

|

| |

|

| Plan of Distribution |

|

|

5 |

|

| |

|

| Legal Matters |

|

|

6 |

|

| |

|

| Experts |

|

|

6 |

|

| |

|

| Material Changes |

|

|

6 |

|

| |

|

| Interests of Named Experts and Counsel |

|

|

6 |

|

| |

|

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities |

|

|

7 |

|

| |

|

| Where You Can Find More Information |

|

|

7 |

|

| |

|

| Incorporation of Documents by Reference |

|

|

7 |

|

ABOUT THIS PROSPECTUS

In this prospectus, the “Company,”

“Amaru,” “we,” “us,” “our,” “ours” and similar names refer to AMARU,

INC. and its consolidated subsidiaries.

You should rely only on the information

contained in this prospectus or incorporated herein. We have not authorized anyone to provide you with information that is different.

The distribution of this prospectus and the offering of our securities in certain jurisdictions may be restricted by law. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of our securities and the distribution of this prospectus outside the United States. This prospectus

does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities

offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

The information contained, or incorporated by reference, in this prospectus is accurate only as of the respective dates thereof,

regardless of the time of delivery of this prospectus, or of any sale of our securities. It is important for you to read and consider

all information contained in this prospectus, including the documents we have referred you to in the section entitled “Where

You Can Find More Information”.

Information on the shares offered pursuant

to this reoffer prospectus, as listed below, do not necessarily indicate that the Selling Stockholder presently intends to sell

any or all of the shares so listed.

PROSPECTUS SUMMARY

This summary highlights selected information

about us, this offering and information appearing elsewhere in this prospectus and in the documents we incorporate by reference.

This summary is not complete and does not contain all the information you should consider before investing in shares of our common

stock in this offering. You should carefully read this entire prospectus, including the “Risk Factors” section beginning

on page 2 of this prospectus and the financial statements and the other information incorporated by reference in this prospectus,

before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

Overview

The Company, through its subsidiaries under

the M2B and WOWtv brand names, is in the Broadband Media Entertainment business, and a provider of interactive Entertainment-on-demand

and e-commerce streaming over Broadband channels, Internet portals and 3G (Third Generation) Devices. The Company has launched

multiple Broadband TV websites with Entertainment, with multiple content channels designed to cater to various consumer segments

and lifestyles. Its content covers diverse genres such as movies, dramas, comedies, documentaries, music, fashion, lifestyle and

more. The Company markets its products through its "M2B" and "WOWtv" brand names. Through these brands, the

Company offers access to a range of content libraries for aggregation, distribution and syndication on Broadband and other media,

including rights for merchandising, product branding, promotion and publicity.

Corporate Information

The Company was incorporated under the

laws of the state of Nevada in September, 1999. The Company's corporate offices are located at 35 Tai Seng Street, #01-01, Tata

Communications Exchange, Singapore 534103; telephone (65) 6309-3059. The corporate website is located at www.amaruinc.com.

As of February 25,

2004 (the "Closing Date"), Amaru acquired M2B World Pte. Ltd. (M2B World), a Singapore corporation, in exchange for 19,500,000

newly issued "restricted" shares of common voting stock of the Company and 143,000 "restricted" Series A Convertible

Preferred Stock shares to the M2B World shareholders on a pro rata basis for the purpose of effecting a tax-free reorganization

pursuant to sections 351, 354 and 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended pursuant to the Agreement and Plan

of Reorganization by and between the Company, M2B World and M2B World shareholders. As a condition of the closing of the share

exchange transaction, certain shareholders of the Company cancelled a total of 1,457,500 shares of common stock. Each one (1) ordinary

share of M2B World has been exchanged for 1.3636363 shares of the Company's Common Stock and 100 shares of the Company's Series

A Convertible Preferred Stock. Each share of the Company's Series A Convertible Preferred Stock had a conversion rate of 38.461538

shares of the Company's common stock. Following the Closing Date, there were 20,000,000 shares of the Company's Common Stock outstanding

and 143,000 shares of the Company's Series A Convertible Preferred Stock outstanding. Immediately prior to the Closing, there were

500,000 shares issued and outstanding. All of the Series A Convertible Preferred Stock was subsequently converted into shares of

common stock of the Company.

The restructuring

and re-capitalization has been treated as a reverse acquisition with M2B World becoming the accounting acquirer. The historical

financial statements prior to the closing of the transaction are those of M2B World.

You can obtain more information regarding

our business and industry by reading our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 filed with the

Securities and Exchange Commission, or SEC on April 15, 2015 and the other reports we file with the SEC.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents that

we incorporate by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the

Exchange Act. Those statements are therefore entitled to the protection of the safe harbor provisions of these laws. These forward-looking

statements, which are usually accompanied by words such as “may,” “might,” “will,” “should,”

“could,” “intends,” “estimates,” “predicts,” “potential,” “continue,”

“believes,” “anticipates,” “plans,” “expects” and similar expressions, involve

risks and uncertainties, and relate to, without limitation, statements about our products, our market opportunities, our strategy,

our competition, our projected revenue, expense levels and cash spend and the adequacy of our available cash resources. These statements

are only predictions based on current expectations and projections about future events. There are important factors that could

cause our actual results, level of activity, performance or achievements to differ materially from those expressed or forecasted

in, or implied by, such forward-looking statements, including those factors to which we refer you in “Risk Factors”

below.

Our business, financial condition, results

of operations and prospects may change. Although we believe that the expectations reflected in these forward-looking statements

are based upon reasonable assumptions, no assurance can be given that such expectations will be attained or that any deviations

will not be material. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed

in this prospectus and the documents that we incorporate by reference herein may not occur and actual results could differ materially

and adversely from those anticipated or implied in the forward-looking statements. We disclaim any obligation or undertaking to

disseminate any updates or revision to any forward-looking statement to reflect any change in our expectations with regard thereto

or any change in events, conditions or circumstances on which any such statement is based.

You should read this prospectus and the

documents that we incorporate by reference herein, of which this prospectus is part, completely and with the understanding that

our actual future results may be materially different from what we expect. You should assume that the information contained, or

incorporated by reference, in this prospectus is accurate only as of the respective dates thereof, regardless of the time of delivery

of this prospectus, or of any sale of our securities. We qualify all of the information presented in this prospectus and particularly

our forward-looking statements, by these cautionary statements.

RISK FACTORS

Investing in our securities involves

a high degree of risk and uncertainty. Please see the risk factors under the heading “Risk Factors” in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2014, as such discussions may be amended, supplemented and updated in subsequent

reports filed by us with the SEC and that is incorporated by reference into this prospectus. Before making an investment decision,

you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus.

The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not

presently known to us or that we currently deem to be immaterial may also affect our business operations. If any of such risks

and uncertainties actually occurs, our business, financial condition and results of operations could be severely harmed. This could

cause the trading price of our common stock to decline, and you could lose all or part of your investment.

Risks Related to this Offering and our Common Stock

We currently do not generate substantial

revenue and will likely need additional funding to meet our future capital needs. Such funding may not be available on favorable

terms, if at all, and may be dilutive to our existing stockholders.

To date, we have generated no substantial

revenue. Therefore, we have to fund all of our operations and development expenditures from cash on hand and equity financings.

We will likely need to raise additional funding for our development programs and commercialization efforts. We cannot provide

assurance that we will be able to raise additional funding on terms favorable to us, or at all. If we raise additional funds through

the issuance of equity securities, our shares of common stock may suffer dilution. If we raise additional funds from debt financing,

we may be obligated to abide by restrictive covenants contained in the debt financing agreements, which may make it more difficult

for us to operate our business. If we are unable to secure additional funding, our ability to continue our development and commercialization

programs would be delayed, reduced or eliminated.

The trading price of our shares of

common stock may fluctuate significantly.

The price of our shares of common stock

may be volatile, which means that it could decline substantially within a short period of time. The trading price of the shares

may fluctuate, and investors may experience a decrease in the value of the shares that they hold, sometimes regardless of our

operating performance or prospects. The trading price of our common stock could fluctuate significantly for many reasons, including

the following:

| |

• |

|

future announcements concerning our business and that of our competitors; |

| |

• |

|

regulatory developments, enforcement actions bearing on advertising, marketing or sales of our current or pipeline products; |

| |

• |

|

quarterly variations in operating results; |

| |

• |

|

negative reporting about us in the press; |

| |

• |

|

introduction of new services or changes in pricing policies by us or our competitors; |

| |

• |

|

acquisition or loss of significant customers, distributors or suppliers; |

| |

• |

|

business acquisitions or divestitures; |

| |

• |

|

changes in third party reimbursement practices; |

| |

• |

|

fluctuations of investor interest in our business sector; and |

| |

• |

|

fluctuations in the economy, world political events or general market conditions. |

You may experience future dilution as a result of future

equity offerings.

In order to raise additional capital, we

may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common

stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any

other offering at a price per share that is less than the price per share paid by purchasers in this offering, and purchasers purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell

additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may

be higher or lower than the price per share paid by purchasers in this offering. In addition, we have a significant number of options

and warrants outstanding. If the holders of our outstanding options and warrants exercise them, you may incur further dilution.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of the Shares covered by this prospectus.

THE SELLING STOCKHOLDERS

This reoffer prospectus relates to Shares

that are being registered for reoffer and resale by Selling Stockholders who have received or acquired, or may hereafter receive

or acquire, the shares pursuant to the Plan. The Selling Stockholders may resell all, a portion, or none of the shares of common

stock from time to time.

The following table sets forth (a) the

name of each Selling Stockholder; (b) the number of shares of common stock beneficially owned by each Selling Stockholder

as of September 30, 2015; (c) the maximum number of shares of common stock that each Selling Stockholder may offer for sale

from time to time pursuant to this reoffer prospectus, whether or not the Selling Stockholder has any present intention to do so

and whether or not such shares have previously been issued to the Selling Stockholders or may in the future be issued, if at all;

and (d) the number of shares of common stock and the percentage of common stock that would be beneficially owned by each Selling

Stockholders assuming the sale of all shares offered hereby. All information with respect to beneficial ownership has been furnished

by the Selling Stockholders. The inclusion in the table below of the individuals named therein shall not be deemed to be an admission

that any such individuals are our “affiliates” as that term is defined under Rule 405 under the Securities Act.

Beneficial ownership is determined according

to the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power.

The beneficial ownership percentages set forth below are based on 203,911,303 shares of common stock outstanding as of September

30, 2015. All shares of common stock owned by such person, including shares of common stock underlying stock options that are currently

exercisable or exercisable within 60 days after September 30, 2015 are deemed to be outstanding and beneficially owned by

that person for the purpose of computing the ownership percentage of that person, but are not considered outstanding for the purpose

of computing the percentage ownership of any other person. Except as otherwise indicated, to our knowledge, each person listed

in the table below has sole voting and investment power with respect to the shares shown to be beneficially owned by such person,

except to the extent that applicable law gives spouses shared authority.

Information concerning the identities of

the Selling Stockholders, the number of shares that may be sold by each Selling Stockholder and information about the shares beneficially

owned by the Selling Stockholders may from time to time be updated in supplements to this reoffer prospectus, which will be filed

with the SEC in accordance with Rule 424(b) of the Securities Act if and when necessary. The names of persons selling shares under

this reoffer prospectus and the amount of such shares are set forth below to the extent we presently have such information.

Information on the shares offered pursuant

to this reoffer prospectus, as listed below, do not necessarily indicate that the Selling Stockholder presently intends to sell

any or all of the shares so listed. Because the Selling Stockholders may sell none, some or all of the shares owned by them which

are included in this reoffer prospectus, no estimate can be given as to the number of shares available for resale hereby that will

be held by the Selling Stockholders upon the termination of the offering made hereby. Although none of the selling stockholders

presently intends to sell any or all of the shares so listed,we have assumed, for purposes of the following table, that the Selling

Stockholders will sell all of the shares owned by them that are being offered hereby, but will not sell any other shares of our

common stock that they presently own.

The address of each Selling Stockholder

is c/o AMARU, INC., 35 Tai Seng Street, # 01-01, Tata Communications Exchange, Singapore 534103.

Name |

|

Position |

|

Number of Shares

Beneficially

Owned |

|

|

Number of Shares

Included in the

Offering |

|

|

Number of

Shares

Beneficially

Owned After the

Offering |

|

|

Percentage of

Shares of

Common

Stock Owned

After the

Offering |

|

| Sakae Torisawa, (1) |

|

Chairman of Board |

|

|

1,712,808 |

|

|

|

10,000,000 |

|

|

|

11,712,808 |

|

|

|

5.74% |

|

| |

|

|

|

|

|

| Chua Leong Hin (1)(2) |

|

CEO and Director |

|

|

0 |

|

|

|

10,000,000 |

|

|

|

10,000,000 |

|

|

|

4.90% |

|

| |

|

|

|

|

|

| Percy Chua Soo Lian (1) |

|

Director |

|

|

0 |

|

|

|

10.000,000 |

|

|

|

10,000,000 |

|

|

|

4.90% |

|

| |

|

|

|

|

|

| (1) |

Except as otherwise indicated, the Company believes that the beneficial owners of Common Stock listed above, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage of the person holding such options or warrants, but are not deemed outstanding for purposes of computing the percentage of any other person. |

| (2) |

Mr. Chua Leong Hin is a shareholder of M2B World Asia Pacific Pte. Ltd, a subsidiary of the Company. He holds 1,296,336 ordinary shares (3.05%) of the total shares outstanding of 42,459, 976 ordinary shares in M2B World Asia Pacific Pte. Ltd. |

PLAN OF DISTRIBUTION

As used in this prospectus, “Selling

Stockholder” includes the Selling Stockholder named above and his or her donees, pledgees, transferees or other successors

in interest selling shares received from named Selling Stockholder as a gift, partnership distribution or other non-sale-related

transfer after the date of this prospectus. We have been advised that the Selling Stockholder may effect sales of the Shares directly,

or indirectly by or through underwriters, agents or broker-dealers, and that the Shares may be sold by one or a combination of

several of the following methods:

| |

• |

|

one or more block transactions, in which the broker or dealer so engaged will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction, or in crosses, in which the same broker acts as an agent on both sides of the trade; |

| |

• |

|

purchases by a broker-dealer or market maker, as principal, and resale by the broker-dealer for its account; |

| |

• |

|

ordinary brokerage transactions or transactions in which a broker solicits purchases; |

| |

• |

|

on the OTC Bulletin Board or on any other national securities exchange or quotation service on which our Shares may be listed or quoted at the time of the sale; |

| |

• |

|

in the over-the-counter market; |

| |

• |

|

through the writing of options, whether the options are listed on an options exchange or otherwise; |

| |

• |

|

through distributions to creditors and equity holders of the Selling Stockholder; or |

| |

• |

|

any combination of the foregoing, or any other available means allowable under applicable law. |

We will bear all costs, expenses and fees

in connection with the registration and sale of the Shares covered by this prospectus, other than underwriting discounts and selling

commissions. We will not receive any proceeds from the sale of the Shares covered hereby. The Selling Stockholder will bear all

commissions and discounts, if any, attributable to sales of the shares. The Selling Stockholder may agree to indemnify any broker-dealer

or agent that participates in transactions involving sales of the shares against certain liabilities, including liabilities arising

under the Securities Act.

The Selling Stockholder may sell the shares

covered by this prospectus from time to time, and may also decide not to sell all or any of the shares he is allowed to sell under

this prospectus. The Selling Stockholder will act independently of us in making decisions regarding the timing, manner and size

of each sale. The Selling Stockholder may effect sales by selling the shares directly to purchasers in individually negotiated

transactions, or to or through broker-dealers, which may act as agents or principals. The Selling Stockholder may sell his shares

at fixed prices, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at varying

prices determined at the time of sale, or at privately negotiated prices.

Additionally, the Selling Stockholder may

engage in hedging transactions with broker-dealers in connection with distributions of shares or otherwise. In those transactions,

broker-dealers may engage in short sales of shares in the course of hedging the positions they assume with the Selling Stockholder.

The Selling Stockholder also may sell shares short and redeliver shares to close out such short positions. The Selling Stockholder

may also enter into option or other transactions with broker-dealers which require the delivery of shares to the broker-dealer.

The broker-dealer may then resell or otherwise transfer such shares pursuant to this prospectus. The Selling Stockholder also may

loan or pledge shares to a broker-dealer. The broker-dealer may sell the shares so loaned or pledged pursuant to this prospectus.

The Selling Stockholder may enter into

derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated

transactions. If the applicable prospectus indicates, in connection with those derivatives, the third parties may sell securities

covered by this prospectus and the applicable prospectus, including in short sale transactions. If so, the third party may use

securities pledged by the Selling Stockholder or borrowed from the Selling Stockholder or others to settle those sales or to close

out any related open borrowings of stock, and may use securities received from the Selling Stockholder in settlement of those derivatives

to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not

identified in this prospectus, will be identified in the applicable prospectus (or a post-effective amendment).

Broker-dealers or agents may receive compensation

in the form of commissions, discounts or concessions from Selling Stockholders. Broker-dealers or agents may also receive compensation

from the purchasers of shares for whom they act as agents or to whom they sell as principals, or both. Compensation as to a particular

broker-dealer might be in excess of customary commissions and will be in amounts to be negotiated in connection with transactions

involving shares. In effecting sales, broker-dealers engaged by the Selling Stockholder may arrange for other broker-dealers to

participate in the resales.

In connection with sales of the Shares

covered hereby, the Selling Stockholder and any broker-dealers or agents and any other participating broker-dealers who execute

sales for the Selling Stockholder may be deemed to be “underwriters” within the meaning of the Securities Act. Accordingly,

any profits realized by the Selling Stockholder and any compensation earned by such broker-dealers or agents may be deemed to be

underwriting discounts and commissions. Because the Selling Stockholder may be deemed to be an “underwriter” within

the meaning of Section 2(11) of the Securities Act, the Selling Stockholder will be subject to the prospectus delivery requirements

of that act. We will make copies of this prospectus (as it may be amended or supplemented from time to time) available to the Selling

Stockholder for the purpose of satisfying the prospectus delivery requirements. In addition, any shares of the Selling Stockholder

covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold in open market

transactions under Rule 144 rather than pursuant to this prospectus.

The Selling Stockholder will be subject

to applicable provisions of Regulation M of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and

regulations thereunder, which provisions may limit the timing of purchases and sales of any of the Shares by the Selling Stockholder.

These restrictions may affect the marketability of such shares.

In order to comply with applicable securities

laws of some states, the Shares may be sold in those jurisdictions only through registered or licensed brokers or dealers. In addition,

in certain states the Shares may not be sold unless they have been registered or qualified for sale in the applicable state or

an exemption from the registration or qualification requirements is available.

To the extent necessary, we may amend or

supplement this prospectus from time to time to describe a specific plan of distribution. We will file a supplement to this prospectus,

if required, upon being notified by the Selling Stockholder that any material arrangement has been entered into with a broker-dealer

for the sale of shares through a block trade, special offering, exchange distribution or secondary distribution or a purchase by

a broker or dealer. The supplement will disclose the name of the Selling Stockholder and of the participating broker-dealer(s);

the number of shares involved; the price at which such shares were sold; the commissions paid or discounts or concessions allowed

to such broker-dealer(s), where applicable; that such broker-dealer(s) did not conduct any investigation to verify the information

contained in or incorporated by reference in this prospectus; and any other facts material to the transaction.

LEGAL MATTERS

The validity of the securities we are offering

will be passed upon by Law Office of Iwona J. Alami, Newport Beach, California.

EXPERTS

The consolidated financial statements of

AMARU, INC. as of December 31, 2014 and 2013 and for each of the years in the two-year period ended December 31, 2014, and management’s

assessment of the effectiveness of internal controls over financial reporting as of December 31, 2014 contained in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2014 have been incorporated by reference herein in reliance upon the report

of Wei, Wei & Co. LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority

of said firm as experts in accounting and auditing.

The audit report covering the December

31, 2014 consolidated financial statements contains an explanatory paragraph that states that the Company has incurred recurring

losses from operations and has limited cash resources, which raise substantial doubt about its ability to continue as a going concern.

The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty.

MATERIAL CHANGES

None.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus

as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being

registered or upon other legal matters in connection with the registration or offering of the Shares was employed on a contingency

basis or had, or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in the Company,

nor was any such person connected with the Company as a promoter, managing or principal underwriter, voting trustee, director,

officer or employee.

DISCLOSURE OF COMMISSION POSITION OF

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to

the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification is against

public policy as expressed in the Act and is, therefore, unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a Registration

Statement on Form S-8 that we filed with the SEC. Certain information in the Registration Statement has been omitted from this

prospectus in accordance with the rules of the SEC. We file annual, quarterly and special reports, proxy statements and other information

with the SEC. You can inspect and copy the Registration Statement as well as reports, proxy statements and other information we

have filed with the SEC at the public reference room maintained by the SEC at 100 F Street N.E. Washington, D.C. 20549, You can

obtain copies from the public reference room of the SEC at 100 F Street N.E. Washington, D.C. 20549, upon payment of certain fees.

You can call the SEC at 1-800-732-0330 for further information about the public reference room. We are also required to file electronic

versions of these documents with the SEC, which may be accessed through the SEC’s World Wide Web site at http://www.sec.gov

.

No dealer, salesperson or other person

is authorized to give any information or to make any representations other than those contained in this prospectus, and, if given

or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not

constitute an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation

of an offer to buy any securities by any person in any jurisdiction where such offer or solicitation is not authorized or is unlawful.

Neither delivery of this prospectus nor any sale hereunder shall, under any circumstances, create any implication that there has

been no change in the affairs of our company since the date hereof.

INCORPORATION OF DOCUMENTS BY REFERENCE

The following documents and information

previously filed or to be filed by us with the SEC are incorporated by reference in this prospectus:

| (a) | | The Company's registration statement on Form 10-SB, as amended, filed on May 9, 2001

(amended on July 6, 2001); |

| (b) | | The Company’s Annual Report on Form 10-K, as amended on May 6, 2015, for its

fiscal year ended December 31, 2014, filed with the Commission on April 15, 2015 (Commission File No. 000-32695); |

| (c) | | The Company’s Quarterly Report on Form 10-Q for its fiscal quarter ended March

31, 2015, filed with the Commission on May 15, 2015 (Commission File No. 000-32695); |

| (d) | | The Company’s Quarterly Report on Form 10-Q, as amended on August 26, 2015 for

its fiscal quarter ended June 30, 2015, filed with the Commission (Commission File No. 000-32695); |

| (e) | | The Company's Definitive Proxy Statement on Schedule 14A filed with the Commission

on July 7, 2014 (Commission File No. 000-32695); |

| (f) | | The Company’s Quarterly Report on Form 10-Q for its fiscal quarter ended September

30, 2014, filed with the Commission on November 13, 2014 (Commission File No. 000-32695); |

| (g) | | The Company’s Quarterly Report on Form 10-Q for its fiscal quarter ended June

30, 2014, filed with the Commission on August 14, 2014 (Commission File No. 000-32695); |

| (h) | | The Company’s Current Reports on Form 8-K, filed with the Commission on September

9, 2014 (Commission File No. 000-32695); and |

| (i) | | the description of the Company's Common Stock contained in the Registrant's Registration

Statement on Form 10-SB, filed pursuant to Section 12(g) of the Exchange Act, including any amendment or report subsequently filed

by the Registrant for the purpose of updating that description. |

In addition, all documents subsequently

filed by us (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such

form that are related to such items unless such Form 8-K expressly provides to the contrary) pursuant to Section 13(a), 13(c),

14 or 15(d) of the Exchange Act before the date our offering is terminated or complete, are deemed to be incorporated by reference

into, and to be a part of, this prospectus. Any statement contained herein or in a document incorporated or deemed to be incorporated

by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement

contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein

modifies or supersedes such earlier statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

You may request a copy of these filings, at

no cost, by writing to or telephoning us at the following address:

Investor Relations

AMARU, INC.

35 Tai Seng Street, #01-01, Tata Communications

Exchange

Singapore 534103

(65) 6309-3059

We also maintain an Internet site at www.Amaru.com

at which there is additional information about our business, but the contents of that site are not incorporated by reference into,

and are not otherwise a part of, this prospectus.

AMARU, INC.

30,000,000 Shares of

Common Stock

Reoffer Prospectus

October 29, 2015

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

| Item 3. |

Incorporation of Certain Documents by Reference. |

The following documents and information previously

filed or to be filed by us with the SEC are incorporated by reference in this prospectus:

| (a) | The Company's registration statement on Form 10-SB, as

amended, filed on May 9, 2001 (amended on July 6, 2001); |

| (b) | The Company’s Annual Report on Form 10-K, as amended

on May 6, 2015, for its fiscal year ended December 31, 2014, filed with the Commission on April 15, 2015 (Commission File No.

000-32695); |

| (c) | The Company’s Quarterly Report on Form 10-Q for its

fiscal quarter ended March 31, 2015, filed with the Commission on May 15, 2015 (Commission File No. 000-32695); |

| (d) | The Company’s Quarterly Report on Form 10-Q, as amended

on August 26, 2015 for its fiscal quarter ended June 30, 2015, filed with the Commission (Commission File No. 000-32695); |

| (e) | The Company's Definitive Proxy Statement on Schedule 14A

filed with the Commission on July 7, 2014 (Commission File No. 000-32695); |

| (f) | The Company’s Quarterly Report on Form 10-Q for its

fiscal quarter ended September 30, 2014, filed with the Commission on November 13, 2014 (Commission File No. 000-32695); |

| (g) | The Company’s Quarterly Report on Form 10-Q for its

fiscal quarter ended June 30, 2014, filed with the Commission on August 14, 2014 (Commission File No. 000-32695); |

| (h) | The Company’s Current Reports on Form 8-K, filed

with the Commission on September 9, 2014 (Commission File No. 000-32695); and |

| (i) | the description of the Company's Common Stock contained

in the Registrant's Registration Statement on Form 10-SB, filed pursuant to Section 12(g) of the Exchange Act, including any amendment

or report subsequently filed by the Registrant for the purpose of updating that description. |

All documents filed by us pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, subsequent to the date of this Registration Statement

and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters

all securities remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part

hereof from the date of filing of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration

Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed

to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

| |

|

Not applicable.

| Item 5. |

Interests of Named Experts and Counsel. |

Certain legal matters with respect to the Common

Stock offered hereby will be passed upon for the Company by Law Offices of Iwona J. Alami, counsel to the Company. The fair market

value of the shares of common stock of the Company held by Ms. Alami does not exceed $50,000.

| Item 6. |

Indemnification of Directors and Officers. |

The Corporation Laws of the State of Nevada

and the Company's Bylaws provide for indemnification of the Company's Directors for liabilities and expenses that they may incur

in such capacities. In general, Directors and Officers are indemnified with respect to actions taken in good faith in a manner

reasonably believed to be in, or not opposed to, the best interests of the Company, and with respect to any criminal action or

proceeding, actions that the indemnitee had no reasonable cause to believe were unlawful. Furthermore, the personal liability of

the Directors is limited as provided in the Company's Articles of Incorporation.

| Item 7. |

Exemption from Registration Claimed. |

Not applicable.

EXHIBITS

| Exhibit |

|

| Number |

Description of Exhibit |

| |

|

| 4 |

2013 Equity Compensation Plan (Filed as Exhibit B to the Company’s Proxy Statement filed with the Commission pursuant to Section 14(a) of the Exchange Act on July 7, 2014 and incorporated herein by this reference.) |

| |

|

| 5 |

Opinion of Legal Counsel (opinion re legality). |

| 23.1 |

Consent of Wei Wei LLP.(consent of independent registered public accounting firm). |

| 23.2 |

Consent of Counsel (included in Exhibit 5) |

The undersigned Company hereby undertakes:

(1) To file, during any period in which

offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any

facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement;

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such

information in this Registration Statement; provided, however , that paragraphs (1)(i) and (1)(ii) do not apply

if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with

or furnished to the Commission by the Company pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by

reference in this Registration Statement.

(2) That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

The undersigned Company hereby undertakes that,

for purposes of determining any liability under the Securities Act each filing of the Company’s annual report pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the

foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer, or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized in Singapore on October 23, 2015.

| |

|

| |

|

AMARU, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Chua Leong Hin |

| |

|

Chua Leong Hin |

| |

|

Chief Executive Officer and President |

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

Date |

| |

|

|

|

| /s/ Chua Leong Hin |

|

Chief Executive Officer, President Interim CFO and Director |

October 23, 2015 |

| Chua Leong Hin |

|

(Principal Executive Officer and Principal Financial officer) |

|

| |

|

|

|

| /s/ Sakae Torisawa |

|

Director and Chairman of the Board of Directors |

October 23, 2015 |

| Sakae Torisawa |

|

|

|

| |

|

|

|

| /s/ Percy Chua Soo Lian |

|

Director |

October 23, 2015 |

| Percy Chua Soo Lian |

|

|

|

| |

|

|

|

EXHIBIT INDEX

| Exhibit |

|

| Number |

Description of Exhibit |

| |

|

| 4 |

2013 Equity Compensation Plan (Filed as Exhibit B to the Company’s Proxy Statement filed with the Commission pursuant to Section 14(a) of the Exchange Act on July 7, 2014 and incorporated herein by this reference.) |

| |

|

| 5 |

Opinion of Legal Counsel (opinion re legality). |

| 23.1 |

Consent of Wei Wei LLP.(consent of independent registered public accounting firm). |

| 23.2 |

Consent of Counsel (included in Exhibit 5) |

EXHIBIT 5.1

LAW OFFICES OF IWONA J. ALAMI

620 NEWPORT CENTER DR., SUITE 1100

NEWPORT BEACH, CA 92660

TEL. (949) 760-6880

October 23, 2015

Securities and Exchange Commission

Division of Corporate Finance

Washington, D.C. 20549

| Re: |

Amaru, Inc. Post-Effective Amendment No. 1 to

Registration Statement on Form S-8 (Reg. No. 333-199838) |

Ladies and Gentlemen:

We refer to the above-captioned registration

statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”),

filed by Amaru, Inc., a Nevada corporation (the “Company”), with the Securities and Exchange Commission on November

4, 2014.

We have examined the originals, photocopies,

certified copies or other evidence of such records of the Company, certificates of officers of the Company and public officials,

and other documents as we have deemed relevant and necessary as a basis for the opinion hereinafter expressed. In such examination,

we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as certified copies or photocopies

and the authenticity of the originals of such latter documents.

Based on our examination mentioned above, we

are of the opinion that the securities being registered to be sold pursuant to the Registration Statement are duly authorized and

will be, when sold in the manner described in the Registration Statement, legally and validly issued, and fully paid and non-assessable.

We hereby consent to the filing of this opinion

as Exhibit 5.1 to the Registration Statement. In giving the foregoing consent, we do not hereby admit that we are in the category

of persons whose consent is required under Section 7 of the Act, or the rules and regulations of the Securities and Exchange

Commission.

Very truly yours,

Law Offices of Iwona J. Alami

/s/ Iwona J. Alami

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We consent to the use of our report dated April 15, 2015, with respect

to the consolidated balance sheets of Amaru, Inc. and subsidiaries (the Company) as of December 31, 2014 and 2013 and the

related consolidated statements of operations and comprehensive loss, stockholders’ equity, and cash flows for each of the

years in the two-year period ended December 31, 2014, incorporated by reference herein and to the reference to our firm under the

heading “Experts” in the prospectus.

Our report dated April 15, 2015 contains an explanatory paragraph

that states that the Company has incurred recurring losses from operations and has limited cash resources, which raise substantial

doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments that

might result from the outcome of that uncertainty.

/s/ Wei, Wei & Co. LLP

Flushing, New York

October 12, 2015

Amaru (CE) (USOTC:AMRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

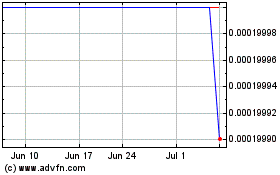

Amaru (CE) (USOTC:AMRU)

Historical Stock Chart

From Apr 2023 to Apr 2024