Japanese Stocks Rise on Hopes for BOJ Easing

October 28 2015 - 10:00PM

Dow Jones News

Japanese stocks rose to their highest levels in two months on

Thursday, amid hopes that the Bank of Japan will announce fresh

easing measures, although gains were capped after the U.S. Federal

Reserve signaled it could raise interest rates as soon as

December.

The Nikkei Stock Average was up 0.6% at 19015.51, reaching its

highest level since late August. Many economists expects that

Japan's central bank will expand its already massive government

bond-buying program at its policy meeting Friday.

"A lot of people have bought Japan in the past few weeks in

anticipation of [Friday's meeting]," said Ilya Feygin, managing

director at New York-based brokerage WallachBeth Capital.

Elsewhere, Australia's S&P ASX 200 was down 0.3% and South

Korea's Kospi was up 0.6%.

U.S. Fed officials suggested they had become less concerned in

recent weeks about turbulence in financial markets and uncertain

economic developments overseas. They pointed specifically to the

next meeting as a time when they would assess if it was time to

raise rates.

Markets around the world have rallied this month on hopes that

the Fed would keep rates lower for longer, while the prospect of

further stimulus from central banks in Europe and Asia also fueled

gains. In September, the Fed left short-term rates unchanged amid

worries about weak growth overseas and concerns about exceptionally

low inflation at home.

The MSCI Asia Pacific Index, up 9.3% for the month as of

Wednesday's close, is on track for its best month since April

2009.

Still, Mr. Feygin noted that region's markets have lost steam in

the past week. "The Fed was a bit more hawkish than people

expected."

The Shanghai Composite Index was down 1.1% this week as of

Wednesday's close, even after the People's Bank of China cut

interest rates last Friday.

"It shows that central banks are an important factor but not all

that powerful…and that markets in China especially need something

more," added Mr. Feygin.

Overnight, U.S. stocks rebounded to new highs after the Fed held

rates near zero.

In Japan, signs of weakness in the economy are pressuring the

Bank of Japan for more stimulus, a move that would be part of a now

two-year-long fight to spark inflation.

Still, Bank of Japan Governor Haruhiko Kuroda hasn't given a

public indication that he believes further easing action is

necessary now, instead saying the bank can still achieve the bank's

2% inflation target next year.

The Japanese yen was up 0.3% at 120.66 to one U.S. dollar.

The Malaysian ringgit was down 0.7% at 4.2950 to one U.S.

dollar. The dollar strengthened broadly against global currencies

following the Fed's statement.

Shares of Nintendo Co. were recently up 0.9%. After the market's

close Wednesday, the company said its operating profit for the

April-to-September period totaled ¥ 8.98 billion ($74.6 million),

buoyed by its core game business and game-interactive figurines and

cards. The gains were a turnaround from a year-earlier loss of ¥

215 million, though analysts expected a profit of ¥ 14.4

billion.

In Australia, shares of Woolworths Ltd. fell 8.4% after the

supermarket operator warned that first-half profit may fall as much

as 35%, as it cuts prices and accelerates investments to compete

with rivals. The company expects after-tax profit of between 900

million Australian dollars (US$639 million) and A$1.0 billion in

the six months through December, which is 28% to 35% lower than a

year earlier, excluding significant items.

Brent oil was up 0.1% at $49.12. U.S. oil prices jumped 6.3%

overnight, the largest one-day percentage gain since Aug. 31.

Gold prices were down 1.5% at $1158.60.

Takashi Nakamichi and Rebecca Thurlow contributed to this

article.

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 21:45 ET (01:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

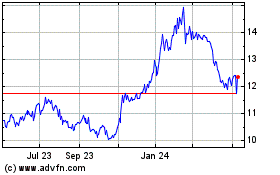

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

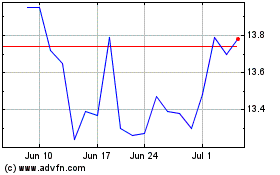

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Apr 2023 to Apr 2024